The Death of Cards?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xoom Rolls out Domestic Money Transfer Services in the U.S

Xoom Rolls Out Domestic Money Transfer Services in the U.S. November 12, 2019 PayPal's international money transfer service works with Walmart and Ria to offer cash pick-up in minutes at 4,700 Walmart and 175 Ria locations across the country SAN JOSE, Calif., Nov. 12, 2019 /PRNewswire/ -- Xoom, PayPal's international money transfer service, today rolled out the ability for customers to send money to recipients in the U.S. for the first time. Through strategic alliances with Walmart and Ria, Americans can now use Xoom to send money fast for cash pick-up typically in minutes at nearly 5,000 locations across the country*. Xoom's services potentially benefit more than 44 million foreign-born people in the U.S.1 who send remittances to family and friends in their home countries. With the introduction of domestic money transfer services, Xoom will now serve even more customers, including more than half of Americans who make domestic person-to-person (P2P) payments2. Using Xoom's mobile app or website, consumers will have the ability to send money quickly and securely for cash pick-up at any Walmart or Ria-owned store in the U.S. "Many of our customers in the U.S. already send money to loved ones in the country, and they usually prefer that the money is available right away," shared Julian King, Xoom's Vice President and General Manager. "This rollout reinforces our commitment to make money transfers fast, easy and affordable for everyone, whether they are at home or on-the-go." "At Ria, we are delighted to further consolidate our relationship with Xoom and Walmart," said Juan Bianchi, CEO of Euronet's Money Transfer Segment. -

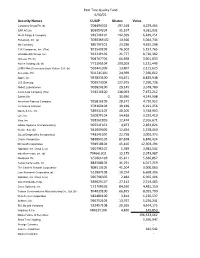

Pear Tree Quality Fund 6/30/21

Pear Tree Quality Fund 6/30/21 Security Names CUSIP Shares Value Compass Group Plc (b) '20449X302 197,348 4,229,464 SAP AG (b) '803054204 31,197 4,381,931 Wells Fargo & Company '949746101 142,399 6,449,251 Facebook, Inc. (a) '30303M102 14,566 5,064,744 3M Company '88579Y101 23,286 4,625,298 TJX Companies, Inc. (The) '872540109 76,502 5,157,765 UnitedHealth Group, Inc. '91324P102 21,777 8,720,382 Unilever Plc (b) '904767704 66,698 3,901,833 Roche Holding Ltd. (b) '771195104 109,203 5,131,449 LVMH Moët Hennessy-Louis Vuitton S.A. (b) '502441306 13,407 2,115,625 Accenture Plc 'G1151C101 24,969 7,360,612 Apple, Inc. '037833100 64,471 8,829,948 U.S. Bancorp '902973304 127,975 7,290,736 Abbott Laboratories '002824100 29,145 3,378,780 Coca-Cola Company (The) '191216100 138,093 7,472,212 Safran SA 0 30,650 4,249,998 American Express Company '025816109 28,572 4,720,952 Johnson & Johnson '478160104 38,189 6,291,256 Merck & Co., Inc. '589331107 48,205 3,748,903 Lyft, Inc. '55087P104 54,438 3,292,410 Visa, Inc. '92826C839 12,474 2,916,671 Adobe Systems Incorporated (a) '00724F101 4,873 2,853,824 Nestle, S.A. (b) '641069406 12,654 1,578,460 Quest Diagnostics Incorporated '74834L100 22,758 3,003,373 Oracle Corporation '68389X105 87,878 6,840,424 Microsoft Corporation '594918104 45,416 12,303,194 Alphabet, Inc. Class C (a) '02079K107 1,589 3,982,542 salesforce.com, inc. -

