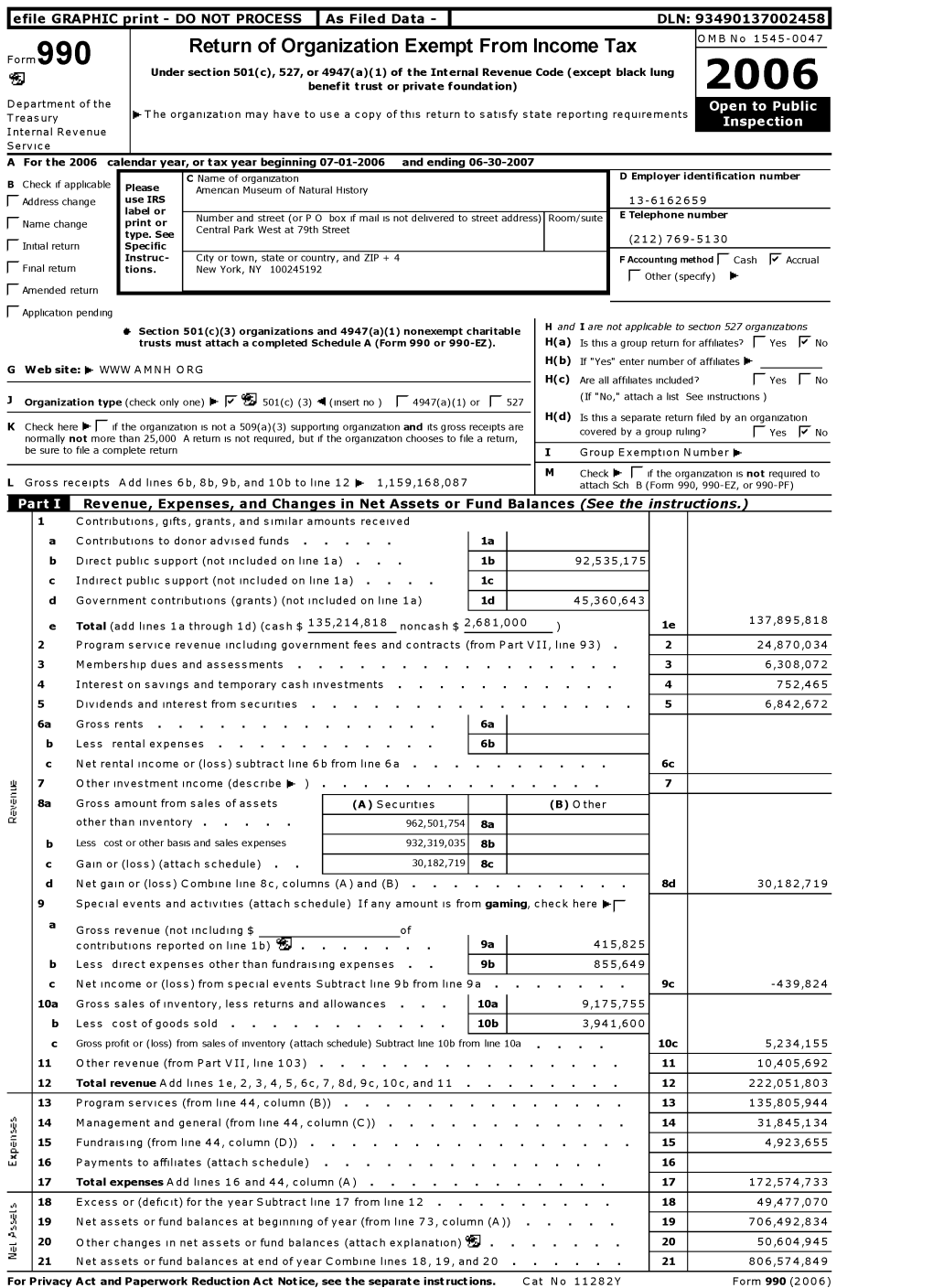

Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Frick Collection Staff As of June 30, 2011

