Iac/Interactivecorp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Silver King Broadcasting

Diller's Latest Tele -Vision; First, a Network of Cubic Zirconium. Now, a Station of Lips ... Page 1 of 5 Welcome to TimesPeople TimesPeople Lets You Share and Discover the Best of NYTimes.com 11:07 AM Recommend Get Started HOME PAGE TODAY'S PAPER VIDEO MOST POPULAR TIMES TOPICS Log In Register Now Search All NYTimes.com Wednesday, August 5, 2009 Business WORLD U.S. N.Y. / REGION BUSINESS TECHNOLOGY SCIENCE HEALTH SPORTS OPINION ARTS STYLE TRAVEL JOBS REAL ESTATE AUTOS Travel Dispatch E -Mail Diller's Latest Tele -Vision; First, a Network of Cubic Sign up for the latest travel features, sent every Saturday. Zirconium. Now, a Station of Lips and Hardbodies. By GERALDINE FABRIKANT See Sample | Privacy Policy Published: Monday, November 23, 1998 How would you promote a television show called ''10'' that visits the SIGN IN TO RECOMMEND beaches of Miami seeking the best-looking guys and girls and lets audiences vote for their favorites? SIGN IN TO E-MAIL PRINT Well, if you work for WAMI, Barry Diller's new television station in REPRINTS Miami, and it is the Thanksgiving season, you create a commercial SHARE that scans bikinied bodies while a voiceover says ''10'' offers ''all the breasts, legs and thighs you can handle.'' Executives at WAMI (pronounced whammy) like to refer to the show as an ''egalitarian, populist beauty pageant.'' The WAMI approach to local television also includes ''Ken's Freakquency,'' a midnight tour of the outre -- replete with body paint, snakes and nose rings -- that derives its name from the R.E.M. -

Downloading of Movies, Television Shows and Other Video Programming, Some of Which Charge a Nominal Or No Fee for Access

