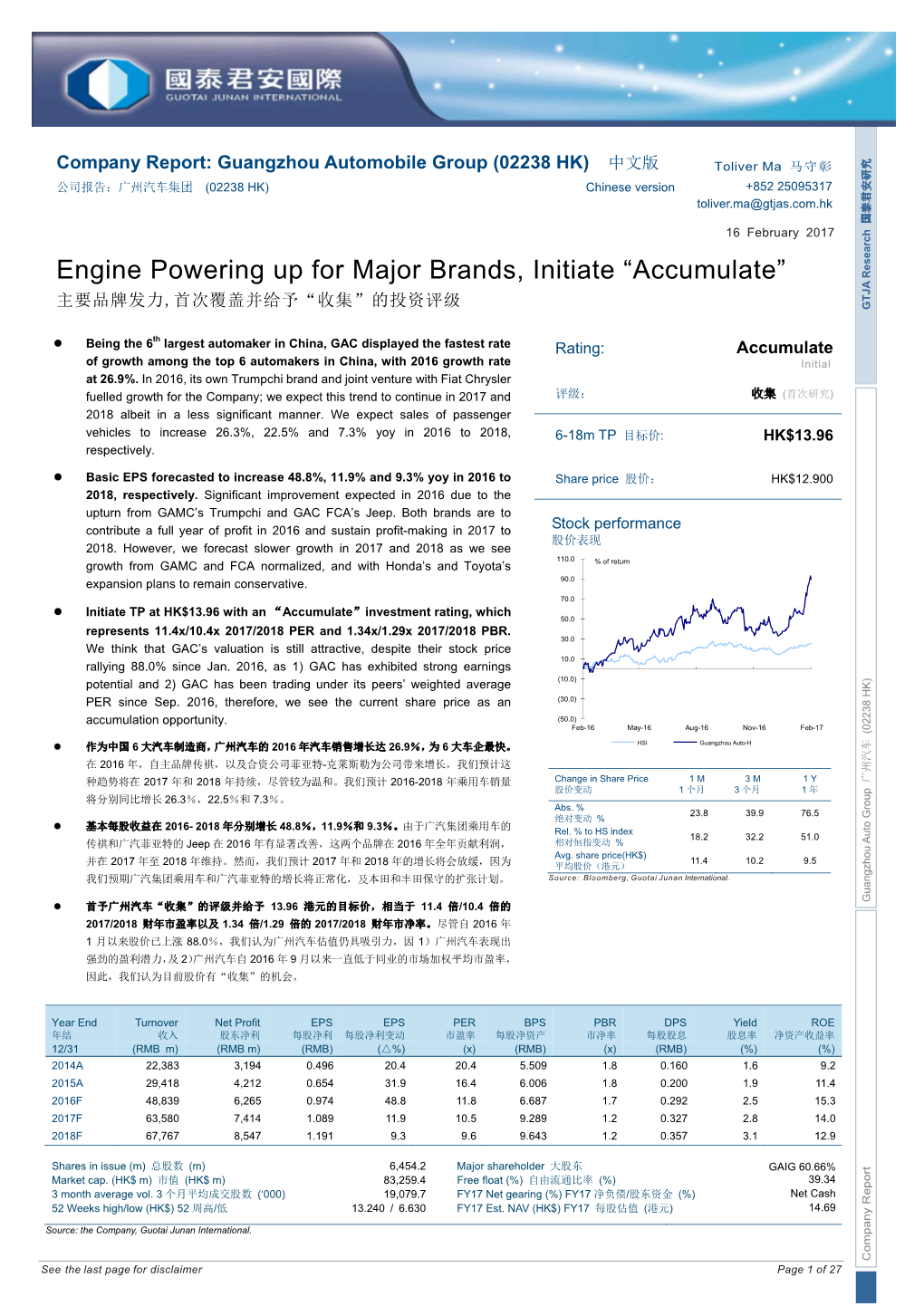

Engine Powering up for Major Brands, Initiate “Accumulate”

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice Regarding Change in Specified Subsidiary

