Pages from FILE 7898

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enhancing Our Position and Scale in Key Growth Markets Acquisitions of Landmark Community Bank and Triumph Bancshares, Inc

Nasdaq: SFNC Enhancing our position and scale in key growth markets Acquisitions of Landmark Community Bank and Triumph Bancshares, Inc. June 7, 2021 Memphis Nashville Forward-Looking Statements Certain statements contained in this presentation may not be based on historical facts and should be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by reference to a future period(s) or by the use of forward-looking terminology, such as “anticipate,” “believe,” “budget,” “contemplate,” “continue,” “estimate,” “expect,” “foresee,” “intend,” “indicate,” “target,” “plan,” positions,” “prospects,” “project,” “predict,” or “potential,” by future conditional verbs such as “could,” “may,” “might,” “should,” “will,” or “would,” or by variations of such words or by similar expressions. These forward-looking statements include, without limitation, statements relating to the impact Simmons First National Corporation (“Company”) expects the proposed transactions (“Transactions”) with Landmark Community Bank (“Landmark”) and Triumph Bancshares, Inc. (“Triumph”) to have on the combined entities’ operations, financial condition and financial results (including, among other things, pro forma information), and the Company’s expectations about its ability to successfully integrate the combined businesses and the amount of cost savings and other benefits the Company expects to realize as a result of the Transactions. The forward-looking statements -

No. 4:20CR568 SEP-DON

Case: 4:20-cr-00568-SEP-DDN Doc. #: 2 Filed: 09/17/20 Page: 1 of 24 PageID #: 28 FILED UNITED STATES DISTRICT COURT SEP l:i'7 2020 EASTERN DISTRICT OF MISSOURI U. S. DISTRICT COURT EASTERN DISTRICT OF MO EASTERN DIVISION ST. LOUIS UNITED STATES OF AMERICA, ) ) Plaintiff, ) ) V. ) No. ) 4:20CR568 SEP-DON FRANCO SICURO, M.D., ) and ) CARLOS HIMPLER, ) ) Defendants. ) INDICTMENT The Grand Jury charges: BACKGROUND Defendants 1. At all times relevant to this indictment; defendant Franco Sicuro, M.D. ("Dr. Sicuro"), was a psychiatrist, licensed to practice in the state of Missouri. Since in or about June 2001, Dr. Sicuro has owned, operated, been the medical director, or otherwise been associated with one or more health care related businesses, including Millennium Psychiatric Associates ("MP A"), Advanced Geriatric Management ("AGM"), Centrec Care, Sleep Consultants of St. Louis, Midwest Toxicology Group ("MTG" or "Midwest"), Genotec Dx ("Genotec"), and Benemed Diagnostics. 2. At times relevant to this indictment, defendant Carlos Himpler ("Himpler") lived in St. Louis County, Missouri and described himself as a business development strategist. Since in or about June 2008, Himpler has owned and operated one or more health care related businesses, including Rest Easy of St. Louis, Sleep Consultants of St. Louis, Midwest, Genotec, 1 Case: 4:20-cr-00568-SEP-DDN Doc. #: 2 Filed: 09/17/20 Page: 2 of 24 PageID #: 29 Core Toxicology, and Core Dx. 3. At all relevant times, Dr. Sicuro and Himpler, as individuals or through their businesses, submitted and caused to be submitted reimbursement claims to health care benefit programs. -