The Frick Collection annual report july 2010 – june 2011 The Frick Collection annual report july 2010 – june 2011 leadership 2 Board of Trustees reports 3 Margot Bogert, Chairman 6 Anne L. Poulet, Director 8 Colin B. Bailey, Associate Director and Peter Jay Sharp Chief Curator 11 Stephen Bury, Andrew W. Mellon Chief Librarian collection 13 Museum Acquisitions 13 Noteable Library Acquisitions public programming 15 Exhibitions 15 Lectures 17 Free Public Evenings 17 Symposia 17 Publications 18 Concerts financial statements 19 Statement of Financial Position 20 Statement of Activities donor support and membership 21 Gifts and Grants 25 Fellows and Friends 32 Corporate Members and Sponsors staff 33 The Frick Collection 36 Frick Art Reference Library cover Giovanni Bellini (c. 1430/1435–1516), detail of St. Francis in the Desert, c. 1475–78, oil on poplar panel, The Frick Collection; photograph by Michael Bodycomb The Frick Collection Board of Trustees As of June 30, 2011 Margot Bogert, Chairman Walter A. Eberstadt, Vice Chairman Franklin W. Hobbs, Treasurer John P. Birkelund, Secretary Peter P. Blanchard III L. F. Boker Doyle Blair Effron Jean-Marie Eveillard Barbara G. Fleischman Emily T. Frick Martha Loring Anne L. Poulet, ex officio Juan Sabater Stephen A. Schwarzman Aso O. Tavitian Helen Clay Chace President Emerita I. Townsend Burden III Walter Joseph Patrick Curley Howard Phipps Jr. Trustees Emeriti Annual Report July 2010–June 2011 2 optimistic that the year ahead will continue range of high-profile media coverage, includ- Report of the Chairman on a steady course. ing a substantial “Why the Frick Matters” Margot Bogert I am happy to report that the physical article published in the Wall Street Journal. -

The Frick Collection W Inte R /Spring 2014 Programs the Frick Collection 1 East 70Th Street, New York, Ny 10021 212.288.0700

The Frick Collection w inte r /Spring 2014 programS The Frick Collection 1 east 70th street, new york, ny 10021 212.288.0700 www.frick.org hours nternationally recognized as a premier museum and Tuesday through Saturday 10:00 a.m. to 6:00 p.m. I research center, The Frick Collection is known for its Sunday 11:00 a.m. to 5:00 p.m. distinguished Old Master paintings and outstanding exam- Closed Mondays, New Year’s Day, Independence Day, ples of European sculpture and decorative arts. Thanksgiving, and Christmas The collection was assembled by the Pittsburgh indus- trialist Henry Clay Frick (1849–1919) and is housed in his family’s former residence on Fifth Avenue. One of New York admission City’s few remaining Gilded Age mansions, it provides a tranquil environment for visitors to experience masterpieces General Public $20 by artists such as Bellini, Rembrandt, Vermeer, Goya, and Seniors (65 and over) $15 Whistler. The museum opened in 1935 and has continued to Students $10 acquire works of art since Mr. Frick’s death. Members Free Adjacent to the museum is the Frick Art Reference Library, founded by Helen Clay Frick as a memorial to her On Sundays from 11:00 a.m. to 1:00 p.m., visitors may father. Today it is one of the leading institutions for research pay what they wish. in the history of art and collecting. Children under ten are not admitted. Along with special exhibitions and an acclaimed con- Group visits are by appointment; call 212.288.0700 cert series, the Frick offers a wide range of lectures, symposia, to schedule. -

Press Release

FRICK COLLECTION ANNOUNCES A MAJOR PAINTING ACQUISITION MURILLO’S SELF-PORTRAIT TO COMPLEMENT THE MUSEUM’S SIGNIFICANT BODY OF SPANISH WORKS In recent years, The Frick Collection has showcased its strength in Spanish paintings through acclaimed exhibitions, publications, events on Velázquez, El Greco, and Goya, and the collecting taste for such works. The focus is warranted, given founder Henry Clay Frick’s early travels to Spain and his deep interest in Spanish artists. Less known, however, is the fact that his first acquisition of Iberian painting was a significant self- portrait by Bartolomé Esteban Murillo (1617–82), a work that has remained in the Frick family since its purchase in 1904. The painting has come to the New York museum as the gift of Mrs. Henry Clay Frick II and the late Dr. Henry Clay Frick II. It is on view in the South Hall. Murillo, Self-Portrait, c. 1650–55, oil on canvas, 42 x 30 ½ inches, Comments Director Ian Wardropper, “We are pleased to share with the The Frick Collection, New York, gift of † Dr. and Mrs. Henry Clay Frick II; photo: Michael Bodycomb public this work by Murillo, a major baroque artist who has not been represented in our holdings despite his significance in the canon of Spanish painting. Our permanent collection continuously evolves―sometimes through gifts, sometimes through purchase―and this growth has occurred over the decades within every media purchased by Henry Clay Frick, each addition amplifying our understanding of various schools and artists. With this very significant acquisition, we are eager to consider our Spanish paintings again in a new light and through fresh scholarship.” Adds Peter Jay Sharp Chief Curator Xavier F. -

