What Type of Structure Is Best for Your Entity?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nominating and Corporate Governance Committee Charter

HORIZON THERAPEUTICS PUBLIC LIMITED COMPANY CHARTER OF THE NOMINATING AND CORPORATE GOVERNANCE COMMITTEE OF THE BOARD OF DIRECTORS AMENDED EFFECTIVE: 18 FEBRUARY 2021 PURPOSE AND POLICY The primary purpose of the Nominating and Corporate Governance Committee (the “Committee”) of the Board of Directors (the “Board”) of Horizon Therapeutics Public Limited Company, an Irish public limited company (the “Company”), shall be to oversee all aspects of the Company’s corporate governance functions on behalf of the Board, including to (i) make recommendations to the Board regarding corporate governance issues; (ii) identify, review and evaluate candidates to serve as directors of the Company consistent with criteria approved by the Board and review and evaluate incumbent directors; (iii) serve as a focal point for communication between such candidates, non-committee directors and the Company’s management; (iv) nominate candidates to serve as directors; and (v) make other recommendations to the Board regarding affairs relating to the directors of the Company. The Committee shall also provide oversight assistance in connection with the Company’s legal, regulatory and ethical compliance programs, policies and procedures as established by management and the Board. The operation of the Committee and this Nominating and Corporate Governance Charter shall be subject to the constitution of the Company as in effect from time to time and the Irish Companies Act 2014, as amended by the Irish Companies (Amendment) Act 2017, the Irish Companies (Accounting) Act 2017 and as may be subsequently amended, updated or replaced from time to time (the “Companies Act”). COMPOSITION The Committee shall consist of at least two members of the Board. -

•One Person Company •Limited Liability Partnership •Private

Corporatization of MSME More than 90% of MSMEs are proprietorship or partnership enterprise. Therefore, it is imperative to strive towards corporatisation of Small & Medium Enterprises for good corporate governance as well as energise the economy as a whole. MSME may be incorporated as: •One Person Company •Limited Liability Partnership •Private Company •Public Company One Person Company “One Person Company” means a company which has only one person as a member. • An OPC is incorporated as a private limited company, where there is only one member and prohibition in regard to invitation to the public for subscription of the securities of the company. • The Salient features of an OPC include the following: An OPC can be formed under Company limited by guarantee or shares. An OPC limited by shares shall have minimum paid up capital of Rs. 1 lakh. An OPC are restricted from the right to transfer its share and Prohibits any invitations to public to subscribe for the securities • An OPC is required to give a legal identity by specifying a name under which the activities of the business could be carried on. The words 'One Person Company' should be mentioned below the name of the company, wherever the name is affixed, used or engraved. PROCESS OF INCORPORATION OF ONE PERSON COMPANY (OPC) • Obtain Digital Signature Certificate [DSC] for the proposed Director(s) • Obtain Director Identification Number [DIN] for the proposed director(s). • Select suitable Company Name, and make an application to the Ministry of Corporate Affairs for availability of name. • Draft MOA & AOA • Sign and file various documents including MOA & AOA with the Registrar of Companies electronically. -

Companies Act 2014

Companies Act 2014 A PUBLIC COMPANY LIMITED BY SHARES MEMORANDUM AND ARTICLES OF ASSOCIATION of EATON CORPORATION PUBLIC LIMITED COMPANY As amended by special resolution dated 26 April 2017 Companies Act 2014 A PUBLIC COMPANY LIMITED BY SHARES CONSTITUTION -of- EATON CORPORATION PUBLIC LIMITED COMPANY MEMORANDUM OF ASSOCIATION 1 The name of the Company is Eaton Corporation Public Limited Company. 2 The Company is to be a public limited company. 3 The objects for which the Company is established are: 3.1 To carry on the business of a holding company and to co-ordinate the administration, finances and activities of any subsidiary companies or associated companies, to do all lawful acts and things whatever that are necessary or convenient in carrying on the business of such a holding company and in particular to carry on in all its branches the business of a management services company, to act as managers and to direct or coordinate the management of other companies or of the business, property and estates of any company or person and to undertake and carry out all such services in connection therewith as may be deemed expedient by the Company’s Board and to exercise its powers as a shareholder of other companies. 3.2 To carry on all or any of the businesses of producers, manufacturers, servicers, buyers, sellers, and distributing agents of and dealers in all kinds of goods, products, merchandise and real and personal property of every class and description; and to acquire, own, hold, lease, sell, mortgage, or otherwise deal in and dispose of such real estate and personal property as may be necessary or useful in connection with said business or the carrying out of any of the purposes of the Company. -

