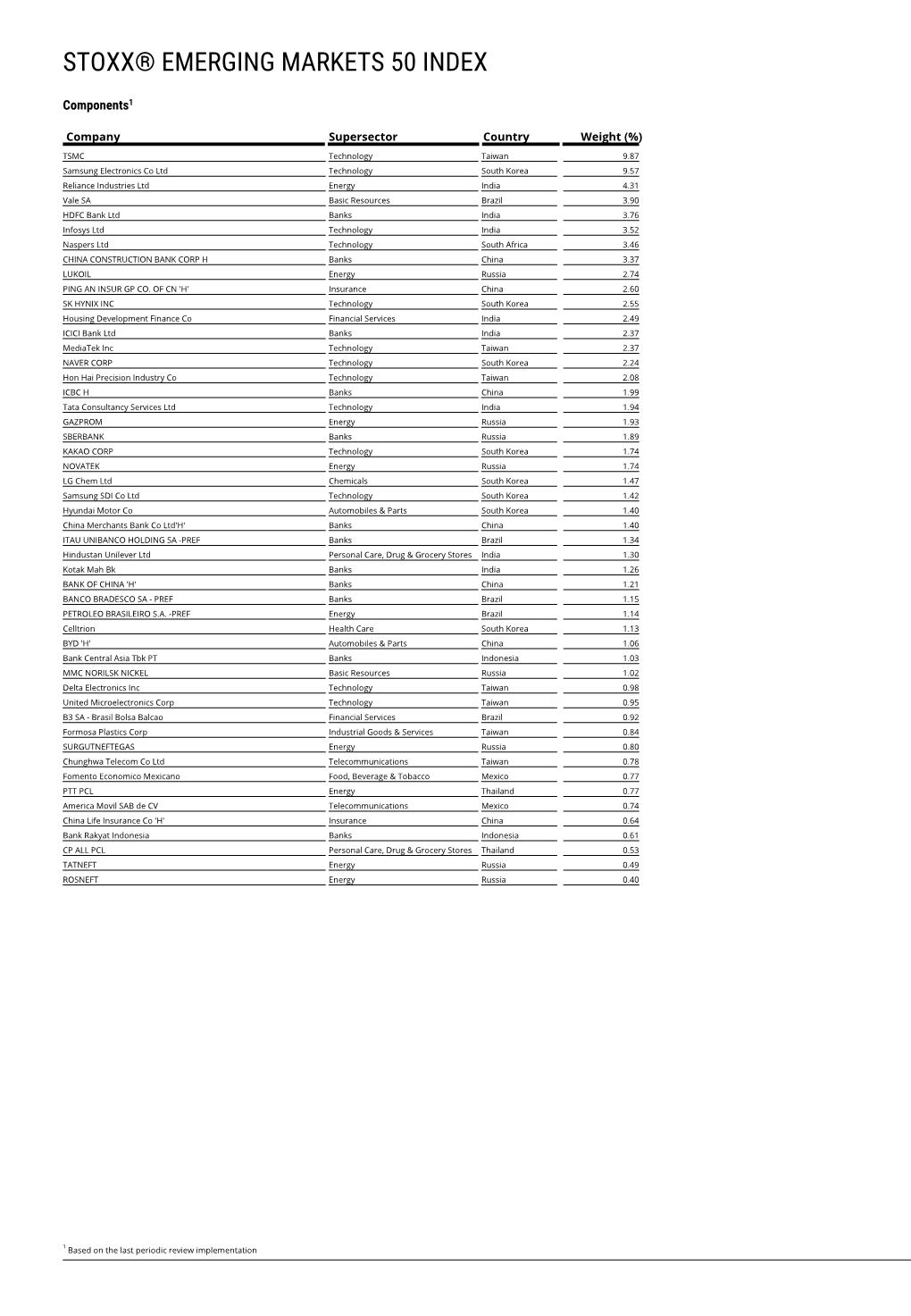

Stoxx® Emerging Markets 50 Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A STUDY on BEHAVIOUR PATTERN of DIVIDEND PAY-OUT: SELECTED BLUE-CHIP COMPANIES in INDIA Author Co - Author Dr.K.R.Sivabagyam A.Ranjitha Assistant Professor K

