Target Audience Definition and Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coca-Cola Enterprises, Inc

A Progressive Digital Media business COMPANY PROFILE Coca-Cola Enterprises, Inc. REFERENCE CODE: 0117F870-5021-4FB1-837B-245E6CC5A3A9 PUBLICATION DATE: 11 Dec 2015 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Coca-Cola Enterprises, Inc. TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 Business Description .....................................................................................................4 History .............................................................................................................................5 Key Employees ...............................................................................................................8 Key Employee Biographies .........................................................................................10 Major Products & Services ..........................................................................................18 Revenue Analysis .........................................................................................................20 SWOT Analysis .............................................................................................................21 Top Competitors ...........................................................................................................25 -

Merchandising Requirements Herb N' Kitchen Market

MERCHANDISING REQUIREMENTS HERB N’ KITCHEN MARKET HN'K UPC NAME SIZE UOM MANUFACTURER XX 49000002841 Dasani Water 20 oz. Coca-cola 78616233800 Glaceau Smartwater 20 oz. Coca-cola XX 22592778013 Ozarka (or Nestle) Natural Spring Water 16.9 oz. Ozarka XX 6827400005 Nestle Pure Life Water 16.9 oz. Nestle XX 4900000044 Coke 20 oz. Coca-cola XX 4900000045 Diet Coke 20 oz. Coca-cola 049000042559 Coke Zero 20 oz. Coca-cola 7292900217 Seagram's Ginger Ale 20 oz. Coca-cola XX 14900000660 Sprite 20 oz. Coca-cola XX 7800008240 Dr. Pepper 20 oz. Dr Pepper Snap XX 7800008372 Diet Dr. Pepper 21 oz. Dr Pepper Snap 492719002558 Fanta Orange 20 oz. Coca-cola XX 7279602271 Ibc Root Beer 20 oz. I.B.C XX 0490003710 PowerAde ZERO Berry Fruit Punch 20 oz. Coca-cola XX 4900000790 PowerAde Mt Blast 20 oz. Coca-cola XX 78616215000400 Glaceau vitamin water XXX 20 oz. Coca-cola XX 78616200297 Glaceau vitamin water ZERO squeezed Lemonade 20 oz. Coca-cola 78616207000 Glaceau vitamin water energy Kiwi - Strawberry 20 oz. Coca-cola 180127000852 ZICO Chocolate Coconut Water 14 oz. Coca-cola XX 61126999100 Red Bull 8.40 oz. Red Bull XX 61126910171 Red Bull Sugar Free 8.40 oz. Red Bull XX 78616233800 Smart Water 1 Ltr Coca-cola And/or San Pell 7478043996 Perrier 16.9 oz. Nestle And/or Perrier 4150880012 San Pellegrino Sparkling 750 ml Nestle XX 657622222015 Honest Tea Honey Green 500 ml Coca-cola 83900005771 XX Gold Peak Unsweetened Tea 18.5 oz. Coca-cola 83900005757 XX Gold Peak Sweet Tea 18.5 oz. -

Notice of Opposition Opposer Information Applicant

Trademark Trial and Appeal Board Electronic Filing System. http://estta.uspto.gov ESTTA Tracking number: ESTTA614768 Filing date: 07/09/2014 IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD Notice of Opposition Notice is hereby given that the following party opposes registration of the indicated application. Opposer Information Name The Coca-Cola Company Granted to Date 07/09/2014 of previous ex- tension Address One Coca-Cola Plaza Atlanta, GA 30313 UNITED STATES Attorney informa- ANDREA E BATES tion BATES & BATES LLC 1890 MARIETTA BLVD ATLANTA, GA 30318 UNITED STATES [email protected], [email protected], [email protected], [email protected] Applicant Information Application No 79132199 Publication date 03/11/2014 Opposition Filing 07/09/2014 Opposition Peri- 07/09/2014 Date od Ends International Re- 1165650 International Re- 01/22/2013 gistration No. gistration Date Applicant Narval Pharma, S.A. C/ Valle de Tena, 20 SPAIN Goods/Services Affected by Opposition Class 005. First Use: 0 First Use In Commerce: 0 All goods and services in the class are opposed, namely: Dietetic substances for medical use, namely, albumin dietary supplements, alginate dietary supplements, by-products of the processing of cereals for dietetic purposes, casein dietary supplements, dietary fibre, enzyme dietary supplements, glucose dietary supplements, lecithin dietary supplements, linseed dietary supplements, linseed oil dietary supplements,pollen dietary supplements, propolis dietary supplements, protein dietary supple- ments, royal jelly dietary supplements,starch for dietetic purposes, wheat germ dietary supplements and yeast dietary supplements; food supplements for medical use; food for babies Class 032. -

