City of Tyler City Council Communication

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

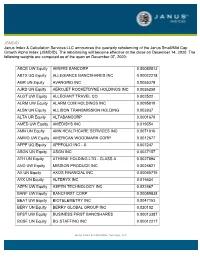

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

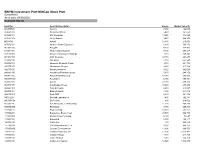

BNYM Investment Port:Midcap Stock Port (Unaudited) As of Date: 09/30/2020 Common Stocks

BNYM Investment Port:MidCap Stock Port (Unaudited) As of date: 09/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002535300 Aaron's 7,450 422,043 00404A109 Acadia Healthcare 5,480 161,550 004498101 ACI Worldwide 13,250 346,223 00508Y102 Acuity Brands 9,470 969,255 BD845X2 Adient 12,480 216,278 00737L103 Adtalem Global Education 6,800 166,872 00766T100 AECOM 4,170 174,473 018581108 Alliance Data Systems 7,130 299,317 01973R101 Allison Transmission Holdings 7,110 249,845 00164V103 AMC Networks 10,710 264,644 023436108 Amedisys 2,760 652,547 025932104 American Financial Group 3,310 221,704 03073E105 AmerisourceBergen 2,220 215,162 042735100 Arrow Electronics 5,620 442,069 04280A100 Arrowhead Pharmaceuticals 5,670 244,150 045487105 Associated Banc-Corp 47,940 605,003 05329W102 Autonation 6,980 369,451 05368V106 Avient 23,030 609,374 053774105 Avis Budget Group 10,600 278,992 05464C101 Axon Enterprise 2,410 218,587 062540109 Bank of Hawaii 4,830 244,012 06417N103 Bank OZK 6,630 141,352 090572207 Bio-Rad Laboratories 1,480 762,881 09073M104 Bio-Techne 880 218,002 05550J101 BJs Wholesale Club Holdings 11,270 468,269 09227Q100 Blackbaud 3,750 209,363 103304101 Boyd Gaming 18,350 563,162 105368203 Brandywine Realty Trust 93,500 966,790 11120U105 Brixmor Property Group 6,300 73,647 117043109 Brunswick 8,150 480,117 12685J105 Cable One 300 565,629 127190304 CACI International, Cl. A 3,980 848,377 12769G100 Caesars Entertainment 11,890 666,553 133131102 Camden Property Trust 11,390 1,013,482 134429109 Campbell Soup 4,440 -

Eligible Bank List

ELIGIBLE BANK LIST PRIME PARTNER BANKS Prime Partner Banks exceed eligibility requirements by paying the higher of 75% of the Federal Funds Rate or 0.75% to support the NC IOLTA program in its mission to ensure that low-income North Carolinians have access to critically-needed legal aid. Settlement Agent Accounts Only To learn more about Prime Partner Banks, contact NC IOLTA at 919-706-4431 or [email protected]. 06/10/2021 ELIGIBLE BANK LIST BENCHMARK BANKS Benchmark Banks are those that meet eligibility requirements by paying the higher of 65% of the Federal Funds Rate or 0.65% to support the NC IOLTA program in its mission. American Bank of the Carolinas Aquesta Bank Bank of America Pinnacle Bank PNC Bank Triad Business Bank COMPLETE LIST OF ELIGIBLE BANKS ~ JUNE 2021 Allegacy Federal Credit Union* First Horizon Bank Southern Bank* Alliance Bank & Trust* First National Bank of PA* Southern First Bank* American Bank of the Carolinas* First Reliance Bank* SunTrust Bank - Now Truist American National Bank* HomeTrust Bank* Surrey Bank Ameris Bank* IberiaBank* Taylorsville Savings Bank* Aquesta Bank* JP Morgan Chase* TD Bank* Atlantic Union Bank KS Bank* Touchstone Bank* Bank of America* LifeStore Bank* TowneBank* Bank of Oak Ridge* Lumbee Guaranty Bank* Triad Business Bank* Bank OZK* Mechanics and Farmers Bank TruPoint Bank* BB&T - Now Truist Morganton Savings Bank* Union Bank* Benchmark Community Bank* Nantahala Bank* United Bank* BlueHarbor Bank* North State Bank* United Community Bank* Carolina State Bank* Park National Bank US Bank* -

FEDERAL DEPOSIT INSURANCE CORPORATION Washington, D.C

FEDERAL DEPOSIT INSURANCE CORPORATION Washington, D.C. 20429 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of report (Date of earliest event reported): July 16, 2018 Bank OZK (Exact name of registrant as specified in its charter) Arkansas (State or other jurisdiction of incorporation) 110 71-0130170 (FDIC Certificate Number) (IRS Employer Identification No.) 17901 Chenal Parkway, Little Rock, Arkansas 72223 (Address of principal executive offices) (Zip Code) (501) 978-2265 (Registrant’s telephone number, including area code) Bank of the Ozarks (Former name or former address, if changed since last report) Check the appropriate box below if the form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.): ( ) Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ( ) Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ( ) Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ( ) Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Federal Home Loan Bank of Dallas Community Support Program