GCSE Business Studies -The Business Framework

GCSE Business Studies The Business Framework Support Materials KS4 Business Studies The Business Framework These documents are part of a larger blended learning pack, developed to support GCSE Business Studies. Each document is complemented by a range of digital resources. These digital resources could be used for whole class stimulus and discussion before directing the students to the corresponding work in the PDF documents, or the students could be asked to work in groups on the paper resources found in the packs and then the digital resource used for feedback and to check understanding. ($4& Business Studies The Business Framework The Business Framework Why and how businesses start People who set up and run their own businesses are often called ENTREPRENEURS. There are a number of reasons why entrepreneurs choose to become self-employed and run their own business. Reasons for starting a business include: Self employment may be an appealing option following redundancy as it provides employment and an income for the owner. Running a successful business can provide personal satisfaction. The ability to be their own boss and make all the decisions, for example, entrepreneurs can choose their hours RIZRUNWRVRPHH[WHQWWR¿WLQZLWKWKHLUOLIHVW\OH Continue to run an existing family business. Self-employment provides the opportunity for business owners to earn a living from a hobby or particular interest. (QWUHSUHQHXUVDUHQ¶WQHFHVVDULO\PRWLYDWHGE\SUR¿WVRPHGHYHORSVRFLDOHQWHUSULVHVFKHPHVWREHQH¿WWKHLU local area. The functions of an entrepreneur An entrepreneur is a person who uses their initiative to start a business enterprise. To succeed and achieve their aims, entrepreneurs need to be able to: )LQGDQGFRPELQHWKHKXPDQSK\VLFDODQG¿QDQFLDOUHVRXUFHVQHHGHGWRVWDUWDEXVLQHVVDQGRUJDQLVH production of a good or service. -

Ishares VI Public Limited Company

iShares VI Public Limited Company (An umbrella investment company with variable capital and having segregated liability between its funds incorporated with limited liability in Ireland under registration number 506453) ___________________________________ Country supplement for investors residing in the Grand Duchy of Luxembourg to the Prospectus dated 18 March 2021 as amended and supplemented from time to time THIS COUNTRY SUPPLEMENT IS INTENDED FOR INVESTORS RESIDING IN THE GRAND DUCHY OF LUXEMBOURG THAT SUBSCRIBE FOR SHARES IN LUXEMBOURG AND FORMS AN INTEGRAL PART OF THE PROSPECTUS 18 MARCH 2021, AS AMENDED AND SUPPLEMENTED FROM TIME TO TIME. This country supplement is dated 18 March 2021 (the "Country Supplement") and forms part of the English language prospectus dated 18 March 2021 as amended and supplemented from time to time (the "Prospectus") for iShares VI plc (the "Company"). In particular, investors should refer to the section headed “Fund Expenses” in the Prospectus. This Country Supplement should be read in the context of and together with the Prospectus. The Prospectus is valid in Luxembourg only if it includes this Country Supplement. Capitalised terms used herein shall have the same meaning than the terms used in the Prospectus. Public Distribution of the Company in Luxembourg At the date hereof, Shares of some or all of the sub-funds of the Company have been notified for public distribution in Luxembourg (each a "Fund" for the purposes of this Country Supplement), all to be issued as provided for in the Prospectus. BNP Paribas Securities Services, Luxembourg Branch with its registered office at 60, avenue J.F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg ("BNP Paribas") has been appointed as paying and representation agent in respect of the Shares of all Funds. -

Setting up in Denmark

Setting up in Denmark 5. Forms of business enterprise Business operations in Denmark may be conducted under the fol- lowing legal forms: public limited company (aktieselskab) branch office (filial) private limited company (anpartsselskab) partnership (interessentskab) limited partnership (kommanditselskab) limited partnership company (kommandit-aktieselskab) co-operative society (andelsselskab) sole proprietorship or one-man firm (enkeltmandsfirma) commercial foundation (erhvervsdrivende fond) European companies European public limited-liability compa- nies, European Economic Interest Groupings and European Co- operative Societies (SE companies, EØFG and SCE) As foreign investors most often set up a public limited company or a branch office, these forms of business are explained in some detail. All public limited companies, private limited companies, limited partnership companies, commercial foundations, sole proprie- torships, partnerships, limited partnerships, co-operatives, cor- DANSKE BANK SETTING UP IN DENMARK 19 MARCH 2007 porate funds, the various types of European companies, branch offices of foreign corporations and other limited liability busi- nesses and societies must register with the Danish Commerce and Companies Agency. The registration is published in the Reg- istration Gazette on the Danish Commerce and Companies Agencys Web site. 5.1 Public limited company (aktieselskab) The Danish Public Companies Act reflects Scandinavian efforts to harmonise legislation with EU rules governing public limited com- panies and the right of establishment. DANSKE BANK SETTING UP IN DENMARK 20 MARCH 2007 5.1.1 Formation procedure The following procedure is mandatory: 1. The promoters must draw up and sign a memorandum of asso- ciation which must contain a draft of the articles of association, the price at which shares are offered for subscription, the period within which the first general meeting is to be held, etc. -

Lesson : 1 Meaning, Characteristics and Types of a Company

LESSON : 1 MEANING, CHARACTERISTICS AND TYPES OF A COMPANY STRUCTURE 1.0 Objective 1.1 Introduction 1.2 Meaning of Company 1.3 Characteristics of a Company 1.4 Distinction between Company and Partnership 1.5 Types of Company 1.6 Summary 1.7 Keywords 1.8 Self Assessment Questions 1.9 Suggested Readings 1.0 OBJECTIVE After reading this lesson, you should be able to: (a) Define a company and explain its features. (b) Make a distribution between company and partnership firm. (c) Explain the various types of companies. 1.1 INTRODUCTION Industrial has revolution led to the emergence of large scale business organizations. These organization require big investments and the risk involved is very high. Limited resources and unlimited liability of partners are two important limitations of partnerships of partnerships in undertaking big business. Joint Stock Company form of business organization has become extremely popular as it provides a solution to (1) overcome the limitations of partnership business. The Multinational companies like Coca-Cola and, General Motors have their investors and customers spread throughout the world. The giant Indian Companies may include the names like Reliance, Talco Bajaj Auto, Infosys Technologies, Hindustan Lever Ltd., Ranbaxy Laboratories Ltd., and Larsen and Tubro etc. 1.2 MEANING OF COMPANY Section 3 (1) (i) of the Companies Act, 1956 defines a company as “a company formed and registered under this Act or an existing company”. Section 3(1) (ii) Of the act states that “an existing company means a company formed and registered under any of the previous companies laws”. This definition does not reveal the distinctive characteristics of a company . -

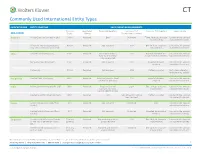

Commonly Used International Entity Types

Commonly Used International Entity Types COUNTRY/REGION ENTITY STRUCTURE BASIC FORMATION REQUIREMENTS Minimum Registered Corporate Secretary Minimum # of Minimum # of Directors Legal Liability ASIA-PACIFIC Capital Address Shareholders/Partners Australia Public Company (Limited or Ltd.) AUD 0 Required One Unlimited Three. At least 2 must be Limited to the amount local residents subscribed for shares Private or Proprietary Company AUD 0 Required Not required 1-50 One. At least 1 must be Limited to the amount (Pty. Ltd. or Proprietary Limited) local resident subscribed for shares China Limited Liability Company CNY 0 Required Not required. But a 1-50 Board of directors or a Limited to the amount local representative single executive director subscribed for shares may be required. Company Limited by Shares CNY 0 Required Not required 2-200 Board of directors Limited to the amount required subscribed for shares Partnership CNY 0 Required Not required 2-50 Partner managed Not a separate legal entity from its parent Hong Kong Limited Private Company HKD 0 Required Required, must be local 1-50 Board of directors Limited to the amount resident or company required subscribed for shares India Private Limited Company (Pvt Ltd) INR 0 Required Required if initial 2-200 Two. At least 1 must be Limited to the amount capital investment local resident subscribed for shares exceeds INR100 million Limited Liability Partnership (LLP) INR 0 Required N/A Two. At least 1 must be Partner managed Limited to the amount local resident subscribed for shares Japan General Corporation (Kabushiki JPY 1 Required Not required Unlimited One Limited to the amount Kaisha) subscribed for shares Limited Liability Company (Godo- JPY 1 Required Not required Unlimited Managed by managing Limited to the amount Kaisha) members subscribed for shares Singapore Private Limited Company (Private $1 in any Required Required and must be 1-50 One. -

