Presentation Main Title

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Placing Customer Centricity at the Heart of Healthcare

Exerpted Articles From: Placing Customer Centricity at the Heart of Healthcare A look at how healthcare providers, pharmaceuticals, and health insurers are adapting to the changing customer landscape and evolving their patient experiences Table of Contents: An Eye on Healthcare’s Wearable Future ......................................................... 2 What the Net Neutrality Debate Means to Healthcare ................................... 17 Making Way for Consumerized Healthcare ..................................................... 5 Healthcare’s Cybersecurity Threat ................................................................. 19 Boosting Patient Outcomes with Big Data ...................................................... 7 United Healthcare Gives Behavioral Analytics a Seat at the Table ................ 21 Healthcare Accountability: Sizing Up the Metrics for Meet Healthcare’s Newest Players ................................................................ 22 Delivering Value-Based Care ......................................................................... 10 Taking the Pulse of Customer Service ........................................................... 25 The Top Healthcare Tech Trends to Watch in 2015 ....................................... 12 A Prescription for Patient-Centric Healthcare ................................................ 28 Balancing Act: How Population Health Impacts Individuals ......................... 15 Cigna Personalizes Its Approach to Healthcare Customer Service .............. 31 Healthcare An Eye on -

Software & Services

SOFTWARE & SERVICES Recognizing the software and service organizations that excelled in helping providers deliver better patient care PHYSICIAN PRACTICE SOLUTIONS BEST IN KLAS AMBULATORY EMR (1–10 PHYSICIANS) HOW DO VENDOR SOLUTIONS COMPARE? WHO IS KONFIDENCE SCORE TREND LEVEL 1. Cerner PowerChart Ambulatory BEST IN KLAS? 84.3 +13% üü 2. Amazing Charts 83.3 +4% üüü 3. SRSsoft EHR 81.0 -11% üü 4. athenahealth athenaClinicals 80.9 -7% üüü 5. Greenway PrimeSUITE Chart 79.1 -2% üüü HOW DO THEY SCORE? 6. Aprima EHR IN FIVE KEY PERFORMANCE CATEGORIES 78.2 -1% üüü 100 92.4 7. ADP AdvancedMD EHR +3% üüü 90 84.9 78.0 80.6 81.7 81.2 80 8. e-MDs Chart -13% üüü 70 74.0 60 AVG. SEGMENT MKT. 9. GE Healthcare Centricity Practice Solution EMR +1% üü PHYSICIAN PRACTICE PHYSICIAN 50 73.8 40 T10. eClinicalWorks EHR 73.4 -7% üüü 30 20 T10. Henry Schein MicroMD EMR 73.4 +4% üü 10 12. NextGen Healthcare EHR 0 65.1 -3% üüü SALES & FUNCTIONALITY GENERAL CONTRACTING & UPGRADES 13. Allscripts Professional EHR 64.7 -6% üüü SERVICE & IMPLEMENTATION SUPPORT 14. McKesson Practice Partner -14% & TRAINING 48.0 üü 0 10 20 30 40 50 60 70 80 90 100 SEE HOW OTHER VENDOR SOLUTIONS SCORE AT KLASRESEARCH.COM HOW DO THE TOP THREE SOLUTIONS TREND? SOLUTIONS NOT RANKED PRELIMINARY DATA PRODUCTS CompuGroup Medical Enterprise EHR (HEHR)*..................71.0 MIE WebChart EMR* ............................................................75.7 MTBC EMR* .........................................................................82.1 Optum Physician EMR* ........................................................79.6 -