Federal Home Loan Bank of Dallas Community Support Program The following members are required to submit a Community Support Statement to the Federal Housing Finance Agency by October 29, 2021. Member City State Southern Bancorp Bank Arkadelphia AR First National Banking Company Ash Flat AR RiverWind Bank Augusta AR First Community Bank Batesville AR The Citizens Bank Batesville AR The First National Bank of North Arkansas Berryville AR Farmers Bank & Trust Company Blytheville AR First Western Bank Booneville AR FNB of Izard County Calico Rock AR Bank of Cave City Cave City AR Centennial Bank Conway AR Chambers Bank Danville AR Arkansas County Bank De Witt AR Bank of Delight Delight AR First State Bank of De Queen Dequeen AR Merchants and Farmers Bank Dumas AR First Financial Bank El Dorado AR Bank of England England AR Bank of Eureka Springs Eureka Springs AR Arvest Bank Fayetteville AR Priority Bank Fayetteville AR Signature Bank of Arkansas Fayetteville AR FBT Bank & Mortgage Fordyce AR Armor Bank Forrest City AR The FNB of Fort Smith Fort Smith AR Bank of Gravette Gravett AR Anstaff Bank Green Forest AR First Service Bank Greenbrier AR Partners Bank Helena AR Horatio State Bank Horatio AR Today's Bank Huntsville AR First Arkansas Bank & Trust Jacksonville AR Arkansas Federal Credit Union Jacksonville AR Bank of Lake Village Lake Village AR Bank of Little Rock Little Rock AR Bank OZK Little Rock AR Eagle Bank & Trust Company Little Rock AR Encore Bank Little Rock AR ManhattanLife Assurance Company of America Little Rock AR USAble Mutual Insurance Company Little Rock AR Central Bank Little Rock AR First State Bank Lonoke AR Farmers Bank & Trust Co. -

Stephens Bank Research Team

Stephens Bank Research Team – Upcoming Investor Events August 22, 2018 Non-Deal Roadshow 2018 Stephens Bank CEO Forum August, 2018 Company Name (Ticker) Company Name (Ticker) Company Name Day Location Allegiance Bancshares, Inc. (ABTX) LegacyTexas Financial Group (LTXB) BancorpSouth Bank (BXS) 22 Boston Ameris Bancorp (ABCB) Merchants Bancorp (MBIN) Banner Corp. (BANR) 28-29 New York, Boston Bank OZK, Inc. (OZK) Midland States Bancorp, Inc. (MSBI) September, 2018 BofI Holding, Inc. (BOFI) National Bank Holdings (NBHC) Company Name Day Location BOK Financial Corporation (BOKF) National Commerce Corp. (NCOM) F.N.B. Corporation (FNB) 11-12 Dallas, Houston Business First Bancshares (BFST) Old Line Bancshares (OLBK) Sterling Bancorp (STL) 19 Boston Byline Bancorp (BY) Old National Bancorp (ONB) November, 2018 Cadence Bancorporation (CADE) Origin Bancorp, Inc. (OBNK) Company Name Day Location CBTX, Inc. (CBTX) Pacific Premier Bancorp, Inc. (PPBI) Carolina Financial Corp. (CARO) 1-2 Kansas City, St. Louis, Dallas CenterState Banks (CSFL) PacWest Bancorp (PACW) Analyst Marketing Chemical Financial (CHFC) Pinnacle Financial (PNFP) August, 2018 City Holding Co (CHCO) Preferred Bank (PFBC) Analyst(s) Day Location County Bancorp (ICBK) Prosperity Bancshares (PB) Terry McEvoy / Austin Nicholas 22-24 New York Stephens 8th Annual Bank Eagle Bancorp (EGBN) RBB Bancorp, Inc. (RBB) Tyler Stafford, CFA 27 New York CEO Forum will take Equity Bancshares (EQBK) Renasant Corp (RNST) th Matt Olney, CFA / Austin Nicholas 28 San Francisco place September 24 – FB Financial Corporation (FBK) Simmons First National Corp (SFNC) 26th in Little Rock – See September, 2018 here for further details. Fidelity Southern Corporation (LION) SmartFinancial (SMBK) Analyst(s) Day Location First Bancshares (FBMS) South State Corporation (SSB) Tyler Stafford, CFA / Matt Olney, CFA 4-5 Kansas City, St. -

