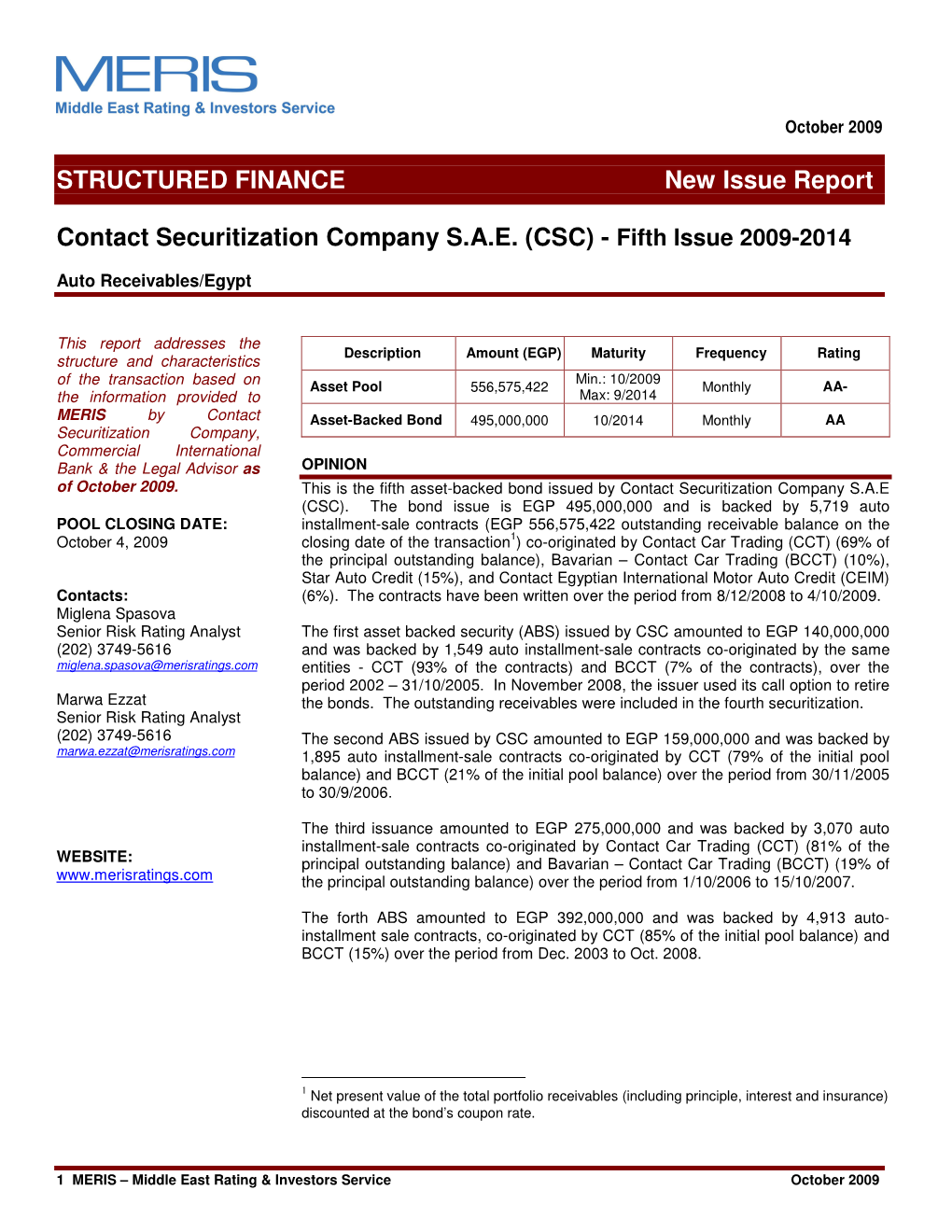

STRUCTURED FINANCE New Issue Report Contact Securitization

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Growing Growing Small

APRIL 2019 NOT FOR SALE www.amcham.org.eg/bmonthly CSR INCENTIVES CSR EDUCATION LOANS EDUCATION NEW MSME LAWS ▲ ▲ ▲ Syrian investors seek inclusion ALSO INSIDE ▲ ▲ ▲ GROWING GROWING SMALL BUSINESS MONTHLY GROWING SMALL APRIL 2019 Cover.qxp_Cover.qxd 4/7/19 5:07 PM Page 1 CHOOSE CHANGE. CHOOSE CHANGE. Sheer Driving Pleasure EXCEED. THE ALL-NEW BMW X3 M40i. The All-New BMW X3 exceeds in every sense of the word. It does it all, does it BIG and then some more. The already amazing SAV comes with the intelligent all-terrain xDrive in its baseline model. It then goes to new extremes with M Performance tuning in its highest configuration, which launches this beast from 0-100km/h in 4.8 seconds. For more details on the all-new, locally assembled BMW X3, please visit the Call Center: 19269 nearest Bavarian Auto Group dealership. www.bmw-eg.com El Morshedy Adv.qxp_Editorial.qxd 4/1/19 12:44 PM Page 2 Advertorial New Heights for Memar el Morshedy Memaar Al Morshedy are successfully questioning conventions of building mixed-use developments in Egypt, garnering them international recognition as real estate trailblazers. Constructing the biggest residential building in the world, which looks like nothing else in Egypt, epitomizes Memaar Al Morshedy CEO, Hassan el Morshedy vision for his com- pany. “I want our projects to be different,” he says. “Skyline perfectly embodies this.” Such innovation led Harvard University to invite Al Morshedy and his father, who founded the company, to make two keynote speeches as the Arab Conference at Harvard in April. -

Communication on Progress

BAVARIAN AUTO GROUP Katameya, Ring Road – Maadi, Cairo, Egypt Tel (+202)27272241 Fax (+202)27272250 www.bag-eg.com Driving for Better Future COMMUNICATION ON PROGRESS MAY 2013 – MAY 2014 Prepared by: Dr. Zakaria Elnaggar Acting General Manager for IT, Training and CSR Page 1 TABLE OF CONTENTS Contents Message from the Chairman __________________________________________________________ 3 BAG Short Profile _________________________________________________________________ 4 BAG Strategy _____________________________________________________________________ 4 BAG Products _____________________________________________________________________ 4 BAG Companies ___________________________________________________________________ 5 BAG Orgnization __________________________________________________________________ 