The Frick Collection Staff As of June 30, 2015

The Frick Collection membersannual report’ magazine july winter2014 – june 2011 2015 annual report summary july 2014 – june 2015 The Frick Collection annual report july 2014 – june 2015 leadership 2 Board of Trustees reports 3 Margot Bogert, Chairman, and Ian Wardropper, Director 5 Xavier F. Salomon, Peter Jay Sharp Chief Curator 8 Stephen J. Bury, Andrew W. Mellon Chief Librarian collection 10 Museum Acquisitions and Notable Library Acquisitions public programming 11 Exhibitions and Lectures 12 Free Public Evenings 13 Symposia, Publications, and Concerts financial statements 14 Statement of Financial Position 15 Statement of Activities donor support and membership 16 Gifts and Grants 20 Director’s Circle and Annual Fund 22 Fellows and Friends 28 Young Fellows 31 Exhibition Support 32 Corporate Members and Sponsors 33 Henry Clay Frick Associates staff 34 The Frick Collection 37 Frick Art Reference Library cover John Singer Sargent (1856–1925), detail of Lady Agnew of Lochnaw, 1892, oil on canvas, Scottish National Gallery, Edinburgh; photograph © Trustees of the National Galleries of Scotland The Frick Collection Board of Trustees As of June 30, 2015 Margot Bogert, Chairman Aso O. Tavitian, Vice Chairman Juan Sabater, Treasurer Michael J. Horvitz, Secretary Peter P. Blanchard III Ayesha Bulchandani-Mathrani Elizabeth M. Eveillard Barbara G. Fleischman Emily T. Frick Franklin W. Hobbs Sidney R. Knafel Monika McLennan James S. Reibel, M.D. Charles M. Royce Stephen A. Schwarzman Melinda Martin Sullivan J. Fife Symington IV Ian Wardropper, ex officio President Emerita Helen Clay Chace Trustees Emeriti John P. Birkelund I. Townsend Burden III Walter Joseph Patrick Curley L. F. Boker Doyle Blair Effron Howard Phipps Jr. -

Frick AR 2000

The Frick Collection Report The Frick Collection Report Andrea Mantegna (‒), Descent into Limbo, c. , tempera on panel, the Barbara Piasecka Johnson Collection. The work will hang in the Enamel Room until August , . The Frick Collection Board of Trustees Henry Clay Frick II, Chairman L. F. Boker Doyle, Treasurer Helen Clay Chace, President Emily T. Frick Peter P. Blanchard III Nicholas H. J. Hall, ex officio Margot C. Bogert Paul G. Pennoyer, Jr., Secretary The Frick Collection Board of Trustees I. Townsend Burden III Howard Phipps, Jr., Vice President Contents Council of The Frick Collection Walter Joseph Patrick Curley Melvin R. Seiden Young Fellows Steering Committee Report of the President Report of the Director Curatorial Council of The Frick Collection Exhibitions, Lectures & Publications Concerts Nicholas H. J. Hall, Chairman Douglas B. Leeds Frick Art Reference Library Julian Agnew Martha Loring, ex officio Public Affairs, Development & Communications Irene Roosevelt Aitken Diane Allen Nixon Gifts & Grants during Jean A. Bonna Richard E. Oldenburg Fellows and Friends of The Frick Collection W. M. Brady Paul G. Pennoyer, Jr. Corporate Members Jonathan Brown Marc Porter Autumn Dinner Vivien R. Clark Samuel Sachs II, ex officio Edwardian Ball Peter Duchin Melvin R. Seiden Financial Statements Robert Garrett Deirdre C. Stam Staff Mauro A. Herlitzka Wynant D. Vanderpoel III Credits Joseph L. Koerner, Vice Chairman Nina Zilkha Jon Landau Young Fellows Steering Committee Nathalie Kaplan, Chairman Martha Loring, Secretary Elizabeth Fleming Jennifer Nilles Amy Mazzola Flynn Victoria Rotenstreich Lisa Rossi Gorrivan Juan Sabater Philip C. Gorrivan Louise Schliemann Julian Iragorri Christine Scornavacca Robert Lindgren Genevieve Wheeler Victoria Lindgren When I assumed the presidency of The Frick Collec- by Enid Haupt, who has stepped down from the tion a year ago, I had but an inkling of the commit- Board after more than a decade of service. -