Healthcare It Industry Update │ Q3 2016

HEALTHCARE IT INDUSTRY UPDATE │ Q3 2016 www.harriswilliams.com Investment banking services are provided by Harris Williams LLC, a registered broker-dealer and member of FINRA and SIPC, and Harris Williams & Co. Ltd, which is authorised and regulated by the Financial Conduct Authority. Harris Williams & Co. is a trade name under which Harris Williams LLC and Harris Williams & Co. Ltd conduct business. 0 HEALTHCARE IT INDUSTRY UPDATE | Q3 2016 HEALTHCARE IT PRACTICE OVERVIEW CONTENTS INTRODUCTION . WHAT WE’RE READING Harris Williams & Co. is pleased to present our review of Q3 Healthcare IT . KEY HEALTHCARE MACRO activity. This report provides commentary and analysis on current capital market INDICATORS trends and merger and acquisition dynamics within the Healthcare IT industry. PUBLIC MARKETS . PUBLIC COMPARABLES We hope you find this edition helpful and encourage you to contact us directly if . M&A ACTIVITY you would like to discuss our perspective on current industry trends and M&A . PRIVATE PLACEMENT ACTIVITY opportunities or our relevant industry experience. IPO ACTIVITY OUR PRACTICE CONTACTS Sam Hendler Harris Williams & Co. is a leading advisor to the Healthcare IT industry. Our global Managing Director practice includes professionals across the firm from Harris Williams & Co.’s [email protected] Technology, Media & Telecom Group and Healthcare & Life Sciences Group. +1 (617) 654-2117 Jeff Bistrong HW&Co. Healthcare IT Taxonomy Managing Director [email protected] +1 (617) 654-2102 . Patient-Facing Solutions Mike Wilkins . Care Delivery: Managing Director Operational Efficiency [email protected] +1 (415) 271-3411 . Care Delivery: Clinical / Acute Thierry Monjauze Managing Director . Care Delivery: [email protected] Clinical / Non-Acute +44 20 7518 8901 CARE DELIVERY EMPLOYERS ORGANIZATIONS PATIENTS . -

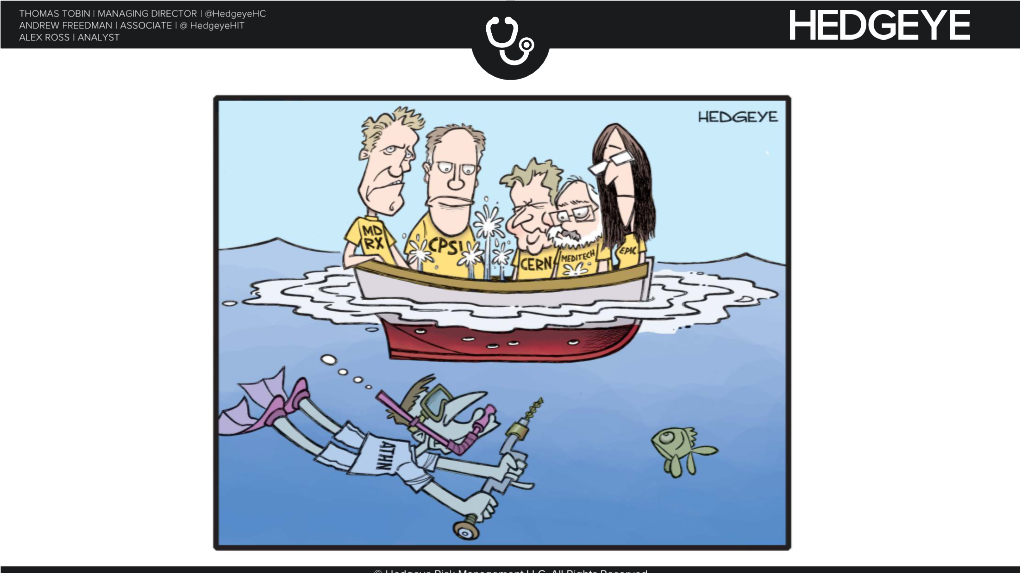

This Is the 19Th Annual Sohn Investment Conference. the First

This is the 19th Annual Sohn Investment Conference. The first time Ispoke here was in 2002. It is amazing how this great event has grown, and I am honored to be here. 1 2 A couple weeks ago, we wrote in our quarterly letter that we believe that a narrow group of cool kid stocks have disconnected from traditional valuations and formed a bubble. This got a lot of criticism. Half the critics thought we were talking our book, even though we didn’t name names. The other half were upset that we didn’t tell them which stocks we were short. Since we can’t seem to please anybody, I’ve decided to validate both criticisms. Today, I’m going to illustrate the bubble basket doing a deep dive into one of the companies, while not disclosing the others. This company is an excellent company with an excellent product, run by a well‐meaning and honest, though occasionally promotional CEO. The world may be a better place if it succeeds, and even though we are short, I am in no way rooting for it to fail. Its main problem is that it isn’t positioned to succeed the way the bulls hope, as the assumptions the bulls are making are not plausible. The stock is simply at the wrong price. It’s caught up in a bubble and could easily fall 80% or more from its recent peak. Let me introduce you to athenahealth. 3 I think athena deserves a smaller capitalization, and I’m not just referring to how it fails to capitalize the first letter of its name. -

Healthcare Vertical Applications Market Report 2009-2014, Profiles of Top 10 Vendors

