Energy Usage in Supermarkets - Modelling and Field Measurements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Supermarkets in India: Struggles Over the Organization of Agricultural Markets and Food Supply Chains

\\jciprod01\productn\M\MIA\68-1\MIA109.txt unknown Seq: 1 12-NOV-13 14:58 Supermarkets in India: Struggles over the Organization of Agricultural Markets and Food Supply Chains AMY J. COHEN* This article analyzes the conflicts and distributional effects of efforts to restructure food supply chains in India. Specifically, it examines how large retail corporations are presently attempting to transform how fresh produce is produced and distributed in the “new” India—and efforts by policymakers, farmers, and traders to resist these changes. It explores these conflicts in West Bengal, a state that has been especially hostile to supermarket chains. Via an ethnographic study of small pro- ducers, traders, corporate leaders, and policymakers in the state, the article illustrates what food systems, and the legal and extralegal rules that govern them, reveal about the organization of markets and the increasingly large-scale concentration of private capital taking place in India and elsewhere in the developing world. INTRODUCTION .............................................................. 20 R I. ON THE RISE OF SUPERMARKETS IN THE WEST ............................ 24 R II. INDIA AND THE GLOBAL SPREAD OF SUPERMARKETS ....................... 29 R III. LAND, LAW, AND AGRICULTURAL MARKETS IN WEST BENGAL .............. 40 R A. Land Reform, Finance Capital, and Agricultural Marketing Law ........ 40 R B. Siliguri Regulated Market ......................................... 47 R C. Kolay Market ................................................... 53 R D. -

Retail Food Sector Retail Foods France

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 9/13/2012 GAIN Report Number: FR9608 France Retail Foods Retail Food Sector Approved By: Lashonda McLeod Agricultural Attaché Prepared By: Laurent J. Journo Ag Marketing Specialist Report Highlights: In 2011, consumers spent approximately 13 percent of their budget on food and beverage purchases. Approximately 70 percent of household food purchases were made in hyper/supermarkets, and hard discounters. As a result of the economic situation in France, consumers are now paying more attention to prices. This situation is likely to continue in 2012 and 2013. Post: Paris Author Defined: Average exchange rate used in this report, unless otherwise specified: Calendar Year 2009: US Dollar 1 = 0.72 Euros Calendar Year 2010: US Dollar 1 = 0.75 Euros Calendar Year 2011: US Dollar 1 = 0.72 Euros (Source: The Federal Bank of New York and/or the International Monetary Fund) SECTION I. MARKET SUMMARY France’s retail distribution network is diverse and sophisticated. The food retail sector is generally comprised of six types of establishments: hypermarkets, supermarkets, hard discounters, convenience, gourmet centers in department stores, and traditional outlets. (See definition Section C of this report). In 2011, sales within the first five categories represented 75 percent of the country’s retail food market, and traditional outlets, which include neighborhood and specialized food stores, represented 25 percent of the market. In 2011, the overall retail food sales in France were valued at $323.6 billion, a 3 percent increase over 2010, due to price increases. -

Décision N° 14-DCC-11 Du 28 Janvier 2014 Relative À La Prise De Contrôle Par La Société Franprix Leader Price Holding De 4

RÉPUBLIQUE FRANÇAISE Décision n° 14-DCC-11 du 28 janvier 2014 relative à la prise de contrôle par la société Franprix Leader Price Holding de 47 magasins de commerce de détail à dominante alimentaire Le Mutant et de 22 fonds de commerce de boucherie L’Autorité de la concurrence, Vu le dossier de notification adressé complet au service des concentrations le 11 décembre 2013, relatif à la prise de contrôle de 47 magasins de commerce de détail à dominante alimentaire et de 22 fonds de commerce de boucherie par la société Franprix Leader Price Holding (« FLPH »), formalisée par un protocole d’accord conclu le 25 octobre 2013 ; Vu le livre IV du code de commerce relatif à la liberté des prix et de la concurrence, et notamment ses articles L. 430-1 à L. 430-7 ; Vu les engagements présentés le 14 janvier 2014 par la partie notifiante ; Vu les éléments complémentaires transmis par les parties au cours de l’instruction ; Adopte la décision suivante : I. Les entreprises concernées et l’opération 1. La société Franprix Leader Price Holding (ci-après « FPLPH ») est une filiale du groupe Casino Guichard Perrachon (ci-après « Casino »), dont le principal objet est la prise de participation dans des sociétés exploitant des magasins sous les enseignes Franprix et Leader Price. Le groupe Casino, troisième acteur français du secteur de la distribution à dominante alimentaire, gère un parc de plus de 12 000 magasins dans le monde (hypermarchés, supermarchés, magasins de proximité, magasins discompteurs) sous les enseignes notamment Géant Casino, Franprix, Casino Supermarché, Petit Casino, Casino Shop, Casino Shopping, Spar, Vival, Monoprix et Leader Price. -