International Fine Art Fair 28 Financial Statements 30 Staff 43 Report of the President

The Frick Collection Annual Report January 1, 2004, through June 30, 2005 The Frick Collection Council of Young Fellows Board of Trustees The Frick Collection Steering Committee As of June 30, 2005 As of June 30, 2005 As of June 30, 2005 Helen Clay Chace W. Mark Brady Nathalie Kaplan President Chairman Chairman Howard Phipps Jr. Jonathan Brown Martha Loring Vice President Vice Chairman Secretary L. F. Boker Doyle Julian Agnew Amy Mazzola Flynn Treasurer Irene Roosevelt Aitken Lisa Rossi Gorrivan Jean A. Bonna Philip C. Gorrivan I. Townsend Burden III Vivien R. Clark Julian Iragorri Secretary Anthony Crichton-Stuart Robert Lindgren Hester Diamond Victoria Lindgren John P. Birkelund Peter Duchin Jennifer Nilles Peter P. Blanchard III Nicholas H. J. Hall Victoria Rotenstreich Margot C. Bogert Jon Landau Marianna Sabater W. Mark Brady Martha Loring, ex officio Louise Schliemann Walter A. Eberstadt Thierry Millerand Catherine Shepard Emily T. Frick Diane Allen Nixon Andrew Thomas Juan Sabater Richard E. Oldenburg Genevieve Wheeler Brown Stephen A. Schwarzman Charles Ryskamp Melvin R. Seiden Stephen K. Scher Deirdre C. Stam Henry Clay Frick II Beatrice Stern Chairman Emeritus George Wachter Isabel S. Wilcox Walter Joseph Patrick Curley Nina Zilkha Trustee Emeritus Paul G. Pennoyer Jr. Trustee Emeritus Contents Report of the President 6 Report of the Director 8 Report of the Chief Curator 10 Lectures 13 Report of the Andrew W. Mellon Librarian 14 Notable Library Acquisitions 16 Concerts 18 Gifts & Grants 19 Director’s Circle 20 Fellows of The Frick Collection 20 Corporate Members & Grants 26 Matching Gift Companies 26 2004 Annual Fund 27 Autumn Dinner 27 International Fine Art Fair 28 Financial Statements 30 Staff 43 report of the president Helen Clay Chace On behalf of the Board of Trustees, I am pleased to revenue from gifts, grants, and memberships. -

The Frick Collection Winter 2015 Programs the Frick Collection 1 East 70Th Street, New York, Ny 10021 212.288.0700

The Frick Collection winter 2015 programs The Frick Collection 1 east 70th street, new york, ny 10021 212.288.0700 www.frick.org Winter 2015 exhibitions 2 acquisition 8 free night 9 talks 10 conversations 11 lectures 12 salon evenings 14 symposium 16 seminars 17 studio 18 students 19 concerts 22 About The Frick Collection 24 Hours, Admission & Membership 27 e x h i b i T i o n s Coypel’s Don Quixote tapestries: illustrating a spanish novel in eighteenth-Century FranCe February 25 through May 17, 2015 A masterpiece of comic fiction, Cervantes’s Don Quixote enjoyed immense popularity from the time it was published (in two volumes, in 1605 and 1615). Reprints and translations spread across Europe, captivating the continental imagina- tion with the adventures of the knight Don Quixote and his companion, Sancho Panza. The novel’s most celebrated epi- sodes inspired a wealth of paintings, prints, and interiors. Most notably, Charles Coypel, painter to Louis XV, created a series of twenty-eight cartoons to be woven into tapestries by the Gobelins manufactory in Paris. Twenty-seven were painted between 1714 and 1734, with the last scene realized in 1751, just before Coypel’s death. To commemorate the 400th anniversary of the publica- tion of the second volume of Don Quixote, the Frick brings together a complete series of Coypel’s imaginative scenes, including two large tapestries from the permanent collec- tion that have not been on view in more than ten years and three Gobelins panels from the J. Paul Getty Museum in Los Angeles. -

