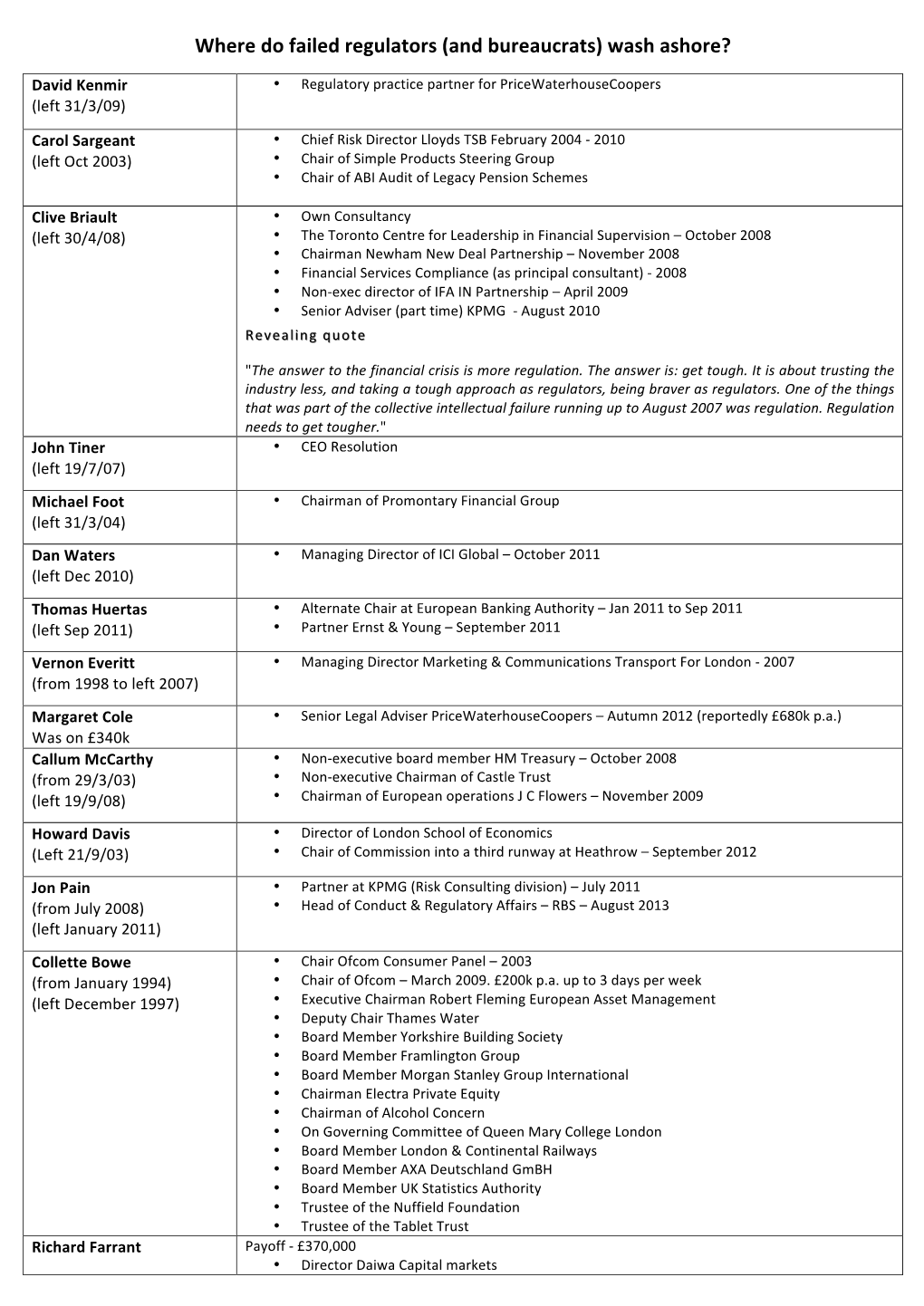

Where Do Failed Regulators (And Bureaucrats) Wash Ashore?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rachel Lomax: Inflation Targeting in Practice - Models, Forecasts and Hunches

