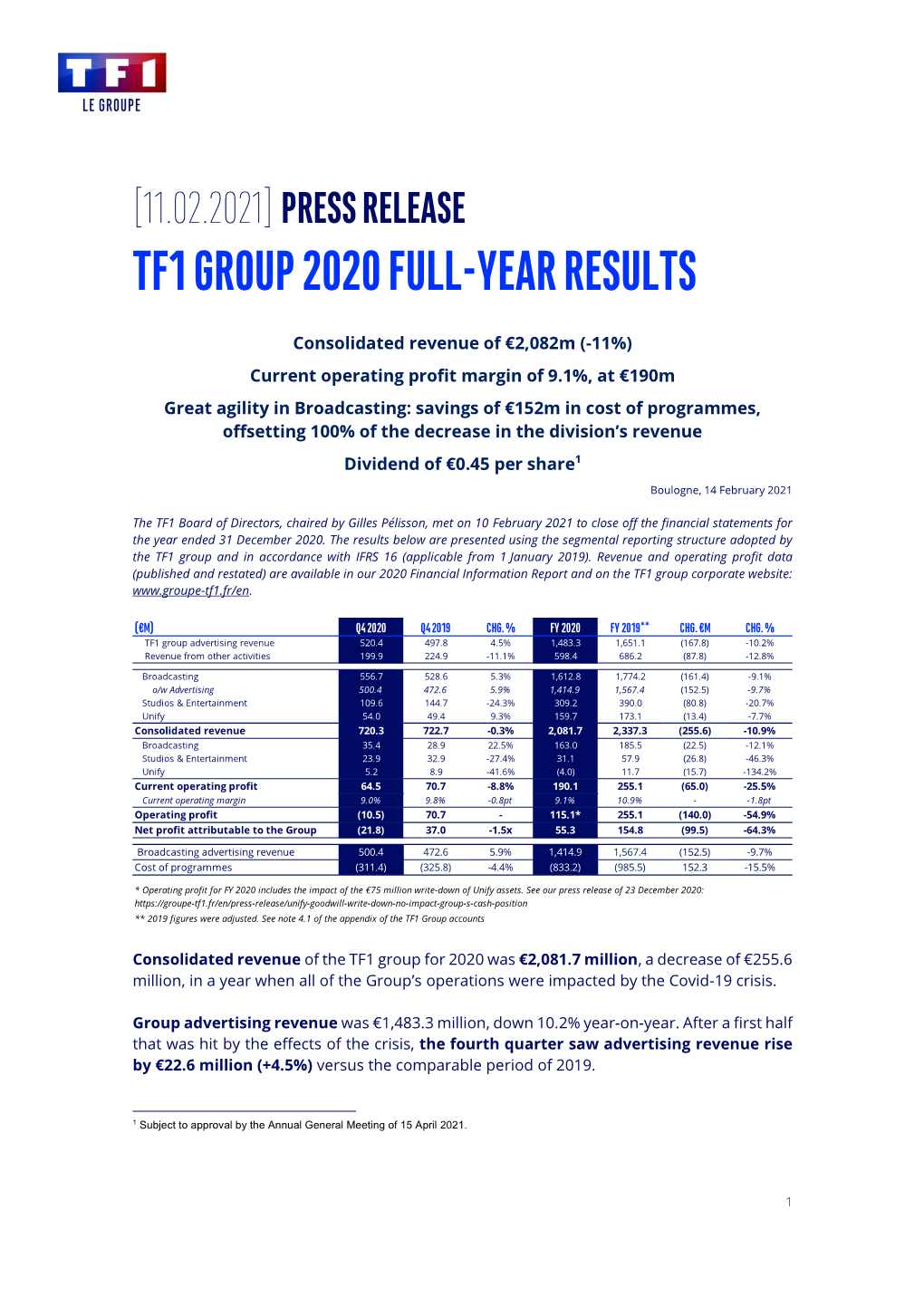

[11.02.2021] Press Release Tf1 Group 2020 Full-Year Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Press Release the Tf1 and Canal+ Groups Acquire