The Frick Collection

The Frick Collection Winter 2016 programs about the frick collection The Frick Collection 1 east 70th street, new york, ny 10021 nternationally recognized as a premier museum and 212.288.0700 frick.org I research center, The Frick Collection is known for its distinguished Old Master paintings and outstanding exam- ples of European sculpture and decorative arts. The collection was assembled by the Pittsburgh industri- alist Henry Clay Frick (1849–1919) and is housed in his fami- ly’s former residence on Fifth Avenue. One of New York City’s few remaining Gilded Age mansions, it provides a tranquil environment for visitors to experience masterpieces by art- ists such as Bellini, Rembrandt, Vermeer, Goya, and Whistler. The museum opened in 1935 and has continued to acquire works of art since Mr. Frick’s death. Winter 2016 Adjacent to the museum is the Frick Art Reference Library, founded by Helen Clay Frick as a memorial to her father. Today it is one of the leading institutions for research in the history of art and collecting. The Library is open to the public free of charge. exhibitions 2 Along with special exhibitions and an acclaimed concert lectures 4 series, the Frick offers a wide range of lectures, symposia, and seminars 8 education programs that foster a deeper appreciation of its permanent collection. studio 9 conversations 10 talks 11 student programs 12 free nights 17 symposia 18 concerts 19 Hours, Admission, School Visits & Membership 20 e x h i b i T i o n s From sèvres to FiFth avenue: to be held in the United States in more than twenty years. -

The Frick Collection Fall 2014 Programs the Frick Collection 1 East 70Th Street, New York, Ny 10021 212.288.0700

The Frick Collection fall 2014 programs The Frick Collection 1 east 70th street, new york, ny 10021 212.288.0700 www.frick.org hours nternationally recognized as a premier museum and Tuesday through Saturday 10:00 a.m. to 6:00 p.m. I research center, The Frick Collection is known for its Sunday 11:00 a.m. to 5:00 p.m. distinguished Old Master paintings and outstanding exam- Closed Mondays, New Year’s Day, Independence Day, ples of European sculpture and decorative arts. Thanksgiving, and Christmas The collection was assembled by the Pittsburgh indus- trialist Henry Clay Frick (1849–1919) and is housed in his family’s former residence on Fifth Avenue. One of New York admission City’s few remaining Gilded Age mansions, it provides a tranquil environment for visitors to experience masterpieces General Public $20 by artists such as Bellini, Rembrandt, Vermeer, Goya, and Seniors (65 and over) $15 Whistler. The museum opened in 1935 and has continued to Students $10 acquire works of art since Mr. Frick’s death. Members Free Adjacent to the museum is the Frick Art Reference Library, founded by Helen Clay Frick as a memorial to her On Sundays from 11:00 a.m. to 1:00 p.m., visitors may father. Today it is one of the leading institutions for research pay what they wish. in the history of art and collecting. The Library is open to the Children under ten are not admitted. public free of charge. Group visits are by appointment; call 212.288.0700 Along with special exhibitions and an acclaimed con- to schedule. -

The Frick Collection 1999

The Frick Collection Report The Frick Collection Report On view in the Living Hall, this magnificent Mantel Clock (Pendule de cheminée), c. ‒, has a movement and dial signed by Thuret and a case by André-Charles Boulle. The clock case is made of hardwoods veneered with intricate and symmetrical marquetry designs composed of tortoiseshell and metal, the hallmark of Boulle furniture, and decorated with gilt-bronze mounts. It was bequeathed to The Frick Collection by Winthrop Edey in . The Frick Collection Board of Trustees Council of The Frick Collection Board of Trustees Contents Council of The Frick Collection Report of the President Henry Clay Frick II Nicholas H. J. Hall, Chairman Report of the Director Joseph L. Koerner, Vice Chairman Curatorial Julian Agnew Exhibitions & Lectures Helen Clay Chace Mrs. Russell B. Aitken Publications Jean A. Bonna Concerts W. Mark Brady Frick Art Reference Library Howard Phipps, Jr. Jonathan Brown Public Affairs, Development & Communications Christopher Burge Gifts during Mrs. William Stratton Clark Fellows of The Frick Collection L. F. Boker Doyle Peter Duchin Associates of the Frick Art Reference Library Mauro A. Herlitzka Sustaining Friends Diane Allen Nixon Corporate Members Paul G. Pennoyer, Jr. Richard E. Oldenburg Young Fellows Steering Committee Paul G. Pennoyer, Jr. Fête Galante Committee Samuel Sachs II, ex officio Financial Statements Margot C. Bogert Melvin R. Seiden Staff Deirdre C. Stam Credits I. Townsend Burden III Walter J. P. Curley Emily T. Frick Nicholas H. J. Hall, ex officio Enid A. Haupt Melvin R. Seiden The signs of a new vitality at The Frick Collection in that have received critical and popular acclaim over future. -

