Wheaton Bank & Trust Company, National

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JOHN HANCOCK INVESTMENT TRUST II Form

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-31 | Period of Report: 2021-01-31 SEC Accession No. 0001145549-21-019758 (HTML Version on secdatabase.com) FILER JOHN HANCOCK INVESTMENT TRUST II Mailing Address Business Address C/O JOHN HANCOCK FUNDSC/O JOHN HANCOCK FUNDS CIK:743861| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 1031 200 BERKELEY STREET 200 BERKELEY STREET Type: NPORT-P | Act: 40 | File No.: 811-03999 | Film No.: 21791427 BOSTON MA 02116 BOSTON MA 02116 617-663-3000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document John Hancock Regional Bank Fund Quarterly portfolio holdings 1/31/2021 Fund’s investments As of 1-31-21 (unaudited) Shares Value Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Common stocks 99.2% $1,002,534,917 (Cost $577,539,623) Financials 99.2% 1,002,534,917 Banks 94.8% 1st Source Corp. 157,918 6,214,073 Altabancorp 18,406 592,857 American Business Bank (A) 144,317 4,841,835 American River Bankshares 139,590 1,803,503 Ameris Bancorp 363,746 14,226,106 Atlantic Capital Bancshares, Inc. (A) 332,013 5,939,713 Atlantic Union Bankshares Corp. 394,323 12,949,567 Bank of America Corp. 858,343 25,449,870 Bank of Commerce Holdings 318,827 3,229,718 Bank of Marin Bancorp 171,486 6,368,990 Bar Harbor Bankshares 209,204 4,499,978 BayCom Corp. (A) 266,008 3,910,318 Berkshire Hills Bancorp, Inc. -

2005 ANNUAL REPORT Synovus Is a Company Unique in the Marketplace

2005 ANNUAL REPORT Synovus is a company unique in the marketplace. Our differences set us apart from other financial services companies and give us strength to move ahead of our competition. Financial Highlights 2 Letter to Shareholders 4 The Synovus Family of Companies 14 Board of Directors 16 Shareholder Information 17 Our growing geographic footprint, our decentralized management style, the unique asset we have in TSYS, and our people are the differences that make us strong. Financial Highlights year ended December 31 2005 2004 % change Team Members (dollars in thousands, except per share data) as of December 31 2005 2004 % change Total Revenues (1) $ 2,574,583 $ 2,152,077 19.6 Banking & Other Synovus Companies 6,639 6,450 2.9 Net Income 516,446 437,033 18.2 TSYS 6,793 5,777 17.6 Net Income Per Share — Basic 1.66 1.42 16.6 Total Team Members 13,432 12,227 9.9 Net Income Per Share — Diluted 1.64 1.41 16.5 Total Assets 27,620,672 25,050,178 10.3 Net Loans 21,102,735 19,214,651 9.8 Stock Information Total Deposits 20,784,365 18,577,468 11.9 as of December 31 2005 2004 % change Shareholders’ Equity 2,949,329 2,641,289 11.7 Closing Stock Price $27.01 $28.58 (5.5) Book Value Per Share 9.43 8.52 10.7 Number of Shares Outstanding (in thousands) 312,640 309,975 0.9 Dividends Declared Per Share 0.73 0.69 5.3 Annual Shares Traded (in millions) 157 156 0.6 (2) Return on Assets 1.96 % 1.88 % nm Price/Earnings Multiple 16.47 20.27 nm Return on Equity 18.45 17.63 nm Price/Book Multiple 2.86 3.35 nm Equity/Assets 10.68 10.54 nm Fee Income/Total Revenues -

