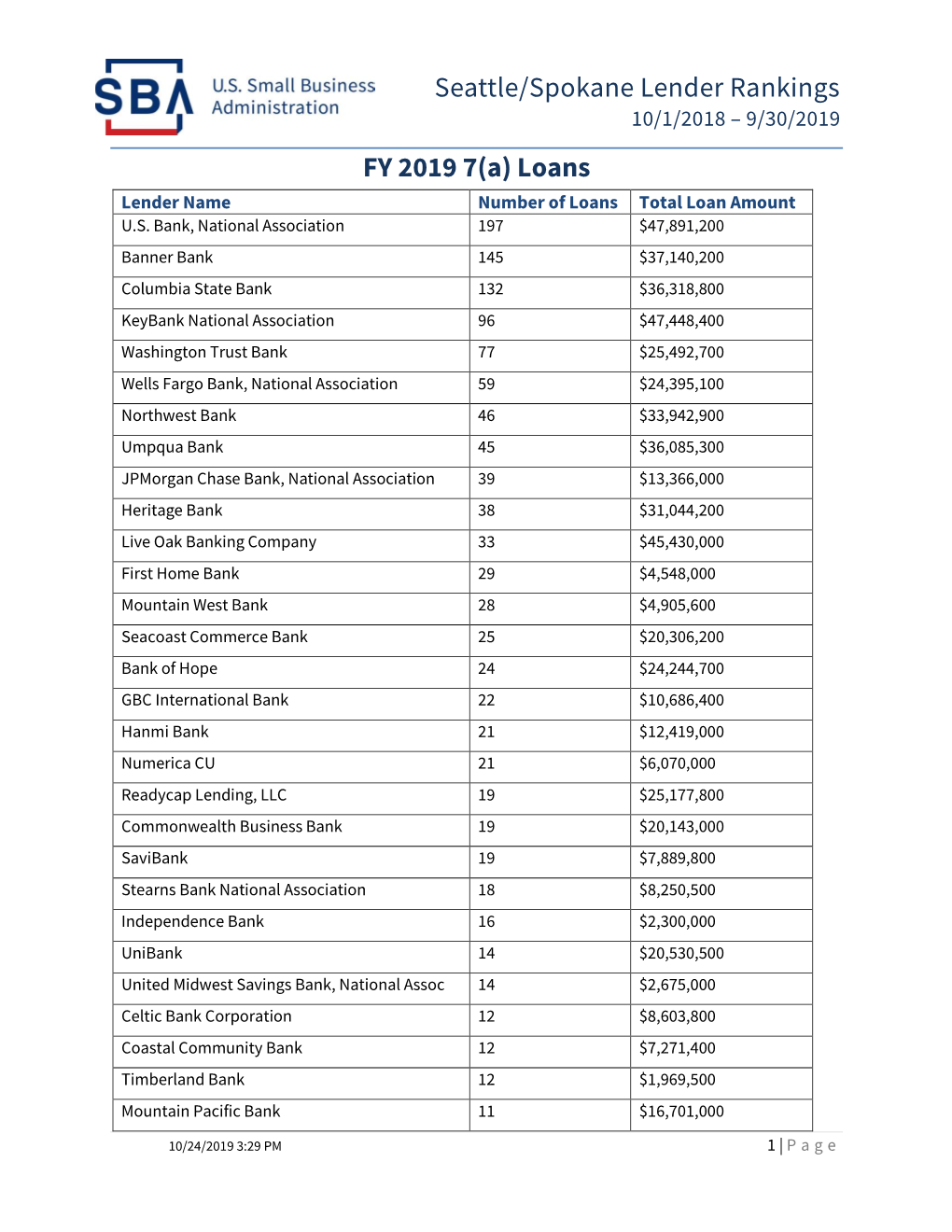

Seattle/Spokane Lender Rankings FY 2019 7(A) Loans

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Social Issues in Selected Recent Mergers and Acquisitions Transactions 2004-2020 Supplement