Download 1 File

. t '’"'W *1 ' ' ’ : i .'-’a -J® • 'J 1 a Iff 1 In 1 , , ',. vi » •• -J- ; -J J' : | J J | j • • . Jfiji .1 . *$| i -fit | I I i 1 •f KfV-J • • - *—«! - . ..» 1 . : l S; % I Jk 1 j 1 " yJt 'il - M— III M mu m 2005 2 Director’s Letter Shipping News Details 4 an inside view Up Close and Behind the Scenes A Kabuki artist’s transformation, in step with the Buddha, conservators’ tools of the trade, and a glimpse into the life of Hokusai. Exhibitions 8 uncovering Yemen Fifty years ago, Wendell Phillips— a real-life Indiana Jones— unearthed the sand-covered ruins along the ancient incense-trading route. 20 ONCE UPON A TIME IN HONG KONG From kung-fu to comedy, classic films mark the Freer's Tenth Annual Made in Hong Kong Film Festival 26 ASIAN GAMES: THE ART OF contest Many of our most familiar games— chess, backgammon, Parcheesi, Ludo, Snakes and Ladders, and playing cards—came to us from Asia. 34 HIGH WIRE ACT Mei-ling Horn weaves metal into clouds for the Perspectives series of contemporary art. 40 AMERICAN beauty Charles Lang Freer's early acquisitions feature beautiful women on the verge of the twentieth century. Acquisitions DYES that BIND Abstract ikats from the Guido Goldman collection enter the Sackler collection. Focus 52 outreach Out of the Galleries and Beyond the Walls Orhan Pamuk’s colorful voice, Xu Bing’s Monkeys get a makeover, Anne van Biema’s lasting legacy, visits from a maharaja and a president, social whirl. Endnote from the archives Around 1900, the Chinese Imperial Court opened its doors to photography, which had until then been ignored. -

The Frick Collection Report the Frick Residence Under Construction, C

The Frick Collection Report The Frick residence under construction, c. The Frick Collection Report Henry Clay Frick and his granddaughter Adelaide at Eagle Rock, Frick’s summer residence in Prides Crossing, Massachusetts, . The image is one of hundreds of Frick family photographs from The Helen Clay Frick Foundation Archives, recently preserved by the Library’s Conservation Department. The Frick Collection Report The Frick Collection Board of Trustees Helen Clay Chace Peter P. Blanchard III Margot C. Bogert I. Townsend Burden III Walter Joseph Patrick Curley L. F. Boker Doyle Council of The Frick Collection Emily T. Frick Nicholas H. J. Hall, Chairman Douglas B. Leeds Julian Agnew Martha Loring, ex officio Henry Clay Frick II Irene Roosevelt Aitken Diane Allen Nixon Jean A. Bonna Richard E. Oldenburg W. M. Brady Paul G. Pennoyer, Jr. Nicholas H. J. Hall Jonathan Brown Marc Porter Vivien R. Clark Samuel Sachs II, ex officio Peter Duchin Melvin R. Seiden Paul G. Pennoyer, Jr. Robert Garrett Deirdre C. Stam Mauro A. Herlitzka Wynant D. Vanderpoel III Joseph L. Koerner, Vice Chairman Nina Zilkha Howard Phipps Jon Landau Juan Sabater Young Fellows Steering Committee Melvin R. Seiden Nathalie Kaplan, Chairman Martha Loring, Secretary Elizabeth Fleming Jennifer Nilles Amy Mazzola Flynn Victoria Rotenstreich Lisa Rossi Gorrivan Juan Sabater Philip C. Gorrivan Louise Schliemann Julian Iragorri Christine Scornavacca Robert Lindgren Genevieve Wheeler Victoria Lindgren The Frick Collection Board of Trustees Contents Council of The Frick Collection Young Fellows Steering Committee Report of the President Report of the Director A Tribute to a Tremendous Force Curatorial Exhibitions, Lectures & Publications Concerts Frick Art Reference Library Public Affairs Gifts & Grants Fellows and Friends of The Frick Collection Corporate Members Autumn Dinner A Tartan Ball Financial Statements Staff Credits The Frick Collection participated in the exuberance and successes of early with an expanding audience and increased programming.