Compliance Engineering Journal ISSN NO: 0898-3577 A STUDY ON BEHAVIOUR PATTERN OF DIVIDEND PAY-OUT: SELECTED BLUE-CHIP COMPANIES IN INDIA Author Co - Author Dr.K.R.Sivabagyam A.Ranjitha Assistant Professor K. Madhu Varshini Department of Commerce N.Deekshithaa Sri Krishna Arts and Science College S. Kabilambika E-mail Id: [email protected] II M.Com Students MOB: 7871809789 E-mail Id: [email protected] [email protected] [email protected] [email protected] Mob: 9486939255; 9715184177; 9025868186 ABSTRACT Reliance Industries, Tata Consultancy services (TCS) and WIPRO in India and The term blue-chip was used to describe observe the behaviour pattern of the three high- priced stocks in 1923 when Oliver measures of dividend policy of the blue- Gingold, an employee at Dow Jones chip companies in India. observed certain stocks trading at $200 or more per share. Poker players bet in blue, KEYWORDS: Blue Chip Companies, white and red chips with blue chips having Dividend Policy, Investment Proposals. more value than both red and white chips. INTRODUCTION Today, blue chips stocks don’t necessarily refer to stocks with a high price tag, but In the exchange of India there are literally more accurately to stocks of high-quality thousands of companies but when it comes companies that have with stood the test of to financial stability only few companies time. A blue-chip company is a are financially stable and in other financial multinational firm that has been in aspects. Long term investors seek out for operation for a number of years. -

Consumer Goods on Path to Recovery; Essentials Hold an Upper Edge Sector Update

Consumer Goods On path to recovery; Essentials hold an upper edge Sector Update Most consumer goods companies started Q4FY2020 with good growth, as Q4FY2020 Results Review gradual recovery was seen in the demand environment (especially in rural markets). However, the outbreak of COVID-19 resulted in a complete lockdown Sector: Consumer Goods in India in the last 10-15 days of March, leading to complete stoppage of production and disruption in supply chain. This impacted sales volumes of most Sector View: Positive companies at the fag end of the quarter, resulting in weak Q4FY2020 numbers. Volumes of most companies (barring food companies) under our coverage declined by 3-22% in Q4FY2020 (revenue of Sharekhan universe declined by 7.8% y-o-y). Companies such as Britannia Industries and Tata Consumer Products Our coverage universe (TCPL) registered growth of 2.5% and 5-6% (at organic level), respectively, in Q4FY2020. On the other hand, companies such as Godrej Consumer Products CMP PT Companies Reco. (Rs) (Rs) (GCPL), Emami, Jyothy Labs, and Dabur India posted double-digit decline in revenue, as pre-season inventory loading by dealers/distributors was affected Asian Paints 1,709 Buy 1,987 by the lockdown. On the international front, companies having large presence Britannia in Africa, Middle East and South East Asian countries registered lower sales in 3,623 Buy 4,060 Industries the international business affected by lockdown and macro headwinds. Lower raw-material prices (especially crude-linked inputs) and lower packaging costs Colgate- 1,383 Positive 1,551 aided gross margins of some companies to expand by 100-300 bps. -