SOCIAL ISSUES IN SELECTED RECENT MERGERS AND ACQUISITIONS TRANSACTIONS 2004-2020 SUPPLEMENT By: Michael T. Holick, Esq. Jun Won Kim, Esq. Justin Stone May 5, 2020 ____________ Copyright © 2020 Simpson Thacher & Bartlett LLP. All Rights Reserved. Mr. Holick is a member, Mr. Kim is an associate and Mr. Stone is a law clerk, of the firm of Simpson Thacher & Bartlett LLP. The authors would like to acknowledge Robert E. Spatt, who authored eight versions of this memorandum during his time as a leading M&A partner of Simpson Thacher & Bartlett LLP—his invaluable leadership, guidance and years of dedication to this memorandum will be long remembered! Also, as a renowned scholar, Mr. Spatt has published various articles on M&A subjects and regularly serves as a faculty member for leading M&A seminars and institutes as the Co- Chairman Emeritus of the Tulane Corporate Law Institute, one of the country’s leading M&A institutes. All or part of this article may have been or may be used in other materials published by the authors or their colleagues. Simpson Thacher & Bartlett LLP Social Issues In Selected Recent Mergers And Acquisitions Transactions 2004-2020 Supplement This memorandum is a supplement of an earlier memorandum (the “April 2004 Memorandum”), attached as Exhibit I, prepared by attorneys at Simpson Thacher & Bartlett LLP, that addressed social issues in selected 2003 and early 2004 mergers and acquisitions transactions (and which in turn updated a prior memorandum covering earlier periods). Readers should review the April 2004 Memorandum for a substantive review of the issues and concepts applicable to this analysis. -

SBA Participating 7A Lenders in Colorado (Colorado Based Lenders in Bold)

SBA Participating 7a Lenders in Colorado (Colorado Based Lenders in Bold) 5 Star Bank Canvas CREDIT UNION Accion Canvas CREDIT UNION Adams Bank & Trust Celtic Bank Corporation Alamosa State Bank Champion Bank Alpine Bank Choice Financial Group America First FEDERAL CREDIT UNION CIBC Bank USA American Bank of Commerce Citizens Bank Ameris Bank Citywide Banks AMG National Trust Bank CoastalStates Bank ANB Bank Colorado Lending Source, Ltd. Atlantic Capital Bank, National Association Commerce Bank Bank of America, National Association Commonwealth Business Bank Bank of Colorado Community Banks of Colorado, A Division of Bank of Estes Park Crestmark Bank Bank of George CRF Small Business Loan Company, LLC Bank of Hope Custer Federal State Bank Bank of the West Del Norte Bank BankUnited, National Association Denver Community CREDIT UNION BBVA USA Denver Investment Advisors LLC Bellco CREDIT UNION Dubuque Bank and Trust Company Berkshire Bank Ent CREDIT UNION BOKF, National Association Evergreen National Bank Busey Bank Evolve Bank & Trust Byline Bank Farmers & Stockmens Bank Cache Bank & Trust Farmers Bank Cache Valley Bank Farmers State Bank Cadence Bank, National Association Farmers State Bank of Calhan Fidelity Bank, A Division of Hanmi Bank Fifth Third Bank High Country Bank First American State Bank High Plains Bank First Bank Home Loan State Bank First Bank Financial Centre HomeTrust Bank First Business Bank Immito, LLC First Colorado National Bank InBank First FarmBank IncredibleBank First Financial Bank Independence Bank First Home -