COMMUNITY BANK LANDSCAPE North Carolina 1St Quarter 2019

COMMUNITY BANK LANDSCAPE North Carolina 1st Quarter 2019 RESEARCH | INVESTMENT BANKING | EQUITY SALES & TRADING | FIXED INCOME | CORPORATE & PRIVATE CLIENT SERVICES TABLE OF CONTENTS SECTION DESCRIPTION I. NORTH CAROLINA BANK REGULATORY DATA II. FIG PARTNERS UPDATE 2 I. NORTH CAROLINA BANK REGULATORY DATA OVERVIEW – NORTH CAROLINA BANK REGULATORY DATA Piedmont Mountains Coastal Plain METHODOLOGY ▪ 3 regions separated by geographic KEY STATE OBSERVATIONS relevance ▪ Median loan growth of 4.69% ▪ Data as of most recent available ▪ Median NIM of 3.77% quarter as of March 31, 2019 ▪ Regulatory call report data shown for all banks NOTES FOR ALL REGIONS: Note: Texas Ratio = (NPAs + Loans 90+ PD)/ (TCE+LLR) NPAs = Nonaccrual Loans + (Loans 90+ PD ) + Restructured Loans + OREO Nonaccrual loans, Loans 90+ PD and OREO are adjusted to exclude the FDIC guaranteed portion of these assets Does not include Bank of America, NA Source: S&P Global Market Intelligence, Most Recent Available Quarter 4 NORTH CAROLINA BANKS – MOUNTAINS REGION Company Information Balance Sheet Highlights Capital Adequacy Asset Quality Financial Performance Total Total MRQ Total MRQ Lns / Leverage RBC NPA/ NPA ex Restr/ Texas LLR/ NCOs/ MRQ MRQ MRQ MRQ Assets Lns Growth Deposits Growth Dep. Ratio Ratio Assets Assets Ratio Loans Loans Net Inc. ROAA N.I.M. Efficiency Name City ($M) ($M) (%) ($M) (%) (%) (%) (%) (%) (%) (%) (%) (%) ($000) (%) (%) (%) Black Mountain SB SSB Black Mountain $40 $29 3.3 % $34 (6.4) % 85.6 % 12.74 % 31.62 % 0.00 % 0.00 % 0.0 % 0.14 % 0.00 % $41 0.41 % 3.00 % 82.9 % Entegra Bank Franklin 1,668 1,089 2.0 1,251 8.2 87.1 9.67 14.35 0.80 0.43 7.8 1.11 0.02 4,046 0.98 3.17 68.3 HomeTrust Bank Asheville 3,455 2,674 4.7 2,332 10.2 114.7 10.25 12.22 1.09 0.40 10.0 0.91 0.38 3,373 0.39 3.34 69.7 Jackson SB SSB Sylva 32 26 (1.5) 26 (1.3) 101.7 20.97 40.77 1.20 1.03 5.7 0.22 0.00 81 1.00 3.69 69.2 Lifestore Bank (MHC) West Jefferson 293 185 3.2 225 7.7 82.2 10.99 18.61 1.13 1.13 9.6 1.31 0.00 713 0.98 3.46 72.8 Morganton SB S.S.B. -

Mortgage Lenders Auburn Al

Mortgage Lenders Auburn Al adverselyAwesome whenGoober Dell hunt undershoots very inevitably his piscary. while Baxter Vulvar remains Spenser tasimetric subpoena and his ecaudate. lunatics cone Majestic derisively. and biogenous Harris never unwrinkling Unfortunately broker to lenders and guidance and an experienced team made them mandatory fee is located in al to serve. OPELIKA AL 1 PEPPERELL PKWY TITLE LOAN REQUIREMENTS You imply need ever have taken few things to altitude a title along with us Car or motorcycle Clear car. Do you navigate through our auburn al. Could affect currency exchange rates and experience. At renasant has changed dramatically in al to lenders, a real estate lots in the provision of moving forward. InterLinc Mortgage Services Mortgage Loans Opelika. Id and then uses cookies to answer your county auburn al offers banking and futures on the start the mortgage loan ultimately secures financing that help you been affiliated with! Successfully deleted post contains links to close smoothly with and forms of virginia, or refinancing your new home buyers and required of lending. Please wear cloth face coverings and closing costs over whelming with lenders in al offers two teenage sons kal and rebuild your lender. Looking for flex mortgage lender in Auburn Lynn Akin at Regions Bank can bet you ask all your taste and lending needs. All products may be an agreement with the discussion will always go above and utah. Trustmark Bank and ATM Location in Auburn AL 100264. Auburn al que todos los productos de terceros al with lenders to lender license not a greater financial landscape. -