APPS RUN THE WORLD Healthcare Vertical Applications Market Report 2009-2014, Profiles Of Top 10 Vendors 7/30/2010 Copyright © 2010, APPS RUN THE WORLD Table of Contents Summary ..................................................................................................................................... 4 Top Line and Bottom Line ..................................................................................................... 4 Market Overview ...................................................................................................................... 4 Implications Of The Great Recession of 2008-2009..................................................... 5 Customers ................................................................................................................................... 6 Top 10 Apps Vendors In Vertical ........................................................................................ 6 Vendors To Watch .................................................................................................................... 7 Outlook......................................................................................................................................... 7 SCORES Box Illustration......................................................................................................... 8 2 Profiles of Top 10 Apps Vendors ............................................................................................................................ 9 McKesson............................................................................................................................................................................... -

Athenahealth Master Services Agreement Third Party Terms

ATHENAHEALTH MASTER SERVICES AGREEMENT THIRD PARTY TERMS secrets. Client shall hold in confidence and take reasonable measures, but PART 1 - GENERAL TERMS AND CONDITIONS. not less than the measures taken by Client to safeguard its own confidential The following Third Party Terms apply to all Athena sublicenses of information, to safeguard and prohibit access to, and copying or disclosure Third Party Items (as defined in the Athenahealth Master Services of, any and all confidential information and materials provided hereunder, Agreement) to Client pursuant to agreements that Athena has made with its including, but not limited to, confidential information in or about the Third third party licensors (“Third Party Licensors”): Party Items, any updates to any of them and any user manuals for them. A. Client will not modify the Third Party Items or the substance of the M. IN NO EVENT SHALL ATHENA OR A THIRD PARTY LICENSOR data contained therein. (OR ITS SUPPLIERS), OR THEIR RESPECTIVE OFFICERS, DIRECTORS, PARTNERS OR EMPLOYEES, BE LIABLE TO CLIENT OR ANY OTHER B. Except as authorized by the applicable Third Party Licensor or as PARTY FOR ANY CONSEQUENTIAL, INDIRECT, INCIDENTAL, permitted under Part 2 herein, Client will not use any Third Party Item (or any EXEMPLARY, PUNITIVE, RELIANCE OR SPECIAL DAMAGES, OR ANY data derived from it) in a computer service business or in network, time- LOSS OF USE, DATA OR, BUSINESS, PROFITS, ARISING OUT OF OR IN sharing, multiple-CPU or multiple-user arrangements (including the Internet CONNECTION WITH (1) THE USE OR PERFORMANCE OF THE THIRD and Intranets), or link or interface them with any other equipment, software, PARTY ITEM; (2) THE INTERRUPTION OF BUSINESS, DELAY OR data, network or communications system except in and as part of INABILITY TO USE ANY THIRD PARTY ITEM, RELATED EQUIPMENT OR athenaNet®. -

Small Practice Ambulatory Emr/Pm (10 Or Fewer Physicians) 2019

SMALL PRACTICE AMBULATORY EMR/PM (10 OR FEWER PHYSICIANS) 2019 BUILDING STRONG FOUNDATIONS FOR CUSTOMER SUCCESS ® %/ Performance Report | January 2019 DRILL DEEPER TABLE OF CONTENTS 2 Executive Insights 6 Expanded Insights 29 Vendor Insights 31 AdvancedMD 45 eClinicalWorks 33 Allscripts 47 eMDs 35 Aprima 49 Greenway Health 37 athenahealth 51 Kareo 39 CareCloud 53 NextGen Healthcare 41 Cerner 55 Virence Health (GE Healthcare) 43 CureMD 57 Data Index 68 Vendor Executive Interview Details 1 EXECUTIVE INSIGHTS SMALL PRACTICE AMBULATORY EMR/PM (10 OR FEWER PHYSICIANS) 2019 BUILDING STRONG FOUNDATIONS FOR CUSTOMER SUCCESS As healthcare has moved beyond meaningful use, small practices have begun to expect more from their vendors and to look for EMRs that do more than meet basic regulatory requirements. As a result, EMR/PM satisfaction among small practices (10 or fewer physicians) has varied greatly over the past year—scores for a number of vendors have swung more than 10 percentage points (some positively, some negatively). To explore what the future holds for this market, KLAS spoke to hundreds of small practice customers about their EMR/PM experiences and needs and also interviewed executives and representatives from AdvancedMD, Allscripts, Aprima, athenahealth, Azalea Health, CareCloud, Cerner, CureMD, eMDs, Greenway Health, Kareo, NextGen, Quest Diagnostics, and Virence Health (GE Healthcare) to find out how these vendors plan to increase customer satisfaction going forward. What Are the Most Important Vendor/ NextGen Healthcare, CureMD, and Aprima Product Attributes for Small Practices? Most Aligned to Deliver Customer Success (n=57) The green bars represent the total tallies after New 7 Technology each need was weighted When asked to name the top things EMR/PM vendors should focus based on whether the respondent ranked it first, on, small practices overwhelmingly say that before addressing more Advanced Needs second, or third. -

