THE COCA-COLA COMPANY Beverages for Life

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital Commerce

CCEP A PLATFORM FOR GROWTH John F. Brock, CEO INVESTOR & ANALYST EVENT Forward-Looking Statements This communication may contain statements, estimates or projections that constitute “forward-looking statements”. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “plan,” “seek,” “may,” “could,” “would,” “should,” “might,” “will,” “forecast,” “outlook,” “guidance,” “possible,” “potential,” “predict” and similar expressions identify forward-looking statements, which generally are not historical in nature. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from Coca-Cola European Partners plc’s (“CCEP”) historical experience and its present expectations or projections. These risks include, but are not limited to, obesity concerns; water scarcity and poor quality; evolving consumer preferences; increased competition and capabilities in the marketplace; product safety and quality concerns; perceived negative health consequences of certain ingredients, such as non-nutritive sweeteners and biotechnology-derived substances, and of other substances present in their beverage products or packaging materials; increased demand for food products and decreased agricultural productivity; changes in the retail landscape or the loss of key retail or foodservice customers; an inability to expand operations in emerging or developing markets; fluctuations in foreign currency exchange rates; interest rate increases; an inability to maintain good -

July 1, 2021 • Hinsdale, Illinois • Volume XV, Issue 41 • 40 Pages • $1 on Newsstands Community Journalism the Way It Was Meant to Be

Thursday, July 1, 2021 • Hinsdale, Illinois • Volume XV, Issue 41 • 40 Pages • $1 on newsstands Community journalism the way it was meant to be Ravine River — Cody and Brayden Jurgenson took to Ravine Road with their kayak Saturday afternoon. Many of the streets throughout northeast Hinsdale were flooded after a Saturday afternoon rainfall. Several longtime residents said they had never seen anything like it. Some speculated that the Tollway’s work along Flagg Creek might have contributed to the flooding. Please read the story on Page 3 for more information. (Jim Slonoff photo) ‘Summer Pursuits’ series Assistant village manager has Central’s final state meets of splashes into its fourth week. spent four decades here. the season recapped. Page 5 Page 14 Page 38 WE WILL BE CLOSED SUNDAY, JULY 4TH INDEPENDENTLY FAMILY OWNED AND OPERATED SINCE 1953 SALE DATES JULY 1-7 FEATURED LACROIX ASST. LAY’S CLASSIC ASST. BREYER’S ASST. SPARKLING WATER POTATO CHIPS ICE CREAM $3.99/12 pks. $2.39/7-8 oz. $3.99/48 oz. ROSEN’S ASST. SIMPLY ASST. DAISY HOT DOG OR LEMONADES OR SOUR CREAM FRUIT DRINKS HAMBURGER BUNS $2.39/8 ct. $1.89/16 oz. 52 oz. $2.49/ BRAT BUNS - $2.59 DELI GROCERY MEAT DAISY SKINLESS OR NATURAL CASING BUSH’S ASST. U.S.D.A. CERTIFIED ANGUS CHOICE BEEF HOT DOGS $5.29/lb. BAKED BEANS $2.29/28 oz. BONELESS STRIP STEAK $24.98/lb. BOAR’S HEAD BEECHWOOD SMOKED HEINZ BABY BLACK FOREST HAM $8.99/lb. SQUEEZE KETCHUP $2.99/38 oz. -

HIV Prevention Ambassador Training Package for Adolescent Girls and Young Women This Training Package Was Developed by the OPTIONS Consortium and Collective Action

