Fort Worth-Arlington, Texas U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

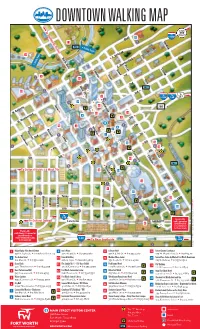

Downtown Walking Map

DOWNTOWN WALKING MAP To To121/ DFW Stockyards District To Airport 26 I-35W Bluff 17 Harding MC ★ Trinity Trails 31 Elm North Main ➤ E. Belknap ➤ Trinity Trails ★ Pecan E. Weatherford Crump Calhoun Grov Jones e 1 1st ➤ 25 Terry 2nd Main St. MC 24 ➤ 3rd To To To 11 I-35W I-30 287 ➤ ➤ 21 Commerce ➤ 4th Taylor 22 B 280 ➤ ➤ W. Belknap 23 18 9 ➤ 4 5th W. Weatherford 13 ➤ 3 Houston 8 6th 1st Burnett 7 Florence ➤ Henderson Lamar ➤ 2 7th 2nd B 20 ➤ 8th 15 3rd 16 ➤ 4th B ➤ Commerce ➤ B 9th Jones B ➤ Calhoun 5th B 5th 14 B B ➤ MC Throckmorton➤ To Cultural District & West 7th 7th 10 B 19 12 10th B 6 Throckmorton 28 14th Henderson Florence St. ➤ Cherr Jennings Macon Texas Burnett Lamar Taylor Monroe 32 15th Commerce y Houston St. ➤ 5 29 13th JANUARY 2016 ★ To I-30 From I-30, sitors Bureau To Cultural District Lancaster Vi B Lancaster exit Lancaster 30 27 (westbound) to Commerce ention & to Downtown nv Co From I-30, h exit Cherry / Lancaster rt Wo (eastbound) or rt Summit (westbound) I-30 To Fo to Downtown To Near Southside I-35W © Copyright 1 Major Ripley Allen Arnold Statue 9 Etta’s Place 17 LaGrave Field 25 Tarrant County Courthouse 398 N. Taylor St. TrinityRiverVision.org 200 W. 3rd St. 817.255.5760 301 N.E. 6th St. 817.332.2287 100 W. Weatherford St. 817.884.1111 2 The Ashton Hotel 10 Federal Building 18 Maddox-Muse Center 26 TownePlace Suites by Marriott Fort Worth Downtown 610 Main St. -

Ten Year Strategic Action Plan

PLANDOWNTOWN 2023 FORT WORTH TEN YEAR STRATEGIC ACTION PLAN 1 12 SH Uptown TRINITY Area ch ea W P UPTOWN S a 5 m u 3 e l - Trinity s H S I H Bluffs 19 9 M Northeast a in Edge Area Tarrant County t 1s Ex Courthouse Expansion d Area 3 2n rd EASTSIDE 3 h ap 4t lkn Be Downtown S f h P r C 5t H he at o U e e Core m n W d M m R e a e h r i r t s n c 6 o H e n o 2 u Southeast T s 8 h t th r o 7 o n 0 c k Edge Area m o h r t t 8 o n ITC h 9t CULTURAL 5th Expansion 7th 7th DISTRICT Burnett Area 2 Henderson- Plaza 10th vention Center Summit J City o n e Hall s Texas H C o e C m n h S d m e u e r e m r r r y s c m e o i n t Expansion Area 1 Lancaster J Lancaster e Lancaster n n i n g s d lv B k r a Holly P t s e Treatment IH-30 r o F Plant Parkview SOUTHEAST Area NEAR FORT SOUTHSIDE WORTH Table of Contents Message from Plan 2023 Chair 1 Executive Summary 2 The Plan 4 Vision 10 Business Development 16 Education 24 Housing 32 Retail, Arts and Entertainment 38 Transportation 42 Urban Design, Open Space and Public Art 50 Committee List, Acknowledgements 62 Message from Plan 2023 Chair Since the summer of 2003, Downtown Fort Worth has made advance - ments on many fronts. -

The Trinity River Project Is Transforming the Identity of Fort Worth Into a Bustling, Waterfront City