Rachel Lomax: Inflation targeting in practice - models, forecasts and hunches Speech by Ms Rachel Lomax, Deputy Governor of the Bank of England, to the 59th International Atlantic Economic Conference, London, 12 March 2005. I am most grateful to Jens Larsen, James Bell, Fabrizio Zampolli and Robin Windle for research support; and to Charlie Bean, Peter Andrews, Spencer Dale, Phil Evans, Laura Piscitelli and other colleagues at the Bank of England for helpful comments. * * * Introduction Five and a half years ago in his Monnet lecture Charles Goodhart1 was able to talk with some confidence of the features that particularly distinguished the UK’s approach to inflation targeting. Today with over 20 countries, in every habitable continent, formally operating some variant of inflation targeting and many more adopting some parts of the framework, all actively sharing experience and best practice, I suspect that most aspects of our approach would find a counterpart somewhere else in the world. But Charles’s focus on the Monetary Policy Committee’s (MPC) personal engagement in producing a published inflation forecast still seems to me to capture the essence of the UK’s approach. Today I want to talk about the role that forecasting has come to play in helping the MPC to take and communicate its decisions. In what sense does the Committee really ‘own’ the published forecasts that go out under its name? How much use do we make of models, and what models do we use? How far do our forecasts appear to drive interest rate decisions? And is there any evidence that this has helped to make policy more or less predictable? Finally I want to end by commenting on some of the issues raised by forecasts as a means of communication. -

University of Surrey Discussion Papers in Economics By

råáp=== = = ======råáîÉêëáíó=çÑ=pìêêÉó Discussion Papers in Economics THE DISSENT VOTING BEHAVIOUR OF BANK OF ENGLAND MPC MEMBERS By Christopher Spencer (University of Surrey) DP 03/06 Department of Economics University of Surrey Guildford Surrey GU2 7XH, UK Telephone +44 (0)1483 689380 Facsimile +44 (0)1483 689548 Web www.econ.surrey.ac.uk ISSN: 1749-5075 The Dissent Voting Behaviour of Bank of England MPC Members∗ Christopher Spencer† Department of Economics, University of Surrey Abstract I examine the propensity of Bank of England Monetary Policy Committee (BoEMPC) members to cast dissenting votes. In particular, I compare the type and frequency of dissenting votes cast by so- called insiders (members of the committee chosen from within the ranks of bank staff)andoutsiders (committee members chosen from outside the ranks of bank staff). Significant differences in the dissent voting behaviour associated with these groups is evidenced. Outsiders are significantly more likely to dissent than insiders; however, whereas outsiders tend to dissent on the side of monetary ease, insiders do so on the side of monetary tightness. I also seek to rationalise why such differences might arise, and in particular, why BoEMPC members might be incentivised to dissent. Amongst other factors, the impact of career backgrounds on dissent voting is examined. Estimates from logit analysis suggest that the effect of career backgrounds is negligible. Keywords: Monetary Policy Committee, insiders, outsiders, dissent voting, career backgrounds, ap- pointment procedures. Contents 1 Introduction 2 2 Relationship to the Literature 2 3 Rationalising Dissent Amongst Insiders and Outsiders - Some Priors 3 3.1CareerIncentives........................................... 4 3.2CareerBackgrounds........................................ -

The Tempered Ordered Probit (TOP) Model with an Application to Monetary Policy William H.Greene Max Gillman Mark N.Harris Christopher Spencer WP 2013 – 10

ISSN 1750-4171 ECONOMICS DISCUSSION PAPER SERIES The Tempered Ordered Probit (TOP) Model With An Application To Monetary Policy William H.Greene Max Gillman Mark N.Harris Christopher Spencer WP 2013 – 10 School of Business and Economics Loughborough University Loughborough LE11 3TU United Kingdom Tel: + 44 (0) 1509 222701 Fax: + 44 (0) 1509 223910 http://www.lboro.ac.uk/departments/sbe/economics/ The Tempered Ordered Probit (TOP) model with an application to monetary policy William H. Greeney Max Gillmanz Mark N. Harrisx Christopher Spencer{ September 2013 Abstract We propose a Tempered Ordered Probit (TOP) model. Our contribution lies not only in explicitly accounting for an excessive number of observations in a given choice category - as is the case in the standard literature on in‡ated models; rather, we introduce a new econometric model which nests the recently developed Middle In‡ated Ordered Probit (MIOP) models of Bagozzi and Mukherjee (2012) and Brooks, Harris, and Spencer (2012) as a special case, and further, can be used as a speci…cation test of the MIOP, where the implicit test is described as being one of symmetry versus asymmetry. In our application, which exploits a panel data-set containing the votes of Bank of England Monetary Policy Committee (MPC) members, we show that the TOP model a¤ords the econometrician considerable ‡exibility with respect to modelling the impact of di¤erent forms of uncertainty on interest rate decisions. Our …ndings, we argue, reveal MPC members’ asymmetric attitudes towards uncertainty and the changeability of interest rates. Keywords: Monetary policy committee, voting, discrete data, uncertainty, tempered equations. -