VX690 User Manual

Sivu 1(36) 28.9.2016 VX690 User Manual English Author: Verifone Finland Oy Date: 28.9.2016 Pages: 20 Sivu 2(36) 28.9.2016 INDEX: 1. BEFORE USE ............................................................................................................................... 5 1.1 Important ......................................................................................................................................... 5 1.2 Terminal Structure ......................................................................................................................... 6 1.3 Terminal start-up and shutdown .................................................................................................. 6 1.4 Technical data ................................................................................................................................ 7 1.5 Connecting cables ......................................................................................................................... 7 1.6 SIM-card.......................................................................................................................................... 8 1.7 Touchscreen ................................................................................................................................... 8 1.8 Using the menus ............................................................................................................................ 9 1.9 Letters and special characters.................................................................................................... -

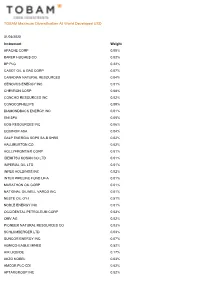

TOBAM Maximum Diversification All World Developed USD

TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight APACHE CORP 0.00% BAKER HUGHES CO 0.02% BP PLC 0.22% CABOT OIL & GAS CORP 0.07% CANADIAN NATURAL RESOURCES 0.04% CENOVUS ENERGY INC 0.01% CHEVRON CORP 0.08% CONCHO RESOURCES INC 0.02% CONOCOPHILLIPS 0.09% DIAMONDBACK ENERGY INC 0.01% ENI SPA 0.05% EOG RESOURCES INC 0.06% EQUINOR ASA 0.04% GALP ENERGIA SGPS SA-B SHRS 0.02% HALLIBURTON CO 0.02% HOLLYFRONTIER CORP 0.01% IDEMITSU KOSAN CO LTD 0.01% IMPERIAL OIL LTD 0.01% INPEX HOLDINGS INC 0.02% INTER PIPELINE FUND LP-A 0.01% MARATHON OIL CORP 0.01% NATIONAL OILWELL VARCO INC 0.01% NESTE OIL OYJ 0.51% NOBLE ENERGY INC 0.01% OCCIDENTAL PETROLEUM CORP 0.03% OMV AG 0.02% PIONEER NATURAL RESOURCES CO 0.03% SCHLUMBERGER LTD 0.03% SUNCOR ENERGY INC 0.07% AGNICO-EAGLE MINES 0.52% AIR LIQUIDE 0.17% AKZO NOBEL 0.03% AMCOR PLC-CDI 0.02% APTARGROUP INC 0.02% TOBAM Maximum Diversification All World Developed USD 31/03/2020 Instrument Weight AVON RESOURCES LTD 0.20% BALL CORP 0.06% CCL INDUSTRIES INC - CL B 0.01% CHR HANSEN HOLDING A/S 0.05% CLARIANT AG-REG 0.01% CORTEVA INC 0.04% CRODA INTERNATIONAL PLC 0.02% EMS-CHEMIE HOLDING AG-REG 0.01% FIRST QUANTUM MINERALS LTD 0.01% FORTESCUE METALS GROUP LTD 0.04% FRANCO-NEVADA CORP 1.01% GIVAUDAN-REG 0.07% INTL FLAVORS & FRAGRANCES 0.04% JAMES HARDIE INDUSTRIES-CDI 0.01% KANSAI PAINT CO LTD 0.01% KIRKLAND LAKE GOLD LTD 0.31% LINDE PLC 0.03% MARTIN MARIETTA MATERIALS 0.03% MOSAIC CO/THE 0.01% NEWCREST MINING LTD 0.60% NEWMONT CORP 1.89% NIPPON PAINT CO LTD 0.03% NORTHERN STAR RESOURCES -

Fee Schedule Effective April 2, 2021 Service Federal Credit Union Corporate Offices Stateside Offices: P.O

