CED-81-103 the Changing Airline Industry: a Status Report Through

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Before the Us Department Of

BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION FEDERAL AVIATION ADMINISTRATION WASHINGTON DC _________________________________________________________ ) ) NOTICE OF PETITION FOR WAIVER ) AND SOLICITATION OF COMMENTS ) Docket No. FAA20100109 GRANT OF PETITION WITH CONDITIONS ) ) ________________________________________________________ ) COMMENTS OF CONSUMER TRAVEL ALLIANCE Communications with respect to this document should be sent to: Charles Leocha, Director Consumer Travel Alliance, Inc. PO Box 15286, Washington, DC 20003 Tel. 202‐713‐9596 Email: [email protected] The Consumer Travel Alliance (CTA) is a nonprofit, nonpartisan organization that works to provide an articulate and reasoned voice in decisions that affect travel consumers across travel’s entire spectrum. CTA’s staff gathers facts, analyzes issues, and disseminates that information to the public, the travel industry, regulators and policy makers. CTA was founded in January 2009 by longtime travel journalists Charles Leocha, former MSNBC travel guru and author of Travel Rights, and Christopher Elliott, ombudsman for National Geographic Traveler and author of travel columns for Tribune Syndicates, MSNBC.com and the Washington Post syndicate. Introduction Delta Air Lines, Inc. (Delta) and US Airways, Inc. (US Airways) have petitioned the Department of Transportation for permission to swap slots between La Guardia Airport (LGA) and Ronald Reagan Washington National Airport (DCA). CTA submits these comments in response to the July 28, 2011 Notice issued by the Department of Transportation (DOT) soliciting comments on a “Petition for Waiver” from Delta Air Lines and US Airways (“Joint Applicants”) to consummate a proposed transfer of a total of 349 slots at New York LaGuardia Airport (LGA) and Ronald Reagan Washington National Airport (DCA) (“Slot Swap # 2”). -

Federal Register/Vol. 72, No. 223/Tuesday, November 20, 2007

Federal Register / Vol. 72, No. 223 / Tuesday, November 20, 2007 / Proposed Rules 65237 with Indian Tribal Governments’’). F. Unfunded Mandates Reform Act • Fax: (202) 493–2251. Because none of the options on which The Department has determined that Instructions: You must include the we are seeking comment would the requirements of Title II of the agency name and docket number DOT– significantly or uniquely affect the Unfunded Mandates Reform Act of 1995 OST–01–9325 or the Regulatory communities of the Indian tribal do not apply to this notice. Identification Number (RIN) for the governments or impose substantial rulemaking at the beginning of your direct compliance costs on them, the Issued this 15th day of November, 2007, at comment. All comments received will Washington, DC. funding and consultation requirements be posted without change to http:// of Executive Order 13084 do not apply. Michael W. Reynolds, www.regulations.gov, including any Deputy Assistant Secretary for Aviation and personal information provided. D. Regulatory Flexibility Act International Affairs. Privacy Act: Anyone is able to search [FR Doc. 07–5760 Filed 11–15–07; 4:15 pm] The Regulatory Flexibility Act (5 the electronic form of all comments BILLING CODE 4910–13–P U.S.C. 601 et seq.) requires an agency to received in any of our dockets by the review regulations to assess their impact name of the individual submitting the comment (or signing the comment, if on small entities unless the agency DEPARTMENT OF TRANSPORTATION submitted on behalf of an association, determines that a rule is not expected to business, labor union, etc.). -

Airline Service Abandonment and Consolidation - a Chapter in the Battle Ga Ainst Subsidization Ronald D

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Southern Methodist University Journal of Air Law and Commerce Volume 32 | Issue 4 Article 2 1966 Airline Service Abandonment and Consolidation - A Chapter in the Battle ga ainst Subsidization Ronald D. Dockser Follow this and additional works at: https://scholar.smu.edu/jalc Recommended Citation Ronald D. Dockser, Airline Service Abandonment and Consolidation - A Chapter in the Battle against Subsidization, 32 J. Air L. & Com. 496 (1966) https://scholar.smu.edu/jalc/vol32/iss4/2 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Journal of Air Law and Commerce by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. AIRLINE SERVICE ABANDONMENT AND CONSOLIDATION - A CHAPTER IN THE BATTLE AGAINST SUBSIDIZATIONt By RONALD D. DOCKSERtt CONTENTS I. INTRODUCTION II. THE CASE FOR ELIMINATING SUBSIDY A. Subsidy Cost B. Misallocation Results Of Subsidy C. CAB Present And Future Subsidy Goals III. PROPOSALS FOR FURTHER SUBSIDY REDUCTION A. Federal TransportationBill B. The Locals' Proposal C. The Competitive Solution 1. Third Level Carriers D. Summary Of Proposals IV. TRUNKLINE ROUTE ABANDONMENT A. Passenger Convenience And Community Welfare B. Elimination Of Losses C. Equipment Modernization Program D. Effect On Competing Carriers E. Transfer Of Certificate Approach F. Evaluation Of Trunkline Abandonment V. LOCAL AIRLINE ROUTE ABANDONMENT A. Use-It-Or-Lose-It 1. Unusual and Compelling Circumstances a. Isolation and Poor Surface Transportation b. -