PRESS RELEASE Boulogne, 4 October 2019 THE TF1 AND CANAL+ GROUPS ACQUIRE BROADCASTING RIGHTS TO THE UEFA WOMEN’S EURO 2021 TOURNAMENT Following the exceptional success and unrivalled media coverage of the FIFA Women’s World Cup, including the highest audience in 2019, the TF1 and CANAL+ groups are delighted to announce the acquisition of rights to the forthcoming UEFA WOMEN’S EURO 2021 football tournament, which will be held in England from 11 July to 1 August 2021. The TF1 group channels will carry exclusive free-to-air coverage of the 14 highest profile fixtures including the opening match, every match involving the French national team, five other pool matches, two quarter- finals, both semi-finals, and the final (hosted by the legendary Wembley Stadium). The Canal+ group will carry exclusive pay-to-view coverage of the entire tournament (31 matches), and will provide its subscribers with exceptional editorial coverage, especially for French national team matches and all key matches in the tournament, including the opening match and the final phase. François PELLISSIER, Head of Sport at the TF1 Group and Chairman of TF1 Publicité, says: “We are delighted at this latest opportunity to showcase women’s football to the widest possible audience. We are also very proud to support Corinne Diacre’s “Les Bleues”, who won the hearts of the French public last June. This acquisition is a further demonstration of our ambition to offer all the best major sporting events, and to get the greatest possible number of viewers behind France’s national teams.” Thierry CHELEMAN, Head of Sport at the Canal+ Group, says: "This is part of our ongoing commitment to women's football. -

Terms and Conditions 2017

DANSE AVEC LES STARS © L.VU/TF1 TERMS AND CONDITIONS 2017 T e r m s and conditions 1 T F 1 2 0 1 7 COMMUNIQUER SUR TF1 Choisissez votre présence sur TF1 afin de répondre au mieux à vos différents objectifs de communication. La publicité dans les écrans publicitaires Vous disposez d’un film publicitaire, votre création peut être diffusée au sein des écrans publicitaires. Ces derniers sont reconnaissables par les « jingles Publicité » les encadrant. Vous pouvez réserver dans ces écrans selon 2 modes d'achat : • ACHAT CONTEXTUEL : LE SPOT À SPOT, LE CHOIX À 100% Ce mode d’achat vous permet de sélectionner les écrans souhaités pour la diffusion de votre spot publicitaire. En relation avec les équipes Planning de TF1 Publicité, vous disposez ainsi de tous les leviers pour une efficacité renforcée de votre campagne. Ecrans fédérateurs, contexte d’émissions engageantes, affinité avec votre cible… tous les ingrédients sont à votre disposition pour répondre à vos objectifs de ventes, de notoriété, d’image, de trafic sur site ou en magasin… Vous êtes l’architecte de votre campagne ! •ACHAT PROGRAMMATIQUE : LE MPI, MODE DE PROGRAMMATION INTERNALISÉE Pour faciliter votre achat d'espace, TF1 Publicité vous propose de prendre en charge la construction de vos campagnes, au travers d’une gamme d’offres en mode de programmation internalisée, avec des niveaux de services différenciés, pour répondre au mieux à vos objectifs de communication. Avec le MPI, l’achat sur TF1 devient simple et rapide. Le parrainage & le placement de produit Vous ne disposez pas d’un film publicitaire, TF1 Publicité vous propose d'autres formes de communication pour répondre à vos objectifs. -

