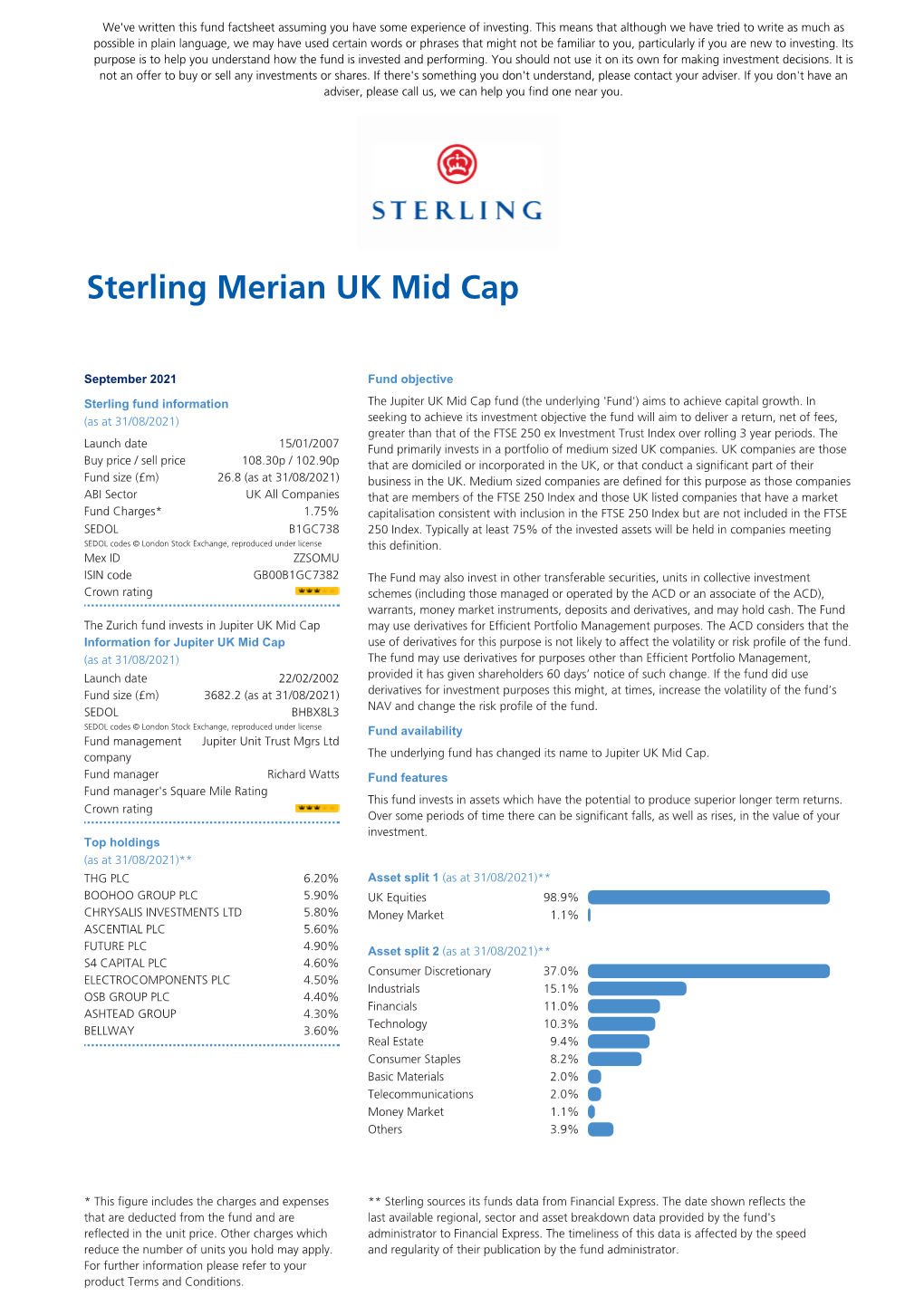

Sterling Merian UK Mid Cap

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The VT Redlands Portfolios

The VT Redlands Portfolios What are the VT Redlands Portfolios? The VT Redlands Portfolio funds each invest in one of four defined “asset classes” namely the Equity, Multi-Asset, Property and Fixed Income categories. Each fund carries a prescribed Risk Profile on a scale of 1 to 7 – with for example Equity being the highest at a factor 5. Each one is used as a building block in the creation of bespoke risk rated investment portfolios for clients of David Williams IFA. By combining the four VT Redlands funds with other asset classes such as With Profits/ Smoothed Managed and Structured Equity funds, our clients can enjoy the benefits of a very wide level of diversification within their portfolios. This reduces volatility and creates the potential for rewarding rates of return year after year. Each Portfolio fund is constructed as a Fund of Funds providing access to the “best of the best” sector funds from a huge investment universe. The Portfolios are designed to meet their objectives as efficiently as possible whilst keeping costs to a minimum and are run according to a strict risk-control criteria. Typically, 15 to 25 different funds are held in each portfolio, with each one in turn managed by leading investment houses such as Fundsmith, Fidelity and Invesco as well as specialist boutiques including Ruffer, Fulcrum and Somerset. Underlying funds have exposure to a great many shares, bonds and other assets, Therefore, a single investment into one of the Redlands Portfolios gives a spread across a myriad of different holdings, countries and investment styles. -

The Virgin UK Index Tracking Trust

The Virgin UK Index Tracking Trust Final Report and Financial Statements For the year ended 15 March 2021 2 The Virgin UK Index Tracking Trust Contents Manager's report 3 Management and professional services 3 Manager's investment report 4 Comparative tables 11 Portfolio statement 12 Top purchases and sales of investments 30 Securities Financing Transactions (SFTs) 32 Statement of total return 36 Statement of change in net assets attributable to unitholders 37 Balance sheet 38 Notes to the financial statements 39 Distribution tables 53 Statement of the Manager’s responsibilities 54 Independent auditor’s report to the unitholders of the Virgin UK Index Tracking Trust 55 Manager’s remuneration 58 Statement of the Trustee’s responsibilities