Bank of England Annual Report 2003 Contents

Bank of England Annual Report 2003 Bank of England Annual Report 2003 Contents 3Governor’s Foreword 6 The Court of Directors 8Governance and Accountability 10 The Bank’s Core Purposes 12 Organisation Overview 14 The Executive and Senior Management 16 Review of Performance against Objectives and Strategy 30 Monetary Policy Committee Processes 34 Objectives and Strategy for 2003/04 35 Financial Framework for 2003/04 39 Personnel and Community Activities 43 Remuneration of Governors, Directors and MPC Members 47 Report from Members of Court 52 Risk Management 55 Report by the Non-Executive Directors 58 Report of the Independent Auditors The Bank’s Financial Statements 60 Banking Department Profit and Loss Account 61 Banking Department Balance Sheet 62 Banking Department Cash Flow Statement 63 Notes to the Banking Department Financial Statements 92 Issue Department Statements of Account 93 Notes to the Issue Department Statements of Account 95 Addresses and Telephone Numbers Eddie George, Governor 2 Bank of England Annual Report 2003 Governor’s Foreword This is the last occasion on which I will write the foreword to the Bank of England’s Annual Report, having had the immense privilege – and enormous pleasure – of serving the Bank as its Governor for the past ten years. At the time of my appointment in 1993, many of our preoccupations were very similar to those we have today – I see that in my first foreword I wrote about the importance of price stability as the primary objective for monetary policy. But what we did not fully appreciate as the Bank entered its fourth century was the extent and speed of the changes it was about to experience, which have proved to be among the most dramatic and interesting in its history. -

Bank of England

Bank of England Annual Report 2001 Bank of England Annual Report 2001 Contents 3 Governor’s Foreword 6 The Court of Directors 8 Governance and Accountability 10 Organisation Overview 12 The Executive and Senior Management 14 The Bank’s Core Purposes 15 Review of Performance against Objectives and Strategy 28 Monetary Policy Committee Processes 33 Objectives and Strategy for 2001/02 34 Financial Framework for 2001/02 38 Personnel, Community Activities and Technical Assistance 43 Remuneration of Governors, Directors and MPC Members 47 Report from Members of Court 51 Risk Management 54 Report by the Non-Executive Directors 56 Report of the Independent Auditors 58 The Bank’s Financial Statements 58 Banking Department Profit and Loss Account 59 Banking Department Balance Sheet 60 Banking Department Cash Flow Statement 61 Notes to the Banking Department Financial Statements 85 Issue Department Statements of Account 86 Notes to the Issue Department Statements of Account 88 Addresses and Telephone Numbers Sir Edward George, Governor 2 Bank of England Annual Report 2001 Governor’s Foreword The past year has seen further steady progress for the UK economy as a whole. By the first 1 quarter of 2001, output was some 2 /2% higher than a year earlier, leaving the annual average rate of growth at around 3% since the recovery from recession began some nine years ago. Employment has continued to rise, to over 28 million on the latest LFS data – the highest number of people in work on record; and the rate of unemployment has continued to decline, to 3.3% on the claimant count – the lowest rate since August 1975. -

The Organisation and Structure of Central Banks. Dissertation

The Organisation and Structure of Central Banks Dissertation Approved as fulfilling the requirements for the degree of Doctor rerum politicarum (Dr. rer. pol.) at the Department of Law and Economics of Technische Universität Darmstadt by Jan Weidner, M.Sc. (born in Darmstadt) First supervisor: Prof. Dr. Volker Nitsch Second supervisor: Prof. Dr. Michael Neugart Date of submission: April 20, 2017 Date of defense: July 13, 2017 Place of publication: Darmstadt Year of publication: 2017 D17 Acknowledgments At this point, I would like to take a moment to thank those who have supported and guided me over the course of writing this dissertation. First and foremost, I owe my doctoral advisor Prof. Dr. Volker Nitsch a huge debt of gratitude for a number of reasons. Firstly, for agreeing to supervise my thesis and, secondly, for offering me a position at his chair. Above all however, I must thank him for the expertise he has shared with me and the moral support he provided me throughout this process. His knowledge, opinions, and advice have always been of great assistance and value to me. I thank Prof. Dr. Michael Neugart greatly for being my second supervisor and for his guidance and advice on many issues. Additionally, my great experience of a Winter School in Shanghai is thanks to him and I will remember this always. Finally, it would be remiss of me not to thank him for the happy hours spent on the football pitch. I wish to express my gratitude to the chairman of my examination committee, Prof. Dr. Jens Krüger, and to the other members of the committee, Prof. -

