CHINA STAR ENTERTAINMENT LIMITED (Incorporated in Bermuda with Limited Liability) (Stock Code: 326)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

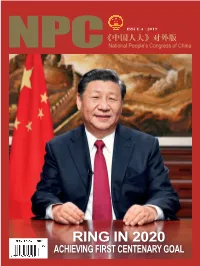

Ring in 2020 Achieving First Centenary Goal President Xi Jinping Delivers 2020 New Year Speech, Vowing to Achieve First Centenary Goal

ISSUE 4 · 2019 《中国人大》对外版 NPC National People’s Congress of China RING IN 2020 ACHIEVING FIRST CENTENARY GOAL President Xi Jinping delivers 2020 New Year speech, vowing to achieve first centenary goal 2 NATIONAL PEOPle’s CoNGRESS OF CHINA President Xi Jinping on December 31 erty by the end of 2019, Xi said. delivered a New Year speech in Beijing to He highlighted advances in science ring in 2020, pledging to achieve the first and technology. Chang’e-4 probe made a President Xi Jinping delivers 2020 New Year centenary goal of building a moderately historic landing on the moon’s far side; prosperous society in all respects in the the Long March-5 Y3 carrier rocket was “milestone” year. successfully launched; polar icebreaker speech, vowing to achieve first centenary goal Xi pledged to lift all rural residents liv- Xuelong 2 set sail on its maiden voyage to ing below the current poverty line out of the Antarctic. poverty and eliminate poverty in all poor A new batch of pilot free trade zones counties. were established, the Shanghai Pilot Free “The year of 2020 is crucial in winning Trade Zone was expanded, the science the anti-poverty battle,” Xi said. “The and technology innovation board was clarion has sounded. We must work to- launched smoothly, and over 2 trillion gether and work hard... to secure a victo- yuan of taxes and fees have been cut over ry in the battle against poverty.” the year. Xi also extended best wishes to Hong Xi noted solid reform progress in na- Kong and Hong Kong compatriots. -

Hk Is Preparing to Enact a Rare Emergency Rule

FOUNDER & PUBLISHER Kowie Geldenhuys EDITOR-IN-CHIEF Paulo Coutinho www.macaudailytimes.com.mo FRIDAY T. 25º/ 32º Air Quality Good MOP 8.00 3388 “ THE TIMES THEY ARE A-CHANGIN’ ” N.º 04 Oct 2019 HKD 10.00 MACAU’S TOP COURT BACKED A POLICE GROSS GAMING REVENUE PORTUGAL’S SOCIALIST PARTY BAN ON HK-RELATED GATHERINGS IN HAS FILED A COMPLAINT AGAINST A RULING DEEMED BY LAWYERS TO BE TOUCHES LOWEST LAWMAKER PEREIRA COUTINHO OVER A ‘POOR IN JUSTIFICATION’ LEVEL IN A YEAR SUSPECTED ELECTORAL VIOLATION P2 P4 P7 China-Australia Australia’s ban on Chinese telecoms giant Huawei’s AP PHOTO involvement in its future 5G networks and its crackdown on foreign covert interference are testing Beijing’s efforts to project its power overseas. More on p11 AP PHOTO MASK BANHK IS PREPARING Taiwan Investigators P3 yesterday were examining TO ENACT A RARE possible structural problems surrounding a bridge that collapsed EMERGENCY RULE in northeastern Taiwan, P8-9 killing six people. AP PHOTO Japan Tokyo Olympic organizers and two government bodies building venues for next year’s games have until the end of the month to agree to outside inspections on construction sites. AP PHOTO India Dozens of journalists in Indian- controlled Kashmir held a sit-in protest yesterday against an ongoing communication blackout in the disputed Himalayan region, describing the blockade of the internet and mobile phones as a government-imposed gag. China marked its National AP PHOTO Day with COURTESY MACAUNEWS.MO COURTESY Diocese a massive parade through upset over the center South Korea A powerful projection of Beijing typhoon has lashed showing-off its southern South Korea, with authorities saying of political military might yesterday that the storm symbols to the world left nine people dead and and Hong five others missing and knocked out power to tens Kong of thousands of homes. -