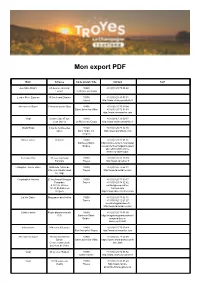

Mon Export PDF

Mon export PDF Nom Adresse Code postal / Ville Contact Tarif Aux Mille Affair's 67 Avenue Général 10440 +33 (0)3 25 75 08 62 Leclerc La Rivière-de-Corps Leader Price Express 30 Boulevard Danton 10000 +33 (0)3 25 80 03 31 Troyes http://www.casino-proximite.fr Intermarché Super 23 boulevard de Dijon 10800 +33 (0)3 25 75 39 94 Saint-Julien-les-Villas +33 (0)3 25 72 93 33 http://www.intermarche.com Vival Centre Cial, 47 rue 10440 +33 (0)9 67 33 60 17 Jean Jaurès La Rivière-de-Corps http://www.casino-proximite.fr Grand Frais 3 rue de l'entrée des 10120 +33 (0)3 25 78 32 35 antes Saint-André-les- http://www.grandfrais.com Vergers Brico Leclerc RD 619 10600 +33 (0)3 25 72 51 51 Barberey-Saint- http://www.e-leclerc.com/st-par Sulpice res-aux-tertres/magasins-speci alises/brico/info--brico- barberey-saint-sulpic Carrefour City 37, rue Raymond 10000 +33 (0)3 25 81 10 79 Poincaré Troyes http://www.carrefour.fr L'Angélus - La vie claire Halles de l'Hôtel de 10000 +33 (0)3 25 73 62 11 Ville, rue Claude Huez Troyes http://www.lavieclaire.com/ 1er étage Coopérative Hermès 23 boulevard Georges 10000 +33 (0)3 25 73 39 17 Pompidou Troyes +33 (0)3 25 78 32 82 & 127 av. Wilson contact@cooperative- 10120 St André les hermes.com Vergers http://cooperative-hermes.com La Vie Claire Mezzanine des Halles 10000 +33 (0)3 25 73 62 11 Troyes +33 (0)9 62 12 21 27 [email protected] http://www.lavieclaire.com/ Géant Casino Route départementale 10600 +33 (0)3 25 71 54 00 619 Barberey-Saint- http://magasins.geantcasino.fr/ Sulpice magasin/troyes- barberey/CG201 Intermarché -

FRENCH MARKET PRESENTATION for : FEVIA from : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19Th June, 2014

FRENCH MARKET PRESENTATION For : FEVIA From : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19th June, 2014 FEVIA 1 I. GREEN SEED GROUP : WHO WE ARE II. MARKET BACKGROUND AND CONSUMER TRENDS III. THE FRENCH RETAIL SECTOR IV. KEY RETAILERS PROFILES V. FOODSERVICE VI. KEY LEARNINGS VII. CASE STUDIES FEVIA 2 Green Seed Group Having 25 years of experience, the Green Seed Group is a unique international network of 11 offices in Europe, North America and Australia, specializing in the food & beverage sector OUR MISSION Advise both French and foreign food and beverage companies or marketing boards, on how to develop a sustainable and profitable position abroad Green Seed France help you to develop your activity in France using our in-depth knowledge of the local food and beverage market and our established contacts within the trade FEVIA 3 A growing and unique international network Germany (+ A, CH) The Netherlands Scandinavia U.S.A./Canada Great Britain Belgium France Portugal Spain Italy 11 offices covering 18 countries Australasia FEVIA 4 The Green Seed model Over the last decade, one of the most important trends in the French food & drink trade has been for retailers to deal with their suppliers on a direct line. Green Seed France has developed its business model around this trend. We act as business facilitators ensuring that every step of the process is managed with maximum efficiency. From first market visit, to launch as well as the ongoing relationship that follows. We offer a highly cost-effective solution of “flexible local sales and marketing management support” aimed at adding value. -