Fee Schedule Effective April 2, 2021 Service Federal Credit Union Corporate Offices Stateside Offices: P.O. Box 1268, Portsmouth, NH 03802 | 800.936.7730 Overseas Offices: Unit 3019, APO AE 09021-3019 | 00800.4728.2000 This Fee Schedule sets forth the conditions, fees and charges applicable to your accounts listed below. This schedule is incorporated as part of your account agreement with Service Federal Credit Union. Checking Accounts Tiers are assigned on the first of each month based on the prior month’s activity and requirements are as follows. Basic: No Requirement. Direct Deposit: Direct Deposit of your Net Pay1 into your checking account each month. Direct Deposit+: DFAS Direct Deposit (Military, military retirees and select government workers who get paid by the Defense Finance and Accounting Service) OR Direct Deposit Tier Requirements and at least 5 payments2 per month. Everyday and Dividend Checking Tier Basic Direct Deposit Direct Deposit+ Savings Transfer Overdraft Protection $5 per transfer $5 per transfer FREE Stop Payment $30 $30 $30 Courtesy Pay Up to $1,000 limit $30 $30 $30 Return Items (NSF) $30 $30 $30 ATM Surcharge and Foreign Transaction Fee None Up to $15 monthly Up to $30 monthly Rebates Out of Network ATM Fee* None None None Cashier's Check $5 $5 No Charge Check Printing Fee Variable Variable 1 free basic box annually Loan Discount** No Discount 0.50% 0.75% Monthly Maintenance Fee Tier Basic Direct Deposit Direct Deposit+ Everyday Checking None None None Dividend Checking $10 $10 $10 (Fee waived with $1,500 min daily balance) Card Fees Miscellaneous Debit Card Replacement - Standard ......................................................................... -

Rules for FNB Business Debit Card

RULES FOR FNB BUSINESS ELECTRON DEBIT CARDS The following Rules will apply to the issue and use of an FNB Business VISA Electron Debit Card (with Limited Function or Full Function) issued by First National Bank of Botswana Ltd, at the request of a Customer (“Bank”). The Rules constitute an agreement between the Customer, the Cardholder and the Bank. Section A: Definitions “Account” means the account nominated by the Customer to which the Card is linked as a primary link. “ATM” means an Automated Teller Machine “Card” means the FNB Business VISA Electron Debit Card issued by the Bank, , with ‘Full Function’ or ‘Limited Function’ as the context dictates. Limited Function Refers to Cards that permit Limited Functions only as described in Section 2 (Use of the Card) Full Function Refers to Cards that permit a much wider range of functions as described in Section 2 (Use of the Card) “Cardholder” means the person who has been nominated by the Customer to use the Card “Customer” means the Customer in whose name the Account is conducted with the Bank. “Limits” means the ATM cash, Point of Sale purchase and over-the-counter cash withdrawals limits both locally and internationally, whichever is applicable to the specific Card. “PIN” means the Cardholder’s Personal Identification Number. “Rules” means the rules that apply to the issue and use of an FNB Business VISA Electron Debit Card (Limited Function or Full Function) issued by the Bank on instruction by the Customer to the nominated Cardholder “POS” means a Supplier’s point-of-sale device, which is enabled to accept the Card. -

Press Release Livi Bank Teams up with Unionpay International to “Shake Up

11 August 2020 Press Release livi bank teams up with UnionPay International to “shake up” payments in Hong Kong livi customers to benefit from fun and exclusive ‘Shake Shake’ rewards livi bank and UnionPay International announced today an exciting new partnership which integrates UnionPay QR Payment into livi’s virtual banking app, which will be available for download tomorrow. livi is an easy, rewarding and lifestyle-driven banking experience, delivered through a simple and stylish mobile app. Through the partnership, livi customers can use the banking app’s digital payment function, the widely accepted UnionPay QR Payment, across 40,000 acceptance points in Hong Kong and gain access to lots of special offers at selected merchants. Probably the most exciting way to unlock everyday monetary rewards in Hong Kong During the promotional period, livi customers can get instant monetary rewards to put towards their next purchase by simply shaking their phones after using UnionPay QR Payment on purchases. This fun and innovative “Shake Shake” feature is a first in the banking world in Hong Kong and aims to make shopping that little bit more rewarding. “We’re thrilled to be joining hands with UnionPay International to offer a fun and innovative payment experience for our customers.” said David Sun, Chief Executive of livi. “Our mission is to give people in Hong Kong an everyday boost to their lives, with a banking experience they will enjoy. Our collaboration strives to achieve this by bringing attractive benefits designed around our customers’ everyday needs.” “UnionPay International is honoured to partner with livi to pioneer the very first QR Payment function in virtual banking in Hong Kong, by issuing the first UnionPay virtual debit cards for livi customers. -