6 BAG Training Academy _____________________________________________________________ 6 CSR Vision _______________________________________________________________________ 6 BAG and Key Stakeholders __________________________________________________________ 7 Areas and Directions of BAG CSR Policy _______________________________________________ 8 Human Rights _____________________________________________________________________ 8 Labour Rights ____________________________________________________________________ 11 Enviroment Rights ________________________________________________________________ 16 Anti-Corruption __________________________________________________________________ 21 Page 2 1. MESSAGE FROM THE CHAIRMAN I'm pleased to confirm -

ESID Working Paper No. 143 the Political Economy of Automotive

ESID Working Paper No. 143 The political economy of automotive industry development policy in middle income countries: A comparative analysis of Egypt, India, South Africa and Turkey Anthony Black,1 Pallavi Roy,2 Amirah El-Haddad3 and Kamil Yilmaz4 May 2020 1 University of Cape Town Email correspondence: [email protected] 2 SOAS, University of London Email correspondence: [email protected] 3 German Development Institute, Bonn Email correspondence: [email protected] 4 Koç University, Istanbul Email correspondence: [email protected] ISBN: 978-1-912593-53-8 email: [email protected] Effective States and Inclusive Development Research Centre (ESID) Global Development Institute, School of Environment, Education and Development, The University of Manchester, Oxford Road, Manchester M13 9PL, UK www.effective-states.org The political economy of automotive industry development policy in middle income countries: A comparative analysis of Egypt, India, South Africa and Turkey Abstract This paper examines the political economy of development policy through the prism of four country case studies (Egypt, India, South Africa and Turkey) of the automotive industry. The objective is not simply to examine the developmental impact of automotive policy, but to illustrate how the policy regime has been the outcome of a contested process. Early growth in the auto sector in the four case countries was enabled by rents from protected markets. The emergence of competitive firms is critically dependent on the nature of state–business relationships and the net outcome of the rent-seeking process in the sector. This hinges on the bargaining power of business, foreign or domestic, vis à vis the government. -