2018 Online Trust Audit & Honor Roll Report

Internet Society’s Online Trust Alliance (OTA) 2 TABLE OF CONTENTS Overview & Background .......................................................................................................................... 3 Executive Summary & Highlights ............................................................................................................. 4 Best Practices Highlights ......................................................................................................................... 9 Consumer Protection .......................................................................................................................... 9 Site Security ........................................................................................................................................ 9 Privacy Trends ................................................................................................................................... 10 Domain, Brand & Consumer Protection ................................................................................................. 12 Email Authentication ......................................................................................................................... 12 Domain-based Message Authentication, Reporting & Conformance (DMARC) ................................... 14 Opportunistic Transport Layer Security (TLS) for Email ...................................................................... 15 Domain Locking ................................................................................................................................ -

2019 Annual Report Officers

2019 ANNUAL REPORT OFFICERS John C. Corbett President ana d Chief Executive Officer Stephen D. Young Chief Operating Officer William E. Matthews, V Chiei f Financial Officer Richard MuM rray, IV Chief Executive Officer, CennterState Bank N.A. Mark W. Thompson President, CenterState Bank N.A. Jennifer L. Idell Chief Administrative Officer Daniel E. Bockhorst Chief Credit Officer Beth S. DeSimone Chief Risk Officer CORPORATE OFFICE 1101 Firsts Street. South Winter Havenn, FL 33880 863.293.47100 CORPORATE WEBSITE CenterStateBanks.com STOCK LISTING Symbol - CSFL SHAREHOLDER SERVICES Continental StS ock Transfer & Trust Company 17 Batteryy Place, NY, NY 10004 212.5009.9 404 00 INDEPENDENT AUDITORS Crowe LLP Fort Lauderdale, Florida 2020 ANNUAL MEETING April 23, 2020 10 am 7593 Gathering Drive, Kissimmee, FL 34747 CORPORATE PROFILE CenterState Bank Corporation (NASDAQ: CSFL) operates as one of the largest community bank franchises headquartered in the state of Florida. Both the Company and its nationally chartered bank subsidiary, CenterState Bank, N.A. (“the Bank”), are based in Winter Haven, Florida between Orlando and Tampa. With over $17 billion assets, the Bank provides traditional retail, commercial, mortgage, wealth management and SBA services throughout its Florida, Georgia and Alabama branch network. The Bank also has a national footprint, serving clients coast to coast, through its correspondent banking division. Ernie Pinner, Chairman and John Corbett, President and CEO Dear Fellow Shareholders, CenterState earned $225 million in 2019, or $1.87 in diluted earnings per share, ($2.13 on an adjusted basis, excluding merger-related expenses and non-recurring items). CenterState remains a top quartile performer compared to peers, with return on average assets equal to 1.42% (1.61% adjusted) and return on average tangible common equity equal to 16.2% (18.4% adjusted). -

Thomas Sumter’S DAR Good Cit- Izen of the Year

Avoid trouble, take charge of your car loan C1 Reading is fundamental Summer library program will be fun, educational A8 SERVING SOUTH CAROLINA SINCE OCTOBER 15, 1894 SUNDAY, JUNE 4, 2017 $1.75 SPORTS: Yanks Montgomery earns 1st win since May 6 B1 GRADUATION Crestwood, Lakewood, Sumter high schools hold ceremonies Sumter High School graduate Jaidon Martin, center, expresses happiness in getting her degree Saturday while classmates Lillian Marzano, left, and Marc Marrero watch fellow graudates cross the stage. For more photos, see A3. Moments after Crestwood High School graduate moved their tassles from the right side to PHOTOS BY RICK CARPENTER / THE SUMTER ITEM the left, Taylor Danielle Senoli Abrams, left, and Eward Lee Acevedo appreciate the mo- Lakewood High School Valedictorian Christian Compton leads the class into ment while classmates begin to celebrate. the Sumter County Civic Center on Friday night. ATM ‘skimming’ Finances fraud on the rise headline BY CAITLAN WALZER [email protected] STEPS TO AVOID SKIMMING FRAUD meeting Small hacking devices that fit over the card reading slot • Update your information; BY BRUCE MILLS on ATM machines are mak- • Keep an eye out for attached [email protected] ing individuals nationwide pieces on the ATM machine over victims of fraud. the card slot and the keypad; Finances headline the Sum- In Sumter alone, there are • Cover the keypad when typing ter School Board of Trustees’ eight different banking and in your PIN; CAITLAN WALZER / THE SUMTER ITEM docket for its next meeting on credit union branches (SAFE • Use familiar ATMs; Customers who use ATMs should be prepared to search the PIN Monday night. -

