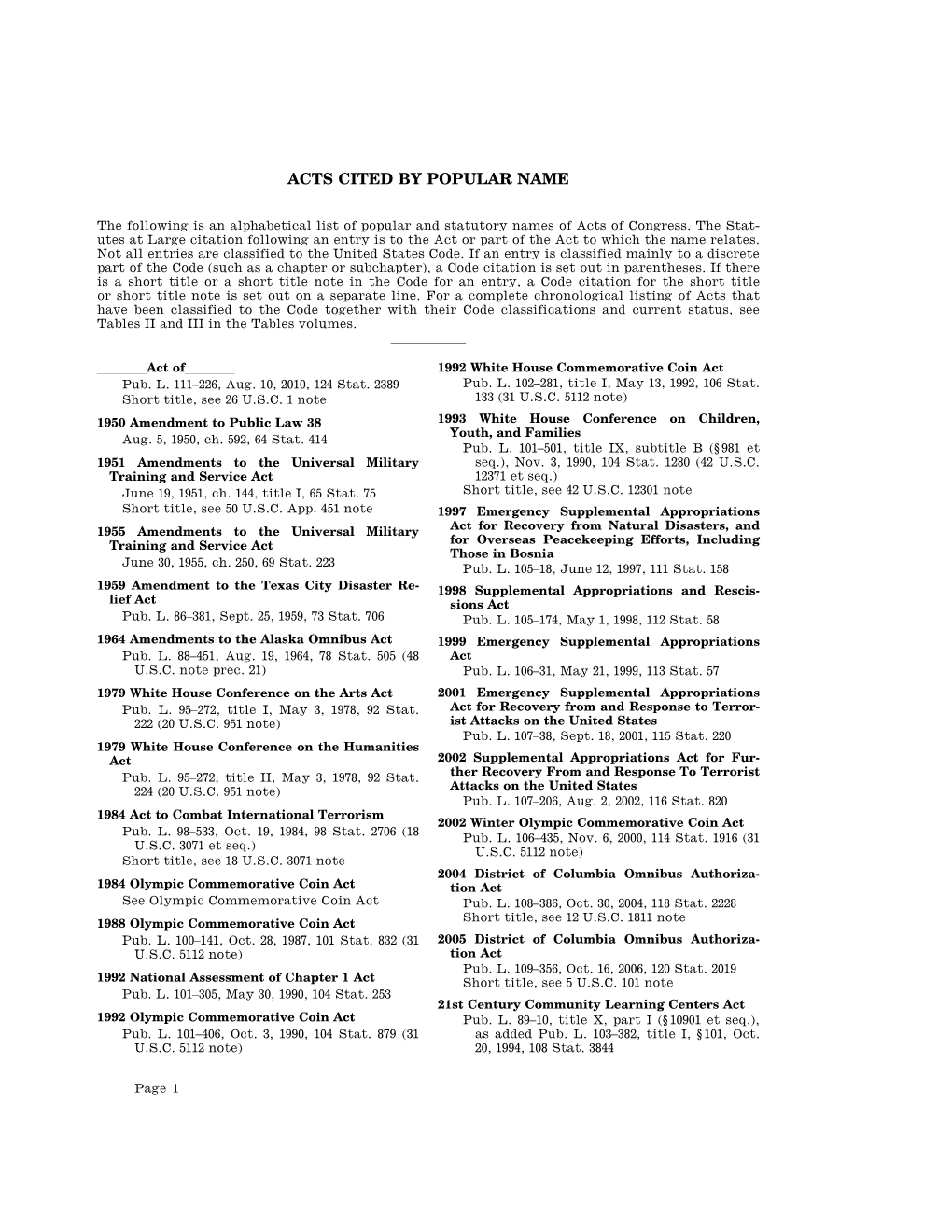

Acts Cited by Popular Name

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Southern Slave Vs. Military Laborer: Black Ambivalence Toward Joining the Union Army Lisa Clark