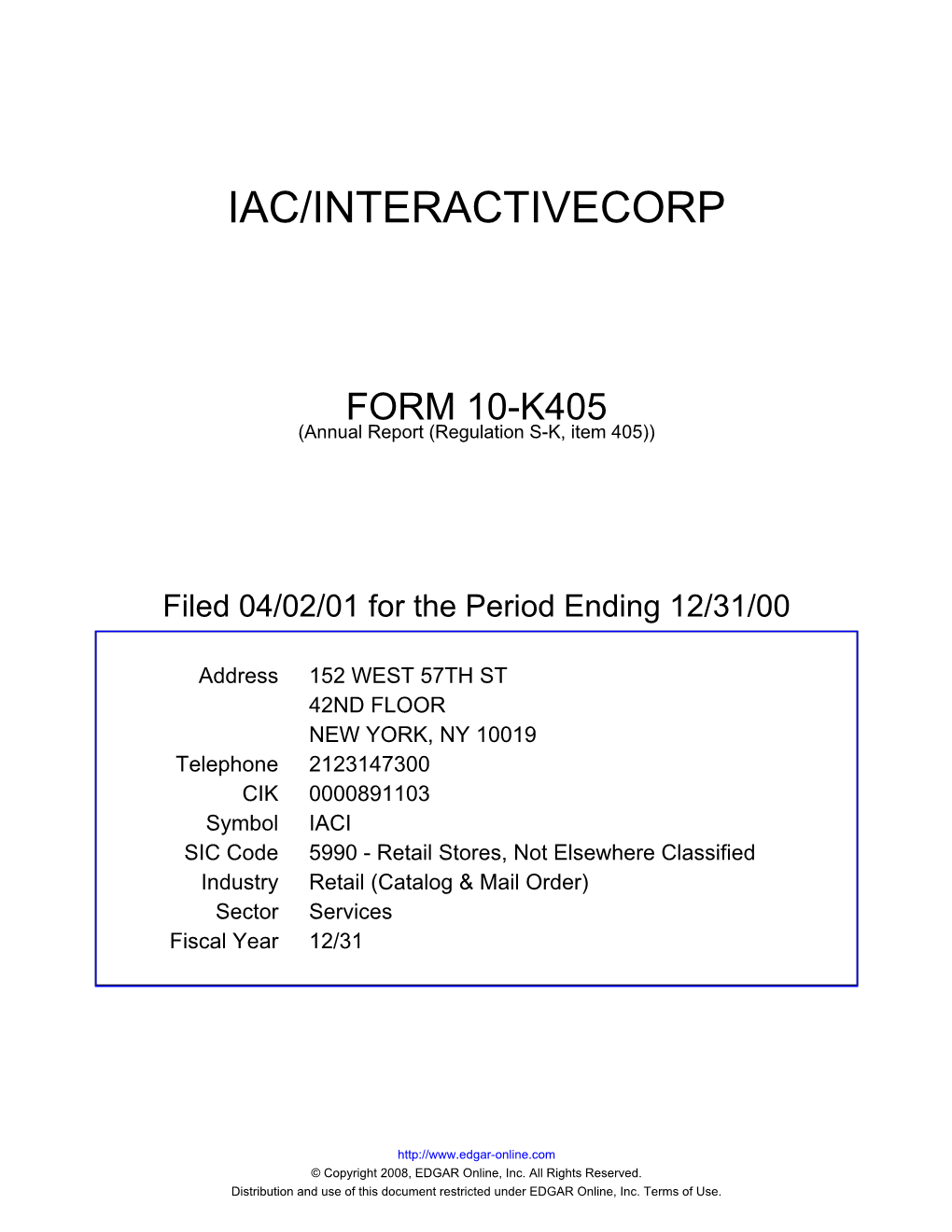

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission file number 001-32871 COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 27-0000798 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) One Comcast Center, Philadelphia, PA 19103-2838 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (215) 286-1700 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Name of Each Exchange on which Registered Class A Common Stock, $0.01 par value NASDAQ Global Select Market Class A Special Common Stock, $0.01 par value NASDAQ Global Select Market 2.0% Exchangeable Subordinated Debentures due 2029 New York Stock Exchange 5.50% Notes due 2029 New York Stock Exchange 6.625% Notes due 2056 New York Stock Exchange 7.00% Notes due 2055 New York Stock Exchange 8.375% Guaranteed Notes due 2013 New York Stock Exchange 9.455% Guaranteed Notes due 2022 New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Federal Communications Commission Washington, D.C. 20554

Federal Communications Commission Washington, D.C. 20554 May 21, 2001 1800E1-DB DA 01-1250 Univision Communications, Inc. c/o Scott R. Flick, Esq. ShawPittman 2300 N Street, NW Washington, D.C. 20037 Re: Applications for Transfer of Control WQHS-TV, Cleveland, OH, et al. BTCCT-20010123AAL-AAX Dear Mr. Flick: This is with regard to the above-referenced applications seeking consent to the transfer of control of 13 licenses currently held by various wholly owned subsidiaries of USA Broadcasting, Inc. (USA Broadcasting), to Univision Communications, Inc. (Univision).1 On March 2, 2001, Theodore M. White, Chief Executive Officer and sole voting shareholder of Urban Broadcasting Corporation (Urban), the permittee of WTMW(TV), Arlington, Virginia, filed a petition to deny.2 USA Broadcasting has a nonvoting stock interest in and contractual relationship with Urban, the substance of which the Commission addressed in Roy M. Speer, 11 FCC Rcd 18393 (1996) (Speer III). Although Univision challenges Urban’s standing, we will consider Urban’s arguments. 47 C.F.R. §73.3587. In connection with the transaction, Univision requests a continued satellite exception pursuant to Note 5 of the television duopoly rule, 47 C.F.R. §73.3555(b), in the New York, New York DMA. 1 A complete list of the applications filed and the licenses to be transferred is attached as Exhibit A. In addition to the 13 stations Univision proposes to acquire in this proceeding, Univision will also acquire USA Broadcasting’s interests in four additional stations: WHSL(TV), East St. Louis, MO; KTVJ(TV), Boulder, CO; KPST-TV, Vallejo, CA; and WTMW(TV), Arlington, VA. -

United States Securities and Exchange Commission Form

As filed with the Securities and Exchange Commission on April 29, 2020 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K/A Amendment No. 1 ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2019 Or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from__________to__________ Commission File No. 001-37636 Match Group, Inc. (Exact name of registrant as specified in its charter) Delaware 26-4278917 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 8750 North Central Expressway, Suite 1400, Dallas, Texas 75231 (Address of Registrant’s principal executive offices and zip code) (214) 576-9352 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of exchange on which registered Common Stock, par value $0.001 MTCH The Nasdaq Global Market LLC (Nasdaq Global Select Market) Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. -