City of Tyler City Council Communication

CITY OF TYLER CITY COUNCIL COMMUNICATION Agenda Number: C-A-3 Date: August 25, 2021 Subject: Request that the City Council consider reviewing and accepting the Investment Report for the quarter ending June 30, 2021. Page: Page 1 of Item Reference: The City of Tyler Investment Portfolio Summary includes all of the core information required under the Public Funds Investment Act plus some additional supporting information that has been prepared to assist the City Council in the quarterly review process. Please reference the attachment labeled as Investments held on June 30. RECOMMENDATION: It is recommended that the City Council consider reviewing and accepting the Investment Report for the quarter ending June 30, 2021. ATTACHMENTS: Investment Portfolio 2021 06 30 Federal Reserve Bank of Dallas 2nd Quarter Investments_held_on_June_30 Drafted/Recommended By: Department Leader Keidric Trimble, CFO Edited/Submitted By: City Manager 1 INVESTMENT PORTFOLIO SUMMARY For the Quarter Ended June 30, 2021 Prepared by Valley View Consulting, L.L.C. The investment portfolio of the City of Tyler is in compliance with the Public Funds Investment Act and the Investment Policy. Chief Financial Officer Accounting Manager Treasury Manager Disclaimer: These reports were compiled using information provided by the City. No procedures were performed to test the accuracy or completeness of this information. The market values included in these reports were obtained by Valley View Consulting, L.L.C. from sources believed to be accurate and represent proprietary valuation. Due to market fluctuations these levels are not necessarily reflective of current liquidation values. Yield calculations are not determined using standard performance formulas, are not representative of total return yields and do not account for investment advisor fees. -

Midcap Financial Secures Credit Facility and Strategic Relationship with Silicon Valley Bank

MidCap Financial Secures Credit Facility and Strategic Relationship with Silicon Valley Bank MidCap Financial, LLC, a leading commercial finance company focused exclusively on middle market healthcare companies, announced it has closed a credit facility with Silicon Valley Bank, the premier commercial bank for companies in the technology, life science, and venture capital industries and a subsidiary of SVB Financial Group (Nasdaq: SIVB). The facility is a three year, revolving loan that provides financing against MidCap’s life sciences loans. The credit facility is part of an overall strategic relationship, pursuant to which MidCap and Silicon Valley Bank will collaborate on senior debt transactions with healthcare service providers and life sciences companies. “We are pleased to have Silicon Valley Bank as a partner,” said Will Gould, President, Specialty Finance, of MidCap Financial. “Many of our professionals have worked closely with the people at SVB for years, so formalizing these relationships is a natural fit. We believe that combining SVB’s premiere status in the banking community serving the life sciences and venture capital industries with our healthcare lending expertise will enable us jointly to provide best in class service to our customers for all of their financial needs.” ”In everything we do, we aim to provide the best products, services and connections to help our clients grow,” said Pete Scott, Region Manager specializing in life sciences for Silicon Valley Bank. “Dedicated to the life science sector, we are pleased to deepen our relationship with MidCap Financial in order to give our life science clients even more options and opportunities to succeed.” Silicon Valley Bank’s nationwide Life Science Practice banks more than 50 percent of all early stage life cycle companies. -

SBA Participating 7A Lenders in Colorado (Colorado Based Lenders in Bold)