The Trinity River Project is transforming the identity of Fort Worth into a bustling, waterfront city. first ever civil works project to win the “Good Neighbor Award” for sustainability from U.S. Army Corps of Engineers. The Trinity River Vision Authority (TRVA) is the organization responsible for the implementation of the Trinity River Vision (TRV) – a master plan for the Trinity River in Fort Worth, Texas. The seeds of this vision are now taking shape before the eyes of the city. While the primary purpose of the project is to provide needed flood protection, it will double the size of the most livable central business district in the nation. The Vision also provides for the creation of new recreational amenities, improved infrastructure, unique public spaces and responsible environmental enhancements. The components TRVA oversees include the creation of Panther Island, a vibrant, pedestrian-oriented, urban waterfront district adjacent to downtown Fort Worth, the expansion of Gateway Park into one of the largest urban-programmed parks in the nation and the enhancement of the river corridor including over 90 user- requested projects along the Trinity Trails. In addition to this, to help attract businesses and entertainment to the district, TRVA is responsible for programming the project’s public spaces, including Panther Island Pavilion, a waterfront event venue directly adjacent to downtown Fort Worth hosting concerts, festivals, runs and other exciting events. Panther Island, the most well-known component of the Trinity River Vision, has triggered a rebirth of the district north of Flowing canals will be the heart downtown Fort Worth into an urban waterfront community. -

Institutional Information

1 Profile Texas Wesleyan University: Located in Fort Worth, Texas, Texas Wesleyan University was founded by the Methodist Episcopal Church, South, in 1890. A committee under the direction of Bishop Joseph S. Key explored locations for a campus and settled on a site east of Fort Worth donated by area pioneers, A.S. Hall, W.D. Hall, and George Tandy. Originally called Polytechnic College, which has the literal meaning “many arts and sciences,” the school held its first classes in September 1891, with a handful of faculty members and 111 students. In 1902, H.A. Boaz assumed the presidency and managed a period of moderate growth. He conceived the idea of a new university for Southern Methodism and planned to develop Polytechnic College into that university. Since 1934, Texas Wesleyan has remained a co-educational liberal arts institution with an increasingly comprehensive academic and student life program. In addition to strong undergraduate programs, the University added graduate programs in education in the 1970s and in nurse anesthesia in the 1980s. Institutional and Professional Accreditation: Texas Wesleyan University is accredited by the Southern Association of Colleges and Schools Commission on Colleges to award baccalaureate, master's, and doctoral level degrees. Contact the Commission on Colleges at 1866 Southern Lane, Decatur, Georgia 30033-4097 or call 404- 679-4500 (Website: www.sacscoc.org) only for questions, comments, or issues related to the accreditation of Texas Wesleyan University. Program accreditations include: AACSB International: The Association to Advance Collegiate Schools of Business Accreditation Council for Business Schools and Programs Commission on Accreditation of Athletic Training Education Council on Accreditation of Nurse Anesthesia Educational Programs National Association of Schools of Music State Board for Educator Certification/Teacher Education Agency University Senate of the United Methodist 2 Campus Texas Wesleyan University maintains a historic campus in east Fort Worth and a site in Burleson, Texas. -

2016-2017 Fact Book Institutional Information

FACT BOOK 2016-2017 Texas Wesleyan University Online Fact B ook The Office of Institutional Research (IR) is pleased to present the Texas Wesleyan University Online Fact Book.The purpose of the Fact Book is to provide frequently requested data, as well as, official University data, in a structured presentation format. The Online Fact Bookprovides Wesleyan faculty, staff, alumni, students, and general public with information that is useful for planning and decision-making. The IR Department compiles much of the information included in the Fact Book from a variety of sources. It is developed in response to common data sets, planning, academic profiles, surveys, and governmental compliance requirements of the University. If you have any questions concerning the information contained in this book or any suggestions as to the content or format, feel free to contact me. Thank you. Sincerely, Sherri Caraballo Travis Smith Director of Institutional Research Institutional Research Analyst email: [email protected] email: [email protected] Office: (817) 531-7511 Office: (817) 531-7510 Fax: (817) 531-7507 Fax: (817) 531-7507 Emanuela Pop Institutional Research Analyst email: [email protected] Office: (817) 531-7500 Fax: (817) 531-7507 Oce of Institutional Research Website: https://txwes.edu/research/ 5 Profile Texas Wesleyan University: Located in Fort Worth, Texas, Texas Wesleyan University was founded by the Methodist Episcopal Church, South, in 1890. A committee under the direction of Bishop Joseph S. Key explored locations for a campus and settled on a site east of Fort Worth donated by area pioneers, A.S. Hall, W.D. Hall, and George Tandy. -