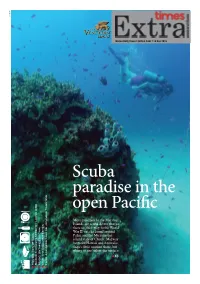

Most Travellers to the Marshall Islands Are Scuba Divers That Go There On

AP PHOTO Macau Daily Times | Edition 2462 | 18 Dec 2015 Scuba paradise in the open Pacific Most travellers to the Marshall Islands are scuba divers that go there on their way to the World War II wrecks found around Palau and the Micronesian island state of Chuuk. Midway between Hawaii and Australia, there's little tourism there, but plenty to see below the surface Untamed by Cam X3 Books: A Ghost’s Story by Lorna Gibb Music: Wine: The Cisalpine Ethos Movies: Son of Saul Food: a modern Take on Japanese Tradition X2 PÁTIO DA ILUSÃO illusion DRIVE IN Lindsey Bahr, AP Film Writer BOOK IT the barbaric tasks he's forced HOLOCAUST TALE 'SON OF SAUL' to commit. But whether his HE AUTOBIOGRAPHY OF quest to give this boy some T ‘ ’ HAUNTS AND PROVOKES final respect is one of sin- cerity, a selfish, desperate KATIE KING attempt to regain some hu- manity or a manifestation of his madness is a question that AP PHOTO only the viewer can answer. One fellow prisoner accuses him of favoring the dead at the expense of the living. It's hard to argue with that. Saul is both selfish and selfless and maybe, ultimately, he's neither. But confusion is the only reality here. No one speaks the same language — a subtlety lost in subtitles — and order only further dissol- ves as the film progresses. The filmmaking is extraor- dinary and somehow, merci- fully, not as visually exploi- tative as it could have been. Nemes, in his first feature, is a bold, experimental voice with Christian Harting, left, and Geza Rohrig in a scene from "Son of Saul" a clear vision — a filmmaker to watch and study for years on of Saul" doesn't just get We rarely leave Saul's point planning a rebellion of some to come. -

12月 DEC English�Version��2013��NO.126

12月 DEC English�Version��2013��NO.126 All Around the City 20/12 14th Anniversary of the Establishment of Macau SAR The ‘Macau Shopping Festival’ is back with bargains and deals galore throughout the month and across the city. Celebrate the 14th Anniversary of the Establishment of the Macau SAR, witness flag-raising ceremonies, join the ‘Parade through Macau, Latin Witness the official flag-raising ceremony in Lotus Square at 8:00am and the Macau headquarters of the City,’ and enjoy spectacular night-time fireworks displays and the exhibition in the Handover Gifts Museum of Macau. And Christmas People’s Liberation Army at 8:30am - and enjoy the many celebrations is here! Which means the city is alive with twinkling fairy lights, private and public parties plus seasonal concerts by the Macau Orchestra and to be held around the city, including a spectacular fireworks display Macau Chinese Orchestra, all wrapped up with much goodwill and joy in multicultural Macau. In addition, revellers won’t want to miss the New Year’s lighting up the night sky over Macau Tower seafront (approx. 9:30pm; Eve Countdown Shows in Senado Square and Taipa! 15 minutes; free). Enjoy the ‘Winter Kaleidoscope’ exhibition in the romantic, lakeside Taipa Houses-Museum - or join the ‘Crazy Jump’ bungee competition from the top Fireworks Display of Macau Tower. The Macau Science Centre celebrates its 4th anniversary with a series of great activities, and you can enjoy a nice cuppa coffee with Tourism hotline: (853) 2833 3000 www.macautourism.gov.mo a good read in the ‘Reading: Savouring Good Times of Life!’ activity. -