New Debit Card Solutions At

New Debit Card Solutions Debit Mastercard and Visa Debit are ready Swiss Banking Services Forum, 22 May 2019 Philippe Eschenmoser, Head Cards & A2A, Swisskey Ltd Maestro/V PAY Have Established Themselves As the “Key to the Account” – Schemes, However, Are Forcing Market Entry For Successor Products Response from the Maestro and V PAY are successful… …but are not future-capable products schemes # cards Maestro V PAY on Lower earnings potential millions8 for issuers as an alternative payment traffic products (e.g. 6 credit cards, TWINT) Issuer 4 V PAY will be 2 decommissioned by VISA Functional limitations: in 20211 – Visa Debit as 0 • No e-commerce the successor 2000 2018 • No preauthorizations Security and stability have End- • No virtualization proven themselves customer High acceptance in CH and Merchants with an online MasterCard is positioning abroad in Europe offer are demanding an DMC in the medium term online-capable debit as the successor to Standard product with an Merchan product Maestro integrated bank card t 2 1: As of 2021 no new V PAY may be issued TWINT (Still) No Substitute For Debit Cards – Credit Cards With Divergent Market Perception TWINT (still) not alternative for debit Credit cards a no alternative for debit Lacking a bank card Debit function Limited target group (age, ~1.1 M 1 ~10 M. creditworthiness...) Issuer ~48.5 k ~170 k1 No direct account debiting DMC/ Visa Debit Potentially high annual fee End-customer Lower customer penetration Banks and merchants DMC/ P2P demand an online- Higher costs Merchant Visa Debit -

General Terms and Conditions for Bank Cards for Individuals and for Providing Payment Services by Card As an Electronic Payment Instrument

GENERAL TERMS AND CONDITIONS FOR BANK CARDS FOR INDIVIDUALS AND FOR PROVIDING PAYMENT SERVICES BY CARD AS AN ELECTRONIC PAYMENT INSTRUMENT Section I. DEFINITIONS 1. Pursuant to these General Terms and Conditions (GTC), the terms and abbreviations listed below shall have the following meaning: Bank card (Card) - A bank card (debit/credit) for individuals, hereinafter referred to as Card, is an electronic payment instrument through which UniCredit Bulbank AD (the BANK) entitles its customers within a fixed term to make payments up to the actual amount of their available own funds on a current account as well as up to an agreed credit limit (for credit cards only) authorized by the Bank. Main debit/credit card - A card issued to the Authorized Holder (the Account Holder of a current/card account). Additional debit/ credit card - A card issued at the request of the authorized main card holder (account holder) related to the same account of the account holder and subordinated to the main debit/ credit card. Authorized Holder of the Main Card – a local or foreign legally capable individual holding the account servicing the card who assumes obligations for the payment of fees and any debt arising from using the Card/s and with whom the Bank concludes a Debit Card Agreement/ Credit Card Agreement. An authorized holder of an additional card is the person specified by the authorized holder of the main card to whom the Bank issues additional debit/credit cards according to these General Terms and Conditions. The Account is a current account maintained in the name of the Authorized Holder of the Main Card. -

Moving Forward. Driving Results. Euronet Worldwide Annual Report 2004 Report Annual Worldwide Euronet