Presentation November 2008

Presentation November 2008 1 Disclaimer All forward-looking statements are TF1 management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. 2 Financial Results 3 Consolidated revenue evolution (1/2) 9 Months 9 Months % €M 2007 2008 2007 2008/2007 Total Revenue 1,880.3 1,970.3 2,763.6 -4.6 % Incl. TF1 Channel Advertising 1,187.8 1,228.7 1,718.3 - 3.3 % Incl. Other Activities 692.5 741.6 1,045.3 -6.6 % H1 H1 Q3 Q3 €M % % 2008 2007 2008 2007 Total Revenue 1,363.5 1,430.6 -4.7 % 516.8 539.7 -4.2 % Incl. TF1 Channel Advertising 891.2 924.7 - 3.6 % 296.6 304.0 -2.4 % Incl. Other Activities 472.3 505.9 - 6.6 % 220.2 235.7 -6.6 % 4 Consolidated revenue evolution (2/2) 9 Months 9 Months €M 2007 2008 2007 (*) France Broadcasting 1,539.8 1,587.5 2,220.5 TF1 Channel 1,193.1 1,235.9 1,729.3 Téléshopping group 109.4 110.9 153.1 Thematic channels in France 138.3 138.0 188.6 TF1 Entreprises 20.8 21.7 40.5 In-house production companies 24.0 23.1 28.1 e-tf1 38.1 42.6 57.4 Others 16.1 15.3 23.5 Audiovisual Rights 105.9 177.9 268.1 Catalogue 39.0 70.7 101.4 TF1 Video 66.9 107.2 166.7 International Broadcasting 234.0 204.9 274.8 Other Activities 0.6 - 0.2 Total revenue 1,880.3 1,970.3 2,763.6 (*) Reclassification of TF1 Hors Média (non-media below-the-line promotional activities) from TF1 Entreprises to Other after its merger into TF1 Publicité, and of WAT from Other to e-TF1 5 A tough economic situation Evolution of advertising revenue by sector (for TF1) Gross revenue (January-October 2008) Evol Jan-Oct. -

Nbcuniversal International Studios, Mediengruppe RTL Deutschland and TF1, Greenlight New Procedural Drama, “Gone"

On behalf of: NBCUniversal International Studios, Mediengruppe RTL Deutschland and TF1 NBCUniversal International Studios, Mediengruppe RTL Deutschland and TF1, Greenlight New Procedural Drama, “Gone" Series order follows a ground-breaking partnership to produce US procedural dramas Series is based on the novel, One Kick, from best-selling author, Chelsea Cain Two-time Golden Globe nominee and SAG Award nominated actor, Chris Noth, to star London, 30 November 2016: NBCUniversal International Studios, Mediengruppe RTL Deutschland (Germany) and TF1 (France) have announced today the greenlight of Gone, a new procedural drama series based on Chelsea Cain’s novel, One Kick. Chris Noth will star in the 12 one-hour episodes, created by Matt Lopez (The Sorcerer’s Apprentice) to be broadcast in late 2017/early 2018. Gone tells the fictional story of Kit “Kick” Lannigan, survivor of a famous child abduction case and Frank Booth (Noth), the F.B.I. agent who rescued her. Determined never to fall victim again, Kick trains in martial arts and the use of firearms. She finds her calling when Booth persuades her onto a special task force he created dedicated to solving abductions and missing persons cases. Paired with former Army Intelligence officer John Bishop, Kick brings her unique understanding of the mind of a predator to this riveting procedural. Noth joins Gone after a number of prominent roles. He starred as Detective Mike Logan on the original Law and Order, and then joined HBO’s ground breaking series, Sex and the City, where he garnered his first Golden Globe nomination for Best Actor in a Comedy Series. -