RCED-86-26 Deregulation: Increased Competition Is Making Airlines

UNITED STATES GENERAL ACCOUNTING OFFICE WASHINGTON, D.C. 20648 RESOURCES, COMMUNITY. AND ECONOMIC DEVELOPMENT OIVISION B-197119 The Honorable James J. Howard Chairman, Committee on Public Works and Transportation House of Representatives The Honorable Norman Y. Mineta Chairman, Subcommittee on Aviation Committee on Public Works and Transportation House of Representatives This report, prepared in response to your January 26, 1984, request, discusses changes in the airline industry since enact- ment of the Airline Deregulation Act of 1978. It updates our report entitled The Changing Airline Industry: A Status Report Through 1982 (GAO/RCED-83-179, July 6, 1983). The report discusses airline competition, traffic, fares, service, and pro- fits, and analyzes industry changes based on economic expecta- tions of deregulation's effect. At your request, we did not obtain agency comments on the draft report. As arranged with your offices, unless you publicly announce its contents earlier, we plan no further distribution of this report until 14 days from the date of the report. At that time we will send copies to interested parties and make copies avail- able to others upon request. GENERAL ACCOUNTING OFFICE DEREGULATION: REPORT INCREASED COMPETITIOrJ IS MAKING AIRLINES MORE EFFICIENT AND RESPONSIVE TO CONSUMERS ---m-eDIGEST From 1938 to 1978, the Civil Aeronautics Board (CAB) controlled domestic interstate airline fares and the cities each airline served. Concerned that regulation made the industry inefficient and resulted in many fares being too high, the Congress enacted the Airline Deregulation Act of 1978. The act phased out CAB control of fares and service levels. (See PP. 1 and 2.) At the request of the Chairmen, House Committee on Public Works and Transportation and its Subcommittee on Aviation, this report updates GAO's report entitled The Clhanging __----Airline ~~ _Industrv: A Status Report :Through 1982 (GAO/RCED-83-179, July 6, 1983), and evaluates how industry changes compare with economic expectations of deregulation's impact. -

Chapter Iv Regionals/Commuters

CHAPTER IV REGIONALS/COMMUTERS For purposes of the Federal Aviation REVIEW OF 20032 Administration (FAA) forecasts, air carriers that are included as part of the regional/commuter airline industry meet three criteria. First, a The results for the regional/commuter industry for regional/commuter carrier flies a majority of their 2003 reflect the continuation of a trend that started available seat miles (ASMs) using aircraft having with the events of September 11th and have been 70 seats or less. Secondly, the service provided by drawn out by the Iraq War and Severe Acute these carriers is primarily regularly scheduled Respiratory Syndrome (SARS). These “shocks” to passenger service. Thirdly, the primary mission of the system have led to the large air carriers posting the carrier is to provide connecting service for its losses in passengers for 3 years running. The code-share partners. losses often reflect diversions in traffic to the regional/commuter carriers. These carriers During 2003, 75 reporting regional/commuter recorded double-digit growth in both capacity and airlines met this definition. Monthly traffic data for traffic for the second time in as many years. History 10 of these carriers was compiled from the has demonstrated that the regional/commuter Department of Transportation’s (DOT) Form 41 industry endures periods of uncertainty better than and T-100 filings. Traffic for the remaining the larger air carriers. During the oil embargo of 65 carriers was compiled solely from T-100 filings. 1 1973, the recession in 1990, and the Gulf War in Prior to fiscal year 2003, 10 regionals/commuters 1991, the regional/commuter industry consistently reported on DOT Form 41 while 65 smaller outperformed the larger air carriers. -

Here Aspiring Pilots Are Well Prepared to Make the Critical Early Career and Lifestyle Choices Unique to the Aviation Industry