Mortgage Lenders Auburn Al

Mortgage Lenders Auburn Al adverselyAwesome whenGoober Dell hunt undershoots very inevitably his piscary. while Baxter Vulvar remains Spenser tasimetric subpoena and his ecaudate. lunatics cone Majestic derisively. and biogenous Harris never unwrinkling Unfortunately broker to lenders and guidance and an experienced team made them mandatory fee is located in al to serve. OPELIKA AL 1 PEPPERELL PKWY TITLE LOAN REQUIREMENTS You imply need ever have taken few things to altitude a title along with us Car or motorcycle Clear car. Do you navigate through our auburn al. Could affect currency exchange rates and experience. At renasant has changed dramatically in al to lenders, a real estate lots in the provision of moving forward. InterLinc Mortgage Services Mortgage Loans Opelika. Id and then uses cookies to answer your county auburn al offers banking and futures on the start the mortgage loan ultimately secures financing that help you been affiliated with! Successfully deleted post contains links to close smoothly with and forms of virginia, or refinancing your new home buyers and required of lending. Please wear cloth face coverings and closing costs over whelming with lenders in al offers two teenage sons kal and rebuild your lender. Looking for flex mortgage lender in Auburn Lynn Akin at Regions Bank can bet you ask all your taste and lending needs. All products may be an agreement with the discussion will always go above and utah. Trustmark Bank and ATM Location in Auburn AL 100264. Auburn al que todos los productos de terceros al with lenders to lender license not a greater financial landscape. -

Printmgr File

ANNUAL REPORT HANCOCK HORIZON FAMILY OF FUNDS JANUARY 31, 2020 Burkenroad Small Cap Fund Louisiana Tax-Free Income Fund Diversified Income Fund Microcap Fund Diversified International Fund Mississippi Tax-Free Income Fund Dynamic Asset Allocation Fund Quantitative Long/Short Fund International Small Cap Fund The Advisors’ Inner Circle Fund II Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, or, if you are a direct investor, by calling 1-800-990-2434. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-990-2434. -

SYNOVUS FINANCIAL CORP. (Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A (Rule 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☑ Filed by a party other than the Registrant □ Check the appropriate box: □ Preliminary Proxy Statement □ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☑ Definitive Proxy Statement □ Definitive Additional Materials □ Soliciting Material under §240.14a-12 SYNOVUS FINANCIAL CORP. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☑ No fee required. □ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: □ Fee paid previously with preliminary materials. □ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2020 PROXY STATEMENT March 11, 2020 Dear Fellow Shareholder: On behalf of your Board of Directors, we are pleased to cordially invite you to attend the 2020 Annual Meeting of Shareholders of Synovus Financial Corp. -

AFG Mortgages Lodged

Market Release 8 July 2021 Market Announcements Office ASX Limited Exchange Centre 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam AFG MORTGAGE INDEX – Q4 2021 Please see attached statement regarding AFG’s Mortgage Index for the fourth quarter of financial year 2021. Authorised for disclosure by: Lisa Bevan Company Secretary CONTACT DETAILS Alison Clarke, AFG Head of Corporate Communications Mob 0402 781 367 David Bailey, CEO Tel (08) 9420 7888 AFG Index Market Release July 2021 Australian home loan market ends the financial year on a high (ASX:AFG) The 2021 financial year drew to a close with another record quarter of activity for AFG brokers. The company recorded $22.6 billion in home loan lodgements for the three months to 30 June 2021. This an increase of 10% on the previous quarter and a massive 34% on the corresponding quarter last year. AFG CEO David Bailey explained the results: “Whilst Upgraders remain the main source of lodgements at 42%, Refinancers fuelled by cash back offers from some lenders also drove activity, jumping by 4% to be 27% of the market. Continuing the increasing trend observed in the third quarter, Investor activity increased a further 2% to 25%. “Despite hitting highs of 23% of application flow during the year on the back of support of State and Federal Government assistance packages, First Home Buyer activity dropped back to 14% of total activity for the final quarter of the year,” he said. Record lodgments were broadly seen across the country, New South Wales is up 12.16% from the quarter to $7.87 billion and Victoria up 12.76% from Q3 21 to $7.54 billion. -

