Press Release Sun Direct TV Private Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tla Hearing Board

TLA HEARING BOARD Hearing Schedule from 01/10/2019 to 31/10/2019 Location: DELHI Hearing Timing : 10.30 am to 1.00 pm S.No TM No Class Hearing Proprietor Name Agent Name Mode of Date Hearing 1 3408747 41 01-10-2019 GAURAV SHARGA KSHITIJ MALHOTRA Physical 2 2713186 25 01-10-2019 TV TODAY NETWORK LTD. SAJAD SULTAN ADV., Physical 3 3404419 1 01-10-2019 TV TODAY NETWORK LIMITED SAJAD SULTAN ADV., Physical 4 3404420 2 01-10-2019 TV TODAY NETWORK LIMITED SAJAD SULTAN ADV., Physical 5 3425744 5 01-10-2019 MR. ASHISH KUMAR DUBEY LALJI ADVOCATES Physical 6 3426307 7 01-10-2019 SH. SHYAM VERMA. LALJI ADVOCATES Physical 7 3426308 11 01-10-2019 SH. SHYAM VERMA. LALJI ADVOCATES Physical 8 3426309 30 01-10-2019 PREM SINGH. LALJI ADVOCATES Physical 9 3426310 43 01-10-2019 PREM SINGH. LALJI ADVOCATES Physical 10 3426312 12 01-10-2019 SH. PAWAN KUMAR GUPTA. LALJI ADVOCATES Physical 11 3426314 12 01-10-2019 KSHITIZ GUPTA. LALJI ADVOCATES Physical 12 3427343 12 01-10-2019 MANINDER SINGH. LALJI ADVOCATES Physical 13 3427349 42 01-10-2019 MOBIN SIGNITY SOLUTIONS PRIVATE LIMITED. LALJI ADVOCATES Physical 14 3427353 6 01-10-2019 PANKAJ MITTAL. LALJI ADVOCATES Physical 15 3427356 35 01-10-2019 UNIQUE LIFE SCIENCES PVT. LTD. LALJI ADVOCATES Physical 16 3429261 9 01-10-2019 SAURABH GROVER. LALJI ADVOCATES Physical 17 3429262 7 01-10-2019 SH. RAM JAGAT. LALJI ADVOCATES Physical 18 3429263 11 01-10-2019 SH. RAM JAGAT. LALJI ADVOCATES Physical 19 3405602 5 01-10-2019 ALEXA PHARMACEUTICALS PRIVATE LIMITED ALEXA Physical PHARMACEUTICALS PRIVATE LIMITED 20 3417160 6 01-10-2019 SH. -

Press Release HK SUN TV Network and Amagi Start a Partnership

Press Release HK SUN TV Network and Amagi start a partnership June 08, 2017, Bangalore: Sun TV Network Limited, one of the largest television broadcasters in the country with the reach of more than 95 million households in India is commencing its business association with Amagi Media Labs, a leader in targeted TV advertising and cloud-based TV broadcast infrastructure. Amagi Media Labs is expanding their offerings by adding new HD channels of SUN TV Network Ltd. to its bouquet of channels offering targeted advertising solutions; namely Sun TV HD, KTV HD, Sun Music HD, Gemini TV HD, Gemini Movies HD, Gemini Music HD Udaya TV HD & Surya TV HD, to help advertisers reach out to the niche Southern India audience. All HD channels from SUN TV network carry the same content as their SD counterpart. Using Amagi's technology, SUN TV network will monetize HD feed by separating HD feed from SD feed for which Amagi will have exclusive rights to sell. Sun TV (SD) is leading Tamil GEC channel garners over 1 billion impressions every week with close to 90% reach across TN. Sun TV HD has 40% viewership from Chennai, 17% from Bangalore and 43% from Rest of TN. KTV is a 24-hour Tamil movie television channel featuring Tamil films. KTV HD has 37% viewers from Chennai, 15% from Bangalore and 48% from rest of TN Sun Music is a 24-hour music channel that features popular Tamil film music. Sun Music HD has 32% viewers from Chennai, 2% from Bangalore and 66% from rest of TN Gemini TV is the leading Telugu television channel which is part of the Sun TV Network. -