LES CHAÎNES TV by Dans Votre Offre Box Très Haut Débit Ou Box 4K De SFR

LES CHAÎNES TV BY Dans votre offre box Très Haut Débit ou box 4K de SFR TNT NATIONALE INFORMATION MUSIQUE EN LANGUE FRANÇAISE NOTRE SÉLÉCTION POUR VOUS TÉLÉ-ACHAT SPORT INFORMATION INTERNATIONALE MULTIPLEX SPORT & ÉCONOMIQUE EN VF CINÉMA ADULTE SÉRIES ET DIVERTISSEMENT DÉCOUVERTE & STYLE DE VIE RÉGIONALES ET LOCALES SERVICE JEUNESSE INFORMATION INTERNATIONALE CHAÎNES GÉNÉRALISTES NOUVELLE GÉNÉRATION MONDE 0 Mosaïque 34 SFR Sport 3 73 TV Breizh 1 TF1 35 SFR Sport 4K 74 TV5 Monde 2 France 2 36 SFR Sport 5 89 Canal info 3 France 3 37 BFM Sport 95 BFM TV 4 Canal+ en clair 38 BFM Paris 96 BFM Sport 5 France 5 39 Discovery Channel 97 BFM Business 6 M6 40 Discovery Science 98 BFM Paris 7 Arte 42 Discovery ID 99 CNews 8 C8 43 My Cuisine 100 LCI 9 W9 46 BFM Business 101 Franceinfo: 10 TMC 47 Euronews 102 LCP-AN 11 NT1 48 France 24 103 LCP- AN 24/24 12 NRJ12 49 i24 News 104 Public Senat 24/24 13 LCP-AN 50 13ème RUE 105 La chaîne météo 14 France 4 51 Syfy 110 SFR Sport 1 15 BFM TV 52 E! Entertainment 111 SFR Sport 2 16 CNews 53 Discovery ID 112 SFR Sport 3 17 CStar 55 My Cuisine 113 SFR Sport 4K 18 Gulli 56 MTV 114 SFR Sport 5 19 France Ô 57 MCM 115 beIN SPORTS 1 20 HD1 58 AB 1 116 beIN SPORTS 2 21 La chaîne L’Équipe 59 Série Club 117 beIN SPORTS 3 22 6ter 60 Game One 118 Canal+ Sport 23 Numéro 23 61 Game One +1 119 Equidia Live 24 RMC Découverte 62 Vivolta 120 Equidia Life 25 Chérie 25 63 J-One 121 OM TV 26 LCI 64 BET 122 OL TV 27 Franceinfo: 66 Netflix 123 Girondins TV 31 Altice Studio 70 Paris Première 124 Motorsport TV 32 SFR Sport 1 71 Téva 125 AB Moteurs 33 SFR Sport 2 72 RTL 9 126 Golf Channel 127 La chaîne L’Équipe 190 Luxe TV 264 TRACE TOCA 129 BFM Sport 191 Fashion TV 265 TRACE TROPICAL 130 Trace Sport Stars 192 Men’s Up 266 TRACE GOSPEL 139 Barker SFR Play VOD illim. -

Orange and the TF1 Group Sign a New Global Distribution Agreement

Boulogne, 8 March 2018 Orange and the TF1 group sign a new global distribution agreement Orange and the TF1 group announce the signature of a new global distribution agreement. This agreement reinstates distribution by Orange of all TF1 group channels, and of the non-linear services associated with the channels. It cements the partnership between the two companies, creating value by providing an enhanced service across all screens for Orange’s TV customers. It also allows Orange’s TV customers to enjoy innovative functionalities around TF1 group programmes: - extended catch-up windows for programmes on MYTF1 - programmes premiered ahead of TV broadcast - innovative, advanced functionalities that will enable Orange to launch new services - two new channels (TF1 + 1, TMC +1) available from the start of the 2018 autumn season - screening in 4K UHD of event programming such as the 2018 FIFA World Cup Russia, the 2019 Japan Rugby World Cup and Formula 1 Grands Prix) The partnership is accompanied by enhancements to the TFOUMax on-demand kids service and the renewal of the distribution agreements for the TV Breizh, Ushuaia TV and Histoire channels, four services that lie at the heart of Orange’s Family TV offer. Finally, Orange and the TF1 group have agreed to work together to develop targeted, enhanced advertising solutions on the TF1 services distributed on Orange platforms. The MYTF1 service, suspended by TF1 on 1 February 2018, will once again be available to Orange subscribers from Monday 12 March. 1 About Orange Orange is one of the world’s leading telecommunications operators with sales of 41 billion euros in 2017 and 152,000 employees worldwide at 31 December 2017, including 93,000 employees in France. -

