Public Version SUBMISSION from MEDIAWORKS HOLDINGS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Where Are the Audiences?

WHERE ARE THE AUDIENCES? Full Report Introduction • New Zealand On Air (NZ On Air) supports and funds audio and visual public media content for New Zealand audiences. It does so through the platform neutral NZ Media Fund which has four streams; scripted, factual, music, and platforms. • Given the platform neutrality of this fund and the need to efficiently and effectively reach both mass and targeted audiences, it is essential NZ On Air have an accurate understanding of the current and evolving behaviour of NZ audiences. • To this end NZ On Air conduct the research study Where Are The Audiences? every two years. The 2014 benchmark study established a point in time view of audience behaviour. The 2016 study identified how audience behaviour had shifted over time. • This document presents the findings of the 2018 study and documents how far the trends revealed in 2016 have moved and identify any new trends evident in NZ audience behaviour. • Since the 2016 study the media environment has continued to evolve. Key changes include: − Ongoing PUTs declines − Anecdotally at least, falling SKY TV subscription and growth of NZ based SVOD services − New TV channels (eg. Bravo, HGTV, Viceland, Jones! Too) and the closure of others (eg. FOUR, TVNZ Kidzone, The Zone) • The 2018 Where Are The Audiences? study aims to hold a mirror up to New Zealand and its people and: − Inform NZ On Air’s content and platform strategy as well as specific content proposals − Continue to position NZ On Air as a thought and knowledge leader with stakeholders including Government, broadcasters and platform owners, content producers, and journalists. -

JMAD Media Ownership Report

JMAD New Zealand Media Ownership Report 2014 Published: 2014 December 5 Author: Merja Myllylahti This New Zealand Ownership Report 2014 is the fourth published by AUT’s Centre for Journalism, Media and Democracy (JMAD). The report finds that the New Zealand media market has failed to produce new, innovative media outlets, and that all the efforts to establish non-profit outlets have proved unsustainable. The report confirms the general findings of previous reports that New Zealand media space has remained highly commercial. It also confirms the financialisation of media ownership in the form of banks and fund managers. The report also observes that in 2014 convergence between New Zealand mass media and the communications sector generally was in full swing. Companies, such as Spark (former Telecom NZ), started to compete head-to-head with the traditional broadcasters on the online on-demand video and television markets. The American online video subscription service Netflix is entering the NZ market in March 2015. Additionally, the report notes evidence of uncomfortable alliances between citizen media, politicians, PR companies and legacy media. As Nicky Hager’s Dirty Politics book revealed, the National Party and PR practitioners used the Whale Oil blog to drive their own agendas. Also, events related to Maori TV, TVNZ and Scoop raise questions about political interference in media affairs. It is now evident that the boundaries between mainstream media, bloggers, public relations practitioners and politicians are blurring. Key events and trends concerning New Zealand media Financialisation of mass media ownership confirmed Substantial changes in Fairfax, APN and MediaWorks ownership Competition heats up in online television and video markets Turbulence at Maori TV Blurred lines among politicians, bloggers, journalists and PR practitioners The JMAD New Zealand media ownership reports are available here: http://www.aut.ac.nz/study- at-aut/study-areas/communications/media-networks/journalism,-media-and-democracy-research- centre/journalists-and-projects 1 1. -