USD XINT M EM HL Taiwan NTR USD Index

Created on 30 th April 2020 XINT M EM HL Taiwan NTR USD Index USD The XINT M EM HL Taiwan NTR USD Index covers the highly liquid and liquid segment of the Taiwanese equity market. The index membership comprises the 89 largest companies by freefloat adjusted market value and represents approximately 85% of the Taiwanese market. INDEX PERFORMANCE - PRICE RETURN USD 130 120 110 100 90 80 70 Dec 2017 Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 Jun 2019 Sep 2019 Dec 2019 Mar 2020 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -7.33 3M 36.87 From 14 Jan 2020 6M 1.07 6M 27.83 To 19 Mar 2020 1Y 11.14 1Y 22.27 Return -29.23% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Taiwan Semiconductor Man Co Ltd 37.57% 252,160 37.57% Technology Hon Hai Precision Industry Co Ltd 4.81% 32,296 4.81% Industrial Goods & Services MediaTek Inc 3.14% 21,069 3.14% Technology Chunghwa Telecom Co Ltd 2.08% 13,992 2.08% Telecommunications Largan Precision Co Ltd 2.07% 13,900 2.07% Personal & Household Goods Formosa Plastics Corp 1.96% 13,167 1.96% Chemicals CTBC Financial Holding Co Ltd 1.86% 12,453 1.86% Banks Nan Ya Plastics Corp 1.71% 11,472 1.71% Chemicals Uni-President Enterprises Corp 1.68% 11,284 1.68% Food & Beverage Mega Financial Holding Co Ltd 1.64% 11,009 1.64% Banks Total 392,803 58.52% This information has been prepared by Index Intelligence GmbH (“IIG”). -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Formosa Plastics Corporation Financial Statements December 31, 2017 and 2016

1 Stock Code:1301 (English Translation of Financial Statements and Report Originally Issued in Chinese) FORMOSA PLASTICS CORPORATION FINANCIAL STATEMENTS DECEMBER 31, 2017 AND 2016 (With Independent Auditors’ Report Thereon) Address:No.100, Shuiguan Rd., Renwu Dist., Kaohsiung City 814, Taiwan (R.O.C.) Telephone:(07)371-1411;(02)2712-2211 The independent auditors’ report and the accompanying financial statements are the English translation of the Chinese version prepared and used in the Republic of China. If there is any conflict between, or any difference in the interpretation of, the English and Chinese language independent auditors’ report and financial statements, the Chinese version shall prevail. 2 Table of Contents Contents Page 1. Cover Page 1 2. Table of Contents 2 3. Independent Auditors’ Report 3 4. Balance Sheets 4 5. Statements of Comprehensive Income 5 6. Statements of Changes in Equity 6 7. Statements of Cash Flows 7 8. Notes to Financial Statements (1) Company history 8 (2) Approval date and procedures of the financial statements 8 (3) Application of new standards, amendments and interpretations 8~13 (4) Summary of significant accounting policies 13~25 (5) Critical accounting judgments and key sources of estimation uncertainly 26 (6) Significant account disclosures 26~55 (7) Related-party transactions 55~61 (8) Pledged properties 61 (9) Significant commitments and contingencies 61~62 (10) Losses due to major disasters 62 (11) Subsequent events 62 (12) Other 62 (13) Other disclosures (a) Information on significant transactions 63~68 (b) Information on investees 69 (c) Information on investment in mainland China 69 (14) Segment information 69 3 KPMG 〵⻍䋑11049⥌纏騟5媯7贫68垜(〵⻍101㣐垜) Telephone ꨶ鑨 + 886 (2) 8101 6666 68F., TAIPEI 101 TOWER, No. -

Taiwan's Top 50 Corporates

Title Page 1 TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATES We provide: A variety of Chinese and English rating credit Our address: https://rrs.taiwanratings.com.tw rating information. Real-time credit rating news. Credit rating results and credit reports on rated corporations and financial institutions. Commentaries and house views on various industrial sectors. Rating definitions and criteria. Rating performance and default information. S&P commentaries on the Greater China region. Multi-media broadcast services. Topics and content from Investor outreach meetings. RRS contains comprehensive research and analysis on both local and international corporations as well as the markets in which they operate. The site has significant reference value for market practitioners and academic institutions who wish to have an insight on the default probability of Taiwanese corporations. (as of June 30, 2015) Chinese English Rating News 3,440 3,406 Rating Reports 2,006 2,145 TRC Local Analysis 462 458 S&P Greater China Region Analysis 76 77 Contact Us Iris Chu; (886) 2 8722-5870; [email protected] TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATESJenny Wu (886) 2 872-5873; [email protected] We warmly welcome you to our latest study of Taiwan's top 50 corporates, covering the island's largest corporations by revenue in 2014. Our survey of Taiwan's top corporates includes an assessment of the 14 industry sectors in which these companies operate, to inform our views on which sectors are most vulnerable to the current global (especially for China) economic environment, as well as the rising strength of China's domestic supply chain. -