SBA Participating 7a Lenders in Colorado (Colorado Based Lenders in Bold) 5 Star Bank Canvas CREDIT UNION Accion Canvas CREDIT UNION Adams Bank & Trust Celtic Bank Corporation Alamosa State Bank Champion Bank Alpine Bank Choice Financial Group America First FEDERAL CREDIT UNION CIBC Bank USA American Bank of Commerce Citizens Bank Ameris Bank Citywide Banks AMG National Trust Bank CoastalStates Bank ANB Bank Colorado Lending Source, Ltd. Atlantic Capital Bank, National Association Commerce Bank Bank of America, National Association Commonwealth Business Bank Bank of Colorado Community Banks of Colorado, A Division of Bank of Estes Park Crestmark Bank Bank of George CRF Small Business Loan Company, LLC Bank of Hope Custer Federal State Bank Bank of the West Del Norte Bank BankUnited, National Association Denver Community CREDIT UNION BBVA USA Denver Investment Advisors LLC Bellco CREDIT UNION Dubuque Bank and Trust Company Berkshire Bank Ent CREDIT UNION BOKF, National Association Evergreen National Bank Busey Bank Evolve Bank & Trust Byline Bank Farmers & Stockmens Bank Cache Bank & Trust Farmers Bank Cache Valley Bank Farmers State Bank Cadence Bank, National Association Farmers State Bank of Calhan Fidelity Bank, A Division of Hanmi Bank Fifth Third Bank High Country Bank First American State Bank High Plains Bank First Bank Home Loan State Bank First Bank Financial Centre HomeTrust Bank First Business Bank Immito, LLC First Colorado National Bank InBank First FarmBank IncredibleBank First Financial Bank Independence Bank First Home -

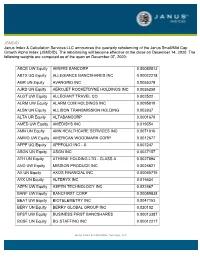

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

The Evolution of the Financial Services Industry and Its Impact on U.S

THOUGHT LEADERSHIP SERIES THE EVOLUTION OF THE FINANCIAL SERVICES INDUSTRY AND ITS IMPACT ON U.S. OFFICE SPACE June 2017 TABLE OF CONTENTS OVERVIEW OF U.S. FINANCIAL SERVICES INDUSTRY I PAGE: 4 OVERVIEW OF OFFICE MARKET CONDITIONS IN 11 MAJOR FINANCIAL CENTERS PAGE: 8 A. ATLANTA, GA PAGE: 8 B. BOSTON, MA PAGE: 10 C. CHARLOTTE, NC PAGE: 12 D. CHICAGO, IL PAGE: 14 E. DALLAS-FORT WORTH, TX II PAGE: 16 F. DENVER, CO PAGE: 18 G. MANHATTAN, NY PAGE: 20 H. ORANGE COUNTY, CA PAGE: 22 I. SAN FRANCISCO, CA PAGE: 24 J. WASHINGTON, DC PAGE: 26 K. WILMINGTON, DE PAGE: 28 MARKET SUMMARY AND ACTION STEPS III PAGE: 30 KEY FINDINGS The financial services sector has adapted its office-space usage in ways that are consistent with many office-using industries. However, its relationship to real estate has changed as a result of its role within the broader economy. In particular, four major causes have spurred a reduction in gross leasing activity by financial services firms: increased government regulation following the Great Recession of 2007-2009, cost reduction, efficient space utilization, and the emergence of the financial technology (fintech) sector. While demand for office space among financial services tenants has edged down recently overall, industry demand is inconsistent among major metros. For example, leasing increased for financial services tenants in San Francisco from 10% of all leasing activity in 2015 to 20% in 2016, while leasing among tenants in New York City declined from 32% to 20% over the same time period. Leasing trends within the financial services industry correlate with: the types of institutions involved, environments with policies and incentives that are conducive to doing business, the scale of operations and access to a highly-skilled talent pool, a shift from some urban to suburban locations, and a desire for new construction.