2019 Winners & Finalists

2019 WINNERS & FINALISTS Associated Craft Award Winner Alison Watt The Radio Bureau Finalists MediaWorks Trade Marketing Team MediaWorks MediaWorks Radio Integration Team MediaWorks Best Community Campaign Winner Dena Roberts, Dominic Harvey, Tom McKenzie, Bex Dewhurst, Ryan Rathbone, Lucy 5 Marathons in 5 Days The Edge Network Carthew, Lucy Hills, Clinton Randell, Megan Annear, Ricky Bannister Finalists Leanne Hutchinson, Jason Gunn, Jay-Jay Feeney, Todd Fisher, Matt Anderson, Shae Jingle Bail More FM Network Osborne, Abby Quinn, Mel Low, Talia Purser Petition for Pride Mel Toomey, Casey Sullivan, Daniel Mac The Edge Wellington Best Content Best Content Director Winner Ryan Rathbone The Edge Network Finalists Ross Flahive ZM Network Christian Boston More FM Network Best Creative Feature Winner Whostalk ZB Phil Guyan, Josh Couch, Grace Bucknell, Phil Yule, Mike Hosking, Daryl Habraken Newstalk ZB Network / CBA Finalists Tarore John Cowan, Josh Couch, Rangi Kipa, Phil Yule Newstalk ZB Network / CBA Poo Towns of New Zealand Jeremy Pickford, Duncan Heyde, Thane Kirby, Jack Honeybone, Roisin Kelly The Rock Network Best Podcast Winner Gone Fishing Adam Dudding, Amy Maas, Tim Watkin, Justin Gregory, Rangi Powick, Jason Dorday RNZ National / Stuff Finalists Black Sheep William Ray, Tim Watkin RNZ National BANG! Melody Thomas, Tim Watkin RNZ National Best Show Producer - Music Show Winner Jeremy Pickford The Rock Drive with Thane & Dunc The Rock Network Finalists Alexandra Mullin The Edge Breakfast with Dom, Meg & Randell The Edge Network Ryan -

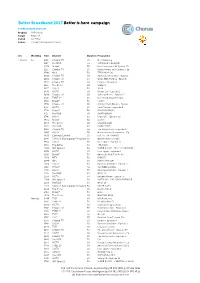

BB2017 Media Overview for Rsps

Better Broadband 2017 Better is here campaign TV PRE AIRDATE SPOTLIST Product All Products Target All 25-54 Period wc 7 May Source TVmap/The Nielsen Company w/c WeekDay Time Channel Duration Programme 7 May 17 Su 1112 Choice TV 30 No Advertising 7 May 17 Su 1217 the BOX 60 SURVIVOR: CAGAYAN 7 May 17 Su 1220 Bravo* 30 Real Housewives Of Sydney, Th 7 May 17 Su 1225 Choice TV 30 Better Homes and Gardens - Ep 7 May 17 Su 1340 MTV 30 TEEN MOM OG 7 May 17 Su 1410 Choice TV 30 American Restoration - Episod 7 May 17 Su 1454 Choice TV 60 Walks With My Dog - Episode 7 May 17 Su 1542 Choice TV 60 Empire - Episode 4 7 May 17 Su 1615 The Zone 60 SLIDERS 7 May 17 Su 1617 HGTV 30 16:00 7 May 17 Su 1640 HGTV 60 Hawaii Life - Episode 2 7 May 17 Su 1650 Choice TV 60 Jamie at Home - Episode 5 7 May 17 Su 1710 TVNZ 2* 60 Home and Away Omnibus 7 May 17 Su 1710 Bravo* 30 Catfish 7 May 17 Su 1710 Choice TV 30 Jimmy's Farm Diaries - Episod 7 May 17 Su 1717 HGTV 30 Yard Crashers - Episode 8 7 May 17 Su 1720 Prime* 30 RUGBY NATION 7 May 17 Su 1727 the BOX 30 SMACKDOWN 7 May 17 Su 1746 HGTV 60 Island Life - Episode 10 7 May 17 Su 1820 Bravo* 30 Catfish 7 May 17 Su 1854 The Zone 60 WIZARD WARS 7 May 17 Su 1905 the BOX 30 MAIN EVENT 7 May 17 Su 1906 Choice TV 60 The Living Room - Episode 37 7 May 17 Su 1906 HGTV 30 House Hunters Renovation - Ep 7 May 17 Su 1930 Comedy Central 30 LIVE AT THE APOLLO 7 May 17 Su 1945 Crime & Investigation Network 30 DEATH ROW STORIES 7 May 17 Su 1954 HGTV 30 Fixer Upper - Episode 6 7 May 17 Su 1955 The Zone 60 THE CAPE 7 May 17 Su 2000 -

