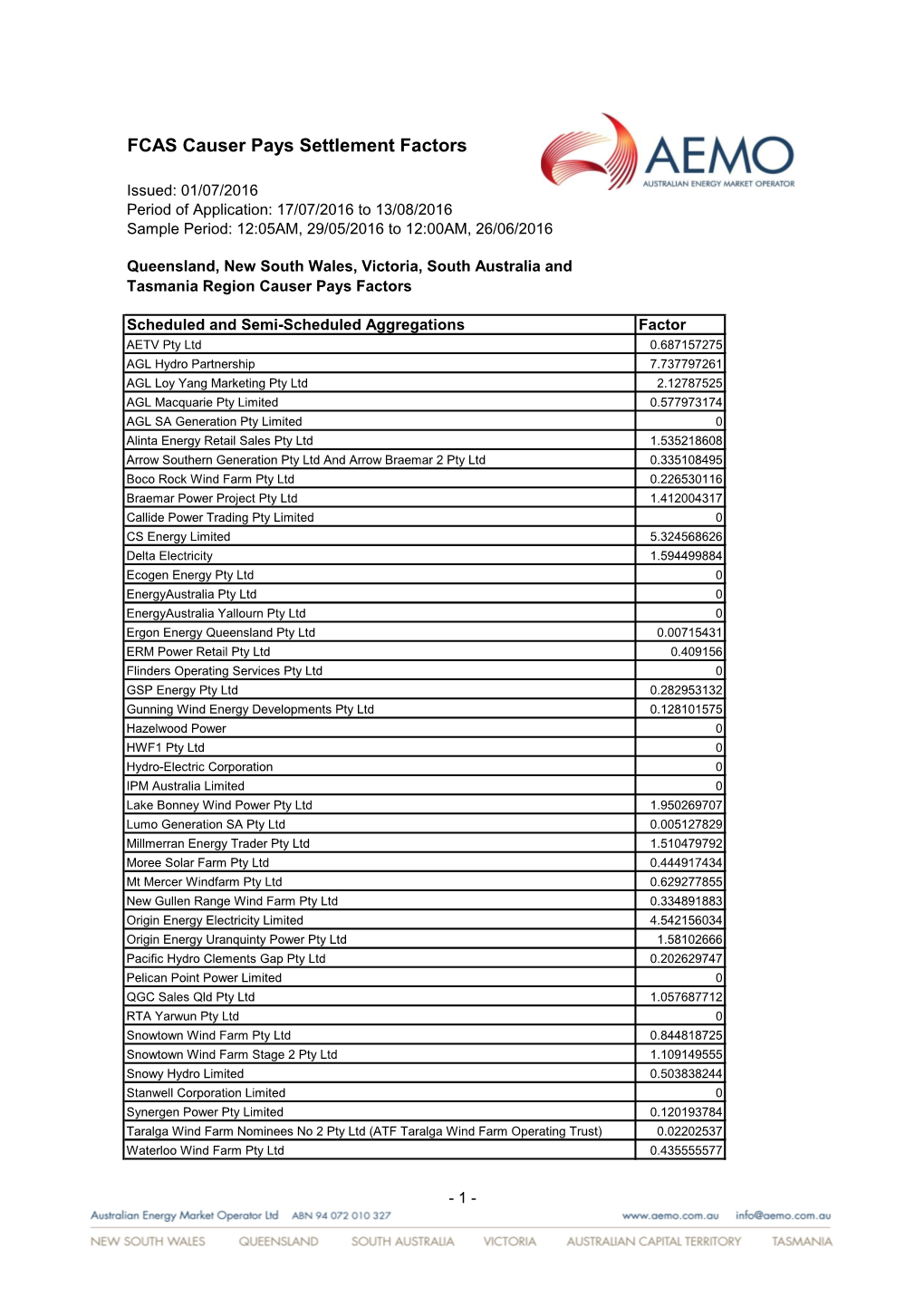

FCAS Causer Pays Settlement Factors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Shell in Australia Modern Slavery Statement