Retailing; Sales Occupations; Secondary Education; Tables (Data); *Training Methods; Training Objectives; Trend Analysis IDENTIFIERS *France

DOCUMENT RESUME ED 379 487 CE 068 311 AUTHOR Baret, Christophe; Bertrand, Olivier TITLE Training in the Retail Trade in France. Report for the FORCE Programme. First Edition. INSTITUTION Europeah Centre for the Development of Vocational Training, Berlin (Germany). REPORT NO ISBN-92-826-3012-6 PUB DATE 94 NOTE 73p.; For reports on other countries, see ED 372 241-243, CE 068 309-314, and CE 068 318. Cover title varies. AVAILABLE FROMUNIPUB, 4661-F Assembly Drive, Lanham, MD 20706-4391 (Catal "gue No. HX-56-94-344-EN-C: 8 European Currency Units). PUB TYPE Reports Research/Technical (143) EDRS PRICE MF01/PC03 Plus Postage. DESCRIPTORS Case Studies; Corporate Education; *Distributive Education; Educational Improvement; Educational Needs; *Educational Trends; *Education Work Relationship; Emplcyment Patterns; Foreign Countries; *Job Training; LaboL Market; Merchandising; Personnel Management; Postsecondary Education; Private Sector; Recruitment; *Retailing; Sales Occupations; Secondary Education; Tables (Data); *Training Methods; Training Objectives; Trend Analysis IDENTIFIERS *France ABSTRACT An international team of researchers studied the following aspects of training in France's retail sector: structure and characteristics, institutional and social context, employment and labor, changing conditions and their implications for skill requirements, and training and recruitment. Data were collected from an analysis of social and labor/employment statistics, literature review, and case studies of six medium and large retail companies repre.enting a mix of company structures and products lines and including a group of independent store owners and a subsidiary of a department store. At three companies, training was designed to improve the company's commercial position, customer service, and efficiency. A fourth company was using training as a policy tool to increase homogeneity between stores within the group. -

European Retail Research GABLER RESEARCH Editors Dirk Morschett, University of Fribourg, Switzerland, [email protected] Thomas Rudolph, University of St

Bernhard Swoboda, Dirk Morschett, Thomas Rudolph, Peter Schnedlitz, Hanna Schramm-Klein (Eds.) European Retail Research GABLER RESEARCH Editors Dirk Morschett, University of Fribourg, Switzerland, [email protected] Thomas Rudolph, University of St. Gallen, Switzerland, [email protected] Peter Schnedlitz, Vienna University of Economics and Business Administration, Austria, [email protected] Hanna Schramm-Klein, Saarland University, Germany, [email protected] Bernhard Swoboda, University of Trier, Germany, [email protected] EDITORIAL ADVISORY BOARD In the editorial advisory board, a number of distinguished experts in retail research from different countries support the editors: – Steve Burt, University of Stirling, UK – Gérard Cliquet, University of Rennes I, France – Enrico Colla, Negocia, France – Ulf Elg, Lund University, Sweden – Martin Fassnacht, WHU - Otto Beisheim School of Management, Germany – Marc Filser, University of Dijon, France – Thomas Foscht, California State University, USA – Huan Carlos Gázquez Abad, University of Almeria, Spain – Arieh Goldman, Hebrew University, Israel – Andrea Gröppel-Klein, Saarland University, Germany – Herbert Kotzab, Copenhagen Business School, Denmark – Michael Levy, Babson College, USA – Cesar M. Maloles III, California State University, USA – Peter J. McGoldrick, Manchester Business School, Manchester University, UK – Richard Michon, Ryerson University, Canada – Dirk Möhlenbruch, University Halle-Wittenberg, Germany – Heli Paavola, University of Tampere, -

Liste Des Produits Concernés Disponibles À La Vente Auprès Des Consommateurs (Mise À Jour Le 1Er Août 2018)