HIV Prevention Ambassador Training Package for Adolescent Girls and Young Women This training package was developed by the OPTIONS Consortium and Collective Action. The OPTIONS Consortium partners who contributed to the development of the training package include FHI 360, AVAC, LVCT Health in Kenya, Pangaea Zimbabwe AIDS Trust in Zimbabwe, and Wits Reproductive Health and HIV Institute in South Africa. The Optimizing Prevention Technology Introduction On Schedule (OPTIONS) Consortium is a five-year cooperative agreement funded by the U.S. President’s Emergency Plan for AIDS Relief (PEPFAR) and the U.S. Agency for International Development (USAID). OPTIONS Consortium partners are conducting a range of activities to support the rollout and scale-up of oral pre-exposure prophylaxis (PrEP) for HIV prevention in Kenya, South Africa, Zimbabwe, and globally. A critical component of OPTIONS’ work is ensuring adolescent girls and young women (AGYW) can access and effectively use oral PrEP for HIV prevention. Empowering AGYW with the knowledge, skills and agency to discuss HIV prevention with their peers, partners, families and communities is key to normalizing oral PrEP so that AGYW can successfully use it to protect themselves from HIV. We would love to hear how you’ve used this training package. Please email us at [email protected]. Illustrations and graphic design: Anthia Mirawidya Instructional design and content writing: Alison Barclay, Sarah Williamson, and Melissa Russell, Collective Action Project leadership and technical writing: Morgan Garcia, Michele Lanham, and Giuliana Morales, FHI 360 Technical guidance: Elmari Briedenhann5, Manju Chatani1, Patriciah Jeckonia3, Bridget Jjuuko2, Jordan Kyongo3, Imelda Mahaka4, Maryline Mireku3, Joseph Murungu4, Definate Nhamo4, Diantha Pillay5, Melanie Pleaner5, Ntokozo Zakwe2 1 AVAC 2 AVAC Fellows 3 LVCT Health 4 Pangea Zimbabwe AIDS Trust 5 Wits Reproductive Health and HIV Institute Recommended citation: OPTIONS Consortium. -

Plan De Desarrollo Urbano Del Municipio De Monterrey 2013-2025

Plan de Desarrollo Urbano del Municipio de Monterrey 2013-2025 0 Plan de Desarrollo Urbano del Municipio de Monterrey 2013-2025 PARTE I SITUACIÓN ACTUAL 1 Plan de Desarrollo Urbano del Municipio de Monterrey 2013-2025 CONTENIDO Págs. 1. Introducción............................................................................................................................................................. 3 2. Enfoque, Alcances y Metodología de Planeación................................................................................................... 5 3. Antecedentes.......................................................................................................................................................... 7 3.1. Históricos. 3.1.1 El Proceso de Urbanización en el Estado. 3.2. De Planeación. 4. Motivación y Fundamentación Jurídica del Plan..................................................................................................... 10 5. Delimitación Municipal............................................................................................................................................ 11 6. Diagnóstico y Pronóstico Integrado........................................................................................................................ 14 6.1. Del Medio Natural............................................................................................................................................ 14 6.1.1. Topografía. 6.1.2. Hidrología. 6.1.3. Geología. 6.1.4. Edafología. 6.1.5. Vegetación. 6.1.6. -

Coca-Cola Enterprises, Inc

A Progressive Digital Media business COMPANY PROFILE Coca-Cola Enterprises, Inc. REFERENCE CODE: 0117F870-5021-4FB1-837B-245E6CC5A3A9 PUBLICATION DATE: 11 Dec 2015 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Coca-Cola Enterprises, Inc. TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 Business Description .....................................................................................................4 History .............................................................................................................................5 Key Employees ...............................................................................................................8 Key Employee Biographies .........................................................................................10 Major Products & Services ..........................................................................................18 Revenue Analysis .........................................................................................................20 SWOT Analysis .............................................................................................................21 Top Competitors ...........................................................................................................25 -