Loan Against Securities – Approved Single Scrips

Loan against securities – Approved Single Scrips SR no ISIN Scrip Name Margin 1 INE216A01030 BRITANNIA INDUSTRIES LIMITED 50 2 INE854D01024 UNITED SPIRITS LIMITED 50 3 INE437A01024 APOLLO HOSPITALS ENTERPRISE LTD 50 4 INE208A01029 ASHOK LEYLAND LTD 50 5 INE021A01026 ASIAN PAINTS LTD 50 6 INE406A01037 AUROBINDO PHARMA LTD 50 7 INE917I01010 BAJAJ AUTO LTD 50 8 INE028A01039 BANK OF BARODA 50 9 INE084A01016 BANK OF INDIA 50 10 INE463A01038 BERGER PAINTS INDIA LTD 50 11 INE029A01011 BHARAT PETROLEUM CORPORATION LTD 50 12 INE323A01026 BOSCH LTD 50 13 INE010B01027 CADILA HEALTHCARE LTD 50 14 INE059A01026 CIPLA LTD 50 15 INE522F01014 COAL INDIA LTD 50 16 INE259A01022 COLGATE-PALMOLIVE (INDIA) LTD 50 17 INE361B01024 DIVIS LABORATORIES LTD 50 18 INE089A01023 DRREDDYS LABORATORIES LTD 50 19 INE129A01019 GAIL (INDIA) LTD 50 20 INE860A01027 HCL TECHNOLOGIES LTD 50 21 INE158A01026 HERO MOTOCORP LTD 50 22 INE038A01020 HINDALCO INDUSTRIES LTD 50 23 INE094A01015 HINDUSTAN PETROLEUM CORPORATION LTD 50 24 INE030A01027 HINDUSTAN UNILEVER LTD 50 25 INE079A01024 AMBUJA CEMENTS LTD 50 26 INE001A01036 HOUSING DEVELOPMENT FINANCE CORPLTD 50 27 INE090A01021 ICICI BANK LTD 50 28 INE242A01010 INDIAN OIL CORPORATION LTD 50 29 INE009A01021 INFOSYS LTD 50 30 INE154A01025 ITC LTD 50 31 INE237A01028 KOTAK MAHINDRA BANK LTD 50 32 INE498L01015 LT FINANCE HOLDINGS LTD 50 33 INE018A01030 LARSEN TOUBRO LTD 50 34 INE326A01037 LUPIN LTD 50 35 INE101A01026 MAHINDRA MAHINDRA LTD 50 36 INE585B01010 MARUTI SUZUKI INDIA LTD 50 37 INE775A01035 MOTHERSON SUMI SYSTEMS LTD 50 38 INE883A01011 -