Sly Fox Buys Big, Gets Back On

17apSRtop25.qxd 4/19/01 5:19 PM Page 59 COVERSTORY Sly Fox buys big, The Top 25 gets back on top Television Groups But biggest station-group would-be Spanish-language network, Azteca America. Rank Network (rank last year) gainers reflect the rapid Meanwhile, Entravision rival Telemundo growth of Spanish-speaking has made just one deal in the past year, cre- audiences across the U.S. ating a duopoly in Los Angeles. But the 1 Fox (2) company moved up several notches on the 2 Viacom (1) By Elizabeth A. Rathbun Top 25 list as Univision swallowed USA. ending the lifting of the FCC’s owner- In the biggest deal of the past year, News 3 Paxson (3) ship cap, the major changes on Corp./Fox Television made plans to take 4 Tribune (4) PBROADCASTING & CABLE’s compila- over Chris-Craft Industries/United Tele- tion of the nation’s Top 25 TV Groups reflect vision, No. 7 on last year’s list. That deal 5 NBC (5) the rapid growth of the Spanish-speaking finally seems to be headed for federal population in the U.S. approval. 6 ABC (6) The list also reflects Industry consolidation But the divestiture 7 Univision (13) the power of the Top 25 doesn’t alter that News Percent of commercial TV stations 8 Gannett (8) groups as whole: They controlled by the top 25 TV groups Corp. returns to the control 44.5% of com- top after buying Chris- 9 Hearst-Argyle (9) mercial TV stations in Craft. This year, News the U.S., up about 7% Corp. -

AFS Year 7 Slate MASTER

AFS YEAR 7 FILM SLATE "1 AFS 2018-2019 FILM THEMES *Please note that this thematic breakdown includes documentary features, documentary shorts, animated shorts and episodic documentaries American Arts & Culture Entrepreneurism Chasing Trane! Blood, Sweat & Beer! Gentlemen of Vision! Chef Flynn! Honky Tonk Heaven: Legend of the Dealt! Broken Spoke! Ella Brennan: Commanding the Table! Jake Shimabukuro: Life on Four Strings Good Fortune! More Art Upstairs! Knife Skills! Moving Stories! New Chefs on the Block! Obit! One Hundred Thousand Beating Hearts! Restless Creature: Wendy Whelan! Human Rights Score: A Film Music Documentary! STEP! A Shot in the Dark! All-American Family! Disability Rights Bending the Arc! A Shot in the Dark! Cradle! All-American Family! Edith + Eddie! Cradle! I Am Jane Doe! Dealt! The Prosecutors! I’ll Push You! Unrest! Pick of the Litter! LGBTQI Reengineering Sam! Served Like a Girl! In A Heartbeat! Unrest! The S Word: Opening the Conversation Stumped# About Suicide! Stumped! "2 Mental Health Awareness Sports Cradle! A Shot in the Dark! Served Like a Girl! All-American Family! The S Word: Opening the Conversation Baltimore Boys! About Suicide! Born to Lead: The Sal Aunese Story! The Work! Boston: The Documentary! Unrest! Down The Fence! We Breathe Again! Run Mama Run! Skid Row Marathon! The Natural World and Space Take Every Wave: The Life of Laird A Plastic Ocean! Hamilton Above and Beyond: NASA’s Journey to STEM Tomorrow! Frans Lanting: The Evolution of Life! Bombshell: The Hedy Lamarr Story! Mosquito! Dream Big: -

Oppdatert Liste Samarbeidspartnere

OPPDATERT LISTE Banijay International Ltd Carey Films Ltd SAMARBEIDSPARTNERE Bankside Films Cargo Film & Releasing Bard Entertainment Carnaby Sales and Distribution Ltd Bardel Distribution Carrere Group D.A. 12 Yard Productions BBC Worldwide Cartoon Network 2929 Entertainment LLC BBL Distribution Inc. Cartoon One 3DD Entertainment BBP Music Publishing c/o Black Bear Caryn Mandabach Productions 9 Story Enterprises Pictures Casanova Multimedia A&E Channel Home Video Beacon Communications Cascade Films Pty Ltd Abduction Films Ltd Becker Group Ltd. Castle Hill Productions Acacia Beijing Asian Union Culture and Media Cats and Docs SAS ACC Action Concept Cinema GmbH & Investment CCI Releasing Co. KG Bejuba Entertainment CDR Communications ACI Bell Phillip Television Productions Inc. Celador Productions Acorn Group Benaroya Pictures Celestial Filmed Entertainment Ltd. ACORN GROUP INC Bend it Like Beckham Productions Celluloid Dreams Acorn Media Bentley Productions Celsius Entertainment Actaeon Films Berlin Animation Film Gmbh Celsius Film Sales Action Concept Best Film and Video Central Independent Television Action Concept Film und Best Picture Show Central Park Media Stuntproduktion GmbH Betty TV Channel 4 Learning Action Image GmbH & Co. KG Beyond International Ltd Chapter 2 Adness Entertainment Co. Ltd. Big Bright House of Tunes Chatsworth Enterprises Adult Swim Productions Big Idea Entertainment Children's Film And Television After Dark Films Big Light Productions Foundation Ager Film Big Talk Productions Chorion Plc AIM Group LLC. Billy Graham Evangelistic Association / Christian Television Association Akkord Film Produktion GmBH World Wide Pictures Ciby 2000 Alain Siritzky Productions Bio Channel Cineflix International Media Alameda Films BKN International Ltd. Cinema Seven Productions Albachiara S.r.l. Blakeway Productions Cinematheque Collection Alcine Pictures Ltd. -