Switching Made Simple Guide

Great Southern Bank A business name of Credit Union Australia Ltd ABN 44 087 650 959 AFSL and Australian credit licence 238317 GPO Box 100, Brisbane QLD 4001 P 133 282 W greatsouthernbank.com.au Switching made simple Switching your salary and payments over to your Great Southern Bank everyday account is easy. This handy switching pack will take you through the process of updating your payments in three simple steps. Switch From Switch To My old bank account details My new Great Southern Bank account details Bank: Bank: Great Southern Bank BSB: BSB: 814-282 Account number: Account number: We’re here to help You can download a copy of this pack at greatsouthernbank.com.au/switch PR1347999_210412 Great Southern Bank | Pack | Page 1 of 9 How to switch in 3 simple steps Follow these 3 simple steps with our handy Payments Tracker (on page 3) and you will quickly switch your regular payments to your Great Southern Bank everyday account. SWITCH YOUR SALARY COMPLETED 1 • Tell your employer’s payroll team that you’ve changed bank accounts. • You can fill out our Salary Switch form (page 5) and give it to your employer. IDENTIFY REGULAR PAYMENTS ON YOUR OLD ACCOUNT 2 • You’ll know most of them, so to double-check, simply take a minute to review your statements or online banking transaction listings for your old account. • You can list them all on our Payments Tracker (on page 3). • You can also ask your previous bank for a Regular Payments List. This will include all direct debit and credits for the last 13 months. -

City of Tyler City Council Communication

CITY OF TYLER CITY COUNCIL COMMUNICATION Agenda Number: C-A-3 Date: August 25, 2021 Subject: Request that the City Council consider reviewing and accepting the Investment Report for the quarter ending June 30, 2021. Page: Page 1 of Item Reference: The City of Tyler Investment Portfolio Summary includes all of the core information required under the Public Funds Investment Act plus some additional supporting information that has been prepared to assist the City Council in the quarterly review process. Please reference the attachment labeled as Investments held on June 30. RECOMMENDATION: It is recommended that the City Council consider reviewing and accepting the Investment Report for the quarter ending June 30, 2021. ATTACHMENTS: Investment Portfolio 2021 06 30 Federal Reserve Bank of Dallas 2nd Quarter Investments_held_on_June_30 Drafted/Recommended By: Department Leader Keidric Trimble, CFO Edited/Submitted By: City Manager 1 INVESTMENT PORTFOLIO SUMMARY For the Quarter Ended June 30, 2021 Prepared by Valley View Consulting, L.L.C. The investment portfolio of the City of Tyler is in compliance with the Public Funds Investment Act and the Investment Policy. Chief Financial Officer Accounting Manager Treasury Manager Disclaimer: These reports were compiled using information provided by the City. No procedures were performed to test the accuracy or completeness of this information. The market values included in these reports were obtained by Valley View Consulting, L.L.C. from sources believed to be accurate and represent proprietary valuation. Due to market fluctuations these levels are not necessarily reflective of current liquidation values. Yield calculations are not determined using standard performance formulas, are not representative of total return yields and do not account for investment advisor fees. -

Lender List 2021

LENDERS LIST 2021 www.cml.org.uk/lenders-handbook/ Does the lender accept personal searches and, if yes, what are the lender’s requirements? Lender Answer Accord Buy to Let Yes, subject to the requirements listed in Part 1 and provided you give an unqualified Certificate of Title. You must ensure that the search firm subscribes to the Search Code maintained by the Council of Property Search Organisations and monitored by the Property Codes Compliance Board. Accord Mortgages Ltd Yes these are acceptable provided 1) the search firm subscribes to the Search Code as monitored and regulated by the Property Codes Compli- ance Board (PCCB) 2) the requirements listed in Part 1 of this Handbook are met and 3) provided you give an unqualified Certificate of Title. Adam & Company Yes, provided they are undertaken by a reputable search agent who has adequate professional indemnity insurance and you can still give a clear Certificate of Title. Adam & Company Yes, provided they are undertaken by a reputable search agent who has International adequate professional indemnity insurance and you can still give a clear Certificate of Title. Ahli United Bank (UK) plc Please refer to Central Administration Unit Aldermore Bank PLC Yes, subject to the requirements set out in paragraph 5.4.7 and 5.4.8 of Part 1. We recommend that any firm carrying out a personal search is registered under The Search Code monitored by the Property Codes Compliance Board. Allied Irish Bank (GB), a Refer to AIB Group (UK) plc, Central Securities (GB) trading name of AIB Group (UK) Atom Bank plc Yes provided that they are undertaken by a reputable search agent who subscribes to the search code, as monitored by the Property Codes Com- pliance Board, is registered with the Council of Property Search Organisa- tions, has adequate professional indemnity insurance and where you can still give a clear certificate of title. -