Downtown Fort Worth & Open Space Plan

Downtown Fort Worth & Open Space Plan DOWNTOWN FORT WORTH IMPROVEMENT DISTRICT | DOWNTOWN FORT WORTH, INC. SPECIAL THANKS Downtown Fort Worth, Inc. DFWI is grateful to the Downtown Green Space Committee members for their time, energy, and dedication to the improvement of Downtown through quality spaces. Downtown Green Space Committee Judy Harman, co-chair Community Volunteer Elaine Petrus, co-chair Community Volunteer Bob Adams Parsons/The Projects Group Hank Akin Klabzuba Properties Leslie Brennan Hahnfeld Hoffer Stanford Ames Fender Ames Fender, Architect Vida Hariri City of Fort Worth, Planning Department Dale Kesteloot Sundance Square Leo Kinney Cash America Karl Komatsu Komatsu Architecture James Nader Nader Design Group Harold Pitchford City of Fort Worth, Parks Department Victoria Powell B. R. Powell & Associates, P.C. Jason Smith Fort Worth Dog Park Association Randy Sorensen Jacobs Carter Burgess Joy Webster XTO Energy, Inc. Much of Downtown’s recent growth has been office construction, hotels, new residential development and the adaptive reuse of office buildings for residential use. These expanding residential, office and visitor populations have created a greater need for usable green and open space Downtown. The desire to have a place for respite and recreation in the center city dates back to the beginning of Fort Worth. In 1892, the City Park Garden, which straddled the Clear Fork of the Trinity River roughly between today’s West Seventh Street and Lancaster bridges, provided such a place. Rotary Park - developed by the Rotary Club in 1916, on the southeast corner of West Seventh and Summit Avenue - included a small bath house and Rotary Club headquarters. -

Bus Route 63X And

North Park & Ride 63X Xpress University Village W University Dr Shopping Center N Bonnie Brae St North Texas Xpress Texas Health 64X Presbyterian Denton Hospital Scripture St Scripture St Texas Health 5 Presbyterian W Oak St 7 NT W Hickory St Park & Ride W Oak St 64X University of North Texas EP/NT S Bonnie Brae St 6 Texas Blvd Texas North 35W 35E 64X Eagle Pkwy i Express service to/from Denton Fort Worth 64X Alliance Airport Galderma Alliance BlvdLaboratories LP Heritage Pkwy63X Alliance Corporate TCC Hadley CEATL 4 Training Center Legacy Crossing 63X 64X 64X Ticket Zones Fort North Park & Ride / Alliance Opportunity Westport Pkwy Worth Alliance Center Denton Rt_63 Golden Triangle Blvd Trinity Metro DCTA Regional North Park & Ride 3 Traveling across both zones requires a regional ticket. Heritage Trace Pkwy 35W i Express service to/from Downtown Fort Worth 63X 64X TEXRail Belknap St Map Key Route Line 35W Weatherford St Throckmorton St Non-Stop Service Houston St Downtown TRE # Scheduled Timepoint Fort Worth # Transfer Center FORT WORTH 6th St CENTRAL STATION Rail Station 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 14, 15, Park & Ride 7th St # 10 15 46 46, 60X, 61X, 63X, 2 1 Transfer to Trinity Metro buses 9th St Jones St 64X, 65X, 66X, 89, Calhoun St Molly, The Dash # Transfer to DCTA buses EP/NT Transfer to UNT shuttle 9th St 12th St Purchase tickets or track your bus 800 Cherry Street with our mobile apps: Fort Worth, Texas 76102 Eective Customer Care: (817) 215-8600 January 10, 2021 Download from your app store. -