Broward County Public Schools Approved Smart Snacks Beverages

Updated October 25, 2019 Broward County Public Schools Approved Smart Snacks Beverages All Brands (water) MS/HS Unflavored water Any size Aquafina Flavor Splash (berry berry, Aquafina HS color me kiwi, really raspberry) 20 oz. Aquafina Flavor Splash sparkling Aquafina HS ( kiwi strawberry, orange citrus) 16.9 oz. Bubly HS Assorted Sparking Waters 12 oz. Campbell Soup Co. MS/HS V-8 Fusion 100 % Juice 8 oz. Canada Dry HS Canada Dry 10-Gingerale 12 oz. Canada Dry HS Diet Ginger Ale 12 oz. Sparkling Seltzer Water Canada Dry HS (Unflavored) 12 oz. Sparkling Seltzer Water (Raspberry, Canada Dry HS Strawberry) 12 oz. Clement Pappas & Co., Inc. MS/HS Fruit Punch-100% Juice 8 oz. Coca-Cola HS POWERADE ZERO Fruit Punch 12 oz. Coca-Cola HS Diet Barq's Beer 12 oz., 20 oz. Coca-Cola HS Cherry Zero, Vanilla Zero 12 oz., 20 oz. Coca-Cola HS Fresca-Original Citrus 12 oz., 20 oz. Coca-Cola HS Fanta Orange Zero 12 oz., 20 oz. Updated October 25, 2019 Broward County Public Schools Approved Smart Snacks Beverages Coca-Cola HS Coke Zero 12 oz., 20 oz. Coca-Cola HS Diet Coke 12 oz., 20 oz. Coca-Cola HS Glaceau vitaminwater 20 oz. Coca-Cola HS Glaceau smartwater 20 oz. Coca-Cola HS Mello-Yellow Zero 12 oz., 20 oz. Coca-Cola HS Pibb Zero 12 oz., 20 oz. Coca-Cola HS Sprite Zero 12 oz., 20 oz. Coca-Cola HS FRESCA 12 oz. Dasani HS Strawberry Dasani 20 oz. Dasani HS Lemon Dasani 20 oz. Dr. Pepper-Snapple HS A& W Root Beer 10 12 oz. -

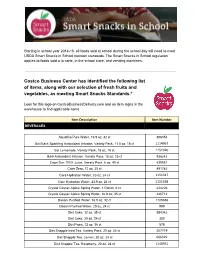

Costco Business Center Has Identified the Following List of Items, Along with Our Selection of Fresh Fruits and Vegetables, As Meeting Smart Snacks Standards.*

Starting in school year 2014-15, all foods sold at school during the school day will need to meet USDA Smart Snacks in School nutrition standards. The Smart Snacks in School regulation applies to foods sold a la carte, in the school store, and vending machines. Costco Business Center has identified the following list of items, along with our selection of fresh fruits and vegetables, as meeting Smart Snacks Standards.* Look for this logo on CostcoBusinessDelivery.com and on item signs in the warehouse to find applicable items. Item Description Item Number BEVERAGES Aquafina Pure Water, 16.9 oz, 32 ct 386454 Bai Black Sparkling Antioxidant Infusion, Variety Pack, 11.5 oz, 15 ct 1114967 Bai Lemonade, Variety Pack, 18 oz, 15 ct 1151920 Bai5 Antioxidant Infusion, Variety Pack, 18 oz, 15 ct 936242 Capri Sun 100% Juice, Variety Pack, 6 oz, 40 ct 438851 Coke Zero, 12 oz, 35 ct 891742 Core Hydration Water, 20 oz, 24 ct 1151317 Core Hydration Water, 23.9 oz, 24 ct 1151318 Crystal Geyser Alpine Spring Water, 1 Gallon, 6 ct 424226 Crystal Geyser Alpine Spring Water, 16.9 oz, 35 ct 440712 Dasani Purified Water, 16.9 oz, 32 ct 1105536 Dasani Purified Water, 20 oz, 24 ct 999 Diet Coke, 12 oz, 35 ct 854342 Diet Coke, 20 oz, 24 ct 380 Diet Pepsi, 12 oz, 36 ct 578 Diet Snapple Iced Tea, Variety Pack, 20 oz, 24 ct 207719 Diet Snapple Tea, Lemon, 20 oz, 24 ct 666929 Diet Snapple Tea, Raspberry, 20 oz, 24 ct 1140561 Essentia Ionized Alkaline Water, 1 Liter, 12 ct 1133505 Essentia Ionized Alkaline Water, 1.5 Liter, 12 ct 1133387 Evian Natural Spring Water, -