Report 2002.Qxd

Bank of England Annual Report 2002 Bank of England Annual Report 2002 Contents 3Governor’s Foreword 6 The Court of Directors 8Governance and Accountability 10 The Bank’s Core Purposes 12 Organisation Overview 14 The Executive and Senior Management 16 Review of Performance against Objectives and Strategy 32 Monetary Policy Committee Processes 36 Objectives and Strategy for 2002/03 37 Financial Framework for 2002/03 41 Personnel and Community Activities 45 Remuneration of Governors, Directors and MPC Members 49 Report from Members of Court 53 Risk Management 56 Report by the Non-Executive Directors 58 Report of the Independent Auditors 60 The Bank’s Financial Statements 60 Banking Department Profit and Loss Account 61 Banking Department Balance Sheet 62 Banking Department Cash Flow Statement 63 Notes to the Banking Department Financial Statements 90 Issue Department Statements of Account 91 Notes to the Issue Department Statements of Account Addresses and Telephone Numbers Eddie George, Governor 2 Bank of England Annual Report 2002 Governor’s Foreword The UK economy has faced a difficult international environment over the past year. The internationally-exposed sectors were severely affected by the global economic slowdown, aggravated by the events of 11 September, and by the continuing weakness of the euro in foreign exchange markets. Although for much of the time we were able to fend off the worst effects on the economy as a whole by stimulating domestic demand, notably consumer spending, this necessarily meant living with a two-speed economy. Even so growth came to a halt in the fourth quarter of 2001 and the first quarter of 2002. -

Inflation Report

Inflation Report May 2000 The Inflation Report is produced quarterly by Bank staff under the guidance of the members of the Monetary Policy Committee. It serves two purposes. First, its preparation provides a comprehensive and forward-looking framework for discussion among MPC members as an aid to our decision making. Second, its publication allows us to share our thinking and explain the reasons for our decisions to those whom they affect. Although not every member will agree with every assumption on which our projections are based, the fan charts represent the MPC’s best collective judgment about the most likely path for inflation and output, and the uncertainties surrounding those central projections. This Report has been prepared and published by the Bank of England in accordance with section 18 of the Bank of England Act 1998. The Monetary Policy Committee: Eddie George, Governor Mervyn King, Deputy Governor responsible for monetary policy David Clementi, Deputy Governor responsible for financial stability Willem Buiter Charles Goodhart DeAnne Julius Ian Plenderleith John Vickers Sushil Wadhwani The Overview of this Inflation Report is available on the Bank’s web site: www.bankofengland.co.uk/inflationreport/infrep.htm The entire Report is available in PDF format on www.bankofengland.co.uk/inflationreport/index.htm Printed by Park Communications Ltd © Bank of England 2000 ISBN 1 85730 167 6 ISSN 1353–6737 Overview In the first quarter of 2000, output in the UK economy was 2.9% higher than a year earlier, and inflation on the RPIX measure was 2.0% in March. Final domestic demand, led by household consumption, grew strongly last year. -

Inflation Report November 2000

Inflation Report November 2000 The Inflation Report is produced quarterly by Bank staff under the guidance of the members of the Monetary Policy Committee. It serves two purposes. First, its preparation provides a comprehensive and forward-looking framework for discussion among MPC members as an aid to our decision making. Second, its publication allows us to share our thinking and explain the reasons for our decisions to those whom they affect. Although not every member will agree with every assumption on which our projections are based, the fan charts represent the MPC’s best collective judgment about the most likely paths for inflation and output, and the uncertainties surrounding those central projections. This Report has been prepared and published by the Bank of England in accordance with section 18 of the Bank of England Act 1998. The Monetary Policy Committee: Eddie George, Governor Mervyn King, Deputy Governor responsible for monetary policy David Clementi, Deputy Governor responsible for financial stability Christopher Allsopp Charles Bean DeAnne Julius Stephen Nickell Ian Plenderleith Sushil Wadhwani The Overview of this Inflation Report is available on the Bank’s web site: www.bankofengland.co.uk/inflationreport/infrep.htm The entire Report is available in PDF format on www.bankofengland.co.uk/inflationreport/index.htm Printed by Park Communications Ltd © Bank of England 2000 ISBN 1 85730 192 7 ISSN 1353–6737 Overview The United Kingdom has continued to experience above-trend growth and low inflation. Output in the third quarter is provisionally estimated to have been 2.9% higher than a year ago, while RPIX inflation was 2.2% in the year to September, marginally below the 1 2 /2% target. -