in respect of the Scheme and Report of the Trustee to the Unitholders of the Virgin UK Index Tracking Trust 59 The Virgin UK Index Tracking Trust 3 Management and professional services For the year ended 15 March 2021 Manager (the ‘Manager’) Virgin Money Unit Trust Managers Limited Jubilee House Directors: S. Bruce (appointed 29 September 2020) Gosforth J. Byrne (appointed 24 May 2021) Newcastle upon Tyne H. Chater NE3 4PL S. Fennessy (resigned 29 September 2020) F. Murphy (appointed 19 October 2020) M. Phibbs J. Scott (resigned 4 December 2020) I. Smith (resigned 19 October 2020) D. Taylor (appointed 29 September 2020) N. L. Tu (resigned 24 May 2021) S. Wemyss (appointed 8 December 2020) Telephone 03456 10 20 30* Authorised and regulated by the Financial Conduct Authority. Investment adviser Aberdeen Asset Managers Limited 10 Queen’s Terrace Aberdeen Aberdeenshire AB10 1XL Authorised and regulated by the Financial Conduct Authority. -

Life After Lockdown

www.whatinvestment.co.uk Issue 460 | July 2021 | £4.50 LIFE AFTER LOCKDOWN A growing concern Are you switched on? A high stakes game Investing in trees could How artifi cial intelligence Peter Elston on why be the antidote to some of is transforming life as infl ation is far more Earth’s biggest challenges we know it complex than it appears Pages 34-35 Pages 50-52 Page 82 001_WI_0721.indd 1 17/06/2021 10:42 ad template.indd 1 17/06/2021 12:02 First word 3 July 2021 On life and investing www.whatinvestment.co.uk Issue 460 | July 2021 | £4.50 LIFE AFTER LOCKDOWN after the pandemic A growing concern Are you switched on? A high stakes game Investing in trees could How artificial intelligence Peter Elston on why be the antidote to some of is transforming life as inflation is far more Earth’s biggest challenges we know it complex than it appears Pages 34-35 Pages 50-52 Page 82 elcome to the July issue As you will learn in this month’s Editorial of What Investment, which issue, some investment trust Editor-in-chief comes at a time when it managers believe there will be a Lawrence Gosling 020 7250 7027 W [email protected] looks like the economy is on the very strong recovery, particularly verge of opening up for the fi rst in areas like consumer spending, Subscriptions Lara Rossett 020 7250 7011 time since March of last year. housebuilding and specialist [email protected] How we view this situation industrial businesses; others don’t Advertising depends largely on what kind of Lawrence Gosling think things will be so simple. -

Chrysalis Investments Limited

THIS PROSPECTUS IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to what action you should take you are recommended to seek your own financial advice immediately from your stockbroker, bank, solicitor, accountant or other independent financial adviser who is authorised under the Financial Services and Markets Act 2000 (the “FSMA”) if you are in the United Kingdom, or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom. This Prospectus comprises a prospectus relating to Chrysalis Investments Limited (the “Company”) in connection with the issue of Shares, prepared in accordance with the Prospectus Regulation Rules of the Financial Conduct Authority made pursuant to section 73A of the FSMA. This Prospectus has been approved by the Financial Conduct Authority for the purposes of the UK version of Regulation (EU) 2017/1129 (the “EU Prospectus Regulation”) which forms part of UK law by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”). The Financial Conduct Authority only approves this Prospectus, as the competent authority under the Prospectus Regulation Rules, as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation. Such approval should not be considered as an endorsement of the Company that is the subject of this Prospectus or of the quality of the Shares. This Prospectus has been drawn up and published in accordance with the UK Prospectus Regulation. Investors should make their own assessment as to the suitability of investing in the Shares. The Shares are only suitable for investors: (i) who understand and are willing to assume the potential risks of capital loss and that there may be limited liquidity in the underlying investments of the Company; (ii) for whom an investment in the Shares is part of a diversified investment programme; and (iii) who fully understand and are willing to assume the risks involved in such an investment. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance BB Healthcare Trust BBH Closed End Investments — GBP 2.01 at close 16 April 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Apr-2015 1D WTD MTD YTD Absolute - - - - Rel.Sector - - - - Rel.Market - - - - VALUATION Data unavailable Trailing PE 6.0 EV/EBITDA 5.4 PB 1.1 PCF -ve Div Yield 2.6 Price/Sales 5.7 Net Debt/Equity 0.0 Div Payout 15.4 ROE 21.6 DESCRIPTION Data unavailable The Company is a closed-ended investment company which to invest in a concentrated portfolio of listed or quoted equities in the global healthcare industry. Past performance is no guarantee of future results. Please see the final page for important legal disclosures. 1 of 4 FTSE COMPANY REPORT: BB Healthcare Trust 16 April 2021 Valuation Metrics Price to Earnings (PE) EV to EBITDA Price to Book (PB) 31-Mar-2021 31-Mar-2021 31-Mar-2021 25 25 1.5 1.4 20 20 +1SD 1.3 +1SD +1SD 1.2 Avg 15 15 1.1 Avg Avg -1SD 1 10 10 0.9 -1SD -1SD 5 5 0.8 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Apr-2016 Apr-2017 Apr-2018 Apr-2019 Apr-2020 Murray International Trust (Ord) 120.0 Murray International Trust (Ord) 100.0 CVC Credit Partners European Opportunities (GBP) 2.3 European Opportunities Trust 120.0 European Opportunities Trust 100.0 Hipgnosis Songs Fund 2.2 Law Debenture Corp 120.0 Law Debenture Corp 100.0 Pacific Horizon Investment Trust 2.0 HICL Infrastructure 64.6 HICL Infrastructure 64.5 Scottish -

21 Apr, 2021 the Third Way – Why Choose

SUPPLEMENT | APRIL 2021 STOCKS AND SHARES ISAs Healthcare and technology could be the best medicine to revitalise your growth ISA The recommended dose for your ISA Seize the day Small and mighty School of thought Don’t dally, act now to profit The Aim market is going Learn about the opportunities from the financials rally from strength to strength in the edtech sector Pages 5 & 6 Pages 12 & 13 Pages 14 & 15 ad template.indd 1 18/03/2021 09:28 Contents Stocks and shares ISAs | April 2021 3 LEADER ‘ Regular investing has a smoothing effect’ Lawrence Gosling , editor-in-chief, What Investment In an ideal world we’d all be smooth ISA operators, contributing regularly and avoiding the mad dash to make investments ahead of a new tax year t is a quirk of human nature that many of us only do I something when we are It is a quirk of human facing a deadline. What else could explain the interest in ISAs and nature that many of us Junior ISAs in March and the fi rst only do something when week of April each year? we are facing a deadline Of course, we can make a contribution into an ISA on any day of a tax year starting from So if you don’t already, perhaps 4 Comfort fi rst 6 April, and there is a strong consider making monthly ISA Why the trend may not always be argument for investing earlier contributions, rather than a your friend when investing for an ISA rather than later. single lump sum at the start That is easy to say in retrospect, or end of a tax year. -