Top Investors Dallas Regional Chamber

DALLAS REGIONAL CHAMBER | TOP INVESTORS DALLAS REGIONAL CHAMBER REGIONAL DALLAS JBJ Management Norton Rose Fulbright Silicon Valley Bank The Fairmont Hotel Top Investors JE Dunn Construction NTT DATA Inc. Simmons Bank The Kroger Co. Jim Ross Law Group PC Omni Dallas Hotel Slalom The University of The Dallas Regional Chamber (DRC) recognizes the following companies and organizations for their membership investment at JLL Omniplan, Inc. Smoothie King Texas at Arlington one of our top levels. Companies in bold print are represented on the DRC Board of Directors. For more information about the Jones Day Omnitracs, LLC SMU - Southern Methodist Thompson & Knight LLP University benefits of membership at these levels call (214) 746-6600. JPMorgan Chase & Co. Oncor Thompson Coburn Southern Dock Products Katten Muchin Rosenman LLP On-Target Supplies Thomson Reuters Southern Glazer’s Wine and KDC Real Estate Development & & Logistics Ltd TIAA Spirits 1820 Productions Bell Nunnally Crowe LLP Google Investments Options Clearing Corporation T-Mobile | Southwest Airlines 4Front Engineered Solutions BGSF CSRS goPuff TOP INVESTORS Ketchum Public Relations Origin Bank Tom Thumb - Albertsons 7-Eleven, Inc. Billingsley Company CyrusOne Granite Properties Southwest Office Systems, Inc. Kilpatrick Townsend ORIX Corporation USA Town of Addison A G Hill Partners LLC BKD LLP Dallas Baptist University Grant Thornton LLP & Stockton LLP Spacee Inc. OYO Hotels and Homes Toyota Motor North America ABC Home & Commercial bkm Total Office of Texas Dallas College Green Brick Partners Kimberly-Clark Corporation Spectra Pacific Builders Transworld Business Advisors - Services Kimley-Horn and Associates Spencer Fane LLP Blackmon Mooring & BMS CAT Dallas Cowboys Football Club Greenberg Traurig Pape-Dawson Downtown Dallas Accenture Ltd. -

Mclagan U.S. Commercial & Multifamily Real Estate Finance

McLagan U.S. Commercial & Multifamily Real Estate Finance Compensation Survey Our comprehensive survey report provides key data on professionals across the major functions/ areas within the Commercial Real Estate Finance industry. Our process enables us to collect data by function, specialization, and business or product group. Our survey collects data on an incumbent-level basis for professionals across major We’re here to functions and roles within the commercial and multifamily real estate finance industry. empower results Contact our team today to Survey elements include: Survey scoping factors include: learn more about McLagan’s survey products. • Base Salary • Long-term / Deferred • Total Cash • Geographic Region • Bonus % of Salary Awards • Total Compensation • Number of Employees Dave Rosenthal • Cash Bonus • Overtime 1.203.326.4349 • Commissions [email protected] For more information on We focus on key positions: McLagan, visit mclagan.aon.com • Asset Pricing & Appraisal • Loan Operations • Physical Asset Management • Commercial Mortgage Backed Securities • Loan Origination • Portfolio Management • Divisional Management • Loan Servicing • Product Specialist • Investor Reporting • Loan Workout • Syndications • Loan Closing • Mezzanine Finance • Underwriting • Loan Documentation & Processing • Multifamily & Affordable Housing Key dates Global benchmarking and advisory solutions customized to your business needs February - March Access to MBA HR Symposium: McLagan presents key human capital trends as part of the roundtable. This HR Symposium, hosted Survey launch / matching calls by the MBA, also serves as a forum to network with colleagues throughout the mortgage banking industry. Data collection is distributed Advisory Solutions: Our consulting approach is customized by project and includes functional benchmarking, pay and performance April analysis, incentive plan review and design, cost to market analysis, and custom market practice studies. -

Rank the Banks Texas – 2018 Q1 Disclosure Statement

Rank The Banks Texas – 2018 Q1 Disclosure Statement This material has been prepared by Banks Street Partners, LLC and its affiliate BSP Securities, LLC (collectively, “BSP”) from certain publicly available and third-party subscriptions. It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. It is provided for informational purposes, intended for your use only, and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. The information provided is not intended to provide a sufficient basis on which to make an investment decision. The information provided herein is as of the dates disclosed and does not constitute forward looking statements. The conclusions supported by this information is subject to change at any time without notice. BSP may, from time to time, participate or invest in transactions with issuers of securities that participate in the markets referred to herein, perform services for or solicit business from such issuers, and/or have a position or effect transactions in the securities or derivatives thereof. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. The information set forth above has been obtained from or based upon sources believed by BSP to be reliable, but BSP do not represent or warrant its accuracy or completeness and is not responsible for losses or damages arising out of errors, omissions or changes in market factors. This material does not purport to contain all of the information that an interested party may desire and, in fact, provides only a limited view of a particular market. -