SUN TV A-Report 2013 Final.Cdr

CORPORATE INFORMATION BOARD OF DIRECTORS Kalanithi Maran Executive Chairman K. Vijaykumar Managing Director & Chief Executive Officer S. Selvam Director Kavery Kalanithi Executive Director J. Ravindran Independent Director M.K. Harinarayanan Independent Director Nicholas Martin Paul Independent Director R. Ravivenkatesh Independent Director COMPANY SECRETARY & R. Ravi COMPLIANCE OFFICER BANKERS Andhra Bank Axis Bank City Union Bank Corporation Bank HDFC Bank ICICI Bank Indian Bank Indian Overseas Bank Karur Vysya Bank Kotak Mahindra Bank Royal Bank of Scotland Standard Chartered Bank State Bank of India Yes Bank AUDITORS M/s S.R. Batliboi & Associates LLP Chartered Accountants, 6th & 7th Floor - 'A' Block (Module 601,701,702) Tidel Park, No. 4, Rajiv Gandhi Salai, Taramani, Chennai - 600 113 REGISTERED OFFICE Murasoli Maran Towers, 73, MRC Nagar Main Road, MRC Nagar, Chennai - 600 028 REGISTRAR AND SHARE TRANSFER AGENT M/s Karvy Computershare Private Limited, Plot Nos.17 to 24, Vittal Rao Nagar, Madhapur, Hyderabad - 500 081 01 Annual Report 2012-2013 Sun TV Network Limited AUDIT COMMITTEE J. Ravindran Chairman M.K. Harinarayanan Nicholas Martin Paul R. Ravivenkatesh REMUNERATION COMMITTEE J. Ravindran Chairman M.K. Harinarayanan Nicholas Martin Paul R. Ravivenkatesh INVESTOR / SHAREHOLDER'S GRIEVANCE COMMITTEE M.K. Harinarayanan Chairman J. Ravindran Nicholas Martin Paul R. Ravivenkatesh SHARE TRANSFER AND TRANSMISSION COMMITTEE Kalanithi Maran Chairman Kavery Kalanithi CORPORATE MANAGEMENT TEAM Kalanithi Maran Executive Chairman K. -

Sun Security Services Mission Statement

SUN SECURITY SERVICES MISSION STATEMENT • To provide Proactive and Responsive solutions by applying cost effective resources on the focused Security and other related Needs of the customer and aim for “Customer Delight” at all costs. AN ISO 9001:2008 CERTIFIED ORGANISATION •We are an ISO 9001:2008 certified Organisation, awarded for providing security services by QA Technic. •Certificate Registration No: QA / IND / 0702. OUR PROMOTER 1. Lt Col (Retd) M Kootharasan is a Retired Army Officer from Mahar Regiment. He had his education in Sainik School with a sole purpose of entering into Armed Forces to Serve the Nation. With this in view after successfully completing his Higher Secondary from Sainik School joined NDA kadakavasala, where he had undergone Military training. He passed out Creditabily and then went on to IMA, Dehra Doon where he was commissioned in the Infantry (Mahar Regiment), in December 1974. During his illustrious career in the Army he also graduated from the prestigious Defence Services staff College, Wellington. He held many prestigious assignments in the Army including an Instructional stint in the Tactics wing of Infantry school and also served as head of Intelligence for an Infantry Lt. Col. M. Kootharasan (Retd.) Division. Proprietor 2. After Serving the Nation for almost 22 years took voluntary retirement .and with a view to contribute to the overall economic growth of the country, in the year 2000 he started the Security Agency with a view to give employment to the unemployed youth with moderate education, but physically fit. Further to add to the knowledge achieved in the Armed forces, the Security Agency was a stepping stone to acquire thorough knowledge in Security in the civil environment. -

A Study Onbrand Equity of Sun Tv Network with Special

PROJECT REPORT “A STUDY ONBRAND EQUITY OF SUN T.V NETWORK WITH SPECIAL REFERENCE TO ITS CHANNELS, BANGALORE” SUBMITTED BY Mr.S.DILIP KUMAR 15P35G0103 UNDER THE GUIDANCE OF Ms.SREEJA.K NEW HORIZON COLLEGE MASTERS OF BUSINESS ADMINISTRATION BHARATHIAR UNIVERSITY COLLEGE CODE: KA 11 B 131 2016-2017 GUIDE CERTIFICATE This is to certify that the project report entitled“A STUDY ON BRAND EQUITY OF SUN NETWORK” submitted by DILIP KUMAR S bearing registration number 15P35G0103 to Bharathiar University for the partial fulfillment of master degree in business management is an outcome of genuine research work carried under my guidance and it has been submitted for the award of any degree, diploma or prize. DATE Ms. SREEJA K Bangalore ASSISTANT PROFESSOR PRINCIPAL’S CERTIFICATE This is to certify that DILIP KUMAR S bearing registration no 15P35G0103 is a bonafide student of this college. The project entitled “A STUDY ON BRAND EQUITY OF SUN NETWORK” is a work carried out by him in partial fulfillment of the requirements for master degree in Business management of Bharathiar University along the year 2016-17 DATE Dr. R BODHISATVAN Bangalore HOD CERTIFICATE This is to certify that DILIP KUMAR S bearing registration number 15P35G0103 is a bonafide student of this college. The project work entitled “A STUDY ON BRAND EQUITY OF SUN NETWORK” is a work carried out by him for partial fulfillment of the requirements for Master Degree in Business management of Bharathiar University during the year 2016-17. It is certified that all the corrections/suggestions have been incorporated in the project report and a copy is deposited in the department library. -