CHINA STAR ENTERTAINMENT LIMITED (Incorporated in Bermuda with Limited Liability) (Stock Code: 326)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA STAR ENTERTAINMENT LIMITED (Incorporated in Bermuda with limited liability) (Stock Code: 326) VOLUNTARY ANNOUNCEMENT UPDATE ON LITIGATION Reference is made to the circular (the “Circular”) of China Star Entertainment Limited (the “Company”) dated 7 June 2018 in relation to, among other things, the Rights Issue. Unless otherwise defined, capitalised terms used in this announcement shall have the same meanings as those defined in the Circular. As set out in the section headed “8. Litigation” in Appendix IV to the Circular, the Group had filed an appeal to the President of the Macau Second Instance Court on 30 December 2016 and this matter had not ruled out as at the Latest Practicable Date (i.e. 5 June 2018). On 11 June 2018, the Company received a letter dated 8 June 2018 from the Tribunal de Ultima Instancia (終審法院) of the Macau Government, in which the Tribunal de Ultima Instancia (終審法院) rejected the application of the final appeal (the “Decision”). Accordingly, Lot 6B will be reclaimed by the Macau Government. As disclosed in the abovementioned section in the Circular and the annual report of the Company for the year ended 31 December 2017 (the “2017 Annual Report”), according to the legal opinion obtained by the Company, the Group has strong legal ground to seek compensation for damages sustained by the Group as a result and the Court will consider and rule taking into account all the essential points including delays caused by the Macau Government. -

Hong Kong with Macau 05 Nights / 06 Days

Hong Kong With Macau 05 Nights / 06 Days Tour Inclusions Macau: 02 Nights • Macau Tower with Entrance • Macau City tour Hong Kong: 03 Nights • City Tour with One-Way Tram Ride to Victoria Peak • Madame Tussauds Wax Museum • Full Day Disney Land Theme Park • Full Day Ocean Park Meals: 05 Breakfast, 01 Meal Coupon, 05 Dinner Kindly Note: Cruise Meals as per Cruise Policy Hotels: • Hong Kong: Regal Riverside Hotel Kowloon or Courtyard by Marriott Sha Tim or Similar • Macau: Venetian Hotel Macau or Similar Suggested Day Wise Itinerary Day: 01 Welcome to Hong Kong!!! Transfer to Macau via Ferry | City Tour of Macau with Macau Tower Welcome to Hong Kong!!! Upon arrival at the airport transfer to SkyPier at Hong Kong International Airport (HKIA) for your ferry to Macau (Approx.60-70 minutes of Ferry). Macau, special administrative region of China, on the country’s southern coast. Its giant casinos and malls on the Cotai Strip, which joins the islands of Taipa and Coloane, have earned it the nickname, "Las Vegas of Asia." On arrival proceed to immigration formalities. Later, meet & greet by our local representative / Tour manager. Later, sit back in the comfort of your coach, we proceed for Macau city tour - take a scenic drive to Lotus Square - the sculpture, made of gilded bronze, weighs 6.5 tonnes, and is 6 meters high. These signify the three main parts of the territory: Macau Peninsula, Taipa Island and Coloane Island. Later, Visit the UNESCO- listed A-Ma Temple and see the statue of Kun Iam, Goddess of Mercy. -