LA GACETA N° 14 De La Fecha 25 01 2018

La Uruca, San José, Costa Rica, jueves 25 de enero del 2018 AÑO CXL Nº 14 96 páginas Informa Que debido al aumento en la cantidad de documentos a publicar en los Diarios Oficiales durante este período, se ampliará el horario de recepción de 7:00 a.m. a las 4:30 p.m., a partir del 15 y hasta el 31 de enero del 2018, ÚNICAMENTE EN LA SUCURSAL EN LA URUCA. La oficina ubicada en el Registro Nacional mantiene su horario habitual de 8:00 a.m. a 3:30 p.m. Pág 2 La Gaceta Nº 14 — Jueves 25 de enero del 2018 Expediente N° 19.117: Pérdida de Credencial de Diputado CONTENIDO por Violación del Principio de Probidad, mediante reforma del artículo 112 de la Constitución Política. Pág Expediente N° 19.252: Ley Conversión del Consejo de N° Transporte Público en la Dirección de Transporte Público. PODER EJECUTIVO Expediente N° 19.308: Reforma del párrafo final del artículo 15 de la Ley Nº 8488, Ley Nacional de Emergencias y Prevención Decretos ................................................................... 2 del Riesgo, de 22 de noviembre de 2005, y sus Reformas. DOCUMENTOS VARIOS........................................ 2 Expediente N° 19.609: Ley Orgánica del Colegio TRIBUNAL SUPREMO DE ELECCIONES Universitario de Cartago. Expediente N° 20.059: Modificación del artículo 218 de la Edictos .................................................................... 58 Ley N° 5395, de 30 de octubre de 1973, Ley General de Salud. Avisos ..................................................................... 58 Expediente N° 20.373: Aprobación del estatuto de la Agencia CONTRATACIÓN ADMINISTRATIVA .............. 59 Internacional de Energías Renovables (IRENA). Expediente N° 20.380: Aprobación de la Enmienda al REGLAMENTOS .................................................. -

Our Way Forward 2020 Progress Report

OUR WAY FORWARD 2020 PROGRESS REPORT Ireland & Northern Ireland Our Way Forward At Coca-Cola, we have evolved our long-term business strategy to give people around the world the drinks they want. We have been listening carefully and are working to ensure that consumers are firmly at the centre of our business so we can continue to grow responsibly. We recognise that people want to manage their sugar intake and are seeking greater choice. To respond, we’ve been on a journey to diversify our portfolio, offering a drink for all occasions, 24/7. In 2017, we set out a series of commitments and are pleased to report on our progress. We’ve reduced sugar We’re diversifying our We’re making low and and calories across portfolio to offer drinks no-sugar drinks the many of our brands for all occasions easy choice through and needs. our “Hero Zero” approach We’re offering smaller, We’re giving people We continue to uphold more convenient the information they our responsible packages so controlling need to make truly marketing sugar is easier. informed choices. commitments to the highest standards Summary of Achievements Today, we sell more low-calorie drinks than We are also expanding our portfolio to offer any other company on the island of Ireland, drinks that respond to new consumer needs. with 64% of our total sales comprising of Recent additions to our portfolio include drinks with less than 5g sugar per 100ml. Glacéau Smartwater, Costa Coffee and Coca-Cola Energy, with or without sugar. We continue to market responsibility and Over the last year alone, we’ve reduced promote our low-calorie options. -