Merchandising Requirements Herb N' Kitchen Market

MERCHANDISING REQUIREMENTS HERB N’ KITCHEN MARKET HN'K UPC NAME SIZE UOM MANUFACTURER XX 49000002841 Dasani Water 20 oz. Coca-cola 78616233800 Glaceau Smartwater 20 oz. Coca-cola XX 22592778013 Ozarka (or Nestle) Natural Spring Water 16.9 oz. Ozarka XX 6827400005 Nestle Pure Life Water 16.9 oz. Nestle XX 4900000044 Coke 20 oz. Coca-cola XX 4900000045 Diet Coke 20 oz. Coca-cola 049000042559 Coke Zero 20 oz. Coca-cola 7292900217 Seagram's Ginger Ale 20 oz. Coca-cola XX 14900000660 Sprite 20 oz. Coca-cola XX 7800008240 Dr. Pepper 20 oz. Dr Pepper Snap XX 7800008372 Diet Dr. Pepper 21 oz. Dr Pepper Snap 492719002558 Fanta Orange 20 oz. Coca-cola XX 7279602271 Ibc Root Beer 20 oz. I.B.C XX 0490003710 PowerAde ZERO Berry Fruit Punch 20 oz. Coca-cola XX 4900000790 PowerAde Mt Blast 20 oz. Coca-cola XX 78616215000400 Glaceau vitamin water XXX 20 oz. Coca-cola XX 78616200297 Glaceau vitamin water ZERO squeezed Lemonade 20 oz. Coca-cola 78616207000 Glaceau vitamin water energy Kiwi - Strawberry 20 oz. Coca-cola 180127000852 ZICO Chocolate Coconut Water 14 oz. Coca-cola XX 61126999100 Red Bull 8.40 oz. Red Bull XX 61126910171 Red Bull Sugar Free 8.40 oz. Red Bull XX 78616233800 Smart Water 1 Ltr Coca-cola And/or San Pell 7478043996 Perrier 16.9 oz. Nestle And/or Perrier 4150880012 San Pellegrino Sparkling 750 ml Nestle XX 657622222015 Honest Tea Honey Green 500 ml Coca-cola 83900005771 XX Gold Peak Unsweetened Tea 18.5 oz. Coca-cola 83900005757 XX Gold Peak Sweet Tea 18.5 oz. -

Atlas De Riesgos Naturales Del Municipio De General Escobedo, N.L.2014

Atlas de Riesgos Naturales de General Escobedo, N.L. 2014 MDT ATLAS DE RIESGOS NATURALES DEL MUNICIPIO DE GENERAL ESCOBEDO, N.L.2014 GGC Fecha 02 de junio 2015 Versión final Número de expediente: DNL/01131/2014 Numero de obra: IA-819021985-N13-2014 General Escobedo, Nuevo León. Gutiérrez Guevara Construcciones, S.A. de C.V. Fray Antonio Margil de Jesús No.236, Col. El Roble, San Nicolás de los Garza, Nuevo León, C.P. 66450, Tel. (81) 80336563, e-mail: [email protected] ESTE PROGRAMA ES DE CARÁCTER PÚBLICO, NO ES PATROCINADO NI PROMOVIDO POR PARTIDO POLÍTICO ALGUNO Y SUS RECURSOS PROVIENEN DE LOS IMPUESTOS QUE PAGAN TODOS LOS CONTRIBUYENTES. ESTA PROHIBIDO EL USO DE ESTE PROGRAMA CON FINES POLÍTICOS, ELECTORALES, DE LUCRO Y OTROS DISTINTOS A LOS ESTABLECIDOS. QUIEN HAGA USO INDEBIDO DE LOS RECURSOS DE ESTE PROGRAMA DEBERÁ SER DENUNCIADO Y SANCIONADO DE ACUERDO CON LA LEY APLICABLE Y ANTE LA AUTORIDAD COMPETENTE. Atlas de Riesgos Naturales del municipio de General Escobedo, Nuevo León 2015 (Informe final) CAPÍTULO I. Introducción y Antecedentes 1.1. Introducción 1.2. Antecedentes 1.3. Objetivo 1.3.1. Objetivos específicos 1.4. Alcances 1.5. Metodología 1.6. Productos finales 1.6.1. Estructurales 1.6.1.1. Falla El Topo 1.6.1.2. Falla Almazán 1.6.2. Pendientes 1.6.2.1. Mapa de peligros en el Cerro del Topo Chico 1.6.2.2. Mapa de riesgos en el Cerro del Topo Chico 1.7. Contenidos del Atlas CAPÍTULO II. Determinación de niveles de análisis y escalas de representación cartográfica 2.1. -

Mexico Is the Number One Consumer of Coca-Cola in the World, with an Average of 225 Litres Per Person