[Translation] May 17, 2018 To: Shareholders of Honda Motor Co., Ltd. From: Honda Motor Co., Ltd. 1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo, 107-8556 Takahiro Hachigo President and Representative Director Notice Regarding Change in Specified Subsidiary Honda Motor Co., Ltd. (“the Company”) hereby announces that it has decided to transfer all of its shares in Honda Automobile (China) Co., Ltd. (“CHAC”), a consolidated subsidiary of the Company, to Guangqi Honda Automobile Co., Ltd. (“GHAC”), and that it has executed a share transfer agreement with GHAC. 1. Reason for change In order to implement reorganization of its automobile business in China and improve business operational efficiency, the Company decided to transfer its shares in CHAC, which is a specified subsidiary of the Company, to GHAC. 2. Outline of specified subsidiary (1) Company name Honda Automobile (China) Co., Ltd. (CHAC) No. 363, Kai Chuang Da Dao, East Section (2) Registered office Guangzhou Economic & Technological Development District Guangzhou Guangdong People’s Republic of China Name of (3) Yasuhide Mizuno, Chairman representative Description of (4) Automobile business (production) business (5) Capital US$ 82 million (6) Date of establishment September 8, 2003 Honda Motor Co., Ltd. 55.0% Major shareholders Guangzhou Auto Group Co., Ltd. 25.0% (7) and ownership Honda Motor (China) Investment Co., Ltd. (“HMCI”) 10.0% percentage Dongfeng Motor Group Co., Ltd. 10.0% CHAC is a consolidated subsidiary of the Company in Capital which the Company has a 55.0% equity interest -

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto

Fulbright-Hays Seminars Abroad Automobility in China Dr. Toni Marzotto “The mountains are high and the emperor is far away.” (Chinese Proverb)1 Title: The Rise of China's Auto Industry: Automobility with Chinese Characteristics Curriculum Project: The project is part of an interdisciplinary course taught in the Political Science Department entitled: The Machine that Changed the World: Automobility in an Age of Scarcity. This course looks at the effects of mass motorization in the United States and compares it with other countries. I am teaching the course this fall; my syllabus contains a section on Chinese Innovations and other global issues. This project will be used to expand this section. Grade Level: Undergraduate students in any major. This course is part of Towson University’s new Core Curriculum approved in 2011. My focus in this course is getting students to consider how automobiles foster the development of a built environment that comes to affect all aspects of life whether in the U.S., China or any country with a car culture. How much of our life is influenced by the automobile? We are what we drive! Objectives and Student Outcomes: My objective in teaching this interdisciplinary course is to provide students with an understanding of how the invention of the automobile in the 1890’s has come to dominate the world in which we live. Today an increasing number of individuals, across the globe, depend on the automobile for many activities. Although the United States was the first country to embrace mass motorization (there are more cars per 1000 inhabitants in the United States than in any other country in the world), other countries are catching up. -

235904547.Pdf

Honda Motor Co., Ltd. (本田技研工業株式会社 Honda Giken Kōgyō KK?, IPA: [hoɴda] ( listen); /ˈhɒndə/) is a Japanese publicmultinational corporation primarily known as a manufacturer of automobiles, motorcycles and power equipment. Honda has been the world's largest motorcycle manufacturer since 1959,[3][4] as well as the world's largest manufacturer of internal combustion engines measured by volume, producing more than 14 million internal combustion engines each year.[5] Honda became the second-largest Japanese automobile manufacturer in 2001.[6][7] Honda was the eighth largest automobile manufacturer in the world behind General Motors, Volkswagen Group, Toyota, Hyundai Motor Group, Ford, Nissan, and PSA in 2011.[8] Honda was the first Japanese automobile manufacturer to release a dedicated luxury brand, Acura, in 1986. Aside from their core automobile and motorcycle businesses, Honda also manufactures garden equipment, marine engines, personal watercraft and power generators, amongst others. Since 1986, Honda has been involved with artificial intelligence/robotics research and released theirASIMO robot in 2000. They have also ventured into aerospace with the establishment of GE Honda Aero Engines in 2004 and theHonda HA-420 HondaJet, which began production in 2012. Honda has three joint-ventures in China (Honda China, Dongfeng Honda, and Guangqi Honda). In 2013, Honda invested about 5.7% (US$ 6.8 billion) of its revenues in research and development.[9] Also in 2013, Honda became the first Japanese automaker to be a net exporter from the United -