Constitution of Dcc Public Limited Company

CONSTITUTION OF DCC PUBLIC LIMITED COMPANY (as amended by all resolutions up to and including 4 February 2021) COMPANIES ACT 2014 COMPANY LIMITED BY SHARES MEMORANDUM OF ASSOCIATION OF DCC PUBLIC LIMITED COMPANY (as amended by all resolutions up to and including 17 July 2015) 1. The name of the Company is DCC Public Limited Company. 2. The Company is to be a public limited company registered under Part 17 of the Companies Act 2014. 3. The objects for which the Company is established are:- (a) To carry on the business of an investment company and for that purpose to acquire and hold either in the name of the Company or that of any nominee shares, stocks, debentures, debenture stocks, bonds, notes, obligations and securities issued or guaranteed by any company wherever incorporated or carrying on business and debentures, debenture stock, bonds, notes, obligations and securities issued or guaranteed by any government, sovereign ruler, public body or authority, supreme, dependent, municipal, local or otherwise in any part of the world. (b) To invest the capital and other moneys of the Company in the purchase or upon the security of shares, stocks, debenture stock, bonds, bills, mortgages, obligations and securities of any kind issued or guaranteed by any company, corporation or undertaking of whatever nature and wheresoever constituted or carrying on business; and shares, stocks, debenture stock, bonds, bills, mortgages, obligations, and securities of any kind issued or guaranteed by any government, state, dominion, colony, sovereign, ruler, commissioners, trust, public, municipal, local or other authority or body of whatsoever nature wheresoever situated. -

TELFA Country-By-Country Compendium Of

Country by country guide 2 telfacountrybycountryguide Table of contents 1. Introduction ............................................................................................................................................. 4 2. Austria ....................................................................................................................................................... 7 3. Belgium ..................................................................................................................................................... 9 4. Cyprus ........................................................................................................................................................ 14 5. Czech Republic ......................................................................................................................................... 17 6. Denmark ................................................................................................................................................... 23 7. Estonia ....................................................................................................................................................... 26 8. France ......................................................................................................................................................... 30 9. Finland ....................................................................................................................................................... 34 10. Germany ................................................................................................................................................... -

Choices of Business Organisation

REVIST@ e – Mercatoria Volumen 3, Número 2. (2004) PARTNERSHIPS AND COMPANIES A COMPARATIVE APPROACH TO UK BUSINESS ORGANISATIONS∗ By David Ricardo Sotomonte Mujica∗∗ INTRODUCTION This paper does not pretend to cover all the different aspects of partnerships and companies as forms of organising business, but to be a guide for the reader in his approach to the two most spread and important types of business associations provided by law for today’s businessman. Therefore, the essay is divided in two basic parts: the first one is dedicated to an independent and separate analysis of partnerships and companies within the UK; and the second one, which is a comparison between both business associations. PARTNERSHIPS & COMPANIES, THE BRITISH TREATMENT. The first step in order to achieve a logical and complete comparison between partnerships and companies from UK’s Law point of view is to understand the main characteristics of both figures and the different subtypes within them. Consequently, this section starts with the essential aspects of every type of partnerships and companies, and finalises with the comparative examination. A. Essential Characteristics i. Companies. As in many other jurisdictions, UK’s Company Law does not define clearly what a company is but describes its formation1 and the different types of companies that may exist. The process or mechanism by which companies are created or formed is called incorporation. As a result of incorporation, the company acquires separate personality becoming an independent legal person distinct from its members and/or directors (this is one of the essential characteristics of companies and is discussed further on this paper). -

UK Public Limited Company

UK Public Limited Company General Type of entity Public Limited Type of law Common Shelf company availability Yes Our time to establish a new company 1 day Minimum government fees (excluding taxation) Not applicable Corporate Taxation 20%-23% Double taxation treaty access Yes Share Capital or Equivalent Standard currency GBP Permitted currencies Any Minimum paid up £50,000 Usual authorised £50,000 Directors or Managers Minimum number Two Local required No Publicly accessible records Yes Location of meetings Anywhere Members Minimum number Two Publicly accessible records Yes Location of meetings Anywhere Company Secretary Required Yes Qualified Yes Accounts Requirement to prepare Yes Audit requirements Yes Requirement to file accounts Yes Publicly accessible accounts Yes Other Requirement to file annual return Yes Yes, but subject to approval of HM Change in domicile permitted Revenue & Customs [130128] 2 GENERAL INFORMATION Introduction A "custom-made" UK company formation has many advantages over an "off-the-shelf" company. It is usually more economical to incorporate a company with the client's choice of name, directors, and shareholders and authorised share capital than to purchase a shelf company and restructure the company. The intended location of the registered office must be stated from the outset. If they wish, clients may be named as the first director and secretary. A same day incorporation service is available from Companies House for an additional fee. COMPANY INFORMATION Type of Company for International Trade and Investment It should be noted that there are two types of PLC, one whose shares are quoted publicly and listed on an International Stock Exchange; the other operates as a private limited company.