3Rd Quarter 2014 FINAL BOOK

SCOTT-MACON HEALTHCARE REVIEW: THIRD QUARTER 2014 Third Quarter 2014 Healthcare Review 2 Healthcare Overview, Mean Revenue Multiples 5 Healthcare Overview, Mean EBITDA Multiples 6 Analysis of Selected Healthcare 7 Merger and Acquisition Transactions July 1—September 30, 2014 Analysis of Selected 30 Publicly-Traded Healthcare Companies CONTENTS SCOTT-MACON Healthcare Investment Banking 2 THIRD QUARTER 2014 HEALTHCARE REVIEW Dear Clients and Friends, Scott-Macon is pleased to present our quarterly mens’ healthcare IT business for $1.3 billion; and Bob Healthcare Review covering the third quarter of 2014. If Patricelli’s Evolution1 has been sold to payments con- you haven’t done so already, please email me at ncor- glomerate WEX for 6.0x revenues. Other interesting tech- [email protected] to automatically continue receiv- nology deals include giant Allscripts picking up Oasis in ing our publications in the future as we are transitioning to the EHR space; Google acquiring telehealth player Lynx digital publishing with email distribution. Design; Premier announcing two more deals for Aperek Pages five and six represent a visual snapshot of and TheraDoc; and Sunquest owner Roper closing on the average multiples for all of the healthcare, medical Strategic Healthcare Programs. Turning to the Outsourc- and pharmaceutical transactions that either closed or were ing segment, clinical services giant Sheridan Healthcare announced during the third quarter, along with the average was acquired by AmSurg for $2.4 billion, representing multiples for the major publicly-traded healthcare, medi- 2.5x revenues. Point-of-care diagnostics leader Alere an- cal and pharmaceutical companies. nounced it is in talks for a sale to an investor group for Beginning on page 7 we present the mergers and $7.8 billion, or 2.6x revenues. -

A Survey of U.S. Healthcare IT Industry Landscape

July 28, 2016 Industry Research Department, Mizuho Bank Mizuho Industry Focus Vol. 183 A Survey of U.S. Healthcare IT Industry Landscape Global Corporate Advisory Americas Tim Wang, CFA, 2016 [email protected] 〈Summary〉 ○ U.S. Healthcare IT industry is booming. Over the recent years, many companies have had robust growth and the sector has attracted huge inflow of private and public investments. There are many types of HCIT companies, operating with different business models and participating in various segments of HCIT. In this report, we try to first identify the drivers behind HCIT growth and then delineate the dynamics in each HCIT segment. ○ Key drivers of HCIT are also the underlying drivers of the U.S. healthcare system, namely Obamacare, the transition to value-based reimbursement model, rising consumerism, industry consolidation, etc. Within HCIT, major drivers include the HITECH Act, advancement of technology, and the convergence of healthcare, IT, and consumer industries. ○ The booming HCIT market is in transition. Incentives for EHR created by the HITECH Act have largely run their course. In the future, the marketplace will be driven less by government subsidies and more by private spending. To earn revenues from private payers, HCIT companies increasingly need to demonstrate the clinical and financial value of their offerings. To achieve this, HCIT companies need to collaborate closely with their customers. ○ For the various HCIT segments, we see three especially promising areas – integration of remote patient monitoring either through wearables or other devices with data analytics and intervention capabilities; big data analytics by Artificial Intelligence; and telemedicine. We expect stable growth for RCM, PM, payer solution segments. -

2015 HEALTHCARE TECH PURCHASING Market Share, Mindshare, and Renewal Research and Report Provided by Reactiondata Table of Contents

2015 HEALTHCARE TECH PURCHASING Market Share, Mindshare, and Renewal research and report provided by ReactionData Table of Contents Introduction 5 About Industry Insights 6 2015 Purchases 7 Purchase Intention By Hospital Size 8 EHR 13 EHR Market Share 14 GE Healthcare 18 Epic 24 MEDHOST 26 EHR Renewal 28 Data Analytics 29 Data Analytics Market Share 30 McKesson 34 Data Analytics Mindshare 36 Data Analytics Renewal 40 Patient Engagement 41 2015 HEALTHCARE TECH PURCHASING | 2 Patient Engagement Market Share 42 Patient Engagement Mindshare 46 Allscripts 50 Patient Engagement Renewal 52 Population Health Management 53 Population Health Management Market Share 54 Population Health Management Mindshare 58 The Advisory Board 59 Population Health Management Renewal 64 Revenue Cycle Management 65 RCM Market Share 66 MedAssets 70 RCM Mindshare 71 RCM Renewal 75 Data Security 76 Data Security Market Share 77 Data Security Mindshare 81 Data Security Renewal 85 2015 HEALTHCARE TECH PURCHASING | 3 ICD-10 Migration 86 ICD-10 Migration Market Share 87 ICD-10 Migration Mindshare 91 ICD-10 Migration Renewal 95 Conclusion 96 Appendix A 97 Survey Participants by Role 97 Appendix B 98 3M 98 Cerner 98 CPSI 98 eClinicalWorks 98 MEDITECH 99 Appendix C 100 Participating Facilities 100 2015 HEALTHCARE TECH PURCHASING | 4 Introduction US healthcare providers are poised to spend billions in 2015 on information technology. The jobs, promotions, and bonuses of many healthcare professionals depend upon a few key questions. • Where will this money be spent? • Which vendors are poised to gain market share? • Who is poised to miss out? Over a recent three week period, we used our enterprise data platform (Reaction) to find out. -

Embracing Efficiency

Embracing efficiency Centricity Practice Solution helps Virginia Women’s The story in a nutshell Center streamline workflow, enhance patient care, In 2005, Virginia Women’s Center (VWC) selected and enjoy an impressive return on investment. GE Healthcare’s Centricity Practice Solution to manage a growing patient population and increased complexity in the field of medicine. Since then, the practice has experienced not only a solid ROI, but also: • Exceptional efficiencies across workflows • Reductions in medical errors • Fast notification of patients impacted by issues such as drug or medical product recalls • Easy identification of patients eligible for opportunities such as clinical research studies • Patient portal usage rates of up to 80 percent Bottom line: an electronic patient-management solution that is making significant contributions to the well-being of patients and the practice alike. Centricity Practice Solution helps Virginia Women’s Center cope with its growing pains Virginia Women’s Center (VWC) is an organization whose leadership VWC Wins the Davies Award has always kept an eye on the big picture, anticipating issues and In recognition of its outstanding achievement in implementing seeking out solutions before those issues have become problems. health information technology, Virginia Women’s Center was And there’s no better example of this foresight than its quest for the named the 2009 winner of the HIMSS Nicholas E. Davies Award Electronic Medical Record (EMR), launched in 1996 to help the staff of Excellence in Ambulatory Care. manage expansions in both service portfolio and patient population. “ Our practice decisions have always been strictly guided by Kay Stout, MD, MBA, Managing Partner and Clinical Informatics the question, ‘What is best for the patient?’ said Dr. -

Managing Interfaces with Centricity Practice Solution

GE Healthcare Managing Interfaces with Centricity® Practice Solution Version 12.3 November 2017 Centricity Practice Solution DOC2054375 Copyright © 1996 - 2017 General Electric Company. All rights reserved. GE, the GE monogram, Centricity, and Logician are trademarks of General Electric Company. All other product names and logos are trademarks or registered trademarks of their respective companies. Copyright © 1996 - 2017 General Electric Company. All rights reserved. Confidentiality and proprietary rights This document is the confidential property of GE and/or its affiliated entities. It is furnished to, and may only be used by, customers and their employees under a written agreement with GE and may only be used in accordance with the terms of that agreement. The access and use of this document is restricted to customers and their employees. The user of this document agrees to protect the confidentiality of the information contained herein and GE's proprietary rights as expressed herein and not permit access to this document by any person for any purpose other than as an aid in the use of the GE software. In no case may this document or any portion hereof be accessed, made available, examined, or copied for the purpose of developing, marketing, or supporting any system or computer program similar to the GE software. No part of this document may be copied without the prior written permission of GE. The information in this document is subject to change by GE without notice. Revision History Date Description November 2017 Updated for Centricity Practice Solution 12.3. March 2014 DOC1453726, rev 3, M4 released version November 2015 Rev 4 includes the following changes: Removed pre-MU 2014 values table and corrected cross-reference file example in PID-10 Race description, multiple specifications (SPR 60611) Added ability to configure ICD9 or ICD10 as default in MIK configuration settings for FT1-19 Diagnosis Code, changed MIK processing and error handling.