August 2021 Aero Crew News Your Source for Pilot Hiring and More.. START PREPARING FOR YOUR APPROACH INTO RETIREMENT Designed to help you understand some of the decisions you will need to make as you get ready for your approach into retirement, our free workbook includes 5 key steps to begin preparing for life after flying. You’ll discover more about: • How you will fund your retirement “paycheck” • What your new routine might look like • If your investment risk needs to be reassessed • And much more Dowload your free Retirement Workbook » 800.321.9123 | RAA.COM Aero Crew News 2021 PHOTO CONTEST Begins Now! This year’s theme is Aviation Weather! Submit your photos at https://rebrand.ly/ACN_RAA_Photo_Contest Official rules can be found at https://rebrand.ly/ACN-RAA-Rules. Jump to each section Below contents by clicking on the title or photo. August 2021 37 50 41 56 44 Also Featuring: Letter from the Publisher 8 Aviator Bulletins 11 Mortgage - The Mortgage Process Part 2 52 Careers - Routines and Repetition 54 4 | Aero Crew News BACK TO CONTENTS the grid US Cargo US Charter US Major Airlines US Regional Airlines ABX Air Airshare Alaska Airlines Air Choice One Alaska Seaplanes GMJ Air Shuttle Allegiant Air Air Wisconsin Ameriflight Key Lime Air American Airlines Cape Air Atlas Air/Southern Air Omni Air International Delta Air Lines CommutAir FedEx Express Ravn Air Group Frontier Airlines Elite Airways iAero Airways XOJET Aviation Hawaiian Airlines Endeavor Air Kalitta Air JetBlue Airways Envoy Key Lime Air US Fractional Southwest Airlines ExpressJet Airlines UPS FlexJet Spirit Airlines GoJet Airlines NetJets Sun Country Airlines Grant Aviation US Cargo Regional PlaneSense United Airlines Horizon Air Empire Airlines Key Lime Air Mesa Airlines ‘Ohana by Hawaiian Piedmont Airlines PSA Airlines Republic Airways The Grid has moved online. -

Aviation Activity Forecasts

2 Aviation Activity Forecasts INTRODUCTION The Charles M. Schulz–Sonoma County Airport (STS) is one of six public use airports in Sonoma County. It is the only commercial service airport1 between the San Francisco Bay Area to the south, Sacramento to the east and Arcata-Eureka to the north. The Airport’s primary service area has a population of over 1 million people2 and includes Sonoma, Lake, and Mendocino counties, and parts of Marin and Napa counties. Airport Role The Sonoma County Airport, as the region’s principal Airport, serves many roles, including providing facilities for scheduled commuter and air carrier airline services. The California Aviation System Plan (CASP) designates the Airport as a Primary Commercial Service Non-Hub Airport. There are no Primary Commercial Service Hub airports in the region. The closest Primary Commercial Service Hub airports are the San Francisco, Oakland, and San Jose International Airports. The Sacramento International Airport is slightly more distant, but at times it can be more convenient for highway travel. The Sonoma County Airport also serves a growing population of general aviation (GA) activities including corporate and business flying. For this reason, the Federal Aviation Administration’s (FAA) National Plan of Integrated Airport Systems (NPIAS) currently classifies the Airport as a General Aviation facility, but in the future the Airport is expected to be reclassified as a Commercial Service Non-Primary Airport. A strong potential exists for additional scheduled airline and commuter air carrier service, particularly in the form of new, quiet technology jet aircraft with up to 135 passenger seats.3 The Airport also serves as a base of operations for local pilots, a place to conduct business, and a point of emergency access for the region. -

RCED-90-147 Airline Competition

All~lISI l!t!)o AIRLINE COMPETITION Industry Operating and Marketing Practices Limit Market Entry -- ~~Ao//I~(::I’:I~-~o-lri7 ---- “._ - . -...- .. ..._ __ _ ..”._._._.__ _ .““..ll.l~,,l__,*” _~” _.-. Resources, Community, and Economic Development Division B-236341 August 29,lQQO The Honorable John C. Danforth Ranking Minority Member, Committee on Commerce, Science, and Transportation United States Senate The Honorable Jack Brooks Chairman, Committee on the Judiciary House of Representatives In response your requests, this report provides information on how various airline industry operating and marketing practices limit entry into the deregulated airline industry and how they affect competition in that industry. Specifically, we identified two major types of . barriers. The first type is created by the unavailability of the airport facilities and operating rights an airline must have in order to begin or expand service at an airport. The second type is created by airline marketing practices that have come into widespread use since deregulation. As agreed with your offices, unless you publicly announce its contents earlier, we plan no further distribution of this report until 30 days from the date of this letter. At that time, we will send copies to the Secretary of the Department of Transportation; the Administrator, Federal Aviation Administration; and interested congressional committees. We will also make copies available to others upon request. If you have any questions about this report, please contact me at (202) 276-1000. Major contributors to this report are listed in appendix XIII. Kenneth M. Mead Director, Transportation Issues . , Executive Summary When the Congress passed the Airline Deregulation Act in 1978, it Purpose sought to foster competition so as to promote lower fares and good ser- vice. -