Liste des produits concernés disponibles à la vente auprès des consommateurs (mise à jour le 1er août 2018) Dénomination Marque Distributeur Légumes Vapeur : Jeunes carottes, petits pois, haricots verts, maïs Freshona Lidl Légumes Vapeur : Carottes, brocolis, maïs Freshona Lidl Chili con carne boulettes au bœuf – 900g Carrefour Carrefour Poêlée de riz au poulet et champignons – 900g Carrefour Carrefour Mélange Caraïbe 1kg D'aucy distribué uniquement en outremer (Mayotte, Guyane, Martinique et Mélange Mexicain 1kg D'aucy Guadeloupe) Carrefour + Intermarché, Super U, Hyper U, Spar, SITIS, Vival, Coccimarket, Vendu au Leclerc, Auchan, G20, Utile, Proxi, Viveco, rayon à la Diagonal, J'aime mon frais, Valma, Shopi, Salade printanière au jambon supérieur coupe Monoprix Vendu au Carrefour + Franprix, Intermarché, Spar, rayon à la Vival, Coccimarket, Coccinelle, Proxi, SALADE LANDAISE ET GESIERS coupe Viveco, Les partenaires sud, Croq frais Carrefour + Franprix, Intermarché, Super U, Hyper U, Spar, SITIS, Vival, Coccimarket, Coccinelle, 8 à Huit, Leclerc, Instant Auchan, Simpli Market, G20, Coop Traiteur Calypso, Nausica Distribution, Couleur SALADE 4 SAISONS AUX TOMATES pour Marché, Utile, Proxi, Viveco, Casino Shop, FRAICHES – barquette 250g Carrefour Relai Mousquetaire Vendu au SALADE PRINTANIERE AU JAMBON rayon à la SUPERIEUR coupe Carrefour, Auchan SALADE Riz Niçois 700g EAN : 3 700 912 304 186 DLC du : 13/07/2018 au assiette 03/08/2018 d’Antoine Auchan SALADE Camarguaise 700g EAN : 3 700 912 304 254 DLC du : 13/07/2018 au assiette 03/08/2018 -

Groupe Casino : Auchan Retail Et Le Groupe Casino Entament Des

3 avril 2018 Groupe Casino : Auchan Retail et le Groupe Casino entament des négociations exclusives en vue de bâtir un partenariat stratégique mondial pour leurs achats alimentaires et non-alimentaires Auchan Retail et le Groupe Casino annoncent avoir entamé des négociations exclusives en vue d’établir, dans le respect des règles de concurrence, un partenariat stratégique leur permettant de négocier ensemble leurs achats en France et à l’international, et ce avec leurs principaux fournisseurs multinationaux alimentaires et non alimentaires. Ce partenariat ambitieux donnera toute sa place aux contrats de filières (fournisseurs/producteurs/distributeurs) tout en permettant d’accompagner le développement de certains fournisseurs français dans les pays couverts par les deux distributeurs (Europe de l’Ouest, Europe de l’Est, Amérique Latine, Asie). Ce partenariat sera en parfaite cohérence avec les engagements pris par les deux groupes dans le cadre des récents Etats Généraux de l’Alimentation. Il ne portera notamment pas sur les produits frais traditionnels agricoles ou de la pêche, ni sur les produits de marque nationale des PME ou des entreprises de taille intermédiaire (ETI). Ainsi, dans un contexte de recomposition des centrales d’achat et d’émergence de nouveaux acteurs, ce partenariat stratégique couvrirait exclusivement les grands industriels nationaux ou internationaux dans les domaines alimentaires et non alimentaires. Par ailleurs, Auchan Retail et le Groupe Casino proposeront d’associer à cette nouvelle dynamique leurs actuels partenaires à l’achat, étant précisé que le Groupe Casino et Intermarché ont mis fin, d’un commun accord, à leur alliance à l’achat en France. Auchan Retail et le Groupe Casino rappellent qu’ils bénéficient d’une vision et d’une culture communes sur les relations avec les fournisseurs et qu’à ce titre cette nouvelle alliance constituerait un ensemble respectueux de l’intérêt de tous : consommateurs, agriculteurs et industriels. -