DocuSign Envelope ID: D3E27182-0A3B-4D38-A884-F3C2C5F0C272 JOINT MODERN SLAVERY STATEMENT UNDER THE MODERN SLAVERY ACT 2018 (CTH) FOR THE REPORTING PERIOD 1 JANUARY 2020 TO 31 DECEMBER 2020 Shell Energy Holdings Australia Limited has prepared this modern slavery statement in consultation with each of the following reporting entities, and is published by the following reporting entities in compliance with the Modern Slavery Act 2018 (Cth) (No. 153, 2018) (“Modern Slavery Act”):- 1) Shell Energy Holdings Australia Limited (“SEHAL”); 2) QGC Upstream Investments Pty Ltd (“QGC Upstream”); 3) QGC Midstream Investments Pty Ltd (“QGC Midstream”); and 4) ERM Power Limited (“ERM Power”), (collectively “Shell”, “our” or “we”)i Note on ERM Power: At the time this statement’s publication, ERM Power Limited will have been re- named to Shell Energy Operations Pty Ltd. However, as this statement pertains to ERM Power Limited’s structure, operations and supply chain from 1 January 2020 to 31 December 2020, we have maintained the previous entity name of ERM Power Limited for this statement. In addition, as ERM Power’s integration into Shell is ongoing, we have noted throughout this statement where ERM Power’s approach or processes differ from that of Shell. Finally, at the time this statement’s publication, ERM Power’s policies, for which links are listed under the “ERM Power” sub-heading in “Our values, policies & approach to human rights”, will be decommissioned; however would be available upon request as ERM has adopted the equivalent Shell policies. Introduction Shell is opposed to all forms of modern slavery. Such exploitation is against Shell’s commitment to respect human rights as set out in the Universal Declaration of Human Rights and the International Labour Organization 1998 Declaration of the Fundamental Principles of Rights at Work. -

Energy 2020 (Report 11: 2020–21)

FINANCIAL AUDIT REPORT 4 February 2021 Energy 2020 Report 11: 2020–21 • Queensland • • Audit Office Better public services As the independent auditor of the Queensland public sector, including local governments, the Queensland Audit Office: • provides professional audit services, which include our audit opinions on the accuracy and reliability of the financial statements of public sector entities • provides entities with insights on their financial performance, risk, and internal controls; and on the efficiency, effectiveness, and economy of public service delivery • produces reports to parliament on the results of our audit work, and on our insights, advice, and recommendations for improvement • conducts investigations into claims of financial waste and mismanagement raised by elected members, state and local government employees, and the public • shares wider learnings and best practice from our work with state and local government entities, our professional networks, industry, and peers. We conduct all our audits and reports to parliament under the Auditor-General Act 2009 (the Act). Our work complies with the Auditor-General Auditing Standards and the Australian standards relevant to assurance engagements. • Financial audit reports summarise the results of our audits of over 400 state and local government entities. • Performance audit reports cover our evaluation of some, or all, of the entities’ efficiency, effectiveness, and economy in providing public services. Depending on the level of assurance we can provide, these reports may also take the form of: • Audit insights, which provide some evaluation and share our insights or learnings from our audit work across government • Audit briefs, which set out key facts, involve some evaluation, and may include findings and recommendations • Audit overviews, which help clients and stakeholders understand complex issues and subjects. -