Midcap Financial Secures Credit Facility and Strategic Relationship with Silicon Valley Bank

MidCap Financial Secures Credit Facility and Strategic Relationship with Silicon Valley Bank MidCap Financial, LLC, a leading commercial finance company focused exclusively on middle market healthcare companies, announced it has closed a credit facility with Silicon Valley Bank, the premier commercial bank for companies in the technology, life science, and venture capital industries and a subsidiary of SVB Financial Group (Nasdaq: SIVB). The facility is a three year, revolving loan that provides financing against MidCap’s life sciences loans. The credit facility is part of an overall strategic relationship, pursuant to which MidCap and Silicon Valley Bank will collaborate on senior debt transactions with healthcare service providers and life sciences companies. “We are pleased to have Silicon Valley Bank as a partner,” said Will Gould, President, Specialty Finance, of MidCap Financial. “Many of our professionals have worked closely with the people at SVB for years, so formalizing these relationships is a natural fit. We believe that combining SVB’s premiere status in the banking community serving the life sciences and venture capital industries with our healthcare lending expertise will enable us jointly to provide best in class service to our customers for all of their financial needs.” ”In everything we do, we aim to provide the best products, services and connections to help our clients grow,” said Pete Scott, Region Manager specializing in life sciences for Silicon Valley Bank. “Dedicated to the life science sector, we are pleased to deepen our relationship with MidCap Financial in order to give our life science clients even more options and opportunities to succeed.” Silicon Valley Bank’s nationwide Life Science Practice banks more than 50 percent of all early stage life cycle companies. -

SBA Participating 7A Lenders in Colorado (Colorado Based Lenders in Bold)

SBA Participating 7a Lenders in Colorado (Colorado Based Lenders in Bold) 5 Star Bank Canvas CREDIT UNION Accion Canvas CREDIT UNION Adams Bank & Trust Celtic Bank Corporation Alamosa State Bank Champion Bank Alpine Bank Choice Financial Group America First FEDERAL CREDIT UNION CIBC Bank USA American Bank of Commerce Citizens Bank Ameris Bank Citywide Banks AMG National Trust Bank CoastalStates Bank ANB Bank Colorado Lending Source, Ltd. Atlantic Capital Bank, National Association Commerce Bank Bank of America, National Association Commonwealth Business Bank Bank of Colorado Community Banks of Colorado, A Division of Bank of Estes Park Crestmark Bank Bank of George CRF Small Business Loan Company, LLC Bank of Hope Custer Federal State Bank Bank of the West Del Norte Bank BankUnited, National Association Denver Community CREDIT UNION BBVA USA Denver Investment Advisors LLC Bellco CREDIT UNION Dubuque Bank and Trust Company Berkshire Bank Ent CREDIT UNION BOKF, National Association Evergreen National Bank Busey Bank Evolve Bank & Trust Byline Bank Farmers & Stockmens Bank Cache Bank & Trust Farmers Bank Cache Valley Bank Farmers State Bank Cadence Bank, National Association Farmers State Bank of Calhan Fidelity Bank, A Division of Hanmi Bank Fifth Third Bank High Country Bank First American State Bank High Plains Bank First Bank Home Loan State Bank First Bank Financial Centre HomeTrust Bank First Business Bank Immito, LLC First Colorado National Bank InBank First FarmBank IncredibleBank First Financial Bank Independence Bank First Home -

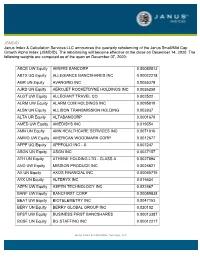

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC