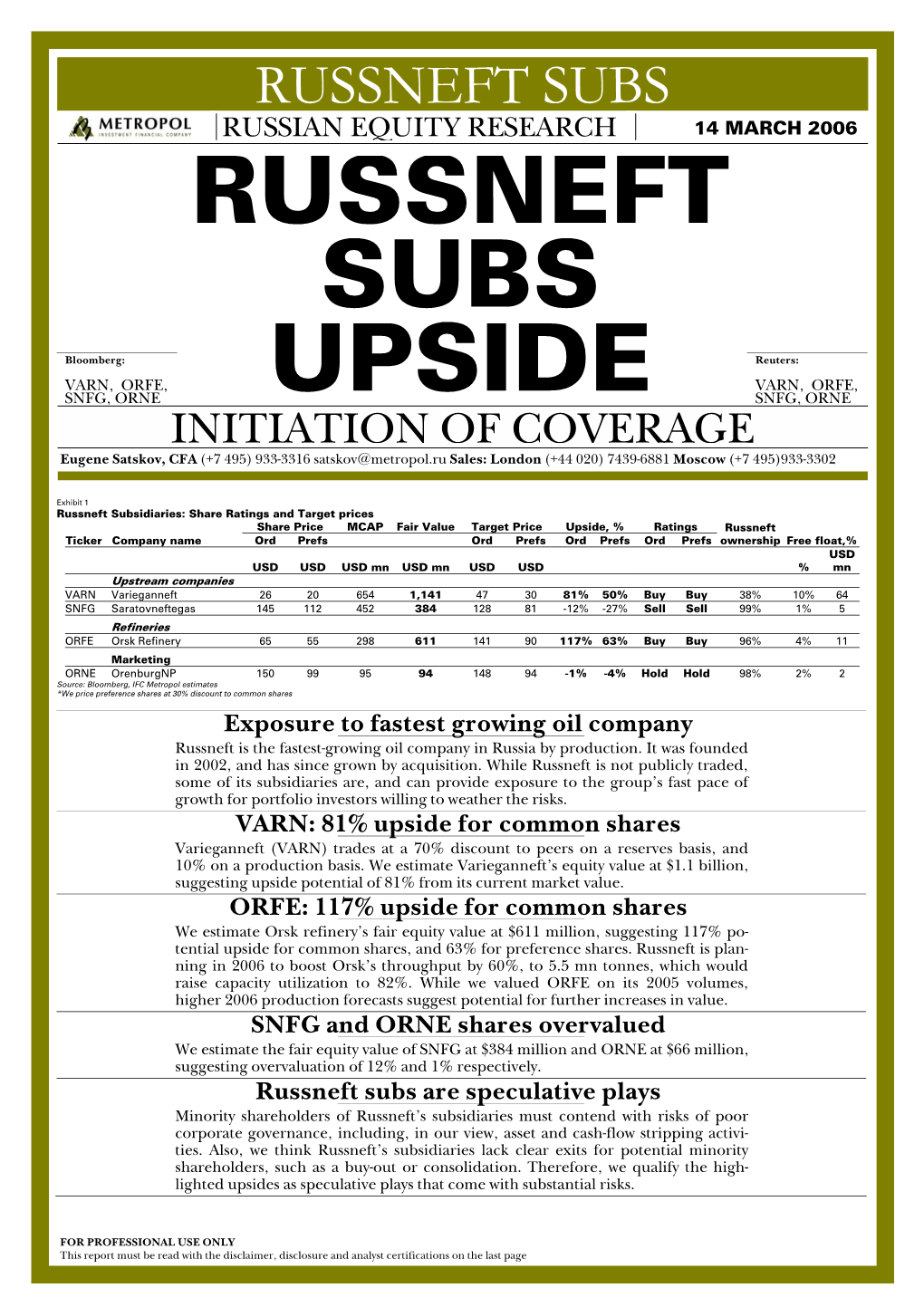

Russneft Subs Upside

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

Possible Future of Russian and CIS Oil Production

Possible future of Russian and CIS oil production Vladimir Milov President, Institute of Energy Policy (http://www.energypolicy.ru) Paris, OECD, June 23rd, 2006 Oil output in Russia: where we are and where we could have been 10 9 Possible (IEP estimate) Actual 8 7 Dec.2002 Source: Oil & Capital, Instit Feb.2003 Apr.2003 Average daily crude oil production in Russia, million Jun.2003 barrels a day Aug.2003 Oct.2003 Dec.2003 ute of Energy Policy estimate Feb.2004 Apr.2004 Jun.2004 Aug.2004 Oct.2004 Dec.2004 Feb.2005 Apr.2005 Jun.2005 Aug.2005 Oct.2005 Dec.2005 Feb.2006 If not the political interference, Russian crude oil output could have reached 10 million barrels a day already. Shift in investments in 2003-2004: from domestic production development to foreign countries Capital investments of the Capex in Russian oil production Russian oil producing companies 12 sector in 2000-2004 10,3 10 Foreign investments of Russian oil producing companies 9 8 8 8 6,45 6,3 6 4,9 4,6 4,7 4 billion USD, money of the day 2 0,1 0 2000 2001 2002 2003 2004 Source: RosStat What’s the reason behind slowdown of crude oil production growth? • Hostile ownership changes • Increase of oil export taxes in 2004 • Ban over private oil pipeline Western Siberia- Murmansk and remaining oil export pipeline bottleneck • Speculation on ‘barbaric production practices’ • The Yukos case Production profiles of the Russian oil producing companies 120% 110% 100% 90% 80% 70% TNK-BP 60% Average daily oil production by companies, % to September 2004Tomskneft Sep.04 Source: Oil & Capital -