Open PDF File of Data Source

Locations Investors | The Coca-Cola Company Search FRONT PAGE BRANDS OUR WAY FORWARD SUSTAINABILITY INNOVATION HISTORY #CocaColaRenew 2017 Annual Review Commitment to Transparency Product Facts (U.S.) 2017 Sustainability Report FRONT PAGE > INVESTORS > CORPORATE GOVERNANCE > PUBLIC POLICY ENGAGEMENT > POLITICAL ENGAGEMENT POLICY INVESTORS MATION INVESTOR WEBCASTS & EVENTS SHAREOWNER INFORMATION CORPORATE GOVERNANCE SEC FILINGS CODE OF BUSINESS CONDUCT REPORT ACCOUNTING ISSUES PUBLIC POLICY ENGAGEMENT CONTACT THE BOARD Political Engagement Policy Like Sign Up to see what your friends like. SHARE: ANOTHER SIP Public Policy Engagement Public Policy: U.S. Focus Political debates take many forms. One version is lobbying: Lobbying is a way The Coca-Cola Company Annual & Other Reports for organizations – including NGOs and companies – to ensure that their views get heard, or at least considered. In the United States, political contributions to candidates – those who are running, as well as incumbents – are another way for organizations to participate in the political process. A third way is via trade LATEST ON KO associations, which lobby on behalf of the companies, organizations, causes and industries they represent. A fourth way is direct advocacy, which is central to policymaking, as described here. $50.17 Because we have a diverse array of constituencies to serve – customers, distributors, NYSE/KO bottlers, small businesses, government, community partners, shareowners and more – we participate in all of these political avenues. +0.00 Quote delayed at least 15 minutes We consider it our duty, and our responsibility, to make our views clear to those who have the potential to impact the laws, regulations and policies that can influence our global business. -

Coca-Cola Ltd. 335 King Street East, Toronto, Ontario, M5A 1L1

Canadian Children’s Food and Beverage Advertising Initiative: The Coca-Cola Company’s Commitment FINAL Section A -- Identifying Information The corporate name and address of the participant: Coca-Cola Ltd. 335 King Street East, Toronto, Ontario, M5A 1L1 Point of contact for implementation of Initiative: Shannon C. Denny Director, Public Affairs Communications 416-424-6373 [email protected] This commitment covers all brands owned by Coca-Cola Ltd. Canada, including: Coca-Cola Coca-Cola Zero Cherry Coke Diet Coke Vanilla Coke Barq’s Diet Barq’s Sprite Sprite Zero Fanta Fresca Five Alive Minute Maid Simply Nestea glaceau vitaminwater glaceau smartwater Dasani Odwalla Fruitopia Powerade Core Power FUZE ZICO May 2016 Section B -- Core Principles – Coca-Cola Canada’s commitment to Responsible Marketing Coca-Cola Ltd. recognizes the positive and important role it can play in helping to shape choice, and developing and promoting a variety of beverage choices for young people that provide refreshment, enjoyment, nutrition and hydration. To help us do that, we define and update our operating guiding principles from time to time. We listen to our customers as well as to our consumers, many of whom are parents, teachers, doctors and community leaders. In response to their needs, our current advertising policy reflects our commitment to support parents and other caregivers in their special roles as gatekeepers in all decisions affecting the lives of their children, including beverage choices. Accordingly, Coca-Cola Ltd. will not directly market to children under the age of 12. We firmly believe that all of our products are of the highest quality and suitable for all consumers. -

THE COCA-COLA COMPANY Beverages for Life

THE COCA-COLA COMPANY beverages for life 2017 Annual Review Table of Contents 2. Letters to Shareowners 12. The Coca-Cola System Value Chain 17. Shareowner Information 6. 2017 Highlights 13. Business Profile 18. Reconciliation of GAAP and 8. Selected Financial Data 14. Management Non-GAAP Financial Measures 9. Our Business 16. Board of Directors 19. Company Statements The Coca-Cola Company WE ARE A TOTAL BEVERAGE COMPANY In 2017, The Coca-Cola Company continued to reshape our shareowners and everyone connected to our business for more robust and sustainable growth with business. This year’s Annual Review offers a snapshot strategic decisions to expand our consumer-centric brand of our ongoing journey to improve our operations, portfolio, enhance our franchise bottling system, deliver build our brands and refresh the world as a total new efficiencies and create more long-term value for our beverage company. 2017 Annual Review 1 A Message from Chairman Muhtar Kent OUR INCLUSIVE APPROACH TO LONG-TERM VALUE CREATION Our story began on May 8, 1886, when the very first Coca-Cola® was sold in Our shareowners. With each decision, we strive to do all we can to create Atlanta, Georgia. From these humble roots, our business has grown to touch near- and long-term value for shareowners like you. We look at our assets— the lives of people in cities, towns and villages across more than 200 nations. including our people, our brand portfolio, our customer and partner relationships—and we make choices to maximize shareowner value. Coca-Cola has a long history of refreshing the world. -