Arca. Mexico is the number one Company. consumer of Coca-Cola in the On the whole, the CSD industry in world, with an average of 225 litres Mexico has recently become aware per person; a disproportionate of a consolidation process destined number which has surpassed the not to end, characterised by inventors. The consumption in the mergers and acquisitions amongst USA is “only” 200 litres per person. the main bottlers. The producers WATER & CSD This fizzy drink is considered an have widened their product Embotelladoras Arca essential part of the Mexican portfolio by also offering isotonic Coca-Cola Group people’s diet and can be found even drinks, mineral water, juice-based Monterrey, Mexico where there is no drinking water. drinks and products deriving from >> 4 shrinkwrappers Such trend on the Mexican market milk. Coca Cola Femsa, one of the SMI LSK 35 F is also evident in economical terms main subsidiaries of The Coca-Cola >> conveyor belts as it represents about 11% of Company in the world, operates in the global sales of The Coca Cola this context, as well as important 4 installation. local bottlers such as ARCA, CIMSA, BEPENSA and TIJUANA. The Coca-Cola Company These businesses, in addition to distributes 4 out of the the products from Atlanta, also 5 top beverage brands in produce their own label beverages. the world: Coca-Cola, Diet SMI has, to date, supplied the Coke, Sprite and Fanta. Coca Cola Group with about 300 During 2007, the company secondary packaging machines, a worked with over 400 brands and over 2,600 different third of which is installed in the beverages. -

Target Audience Definition and Analysis

AD PLAN Smartwater: Made from a Big Idea By: Avinanda Mukherjee, Hao Wang, Jonathan De Costa &Valentine Boisriveaud Situation Analysis The category: •Highly saturated and competitive product category •The bottle of water market has declined. •In 2011, sales of bottled water are estimated at $12.1 billion, which represents a growth of 5% in current prices during 2006-11. After factoring in inflation, bottled water sales declined 1% during this period (Mintel). •Explanation for this recession: •The market has faced a number of challenges such as the high rate of unemployment among the key consumer groups, increasing competition from private labels, and consumer recognition of high-sugar status of enhanced/flavored waters. •The recession and ensuing slow recovery prompted consumers to turn to an almost- free bottled water alternative: tap water. •the increasing competition from private labels as well as consumers’ recognition of the fact that many brands are as sugary as other non-alcoholic beverages have created the slow decline of the consummation of bottle of water. In fact, many consumers swapped high-calorie beverages such as soda for enhanced/flavored water to reduce sugar in their diets. •If the market of bottled water is in decline, the consumption of bottled water seems to have increased since 2009. •Bottled water market has experienced volume consumption growth during 2009-11; however, bottled water sales remained sluggish in 2011. The market needs to address the issue of price promotion as well as the key consumer attrition as blacks, teens, and Hispanics appear to moving away from this category. (Mintel May 2012 report on bottled water) Situation Analysis The category: •Foundation of private labels. -

2018 Business & Sustainability Report

2018 Business & Sustainability Report CEO/Board Our Priority Portfolio World Without Water Sustainable People & Partnerships Climate Regional Data Letters Company Issues Transformation Waste Agriculture Communities Change Highlights Appendix Letter from James Quincey 3 SUSTAINABLE AGRICULTURE 30 Letter from Our Board of Directors 5 Shared Opportunity: Agriculture Sustainable Growth for Across the globe and around the clock, OUR COMPANY India’s Smallholder Farmers At A Glance 6 and Our Portfolio 32 we never stop working to give people The Coca-Cola System 7 Total Beverage Portfolio 8 the drinks they want and to improve CARING FOR PEOPLE Business Transformation AND COMMUNITIES 33 the world we all share. Timeline 9 Human Rights 34 Selected Financial Data 10 Women’s Economic Progress Against Our Empowerment 35 We turn our passion for consumers Sustainability Goals 11 Workplace 36 into the brands people love, and create Our System in Context 12 Diversity & Inclusion 37 shared opportunity through growth. Giving Back 38 PRIORITY ISSUES Our Approach to Managing Our Priorities 13 PARTNERSHIPS 39 Priority Issues: Stakeholder Engagement 40 That’s the essence of Risks & Opportunities 15 Sustainable Development Goals 41 PORTFOLIO TRANSFORMATION 17 our transformation. Providing Choice to Consumers 18 A GLOBAL PERSPECTIVE ON CLIMATE CHANGE 43 Reducing Calories— Expanding Portfolio 19 REGIONAL HIGHLIGHTS 46 Shared Opportunity: Sugar Reduction ABOUT THIS REPORT 51 Refreshingly Less Sugar 20 DATA APPENDIX 52 WORLD WITHOUT WASTE 21 ASSURANCE STATEMENT 67 -