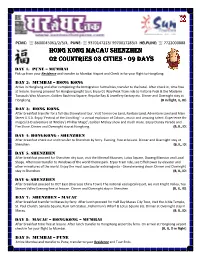

Hong Kong Macau Shenzhen Hong Kong

PCMC: ℡ 8600045061/2/3/4, PUNE: ℡ 9370147213/ 9970017283/4 HELPLINE: ℡ 7722000888 HONG KONG MACAU SHENZHEN 00020222 COUNTRCOUNTRIESIES 00030333 CITIES --- 090909 DAYS DAY 1: PUNE – MUMBAI Pick up from your Residence and transfer to Mumbai Airport and Check in for your flight to HongKong. DAY 2: MUMBAI – HONG KONG Arrive in Hongkong and after completing the Immigration formalities, transfer to the hotel. After check in, time free at leisure. Evening proceed for Hongkong night tour; Enjoy 01 Way Peak Tram ride to Victoria Peak & the Madame Tussauds Wax Museum, Golden Bauhinia Square, Repulse Bay & Jewellery factory etc. Dinner and Overnight stay at Hongkong. (B in flight, IL, ID) DAY 3: HONG KONG After breakfast transfer for a full day Disneyland tour . Visit Tomorrow Land, Fantasy Land, Adventure Land and Main Street U.S.A. Enjoy 'Festival of the Lion King' - a virtual explosion of Colours, music and amazing talent. Experience the magical 3-D adventure at 'Mickey's Philhar Magic', Golden Mickey show and much more. Enjoy Disney Parade and Fire Show. Dinner and Overnight stay at Hongkong. (B, IL, ID) DAY 4: HONGKONG - SHENZHEN After breakfast check out and transfer to Shenzhen by ferry. Evening free at leisure. Dinner and Overnight stay at Shenzhen. (B, IL, ID) DAY 5: SHENZHEN After breakfast proceed for Shenzhen city tour, visit the Mineral Museum, Lotus Square, Diwang Mansion and Local Shops. Afternoon transfer to Windows of the world theme park. Enjoy Tram ride, see Eiffel tower by elevator and other miniatures of the world. Enjoy the most spectacular extravaganza - Grand evening show. Dinner and Overnight stay in Shenzhen. -

China Star Entertainment Limited

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this document or as to the action to be taken, you should consult your licensed securities dealer or registered institution in Sch I, III securities, bank manager, solicitor, professional accountant or other professional adviser. Sch I, III If you have sold or transferred all your securities in China Star Entertainment Limited, you should at once hand this document together with the accompanying Acceptance Form and the accompanying form of proxy to the purchaser or transferee or to the licensed securities dealer or registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. This document should be read in conjunction with the accompanying Acceptance Form, the contents of which form part of the terms of the Offer contained therein. All capitalised terms used in this cover page have the same meanings as defined in this document. CHINA STAR ENTERTAINMENT LIMITED (Incorporated in Bermuda with limited liability) (Stock Code: 326) Sch I(1) (Warrant Code: -

Oct All Around the City

10 月 Oct English VersionNO.112 2012 All Around the City We need your support in transforming Macau into a water conservation city! On the first day of October - China’s annual National Day - the city is abuzz with flag-raising ceremonies and performances and the Speed merchants will want to make a beeline for the Macau International Kart Grand Prix, while golfers can size up the international spectacular finale of the Macau International Fireworks Display Contest. Music lovers can enjoy a broad repertoire of performances competition at this year’s Macau Open. Art lovers will be entranced by the ‘The Sun Never Left - Public Art Performance’ and Dai Kai at the Macau International Music Festival concerts in the ancient environs of atmospheric Macau World Heritage sites, while visitors Art Fair as well as the Macau Tourism and Cultural Activities Centre and Macau Story House - all of which offer local creative products can enjoy Chung Yeung festivities such as hiking or the Macau A-Ma Cultural & Tourism Festival in the A-Ma Cultural Village on at reasonable prices. Meanwhile, why not put aside some time for reflection at exhibitions such as ‘Sketches by George Chinnery’, Mt. Coloane. Appreciate UNESCO-listed Taoist music in Taoism Cultural Week 2012 and enjoy free performances of Chinese Lion ‘Macau Art Window’, ‘The Wonderful World of Puppets’ and the ‘Handover Gifts Exhibition’. Dances, the Drunken Dragon Dance, Chinese martial arts, Portuguese Folk Dancing and various other dance presentations during weekends around the city. The UNESCO-listed Lou Kau Mansion continues its arts and crafts demonstrations by award-winning Mainland artisans, while the Mandarin’s House hosts comedy drama and Dom Pedro V Theatre flings open its doors to an appreciative public eager to see the The fun-fuelled Oktoberfest and Macau International Beer Festival provide drinks, shows and competitions - plus great networking first Western theatre built in China. -