Honda Cars India

Honda Cars India Honda Cars India Limited Type Subsidiary Industry Automotive Founded December 1995 Headquarters Greater Noida, Uttar Pradesh Number of Greater Noida, Uttar Pradesh locations Bhiwadi, Rajasthan Mr. Hironori Kanayama, President Key people and CEO [1] Products Automobiles Parent Honda Website hondacarindia.com Honda Cars India Ltd. (HCIL) is a subsidiary of the Honda of Japan for the production, marketing and export of passenger cars in India. Formerly known as Honda Siel Cars India Ltd, it began operations in December 1995 as a joint venture between Honda Motor Company and Usha International of Siddharth Shriram Group. In August, 2012, Honda bought out Usha International's entire 3.16 percent stake for 1.8 billion in the joint venture. The company officially changed its name to Honda Cars India Ltd. (HCIL) and became a 100% subsidiary of Honda. It operates production facilities at Greater Noida in Uttar Pradesh and at Bhiwadi in Rajasthan. The company's total investment in its production facilities in India as of 2010 was over 16.2 billion. Contents Facilities HCIL's first manufacturing unit at Greater Noida commenced operations in 1997. Setup at an initial investment of over 4.5 billion, the plant is spread over 150 acres (0.61 km2). The initial capacity of the plant was 30,000 cars per annum, which was thereafter increased to 50,000 cars on a two-shift basis. The capacity has further been enhanced to 100,000 units annually as of 2008. This expansion led to an increase in the covered area in the plant from 107,000 m² to over 130,000 m². -

Car Wars 2020-2023 the Rise (And Fall) of the Crossover?

The US Automotive Product Pipeline Car Wars 2020-2023 The Rise (and Fall) of the Crossover? Equity | 10 May 2019 Car Wars thesis and investment relevance Car Wars is an annual proprietary study that assesses the relative strength of each automaker’s product pipeline in the US. The purpose is to quantify industry product trends, and then relate our findings to investment decisions. Our thesis is fairly straightforward: we believe replacement rate drives showroom age, which drives market United States Autos/Car Manufacturers share, which drives profits and stock prices. OEMs with the highest replacement rate and youngest showroom age have generally gained share from model years 2004-19. John Murphy, CFA Research Analyst Ten key findings of our study MLPF&S +1 646 855 2025 1. Product activity remains reasonably robust across the industry, but the ramp into a [email protected] softening market will likely drive overcrowding and profit pressure. Aileen Smith Research Analyst 2. New vehicle introductions are 70% CUVs and Light Trucks, and just 24% Small and MLPF&S Mid/Large Cars. The material CUV overweight (45%) will likely pressure the +1 646 743 2007 [email protected] segment’s profitability to the low of passenger cars, and/or will leave dealers with a Yarden Amsalem dearth of entry level product to offer, further increasing an emphasis on used cars. Research Analyst MLPF&S 3. Product cadence overall continues to converge, making the market increasingly [email protected] competitive, which should drive incremental profit pressure across the value chain. Gwen Yucong Shi 4. -

Environment 2 Safety 3 Quality 4 Human Resources 5 Social Activity 6 Supply Chain 7 GRI Content Index 8 Assurance 9 Financial Data

Contents 1 Editorial Policy 2 Overview of Honda 3 Message from the President and CEO 4 Special Feature 5 Sustainability Management 6 Performance Report 1 Environment 2 Safety 3 Quality 4 Human Resources 5 Social Activity 6 Supply Chain 7 GRI Content Index 8 Assurance 9 Financial Data 6 Environment 30% We are aiming to reduce the CO2 emissions intensity of motorcycles, automobiles and power products by 30% compared with 2000 levels by 2020, and are engaging in three initiatives to achieve this. environment Honda SUSTAINABILITY REPORT 2016 24 G4-SO2,G4-DMA Contents 1 Editorial Policy 2 Overview of Honda 3 Message from the President and CEO 4 Special Feature 5 Sustainability Management 6 Performance Report 1 Environment 2 Safety 3 Quality 4 Human Resources 5 Social Activity 6 Supply Chain 7 GRI Content Index 8 Assurance 9 Financial Data Basic Approach Honda’s Environment Statement/Honda Honda’s Environment Statement As a responsible member of society whose task lies in the preservation of the global environ- Environmental and ment, the company will make efforts to contribute to human health and the preservation of the global environment in each phase of its corporate activity. Only in this way will we be able to Safety Vision count on a successful future not only for our company, but for the world. We should pursue our daily business under the following principles: Ever since the 1960s, Honda has actively endeavored to solve environmental problems. We developed the low-pollution CVCC engine that successfully reduced carbon monoxide, hydrocarbon 1. We will make efforts to recycle materials and conserve energy and nitrogen oxide (NOx) emissions, while we were the world’s at every stage of our products’ life cycle from research, design, first automaker to comply with U.S. -