THE DASH SCHEDULE Panther Island

Effective Sep. 22, 2019 TRINITY METRO THE DASH SCHEDULE Panther Island SUNDANCE W 2nd St. SQUARE 280 Houston St. Commerce St. Fort Worth Currie St. Montgomery Plaza Central Station W 7th St. 7th & University W 7th St. W 6th St. Jones St. Henderson St. Henderson St. FORT WORTH Calhoun St. CONVENTION CENTER Camp Bowie Blvd. Montgomery St. W Lancaster Ave. W Lancaster Ave. Fort Worth T&P Station Gendy St. CULTURAL DISTRICT I30 Jennings Ave. Jennings Ave. E Vickery Blvd. S Main St. Harley Dickies Arena University Dr. Ave. University Dr. Trinity Park Trail Dr. Dash Route & Time Points I30 Dash Direction TEXRail & TRE Station Sunday – Thursday IT’S ELECTRIC! WESTBOUND – TO THE CULTURAL DISTRICT EASTBOUND – TO DOWNTOWN FORT WORTH CENTRAL MONTGOMERY DICKIES DICKIES 7TH & CENTRAL EXPLORE STATION PLAZA ARENA ARENA UNIVERSITY STATION +THE CULTURAL DISTRICT 1 2 3 1 2 3 DOWNTOWN FORT WORTH 9:30 9:43 9:52 9:22 9:33 9:44 The Dash by Trinity Metro is an all electric bus. 9:45 9:58 10:07 9:37 9:48 9:59 Kick back and recharge in our stylish seats as 10:00 10:13 10:22 9:52 10:03 10:14 you dash between downtown Fort Worth and every 15 minutes the Cultural District. 9:45 9:58 10:07 9:52 10:03 10:14 10:00 10:13 10:22 10:07 10:18 10:29 10:15 10:28 10:37 10:22 10:33 10:44 SERVING a.m. times p.m. times • Sundance Square • Montgomery Plaza Friday – Saturday • Crockett Row WESTBOUND – TO THE CULTURAL DISTRICT EASTBOUND – TO DOWNTOWN FORT WORTH CENTRAL MONTGOMERY DICKIES DICKIES 7TH & CENTRAL • Dickies Arena STATION PLAZA ARENA ARENA UNIVERSITY STATION • UNT Health Science Center 1 2 3 1 2 3 • Amon Carter Museum of American Art 9:30 9:43 9:52 9:22 9:33 9:44 • Kimbell Art Museum 9:45 9:58 10:07 9:37 9:48 9:59 • Modern Art Museum of Fort Worth 10:00 10:13 10:22 9:52 10:03 10:14 every 15 minutes TICKETS* 11:45 11:58 12:07 11:52 12:03 12:14 12:00 12:13 12:22 12:07 12:18 12:29 ONE WAY: $2 ALL DAY: $5 12:15 12:28 12:37 12:22 12:33 12:44 *Reduced options available. -

Dean, School of Interdisciplinary Studies Texas Christian University Leadership Profile

Dean, School of Interdisciplinary Studies Texas Christian University Leadership Profile Texas Christian University (TCU) invites nominations and applications for the position of Dean of the School of Interdisciplinary Studies (SIS). The next Dean will have the opportunity to lead a high-potential School and sharpen its strategic focus by capitalizing on current strengths and identifying new areas of synergy and innovation. Inherently problem based, Interdisciplinary Studies connects diverse experts and methods to address complex challenges. It invariably contains an integrative element (for example, race, gender, sexuality, class) that brings together and benefits from traditional disciplinary knowledge and tools. A private university located in Fort Worth, Texas, TCU is classified as a top 100 National University by U.S. News & World Report and has a Carnegie Classification of R2: Doctoral Universities – High Research Activity. The University has a $1.9 billion endowment and enrolls over 11,300 students. SIS and TCU support a robust teacher-scholar model that integrates teaching and research to benefit undergraduate and graduate students. SCHOOL OF INTERDISCIPLINARY STUDIES Founded in 2018, the School of Interdisciplinary Studies allows students to integrate content, data, methods, tools, concepts, and theories from two or more disciplines to construct a more comprehensive and finely tuned understanding of a problem. Ideal for addressing complex challenges that transcend individual disciplines or professions, the School of Interdisciplinary -