Reiderstvo: Asset-Grabbing in Russia

Russia and Eurasia PP 2014/03 Reiderstvo: Asset-Grabbing in Russia Philip Hanson Chatham House and University of Birmingham March 2014 The views expressed in this document are the sole responsibility of the author(s) and do not necessarily reflect the view of Chatham House, its staff, associates or Council. Chatham House is independent and owes no allegiance to any government or to any political body. It does not take institutional positions on policy issues. This document is issued on the understanding that if any extract is used, the author(s)/ speaker(s) and Chatham House should be credited, preferably with the date of the publication or details of the event. Where this document refers to or reports statements made by speakers at an event every effort has been made to provide a fair representation of their views and opinions, but the ultimate responsibility for accuracy lies with this document’s author(s). The published text of speeches and presentations may differ from delivery. Reiderstvo: Asset-Grabbing In Russia SUMMARY POINTS • The illicit acquisition of a business or part of a business in Russia (known as reiderstvo or asset-grabbing) is widespread and one of the risks of doing business there. • The common ingredients of reiderstvo are the complicity of any or all of the tax, security, law-enforcement and judicial authorities, and the use of charges that are either freely invented or examples of the highly selective use of accusations that could have been levelled at many other business people but were not. • Reiderstvo is made possible by corruption and contributes to market-entry barriers and the insufficient restructuring of incumbent firms. -