JMAD New Zealand Media Ownership Report 2013

JMAD New Zealand Media Ownership Report 2013 Published: November 28, 2013 Author: Merja Myllylahti This New Zealand Ownership Report 2013 published by AUT’s Centre for Journalism, Media and Democracy (JMAD) outlines how the financialisation of New Zealand media intensified as News Limited pulled out of Sky TV, and as lenders took 100 percent control of MediaWorks. In 2013, controversy erupted when it was revealed that a journalist’s phone records had been handed to a ministerial inquiry without her consent. The move was condemned by over 300 journalists as the government’s invasion of privacy was seen as a threat to media freedom. The government also passed legislation giving extra surveillance powers to the Government Communication Security Bureau (GCSB). This represented an institutional threat to journalistic autonomy. The report also finds that the bloggers and blogosphere gained prominence and influence in relation to the commercially driven mainstream media. In October 2013, there were 280 ranked blogs in New Zealand, and the top political blogs recorded high visitor numbers. Key events and trends concerning New Zealand media ownership Financial institutions take control of Sky TV and MediaWorks MediaWorks goes into receivership, keeps losing content rights Bauer media grows in influence, buys The Listener and other magazines Sky TV stirred, but not shaken by the Commerce Commission and new competitors Leading newspapers stall paywalls, local papers launch them APN and Fairfax newsrooms shrink, profit boosted by asset sales and job cuts This New Zealand Media Ownership Report is the third published by AUT’s Centre for Journalism, Media and Democracy (JMAD). -

Contact Information for BSA Callers

Contact information for BSA callers Our website has links to the main broadcasters’ websites and contact details (see Broadcaster Links). Links to the broadcasters’ online complaints forms appear under Formal Complaint to the Broadcaster/'If you are ready to make a complaint to the broadcaster now'. ABLE (captioning and audio description service) www.able.co.nz Advertising Standards Authority (help line) 0800 234 357 deals with complaints about advertisements [email protected] / www.asa.co.nz APRA (The Australasian Performing Right Assn) 0800 692 772 issues licences for businesses to play recorded www.apra.co.nz music in public Births, Deaths and Marriages 0800 22 52 52 copy of birth certificate required BSA freephone number 0800 366 996 Coalition for Better Broadcasting 021 666297 advocates for higher standards & better content www.betterbroadcasting.co.nz Complaints agencies: Complaint Line for a list of all agencies dealing with complaints www.complaintline.org.nz Consumer Affairs 04 474 2750 deals with scams www.consumeraffairs.govt.nz/scams information on how to complain for consumers www.consumeraffairs.govt.nz/for- consumers/how-to-complain Copyright: Copyright Council of New Zealand www.copyright.org.nz Ministry of Business, Innovation and www.med.govt.nz/business/intellectual- Employment (MBIE) property/copyright Department of Building and Housing 0800 737 666 PO Box 10729 Wellington 6143 Freeview channels not working: 0800 373 384 (Freeview 0800 number) Going Digital www.goingdigital.co.nz Fair Go NO phone calls Private Bag fax: -