Acronimos Automotriz

ACRONIMOS AUTOMOTRIZ 0LEV 1AX 1BBL 1BC 1DOF 1HP 1MR 1OHC 1SR 1STR 1TT 1WD 1ZYL 12HOS 2AT 2AV 2AX 2BBL 2BC 2CAM 2CE 2CEO 2CO 2CT 2CV 2CVC 2CW 2DFB 2DH 2DOF 2DP 2DR 2DS 2DV 2DW 2F2F 2GR 2K1 2LH 2LR 2MH 2MHEV 2NH 2OHC 2OHV 2RA 2RM 2RV 2SE 2SF 2SLB 2SO 2SPD 2SR 2SRB 2STR 2TBO 2TP 2TT 2VPC 2WB 2WD 2WLTL 2WS 2WTL 2WV 2ZYL 24HLM 24HN 24HOD 24HRS 3AV 3AX 3BL 3CC 3CE 3CV 3DCC 3DD 3DHB 3DOF 3DR 3DS 3DV 3DW 3GR 3GT 3LH 3LR 3MA 3PB 3PH 3PSB 3PT 3SK 3ST 3STR 3TBO 3VPC 3WC 3WCC 3WD 3WEV 3WH 3WP 3WS 3WT 3WV 3ZYL 4ABS 4ADT 4AT 4AV 4AX 4BBL 4CE 4CL 4CLT 4CV 4DC 4DH 4DR 4DS 4DSC 4DV 4DW 4EAT 4ECT 4ETC 4ETS 4EW 4FV 4GA 4GR 4HLC 4LF 4LH 4LLC 4LR 4LS 4MT 4RA 4RD 4RM 4RT 4SE 4SLB 4SPD 4SRB 4SS 4ST 4STR 4TB 4VPC 4WA 4WABS 4WAL 4WAS 4WB 4WC 4WD 4WDA 4WDB 4WDC 4WDO 4WDR 4WIS 4WOTY 4WS 4WV 4WW 4X2 4X4 4ZYL 5AT 5DHB 5DR 5DS 5DSB 5DV 5DW 5GA 5GR 5MAN 5MT 5SS 5ST 5STR 5VPC 5WC 5WD 5WH 5ZYL 6AT 6CE 6CL 6CM 6DOF 6DR 6GA 6HSP 6MAN 6MT 6RDS 6SS 6ST 6STR 6WD 6WH 6WV 6X6 6ZYL 7SS 7STR 8CL 8CLT 8CM 8CTF 8WD 8X8 8ZYL 9STR A&E A&F A&J A1GP A4K A4WD A5K A7C AAA AAAA AAAFTS AAAM AAAS AAB AABC AABS AAC AACA AACC AACET AACF AACN AAD AADA AADF AADT AADTT AAE AAF AAFEA AAFLS AAFRSR AAG AAGT AAHF AAI AAIA AAITF AAIW AAK AAL AALA AALM AAM AAMA AAMVA AAN AAOL AAP AAPAC AAPC AAPEC AAPEX AAPS AAPTS AAR AARA AARDA AARN AARS AAS AASA AASHTO AASP AASRV AAT AATA AATC AAV AAV8 AAW AAWDC AAWF AAWT AAZ ABA ABAG ABAN ABARS ABB ABC ABCA ABCV ABD ABDC ABE ABEIVA ABFD ABG ABH ABHP ABI ABIAUTO ABK ABL ABLS ABM ABN ABO ABOT ABP ABPV ABR ABRAVE ABRN ABRS ABS ABSA ABSBSC ABSL ABSS ABSSL ABSV ABT ABTT -