Estta971455 05/05/2019 in the United States Patent And

Trademark Trial and Appeal Board Electronic Filing System. http://estta.uspto.gov ESTTA Tracking number: ESTTA971455 Filing date: 05/05/2019 IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD Proceeding 91230917 Party Defendant RLP Ventures, LLC Correspondence RLP VENTURES LLC Address PO BOX 2605 NEW YORK, NY 10108-2605 UNITED STATES [email protected] no phone number provided Submission Other Motions/Papers Filer's Name Ramona Prioleau Filer's email [email protected] Signature /Ramona Prioleau/ Date 05/05/2019 Attachments Opposition to Motion and Cross-Motions.pdf(239948 bytes ) Declaration Exhibits.pdf(5761623 bytes ) IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD MATCH GROUP, LLC (successor-in- interest to TINDER, INC.) Opposer, Opposition No. 91230917 v. RLP VENTURES, LLC Applicant. OPPOSITION TO MOTION FOR PROTECTIVE ORDER AND CROSS- MOTIONS TO COMPEL DEPOSITIONS AND EXTEND TESTIMONY PERIOD I. INTRODUCTION Applicant RLP Ventures, LLC (“Applicant”) hereby responds to and opposes the Motion for Protective Order of Match Group, LLC (“Opposer”). Applicant opposes the Motion for Protective Order on the grounds that Opposer: (i) lacks standing to make a motion on behalf of the individuals noticed for deposition; (ii) a motion for a protective order is an improper response to a notice of testimonial deposition under Trademark Trial and Appeal Board Manual of Procedure (“TBMP”) §§ 521 and 526; and (iii) the Opposer has provided misleading information in its motion for protective order. As a general matter, Applicant opposes the Motion for Protective Order also on the grounds that Applicant’s Notices of Deposition (i) are clear; (ii) seek clearly relevant information, that is tied to the specific grounds for opposition asserted by Opposer; and (iii) are not intended to harass the individuals noticed for deposition. -

Yelp Will Continue to Dominate Online Review Market

INITIAL REPORT Susan Jennings Kantari, [email protected] Yelp Will Continue to Dominate Online Review Market Companies: ANGI, FB, GOOG, GRPN, IACI, OPEN, RLOC, TRIP, YELP, YHOO June 20, 2013 Research Question: Will a focus on mobile advertising, nontraditional review areas, and international expansion allow Yelp to continue its growth through the remainder of 2013 despite a rise in competition? Summary of Findings Silo Summaries 1) BUSINESSES USING YELP Yelp Inc. (YELP) will continue to post growth Yelp will continue to grow throughout the rest of 2013, according to the through the remainder of this year because it six of 10 sources who commented on the company’s future, and will faces little immediate competition in the growing remain the market’s dominant player, according to five. Six sources were market of online reviews. Google Inc. (GOOG) familiar with Yelp’s mobile app and use it to check reviews and analytics. poses the greatest threat to Yelp, but must Seven of the 10 sources said Yelp lacks a significant near-term threat. improve its updates and customer service. The remaining three said Google will be an issue, including one source who said Google already has taken some of Yelp’s share. Three sources Facebook Inc. (FB) lacks content. reported having difficulty in understanding Yelp’s review filtering Seventeen of 19 sources who commented on algorithms, but four others said the filter was reliable. Yelp could stand to Yelp’s future foresee growth for the company. improve its social engagement capabilities, to give business owners the One Yelp reviewer said growth will depend on the power to filter reviews, and to provide better customer service and a more transparent filtering system. -