Thinktv FACT PACK NEW ZEALAND

ThinkTV FACT PACK JAN TO DEC 2017 NEW ZEALAND TV Has Changed NEW ZEALAND Today’s TV is a sensory experience enjoyed by over 3 million viewers every week. Powered by new technologies to make TV available to New Zealanders anywhere, any time on any screen. To help advertisers and agencies understand how TV evolved over the last year, ThinkTV has created a Fact Pack with all the stats for New Zealand TV. ThinkTV’s Fact Pack summarises the New Zealand TV marketplace, in-home TV viewing, timeshifted viewing and online video consumption. And, because we know today’s TV is powered by amazing content, we’ve included information on some top shows, top advertisers and top adverts to provide you with an insight into what was watched by New Zealanders in 2017. 2017 THE NEW ZEALAND TV MARKETPLACE BIG, SMALL, MOBILE, SMART, CONNECTED, 1. HD-capable TV sets are now in CURVED, VIRTUAL, 3D, virtually every home in New Zealand DELAYED, HD, 4K, 2. Each home now has on average ON-DEMAND, CAST, 7.6 screens capable of viewing video STREAM… 3. Almost 1 in every 3 homes has a internet-connected smart TV THE TV IS AS CENTRAL TO OUR ENTERTAINMENT AS IT’S EVER BEEN. BUT FIRST, A QUICK PEAK INSIDE NEW ZEALAND’S LIVING ROOMS • In 2015 New Zealand TV celebrated 55 years of broadcast with the first transmission on 1 June, 1960 • Today’s TV experience includes Four HD Free-to-air channels Two Commercial Free-to-Air broadcasters One Subscription TV provider • Today’s TV is DIGITAL in fact, Digital TV debuted in 2006 followed by multi-channels in 2007 • In its 58th year, New Zealand TV continues to change and evolve. -

Research in the Spotlight What Am I Discovering?

RESEARCH IN THE SPOTLIGHT WHAT AM I DISCOVERING? side of the world to measure the effects of poi on UNINEWS highlights some of the University physical and cognitive function in a clinical trial. research milestones that have hit the I wanted to discover how science and culture headlines in the past couple of months. might meet, and what they might say to each other about a weight orbiting on the end of a FISHING string. A study that exposed six decades of Working between the Centre for Brain widespread under reporting and dumping of Research and Dance Studies, the first round of marine fish has been covered extensively in an assessor-blind randomised control trial has the media. Lead researcher Dr Glenn Simmons just concluded. Forty healthy adults over 60 from the New Zealand Asia Institute at the years old participated in a month of International Business School appeared on Nine To Noon, Poi lessons (treatment group) or Tai Chi lessons Paul Henry, Radio Live, NewsHub and One (control group), and underwent a series of News, and was quoted in print and online. The pre- and post-tests measuring things like research, part of a decade-long, international balance, upper limb range of motion, bimanual project to assess the total global marine catch, coordination, grip strength, and cognitive put the true New Zealand catch at 2.7 times flexibility. Feedback from the participants official figures. after their International Poi lessons has been exciting: “Positive on flexibility, stress release, coordination and concentration. Totally, totally GRADUATION positive. Mental and physical.” “I am able to AGING GRACEFULLY use my left wrist more freely, and I am focusing The story of 84-year-old Nancy Keat, oldest better. -