Commercial Vehicles

A new social contract for MENA countries: Experiences from Development and Social Policies Sustainable Economic and Social Development Department Stabilization and Development in the Middle East and North Africa German Development Institute Tulpenfeld 6 D-53113 Bonn, Germany Twitter: #MENAsp16 International Conference Bonn, 05 - 06.12.2016 © 2009 German Development Institute / Deutsches Institut für Entwicklungspolitik (DIE) The Political Economy of a Sector in Crisis: Industrial Policy and Political Connections in the Egyptian Automotive Industry On the Politics of State-Business Relations and Consequences for Development Trajectories: the case of the automotive industry in Egypt Amirah El-Haddad Senior Economist , German Development Institute, Bonn, Germany, [email protected] Professor of Economics - Faculty of Economics and Political Sciences, Cairo University Jeremy Hodge Jeremy Hodge, Analyst at Ergo, [email protected] Nizar Manek, London based consultant and investigative reporter, [email protected] Research Team: Marian Adel Economist © 2009 German Development Institute / Deutsches Institut für Entwicklungspolitik (DIE) Outline macro environment within which this industry has operated in Egypt interconnected network of politically connected firms and its influence over the policy making process in Egypt. © 2009 German Development Institute / Deutsches Institut für Entwicklungspolitik (DIE) History and Background: Protectionism Egy automotive industry developed under the country’s policy of ISI protecting it from imports competition In 1974 import bans on direct import of vehicles, raw materials & spare parts were lifted. But sector insulated itself from successive waves of liberalization in both the 1970s and 1990s. – ERSAP’s most significant & influential policy 90s: rationalization of tariff structure ↓ tariff dispersion and bands. – But sector was one of the few sectors that were largely exempt from these requirements. -

Catalogue of Automotive Industry Suppliers

JANUARY 2021 THE ENGINEERING EXPORT COUNCIL OF EGYPT Automotive Sector UNITED FOR LIQUID BATTERIES United Batteries Co. has been building its flooded lead acid batteries since year 1989, and has always put quality before quantity since the day their first battery rolled off the assembly line. OEM CUSTOMERS Ghabbour – Suzuki www.uni-bat.com TRUST FOR ENGINEERING INDUSTRIES Trust for Engineering Industries is a seating solutions company that stands out with its high quality, and competitive prices in the automotive market. In 2018 a full range of medical furniture was introduced by TRUST – MEDI. OEM CUSTOMERS Suzuki Egypt- Ghabbour Hashim Bus- Khalaf Bus- El Wahab Group Al Shehab Auto- MCV ز http://www.trust-industries.com/ TREDCO FOR ENGINEERING INDUSTRIES Tredco for Engineering Industries is the market leader of polyurethane industries in Egypt since 1985. Tredco has explored diversified business lines throughout history, with significant presence in different markets and always succeeding in delivering above and beyond its customer's expectations. Tredco has 5 major factories: car seats, automotive interior trims, polyurethane products, exhaust systems, and sheet metal parts. OEM CUSTOMERS Hyundai, Chevrolet, Isuzu, Suzuki, Geely, Chery, Volvo, Mitsubishi. www.Tredcoei.com TAWAKOL METAL & ENGINEERING INDUSTRIES (TMEI) TMEI is a manufacturer of automotive brake drums, brake rotors & wheel hubs. TMEI is backed by the diversified metallurgical and technical experience of its mother company Tawakol Metal Industries (TMI), using the most modern CNC metal machining equipment. TMEI’s 45 years in the business backed by an experienced workforce consisting of over 450 of the best-qualified professionals in the trade, give TMEI the advantage of being a leading manufacturer of high quality raw and machined cast iron products. -

Assessment of the State of Development of Automobile

ASSESSMENT OF THE STATE OF DEVELOPMENT OF AUTOMOBILE DESIGN AND MANUFACTURING IN GHANA BY AKAYETI, ANTHONY A THESIS SUBMITTED TO THE DEPARTMENT OF MECHANICAL ENGINEERING, IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE AWARD OF DEGREE OF MASTER OF SCIENCE IN MECHANICAL ENGINEERING FEBRUARY, 2015 DECLARATION I hereby declare that this submission is the result of my own work towards an MSc. in Mechanical Engineering, and that, to the best of my knowledge, this report contains no material, neither previously published by another person nor submitted for the award of any other degree of a university, except where acknowledgement has been duly made in the text. Any opinion or view expressed and any errors found in this work, however, are exclusively my responsibility and do not necessarily represent the organizations or individuals who have been cited in this work. AKAYETI ANTHONY ...................................... ........................ (STUDENT ID No: PG59337-11) CERTIFIED BY: DR. S.M. SACKEY ...................................... ........................ (Supervisor) MR. DENIS EDEM KWAME DZEBRE...................................... ........................ (Second Supervisor) DR. GABRIEL TAKYI ...................................... ........................ Head of Department (Mechanical Engineering) i DEDICATION This work is dedicated to my family and friends, especially my late father Mr.Akayeti John, my mother Mrs. Akayeti Paulina Atompoka and my children; Kibuka and Antonia who have in many ways enriched my life, God bless you. ii ACKNOWLEDGEMENTS First and foremost, I am grateful to the almighty GOD from whom we seek knowledge. I also wish to express my sincere and profound gratitude to Dr. S.M Sackey, my supervisor for his significant contribution in shaping this study. I am equally grateful to Mr. Denis Edem Kwame Dzebre for his useful contributions in this work, Mr. -