Southern Adventist University KnowledgeExchange@Southern Senior Research Projects Southern Scholars 1996 Southern Slave vs. Military Laborer: Black Ambivalence Toward Joining the Union Army Lisa Clark Follow this and additional works at: https://knowledge.e.southern.edu/senior_research Part of the History Commons Recommended Citation Clark, Lisa, "Southern Slave vs. Military Laborer: Black Ambivalence Toward Joining the Union Army" (1996). Senior Research Projects. 119. https://knowledge.e.southern.edu/senior_research/119 This Article is brought to you for free and open access by the Southern Scholars at KnowledgeExchange@Southern. It has been accepted for inclusion in Senior Research Projects by an authorized administrator of KnowledgeExchange@Southern. For more information, please contact [email protected]. Southern Slave vs. Military Laborer: Black Ambivalence Toward Joining the Union Army by Usa Clark Aprfi 17, 1996 2 Fort Sumter was under fire! The war was on! The news flashed through the cotton fields and tobacco plantations of the South. For most slaves, the commencement of the Civil War brought hope. Enslaved, oppressed, denied education and self-determination, the southern black looked with eagerness to his emancipation. In many cases, the negro slave desired to help fight his former owners, to bring down the institution of slavery. Imagine his surprise, then, upon greeting the northern army with open arms, only to be forced to serve the white officers, cook for and clean up after the troops, and perform hard, manual labor for the military. There was D~glory on the battlefield. Promises made for equal pay were broken so many times they became meaningless. The mixed emotions engendered by this reality resulted in confusion and contradiction. -

Lyman Trumbull: Author of the Thirteenth Amendment, Author of the Civil Rights Act, and the First Second Amendment Lawyer

KOPEL (1117–1192).DOCX (DO NOT DELETE) 5/2/16 4:20 PM Lyman Trumbull: Author of the Thirteenth Amendment, Author of the Civil Rights Act, and the First Second Amendment Lawyer David B. Kopel* This Article provides the first legal biography of lawyer and Senator Lyman Trumbull, one of the most important lawyers and politicians of the nineteenth century. Early in his career, as the leading anti-slavery lawyer in Illinois in the 1830s, he won the cases constricting and then abolishing slavery in that state; six decades later, Trumbull represented imprisoned labor leader Eugene Debs in the Supreme Court, and wrote the Populist Party platform. In between, Trumbull helped found the Republican Party, and served three U.S. Senate terms, chairing the judiciary committee. One of the greatest leaders of America’s “Second Founding,” Trumbull wrote the Thirteenth Amendment, the Civil Rights Act, and the Freedmen’s Bureau Act. The latter two were expressly intended to protect the Second Amendment rights of former slaves. Another Trumbull law, the Second Confiscation Act, was the first federal statute to providing for arming freedmen. After leaving the Senate, Trumbull continued his fight for arms rights for workingmen, bringing Presser v. Illinois to the U.S. Supreme Court in 1886, and Dunne v. Illinois to the Illinois Supreme Court in 1879. His 1894 Populist Party platform was a fiery affirmation of Second Amendment principles. In the decades following the end of President James Madison’s Administration in 1817, no American lawyer or legislator did as much as Trumbull in defense of Second Amendment. -