指數etf (2805) 截至 31/01/2014 2805

領航富時亞洲(日本除外)指數ETF (2805) 截至 31/01/2014 2805 成分股數目 669 證券百分比 99.66% 現金及現金等類百分比 0.34% 其他 0.00% 證券名稱 證券代號 交易所 資產淨值百分比 Samsung Electronics Co. Ltd. 005930 XKRX 4.36% Taiwan Semiconductor Manufacturing Co. Ltd. 2330 XTAI 2.82% Tencent Holdings Ltd. 700 XHKG 2.20% AIA Group Ltd. 1299 XHKG 1.91% China Construction Bank Corp. 939 XHKG 1.78% China Mobile Ltd. 941 XHKG 1.69% Industrial & Commercial Bank of China Ltd. 1398 XHKG 1.59% Hyundai Motor Co. 005380 XKRX 1.14% Bank of China Ltd. 3988 XHKG 1.13% Hon Hai Precision Industry Co. Ltd. 2317 XTAI 1.13% Hutchison Whampoa Ltd. 13 XHKG 0.98% Infosys Ltd. INFY XNSE 0.97% CNOOC Ltd. 883 XHKG 0.84% Oversea-Chinese Banking Corp. Ltd. O39 XSES 0.74% Housing Development Finance Corp. HDFC XNSE 0.73% DBS Group Holdings Ltd. D05 XSES 0.72% Reliance Industries Ltd. RELIANCE XNSE 0.72% Galaxy Entertainment Group Ltd. 27 XHKG 0.72% China Life Insurance Co. Ltd. 2628 XHKG 0.71% Singapore Telecommunications Ltd. Z74 XSES 0.70% PetroChina Co. Ltd. 857 XHKG 0.70% POSCO 005490 XKRX 0.69% Shinhan Financial Group Co. Ltd. 055550 XKRX 0.69% Hong Kong Exchanges and Clearing Ltd. 388 XHKG 0.68% China Petroleum & Chemical Corp. 386 XHKG 0.68% Hyundai Mobis 012330 XKRX 0.67% Cheung Kong Holdings Ltd. 1 XHKG 0.66% Sands China Ltd. 1928 XHKG 0.62% Sun Hung Kai Properties Ltd. 16 XHKG 0.62% United Overseas Bank Ltd. U11 XSES 0.62% SK Hynix Inc. -

Hindustan Unilever Limited

Hindustan Unilever Limited Shift to Biomass Fired Burners CASE STUDY Figure 1: Nashik Biomass Boiler Figure 2: Orai Burner for incorporation of Vegetable Oil Residue Summary Hindustan Unilever Limited (HUL) has more than 20 manufacturing sites, where fossil fuel is being used to generate steam and hot air for process heating. To minimize our dependence on conventional fossil fuels and reduce CO2 emissions, the company started focusing on renewable energy opportunities since 2009. Prior to this, only 5 of our sites had biogenic fuel firing. A long-term road map for conversion of major fuel consuming sites was drawn-up. Since then, the company has commissioned 10 biomass fired Boilers and Hot Air Generators in India. Presently, more than 60,000 T of biogenic fuel is utilized annually for our process heating. Objective of Intervention The objective of the case study is to demonstrate the impact of biomass-based fuel usage on CO2 reduction along deliverance of cost savings. Type of Intervention and Location The intervention is to increase the share of renewable energy in HUL’s overall energy consumption portfolio by maximizing utilization of biomass fired fuels and reducing dependence on fossil fuels. The Reinforcing India’s Commitment Page 1 sites of intervention are the following locations where biomass-fired burners have been installed post-2010. These include biomass fuel-based Hot Air Generators (HAG) and Boilers (BMB): Chiplun (HAG), Goa (BMB), Haldia (HAG), Haridwar (BMB), Hosur (BMB), Mysore (BMB), Nashik (BMB), Orai (BMB), and Rajpura (HAG and BMB). Description of Intervention Since 2009, we have invested more than INR 60 crores in installation of Biomass Fired Steam Boilers and Hot Air Generators. -

Formosa Chemicals & Fibre Corporation And

FORMOSA CHEMICALS & FIBRE CORPORATION AND SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS AND REVIEW REPORT OF INDEPENDENT ACCOUNTANTS SEPTEMBER 30, 2019 AND 2018 ------------------------------------------------------------------------------------------------------------------------------------ For the convenience of readers and for information purpose only, the auditors’ report and the accompanying financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. In the event of any discrepancy between the English version and the original Chinese version or any differences in the interpretation of the two versions, the Chinese-language auditors’ report and financial statements shall prevail. WorldReginfo - e4fed8b1-59f2-413e-8a24-3b17fd46faf1 FORMOSA CHEMICALS & FIBRE CORPORATION AND SUBSIDIARIES INDEX Items Pages Index Report of Independent Accountants 1-3 Consolidated Balance Sheets 4-5 Consolidated Statements of Comprehensive Income 6-7 Consolidated Statements of Changes in Equity 8-9 Consolidated Statements of Cash Flows 10-11 Notes to Consolidated Financial Statements 12-108 WorldReginfo - e4fed8b1-59f2-413e-8a24-3b17fd46faf1 REVIEW REPORT OF INDEPENDENT ACCOUNTANTS TRANSLATED FROM CHINESE PWCR19000124 To the Board of Directors and Shareholders of Formosa Chemicals & Fibre Corporation Introduction We have reviewed the accompanying consolidated balance sheets of Formosa Chemicals & Fibre Corporation and subsidiaries (the “Group”) as at September 30, 2019 and 2018, -