Jupiter Fund of Investment Trusts RICHARD CURLING Fund Manager

I GBP ACC | UNIT TRUST AUG 2021 Jupiter Fund of Investment Trusts RICHARD CURLING Fund Manager Fund Objective and Investment Policy Fund Management Objective: The objective of the Fund is to provide capital growth over the long term (at least five years). Richard Curling joined Jupiter in 2006. Richard has managed the Jupiter fund of Investment Trusts since Policy: At least 70% of the Fund is invested in shares of investment trusts and other closed-ended investment January 2012. companies listed on the London Stock Exchange. Up to 30% of the Fund may be invested in other assets, including shares of other companies and closed or open-ended funds (including funds managed by Jupiter and its associates), cash and near cash. Fund Information as at 31.08.2021 Product Information Price Information Launch Date Fund: 09.12.1996 Every Business Day in the United Valuation Day: Launch Date Share Class: 17.09.2012 Kingdom Comparator 1 Benchmark: IA Global Base Currency Fund: GBP Comparator 2 Benchmark: FTSE All Share Closed End Investments Currency Share Class: GBP Morningstar Category: Global Flex-Cap Equity Available on: www.jupiteram.com Fund Size Fund Value: GBP 155m Holdings: 59 Fund Performance as at 31.08.2021 Cumulative Performance (%) Performance Over 5 Years (%) 1 m 3 m YTD 1 yr 3 yrs 5 yrs 120 Fund 4.4 7.4 12.8 37.8 47.4 103.4 100 Comparator 1 Benchmark 3.4 7.8 14.7 26.4 42.3 84.9 e 80 Comparator 2 Benchmark 3.4 5.9 10.9 28.9 44.4 91.9 g n Quartile Ranking 1 3 3 1 2 1 a h 60 C Rolling 12-month Performance (%) % 40 01 Sep ‘20 to 01 Sep ‘19 to 01 Sep ‘18 to 01 Sep ‘17 to 01 Sep ‘16 to 20 31 Aug ‘21 31 Aug ‘20 31 Aug ‘19 31 Aug ‘18 31 Aug ‘17 Fund 37.8 10.0 -2.7 11.5 23.7 0 08/16 08/17 08/18 08/19 08/20 08/21 Comparator 1 Benchmark 26.4 6.7 5.4 10.5 17.6 Fund Comparator 2 Benchmark 28.9 9.0 2.7 9.8 21.1 Comparator 1 Benchmark Calendar Year Performance (%) Comparator 2 Benchmark YTD 2020 2019 2018 2017 Past performance is no guide to the future. -

UK and European Equities Voting Summary Report Q1 2021

FOR PROFESSIONAL CLIENTS/QUALIFIED INVESTORS ONLY – NOT FOR RETAIL USE OR DISTRIBUTION UK and European Equities Voting Summary Report Q1 2021 Table of contents FIRST LETTER OF COMPANY NAME PAGE FIRST LETTER OF COMPANY NAME PAGE # – N 72 A 3 O 79 B 13 P 81 C 21 Q 84 D 32 R 85 E 37 S 88 F 43 T 110 G 47 U 121 H 51 V 124 I 55 W 128 J 58 X – K 62 Y 130 L 65 Z 131 M 67 These voting summary reports represent voting activity for accounts managed by Portfolio Managers in London of J.P. Morgan Asset Management (UK) Ltd. Information regarding proxy voting activity is available for JPMAM accounts, where securities are held in the accounts. Please contact your client account manager/client advisor for any further inquiries related to proxy voting in your account. 2 | UK AND EUROPEAN EQUITIES – VOTING SUMMARY REPORT BACK TO CONTENTS Meeting Record Meeting Proposal Management Vote Company Name Date Date Type Proponent Number Proposal Text Recommendation Instruction A.P. Moller-Maersk A/S 23-Mar-21 16-Mar-21 Annual Management 1 Receive Report of Board A.P. Moller-Maersk A/S 23-Mar-21 16-Mar-21 Annual Management 2 Accept Financial Statements and Statutory Reports For For A.P. Moller-Maersk A/S 23-Mar-21 16-Mar-21 Annual Management 3 Approve Discharge of Management and Board For For A.P. Moller-Maersk A/S 23-Mar-21 16-Mar-21 Annual Management 4 Approve Allocation of Income and Dividends of DKK 330 Per Share For For A.P. -