Kerjasama Rusia - Arab Saudi Di Bidang Energi Minyak

eJournal Ilmu Hubungan Internasional, 2017, 5 (3) 965-978 ISSN 2477-2623 (online), ISSN 2477-2615 (print), ejournal.hi.fisip-unmul.ac.id © Copyright 2016 KERJASAMA RUSIA - ARAB SAUDI DI BIDANG ENERGI MINYAK Achmad Salim1 Nim. 1002045113 Abstract The Freezing Oil program is an effort between Russia and Saudi Arabia to stabilize oil prices in the global market through a process of production restrictions in order to stabilize oil prices in the market. This research aims to explain the cooperation of Russia and Saudi Arabia in the field of energy oil based on the Joint Statement on Oil Market Cooperation 2016. The results of the research show that the implementation of the Freezing Oil program through a production restriction process undertaken by Russia and Saudi Arabia is both countries agreed to both limit production, it proved successful can increase the price of oil in the global market with the results of stable oil prices In the range of US $ 50 barrels. Type of research used is descriptive, The data presented is secondary data. The theory used is International Cooperation. Keywords : energy cooperation, Joint Statement on Oil Market Cooperation 2016, Russia, Saudi Arabia. Pendahuluan Rusia merupakan salah satu negara yang memiliki sumber daya alam berupa minyak dan gas bumi yang cukup besar. Menurut data Rosneft, pada September 2014, cadangan minyak Rusia mencapai 130m3 juta ton dan gas mencapai 396m3 juta (https://www.rosneft.com). Selain itu, pada tahun 2015, produk hasil olahan minyak dan gas Rusia menyumbang 63% dari total komoditas yang diekspornya. Bahkan di tahun yang sama, Rusia menempati peringkat ke-2 negara penghasil minyak dunia dengan persentasi sekitar 11% produksi minyak dunia dengan devisa sekitar US $86.2 juta dibawah Arab Saudi dengan 16% produksi minyak mentah dunia (http://www.worldstopexports.com) Hal ini membuktikan bahwa Rusia sangat bergantung pada komoditas minyak dan gas sebagai penghasil devisa negaranya. -

M&A in Eurasian Oil and Gas Sector: a Framework

Ling Chen, Bhuvan Jain, M&A IN EURASIAN OIL AND Sunil Kurien, Daim Shah, GAS SECTOR: A FRAMEWORK Jie Shen and Ke Wei December 2011 EXECUTIVE SUMMARY High oil prices, ongoing economic liberalization and significant increases in global capital flows have opened up a host of new investment and development opportunities, especially for resource-rich countries like Russia, Azerbaijan, Turkmenistan and Kazakhstan. Given their heavy economic dependence on revenues from energy exports, both privately owned and national oil and gas companies (NOCs) of these countries are looking to expand by actively seeking mergers & acquisitions (M&A) opportunities globally. This paper analyzes the scope for outbound M&A transactions by energy companies in the Eurasian region, in particular investments aimed at establishing a market presence in North America and Europe. This analysis is performed through the development of an M&A framework that gauges the likelihood of future outbound activities, focusing on large oil and gas companies in Russia, Kazakhstan and Azerbaijan. The framework identifies 6 key factors that play a vital role in any M&A decision and execution. To account for their differing level of importance in the deal-making process, each criterion is allocated a different weight. The first necessary condition is the availability of financial resources, which is assigned a 20% weight. Possible synergies (20%), which underline the rationale for pursuing some opportunities over others, provide clues as to the areas in which hydrocarbon companies from the CIS will invest. Outbound M&A transactions are also affected by political risk (10%) and a company’s prior experience, captured in terms of past acquisitions (5%). -

The London School of Economics and Political Science State-Led Coercive Takeovers in Putin's Russia: Explaining the Underlying

The London School of Economics and Political Science State-led coercive takeovers in Putin’s Russia: explaining the underlying motives and ownership outcomes Andrew Yorke A thesis submitted to the Department of Government at the London School of Economics and Political Science for the degree of Doctor of Philosophy, London, April 2014 Declaration I certify that the thesis I have presented for examination for the MPhil/PhD degree of the London School of Economics and Political Science is solely my own work other than where I have clearly indicated that it is the work of others (in which case the extent of any work carried out jointly by me and any other person is clearly identified in it). The copyright of this thesis rests with the author. Quotation from it is permitted, provided that full acknowledgement is made. This thesis may not be reproduced without my prior written consent. I warrant that this authorisation does not, to the best of my belief, infringe the rights of any third party. Abstract Since Vladimir Putin first became Russia’s President in 2000, the state has played an increasingly active and interventionist role in the economy, including through its involvement in a large number of coercive takeovers of privately-owned businesses. The best known case is the Yukos affair, but there have been many other, less prominent takeovers. These have largely been explained as predatory acts by state officials seeking to enrich themselves or increase their power. This has contributed to the perception that Putin’s Russia is a kleptocracy, with the state given free rein to engage in economically-destructive attacks on property rights. -