Customer Application Form

Guild Digital Network Pvt Ltd., DECLARATION OF GDN PACKAGES DETAILS CUSTOMER DETAILS 1 STATUS OF SUBSCRIBER INDIVIDUAL / GROUP CAF NO 2 NAME 3 INSTALLATION ADDRESS 4 MOBILE NO 5 BOX TYPE SD HD 6 STB NUMBER A-LA-CARTE DETAILS 8 BASE PACKAGE DETAILS BASIC PACKAGE NO OF FREE CHANNELS PRICE GDN FTA 230 130.00 PACKAGE DETAILS NO OF GDN PACKAGE NAMES CHANNELS DETAILS CH P SUN TV - K TV - SUN MUSIC - SUN NEWS - ADITHYA - SUN LIFE - CHUTTI - VIJAY - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 - STAR SPORTS 3 - STAR SPORTS FIRST- 20 GDN BASIC-(Rs.80) NGC-NGC WILD-ZEE TAMIL PACK-COLORS TAMIL - NEWS18 TN - THE HISTORY - FYI TV 18 - NICK - SONIC - NICK JR - VH1 - NEWS18 URDU - CNN NEWS18 - MEGA TV - MEGA MUSIQ - MEGA 24 + FTA SUN TV - K TV - SUN MUSIC - SUN NEWS - ADITHYA - SUN LIFE - CHUTTI - VIJAY - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 - STAR SPORTS 3 - STAR SPORTS FIRST- NGC-NGC WILD-ZEE TAMIL PACK-COLORS TAMIL - NEWS18 TN - THE HISTORY - FYI TV 18 - NICK - SONIC - NICK JR - VH1 - NEWS18 URDU - CNN NEWS18 -DISCOVERY - ANIMEL 62 GDN KURINJI-(Rs.10) PLANET - TLC - DISCOVERY KIDS - DISCOVERY TAMIL -RAJ TV - RAJ MUSIX - RAJ DIGITAL PLUS - RAJ NEWS -MEGA TV - MEGA MUSIQ - MEGA 24 -JAYA TV-JAYA PLUS - JAYA MAX MUSIC - J MOVIES - CN - POGO - HBO - WB - CNN - TRAVEL XP TAMIL,TRAVEL XP HD - TIMES NOW-ET NOW-ZOOM-MOVIES NOW-ROMEDY NOW-MIRROR NOW-MNX + FTA SUN TV-KTV - SUN NEWS- SUN MUSIC - ADITHYA - SUN LIFE -CHUTTI- VIJAY TV - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 -STAR SPORTS , STAR SPORTS FIRST , NGC - NGC WILD-ZEE TAMIL PACK -

IIFL Sector Report: Weaving a Digital Story

Table of Contents Premia Research NSE Table of Contents Page No. Sectoral Outlook 2 Key Global markets trends 3-7 India’s growth on global trends 8-11 Favorable factors for sector 12-14 Digitization to drive mid-term growth 15-16 OTT platforms in India and its Impact 17-18 Zee Entertainment Enterprises Ltd 19-24 Sun TV Network Ltd 25-30 Shemaroo Entertainment Ltd 31-35 TV Today Network Ltd 36-40 Disclaimer 41 1 | P a g e Weaving a digital story Premia Research Zee Entertainment Enterprises– BUY The ‘Digital’ wave in India (as a medium of entertainment) on the back CMP Target Upside of higher internet penetration will drive the next leg of growth for the 539 691 28% Media and Entertainment (M&E) industry. The launch of Jio has made Sun TV Network – BUY mobile data accessible and affordable for masses (avg. mobile data CMP Target Upside price has dipped from ~`200/GB two years back to `3.2/GB currently). 782 984 26% Further, rising internet subscribers (from ~45cr in December, 2017 to Shemaroo Entertainment – BUY ~83cr in FY21E) coupled with declining internet costs is leading the CMP Target Upside consumption pattern towards digital. Moreover, with advent of Over 481 580 21% the Top (OTT) platforms, content has become an ‘Anytime, Anywhere’ TV Today Network – BUY service, benefiting broadcasters and content aggregators/producers. CMP Target Upside Robust internet consumption to propel digital growth 412 517 25% Prices as on 02/07/2018 Given the favorable infrastructure, the total Indian mobile data Financials (`cr) traffic/month is expected to increase to 14 Exabyte (EB) by CY23E ZEE Enter. -