Honest Tea Business Plan – December 1998

Business Plan for 1999 December 1998 4905 Del Ray Avenue, Suite 304 Bethesda, Maryland 20814 Phone: 301-652-3556 Fax: 301-652-3557 Email: [email protected] Honest Tea Business Plan – December 1998 TABLE OF CONTENTS Mission Statement ..…………………………………………………………4 Executive Summary ..………………………………………………………..5 Company Story ..…………………………………………………………….6 Product.……………………………………………………………………….6 Product description ..…………………………………………..…….6-8 Flagship line of flavors and new flavors for 1999……………………..8-9 Production and manufacturing ..………………………………..……9-10 Market Opportunity …………………………………………………………10 Profile of target customer ……………………………………………12 Market research and market response ……………………………….13-16 Marketing and Distribution …………………………………………………..16 Distribution and promotion …………………………………………..16-17 Packaging and pricing …..……………………………………………17 International markets …………………..……………………….…….17-18 Product development and future products ……………………………18 Management …………………………………………………………………..18-20 Statement and aspirations for social responsibility ……………………………20-21 Financial Statements YTD and Projections ……………………………………21-23 The Investment Opportunity …………………………………………………..24 The Offering ……………………………………………………………24 Financing History ….…………………………………………………..24 Exit strategies ………………………………………………………….25 Investment risks ………………….…………………………………….25 Competitive Advantage ………………………….…………………….25-26 A Parting Thought .………………………………………………….……..…26 2 Honest Tea Business Plan – December 1998 Mission Statement Honest Tea seeks to provide bottled tea that tastes like tea- -

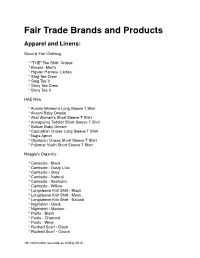

Fair Trade Products List from Cassie

Fair Trade Brands and Products Apparel and Linens: Good & Fair Clothing * "THE" Tee Shirt- Unisex * Boxers- Men's * Hipster Panties- Ladies * Stag Tee Crew * Stag Tee V * Story Tee Crew * Story Tee V HAE Now * Acadia Women's Long Sleeve T Shirt * Akashi Baby Onesie * Altai Women's Short Sleeve T Shirt * Annapurna Toddler Short Sleeve T Shirt * Balkan Baby Onesie * Cascadian Unisex Long Sleeve T Shirt * Napa Apron * Olympian Unisex Short Sleeve T Shirt * Palomar Youth Short Sleeve T Shirt Maggie's Organics * Camisole - Black * Camisole - Dusty Lilac * Camisole - Grey * Camisole - Natural * Camisole - Seafoam * Camisole - Willow * Longsleeve Knit Shirt - Black * Longsleeve Knit Shirt - Moss * Longsleeve Knit Shirt - Natural * Nightshirt - Black * Nightshirt - Maroon * Pants - Black * Pants - Charcoal * Pants - Wine * Ruched Scarf - Black * Ruched Scarf - Cocoa *All information accurate as of May 2012 * Ruched Scarf - Plum * Ruched Scarf - Willow * Sleeveless Dress - Black * Sleeveless Dress - Cocoa * Sleeveless Dress - Plum * Sleeveless Dress - Willow * Tank Top - Black * Tank Top - Dusty Lilac * Tank Top - Grey * Tank Top - Plum * Tank Top - Seafoam * Tank Top - White * Tank Top - Willow * Unisex Tee - Cocoa * Unisex Tee - Moss * Unisex Tee - Willow * V-Neck Tee - Cocoa * V-Neck Tee - Moss * V-Neck Tee - Willow * Women's Hoodie - Black - S * Women's Hoodie - Charcoal * Women's Hoodie - Wine * Wrap Top - Black - Large * Wrap Top - Black - Medium * Wrap Top - Black - Small * Wrap Top - Black - Xlarge * Wrap Top - Black - XXLarge * Wrap Top