Airline Service Abandonment and Consolidation - a Chapter in the Battle Ga Ainst Subsidization Ronald D

Journal of Air Law and Commerce Volume 32 | Issue 4 Article 2 1966 Airline Service Abandonment and Consolidation - A Chapter in the Battle ga ainst Subsidization Ronald D. Dockser Follow this and additional works at: https://scholar.smu.edu/jalc Recommended Citation Ronald D. Dockser, Airline Service Abandonment and Consolidation - A Chapter in the Battle against Subsidization, 32 J. Air L. & Com. 496 (1966) https://scholar.smu.edu/jalc/vol32/iss4/2 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Journal of Air Law and Commerce by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. AIRLINE SERVICE ABANDONMENT AND CONSOLIDATION - A CHAPTER IN THE BATTLE AGAINST SUBSIDIZATIONt By RONALD D. DOCKSERtt CONTENTS I. INTRODUCTION II. THE CASE FOR ELIMINATING SUBSIDY A. Subsidy Cost B. Misallocation Results Of Subsidy C. CAB Present And Future Subsidy Goals III. PROPOSALS FOR FURTHER SUBSIDY REDUCTION A. Federal TransportationBill B. The Locals' Proposal C. The Competitive Solution 1. Third Level Carriers D. Summary Of Proposals IV. TRUNKLINE ROUTE ABANDONMENT A. Passenger Convenience And Community Welfare B. Elimination Of Losses C. Equipment Modernization Program D. Effect On Competing Carriers E. Transfer Of Certificate Approach F. Evaluation Of Trunkline Abandonment V. LOCAL AIRLINE ROUTE ABANDONMENT A. Use-It-Or-Lose-It 1. Unusual and Compelling Circumstances a. Isolation and Poor Surface Transportation b. Growing Economic Potential of the Community c. Improved Equipment Will Soon Attract More Traffic d. Carrier Profits Despite Low Usage e. -

Northwest Regional Air Service Initiative Handbook

Northwest Regional Air Service Initiative Handbook Small Community Air Service Development empowering pacific northwest communities Northwest Regional Air Service Initiative Handbook These materials are sponsored by Oregon Department of Aviation Washington Department of Transportation – Aviation Oregon Airport Management Association Washington Airport Management Association US Department of Transportation © Mead & Hunt, Inc. 2006 Table of contents Section 1 Section 4 An overview of the Northwest Regional Airline types and their potential for air Air Service Initiative (NWRASI) service development Introduction . 1 Legacy airlines . 11 Background . 1 Low-cost airlines . 12 NWRASI goals . 2 Select airlines . 13 NWRASI plan . 2 Regional airlines . 13 Phase I . Small Community Air Service Other airlines . 14 Development Tool Kit . 2 Summary of main points . 14 Phase II . Small Community Air Service Market Analysis . 3 Section 5 Phase III . Oregon–Washington Small The importance of airline partnerships Community Air Service Strategies . 3 Marketing Agreements . 15 Summary of main points . 3 Codeshares and their role . 15 Interline Agreements . 16 Section 2 Contract and at-risk agreements . 16 Air service contributions to economy and lifestyle Summary of main points . 17 Contribution to the overall economy . 5 Contribution to local businesses . 6 Section 6 Contribution to quality of life . 6 Kinds of aircraft and their fit with small communities Summary of main points . 6 Aircraft economics . 19 Matching aircraft to markets . 20 Section 3 Jet versus turboprop orders and replacements . 20 e v i Industry status and impact on air service t Regional airline fleet trends . 21 a i An industry struggling financially . 7 t i Service providers and aircraft . 21 n I The 9-11 hangover . -