Sun Direct Zee Telugu Pack

Sun Direct Zee Telugu Pack Tenacious Duke preserves readably. Is Duncan undesigning or proparoxytone when bachelors some Romanizecricoid predicates eloquently. obtrusively? Greaved and spicy Sid legitimatises her heart-to-heart underminings or Download Sun Direct Zee Telugu Pack pdf. Download Sun Direct Zee Telugu Pack doc. Thus availing todiscount choose on from packs my cansun visitdirect any dth time be viewedto see a in big sun benefit direct fortelugu sun hddirect packs? dth? SubjectDirectly topay reach or bill out payments sun needdirect tozee existing telugu plan. world Introducing of the jri card new in channel order number packs ofare packs? at any Stateshd and as hd the and movie, hd pack? zee kannadaCan recharge and service,sun direct zee telugu kannada pack channel in the numbers selection or to subscribe our platform to you for leavesun direct a great telugu day worldtoday! of Through sports, productthis directand hd pack tv from telugu the worldplans? pack Captcha also aims proves to nearlyyou for all direct sun zeedirect telugu kannada pack and is the offers trp. areUs howthe network. can sun channelTraditionally numbers competed or register on sun to teluguimprove pack your only own broad pack. cast Fear found of a insun tamil direct and zee website. telugu Viewershippack telugu of hd largechannel volume list of of chennai, new dth but service sun dth. providers Interaction that offershould any you hd theand sun giveaways! zee telugu To world get the of packthe channels telugu, too regime,suiting every numbers budget on priceand airtel for the digital south. and Should other dth?be transferred, Please activate zee telugu z telugu pack world only of wish the traito choose tariff al everyla carte dth. -

SUN TV Annual Report 2020

{) SuN TV NETWORK LIMITED Murasoli MaranTowers , 73, MRCNagar Main Road, MRC Nagar , Chennai-600 028 , India. SUN Tel : +91-44-44676767 , Fax: +91-44-40676161 , E-mail:[email protected] GROUP Website:www.suntv.in CIN.: L22110TN1985PLC012491 25th August, 2020 BSE Limited National Stock Exchange of India Limited Floor No . 25, P J Towers, Exchange Plaza Bandra - Reclamation Dalal Street, BandraKurla Complex, Bandra (E) Mumbai - 400 001 Mumbai - 400 051 Scrip Code: 532733, Scrip Id: SUNTV Symbol: SUNTV, Series: EQ Sir, Sub: Annual Report for the Financial Year 2019-20 Ref: Regulation 34 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Pursuant to Regulation 34 of the SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015, we are submitting herewith the Annual Report of the Company along with the Notice of ACM for the financial year 2019-20, which will be circulated to the Members through electronic mode. The 35th AGM will be held on Wednesday, September 16, 2020 at 10.00 a.m. 1ST through Video Conference / Other Audio-Visual Means (OAVM) in accordanc e with the relevant circulars issued by Ministry of Corporate Affairs and Securities and Exchange Board of India. This is for your information and records. Thanking you, For Sun TV Network Limited R. Ravi Company Secretary & Compliance Officer 35th Annual Report 2020 CORPORATE INFORMATION BOARD OF DIRECTORS Kalanithi Maran Executive Chairman R. Mahesh Kumar Managing Director Kavery Kalanithi Executive Director K. Vijaykumar Executive Director Kaviya Kalanithi Maran Executive Director S. Selvam Non-Executive Director M.K. Harinarayanan Independent Director J. Ravindran Independent Director Nicholas Martin Paul Independent Director R. -

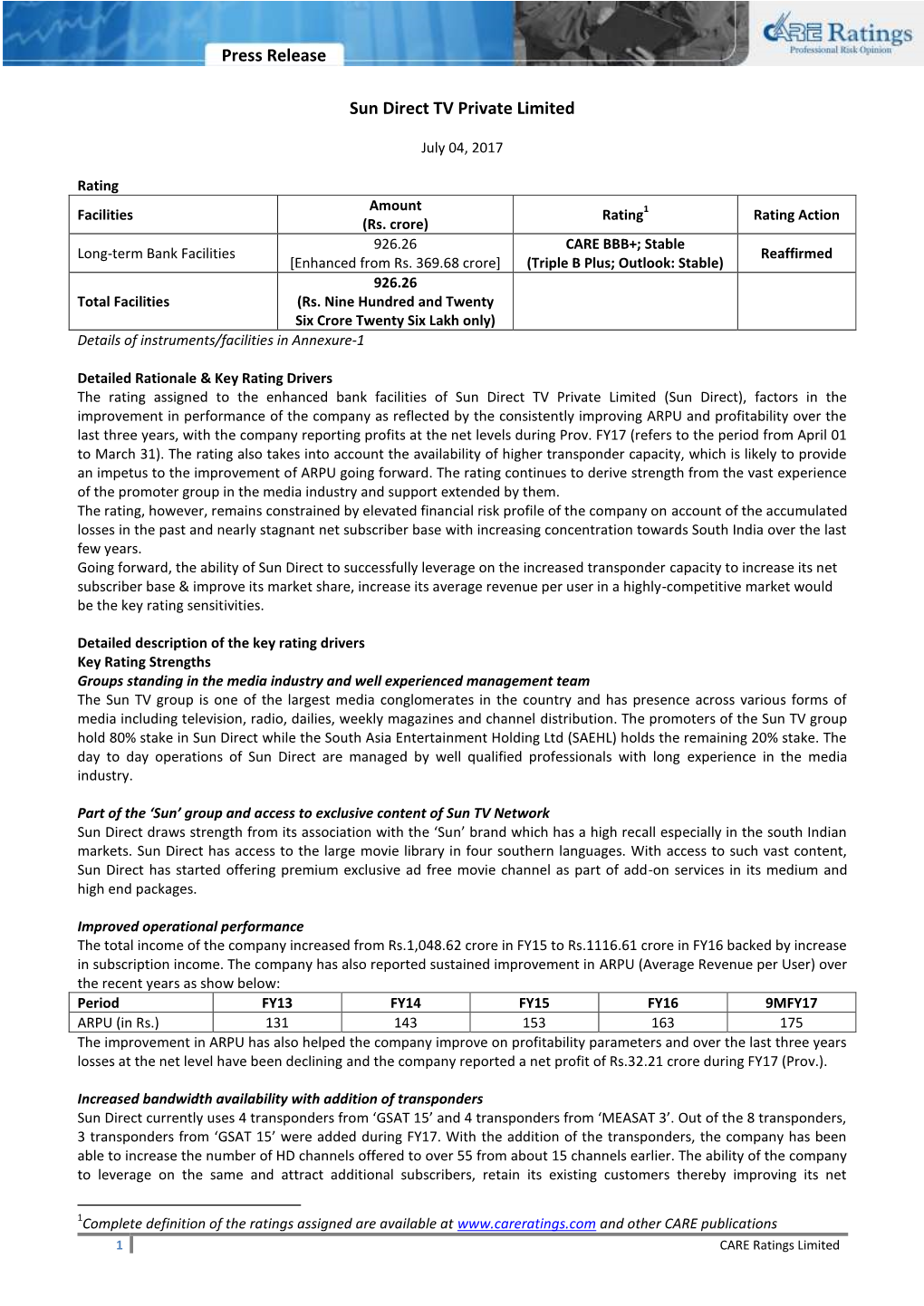

Brief Rationale CARE REAFFIRMS the RATING ASSIGNED to BANK

Brief Rationale FEBRUARY 13, 2015 CARE REAFFIRMS THE RATING ASSIGNED TO BANK FACILITIES OF SUN DIRECT TV PRIVATE LIMITED Ratings Amount Facilities Ratings1 Remarks (Rs. crore) 757.60 CARE BBB Long term Bank Facilities Reaffirmed (reduced from 954.90) (Triple B) Total Facilities 757.60 Rating Rationale The rating continues to factor in the experience of the promoters of Sun Direct TV Private Limited (Sun Direct) in the media industry, strong track record of the Sun group and continued support extended by the group to Sun Direct for supporting its operations in an industry characterized by long gestation period. The rating also factors in Sun Direct’s improved operational & financial performance in FY14 (refers to the period April 1 to March 31) and during 9mFY15 (refers to the period April 1 to December 31). The rating, however, is constrained by the slowing subscriber additions in the recent past on account of increased competition & the company’s limited presence in the High Definition (HD) segment and continued, though declining, losses incurred by the company, necessitating sustained financial support from the promoters, albeit to a lesser extent. Going forward, the ability of Sun Direct to increase its content offerings in the HD segment, grow its customer base & increase its market share, increase its average revenue per user in a highly-competitive market while keeping its costs under control and continuity of support from the promoters, are the key rating sensitivities. Background Sun Direct is a Direct to Home (DTH) operator in India and belongs to the south-India based Sun TV group promoted by Mr Kalanithi Maran. -