Investor Presentation

Investor Presentation September / October 2011 TF1 GROUP Pay TV Advertising Diversification Audiovisual Broadcasting Free Channels Production (()France) adggyency & Internet rights international 2011: A RECORD FOR TV CONSUMPTION Women<50: 3h52 12’ min more vs 2010 / +5% 3h52 3h44 4 +: 3h46 3h40 3h40 16’min more vs 2010 / +8% 3h34 3h32 3h46 3h28 3h31 3h24 3h24 3h13 3h19 3h27 3h24 3h26 3h29 3h23 3h30 3h11 3h22 3h23 3h02 3h18 3h16 3h03 3h08 3h09 3h14 3h00 3h00 2h59 2h57 2h53 3h07 3h03 2h59 2h52 2h47 2h51 2h46 2h46 2h39 2h42 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: Médiamétrie/Médiamat (TV Consumption / January-July) TF1, A EUROPEAN LEADER Audience share (in%) of leading European channels Gap between each leader on their own national territories for H1 2011 (*) and its challenger Leader TF1 23,8 8.6 pts Challenger France 2 15,2 Leader BBC 1 20,9 5.4 pts Challenger ITV1 15,5 Leader RTL 14,2 1.4 pts Challenger Das Erste 12,8 Leader TVE1 14,9 0.8 pts Challenger Tele 5 14,1 Leader Rai 1 19,1 1.5 pts Challenger Canale 5 17,6 Source: Médiamétrie – 1st half 2011. 4 + (France) / Eurodata TV – BARB - Kanter Media (UK) / Eurodata TV – AGB – GFK (Germany) / Kantar Media (Spain) / Eurodata TV – Auditel – AGB Nielsen (Italy). FIRST-HALF 2011: UNRIVALLED TELEVISION OFFER 50 best audiences All channels combined 23. 8% 26. 8% audience share audience share Individuals Women<50 pdm Very solid leader 6.3 50 / 16 / 2 million viewers 50 prime time with over 8 million viewers in prime time 16 with over 9 million 87% 2 with over 10 million of top evenings with Individuals Source: Médiamétrie – Médiamat 5 TF1, 1ST FRENCH TV CHANNEL (ON INDIVIDUALS – 4 YEARS AND +) Audience share 4 years and + (in %) Jan.–Aug. -

Industrial Trajectory and Regulation of the French TV-Market Victor Lavialle

Industrial trajectory and regulation of the French TV-market Victor Lavialle To cite this version: Victor Lavialle. Industrial trajectory and regulation of the French TV-market. Economics and Fi- nance. Université Paris sciences et lettres, 2019. English. NNT : 2019PSLEM049. tel-02439079 HAL Id: tel-02439079 https://pastel.archives-ouvertes.fr/tel-02439079 Submitted on 14 Jan 2020 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Prepar´ ee´ a` MINES ParisTech Trajectoire Industrielle et Reglementation´ de l’Audiovisuel en France Industrial Trajectory and Regulation of the French TV-market Soutenue par Composition du jury : Victor Lavialle Franc¸oise Benhamou Le 17 decembre´ 2019 Professeure d’Economie,´ Universite´ Presidente´ Paris 13 Marc BOURREAU Professeur d’Economie,´ Tel´ ecom´ Paris- Rapporteur ´ o Tech Ecole doctorale n 396 Paul BELLEFLAMME Economie,´ Organisation, Professeur, UC Louvain Rapporteur Societ´ e´ Thomas PARIS Professeur, HEC Paris Examinateur Elisabeth´ FLURY-HERARD¨ Vice-presidente´ de l’Autorite´ de la Con- Examinatrice Specialit´ e´ currence Olivier BOMSEL Economie´ et Finance Professeur d’Economie,´ Mines Paris- Directeur de these` Tech Acknowledgements First and foremost, I would like to express my gratitude to Olivier Bomsel, for trusting me with this challenging research topic, and for providing me with a dedicated and pedagogical supervision. -