Honda Says Two China Plants to Resume

Honda says two China plants to resume http://www.chinalaborwatch.org/newscast/38 ENGLISH | 中文 HOME ABOUT US OUR WORK REPORTS MEDIA CENTER GET INVOLVED RESOURCES Saturday, June 12, 2010 Source: Honda says two China plants to resume AFP Japan's number two automaker Honda Motor said production was set to resume at two vehicle assembly plants in southern China after a strike at an exhaust parts maker ended. But a new labour dispute involving workers at a factory in the southern province of Guangdong that produces car locks and key sets for Honda remained "unchanged", a Beijing-based spokesman told AFP. The latest action to hit Honda comes after a spate of suicides at Taiwanese high tech firm Foxconn and violent clashes at a Taiwan- funded rubber factory in China which have highlighted growing worker discontent over pay and conditions. Advertisement: Story continues below Production at two plants run by Honda's Chinese joint venture Guangqi Honda Automobile have been shut down for two days, primarily due to the strike at a parts plant producing exhaust and muffler components. But Honda Japan said Thursday in a statement that the labour action at Foshan Fengfu Autoparts, a joint venture between Honda's subsidiary Yutaka Giken and a Taiwanese firm, had been resolved and work resumed Thursday. "So Guangqi Honda decided to resume operations from June 11," Honda Japan said in a statement. The new ongoing dispute involving workers at the Honda Lock (Guangdong) Co, which has about 1,500 employees, erupted on Wednesday. The state Xinhua news agency reported that staff were seeking a monthly pay increase from Y1,700 ($A21.94) yuan to Y2,040 ($A26.33) yuan. -

United States Securities and Exchange Commission Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2021 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number 1-7628 HONDA GIKEN KOGYO KABUSHIKI KAISHA (Exact name of Registrant as specified in its charter) HONDA MOTOR CO., LTD. (Translation of Registrant’s name into English) JAPAN (Jurisdiction of incorporation or organization) No. 1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo 107-8556, Japan (Address of principal executive offices) Rikako Suzuki [email protected], +81-3-5412-1134, No. 1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo 107-8556, Japan (Name, E-mail and/or Facsimile number, Telephone and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Act. Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock* HMC New York Stock Exchange American Depositary Shares** Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. -

FY2016 Form 20-F

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2016 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number 1-7628 HONDA GIKEN KOGYO KABUSHIKI KAISHA (Exact name of Registrant as specified in its charter) HONDA MOTOR CO., LTD. (Translation of Registrant’s name into English) JAPAN (Jurisdiction of incorporation or organization) No. 1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo 107-8556, Japan (Address of principal executive offices) Narushi Yazaki, Honda North America, Inc., [email protected], (212)707-9920, 156 West 56th Street, 20th Floor, New York, NY 10019, U.S.A. (Name, E-mail and/or Facsimile number, Telephone and Address of Company Contact Person) Securities registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered Common Stock* New York Stock Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None (Title of class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