Federal Home Loan Bank of Dallas Community Support Program

Federal Home Loan Bank of Dallas Community Support Program The following members are required to submit a Community Support Statement to the Federal Housing Finance Agency by October 29, 2021. Member City State Southern Bancorp Bank Arkadelphia AR First National Banking Company Ash Flat AR RiverWind Bank Augusta AR First Community Bank Batesville AR The Citizens Bank Batesville AR The First National Bank of North Arkansas Berryville AR Farmers Bank & Trust Company Blytheville AR First Western Bank Booneville AR FNB of Izard County Calico Rock AR Bank of Cave City Cave City AR Centennial Bank Conway AR Chambers Bank Danville AR Arkansas County Bank De Witt AR Bank of Delight Delight AR First State Bank of De Queen Dequeen AR Merchants and Farmers Bank Dumas AR First Financial Bank El Dorado AR Bank of England England AR Bank of Eureka Springs Eureka Springs AR Arvest Bank Fayetteville AR Priority Bank Fayetteville AR Signature Bank of Arkansas Fayetteville AR FBT Bank & Mortgage Fordyce AR Armor Bank Forrest City AR The FNB of Fort Smith Fort Smith AR Bank of Gravette Gravett AR Anstaff Bank Green Forest AR First Service Bank Greenbrier AR Partners Bank Helena AR Horatio State Bank Horatio AR Today's Bank Huntsville AR First Arkansas Bank & Trust Jacksonville AR Arkansas Federal Credit Union Jacksonville AR Bank of Lake Village Lake Village AR Bank of Little Rock Little Rock AR Bank OZK Little Rock AR Eagle Bank & Trust Company Little Rock AR Encore Bank Little Rock AR ManhattanLife Assurance Company of America Little Rock AR USAble Mutual Insurance Company Little Rock AR Central Bank Little Rock AR First State Bank Lonoke AR Farmers Bank & Trust Co. -

PPP Lender Activity Lookup.Xlsx

Texas Lenders participating in PPP Lender Name Project State Frost Bank TX JPMorgan Chase Bank, National Association TX BBVA USA TX Zions Bank, A Division of TX PlainsCapital Bank TX Allegiance Bank TX First Financial Bank, National Association TX Texas Capital Bank, National Association TX Prosperity Bank TX BOKF, National Association TX Independent Bank TX Amarillo National Bank TX First United Bank and Trust Company TX Comerica Bank TX Third Coast Bank SSB TX Cadence Bank, National Association TX Truist Bank d/b/a Branch Banking & Trust TX Co BancorpSouth Bank TX Broadway National Bank TX Veritex Community Bank TX Bank of America, National Association TX CommunityBank of Texas, National TX Association KeyBank National Association TX Spirit of Texas Bank, SSB TX Southside Bank TX Woodforest National Bank TX Regions Bank TX Updated as of April 23, 2020 Origin Bank TX Readycap Lending, LLC TX Inwood National Bank TX Happy State Bank TX WestStar Bank TX International Bank of Commerce TX The American National Bank of Texas TX Texas Security Bank TX Texas Bank and Trust Company TX Horizon Bank, SSB TX Simmons Bank TX Guaranty Bank & Trust, National TX Association City Bank TX Wallis Bank TX American Momentum Bank TX The Bank of San Antonio TX IBERIABANK TX FirstCapital Bank of Texas, National TX Association BMO Harris Bank National Association TX Austin Bank, Texas National Association TX Affiliated Bank, National Association TX Texas First Bank TX Vantage Bank Texas TX Citizens National Bank of Texas TX VeraBank, National Association TX -

PPP Lenders in the Houston District in 2020

PPP Lenders in the Houston District in 2020 1st National Bank of Texas Fayetteville Bank Accion First Bank of the Lake Affiliated Bank, National Association First Citizens Bank Allegiance Bank First Community Bank Amerant Bank, National Association First Community CU Ameris Bank First Financial Bank, National Association American Bank First Home Bank American First National Bank First Horizon Bank American Momentum Bank First National Bank American State Bank First National Bank of Alvin Amegy Bank First National Bank of Anderson Anahuac National Bank First National Bank of Huntsville Associated CU of Texas First National Bank of Jasper Austin Bank, Texas National Association First National Bank Texas Austin County State Bank First Service Credit Union BancorpSouth Bank First State Bank (Manvel) Bank of America, National Association First State Bank of Texas Bank of Brenham, N.A. First Capital Bank of Texas, National Association Bank of Hope First-Citizens Bank & Trust Company Bank of Houston, National Association Frost Bank Bank OZK Golden Bank, National Association Bank of Texas Guaranty Bank & Trust, National Association BBVA USA Gulf Capital Bank Brazos Valley Schools Credit Union Hancock Whitney Bank Cadence Bank, National Association Hanmi Bank Capital Bank Hometown Bank, National Association Capital One, National Association Houston FCU Cathay Bank HSBC Bank USA, National Association Central Bank Independent Bank Citizens Bank Industry State Bank Citizens Bank, National Association International Bank of Commerce Citizens National -

Quarterly Fiscal Holdings

American Century Investments® Quarterly Portfolio Holdings Strategic Allocation: Aggressive Fund April 30, 2021 Strategic Allocation: Aggressive - Schedule of Investments APRIL 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) AFFILIATED FUNDS(1) — 48.5% American Century Diversified Corporate Bond ETF 288,278 15,027,384 American Century Focused Dynamic Growth ETF 576,449 45,907,073 American Century Focused Large Cap Value ETF 965,996 57,732,751 American Century Quality Diversified International ETF 635,075 32,780,603 American Century STOXX U.S. Quality Growth ETF 678,784 45,470,993 American Century STOXX U.S. Quality Value ETF 1,176,080 58,000,973 Avantis Emerging Markets Equity ETF 458,877 30,955,842 Avantis International Equity ETF 493,981 30,809,595 Avantis International Small Cap Value ETF 168,300 10,887,327 Avantis U.S. Equity ETF 834,426 60,537,606 Avantis U.S. Small Cap Value ETF 265,514 19,621,485 TOTAL AFFILIATED FUNDS (Cost $306,940,548) 407,731,632 COMMON STOCKS — 32.1% Aerospace and Defense — 0.5% Babcock International Group plc(2) 78,357 311,872 BAE Systems plc 137,004 957,004 CAE, Inc.(2) 5,109 160,027 General Dynamics Corp. 4,198 798,586 Lockheed Martin Corp. 1,637 622,977 Mercury Systems, Inc.(2) 2,987 224,742 Safran SA(2) 3,561 531,688 Spirit AeroSystems Holdings, Inc., Class A 3,887 177,597 Textron, Inc. 7,526 483,470 4,267,963 Air Freight and Logistics — 0.1% Expeditors International of Washington, Inc. 2,182 239,715 United Parcel Service, Inc., Class B 3,285 669,680 909,395 Airlines — 0.2% Alaska Air Group, Inc.(2) 1,132 78,266 Ryanair Holdings plc, ADR(2) 2,689 314,210 Southwest Airlines Co.(2) 16,241 1,019,610 1,412,086 Auto Components — 0.4% Aptiv plc(2) 11,077 1,593,869 BorgWarner, Inc. -

Wheaton Bank & Trust Company, National

Wheaton Bank & Trust Company, National DE Association Noah Bank DE F & M Bank and Trust Company DE Synovus Bank DE Bank of the West DE Sunwest Bank DE Central Pacific Bank DE First American Bank DE U.S. Bank, National Association DE Peoples Community Bank DE PromiseOne Bank DE First Financial Bank DE Intuit Financing Inc. DE Savoy Bank DE Truist Bank d/b/a Branch Banking & Trust FL Co City National Bank of Florida FL CenterState Bank, National Association FL BankUnited, National Association FL Regions Bank FL JPMorgan Chase Bank, National Association FL PNC Bank, National Association FL Valley National Bank FL IBERIABANK FL Synovus Bank FL TD Bank, National Association FL Centennial Bank FL Seacoast National Bank FL Bank of America, National Association FL Hancock Whitney Bank FL BBVA USA FL The Bank of Tampa FL Ameris Bank FL Fifth Third Bank FL First Home Bank FL Readycap Lending, LLC FL Seaside National Bank & Trust FL Professional Bank FL ServisFirst Bank FL First Florida Integrity Bank FL Cogent Bank FL First Federal Bank FL Updated as of April 23, 2020 Capital City Bank FL Ocean Bank FL KeyBank National Association FL First Horizon Bank FL Amerant Bank, National Association FL BMO Harris Bank National Association FL Trustmark National Bank FL One Florida Bank FL Citizens Bank and Trust FL Citizens First Bank FL First-Citizens Bank & Trust Company FL Ally Bank FL Bank of Central Florida FL Bank OZK FL FirstBank Puerto Rico FL Pilot Bank FL Citibank, N.A. FL Cadence Bank, National Association FL Prime Meridian Bank FL First Citrus Bank FL Newtek Small Business Finance, Inc. -