BUILDING STRONGER COMMUNITIES Wind's Growing

BUILDING STRONGER COMMUNITIES Wind’s Growing Role in Regional Australia 1 This report has been compiled from research and interviews in respect of select wind farm projects in Australia. Opinions expressed are those of the author. Estimates where given are based on evidence available procured through research and interviews.To the best of our knowledge, the information contained herein is accurate and reliable as of the date PHOTO (COVER): of publication; however, we do not assume any liability whatsoever for Pouring a concrete turbine the accuracy and completeness of the above information. footing. © Sapphire Wind Farm. This report does not purport to give nor contain any advice, including PHOTO (ABOVE): Local farmers discuss wind legal or fnancial advice and is not a substitute for advice, and no person farm projects in NSW Southern may rely on this report without the express consent of the author. Tablelands. © AWA. 2 BUILDING STRONGER COMMUNITIES Wind’s Growing Role in Regional Australia CONTENTS Executive Summary 2 Wind Delivers New Benefits for Regional Australia 4 Sharing Community Benefits 6 Community Enhancement Funds 8 Addressing Community Needs Through Community Enhancement Funds 11 Additional Benefts Beyond Community Enhancement Funds 15 Community Initiated Wind Farms 16 Community Co-ownership and Co-investment Models 19 Payments to Host Landholders 20 Payments to Neighbours 23 Doing Business 24 Local Jobs and Investment 25 Contributions to Councils 26 Appendix A – Community Enhancement Funds 29 Appendix B – Methodology 31 References -

Dundonnell Wind Farm

Dundonnell Wind Farm Fact Sheet Tilt Renewables is an owner, operator and Project facts developer of renewable generation assets • Circa $600 million project February • Up to 88 turbines 2018 across Australia and New Zealand, primarily • Blade tip height 189 metres consisting of wind, solar and storage projects. • Installed capacity of about 330MWs • 12 host landholders We have an existing asset base of 307 operating turbines across seven wind farms with a total installed capacity of 582MW. In addition, the Salt Creek Wind • About 4500 hectares Farm in Victoria is under construction, which when completed will add another • 38 kilometres of 220kV overhead 54MW to the operational portfolio. transmission line to the connection at the MOPS substation This includes the Snowtown Wind Farm - South Australia’s largest and Australia’s second largest wind farm - and Tararua Wind Farm, New Zealand’s • Underground 33kV cables largest wind farm. between the turbines • Onsite quarry and concrete batching plants Project description • Agreements in place with all occupied The inspiration for the circa $600 million Dundonnell Wind Farm came dwellings within two kilometres from a group of local land holders who were keen to source a wind farm for their properties. Project benefits Tilt Renewables (then Trustpower) purchased the site from developer NewEn Environmental Australia in June 2013. The site is sparsely populated, largely made of stony rise The Dundonnell Wind Farm will produce country and predominantly used for grazing stock. enough clean energy each year to power more than 155,000 homes and save the All occupied dwellings within two kilometres of a proposed WTG are emission of roughly 670,000 tonnes of participating in the project. -

Final Report

The Senate Select Committee on Wind Turbines Final report August 2015 Commonwealth of Australia 2015 ISBN 978-1-76010-260-9 Secretariat Ms Jeanette Radcliffe (Committee Secretary) Ms Jackie Morris (Acting Secretary) Dr Richard Grant (Principal Research Officer) Ms Kate Gauthier (Principal Research Officer) Ms Trish Carling (Senior Research Officer) Mr Tasman Larnach (Senior Research Officer) Dr Joshua Forkert (Senior Research Officer) Ms Carol Stewart (Administrative Officer) Ms Kimberley Balaga (Administrative Officer) Ms Sarah Batts (Administrative Officer) PO Box 6100 Parliament House Canberra ACT 2600 Phone: 02 6277 3241 Fax: 02 6277 5829 E-mail: [email protected] Internet: www.aph.gov.au/select_windturbines This document was produced by the Senate Select Wind Turbines Committee Secretariat and printed by the Senate Printing Unit, Parliament House, Canberra. This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Australia License. The details of this licence are available on the Creative Commons website: http://creativecommons.org/licenses/by-nc-nd/3.0/au/ ii MEMBERSHIP OF THE COMMITTEE 44th Parliament Members Senator John Madigan, Chair Victoria, IND Senator Bob Day AO, Deputy Chair South Australia, FFP Senator Chris Back Western Australia, LP Senator Matthew Canavan Queensland, NATS Senator David Leyonhjelm New South Wales, LDP Senator Anne Urquhart Tasmania, ALP Substitute members Senator Gavin Marshall Victoria, ALP for Senator Anne Urquhart (from 18 May to 18 May 2015) Participating members for this inquiry Senator Nick Xenophon South Australia, IND Senator the Hon Doug Cameron New South Wales, ALP iii iv TABLE OF CONTENTS Membership of the Committee ........................................................................ iii Tables and Figures ............................................................................................ -