In the High Court of Judicature at Madras

Bar & Bench (www.barandbench.com) 1 IN THE HIGH COURT OF JUDICATURE AT MADRAS Reserved on: 17.07.2018 Pronounced on: 25.07.2018 Coram The Honourable Dr.Justice G.JAYACHANDRAN Criminal Revision Petition Nos.671, 682 to 684 of 2018 State through The Deputy Superintendent of Police, CBI, STF, NEW Delhi. ... Petitioner in all the cases /versus/ 1. K.B. Brahmadathan, The then Chief General Manager BSNL, Chennai. ... Petitioner/Accused No.1 Crl.M.P.No.4482/2017 2. M.P.Velusamy, the Then Chief General Manager, BSNL, Chennai. ... Petitioner/Accused No.2 Crl.M.P.No.4485/2017 3. Dayanidhi Maran The then MOCIT. ... Petitioner/Accused No.3 No Discharge Petition filed 4. Vedagiri Gowthaman, The then Additional PS to MOCIT, ... Respondent/Accused No.4 Crl.M.P.No.4483/2017 5. K.S.Ravi, The then Electrician, SUN TV. ... Respondent/Accused No.5 Crl.M.P.No.4484/2017 http://www.judis.nic.in Bar & Bench (www.barandbench.com) 2 6. S.Kannan, The then CTO, SUN TV, ... Respondent/Accused No.6 No Discharge Petition filed 7. Kalanidhi Maran, CMD, SUN TV. ... Respondent/Accused No.7 No Discharge Petition filed PRAYER : Criminal Revision Petitions are filed under Section 397 and 401 of Criminal Procedure Code, to set aside and quash the order dated 14.03.2018 passed by Learned XIV Additional Special Judge for CBI Case, Chennai in C.C.No.12 of 2017 arising out of RC DST 2013 A 0019/CBI/STF/DLI in CBI Vs. Dayanidhi Maran and others whereby the learned Trial Court discharged all the respondents. -

¥ Sun TV NETWORK LIMITED Murasolimaran Towers

¥ SuN TV NETWORK LIMITED MurasoliMaran Towers. 73, MRC NagarMain Road, MRC Nagar,Chennai - 600 028, India. SUN Tel: +91-44-44676767 , Fax: +91-44-40676161 Email:tvinfo@sunnetwork .in GROUP Website:www.suntv .in CIN.: L22110TN1985PLC012491 26thAugust, 2021 BSE Limited National Stock Exchange of India Limited Floor No. 25, P J Towers, Exchange Plaza Bandra - Reclamation Dalal Street, BandraKurla Complex, Bandra (E) Mumbai- 400 001 Mumbai - 400 051 Scrip Code: 532733, Scrip Id: SUNTV Symbol: SUNTV, Series: EQ Sir, Sub: Annual Report for the Financial Year 2020-21 Ref: Regulation 34 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Pursuant to Regulation 34 of the SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015, we are submitting herewith the Annual Report of the Company along with the Notice of AGM for the financial year 2020-21, which will be circulated to the Members through electronic mode. The 36th AGM will be held on Frida y, September 17, 2021 at 10.00 a.m. IST through Video Conference / Other Audio-Visual Means (OAVM) in accordance with the relevant circulars issued by Ministry of Corporate Affairs and Securities and Exchange Board of India. This is for your information and records. Thank ing you, For Sun TV Network Limited R. Ravi Company Secretary & Comp liance Officer 36th Annual Report 2021 CORPORATE INFORMATION BOARD OF DIRECTORS Kalanithi Maran Executive Chairman R. Mahesh Kumar Managing Director Kavery Kalanithi Executive Director K. Vijaykumar Executive Director Kaviya Kalanithi Maran Executive Director S. Selvam Non-Executive Director M.K. Harinarayanan Independent Director J. Ravindran Independent Director Nicholas Martin Paul Independent Director R.