Cipla Limited

Cipla Limited Registered Office: Cipla House, Peninsula Business Park, Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013 Phone: (9122) 2482 6000, Fax: (9122) 2482 6893, Email: [email protected], Website: www.cipla.com Corporate Identity Number: L24239MH1935PLC002380 Annexure to the Board’s Report Particulars of employee remuneration for the financial year ended 31st March, 2019 As required under section 197(12) of the Companies Act, 2013, read with rule 5(2) and (3) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014. Employed throughout the year Name Designation Qualification Experience Age Date of Last employment Remuneration (in years) (in years) Employment (Rs.) Abhay Kumar Chief Talent Officer Master of Arts / 17 53 3/10/2016 Piramal Pharma 15,034,298.00 Srivastava Master of Personal Solutions Management Ademola Olukayode Head - Quality Doctorate / MPH / B. 17 48 20/6/2018 US FOOD AND DRUG 17,982,961.00 Daramola Compliance & Tech. ADMINISTRATION Sustainability (US FDA) Ajay Luharuka Head Finance - IPD, B.com,MMS,CFA 23 46 11/7/1996 NIIT Limited 11,922,994.00 API, Specialty & Global Respi Aliakbar Rangwala Senior Business Head M. Sc. / B. Sc. 19 42 19/1/2009 NA 10,677,779.00 - Chronic & Emerging - India Business Alpana Vartak Head - Talent MBA (HR) / B. Sc. 15 41 8/1/2018 Coco - Cola 10,312,782.00 Acquisition Company Anil Kartha Site Head - Bsc, Bpharm 28 56 27/5/1991 Vysali 12,525,338.00 Patalganga - Pharmaceuticals Formulations Anindya Kumar Shee Head - Organization B. Tech. / MBA 18 48 14/1/2016 Reliance Industries 11,084,298.00 Development Ltd. -

Hindustan Unilever (HINLEV)

HindustanTAT Unilever (HINLEV) CMP: | 1670 Target: | 1900 ( 14%) Target Period: 12 months HOLD May 6, 2019 Volume growth moderates on high base… Hindustan Unilever (HUL) reported a healthy set of numbers with revenue growth of 9.3% YoY on the back of 7% volume growth. Volume growth moderated on a high base, after delivering five consecutive quarters of double digit growth. Operating margins expanded 83 bps YoY to 23.3% well Particulars supported by a 63 bps decline in marketing expenses to sales, 35 bps Particular (| crore) Amount reduction in employee expenses to sales and 11 bps decline in other Market Capitalization 360,720.0 overheads to sales, partly offset by a 27 bps increase in material costs to Total Debt (FY19) 0.0 sales. Led by healthy sales growth and strong margins, net profit for the Cash and Investments (FY19) 6,381.0 Result Update Result quarter grew 13.8% YoY to | 1,538 crore. EV 354,339.0 52 week H/L (|) 1870 / 1443 Leveraging direct reach & building blocks in e-commerce Equity capital 216.0 Face value | 1 Consumer companies have been historically dependent on wholesale FII Holding (%) 11.8 channel as its main trade channel. HUL, which has total reach of 7 million DII Holding (%) 7.0 outlets, has built its direct reach over the period and it stands at around 50%; much higher than other FMCG players. This gives it an edge over its peers, Key Highlights especially when the wholesale channel is under pressure. Proactively, HUL is also increasing its presence in e-commerce (3% of turnover) which has Home care (35% of revenue) posted been growing at a fast pace post GST implementation.