Accepted Lenders with City and State-2020-12-31-14-49-16.Xlsx

Main Street Lending Program ‐ Accepted Lenders As of 2020‐12‐31 14:49:16 Eastern Standard Time/EST Lender Institution Name Lender City Lender State 1ST CONSTITUTION BANK CRANBURY NJ 1ST STATE BANK SAGINAW MI 1ST SUMMIT BANK JOHNSTOWN PA ABANCA CORP BANCARIA MIAMI BR MIAMI FL ACADEMY BANK, N.A. KANSAS CITY MO ACCESS BANK OMAHA NE ADAMS BANK & TRUST OGALLALA NE AFFILIATED BANK, NATIONAL ASSOCIATION BEDFORD TX AIMBANK LITTLEFIELD TX ALERUS FINANCIAL, NATIONAL ASSOCIATION GRAND FORKS ND ALLEGIANCE BANK HOUSTON TX ALLIANCE BANK LAKE CITY MN ALLIED FIRST BANK, SB OSWEGO IL ALMA BANK ASTORIA NY ALTAMAHA BANK AND TRUST COMPANY VIDALIA GA AMERANT BANK, NATIONAL ASSOCIATION CORAL GABLES FL AMERICAN BANK & TRUST WESSINGTON SPRINGS SD AMERICAN BANK & TRUST COMPANY INC. BOWLING GREEN KY AMERICAN BANK AND TRUST COMPANY TULSA OK AMERICAN BANK OF COMMERCE WOLFFORTH TX AMERICAN BANK, NATIONAL ASSOCIATION LE MARS IA AMERICAN BANK, NATIONAL ASSOCIATION DALLAS TX AMERICAN BUSINESS BANK LOS ANGELES CA AMERICAN EQUITY BANK MINNETONKA MN AMERICAN NATIONAL BANK OF TEXAS, THE TERRELL TX AMERICAN STATE BANK ARP TX AMERICA'S CHRISTIAN CREDIT UNION GLENDORA CA AMERIS BANK ATLANTA GA AMERISERV FINANCIAL BANK JOHNSTOWN PA ANB BANK DENVER CO ANECA FEDERAL CREDIT UNION SHREVEPORT LA APEX BANK CAMDEN TN APOLLO BANK MIAMI FL AQUESTA BANK CORNELIUS NC ARVEST BANK FAYETTEVILLE AR ASSOCIATED BANK, NATIONAL ASSOCIATION GREEN BAY WI ATLANTIC CAPITAL BANK, NATIONAL ASSOCIATION ATLANTA GA AXOS BANK SAN DIEGO CA B1BANK BATON ROUGE LA BANC OF CALIFORNIA, NATIONAL ASSOCIATION SANTA -

Texas Capital Bancshares, Inc

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the fiscal year ended December 31, 2020 ☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the transition period from to Commission file number 001-34657 TEXAS CAPITAL BANCSHARES, INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 75-2679109 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 2000 McKinney Avenue Suite 700 Dallas TX USA 75201 (Address of principal executive offices) (Zip Code) 214/932-6600 (Registrant’s telephone number, including area code) N/A (Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report) Securities registered under Section 12(b) of the Exchange Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.01 per share TCBI Nasdaq Stock Market 6.5% Non-Cumulative Perpetual Preferred Stock Series A, par value $0.01 per share TCBIP Nasdaq Stock Market Securities registered under Section 12(g) of the Exchange Act: None Indicate by check mark if the issuer is a well-known seasoned issuer pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the issuer is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.