South Park & Ride Xpress

Houston St 35W 6th St 7th St South Park & BelknapThrockmorton St St 65X Downtown Ride Xpress 5 Fort Worth Weatherford St 9th St Fort Worth 7th St 6th St Houston St 3 Central Station Jones St 4 (previously named Fort Worth Map Key Intermodal Transportation Center) HYDE 30 Route Line PARK Non-Stop Service Lancaster Ave # Scheduled Timepoint Rosedale St # Transfer Center I-35W # Transfer to other buses Allen Ave Rail Station St Hemphill i Park & Ride CCT Stop from South Park & Ride at VA Clinic at 12:10 PM Seminary Dr i VA Clinic AM 20 Pick up along southbound service road BEFORE reaching South Park & Ride for departures. Use I-35 Altamesa Blvd northbound into downtown. 1 i Rt_65 PM Drop os along service road DOWNTOWN Sycamore School Rd northbound AFTER going to Belknap St Criminal Commerce St South Park & Ride. Weatherford St Justice Calhoun St1st St T Tarrant E 4th St Center 2nd St X Elm St R s County Main St s a Everman Pkwy Houston St re i 35W College 3rd St l xp E Throckmorton St ay Taylor St 4th St ailw Sundance ty R Corrections 5th St i I-35W Burnett St rin Center Square T Henderson St Bass Hall FORT WORTH Jones St CENTRAL STATION Public 6th St Library 1, 2, 3, 4, 5, 6, 7, 8, 9, 7th St YMCA 5 10, 11, 12, 14, 15, 46, Rendon Crowley Rd 8th St 5th St 60X, 61X, 63X, 64X, Trinity Metro 9th St 7th St Ticket Sales 3 65X, 66X, 89, Center The Dash, Molly 4 ThrockmortonHouston St St 10th St Cherry St Convention Texas St US Courts City Center Jones St South Park & Ride Lake St Lake Collier St Burnett St Lamar St Lamar Hall 13th St 2 Jennings -

The History of Wbap

THE 50,000 WATT BLOWTORCH OF THE GREAT SOUTHWEST: THE HISTORY OF WBAP Chad M. Dixon Thesis Prepared for the Degree of MASTER OF ARTS UNIVERSITY OF NORTH TEXAS December 2016 APPROVED: Xiaoqun Zhang, Major Professor Russ Campbell, Committee Member Terry Moellinger, Committee Member Eugene Martin, Chair of the Department of Media Arts David Holdeman, Dean of the School of Arts and Sciences Victor Prybutok, Vice Provost of the Toulouse Graduate School Dixon, Chad M. The 50,000 Watt Blowtorch of the Great Southwest: The History of WBAP. Master of Arts (Media Industry and Critical Studies), December 2016, 102 pp., references, 112 titles. This paper looks at the history of WBAP while examining how programming has changed from 1922-2014 and how WBAPs audience helped shape programming at the station. This paper reveals four formatting changes throughout the stations history and provides in-depth statistical analysis of how WBAPs audience changed during the stations 90 plus years of existence. Copyright 2016 by Chad M. Dixon ii TABLE OF CONTENTS Page CHAPTER 1. INTRODUCTION ....................................................................................... 1 CHAPTER 2. HISTORY OF WBAP 1922-2014 ............................................................... 5 CHAPTER 3. FACILITIES AND OWNERSHIP ............................................................. 33 Ownership .......................................................................................................... 36 CHAPTER 4. SOCIETY, AUDIENCE AND PROGRAMING ......................................... -

Fort Worth, Where Your Safety, Care and Recovery Are Our Numb

Welcome to Baylor Scott & White All Saints Medical Center – Fort Worth, where your safety, care and recovery are our number one priority. We will empower you to be an active participant in your care. Our care philosophy puts you and your family at the center, surrounded by your care team, physicians and administration. We are all focused on providing important resources and clinical quality to get you back to good health. With enhanced cleaning, patient screening and virtual appointment options, our commitment to serving you safely has never been stronger. This guide will provide you with a list of important resources and amenities available to you during your stay. Please let your care provider know if there is anything you need to make your stay a quality healthcare experience. Thank you for choosing us; we are honored to be your provider of choice. Sincerely, WE CARE DEEPLY ABOUT YOUR EXPERIENCE After you return home, you may Michael Sanborn, FACHE receive a survey President, Baylor Scott & White All Saints Medical Center – Fort Worth in the mail. We ask that you complete and return the survey. Your input helps us to recognize those who provide exceptional care and areas in which we can improve. We appreciate your assistance with providing us your valuable feedback. BAYLOR SCOTT & WHITE ALL SAINTS MEDICAL CENTER - FORT WORTH | BSWHEALTH.COM/FORTWORTH 1 About your hospital Located near downtown Fort Worth, we are a full-service hospital dedicated to providing quality healthcare to our community. Our not-for-profit hospital celebrated 100 years of service in 2006. We have 538 licensed beds and offer a broad range of medical services, including programs of excellence in cardiology, transplantation, oncology and women’s and children’s services.