ERM Power's Neerabup

PROSPECTUS for the offer of 57,142,858 Shares at $1.75 per Share in ERM Power For personal use only Global Co-ordinator Joint Lead Managers ERMERR M POWERPOWEPOWP OWE R PROSPECTUSPROSPEOSP CTUCTUSTU 1 Important Information Offer Information. Proportionate consolidation is not consistent with Australian The Offer contained in this Prospectus is an invitation to acquire fully Accounting Standards as set out in Sections 1.2 and 8.2. paid ordinary shares in ERM Power Limited (‘ERM Power’ or the All fi nancial amounts contained in this Prospectus are expressed in ‘Company’) (‘Shares’). Australian currency unless otherwise stated. Any discrepancies between Lodgement and listing totals and sums and components in tables and fi gures contained in this This Prospectus is dated 17 November 2010 and a copy was lodged with Prospectus are due to rounding. ASIC on that date. No Shares will be issued on the basis of this Prospectus Disclaimer after the date that is 13 months after 17 November 2010. No person is authorised to give any information or to make any ERM Power will, within seven days after the date of this Prospectus, apply representation in connection with the Offer which is not contained in this to ASX for admission to the offi cial list of ASX and quotation of Shares on Prospectus. Any information not so contained may not be relied upon ASX. Neither ASIC nor ASX takes any responsibility for the contents of this as having been authorised by ERM Power, the Joint Lead Managers or Prospectus or the merits of the investment to which this Prospectus relates. -

Vol 3 – App. 36 – RACL Environmental Record

Environmental Impact Statement - VOLUME 3 Appendix 36 RACL Environmental Record Prepared by RATCH Australia Corporation Limited PR100246 / R72894; Volume 3 TRANSFIELD SERVICES Australia & New Zealand HSE HAZARDS DOCUMENT No. TMP-2000-EV-0001 1.0 PURPOSE To outline the process to be followed for identifying and assessing the HSE hazards and relevant HSE legal requirements associated with Transfield Services operations and Supplier/Subcontractor activities, products and services. 2.0 SCOPE This procedure applies to all Transfield Services operations, sites and offices. It applies to the management of HSE hazards that arise in the course of activities at these sites and offices. The exact requirements of this procedure must be implemented as defined. Deviation from this procedure is only permissible where the stated criteria cannot be fulfilled and the deviation is approved by the respective Industry HSE Manager or Operations General Manager. Approvals shall be via e-mail and maintained as a record with all other document approvals, refer TMP-0000- QA-0005 – Document Control Procedure. 2.1 Adoption of a Client’s Hazard Controls, Procedures & Processes A client’s hazard controls, procedures and processes can be considered for adoption under any or all of the following circumstances:- 1. A gap analysis has been undertaken against Transfield Services’ procedures and processes and no inconsistencies have been identified between the client’s and Transfield’s identified procedures and processes. 2. The gap analysis finds that the client’s procedures and processes are equal to or better than those identified by Transfield Services 3. The client’s hazard controls, procedures and processes comply with regional legislative requirements. -

ERM Power Limited Notes to the Financial Statements for the HALF YEAR ENDED 31 DECEMBER 2016