View Annual Report

‘09 JSC GAZPROM NEFT ANNUAL REPORT 2009 ENERGY FOR LIFE ENERGY FOR PEOPLE JSC GAZPROM NEFT ANNUAL REPORT 2009 CONtENts 2 1. MESSAGE TO SHAREHOLDERS 110 11. ENVIRONMENT, ENERGY SAVING, INNOVATION 8 2. KEY PERFORMANCE INDICATORS 122 12. SOCIAL POLICY 124 PERSONNEL, OCCUPATIONAL SAFETY AND 10 3. 2009 HIGHLIGHTS HEALTH 16 4. COMPANY’S PROFILE 128 13. TO SHAREHOLDERS AND INVESTORS 18 COMPANY’S HISTORY 130 AUTHORIZED CAPITAL, SHAREHOLDER CAPITAL 19 COMPANY’S STRUCTURE STRUCTURE 20 GEOGRAPHY OF OPERATIONS 130 STOCK MARKET AND CAPITALIZATION 30 HIGHLIGHTS OF THE YEAR 132 PARTICIPATION IN THE DEPOSITARY RECEIPT 32 COMPETITIVE STATE OF THE COMPANY PROGRAM 134 DIVIDEND HISTORY 36 5. KEY PERFORMANCE INDICATORS OF THE COM- 135 OBSERVING THE CORPORATE CODE OF CON- PANY IN 2009 BY TYPE OF OPERATION DUCT 38 OIL AND GAS EXPLORATION AND PRODUCTION 40 RESOURCE BASE 138 14. MAJOR TRANSACTIONS AND RELATED PARTY 40 EXPLORATION TRANSACTIONS 41 LICENSING 42 HYDROCARBON PRODUCTION 144 15. ASSET MANAGEMENT AND IMPROVEMENT OF 44 REFINERIES & MARKETING REGIONS CORPORATE STRUCTURE 46 REFINING 48 PRODUCTION OF PETROLEUM PRODUCTS 148 16. CREDIT RATINGS AND DEBT PORTFOLIO MAN- 52 PREMIUM BUSINESS SEGMENTS AGEMENT 54 6. COMPANY’S GROWTH PROSPECTS 154 17. GLOSSARY OF KEY TERMS AND DEFINITIONS 60 7. INVESTMENT: TECHNICAL REEQUIPMENT AND 156 18. ADDRESSES AND CONTACTS DEVELOPMENT OF THE COMPANY 64 8. PERFORMANCE AND FINANCIAL INDICATORS 66 PERFORMANCE AND FINANCIAL INDICATORS 70 Management’S DISCUSSION AND Analysis OF FINANCIAL CONDITION AND Results OF Operations FOR 2009, 2008 AND 2007 86 9. MAJOR RISK FACTORS 94 10. Corporate Governance 102 BOARD OF DIRECTORS’ ACTIVITIES IN 2009 104 MEMBERSHIP OF THE MANAGEMENT BOARD 108 TOTAL AMOUNT OF REMUNERATION TO MEM- BERS OF THE BOARD OF DIRECTORS AND MANAGEMENT BOARD 1 JSC GAZPROM NEFT ANNUAL REPORT 2009 Dear Shareholders The oil business of Gazprom Group has successfully overcome the 2009 crisis. -