The First Confiscation Act (August 6, 1861) Freedmen & Southern Society Project

Maria Ward’s primary document project (designed with 8th graders in mind) Student objectives: ~ The student will analyze historical documents and use this knowledge to better understand Lincoln’s actions during the Civil War. ~The student will find evidence to support Lincoln’s belief that emancipation is for the purpose of saving the Union, and that it must be done in a constitutional manner. Documents: ~Abraham Lincoln’s Letter to Horace Greeley August 22, 1862 Teaching American History Ashbrook Center for Public Affairs at Ashland University http://teachingamericanhistory.org/library/index.asp?subcategory=4 ~The First Confiscation Act (August 6, 1861) Freedmen & Southern Society Project http://www.history.umd.edu/Freedmen/conact1.htm ~Excerpt from the Proclamation Revoking General Hunter’s Order of Military Emancipation of May 9, 1862 Freedmen & Southern Society Project http://www.history.umd.edu/Freedmen/hunter.htm Narrative: Students will analyze Abraham Lincoln’s letter to Horace Greeley, August 22, 1862, the (first) Confiscation Act of 1861 and an excerpt from Lincoln’s the Proclamation Revoking General Hunter’s Order of Military Emancipation of May 9, 1862 to explain and support Lincoln’s belief that the purpose of the war is to save the Union, and that any action regarding the emancipation of enslaved persons should be carried out in a constitutional manner. Narrative that is more like a lesson plan: Students will first analyze Abraham Lincoln’s letter to Horace Greeley, August 22, 1862. This letter is in response to Greeley’s open letter titled, “The Prayer of Twenty Millions” in which Greeley urges Lincoln to free the slaves. -

37Th Congress

Thirty-Seventh Congress July 4, 1861-Mar. 3, 1863 First Administration of Abraham Lincoln Historical Background ............................................................................................................. 1 War or Peace? ............................................................................................................................. 2 Economic Trends and Conditions ....................................................................................... 4 1861 Events ................................................................................................................................. 5 1862 Events ................................................................................................................................. 6 Major Acts ..................................................................................................................................... 9 President Abraham Historical Background Lincoln By early June 1861, ten additional slave States had followed South Carolina into secession, and a convention of seceding States met in Montgomery, Alabama, to form a new government, the Confederate States of America. House Senate Although compromises continued to be proposed, neither the North nor the Majority Majority South really believed that they could agree to any further modification of Party: Party: their principles. President Abraham Lincoln insisted in his inaugural address Republican Republican (108 Seats) (31 seats) on March 4, 1861, that the Union was older than the Constitution, -

Line Item Veto and the Tax Legislative Process: a Futile Effort at Deficit Reduction, but a Step Toward Tax Integrity Gordon T

Hastings Law Journal Volume 49 | Issue 1 Article 1 1-1997 Line Item Veto and the Tax Legislative Process: A Futile Effort at Deficit Reduction, But a Step Toward Tax Integrity Gordon T. Butler Follow this and additional works at: https://repository.uchastings.edu/hastings_law_journal Part of the Law Commons Recommended Citation Gordon T. Butler, Line Item Veto and the Tax Legislative Process: A Futile Effort at Deficit Reduction, But a Step Toward Tax Integrity, 49 Hastings L.J. 1 (1997). Available at: https://repository.uchastings.edu/hastings_law_journal/vol49/iss1/1 This Article is brought to you for free and open access by the Law Journals at UC Hastings Scholarship Repository. It has been accepted for inclusion in Hastings Law Journal by an authorized editor of UC Hastings Scholarship Repository. For more information, please contact [email protected]. The Line Item Veto and the Tax Legislative Process: A Futile Effort at Deficit Reduction, But a Step Toward Tax Integrity by GORDON T. BUTLER* Table of Contents Introduction ...................................................................... 2 I. The Problem of the Deficit and the Budget Process ............... 4 II. The Line Item Veto ...................................................... 21 A. 1995 Congressional Proposals ................................. 21 (1) House Bill 2 and "Enhanced Rescission" ................ 22 (2) Senate Bill 4 and "Separate Enrollment". ............... 24 B. The Line Item Veto of 1996 ...................................... 26 (1) The Act ....................................................... 26 (2) Constitutionality of the Line Item Veto .................. 31 (a) Separate Enrollment Form ............................... 41 (b) Enhanced Rescission Form ............................ 43 (3) Comparison with State Item Veto Authority ............... 52 (4) Critique of the Line Item Veto Act of 1996 ............. 56 m. Are "Tax Expenditures" Expenditures? ......... -