Friday Scratch Sheet

FRIDAY SCRATCH SHEET Flag Yacht Name Owner's First Owner's Last Yacht Club Sail NumberYacht LOA Rating ORC Pennant Zero 1 Jeroboam Laurent Givry HHSA USA 61017 Farr 400 40 506.2 2 Kurranulla Stuart Jones Liberty Sailing Club USA 38007 Sydney 38 38 580.4 3 Temptress John Gowell NYYC, Conanicut YC, CCA USA 43950 Taylor 41 41 598.9 4 Kalevala II Tapio Saavalainen Annapolis Yacht Club USA 52439 Grand Soleil 37 B&C 37 616.1 IRC 1 Pennant One 1 Warrior Stephen Murry, Jr SYC ISA 60063 Volvo 70 70 1.724 2 Prospector Shelter Island Transatlantic Partners Shelter Island YC / NYYC / RORC / STYC USA 60669 Mills 68 68 1.545 3 SPOOKIE Steve & Heidi Benjamin Seawanhaka Corinthian & Noroton USA 95 TP52 52 1.414 4 Gladiator Tony Langley Royal Thames Yacht Club GBR 11152X TP52 52 1.413 5 Hooligan Theodore Papenthien NASS USA 52100 TP52 52 1.388 IRC 2 Pennant Two 1 Siren William Hubbard NYYC/Pequot/RORC/RBYC USA 2600 RP 56 56 1.334 2 Stark Raving Mad Jim Madden New York ITA 5003 Club Swan 50 50 1.313 3 Pterodactyl Scott Weisman NYYC/Sunningdale USA 45045 RP 45 45 1.307 4 Watermark Jack LeFort NYYC USA 753 Bermuda 50 50 1.273 5 Temptation/Oakcliff Arthur Santry NYYC USA 50069 Custon Ker 50 50 1.256 6 Christopher Dragon Andrew & Linda Weiss NYYC USA 4304 Ker 43 43 1.207 IRC 3 Pennant Seven 1 The Cat Came Back Lincoln Mossop NYYC USA 4212 Swan 42 42 1.166 2 Entropy Patricia Young NYYC USA 50400 Tripp 41 41 1.149 3 Pendragon Quentin Thomas DYS USA 70 X-41 41 1.126 4 Bravo Sedgwick Ward SIYC/AYC/NYYC USA 60909 J 111 36.5 1.108 5 Old School Ganson Evans STC USA -

Palmerston North Radio Stations

Palmerston North Radio Stations Frequency Station Location Format Whanganui (Bastia Hill) Mainstream Radio 87.6 FM and Palmerston rock(1990s- 2018 Hauraki North (Wharite) 2010s) Palmerston Full service iwi 89.8 FM Kia Ora FM Unknown Unknown North (Wharite) radio Palmerston Contemporary 2QQ, Q91 FM, 90.6 FM ZM 1980s North (Wharite) hits ZMFM Palmerston Christian 91.4 FM Rhema FM Unknown North (Wharite) contemporary Palmerston Adult 92.2 FM More FM 1986 2XS FM North (Wharite) contemporary Palmerston Contemporary 93.0 FM The Edge 1998 Country FM North (Wharite) Hit Radio Palmerston 93.8 FM Radio Live Talk Radio Unknown Radio Pacific North (Wharite) Palmerston 94.6 FM The Sound Classic Rock Unknown Solid Gold FM North (Wharite) Palmerston 95.4 FM The Rock Rock Unknown North (Wharite) Palmerston Hip Hop and 97.0 FM Mai FM Unknown North (Wharite) RnB Classic Hits Palmerston Adult 97.8 FM The Hits 1938 97.8 ZAFM, North (Wharite) contemporary 98FM, 2ZA Palmerston 98.6 FM The Breeze Easy listening 2006 Magic FM North (Wharite) Palmerston North Radio Stations Frequency Station Location Format Radio Palmerston 99.4 FM Campus radio Unknown Radio Massey Control North (Wharite) Palmerston 104.2 FM Magic Oldies 2014 Magic FM North (Wharite) Vision 100 Palmerston 105.0 FM Various radio Unknown Unknown FM North (Kahuterawa) Palmerston Pop music (60s- 105.8 FM Coast 2018 North (Kahuterawa) 1970s) 107.1 FM George FM Palmerston North Dance Music Community 2XS, Bright & Radio Easy, Classic 828 AM Trackside / Palmerston North TAB Unknown Hits, Magic, TAB The Breeze Access Triple Access Community Nine, 999 AM Palmerston North Unknown Manawatu radio Manawatu Sounz AM Pop Palmerston 1548 AM Mix music (1980s- 2005 North (Kahuterawa) 1990s) Palmerston North Radio Stations New Zealand Low Power FM Radio Station Database (Current List Settings) Broadcast Area: Palmerston North Order: Ascending ( A-Z ) Results: 5 Stations Listed. -