MPC Minutes 2.Qxd

Publication date: 17 October 2001 MINUTES OF THE SPECIAL MONETARY POLICY COMMITTEE MEETING 18 September 2001 These are the Minutes of the special Monetary Policy Committee meeting held on 18 September 2001. They are also available on the Internet: (http://www.bankofengland.co.uk/mpc/mpc0110a.pdf). The Bank of England Act 1998 gives the Bank of England operational responsibility for setting interest rates to meet the Government’s inflation target. Operational decisions are taken by the Bank’s Monetary Policy Committee. This meeting was convened by the Governor under the provisions of paragraph 10(2) of Schedule 3 to the Bank of England Act 1998. MINUTES OF THE SPECIAL MONETARY POLICY COMMITTEE MEETING HELD ON 18 SEPTEMBER 2001 1 The Governor convened a special meeting of the Monetary Policy Committee to review the stance of policy following the terrorist attacks in the United States, the decision by the Federal Reserve to reduce interest rates on 17 September, and the responses of other central banks to that move. 2 Following the terrorist attacks, the immediate priority for central banks and market participants was to ensure that financial markets continued to operate in an orderly manner. Central banks were providing additional liquidity on a temporary basis to ensure that there was no disruption to payment and settlement systems. 3 The more relevant consideration for the MPC related to the potential impact of the attacks on business and consumer confidence and hence on the global economy, in the light of market movements up to and including Monday 17 September and the reductions in interest rates by other central banks. -

Inflation Report

Inflation Report February 1999 The Inflation Report is produced quarterly by Bank staff under the guidance of the members of the Monetary Policy Committee. It serves two purposes. First, its preparation provides a comprehensive and forward-looking framework for discussion among MPC members as an aid to our decision making. Second, its publication allows us to share our thinking and explain the reasons for our decisions to those whom they affect. Although not every member will agree with every assumption on which our projections are based, the fan charts represent the MPC’s best collective judgment about the most likely path for inflation and output, and the uncertainties surrounding those central projections. The Report has been prepared and published by the Bank of England in accordance with section 18 of the Bank of England Act 1998. The Monetary Policy Committee: Eddie George, Governor Mervyn King, Deputy Governor responsible for monetary policy David Clementi, Deputy Governor responsible for financial stability Alan Budd Willem Buiter Charles Goodhart DeAnne Julius Ian Plenderleith John Vickers The Overview of this Inflation Report is available on the Bank’s web site: www.bankofengland.co.uk/infrep.htm. The entire Report is available in PDF format on www.bankofengland.co.uk/ir.htm. Printed by Park Communications Ltd © Bank of England 1999 ISBN 1 85730 191 9 ISSN 1353–6737 Overview 1 Inflation on the RPIX measure was close to the 2 /2% target level for most of last year. Since the summer, however, economic developments both internationally and in the UK have substantially shifted the balance of risks to future inflation. -

Governance and Regulation of the BBC As Part of Charter Renewal

A Review of the Governance and Regulation of the BBC Sir David Clementi March 2016 1 2 A Review of the Governance and Regulation of the BBC Presented to Parliament by the Secretary of State for Culture, Media and Sport by Command of Her Majesty March 2016 Cm 9209 1 © Crown copyright 2016 This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: [email protected] Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. This publication is available at www.gov.uk/government/publications Any enquiries regarding this publication should be sent to us at [email protected] Print ISBN 9781474128131 Web ISBN 9781474128148 ID 10021601 03/16 Printed on paper containing 75% recycled fibre content minimum Printed in the UK by the Williams Lea Group on behalf of the Controller of Her Majesty’s Stationery Office 2 CONTENTS Foreword 4 Summary of Main Recommendations 7 Chapter 1: Models of Governance and Regulation 12 Chapter 2: Mechanisms of Governance and Regulation 43 Chapter 3: Engagement with the Public 61 Chapter 4: Editorial Standards and Complaint Systems 71 Appendix 1. Terms of Reference 85 Appendix 2. List of Parties Consulted 86 Appendix 3. Table of Recommendations 89 Appendix 4. Oversight of BBC Output 93 3 FOREWORD To the Secretary of State for Culture, Media and Sport 1.