More Than 50 Years of Trade Rule Discrimination on Taxation: How Trade with China Is Affected

MORE THAN 50 YEARS OF TRADE RULE DISCRIMINATION ON TAXATION: HOW TRADE WITH CHINA IS AFFECTED Trade Lawyers Advisory Group Terence P. Stewart, Esq. Eric P. Salonen, Esq. Patrick J. McDonough, Esq. Stewart and Stewart August 2007 Copyright © 2007 by The Trade Lawyers Advisory Group LLC This project is funded by a grant from the U.S. Small Business Administration (SBA). SBA’s funding should not be construed as an endorsement of any products, opinions or services. All SBA-funded projects are extended to the public on a nondiscriminatory basis. MORE THAN 50 YEARS OF TRADE RULE DISCRIMINATION ON TAXATION: HOW TRADE WITH CHINA IS AFFECTED TABLE OF CONTENTS PAGE EXECUTIVE SUMMARY.............................................................................................. iv INTRODUCTION ................................................................................................................ 1 I. U.S. EXPORTERS AND PRODUCERS ARE COMPETITIVELY DISADVANTAGED BY THE DIFFERENTIAL TREATMENT OF DIRECT AND INDIRECT TAXES IN INTERNATIONAL TRADE .............................................. 2 II. HISTORICAL BACKGROUND TO THE DIFFERENTIAL TREATMENT OF INDIRECT AND DIRECT TAXES IN INTERNATIONAL TRADE WITH RESPECT TO BORDER ADJUSTABILITY................................................................. 21 A. Border Adjustability of Taxes ................................................................. 21 B. 18th and 19th Century Examples of the Application of Border Tax Adjustments ......................................................................... -

Academic Search Complete

Academic Search Complete Pavadinimas Prenumerata nuo Prenumerata iki Metai nuo Metai iki 1 Technology times 2021-04-01 2021-12-31 20140601 20210327 2 Organization Development Review 2021-04-01 2021-12-31 20190101 3 PRESENCE: Virtual & Augmented Reality 2021-04-01 2021-12-31 20180101 4 Television Week 2021-04-01 2021-12-31 20030310 20090601 5 Virginia Declaration of Rights and Cardinal Bellarmine 2021-04-01 2021-12-31 6 U.S. News & World Report: The Report 2021-04-01 2021-12-31 20200124 7 Education Journal Review 2021-04-01 2021-12-31 20180101 8 BioCycle CONNECT 2021-04-01 2021-12-31 20200108 9 High Power Computing 2021-04-01 2021-12-31 20191001 10 Economic Review (Uzbekistan) 2021-04-01 2021-12-31 20130801 11 Civil Disobedience 2021-04-01 2021-12-31 12 Appeal to the Coloured Citizens of the World 2021-04-01 2021-12-31 13 IUP Journal of Environmental & Healthcare Law 2021-04-01 2021-12-31 14 View of the Revolution (Through Indian Eyes) 2021-04-01 2021-12-31 15 Narrative of Her Life: Mary Jemison 2021-04-01 2021-12-31 16 Follette's Platform of 1924 2021-04-01 2021-12-31 17 Dred Scott, Plaintiff in Error, v. John F. A. Sanford 2021-04-01 2021-12-31 18 U.S. News - The Civic Report 2021-04-01 2021-12-31 20180928 20200117 19 Supreme Court Cases: The Twenty-first Century (2000 - Present) 2021-04-01 2021-12-31 20 Geophysical Report 2021-04-01 2021-12-31 21 Adult Literacy 2021-04-01 2021-12-31 2000 22 Report on In-Class Variables: Fall 1987 & Fall 1992 2021-04-01 2021-12-31 2000 23 Report of investigation : the Aldrich Ames espionage case / Permanent Select Committee on Intelligence,2021-04-01 U.S. -

Report No. 82-156 Gov Major Acts of Congress And

REPORT NO. 82-156 GOV MAJOR ACTS OF CONGRESS AND TREATIES APPROVED BY THE SENATE 1789-1980 Christopher Dell Stephen W. Stathis Analysts in American National Governent Government Division September 1982 CONmGHnItNA^l JK 1000 B RE filmH C SE HVICA^^ ABSTRACT During the nearly two centuries since the framing of the Constitution, more than 41,000 public bills have been approved by Congress, submitted to the President for his approval and become law. The seven hundred or so acts summarized in this compilation represent the major acts approved by Congress in its efforts to determine national policies to be carried out by the executive branch, to authorize appropriations to carry out these policies, and to fulfill its responsibility of assuring that such actions are being carried out in accordance with congressional intent. Also included are those treaties considered to be of similar importance. An extensive index allows each entry in this work to be located with relative ease. The authors wish to credit Daphine Lee, Larry Nunley, and Lenora Pruitt for the secretarial production of this report. CONTENTS ABSTRACT.................................................................. 111 CONGRESSES: 1st (March 4, 1789-March 3, 1791)..................................... 3 2nd (October 24, 1791-March 2, 1793)................................... 7 3rd (December 2, 1793-March 3, 1795).................................. 8 4th (December 7, 1795-March 3, 1797).................................. 9 5th (May 15, 1797-March 3, 1799)....................................... 11 6th (December 2, 1799-March 3, 1801)................................... 13 7th (December 7, 1801-Marh 3, 1803)................................... 14 8th (October 17, 1803-March 3, 1805)....... ........................... 15 9th (December 2, 1805-March 3, 1807)................................... 16 10th (October 26, 1807-March 3, 1809).................................. -

Slavery in the United States - Wikipedia Page 1 of 25

Slavery in the United States - Wikipedia Page 1 of 25 Slavery in the United States Slavery in the United States was the legal institution of human chattel enslavement, primarily of Africans and African Americans, that existed in the United States of America in the 18th and 19th centuries. Slavery had been practiced by Americans under British rule from early colonial days, and was legal in all Thirteen Colonies at the time of the Declaration of Independence in 1776. It lasted until the end of the American Civil War. By the time of the American Revolution (1775–1783), the status of slave had been institutionalized as a racial caste associated with African ancestry.[1] When the United States Constitution was ratified (1789), a relatively small number of free people of color were among the voting citizens (male property owners).[2] During and immediately following the Revolutionary War, abolitionist laws were passed in most Northern states and a movement developed to abolish slavery. Most of these states had a higher proportion of free labor than in the South and economies based on different industries. They abolished slavery by the end of the 18th century, some with gradual systems that kept adults as slaves for two decades. However, the rapid expansion of the cotton industry in the Deep South after the invention of the cotton gin greatly increased demand for slave labor, and the An animation showing when United States territories and states Southern states continued as slave societies. Those states attempted to extend slavery into the new Western forbade or allowed slavery, 1789–1861. -

