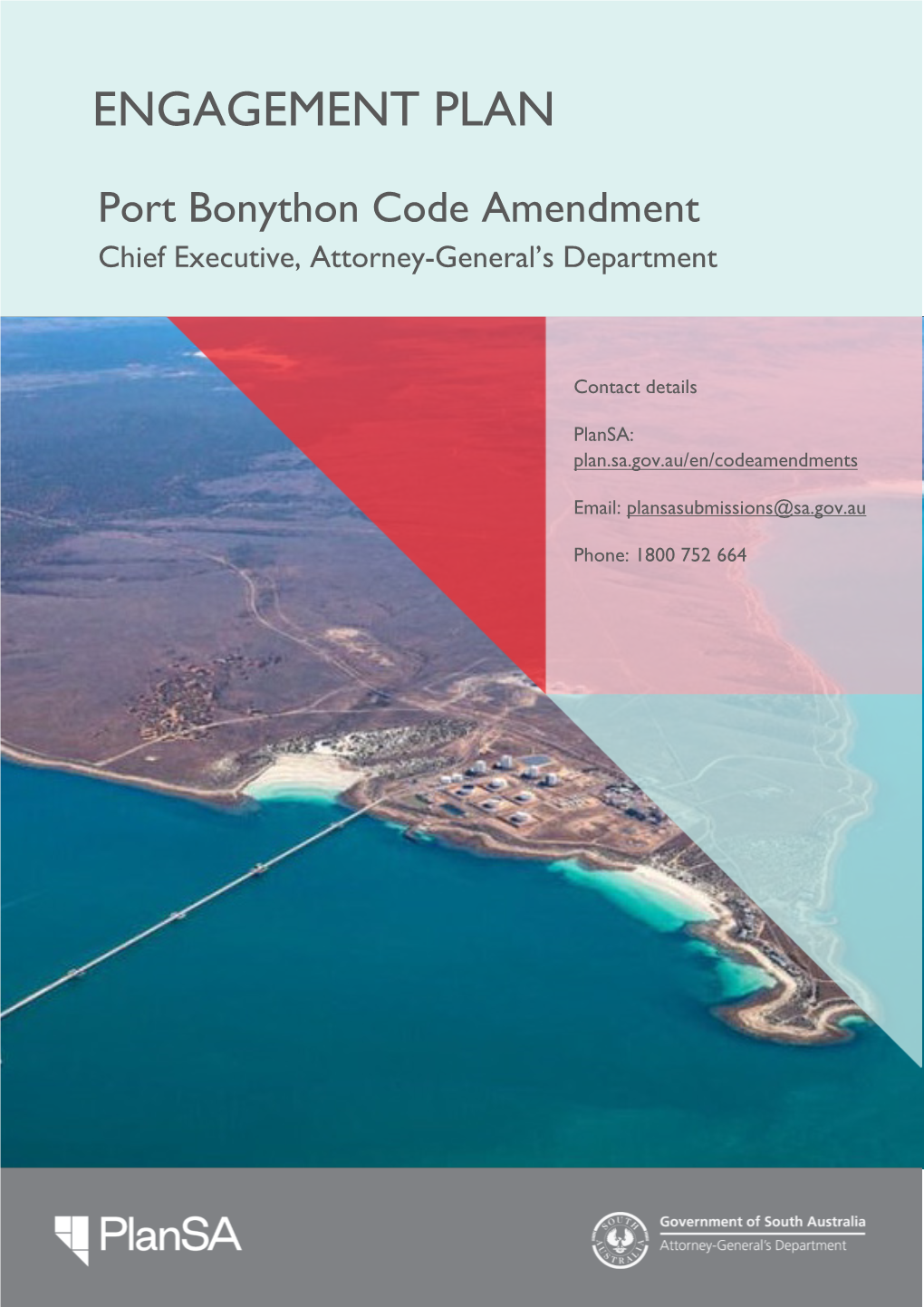

Port Bonython Code Amendment Chief Executive, Attorney-General’S Department

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Whyalla and EP Heavy Industry Cluster Summary Background

Whyalla and EP Heavy Industry Cluster Summary Background: . The Heavy Industry Cluster project was initiated and developed by RDAWEP, mid 2015 in response to a need for action to address poor operating conditions experienced by major businesses operating in Whyalla and Eyre Peninsula and their supply chains . The project objective is to support growth and sustainability of businesses operating in the Whyalla and Eyre Peninsula region which are themselves either a heavy manufacturing business or operate as part of a heavy industry supply chain . The cluster is industry led and chaired by Theuns Victor, GM OneSteel/Arrium Steelworks . Consists of a core leadership of 9 CEO’s of major regional heavy industry businesses . Includes CEO level participation from the Whyalla Council, RDAWEP and Deputy CEO of DSD . There is engagement with an additional 52 Supply chain companies Future direction for the next 12 months includes work to progress three specific areas of focus: 1. New opportunities Identify, pursue and promote new opportunities for Whyalla and regional business, including Defence and other major projects; 1.1 Defence Projects, including Access and Accreditation 1.2 Collective Bidding, How to structure and market to enable joint bids for new opportunities 1.3 Other opportunities/projects for Whyalla including mining, resource processing and renewable energy 2. Training and Workforce development/Trade skill sets 2.1 Building capability for defence and heavy industry projects with vocational training and industry placement 3. Ultra High Speed Internet 3.1 Connecting Whyalla to AARnet, very high speed broadband, similar to Northern Adelaide Gig City concept Other initiatives in progress or that will be progressed: . -