Téléchargez Le Document Au Format PDF Format

S O M M A I R E AVANT-PROPOS . 7 I. PROGRAMMES . 9 I. Offre de programmes et audience . 11 II. Offre de programmes par genre . 24 II. RESPECT DES OBLIGATIONS ET DES ENGAGEMENTS . 45 I. Pluralisme de l’information . 47 II. Honnêteté de l’information, déontologie de la programmation . 51 III. Protection de l’enfance et de l’adolescence . 53 IV. Œuvres audiovisuelles . 69 V. Œuvres cinématographiques . 100 VI. Programmes destinés à la jeunesse . 112 VII. Publicité et parrainage . 126 VIII. Obligations de service public et obligations spécifiques . 135 III. SITUATION FINANCIÈRE . 161 I. Résultats des sociétés . 163 II. Résultats des groupes . 171 IV. ANNEXES . 177 I. Organigrammes . 178 II. Grilles des programmes . 182 III. Programmes régionaux de France 3 . 194 IV. Bilan synthétique de RFO . 197 AVANT-PROPOS Une vision panoramique des évolutions de l’audiovisuel hertzien terrestre Avec ce « bilan des bilans » des grandes chaînes nationales hertziennes pour l’exercice 2000, le CSA propose, comme il le fait régulièrement depuis 1997, un panoramique, au sens cinématographique du terme, d’une partie essentielle de l’audiovisuel français qui permet d’appréhender ses grandes évolutions. Tout en présentant également une série de gros plans sur chacune des sociétés concernées, un tel document s’attache en effet, en privilégiant les plans d’ensemble et en usant du procédé du retour en arrière, à dégager les lignes de force des changements intervenus par rapport à l’année précédente, que ce soit en matière d’offre de programmes et d’audience, de respect des engagements souscrits ou de résultats financiers enregistrés. -

Must-Carry Rules, and Access to Free-DTT

Access to TV platforms: must-carry rules, and access to free-DTT European Audiovisual Observatory for the European Commission - DG COMM Deirdre Kevin and Agnes Schneeberger European Audiovisual Observatory December 2015 1 | Page Table of Contents Introduction and context of study 7 Executive Summary 9 1 Must-carry 14 1.1 Universal Services Directive 14 1.2 Platforms referred to in must-carry rules 16 1.3 Must-carry channels and services 19 1.4 Other content access rules 28 1.5 Issues of cost in relation to must-carry 30 2 Digital Terrestrial Television 34 2.1 DTT licensing and obstacles to access 34 2.2 Public service broadcasters MUXs 37 2.3 Must-carry rules and digital terrestrial television 37 2.4 DTT across Europe 38 2.5 Channels on Free DTT services 45 Recent legal developments 50 Country Reports 52 3 AL - ALBANIA 53 3.1 Must-carry rules 53 3.2 Other access rules 54 3.3 DTT networks and platform operators 54 3.4 Summary and conclusion 54 4 AT – AUSTRIA 55 4.1 Must-carry rules 55 4.2 Other access rules 58 4.3 Access to free DTT 59 4.4 Conclusion and summary 60 5 BA – BOSNIA AND HERZEGOVINA 61 5.1 Must-carry rules 61 5.2 Other access rules 62 5.3 DTT development 62 5.4 Summary and conclusion 62 6 BE – BELGIUM 63 6.1 Must-carry rules 63 6.2 Other access rules 70 6.3 Access to free DTT 72 6.4 Conclusion and summary 73 7 BG – BULGARIA 75 2 | Page 7.1 Must-carry rules 75 7.2 Must offer 75 7.3 Access to free DTT 76 7.4 Summary and conclusion 76 8 CH – SWITZERLAND 77 8.1 Must-carry rules 77 8.2 Other access rules 79 8.3 Access to free DTT -