CONGRESSIONAL RECORD-SENAT:M SENATE

• 1934 _CONGRESSIONAL RECORD-SENAT:m 1039 Societies, representing upward of 100,000 men, against House Hale Lonergan Pittman Thomas, Utah Harrison McAdoo Pope Thompson bill 5978 relating to birth control; to the Committee on the Hastings McCarran Reynolds Townsend Judiciary. Hatch McGlll Robinson, Ark. Trammell Hatfield McKellar Robinson, Ind: Tydings 1707. Also, petition of Philip and Felicia Kornreich and Hayden McNary Russell Vandenberg 46 other residents of Paterson, N.J., against the passage <>f Johnson Murphy Schall VanNuys the Tugwell bill; to the Committee on Interstate and For Kean Neely Sheppard Wagner Keyes Norris Shipstead Walcott eign Commerce. King Nye Smith Walsh 1708. By Mr. SNELL: Petition of citizens of Canton, N.Y., La Follette O'Mahoney Steiwer Wheeler protesting against war preparations of the United States; to Lewis Overton Stephens White the Committee on Appropriations. Logan Patterson Thomas, Okla. 1709. By Mr. SUTPHIN: Petition of West End Parent Mr. FESS. I desire to announce that the senior Senator Teachers Association, endorsing the principles enunciated in from Rhode Island [Mr. METCALF], the junior Senator from the proposed revision of the present Federal Food and Drug Rhode Island [Mr. HEBERT], the Senator from South Da Act; to the Committee on Agriculture. kota [Mr. NORBECK], and the Senator from Pennsylvania [Mr. REED] are necessarily absent from the Senate. Mr. LEWIS. I desire to announce that the Senator from SENATE Louisiana [Mr. LoNG l is necessarily detained from the Senate. MONDAY, JANUARY 22,, 1934 The VICE PRESIDENT. Ninety-one Senators having (Legislative day of Thursday, Jan. 11, 1934) answered to their names, a quorum is present. -

Table of Contents

Table of Contents Preface ..................................................................................................... ix Introductory Notes to Tables ................................................................. xi Chapter A: Selected Economic Statistics ............................................... 1 A1. Resident Population of the United States ............................................................................3 A2. Resident Population by State ..............................................................................................4 A3. Number of Households in the United States .......................................................................6 A4. Total Population by Age Group............................................................................................7 A5. Total Population by Age Group, Percentages .......................................................................8 A6. Civilian Labor Force by Employment Status .......................................................................9 A7. Gross Domestic Product, Net National Product, and National Income ...................................................................................................10 A8. Gross Domestic Product by Component ..........................................................................11 A9. State Gross Domestic Product...........................................................................................12 A10. Selected Economic Measures, Rates of Change...............................................................14 -

Description of Provisions Listed for Further Hearings by the Committee on Finance On

[COMMITTEE PEINT] DESCRIPTION OF PROVISIONS LISTED FOR FURTHER HEARINGS BY THE COMMITTEE ON FINANCE ON JULY 20, 21, AND 22, 1976 Prepaeed for the Use of the COMMITTEE ON FINANCE BY THE STAFF OF THE JOINT COMMITTEE ON INTERNAL REVENUE TAXATION JULY 19, 1976 U.S. GOVERNMENT PRINTING OFFICE 74-376 WASHINGTON : 1976 JCS-30-76 •/[ TABLE OF CONTENTS Paee I. Introduction 1 II. Description of Provisions : 2 1. At-Risk Limitation for Limited Partners (see. 210 of the bill) 2 2. Refunds of Unutilized Investment Tax Credits (sec. 802 of the bill) 4 3. Expiring Investment and Foreign Tax Credits (sec. 803 of the bill) ,5 4. Investment Credit in the Case of Vessels Constructed from Capital Construction Funds (sec. 806 of the I»ill) (^ 5. Foreign Trusts Having One or More U.S. Beneficiaries To Be Taxed Currently to Grantor (sec. 1011 of the bill) 7 6. Investment in U.S. Property by Controlled Foreign Corpora- tions (sec. 1021 of the bill) 7 7. Exclusion from Subpart F of Certain Earnings of Insurance Companies (sec. 1023 of the bill) 8 8. Shipping Profits of Foreign Corporations (sec. 1024 of the bill) .____ 10 9. Limitation on Definition of Tax Haven Income for Agricultural Products (sec. 1025 of the bill) 11 10. Repeal of the Per-Country Foreign Tax Credit Limitation ( sec. 1031 of the bill) 12 11. Recapture of Foreign Losses (sec. 1032 of the bill) 13 12. Transitional Carryback of Foreign Taxes on Oil and Gas Extraction Income (sec. 103.> of the bill) : 15 13. Transitional Rule for Recapture of Foreign Oil-Related Losses (sec.