Thursday, 23 February 2017 RESULTS FOR ANNOUNCEMENT TO THE MARKET Please find attached the following documents relating to ERM Power’s results for the six months ended 31 December 2016: 1. Appendix 4D 2. Half Year Financial Report including Management Discussion and Analysis and Directors’ Report Phil Davis Group General Counsel & Company Secretary ERM Power Limited About ERM Power ERM Power is an Australian energy company operating electricity sales, generation and energy solutions businesses. The Company has grown to become the second largest electricity provider to commercial businesses and industrials in Australia by load, with operations in every state and the Australian Capital Territory. A growing range of energy solutions products and services are being delivered, including lighting and energy efficiency software and data analytics, to the Company’s existing and new customer base. ERM Power also sells electricity in several markets in the United States. The Company operates 497 megawatts of low emission, gas-fired peaking power stations in Western Australia and Queensland. www.ermpower.com.au Appendix 4D ERM Power Limited ABN 28 122 259 223 Results for announcement to the market for the half year ended 31 December 2016 Notification in Accordance with Listing Rule 4.2A.3 (The amount and percentage changes are in relation to the previous corresponding period) 1. Results for the half year 1H 2017 1H 2016 $'000 $'000 1.1. Revenue from ordinary activities: 1.1.1 Revenue from ordinary continuing activities: ERM Power Limited and controlled entities up 5% to 1,340,505 1,282,471 1.2. Profit from ordinary continuing activities: 1.2.1. -

Stanwell Corporation Limited's Assets

The Energy Efficiency Opportunities program – experience from industry September 2011 Overview • Stanwell Corporation Limited • Electricity sector in Australia • Energy Efficiency Opportunities Act (EEO) – Overview and intend of legislation – EEO Framework – EEO versus Energy Audit/Energy Management System – EEO extension to the generation sector • EEO alignment with industry needs Stanwell Corporation Limited Stanwell Corporation Limited’s assets Stanwell Power Station 1,400 MW Tarong Power Station 1,400 MW Tarong North Power Station 443 MW Collinsville Power Station 195MW Swanbank E 385MW Northern Hydros and Wivenhoe Small 183 MW Hydro/Peaking Plant (Mackay Gas Turbine) Total 4,006 MW Electricity sector in Australia Businesses: 57 Revenue: $20.9bn Profit: $3.8bn Annual growth: 7.4% Wages: $1.0bn The Energy Efficiency Opportunities Act covers electricity generation sector – 01 July 2011 Overview of the EEO Act • Targets industrial energy efficiency • Coverage • Assess, identify and report • Program cycles • Objectives EEO Assessment Framework •Leadership •People •Information, data and analysis •Opportunity identification and evaluation •Decision making •Communicating outcomes How can EEO add value to companies? • Challenges systems and assumptions • Triple Bottom Line improvement • Reduces energy use and greenhouse gas emissions • Increases internal communication • Empowers in-house personnel • Board visibility • DRET 2010 report - Identified opportunities save pa – 141.9PJ energy use (2.5% Australia’s total) – 11.2million tonnes emissions (2% Australia’s totals) – $1.2billion EEO - alignment with industry needs • Early consultation with industry • Leverages off existing business activities • Provides extensive support material, skills and guidance • Information exchange • Promotion – case studies • Interaction – Listen, understand and act • Ideas for improvement thank you Gabriele Sartori +61 437 711 871 [email protected]. -

2014-15 Annual Report

ANNUAL REPORT 2014/15 DIVERSIFIED ENERGY ABOUT ABOUT THIS REPORT STANWELL This report provides an overview of the major initiatives Stanwell is a diversified energy business. and achievements of Stanwell Corporation Limited We own coal, gas and water assets, which we (Stanwell) as well as the business’ financial and use to generate electricity; we sell electricity non-financial performance for the 12 months ended directly to business customers; and we trade 30 June 2015. gas, coal and electricity products. Each year, we document the nature and scope of our strategies, objectives and actions in our Statement of With a generating capacity of more than 4,000 megawatts (MW), Stanwell is the largest Corporate Intent. The Statement of Corporate Intent electricity generator in Queensland. We have the represents our performance agreement with our capacity to supply approximately 45 per cent of shareholding Ministers. Our performance against our the State’s peak electricity requirements through 2014/15 Statement of Corporate Intent is summarised our coal, gas and hydro generation assets. on pages 3 to 19. We are a proud generator of environmentally- Electronic versions of this and previous years’ reports responsible energy. Through our portfolio of hydro are available online at www.stanwell.com or from power stations, we generate more than 150 MW Stanwell’s Stakeholder Engagement team on of clean energy. We also operate two of Australia’s 1800 300 351. most efficient coal-fired power stations: the supercritical 443 MW Tarong North Power Station and the sub-critical 1,460 MW Stanwell Power Station. We have undertaken a number of initiatives to optimise the efficiency of our coal-fired plant and reduce emissions. -