My Favourites

My favourites Nom Adresse Code postal / Ville Contact Rate Casino supermarché 3, rue de la Mission 10000 +33 (0)3 25 72 17 00 Troyes sceconsommateurs@groupe- casino.fr https://magasins.supercasino.f r/supermarche/troyes- mission/CS118 Le petit Casino 85 Ave du 1er Mai 10000 +33 (0)3 25 80 30 75 Troyes http://www.casino-proximite.fr La Vie Claire Mezzanine des Halles 10000 +33 (0)3 25 73 62 11 Troyes +33 (0)9 62 12 21 27 [email protected] http://www.lavieclaire.com/ Leader Price - Pompidou 6 boulevard Georges 10000 +33 (0)3 25 72 96 70 Pompidou Troyes http://www.leaderprice.fr Action Rue de l'Avenir 10410 +33 0(3) 25 80 00 20 Parc Commercial Saint-Parres-aux- http://www.action.fr/ BeGreen Tertres Aux Mille Affair's 67 Avenue Général 10440 +33 (0)3 25 75 08 62 Leclerc La Rivière-de-Corps Carrefour Contact 134/136 avenue 10300 +33 (0)3 25 45 31 20 Gallieni Sainte-Savine http://www.carrefour.fr Dia Route d'Auxerre, RN 10430 http://www.dia.fr 77 Rosières-près-Troyes BeGreen Parc commercial 10410 contact@begreen- beGreen Saint-Parres-aux- saintparres.fr Tertres http://begreen-saintparres.fr/ Carrefour - Carrefour Drive Avenue Charles de 10120 +33 (0)3 25 42 23 79 Refuge, BP 17 Saint-André-les- http://www.carrefour.fr Vergers Intermarché Super Troyes - 70, rue des Marots 10000 +33 (0)3 25 71 51 05 Marots Troyes http://www.intermarche.com E.Leclerc - express 9 Chemin de la 10270 +33 (0)3 25 72 16 16 Marrière Lusigny-sur-Barse +33 (0)3 25 73 61 44 expresslusigny.sipan@scapest .fr Vival 60 avenue Anatole 10000 +33 (0)3 25 82 22 37 France Troyes -

Retail Supermarket Globalization: Who’S Winning?

RETAIL SUPERMARKET GLOBALIZATION: WHO’S WINNING? October 2001 CORIOLISRESEARCH Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. Recent reports have included an analysis of the impact of the arrival of the German supermarket chain Aldi in Australia, answering the question: “Will selling groceries over the internet ever work?,” and this analysis of retail supermarket globalization. ! The lead researcher on this report was Tim Morris, one of the founding partners of Coriolis Research. Tim graduated from Cornell University in New York with a degree in Agricultural Economics, with a specialisation in Food Industry Management. Tim has worked for a number of international retailers and manufacturers, including Nestlé, Dreyer’s Ice Cream, Kraft/General Foods, Safeway and Woolworths New Zealand. Before helping to found Coriolis Research, Tim was a consultant for Swander Pace (now part of Kurt Salmon) in San Francisco, where he worked on management consulting and acquisition projects for clients including Danone, Heinz, Bestfoods and ConAgra. ! The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low- pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane. -

Mutation De La GMS Française : Quelles Implications Pour Le Business Model Des IAA ?

Mutation de la GMS française : quelles implications pour le business model des IAA ? Les Rencontres d’Unigrains Le 6 novembre 2019 Anne COUDERC Etudes Economiques Les acteurs de la Grande Distribution alimentaire française 1 Principales caractéristiques 2 Un modèle en perte de vitesse Des ventes qui se tassent et des profits qui chutent 3 Les causes structurelles des difficultés de la grande distribution Nouvelles technologies et changements de comportement consommateur 4 De nouvelles stratégies émergent Des réponses qui varient toutefois à la marge 5 Les implications pour les IAA Risques et opportunités Les rencontres d'UNIGRAINS - Mutation de la GMS française : quelles implications pour le business model des IAA ? 6 novembre 2019 Les acteurs de la Grande Distribution alimentaire française 1 Principales caractéristiques 2 Un modèle en perte de vitesse Des ventes qui se tassent et des profits qui chutent 3 Les causes structurelles des difficultés de la grande distribution Nouvelles technologies et changements de comportement consommateur 4 De nouvelles stratégies émergent Des réponses qui varient toutefois à la marge 5 Les implications pour les IAA Risques et opportunités Les rencontres d'UNIGRAINS - Mutation de la GMS française : quelles implications pour le business model des IAA ? 6 novembre 2019 Les GSA, le circuit de distribution alimentaire majoritaire Les Grandes Surfaces Alimentaires, bien qu’en légère diminution, représentent toujours 65% des dépenses de consommation alimentaire à domicile Produits alimentaires hors tabac : 65%