2Nd Quarter 2020

To: Mayor and Council From: Ron Olson, Finance Director Subject: Budget Update Date: July 24, 2020 Attachments: 1. Revenue Summary 2. Revenue Detail 3. Expenditure Summary 4. Expenditure Detail 5. Investment Information 6. Vendor Listing The first quarter General Fund year to date budget to actual comparisons are included with this memo. They are as of the end of June which represents 50% of the year. Revenues are currently at 55.0% of budget with expenditures at 44.43% of budget. General Fund Revenues At 55% of revenues the City is currently on pace to exceed revenues for the year. For comparison purposes, 2019 revenues at the end of the 2nd quarter were 59% and finished the year at 107% of budget. Tax revenues are at 45% of budget compared to 44% last year. However, this year Hennepin County allowed property taxes to be paid until July 15th without penalty so some collections have been delayed. It is estimated that once all the first half collections are received in July, that property tax revenues for the first half will be at 49% which is within the normal range of collections. While the revenues are looking good through June 30th, Covid 19 still remains a concern for later this year and early next year. Some states that have reopened their economies are seeing spikes in cases and hospitalizations. If this leads to another shutdown, this could affect our revenue streams. With this in mind, it would be wise to keep a close watch on expenditures the rest of this year. For revenues other than taxes, Licenses and permits are at 52% of budget. -

Partnering to Create Significant Strategic and Financial Value

Partnering to Create Significant Strategic and Financial Value May 17, 2021 Table of Contents I. Transaction Overview II. Merger Structure III. Summary 2 Section I. Transaction Overview Transaction Overview Combined Franchise Highlights Combining with Cornerstone Brings Scale Enhanced Through Partnership… $1.4B in Assets $0.9B in Loans $1.2B in Deposits …Resulting in a Franchise with Multiple Highly Compelling Attributes, Including: • Presence in key Southeastern markets including Atlanta, Savannah, and Hilton Head / Bluffton, SC • 10 branch locations post integration (2) • Pro forma franchise among the largest COSO (9 branches) (1) independent community banks in Atlanta Cornerstone (3 branches ) (2) (1) Inclusive of the Alpharetta and Sandy Springs branches opening Spring, 2021 (2) Certain Cornerstone locations are expected to be consolidated with existing CSB locations Source: S&P Global Market Intelligence 4 Transaction Overview Transaction Rationale Transaction Rationale . Capitalize on the ongoing dislocation within the Atlanta marketplace to create one of the few independent, $1+ billion community banks in Georgia and South Carolina, driving financial performance and immediately enhancing franchise scarcity value for shareholders of CoastalSouth Bancshares, Inc. (“CSB”) and Cornerstone Bancshares, Inc. (“Cornerstone”) Strategic Rationale . Creates a high-performing and well-capitalized community-focused commercial bank with a highly attractive level of scale in one of the largest metropolitan markets in the U.S. Offers broad opportunities for the pro forma organization to continue to pursue strategic initiatives, including organic and acquisitive growth strategies, as well as liquidity strategies . Extensive credit due diligence performed, with reviews completed by two, independent consulting firms, supplemental to the CSB team’s internal credit view Conservatively . -

PPP Lenders in the Houston District in 2020

PPP Lenders in the Houston District in 2020 1st National Bank of Texas Fayetteville Bank Accion First Bank of the Lake Affiliated Bank, National Association First Citizens Bank Allegiance Bank First Community Bank Amerant Bank, National Association First Community CU Ameris Bank First Financial Bank, National Association American Bank First Home Bank American First National Bank First Horizon Bank American Momentum Bank First National Bank American State Bank First National Bank of Alvin Amegy Bank First National Bank of Anderson Anahuac National Bank First National Bank of Huntsville Associated CU of Texas First National Bank of Jasper Austin Bank, Texas National Association First National Bank Texas Austin County State Bank First Service Credit Union BancorpSouth Bank First State Bank (Manvel) Bank of America, National Association First State Bank of Texas Bank of Brenham, N.A. First Capital Bank of Texas, National Association Bank of Hope First-Citizens Bank & Trust Company Bank of Houston, National Association Frost Bank Bank OZK Golden Bank, National Association Bank of Texas Guaranty Bank & Trust, National Association BBVA USA Gulf Capital Bank Brazos Valley Schools Credit Union Hancock Whitney Bank Cadence Bank, National Association Hanmi Bank Capital Bank Hometown Bank, National Association Capital One, National Association Houston FCU Cathay Bank HSBC Bank USA, National Association Central Bank Independent Bank Citizens Bank Industry State Bank Citizens Bank, National Association International Bank of Commerce Citizens National -