FTSE 350 Companies Audited by KPMG

FTSE 350 companies audited by KPMG KPMG LLP1 expects to issue an audit report for 67 FTSE 350 companies within the next 12 months Data as at 30 June 2021 Company FTSE Index2 Industry classification (ICB Supersector)2 3i Group Plc FTSE 100 Financial services Aggreko Plc FTSE 250 Industrial goods and services AO World Plc FTSE 250 Retail Ascential Plc FTSE 250 Technology Ashmore Group Plc FTSE 250 Financial services Auto Trader Group Plc FTSE 100 Technology AVI Global Trust plc FTSE 250 Financial services Avon Rubber Plc FTSE 250 Industrial goods and services B&M European Value Retail SA FTSE 100 Retail Baillie Gifford Japan Trust Plc FTSE 250 Financial services Baillie Gifford Shin Nippon FTSE 250 Financial services Baillie Gifford US Growth Trust FTSE 250 Financial services Balfour Beatty Plc FTSE 250 Consumer products and services Barclays Plc FTSE 100 Banks Berkeley Group Holdings (The) Plc FTSE 100 Consumer products and services Big Yellow Group plc FTSE 250 Real estate British American Tobacco Plc FTSE 100 Food, beverage and tobacco BT Group Plc FTSE 100 Telecommunications Capita Plc FTSE 250 Industrial goods and services Chemring Group Plc FTSE 250 Industrial goods and services Compass Group Plc FTSE 100 Consumer products and services Computacenter Plc FTSE 250 Technology Croda International Plc FTSE 100 Basic resources Entain Plc FTSE 100 Travel and leisure Experian Plc FTSE 100 Industrial goods and services Grainger Plc FTSE 250 Real estate HICL Infrastructure Plc FTSE 250 Financial services International Consolidated Airlines Group -

Worst-Case Scenario Offers Bright Outlook for Post-Pandemic UK

INVESTMENTINSPIRING & INFORMING INVESTMENT PROFESSIONALS FOR 25 YEARS investmentweek.co.uk WEEK 3 May 2021 Worst-case scenario off ers bright outlook for post-pandemic UK dividends BY JAMES BAXTER-DERRINGTON strong dividend growth in the UK dividends full year basis (inc. special dividends) coming years.” Investors are anticipating the return of bumper special 130 Impact of special dividends dividends and payouts from £bn Many other sectors are set to pay the banking sector amid an 110 better than expected dividends improving outlook for income in for the coming year, with media, 90 the UK equities market. insurance, telecoms, building The worst-case scenario for 70 materials, utilities and mining the UK dividend market in 2021 all exceeding Link Group’s initial now sees payouts rising by at 50 predictions. Mining payouts are least 0.9% this year, with the looking particularly strong with best-case envisioning a rise of 30 commodity prices driven higher 5.6%, according to the latest Link 2015 2016 2017 2018 2019 2020 2021 2021 by the global economic recovery Group UK Dividend Monitor. best case worst case and the big miners utilising Only last quarter, Link was still special dividends to “pass on anticipating a decline of 0.6% in declaring dividends in line with Q2 will see HSBC distribute bumper profits”. the worst case, but with plenty our best-case scenario as the roughly £2.2bn to investors, more BHP Group shelled out of companies paying best-case economy comes back to life and than twice as much as all the enough in Q1 to rank as the third predictions over the first quarter, constraints on payouts are lifted,” other banks combined, and from largest payer, while Rio Tinto is the gap has narrowed between said Ian Stokes, managing director 2022 the global banking giant will anticipating distributing close to the top and bottom forecasts. -

Annual Report 2020

Annual Report 2020 Support. Grow. Succeed. Annual Report 2020 Introduction 1 10 Managing the union 25 Member Contact Centre � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 25 1 Responding to the pandemic 3 Data Protection 2020 � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 25 Our members at the forefront � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �3 Employee salaries � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 26 Speaking up for those hit hardest � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 Schedule of investments – year ended 31 December 2020 � � � 27 Adapting as a union � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �4 11 Other organisations 31 2 Sector round-ups 5 Charities � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 31 Bectu sector � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �5 Affiliations and linked organisations � � � � � � � � � � � � � � � � � � � � � � � � � � � � 31 Energy Sector � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 12 NEC, officers and sub-committees 33 Public Services Sector � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �9 Presidential