The Future of Russian Oil Production in the Short, Medium, and Long Term

September 2019 The Future of Russian Oil Production in the Short, Medium, and Long Term Introduction This paper has two major goals. The first is to update reports published by the Oxford Institute for Energy Studies in April 2015 and February 2017 which both assessed the short-term outlook for Russian oil production in the light of sanctions and the first OPEC+ agreement which committed Russia to a production cut of 300,000 bpd from January 2017. Both these papers argued that, despite the impact of sanctions on the financing of the Russian oil sector and the availability of international technology in some spheres (most specifically offshore, the Arctic, and shale oil), the immediate impact on Russian oil production would be low due to the number of new projects already under development or close to production. Indeed, it was already clear in February 2017 that the main constraint on Russian oil output in the short-term would be the low oil price and the resulting cooperation between OPEC and non-OPEC producers to constrain production in order to reduce the oversupply of oil in the global market. As will be discussed below, the initial plan for a six-month production cut by the OPEC+ group was ultimately extended to 18 months, and then after only a six-month period of increased output a new agreement was put into place at the start of 2019. As a result, the full potential of Russian production has yet to be proven, with the Russian oil companies remaining frustrated at the necessity of holding back new fields and restraining production at many existing assets. -

Russia Sanctions Update – Us / Eu (& Uk) Overview

RUSSIA SANCTIONS UPDATE – US / EU (& UK) OVERVIEW & RUSSIAN COUNTERSANCTIONS as of 8 July 2021 © 2018 Morgan, Lewis & Bockius LLP CONTENTS • What’s Newest …………………………………………………....... 5 • Basic Framework – US/EU/UK..…………………....................... 14 • US Sectoral Sanctions – OFAC ..……………………………...…17 • US Sectoral Sanctions – BIS ………………………………..….. 25 • US Direct Sanctions – SDNs …………………………………..... 33 • US Crimea Sanctions ……………………………………..…...... 47 • CAATSA / Guidances / Lists …………………………................ 48 • Export Pipeline Sanctions.…………………………………………62 • CBW Act Sanctions …………………………………………..….. 63 • Proposed Further US Laws……………………………………..... 69 • EU Sectoral Sanctions ……………………………….…………... 71 • EU Crimea Sanctions …………………………………………..... 82 • EU Direct Sanctions (SDN-like, etc.) …………………………….83 • UK Sanctions (post-Brexit)…………………………………………84 • Russia’s Countersanctions……………………………………...... 86 Our International Trade / Sanctions Team DUBAI Rebecca Kelly Partner / +971.4.312.1830 [email protected] SHANGHAI Todd Liao Partner / +86.21.8022.8799 [email protected] SINGAPORE Wendy Tan Partner / +65.6389.3078 [email protected] 3 Important Notes: This is only a summary-style slide presentation, provided as general information to clients and friends of Morgan, Lewis & Bockius LLP. It should not be construed as, and does not constitute, legal advice on any specific matter or set of facts (nor does it create an attorney-client relationship). The Russia sanctions regime is quite complex. Many of its provisions overlap with one another, and are otherwise subject to varying interpretations and application. Thus, legal advice should be sought for each specific situation. (Even official FAQs or other “guidelines” published by the relevant government agencies are subject to change or withdrawal – and are, in any event, alone neither dispositive or sufficient for pursuing a particular course of action.) We have made reasonable efforts to assure that this presentation is current up to the day before the date appearing on the cover page. -

Russia Intelligence

RIA60 30/08/07 9:34 Page 1 N°60 - August 30 2007 Published every two weeks / International Edition CONTENTS KREMLIN c P. 1-2 Politics & Government A new season marked by « low blows » KREMLIN Time seems to have accelerated in Moscow since a few days and the “post Putin” manoeuvres c A new season marked by have gotten off to a flying start even before the end of the vacations. On the side of the media close « low blows » to the Kremlin, the progressive and powerful ascendancy of Sergey Ivanov is being orchestrated, FOCUS to the point that it is in fashion to now consider him as the “successor” in the face of a Dmitry c Sergey Naryshkin Medvedev who has never really been convincing or taken on the profile of a future Russian leader. reinforces his positions But on the sidelines the blows are coming in low. Such as the attempts to gain control of Russ- neft, the 10th petroleum company of the country, controlled by Mikhail Gutseriev, of which we P. 3-7 Business & Networks have often spoken in these columns (Russia Intelligence n°56 of May 31 2007).At the beginning ENERGY of the summer, Oleg Deripaska and Mikhail Gutseriev, constrained and forced, reached an accord c Gazprom’s new targets so that the group Base Element buys Russneft for a little more than 3 billion dollars (or a price BEHIND THE SCENE inferior to all the evaluations, which ranged between 6 and 8 billion), with the approval of Vladimir c Total’s Russian idyll Putin. -