Final Report

BLACK SYSTEM SOUTH AUSTRALIA 28 SEPTEMBER 2016 Published: March 2017 BLACK SYSTEM SOUTH AUSTRALIA 28 SEPTEMBER 2016 – FINAL REPORT IMPORTANT NOTICE Purpose AEMO has prepared this final report of its review of the Black System in South Australia on Wednesday 28 September 2016, under clauses 3.14 and 4.8.15 of the National Electricity Rules (NER). This report is based on information available to AEMO as of 23 March 2017. Disclaimer AEMO has been provided with data by Registered Participants as to the performance of some equipment leading up to, during, and after the Black System. In addition, AEMO has collated information from its own systems. Any views expressed in this update report are those of AEMO unless otherwise stated, and may be based on information given to AEMO by other persons. Accordingly, to the maximum extent permitted by law, AEMO and its officers, employees and consultants involved in the preparation of this update report: make no representation or warranty, express or implied, as to the currency, accuracy, reliability or completeness of the information in this update report; and, are not liable (whether by reason of negligence or otherwise) for any statements or representations in this update report, or any omissions from it, or for any use or reliance on the information in it. © 2017 Australian Energy Market Operator Limited. The material in this publication may be used in accordance with the copyright permissions on AEMO’s website. Australian Energy Market Operator Ltd ABN 94 072 010 327 www.aemo.com.au [email protected] NEW SOUTH WALES QUEENSLAND SOUTH AUSTRALIA VICTORIA AUSTRALIAN CAPITAL TERRITORY TASMANIA WESTERN AUSTRALIA BLACK SYSTEM SOUTH AUSTRALIA 28 SEPTEMBER 2016 – FINAL REPORT NER TERMS, ABBREVIATIONS, AND MEASURES This report uses many terms that have meanings defined in the National Electricity Rules (NER). -

Snowtown Wind Farm Stage 2 Investor and Analyst Briefing 26 July 2012 July 2012

Snowtown Wind Farm Stage 2 Investor and Analyst Briefing 26 July 2012 Disclaimer The information set out below relates to future matters, that are subject to a number of risks and uncertainties (many of which are beyond the control of TrustPower, which may cause the actual results, performance or achievements of TrustPower or the TrustPower Group to be materially different from the future results set out below. The inclusion of the forward- looking information below should not be regarded as a representation or warranty by TrustPower, the directors of TrustPower or any other person that those forwar d-loo king s ta temen ts w ill be ac hieve d or tha t the assump tions underlying any forward-looking statements will in fact be correct. Date: 26-Jul-12 Snowtown Wind Farm Stage 2: Investor and analyst briefing 2 Outline • Key project information • Wind farm contract suite • Construction timetable • Approvals and regulatory framework • Project economics • Financing • Sale of Snowtown 2 South – update Date: 26-Jul-12 Snowtown Wind Farm Stage 2: Investor and analyst briefing 3 Project summary • Site located 140 km north of Adelaide • 100 MW Stage 1 commissioned in 2008 – 44% long-term cappyacity factor, ,p prior to Stag e 2 • Stage 2: 270 MW, split into two separate wind farms – 90 × 3 MW turbines – 48 turbines for Snowtown 2 North (144 MW) – 42 turbines for Snowtown 2 South (126 MW) • Total expected project cost ≤ A$439m •Cappyacity factor for Stag e 2 ≈ 42% (()40% North and 44% South) • PPAs cover 100% of Stage 2 output Date: 26-Jul-12 Snowtown