MOVING FORWARD. DRIVING RESULTS. EURONET WORLDWIDE ANNUAL REPORT 2004 REPORT ANNUAL WORLDWIDE EURONET EURONET WORLDWIDE ANNUAL REPORT 2004 The Transaction Highway At Euronet Worldwide, Inc. secure electronic financial transactions are the driving force of our business. Our mission is to bring electronic payment convenience to millions who have not had it before. Every day, our operations centers in six countries connect consumers, banks, retailers and mobile operators around the world, and we process millions of transactions a day over this transaction highway. We are the world's largest processor of prepaid transactions, supporting more than 175,000 point-of-sale (POS) terminals at small and major retailers around the world. We operate the largest pan-European automated teller machine (ATM) network across 14 countries and the largest shared ATM network in India. Our comprehensive software powers not only our own international processing centers, but it also supports more than 46 million transactions per month for integrated ATM, POS, telephone, Internet and mobile banking solutions for our customers in more than 60 countries. Glossary ATM – Automated Teller Machine EMEA - Europe, Middle East and Africa An unattended electronic machine in a public Euronet has an EMEA regional business unit in place that dispenses cash and bank account the EFT Processing Segment. information when a personal coded card is EPS - Earnings per Share used. A company's profit divided by each fully-diluted Contents EBITDA - Earnings before interest, taxes, share of common stock. depreciation and amortization 3...Letter to Our Shareholders E-top-up – Electronic top up EBITDA is the result of operating profit plus The ability to add airtime to a prepaid mobile 5...2004 Company Highlights depreciation and amortization. -

ANNUAL REPORT June 30, 2021

JOB TITLE SA FUNDS AR REVISION 8 SERIAL <12345678> TIME Friday, August 27, 2021 JOB NUMBER 393837-1 TYPE PAGE NO. I ANNUAL REPORT June 30, 2021 PORTFOLIOS OF INVESTMENTS SA U.S. Fixed Income Fund SA Global Fixed Income Fund SA U.S. Core Market Fund SA U.S. Value Fund SA U.S. Small Company Fund SA International Value Fund SA International Small Company Fund SA Emerging Markets Value Fund SA Real Estate Securities Fund SA Worldwide Moderate Growth Fund Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of each Fund’s shareholder reports, unless you specifically request paper copies of the reports from the SA Funds - Investment Trust (the “Trust”) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Trust’s website (http://www.sa-funds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Trust, you may inform the Trust that you wish to continue receiving paper copies of your shareholder reports by contacting us at (844) 366-0905. -

In 20 Words High Performer, Inspired, Team Player, Achiever, University Education

CURRICULUM VITAE Eric de Putter 106 Pembury Road, Tonbridge, Kent TN9 2JG Mobile +44 7950 449188 [email protected] In 20 words High performer, inspired, team player, achiever, university education. 20 years experience in the banking industry, gained throughout UK/Ireland/Europe. Main skills Seeing the bigger picture & thinking outside the box Able to communicate effectively at all levels within an organisation and without Understand card business from all angles, strategic, business, IT and operational Multi-lingual (English, Dutch, basic German/French) Date of birth 13 November 1968 Marital status Married, four children Work experience: position at Payment Redesign, UK Current position: Managing partner & co-founder, Europe (January ’13 – present) Accountabilities Set-up the company as a boutique consultancy in the payment industry, associate partner selection and commercial strategy. Key achievements Discussing partnerships for POS services Consultancy assignment Work experience: position held at EVRY London, UK Current position: Director Business Development, Europe (June ’10 – December’12) Accountabilities Responsible for entry into Western Europe (shared with a fellow business development director), driving various ATM and POS bids and ensuring that export-selected products have a well-defined strategy. Manage a sales pipeline (started at zero) to € 100M+). Key achievements Doubled EVRY’s ATM footprint from 4 BAU markets to 8, gaining projects in the UK, Republic of Ireland, Netherlands and Belgium Broker a partnership with the card centre-of-excellence of a well-known European bank Develop and contribute to partnerships to complete the ATM value-chain, improving the sales channels and maturity of the European offering Eric de Putter Page 2 Work experience: positions held at VocaLink London, UK Last held position: Account Director/European card director (Sept ’08 – May ‘10) Accountabilities Responsible for European card strategy and immediate sales opportunities.