Russia: Business and State

’Ifri ’Ifri _____________________________________________________________________ Russia: Business and State _____________________________________________________________________ Igor Bunin, Alexey Makarkin November 2015 . Russia/NIS Center Ifri is a research center and a forum for debate on major international political and economic issues. Headed by Thierry de Montbrial since its founding in 1979, Ifri is a non-governmental and a non-profit organization. As an independent think tank, Ifri sets its own research agenda, publishing its findings regularly for a global audience. With offices in Paris and Brussels, Ifri stands out as one of the rare French think tanks to have positioned itself at the very heart of European debate. Using an interdisciplinary approach, Ifri brings together political and economic decision-makers, researchers and interna tionally renowned experts to animate its debates and research activities. The opinions expressed in this article are the authors’ alone and do not reflect the official views of their institutions. ISBN : 978-2-36567-475-1 © All rights reserved, Ifri, 2015 Ifri Ifri-Bruxelles 27, rue de la Procession Rue Marie-Thérèse, 21 75740 Paris Cedex 15 – FRANCE 1000 – Bruxelles – BELGIQUE Tél. : +33 (0)1 40 61 60 00 Tél. : +32 (0)2 238 51 10 Fax : +33 (0)1 40 61 60 60 Fax : +32 (0)2 238 51 15 Email : [email protected] Email : [email protected] Website : Ifri.org Russie.Nei.Visions Russie.Nei.Visions is an online collection of articles dedicated to Russia and the other new independent states (Belarus, Ukraine, Moldova, Armenia, Georgia, Azerbaijan, Kazakhstan, Uzbekistan, Turkmenistan, Tajikistan and Kyrgyzstan). Written by leading experts, these policy-oriented papers deal with strategic, political and economic issues. -

Oil Market Effects from U.S. Economic Sanctions: Iran, Russia, Venezuela

Oil Market Effects from U.S. Economic Sanctions: Iran, Russia, Venezuela February 5, 2020 Congressional Research Service https://crsreports.congress.gov R46213 SUMMARY R46213 Oil Market Effects from U.S. Economic February 5, 2020 Sanctions: Iran, Russia, Venezuela Phillip Brown Economic sanctions imposed by the United States—through enacted legislation and executive Specialist in Energy Policy action—on Iran, Russia, and Venezuela aim to pressure the ruling governments to change their behavior and policies. Currently, these sanctions aim to either eliminate (Iran) or restrict (Venezuela) crude oil trade of as much as 3.3 million to 4.0 million barrels per day (bpd), roughly 3%-4% of global petroleum supply. Estimated oil production volumes affected to date have been approximately 1.7 million bpd from Iran. Venezuela oil production has also likely been affected, although accurately quantifying volumes is difficult due to monthly oil production declines over a period of years prior to U.S. sanctions affecting oil trade in January 2019. Sanctions imposed on Russia’s oil sector generally target longer-term oil production and to date have not reduced Russian oil supply or trade. Oil production in Russia has increased since oil-sector sanctions began in 2014, although the country has arguably incurred economic costs in order to incentivize and support oil output levels. Sanctions targeting Iran’s oil sector date back to the 1980s and affect virtually every element of Iran’s oil sector (e.g., investment, shipping, insurance, and exports). Legislation enacted in 2011 (P.L. 112-81) and 2013 (P.L. 112-239), along with subsequent executive orders (E.O.s), created a sanctions framework designed to discourage oil importers—by sanctioning banks that transact with Iran or facilitate oil transactions, as well as entities that buy Iranian oil—from purchasing crude oil and other petroleum and petrochemical products from Iran.