Quick Tips Simply More Ways to Enjoy Tv Channel Guide

QUICK TIPS SIMPLY MORE WAYS TO ENJOY TV Press the Main Menu button to access Add/Remove Channels from your the TV Guide, On Demand, My TV, Favourites CHANNEL GUIDE Search, Settings and My Account Highlight the channel you want to save in the TV guide, then press on your TV Press the TV Guide button to access remote. A heart icon will appear next GUIDE the programme menu and filter by to the channel. favourites or genre. Record a Show with your Video Press the i button to get information Recorder about the programme you are Storage space must be purchased to watching. house your recordings. Press the Red button on your remote while watching Use the CH+/CH- buttons to scroll the + a show or after selecting a programme channel lineup. – on the TV guide. Use the Right/Left arrow keys to see View Recordings what’s playing at a later date or time Press My TV on your remote and with the Mini-Guide. select recordings. Press OK to confirm any command on your TV guide. Pause & Rewind Live TV Press the Rewind button to go back + Use the VOL+/VOL- button to control up to two hours from the current TV the volume. guide time. Pres Play when ready – to watch. To return to live TV (current Press the TV Button to return to live programme schedule), simply press TV programming. Stop Press the Blue Button to help you Watch On Demand search the live TV or On-Demand Press the On Demand button on your programmes. -

Comcast Channel Lineup for WCUPA HD Channels Only When HDMI Cable Used to Connect to Set Top Cable Box

Comcast Channel Lineup for WCUPA HD Channels only when HDMI cable used to connect to Set Top Cable Box CH. NETWORK Standard Def CH. NETWORK Standard Def CH. MUSIC STATIONS 2 MeTV (KJWP, Phila.) 263 RT (WYBE, Phila.) 401 Music Choice Hit List 3 CBS 3 (KYW, Phila.) 264 France 24 (WYBE, Phila.) 402 Music Choice Max 4 WACP 265 NHK World (WYBE, Phila.) 403 Dance / EDM 6 6 ABC (WPVI, Phila.) 266 Create (WLVT, Allentown) 404 Music Choice Indie 7 PHL 17 (WPHL, Phila.) 267 V-me (WLVT, Allentown) 405 Hip-Hop and R&B 8 NBC 8 (WGAL, Phila.) 268 Azteca (WZPA, Phila.) 406 Music Choice Rap 9 Fox 29 (WTXF, Phila.) 278 The Works (WTVE, Phila.) 407 Hip-Hop Classics 10 NBC 10 (WCAU, Phila.) 283 EVINE Live 408 Music Choice Throwback Jamz 11 QVC 287 Daystar 409 Music Choice R&B Classics 12 WHYY (PBS, Phila.) 291 EWTN 410 Music Choice R&B Soul 13 CW Philly 57 (WPSG, Phila.) 294 The Word 411 Music Choice Gospel 14 Animal Planet 294 Inspiration 412 Music Choice Reggae 15 WFMZ 500 On Demand Previews 413 Music Choice Rock 16 Univision (WUVP. Phila.) 550 XFINITY Latino 414 Music Choice Metal 17 MSNBC 556 TeleXitos (WWSI, Phila.) 415 Music Choice Alternative 18 TBN (WGTW, Phila.) 558 V-me (WLVT, Allentown) 416 Music Choice Adult Alternative 19 NJTV 561 Univision (WUVP, Phila.) 417 Music Choice Retro Rock 20 HSN 563 UniMás (WFPA, Phila.) 418 Music Choice Classic Rock 21 WMCN 565 Telemundo (WWSI, Phila.) 419 Music Choice Soft Rock 22 EWTN 568 Azteca (WZPA, Phila.) 420 Music Choice Love Songs 23 39 PBS (WLVT, Allentown) 725 FXX 421 Music Choice Pop Hits 24 Telemundo (WWSI, Phila.) 733 NFL Network 422 Music Choice Party Favorites 25 WTVE 965 Chalfont Borough Gov.