2011 Bottled Water Scorecard

2011 Bottled Water Scorecard Study authors: Nneka Leiba, MPH, Analyst Sean Gray, MS, Senior Analyst Jane Houlihan, MSCE, Senior VP for Research http://www.ewg.org/bottled-water-2011-home http://www.ewg.org/bottled-water-2011-home Acknowledgments Study authors: Nneka Leiba, MPH, Analyst; Sean Gray, MS, Senior Analyst; Jane Houlihan, MSCE, Sr VP for Research EWG’s 2011 Bottled Water Scorecard was made possible by grants from the Park Foundation, the Richard & Rhoda Goldman Fund, the Turner Foundation, Inc. and the Popplestone Foundation. Thanks to EWG’s Aman Anderson, who created the report’s illustrations and designed the PDF and website versions of the study. Thanks also to our editors, Nils Bruzelius and Elaine Shannon, to Alex Formuzis for coordinating the release of the study, and to Chuq Yang for IT support. The opinions expressed in this report are those of EWG and do not necessarily reflect the views of the sup- porters listed above. Environmental Working Group is responsible for any errors of fact or interpretation contained in this report. Copyright © 2011 by the Environmental Working Group. All rights reserved. 2 Environmental Working Group 2011 Bottled Water Scorecard Contents i. Summary. 4 ii. Overview. 5 iii. Companies Flout California Labeling Law . 11 iv. Shelf of Shame. .14 v. How Much Do We Drink. 19 vi. Tips for Safe Drinking Water. .20 vii. Complete Score Card for All Bottled Waters Surveyed . 22 viii. Study Methodology. 36 Update (Jan. 25, 2011) California’s Public Health Department appears to interpret S.B. 220’s source-listing requirement narrowly in light of federal law. -

View Annual Report, See Page 256

Coca‑Cola Hellenic Bottling Company 2018 Integrated Annual Report IN GOOD COMPANY 2018 Integrated Annual Report 2018 HIGHLIGHTS VOLUME (m unit cases) 2,192 2017: 2,104 NET SALES REVENUE (€m) 6,657 2017: 6,522 COMPARABLE EBIT 1 (€m) EBIT (€m) 681 639 2017: 621 2017: 590 COMPARABLE EBIT MARGIN1 (%) EBIT MARGIN (%) 10.2 9.6 2017: 9.5 2017: 9.0 COMPARABLE NET PROFIT1, 2 (€m) NET PROFIT2 (€m) 480 447 2017: 450 2017: 426 COMPARABLE EPS1 (€) BASIC EPS (€) 1.31 1.22 2017: 1.23 2017: 1.17 ROIC (%) 13.7 2017: 12.4 CARBON EMISSIONS REDUCED PACKAGING RECOVERED ACROSS THE VALUE CHAIN FOR RECYCLING 25% 45% COMPARED WITH 2010 BASELINE 1. For details on APMs, refer to the Alternative performance measures section. 2. Net Profit and comparable net profit refer to net profit and comparable net profit respectively after tax attributable to owners of the parent. Strategic Report SR Corporate Governance CG Financial Statements FS About our report CONTENTS Swiss Statutory Reporting SSR The 2018 Integrated Annual Report (‘Annual Report’) consolidates Supplementary Information SI Coca‑Cola HBC AG’s UK and Swiss Strategic Report disclosure requirements while meeting 3 Our business the disclosure requirements for its 4 Chairman’s letter secondary listing on the Athens Exchange 6 Chief Executive Officer’s Q&A and the sustainability reporting standards. 10 Our stakeholders For more information about our Integrated 12 Market review Annual Report, see page 256. 14 Our business model 16 Our growth model More online 17 Our strategy and KPIs 24 Our 2025 sustainability commitments www.coca‑colahellenic.com 26 Our people 34 Our communities Navigating this report 40 Our consumers We are In Good Company with all 48 Our customers our stakeholders.