Codes Used in D&M

CODES USED IN D&M - MCPS A DISTRIBUTIONS D&M Code D&M Name Category Further details Source Type Code Source Type Name Z98 UK/Ireland Commercial International 2 20 South African (SAMRO) General & Broadcasting (TV only) International 3 Overseas 21 Australian (APRA) General & Broadcasting International 3 Overseas 36 USA (BMI) General & Broadcasting International 3 Overseas 38 USA (SESAC) Broadcasting International 3 Overseas 39 USA (ASCAP) General & Broadcasting International 3 Overseas 47 Japanese (JASRAC) General & Broadcasting International 3 Overseas 48 Israeli (ACUM) General & Broadcasting International 3 Overseas 048M Norway (NCB) International 3 Overseas 049M Algeria (ONDA) International 3 Overseas 58 Bulgarian (MUSICAUTOR) General & Broadcasting International 3 Overseas 62 Russian (RAO) General & Broadcasting International 3 Overseas 74 Austrian (AKM) General & Broadcasting International 3 Overseas 75 Belgian (SABAM) General & Broadcasting International 3 Overseas 79 Hungarian (ARTISJUS) General & Broadcasting International 3 Overseas 80 Danish (KODA) General & Broadcasting International 3 Overseas 81 Netherlands (BUMA) General & Broadcasting International 3 Overseas 83 Finnish (TEOSTO) General & Broadcasting International 3 Overseas 84 French (SACEM) General & Broadcasting International 3 Overseas 85 German (GEMA) General & Broadcasting International 3 Overseas 86 Hong Kong (CASH) General & Broadcasting International 3 Overseas 87 Italian (SIAE) General & Broadcasting International 3 Overseas 88 Mexican (SACM) General & Broadcasting -

View Annual Report

Annual REPORT 2000 50 Years of MEXICAN TELEVISION Televisa celebrates five decades of providing entertainment and informing the public of all ages, with telenovelas, newscast, programs for children, musicals, games shows and sitcoms. Being a principal player in the history of Mexi- can television, Televisa forms part of the past and present reaching different generations, establishing itself as a leader in entertainment and information in the Spanish speaking world. Achievements 2000 In the past three years, Grupo Televisa has surpassed the goals of “Televisa 2000”: • The cost reduction program exceeded US $200 million. • Television audience market share increased from 67% to 75% in National Sign-on to Sign-off. • The DTH platform was successful; SKY is the leader in Mexico with more than a 70% market share. • Grupo Televisa’s EBITDA margin increased from 18% to 29% in three years. Grupo Televisa intends to capitalize on its position as the leading media company in the Spanish-speaking world and Mexico’s dominant advertising medium achieve earnings growth and increase shareholder value. 1 2000 was a landmark year for Grupo Televisa. It marked the successful comple- tion of a three year plan to increase our television audience market share, implement efficient business practices, launch our Direct-to-Home (DTH) venture, and increase our consolidated EBITDA margin. I am proud to announce to our shareholders that we have been successful on all fronts, further solidifying Grupo Televisa’s position as the leading company in the Spanish-speaking world. Today, Grupo Televisa is a more efficient company. Our market share of the television audience has increased from 67% to 75%. -

Robert A. Darwell

Robert A. Darwell Partner T: +1.310.228.3740 1901 Avenue of the Stars C: +1.310.925.0865 Suite 1600 F: +1.310.228.3999 Los Angeles, CA 90067 [email protected] Robert Darwell is a senior partner in the Entertainment and Digital Media Practice Group in the firm's Century City office. Areas of Practice 2021 has proven to be another banner year for Darwell and his team. Darwell represented Hemisphere Media Group in connection with its acquisition of Lionsgate’s 75% interest in the Spanish language SVOD platform Pantaya and distribution company Pantelion. Following that deal, Darwell and his colleagues represented Amazon in connection with its acquisition of MGM, Amazon’s second largest acquisition in history. The team worked tirelessly to analyze and diligence the treasured MGM library and studio assets. On top of that, Darwell also guided Amazon Studios in connection with numerous television and motion picture projects, including the 2021 Cannes Film winners “A Hero” (Grand Prix) and “Annette”, which opened the Festival and with won Best Director for Leos Carax. Over the course of Darwell's legal career, he’s worked on the development, finance, production and distribution of hundreds of motion pictures and television productions (including personal favorites such as “Traffic”, “Brokeback Mountain”, and “Eternal Sunshine of the Spotless Mind”). In addition, he regularly handles major newsworthy deals such as Disney’s termination of Bob and Harvey Weinstein (which garnered him the prestigious CLAY Award as California Entertainment Lawyer of the Year for Entertainment) and Disney’s subsequent sale of Miramax. Darwell also acted as lead entertainment counsel to Comcast in connection with its acquisition of NBC Universal.