Holiday Tours § Travel Ptd

HEARTLINK HOLIDAYS PTE LTD 32 Seletar Terrace, Singapore 806933, Tel: 65-68755563, Fax: 65-68812302 www.heartlinkholidays.com Registration No: 201100061N TA02039 10 days Guangzhou, Macau, Hong Kong tour Day 1 Guangzhou Meet our local guide at Guangzhou International Airport and transfer to your city hotel, upon arrival check in. Gather at the hotel lobby at 6:00pm and transfer to wharf to take the cruise ship. Enjoy the dinner as well as the night scene along the Pear River while on board. Measured from the farthest reaches of the Xi Jiang, the Pearl River system is China's third longest river, and second largest by volume. The Pearl River is named this because of all the pearl colored shells that lie at the bottom of the river in the section that flows through the city of Guangzhou. Day 2 Guangzhou (B/L/D) After a sumptuous breakfast depart for the Guangzhou HuangHuaGang seventy-two martyr cemetery, also called Huanghuagang Park serves as a memorial site of the 72 martyrs who died in the “Second Guangzhou Uprising” which was organized by Sun Yat-sen on April 27th 1911. The cemetery is considered as the symbol of the great role that Guangzhou played in the revolutionary course in China at the beginning of the 20th century. Thereafter, visit the Yue Xiu Park, the city center garden in Guangzhou and also one of the top 8 great scenes in the city. After an enjoyable lunch, transfer to visit the Guangzhou Ocean Park. It is a fantastic undersea world inside the city zoo, functioning entertainment center, attraction site, research foundation and education institutes. -

Environmental, Social & Governance Report 2020

About Us SJM Holdings Limited (“SJMH” or the “Company”) is a leading owner, operator and developer of casinos and integrated entertainment resorts in Macau. Our subsidiary Sociedade de Jogos de Macau, S.A. (“SJM”) is one of the three original concessionaires in Macau, authorised by the Government of the Macau Special Administrative Region to operate casinos and gaming areas. “From society to society” is a core value of the SJM Group. We are committed to supporting education, arts and culture, sports and other charitable activities to benefit the residents of Macau and encourage our employees to do likewise. SJM owns and operates the Grand Lisboa hotel and casino, as well as 18 other casinos located in prime locations on the Macau Peninsula and Taipa. The Company’s operations cater to a wide spectrum of patrons, with mass market and VIP gaming tables, slot machines and hospitality services including fine and casual dining and luxury accommodation. SJM has recently completed construction of the Grand Lisboa Palace, our integrated resort on Cotai, which is undergoing final inspections. The Grand Lisboa Palace will feature a total of approximately 1,900 hotel rooms and suites in three hotel towers – Grand Lisboa Palace Macau, Palazzo Versace Macau and THE KARL LAGERFELD – as well as facilities for meetings and conferences, shopping, dining, gaming and entertainment. Contents Our Founder Dr. Stanley Ho .............................................................................................. 2 Message from Our Chairman ........................................................................................... -

WP00 Warning 34895-09P 1..1

THIS WEB PROOF INFORMATIONPACKIS IN DRAFT FORM. The information containedin it is incomplete and is subject to change. This Web Proof Information Pack must be read in conjunction with the section headed ‘‘Warning’’ on the cover of this Web Proof Information Pack. BUSINESS OVERVIEW We are one of the leading owners of entertainment and casino gaming facilities in Macau. We own the largest entertainment and leisure complex in the Macau Peninsula in terms of site area and, as at 31 December 2012, we are the second largest gaming service provider, in terms of the total number of gaming tables in our properties, among the casinos operating under service agreements in Macau(1). In terms of net win per table per day, the casino gaming facilities in The Landmark Macau were also one of the highest performing casinos in Macau in 2010 and 2011, and were above the industry average in 2012(1). We have two major properties, The Landmark Macau, an award-winning integrated hotel, casino and luxury shopping complex, featuring a five-star hotel and Macau’s first themed casino, located in the heart of the Macau Peninsula, and Macau Fisherman’s Wharf, a waterfront integrated gaming, hotel, convention and entertainment complex located on the outer harbor of the Macau Peninsula. As well as operating our hotel and non-gaming entertainment properties, we provide Gaming Services to SJM at the two major casinos located on our properties that are operated by it, namely Pharaoh’s Palace Casino in The Landmark Macau and Babylon Casino at Macau Fisherman’s Wharf.