Updated July 2021 1

2021 Honda Digital FactBook Updated July 2021 1 Table of Contents Key Locations and Contacts by Region 2 Public Relations Directory North America: Automobile North America: Power Equipment Torrance, CA Motorsports Power Equipment American Honda Motor Co., Inc. Chuck Schifsky Alpharetta, GA 1919 Torrance Boulevard [email protected] American Honda Motor Co., Inc. Torrance, CA 90501-2746 4900 Marconi Drive Safety, Regulatory and Recalls Alpharetta, GA 30005 Phone: 310-783-3170 Fax: 310-783-3622 Chris Martin Jessica Fini [email protected] Phone: 770-712-3082 Fax: 678-339-2670 [email protected] Honda and Acura: Regional North America: Powersports Shigeki Endo Lynn Seely [email protected] (Midwest Media Relations) Torrance, CA [email protected] American Honda Motor Co., Inc. Honda 4900 Marconi Drive Natalie Kumaratne Chris Naughton Alpharetta, GA 30005 [email protected] (North East Media Relations) Phone: 310-783-3846 [email protected] Carl Pulley Brandon Wilson (West Coast Media Relations) [email protected] [email protected] Colin Miller Acura (2-Wheel, On/Off-Road) Andrew Quillin [email protected] [email protected] Ryan Dudek Karina Gonzalez (2-Wheel, Off-Road) (West Coast Media Relations) [email protected] [email protected] Ben Hoang (ATV, Side-by-Side) [email protected] 3 Public Relations Directory North America: Corporate Communications Public Affairs Torrance, CA Ohio Manufacturing and R&D: Washington, -

The New Passenger Car Fleet in China, 2010 Technology Assessment and International Comparisons

THE NEW PASSENGER CAR FLEET IN CHINA, 2010 Technology Assessment and International Comparisons 9 9 8.9 8.5 8.6 7.6 7.4 6.7 6.6 6.4 5.8 5.0 Mini Small Lower Medium Medium Large SUV Fuel consumption L/100km ( China; EU) Authors Hui He, policy analyst Jun Tu; researcher Acknowledgement The authors would like to thank the ClimateWorks Foundation for sponsoring this study. We are especially grateful to the following experts in China, Europe, and the United States who generously contributed their time in reviewing versions of this report: – Tang Dagang and Ding Yan of the Vehicle Emission Control Center (VECC) – Wu Ye and Huo Hong of Tsinghua University – Jin Yuefu, Wang Zhao, and Bao Xiang of the China Automotive Technology And Research Center (CATARC) – An Feng and Ma Dong of the Innovation Center for Energy and Transportation (iCET) – Francois Cuenot of the International Energy Agency (IEA) – John Decicco of the University of Michigan – Ed Pike of Energy Solutions We would also like to thank the following ICCT staff who closely reviewed this report. – Anup Bandivadekar, program director – Gaurav Bansal, researcher – Anil Baral, senior researcher – Freda Fung, senior policy analyst – John German, senior fellow – Drew Kodjak, executive director – Peter Mock, managing director, ICCT Europe All errors and omissions are the sole responsibility of the authors. International Council on Clean Transportation 1225 I Street NW, Suite 900 Washington DC 20005 www.theicct.org © 2012 International Council on Clean Transportation Design by Hahn und Zimmerman, -

The Sustainability of Joint Ventures Between State Owned Enterprises And

Journal of Business and Economics, ISSN 2155-7950, USA April 2014, Volume 5, No. 4, pp. 462-483 DOI: 10.15341/jbe(2155-7950)/04.05.2014/004 Academic Star Publishing Company, 2014 http://www.academicstar.us The Sustainability of Joint Ventures between State Owned Enterprises and Global Firms for Car Making Business in China Byunghun Choi (Kongju National University, Korea) Abstract: Since 2009 China has kept the first place globally at the automobile production and the sales volume. The practical growth engine for China’s automobile industry is Joint Venture (JV) makers between State Owned Enterprises (SOEs) and global makers which having concentrated on passenger car making business. The JVs’ role at the passenger car business of China has been expanded continuously since early 1990s. Chinese government has strictly prevented a foreign maker from holding above 50% of whole equity of a JV at vehicle making business. It means that the strategic alliances like non-equity alliances, equity alliances or JV have been feasible options for global makers to take for entering China’s vehicle making business. Therefore this study took a deep interest in how much sustainable the JV contracts in China, and tried to access the issues through industry based view and institution based view. At industry based view, this study analyzed which strategy is more desirable among three types of strategies; non-equity alliances, equity alliances and acquisitions. To do so this study applied the framework suggested by Dyer, Kale & Singh (2004) for deciding which strategy is relatively more suitable than others according to five factors; types of synergies, nature of resources, extent of redundant resources, degree of market uncertainty, and level of competition.