Training & Consultancy Firms Market Overview Egypt

Training & Consultancy Firms Market Overview Egypt Pillars Consultancy www.PILLARS-EG.COM [email protected] Egypt Training Market Overview Table of Contents LTC : Leadership Training & Consultancy Brilliance • About LTC • Overview • Solutions • Products/ Services • Assessment Tools • Edge Consultants Overview • Partners • Key Clients by Sector Zad Group • Overview Dale Carnegie Overview • Solutions/ Methodology/partners • Curriculum Area • References/Clients • Assessment (Training /Organizational /Talent) • Government Agencies/ Individuals ITS for Training • References / Clients (1/2) • Overview • Training & Consultancy/ Accreditations LOGIC Overview • Management Training Career Gates • Market Research • About • Management Consulting • Products / Services • Assessment Center • Strategic Partners • Clients Skills Worldwide IMI • About • About • Products/Services – Franchising • Strategic Partners • References / Clients • Public/Tailor Made/Programs • Key Accounts International affiliation Training Industry.com 2011 Top 20 Leadership Training Companies Training Industry.com Aspire Overview Top 20 Leadership Training Companies Training Industry.com Scitron • Overview • Strategic Partners • Products • References / Clients • Knowledge Overview 2 Training & Consultancy Egypt Dale Carnegie Egypt.dalecarnegie.com Skills worldwide skills-worldwide.com .imiegypt.com LTC ltc-intl.com IMI-Int’l company for HR AUC Aucegypt.edu Logic FTTC [email protected] Quest quest.com.eg Career Gates careergates.org Scitron scitronweb.com ZAD GROUP: zadgroup.org -

AUTOMOTIVE INDUSTRY in Egyptxxxxxxxxxxxxxx2222

AUTOMOTIVE INDUSTRY IN EGYPT 13 pages 1. Abstract 2. Summary 3. Egyptian Market for Automobiles and Auto spare parts (imports) 4. Exporting 5. Market Profile 6. Local Production 7. Local Content 8. Current Status and Future Prospects 9. End Users Analysis 10. Market Access 11. Customs and WTO Issues 12. Public tender procedures 13. Import Procedures & Regulations THAI TRADE CENTER, CAIRO SHERIF YEHYA OCOTBER, 2013 Automotive Industry in Egypt 1 Thai Trade Center, Cairo Sherif Yehya 1. Abstract : Basic data The Egyptian market is an important one due - No. of producers/assemblers: 26 to its population (some 90 million), its leading - Annual capacity: 325,000 vehicles position in Middle Eastern affairs, and its - No. of feeder industries factories: 338 central location bridging three - Annual production: US# 655 million continents: Europe, Asia, and Africa. - No. of brands: 62 - Sales (2011): 90,000 vehicles (annually) Egypt’s automotive market is growing due to - No. of registered cars: 5.6 million (2011) an increase in car loans, however the local 20% buses 30% trucks industry is unable to keep up with demand and 50% passenger additional investment is needed in this vital - Expected No. in 2012: 7.1 million sector. Sources : Egyptian Automobile Manufacturers’ Association (EAMA). The earliest beginnings of the Egyptian automotive industry date back to the year 1960. During the socialist era, the government pledged to transform the country from an agricultural economy to an industrial one, and the first completely Egyptian car was produced. The car soon went out of production, as it was unable to compete with foreign brands, especially following the end of socialism and the move toward a more liberal market. -