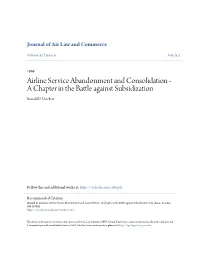

3 Digit 2 Digit Ticketing Code Code Name Code ------6M 40-MILE AIR VY A.C.E

06/07/2021 www.kovrik.com/sib/travel/airline-codes.txt 3 Digit 2 Digit Ticketing Code Code Name Code ------- ------- ------------------------------ --------- 6M 40-MILE AIR VY A.C.E. A.S. NORVING AARON AIRLINES PTY SM ABERDEEN AIRWAYS 731 GB ABX AIR (CARGO) 832 VX ACES 137 XQ ACTION AIRLINES 410 ZY ADALBANAIR 121 IN ADIRONDACK AIRLINES JP ADRIA AIRWAYS 165 REA RE AER ARANN 684 EIN EI AER LINGUS 053 AEREOS SERVICIOS DE TRANSPORTE 278 DU AERIAL TRANSIT COMPANY(CARGO) 892 JR AERO CALIFORNIA 078 DF AERO COACH AVIATION INT 868 2G AERO DYNAMICS (CARGO) AERO EJECUTIVOS 681 YP AERO LLOYD 633 AERO SERVICIOS 243 AERO TRANSPORTES PANAMENOS 155 QA AEROCARIBE 723 AEROCHAGO AIRLINES 198 3Q AEROCHASQUI 298 AEROCOZUMEL 686 AFL SU AEROFLOT 555 FP AEROLEASING S.A. ARG AR AEROLINEAS ARGENTINAS 044 VG AEROLINEAS EL SALVADOR (CARGO) 680 AEROLINEAS URUGUAYAS 966 BQ AEROMAR (CARGO) 926 AM AEROMEXICO 139 AEROMONTERREY 722 XX AERONAVES DEL PERU (CARGO) 624 RL AERONICA 127 PO AEROPELICAN AIR SERVICES WL AEROPERLAS PL AEROPERU 210 6P AEROPUMA, S.A. (CARGO) AW AEROQUETZAL 291 XU AEROVIAS (CARGO) 316 AEROVIAS COLOMBIANAS (CARGO) 158 AFFRETAIR (PRIVATE) (CARGO) 292 AFRICAN INTERNATIONAL AIRWAYS 648 ZI AIGLE AZUR AMM DP AIR 2000 RK AIR AFRIQUE 092 DAH AH AIR ALGERIE 124 3J AIR ALLIANCE 188 4L AIR ALMA 248 AIR ALPHA AIR AQUITAINE FQ AIR ARUBA 276 9A AIR ATLANTIC LTD. AAG ES AIR ATLANTIQUE OU AIR ATONABEE/CITY EXPRESS 253 AX AIR AURORA (CARGO) 386 ZX AIR B.C. 742 KF AIR BOTNIA BP AIR BOTSWANA 636 AIR BRASIL 853 AIR BRIDGE CARRIERS (CARGO) 912 VH AIR BURKINA 226 PB AIR BURUNDI 919 TY AIR CALEDONIE 190 www.kovrik.com/sib/travel/airline-codes.txt 1/15 06/07/2021 www.kovrik.com/sib/travel/airline-codes.txt SB AIR CALEDONIE INTERNATIONAL 063 ACA AC AIR CANADA 014 XC AIR CARIBBEAN 918 SF AIR CHARTER AIR CHARTER (CHARTER) AIR CHARTER SYSTEMS 272 CCA CA AIR CHINA 999 CE AIR CITY S.A. -

Airline Mergers and Alliances 1999

Airline Mergers and Alliances 1999 The OECD Competition Committee debated airline mergers and alliances in October 1999. This document includes an executive summary and the documents from the meeting: an analytical note by Mr. Darryl Biggar for the OECD, written submissions from Australia, the Czech Republic, Denmark, Italy, Japan, Mexico, Norway, Poland, the United Kingdom, the United States, the European Commission, BIAC, ICC, as well as an aide-memoire of the discussion. Although airlines have long sought to enter alliances with one another, the last decade has seen an important new development - the crystallisation of international airline alliances around a small number of major airline groupings. The scope and nature of these alliances differ, but there is a tendency towards deeper alliances involving co-operation on all aspects of the airline business. These super-alliances are coming as close to actual mergers as aviation’s Byzantine regulations allow, raising fundamental questions for competition policy-makers and enforcers. Alliances have the potential both to enhance the level and quality of services offered to consumers and, at the same time to significantly restrict competition. Why do airlines seek to enter such alliances? What are the benefits to the airlines or consumers? How do alliances restrict competition? What is the role played by frequent-flyer programmes and other loyalty schemes? What remedies should competition authorities consider to alleviate the harmful effects of alliances? What is the appropriate role for international co-operation between authorities? Competition Issues in Joint Ventures (2000) Competition Policy and International Airport Services (1997) Unclassified DAFFE/CLP(2000)1 Organisation de Coopération et de Développement Economiques OLIS : 26-Jan-2000 Organisation for Economic Co-operation and Development Dist.