Wheaton Bank & Trust Company, National

Wheaton Bank & Trust Company, National DE Association Noah Bank DE F & M Bank and Trust Company DE Synovus Bank DE Bank of the West DE Sunwest Bank DE Central Pacific Bank DE First American Bank DE U.S. Bank, National Association DE Peoples Community Bank DE PromiseOne Bank DE First Financial Bank DE Intuit Financing Inc. DE Savoy Bank DE Truist Bank d/b/a Branch Banking & Trust FL Co City National Bank of Florida FL CenterState Bank, National Association FL BankUnited, National Association FL Regions Bank FL JPMorgan Chase Bank, National Association FL PNC Bank, National Association FL Valley National Bank FL IBERIABANK FL Synovus Bank FL TD Bank, National Association FL Centennial Bank FL Seacoast National Bank FL Bank of America, National Association FL Hancock Whitney Bank FL BBVA USA FL The Bank of Tampa FL Ameris Bank FL Fifth Third Bank FL First Home Bank FL Readycap Lending, LLC FL Seaside National Bank & Trust FL Professional Bank FL ServisFirst Bank FL First Florida Integrity Bank FL Cogent Bank FL First Federal Bank FL Updated as of April 23, 2020 Capital City Bank FL Ocean Bank FL KeyBank National Association FL First Horizon Bank FL Amerant Bank, National Association FL BMO Harris Bank National Association FL Trustmark National Bank FL One Florida Bank FL Citizens Bank and Trust FL Citizens First Bank FL First-Citizens Bank & Trust Company FL Ally Bank FL Bank of Central Florida FL Bank OZK FL FirstBank Puerto Rico FL Pilot Bank FL Citibank, N.A. FL Cadence Bank, National Association FL Prime Meridian Bank FL First Citrus Bank FL Newtek Small Business Finance, Inc. -

Equity Research Statistical Review

STEPHENS INC. – EQUITY RESEARCH STATISTICAL REVIEW January 2019 © 2019 Stephens Inc. 111 Center Street Little Rock, AR 72201 501-377-2000/800-643-9691 stephens.com Member NYSE, SIPC CONFIDENTIALRefer to pages AND PROPRIETARY61-65 for MLP INFORMATION and REIT OF Company STEPHENS INC|-Specific MEMBER RisksNYSE, SIPC Refer to Appendix on page 66 for Important Disclosures and Analyst Certification January 2019 Monthly Statistical Review Equity Research Industry Coverage List ........................................................................................................................................................ 2 Equity Research Company Coverage List ..................................................................................................................................................... 10 Coverage Changes ...................................................................................................................................................................................... 16 Rating Changes ........................................................................................................................................................................................... 17 Consumer Healthcare Grocery/C-Store .................................................................. 18 Diagnostics and Life Science Tools ............................................ 34 Restaurants ........................................................................ 19 Healthcare Services ............................................................. -

Meridian Growth Fund Schedule of Investments September 30, 2020 (Unaudited)

Meridian Growth Fund Schedule of Investments September 30, 2020 (Unaudited) Shares Value Shares Value Common Stocks - 95.7% Exact Sciences Corp. 1,2 131,771 $ 13,434,054 Communication Services - 3.7% Forte Biosciences, Inc. Acquisition Date: 12/31/18, Entertainment - 0.3% 2,3 Cinemark Holdings, Inc. 1 531,389 $ 5,313,890 Cost $4,000,000 1,174,685 48,436,374 Heron Therapeutics, Inc. 1,2 964,892 14,299,699 Interactive Media & Services - 3.4% Immunomedics, Inc. 2 415,286 35,311,769 Cargurus, Inc. 2 362,805 7,847,472 Kiniksa Pharmaceuticals Ltd. 2 Pinterest, Inc. Class A 954,347 39,614,944 Class A 1,2 318,174 4,874,426 Vroom, Inc. Kodiak Sciences, Inc. 1,2 221,706 13,127,212 Acquisition Date: 11/21/19, Neurocrine Biosciences, Inc. 2 120,038 11,542,854 Cost $5,499,794 2,3 404,500 17,803,259 Precision BioSciences, Inc. 2 408,976 2,519,292 65,265,675 Viking Therapeutics, Inc. 1,2 1,559,541 9,076,529 Total Communication Services 70,579,565 177,612,597 Consumer Discretionary - 13.0% Health Care Equipment & Supplies - 11.5% ABIOMED, Inc. 2 46,765 12,956,711 Auto Components - 0.4% Axogen, Inc. 2 1,294,843 15,059,024 Fox Factory Holding Corp. 1,2 91,309 6,786,998 Cooper Cos., Inc. (The) 61,722 20,807,720 Diversified Consumer Services - 2.1% Hologic, Inc. 2 411,835 27,374,672 frontdoor, Inc. 2 765,499 29,785,566 Integra LifeSciences Holdings 2 Grand Canyon Education, Inc.