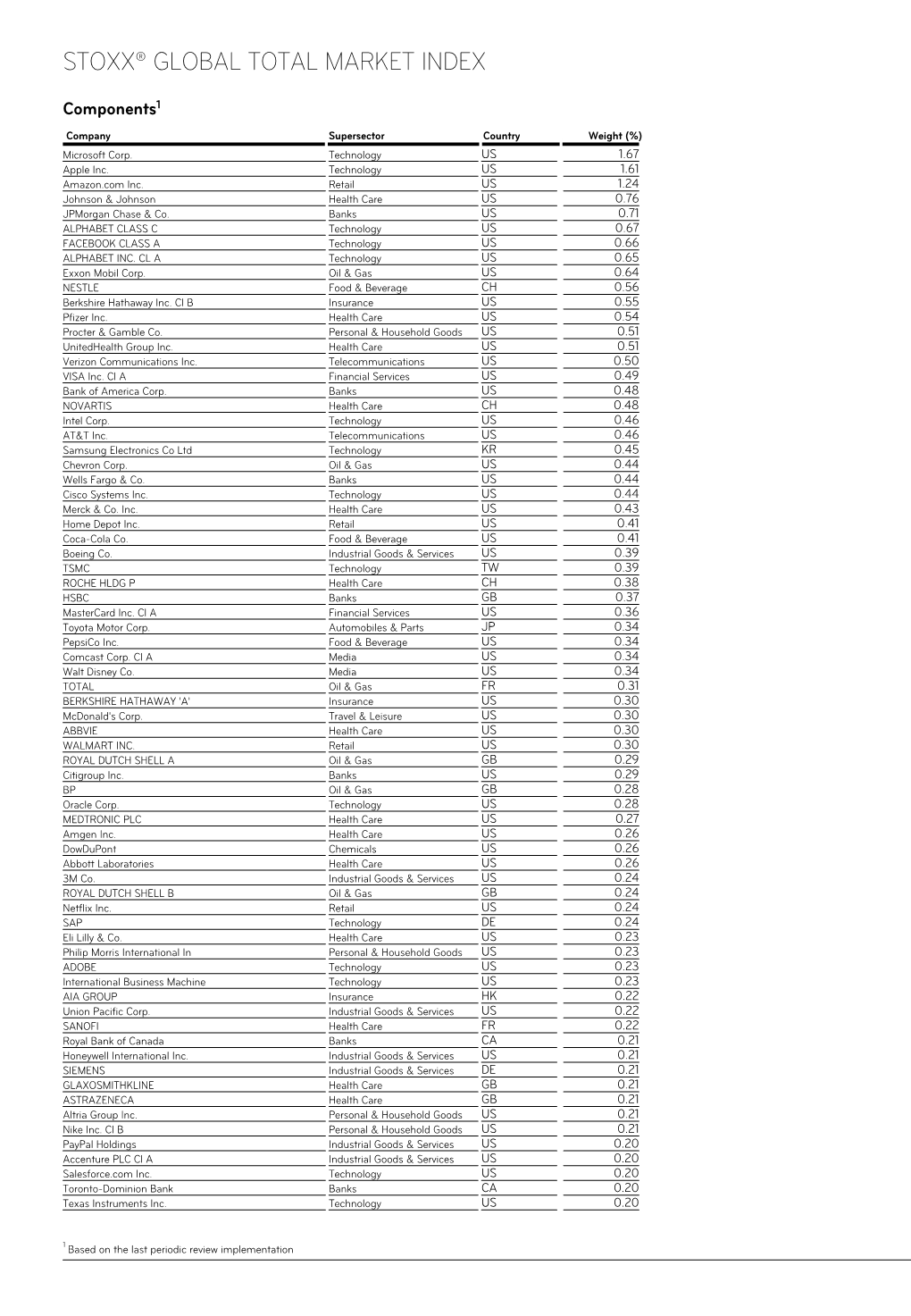

Stoxx® Global Total Market Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

Birth and Evolution of Korean Reality Show Formats

Georgia State University ScholarWorks @ Georgia State University Film, Media & Theatre Dissertations School of Film, Media & Theatre Spring 5-6-2019 Dynamics of a Periphery TV Industry: Birth and Evolution of Korean Reality Show Formats Soo keung Jung [email protected] Follow this and additional works at: https://scholarworks.gsu.edu/fmt_dissertations Recommended Citation Jung, Soo keung, "Dynamics of a Periphery TV Industry: Birth and Evolution of Korean Reality Show Formats." Dissertation, Georgia State University, 2019. https://scholarworks.gsu.edu/fmt_dissertations/7 This Dissertation is brought to you for free and open access by the School of Film, Media & Theatre at ScholarWorks @ Georgia State University. It has been accepted for inclusion in Film, Media & Theatre Dissertations by an authorized administrator of ScholarWorks @ Georgia State University. For more information, please contact [email protected]. DYNAMICS OF A PERIPHERY TV INDUSTRY: BIRTH AND EVOLUTION OF KOREAN REALITY SHOW FORMATS by SOOKEUNG JUNG Under the Direction of Ethan Tussey and Sharon Shahaf, PhD ABSTRACT Television format, a tradable program package, has allowed Korean television the new opportunity to be recognized globally. The booming transnational production of Korean reality formats have transformed the production culture, aesthetics and structure of the local television. This study, using a historical and practical approach to the evolution of the Korean reality formats, examines the dynamic relations between producer, industry and text in the -

Annual Report and Financial Statements

Annual Report and Financial Statements for the year ended 31 December 2019 Dimensional Funds ICVC Authorised by the Financial Conduct Authority No marketing notification has been submitted in Germany for the following Funds of Dimensional Funds ICVC: Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund Accordingly, these Funds must not be publicly marketed in Germany. Table of Contents Dimensional Funds ICVC General Information* 2 Investment Objectives and Policies* 3 Authorised Corporate Director’s Investment Report* 5 Incorporation and Share Capital* 9 The Funds* 9 Fund Cross-Holdings* 9 Fund and Shareholder Liability* 9 Regulatory Disclosure* 9 Potential Implications of Brexit* 9 Responsibilities of the Authorised Corporate Director 10 Responsibilities of the Depositary 10 Report of the Depositary to the Shareholders 10 Directors' Statement 10 Independent Auditors’ Report to the Shareholders of Dimensional Funds ICVC 11 The Annual Report and Financial Statements for each of the below sub-funds (the “Funds”); Emerging Markets Core Equity Fund Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund are set out in the following order: Fund Information* 13 Portfolio Statement* 30 Statement of Total Return 139 Statement of Change in Net Assets Attributable to Shareholders 139 Balance Sheet 140 Notes to the Financial Statements 141 Distribution Tables 160 Remuneration Disclosures (unaudited)* 169 Supplemental Information (unaudited)* 170 * These collectively comprise the Authorised Corporate Director’s (“ACD”) Report. Dimensional Fund Advisors Ltd. -

KOREA Morning Focus

March 15, 2018 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) SM Entertainment (041510/Buy/TP: W50,000) KOSPI 2,486.08 -8.41 -0.34 Positive on KeyEast/FNC Add Culture acquisition KOSPI 200 321.99 -0.99 -0.31 KOSDAQ 886.92 0.67 0.08 Sector News & Analysis Turnover ('000 shares, Wbn) Volume Value Internet/Game (Overweight) KOSPI 357,035 6,259 Japan visit note: Expanding lifestyle presence KOSPI 200 74,841 4,749 KOSDAQ 920,060 5,181 Market Cap (Wbn) Value KOSPI 1,652,629 KOSDAQ 285,293 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,580 1,709 -130 Institutional 1,232 1,375 -142 Retail 3,437 3,154 283 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 366 440 -74 Institutional 184 235 -51 Retail 4,617 4,481 136 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,309 1,502 -192 KOSDAQ 187 197 -10 Advances & Declines Advances Declines Unchanged KOSPI 324 502 61 KOSDAQ 525 638 92 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,588,000 5,000 645 Celltrion 306,500 -4,500 582 Hynix 90,700 700 512 Pharmicell 8,710 2,010 230 KODEX LEVERAGE 17,215 -40 212 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 119,900 2,600 250 NATURECELL 54,600 2,000 171 CIS 2,495 265 138 Diostech 38,550 250 108 Celltrion Healthcare 104,900 0 92 Note: As of March 14, 2018 Mirae Asset Daewoo Research SM Entertainment (041510 KQ) Positive on KeyEast/FNC Add Culture acquisition Entertainment Acquisition of rivals to strengthen content production business; Maintain positive view Company Update We reaffirm our Buy call and target price of W50,000 on SM Entertainment. -

Entertainment, Arts and Sports Law Journal a Publication of the Entertainment, Arts and Sports Law Section of the New York State Bar Association

NYSBA FALL/WINTER 2008 | VOL. 19 | NO. 4 Entertainment, Arts and Sports Law Journal A publication of the Entertainment, Arts and Sports Law Section of the New York State Bar Association Inside • 22008008 LLegislationegislation AAffectingffecting EEntertainment,ntertainment, AArtsrts aandnd SSportsports LLawaw • AApplyingpplying tthehe DDoctrineoctrine fforor HHireire aandnd JJointoint WWorksorks toto WWebeb ssiteite DDevelopmentevelopment • CConceptualonceptual AArtrt aandnd AArtrt TTheftheft • CCompulsoryompulsory MMechanicalechanical LLicensingicensing • CComparativeomparative AAnalysisnalysis oonn PPSPSP SSoftwareoftware CCasesases • TTiffanyiffany vv.. eeBayBay, tthehe PPerfecterfect 1100 CCasesases . aandnd mmoreore WWW.NYSBA.ORG/EASL EASLJournFallWinter08.indd 1 12/1/2008 12:05:50 PM From the NYSBA Book Store Entertainment Litigation Entertainment Litigation is a thorough exposition of the basics that manages to address in a simple, accessible way the pitfalls and the complexities of the fi eld, so that artists, armed with that knowledge, and their representatives can best minimize the risk of litigation and avoid the courtroom. Written by experts in the fi eld, Entertainment Litigation is the manual for anyone practicing in this fast-paced, ever-changing area of law. Contents 1. Contracts Without 8. The Safe Harbor Provisions of the an Obligation Digital Millennium Copyright Act and “X”.com 2. Artist-Manager Conflicts 9. Trademarks for Artists 3. Artist-Dealer Relations: EDITORS and Entertainers Representing the Peter Herbert, Esq. Visual Artist 10. Internet: A Business Owner’s Hinckley, Allen & Snyder LLP Checklist for Avoiding Web Site 4. Intellectual Property Overview: Boston, MA Pitfalls Right of Privacy / Publicity Elissa D. Hecker and the Lanham Act 11. Internet Legal Issues Law Offi ce of Elissa D. Hecker Irvington, NY 5. Anatomy of a Copyright 12. -

ISP Liability in the Field of Copyright

Internet Service Providers’ Liability in the Field of Copyright: A Review of Asia-Pacific Copyright Law WIPO International Seminar on Copyright Jointly organized by WIPO and the Ministry of Culture of Brazil 26 November 2008 A/Prof Daniel Seng Faculty of Law, National University of Singapore 1 Internet Intermediaries • Who is an Internet “service provider”? – Infrastructure intermediaries e.g. Internet Access Service Providers, proxies, DNS – Services intermediaries e.g. search engines, archives – Software developers of networks and connectivity tools e.g. FreeNet, Kazaa, Morpheus – Operators and hosting companies e.g. content hosts, exchange platforms, forums – Diverse types of intermediaries with different roles offering different services • Are intermediaries liable for: – Direct liability e.g. reproductions, communication of works on their infrastructure? – Indirect/secondary liability e.g. authorising or facilitating the infringement of their users/subscribers? 2 Developments Worldwide • Legislative Developments to Protect Internet Service Providers – WIPO Copyright and Performances and Phonograms Treaties 1996 – US Digital Millennium Copyright Act 1998 – Australian Copyright Amendment (Digital Agenda) Act 2000 – EU Information Society and E-Commerce Directives 2001 – Singapore Copyright Amendment Act 2005 – HK Copyright (Amendment) Bill (proposed, 2007) – New Zealand Copyright (New Technologies) Amendment Act 2008 – France, “Three-Strikes” Law (4 Nov 2008); cf: U.K.’s “Graduated Response” Law 3 Litigation Worldwide • Exposure of -

Download Exceeds 5 Million People - Established Game Duck, a Subsidiary for Game Play Storage and Sharing Service

1 Research on Promoting SMEs’ Participation in Global Value Chains – ICT/Electronic Industry Table of Contents Executive Summary ..................................................................................................................................1 1. Overview.................................................................................................................................................3 1.1. Background and Purpose .................................................................................................. 3 1.2. Scope of Study .................................................................................................................. 4 2. Concept of GVC and SMEs’ Participation in GVC .......................................................................5 2.1. Concept of GVC and SMEs’ Participation ....................................................................... 5 2.1.1. Concept and Significance of GVC ........................................................................ 5 2.1.2. Review of Precedent Studies on GVC ................................................................ 15 2.1.3. Patterns and Types of GVC Structure ................................................................. 17 2.1.4. Significance of SMEs’ Participation in GVC ..................................................... 22 2.2. Changes and Development of GVC Structure ................................................................ 25 2.2.1. Outlook of GVC Structure Changes .................................................................. -

The K-Pop Wave: an Economic Analysis

The K-pop Wave: An Economic Analysis Patrick A. Messerlin1 Wonkyu Shin2 (new revision October 6, 2013) ABSTRACT This paper first shows the key role of the Korean entertainment firms in the K-pop wave: they have found the right niche in which to operate— the ‘dance-intensive’ segment—and worked out a very innovative mix of old and new technologies for developing the Korean comparative advantages in this segment. Secondly, the paper focuses on the most significant features of the Korean market which have contributed to the K-pop success in the world: the relative smallness of this market, its high level of competition, its lower prices than in any other large developed country, and its innovative ways to cope with intellectual property rights issues. Thirdly, the paper discusses the many ways the K-pop wave could ensure its sustainability, in particular by developing and channeling the huge pool of skills and resources of the current K- pop stars to new entertainment and art activities. Last but not least, the paper addresses the key issue of the ‘Koreanness’ of the K-pop wave: does K-pop send some deep messages from and about Korea to the world? It argues that it does. Keywords: Entertainment; Comparative advantages; Services; Trade in services; Internet; Digital music; Technologies; Intellectual Property Rights; Culture; Koreanness. JEL classification: L82, O33, O34, Z1 Acknowledgements: We thank Dukgeun Ahn, Jinwoo Choi, Keun Lee, Walter G. Park and the participants to the seminars at the Graduate School of International Studies of Seoul National University, Hanyang University and STEPI (Science and Technology Policy Institute). -

“PRESENCE” of JAPAN in KOREA's POPULAR MUSIC CULTURE by Eun-Young Ju

TRANSNATIONAL CULTURAL TRAFFIC IN NORTHEAST ASIA: THE “PRESENCE” OF JAPAN IN KOREA’S POPULAR MUSIC CULTURE by Eun-Young Jung M.A. in Ethnomusicology, Arizona State University, 2001 Submitted to the Graduate Faculty of School of Arts and Sciences in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Pittsburgh 2007 UNIVERSITY OF PITTSBURGH SCHOOL OF ARTS AND SCIENCES This dissertation was presented by Eun-Young Jung It was defended on April 30, 2007 and approved by Richard Smethurst, Professor, Department of History Mathew Rosenblum, Professor, Department of Music Andrew Weintraub, Associate Professor, Department of Music Dissertation Advisor: Bell Yung, Professor, Department of Music ii Copyright © by Eun-Young Jung 2007 iii TRANSNATIONAL CULTURAL TRAFFIC IN NORTHEAST ASIA: THE “PRESENCE” OF JAPAN IN KOREA’S POPULAR MUSIC CULTURE Eun-Young Jung, PhD University of Pittsburgh, 2007 Korea’s nationalistic antagonism towards Japan and “things Japanese” has mostly been a response to the colonial annexation by Japan (1910-1945). Despite their close economic relationship since 1965, their conflicting historic and political relationships and deep-seated prejudice against each other have continued. The Korean government’s official ban on the direct import of Japanese cultural products existed until 1997, but various kinds of Japanese cultural products, including popular music, found their way into Korea through various legal and illegal routes and influenced contemporary Korean popular culture. Since 1998, under Korea’s Open- Door Policy, legally available Japanese popular cultural products became widely consumed, especially among young Koreans fascinated by Japan’s quintessentially postmodern popular culture, despite lingering resentments towards Japan. -

Orientaliska Studier

ORIENTALISKA STUDIER Special Issue International Conference: 60th Anniversary of Diplomatic Relations between the Kingdom of Sweden and the Republic of Korea (ROK), May 23-24, 2019 No. 159 2019 ORIENTALISKA STUDIER No. 159, 2019 Tidskriften Orientaliska studier utges av Föreningen för orientaliska studier vid Stockholms universitet och utkommer med 3-4 nummer per år. MEDLEMSKAP & PRENUMERATION Medlemskap i Föreningen för orientaliska studier kostar 120 kr/år och inkluderar tidskriften. Medlemskapet är öppet för alla privatpersoner och erhålles genom att medlemsavgiften insättes på föreningens postgirokonto 45 90 26-1. Enbart prenumeration kostar 150 kr/år och beställning av enstaka lösnummer 30 kr inklusive porto. För prenumeranter och medlemmar utanför Norden är priset 300 kr/år inklusive porto. ADRESS Orientaliska studier Stockholms universitet Kräftriket 4B 106 91 Stockholm E-post: [email protected], [email protected] http://www.orientaliskastudier.se REDAKTION Ansvarig utgivare: Torbjörn Lodén Redaktör: Gabriel Jonsson ISSN: 0345-8997 Print: Kalejdoskop Preface Gabriel Jonsson An Outline of Sweden-Republic of Korea 5 Relations Anna-Karin Jonsson The Work of the Swedish Institute of Interna- 15 & Björn Jerdén tional Affairs (UI) on the Republic of Korea Sangsoo Lee Institute for Security and Development Policy 18 (ISDP) Korea Center Lars Vargö Korea - en civilisation i kläm 21 Sonja Häussler Diversification of Korean studies at Stockholm 30 University: From linguistics to cultural and social studies Jimmyn Parc The -

Media Content the Next Players of China’S Growth

Media Content The next players of China’s growth A look into the growth pattern of China’s culture industry Overweight (Maintain) China has become a central player in almost every industry across the world. The media content industry is no exception. In our recent overseas marketing trip, we met many Industry Report foreign investors asking about Korean content stocks, and were left with the impression March 23, 2016 that investors were looking for the next players to benefit from China’s growth. In 2015, the tertiary industry contributed to more than half of China’s GDP for the first Daewoo Securities CCCo.,Co., Ltd. time ever, signaling a change in global stock leadership. China’s box-office market has been growing at an astonishing rate, outpacing forecasters’ predictions. Historically, US [Telecom Service / Media] cultural spending increased significantly when the country’s GDP per capita rose from Jee-hyun Moon US$4,000 to US$20,000. At present, China’s GDP per capita is just US$8,000. +822-768-3615 Furthermore, the Chinese government has pledged to develop the culture industry into [email protected] one of the backbones of its economy. Nu-ri Ha With infrastructure nearly complete, next big investment will be in content +822-768-4130 [email protected] China’s culture industry now has most of the necessary infrastructure in place. The boom in multiplex theater co nstruction has led to a considerable rise in the number of Hong-mei Cui screens, and box-office revenue is surging in third- and fourth-tier cities. -

SM Entertainment

SM Entertainment (041510 KQ ) Positive on KeyEast/FNC Add Culture acquisitions Acquisition of rivals to strengthen content production business; Maintain positive view Entertainment We reaffirm our Buy call and target price of W50,000 on SM Entertainment. We continue to maintain a positive view on entertainment firms’ entry into content Company Report productio n, and believe SM Entertainment’s latest acquisitions will broaden the company’s opportunities in this area. We believe investors should focus on new March 15, 2018 business prospects rather than dilution (4.2%) from the share issue. Since 2015, the secondary businesse s (F&B, fashion, cosmetics) of entertainment firms (including SM Entertainment) have been largely disappointing, weighing on their overall earnings. However, we think there is clear potential for synergy between SM (Maintain) Buy Entertainment’s core business and content production, especially in terms of the use of artist-creator resources and the financial compatibility of advertising and content Target Price (12M, W) 50,000 production (stability and profitability). Acquiring KeyEast (25.1%) and FNC Add Culture (30.5%) for a total of W80bn Share Price (03/14/18, W) 41,600 Before yesterday’s market opening, SM Entertainment announced that it had agreed to acquire a 25.1% stake in KeyEast for W50bn (W2,570 per share) and a 30.5% stake in Expected Return 20% FNC Add Culture for W30bn. The company will fund the W80bn deal through a combination of p rivate placement, purchase of existing shares, and equity issue participation. More specifically, SM Entertainment will: 1) issue 920,000 new shares OP (17P, Wbn) 11 (W35bn) to Bae Yong-joon, KeyEast’s current largest shareholder; 2) acquire existing Consensus OP (17F, Wbn) 17 shares of KeyEast (W15bn) and FNC Add Culture (W20bn); and 3) participate in FNC Add Culture’s equity issue (W10bn).