Jamesgillies-Mediatraining.Pdf

Working with the media “We all remember what it was like to be 18: the idea of going to a party with one’s mother was pretty much up there with joining the after school physics club in terms of social humiliation.” 61% feel well or very well 79% interested or very interested informed 91% never attend public events Public sector scientists most trusted (older surveys) 66% think science makes our lives healthier, easier Politicians and journalists and more comfortable least trusted (older surveys) (down from 78% in 2005) “There is a general shift 29%: The sun goes round the towards scepticism compared Earth (2005) to the 2005 survey” (2010) UK poll 2000, 2005, 2008, 2011 • Public increasingly values science, and scientists • Public want to hear more about science • Public feel less well informed than they did in 2008… • …Particularly when there’s conflicting information to deal with • People are concerned about regulation and scientific ethics… • … stemming from lack of understanding of the scientific process • The general public can not be treated as a homogeneous entity Pew research Center September 2020 But that’s just what they say Evidence tells a different story • Number of young people opting for science at point of choice falling • Personal decisions reveal science/society disconnect – GMO, MMR, energy options, COVID-19… This is why we communicate… • Altruism – we believe it’s a good thing to do • Self interest – we believe it’s the right way to ensure sustained support • Obligation – we’re a publicly funded organization • Lisbon objectives – the only way to provide scientists is to engage with young people • Science based society – everyone’s life depends on science. -

As of August 27Th COUNTRY COMPANY JOB TITLE

As of August 27th COUNTRY COMPANY JOB TITLE AFGHANISTAN MOBY GROUP Director, channels/acquisitions ALBANIA TVKLAN SH.A Head of Programming & Acq. AUSTRALIA AUSTRALIAN BROADCASTING CORPORATION Acquisitions manager AUSTRALIA FOXTEL Acquisitions executive AUSTRALIA SBS Head of Network Programming AUSTRALIA SBS Channel Manager Main Channel AUSTRALIA SBS Head of Unscripted AUSTRALIA SBS Australia Channel Manager, SBS Food AUSTRALIA SBS Television International Content Consultant AUSTRALIA Special Broadcast Service Director TV and Online Content AUSTRALIA SPECIAL BROADCASTING SERVICE CORPORATION Acquisitions manager (unscripted) AUSTRIA A1 TELEKOM AUSTRIA AG Head of Broadcast & SAT AUSTRIA A1 TELEKOM AUSTRIA AG Broadcast & SAT AZERBAIJAN PUBLIC TELEVISION & RADIO BROADCASTING AZERBAIJAN Director general COMPANY AZERBAIJAN PUBLIC TELEVISION & RADIO BROADCASTING AZERBAIJAN Head of IR COMPANY AZERBAIJAN PUBLIC TELEVISION & RADIO BROADCASTING AZERBAIJAN Deputy DG COMPANY AZERBAIJAN GAMETV.AZ PRODUCER CENTRE General director BELARUS MEDIA CONTACT Buyer BELARUS MEDIA CONTACT Ceo BELGIUM NOA PRODUCTIONS Ceo ‐ producer BELGIUM PANENKA NV Managing partner RTBF RADIO TELEVISION BELGE COMMUNAUTE BELGIUM Head of Acquisition Documentary FRANCAISE RTBF RADIO TELEVISION BELGE COMMUNAUTE BELGIUM Responsable Achats Programmes de Flux FRANCAISE RTBF RADIO TELEVISION BELGE COMMUNAUTE BELGIUM Buyer FRANCAISE RTBF RADIO TELEVISION BELGE COMMUNAUTE BELGIUM Head of Documentary Department FRANCAISE RTBF RADIO TELEVISION BELGE COMMUNAUTE BELGIUM Content acquisition