Hussein Mostafa Mohamed - Biography

Hussein Mostafa Mohamed - Biography Hussein Mostafa is an Egyptian vehicle mechanical engineer with over 44 years of experience in the automotive industry, military, presidential affairs, diplomatic affairs, governmental affairs and general management with intensive planning and negotiation abilities and high multicultural communication skills and international connections. After Graduating, Hussein filled several positions in the Egyptian Armed Forces and Army Vehicle Department such as commander of base army workshops, Manager of Strategic Operations & Planning, Director of Procurement Department, Director of Research Department. All of which build the base of his intensive military experience and also his automotive and general management experience. During this period Hussein served also as a counselor for the Sultan’s of Oman Armed Forces in Sultanate of Oman for all vehicles, transportation, contracting, and training related issues where he built the base of his gulf culture experience. Afterwards Hussein was selected to move to the Presidential Guard and Presidency in Egypt in the position of the Director of Vehicles Department, in this position Hussein added a lot to his experience especially in fields like presidential affairs, vehicle armoring, multicultural communications, high level negotiations and diplomatic affairs and he also gained a lot of long lasting international connections. Hussein moved from the presidency to be the Undersecretary of the Ministry of Electricity in Egypt and then to be the First Undersecretary of -

Customer Satisfaction Is a Term Frequently Used in Marketing. It Is a Measure of How Products and Services Supplied by a Company Meet Or Surpass Customer Expectation

Customer satisfaction is a term frequently used in marketing. It is a measure of how products and services supplied by a company meet or surpass customer expectation. Customer satisfaction is defined as "the number of customers, or percentage of total customers, whose reported experience with a firm, its products, or its services (ratings) exceeds specified satisfaction goals."[1] In a survey of nearly 200 senior marketing managers, 71 percent responded that they found a customer satisfaction metric very useful in managing and monitoring their businesses.[1] It is seen as a key performance indicator within business and is often part of a Balanced Scorecard. In a competitive marketplace where businesses compete for customers, customer satisfaction is seen as a key differentiator and increasingly has become a key element of business strategy.[2] "Within organizations, customer satisfaction ratings can have powerful effects. They focus employees on the importance of fulfilling customers' expectations. Furthermore, when these ratings dip, they warn of problems that can affect sales and profitability.... These metrics quantify an important dynamic. When a brand has loyal customers, it gains positive word-of-mouth marketing, which is both free and highly effective."[1] Therefore, it is essential for businesses to effectively manage customer satisfaction. To be able do this, firms need reliable and representative measures of satisfaction. "In researching satisfaction, firms generally ask customers whether their product or service has met or exceeded expectations. Thus, expectations are a key factor behind satisfaction. When customers have high expectations and the reality falls short, they will be disappointed and will likely rate their experience as less than satisfying. -

Wydział Promocji Handlu I Inwestycji

Branża motoryzacyjna Egiptu – możliwości współpracy firm 1. Branża motoryzacyjna w gospodarce Egiptu Egipt należy do niewielu krajów dysponujących możliwościami wytwórczymi do produkcji samochodowej i jest największym producentem motoryzacyjnym w regionie MENA /Afryki Północnej i Bliskiego Wschodu/. Egipski sektor motoryzacyjny uznawany jest za wysoce zdywersyfikowany – obejmuje produkcję samochodów osobowych, autobusów, mikrobusów, samochodów ciężarowych oraz branżę podzespołów/części zamiennych.1 Regulacje w zakresie montażu pojazdów samochodowych Rząd Egiptu realizuje politykę rozwoju lokalnych montowni samochodowych i ochrony przed konkurencyjnym importem. Celowi temu służy wymóg określający wsad produktu krajowego w produkcie końcowym, którego wielkość określona została zmodyfikowanym dekretem prezydenckim nr 907 z 2005 r. Dekret określa ułatwienia inwestycyjne dla producentów uwzględniających regułę wsadu krajowego w produkcie końcowym. Zarząd Rozwoju Przemysłowego /IDA/ zobowiązał egipskie montownie samochodów do przestrzegania minimum 45% wsadu krajowej produkcji jako podstawy do korzystania z redukcji taryf celnych w imporcie komponentów do montażu. Dodatkowe regulacje /kompensacja eksportem wsadu mniejszego od 45%; kwartalnego raportowania przez montownię proporcji elementów stosowanych w produkcji; udostępnianie dokumentacji produkcyjnej dla celów kontrolnych; udostępnianie dokumentacji celnej dla kontroli zachowania wsadu krajowego w skali roku/ są wymagane pod rygorem unieważnienia rejestracji montowni w rejestrze gospodarczym.