To Download the Whyalla Trip Guide

c/- Adelaide University Sport, University of Adelaide, SA 5005 Whyalla Trip Guide General Trip Overview Revision 0 (compiled by David Warren 30/05/2018) Whyalla Trip Guide Rev0 Page 1 Adelaide University Scuba Diving Club Table of contents Table of contents ......................................................................................................................... 2 1 Introduction ......................................................................................................................... 3 2 Location ............................................................................................................................... 4 2.1 Accommodation .................................................................................................................................... 6 3 Finances ............................................................................................................................... 7 4 Diving ................................................................................................................................... 8 4.1 Shore Sites ............................................................................................................................................. 8 4.1.1 Stony Point ............................................................................................................................................................................. 8 4.1.2 Black Point ............................................................................................................................................................................. -

Whyalla and Eyre Peninsula

SOUTH AUSTRALIAN CENTRE FOR ECONOMIC STUDIES ADELAIDE & FLINDERS UNIVERSITIES Regional Development Australia Whyalla and Eyre Peninsula Overview Geography RDA Whyalla and Eyre Peninsula covers an area of 170,500 square kilometres or 17.3 per cent of the State’s land mass. Population As at 30th June 2010 the region’s population was 58,700 persons or 3.6 per cent of the State’s population. The Indigenous population was estimated at 2,500 persons or 4.4 per cent of the region’s population. Economy and Labour force The region contributed $2,297 million to the State economy in 2006/07 or 3.4 per cent of gross state product. The four largest employing industries in the Whyalla Eyre Peninsula region were agriculture and fisheries (18.2 per cent), retail trade (14.3 per cent), manufacturing (11.9 per cent) and health and community services (10.9 per cent). Mining was relatively small at 1.4 per cent but is likely to show strong growth in the median term. The labour market is relatively strong with a participation rate above the State average and lower unemployment than the State average. Participation in VET courses is well above that for the State as a whole, while full-time participation in secondary school at age 16 is 71.4 per cent compared to South Australia at 78.4 per cent. NAPLAN reading results at year 3 are 15 percentage points lower than the State average but by year 7 they are 4.5 percentage points below the State average which indicates stronger school attendance over primary years of schooling. -

2021 Sustainability Report 3

1 2021 Sustainability Report 3 Contents CEO statement We acknowledge the Traditional Owners It is with great pleasure that I present the 2021 of the land on which our operations exist 3 CEO statement Santos Sustainability Report, demonstrating how and on which we work. We recognise their the principles of sustainability are critical to 4 About us the way that we operate our business and deliver continuing connection to land, waters on our Transform-Build-Grow strategy. and culture. We pay our respects to their 7 Our approach to sustainability Elders past, present and emerging. As Australia’s biggest domestic gas supplier and a leading 7 Our sustainability pillars Asia-Pacific LNG supplier, Santos has improved the lives of people throughout Australia and Asia for more santos.com/sustainability/ Governance and than 50 years. Our values drive everything we do, as we 9 build a better future for our customers, employees and management approaches the communities in which we operate. With significant expansion in recent years, this responsibility grows even As a major fuels producer for the Asia-Pacific region, 12 Structure of this report greater. Santos assets span across Australia, Papua Santos has an important global role to play in a sustainable New Guinea and Timor-Leste, with our focus continuing world. We are committed to realising a global future where 13 Economic sustainability to be on safely providing cleaner, reliable, low-cost temperature increase is limited to below 2 degrees Celsius, fuel products. while reliable and affordable energy continues to power 17 Health and safety domestic and global markets. -

Olympic Dam Expansion Draft Environmental Impact Statement 2009 Executive Summary

OLYMPIC DAM EXPANSION DRAFT ENVIRONMENTAL IMPACT STATEMENT 2009 EXECUTIVE SUMMARY Olympic Dam Expansion Draft Environmental Impact Statement 2009 Executive Summary 1 DISCLAIMER The Draft Environmental Impact Statement (Draft EIS) has been prepared by Arup Pty Ltd and ENSR Australia Pty Ltd (Arup/ENSR) on behalf of BHP Billiton Olympic Dam Corporation Pty Ltd (BHP Billiton) for submission to the Commonwealth Minister for Environment, Heritage and the Arts under the Environment Protection and Biodiversity Conservation Act 1999 (Commonwealth), the South Australian Minister for Mineral Resources Development under the Development Act 1993 (SA) and the Roxby Downs (Indenture Ratification) Act 1982 (SA) (and the indenture scheduled to that Act) and the Northern Territory Minister for Natural Resources, Environment and Heritage under the Environmental Assessment Act and the Environmental Assessment Administrative Procedures (together, the Ministers). The Draft EIS has been prepared for that purpose only and no one other than the Ministers should rely on the information contained in the Draft EIS to make any decision. In preparing the Draft EIS, Arup/ENSR and BHP Billiton have relied on information provided by specialist consultants, government agencies and other third parties available during preparation. BHP Billiton has not fully verified the accuracy or completeness of that information, except where expressly acknowledged in the Draft EIS. The Draft EIS has been prepared for information purposes only and, to the full extent permitted by law, BHP Billiton, in respect of all persons other than the Ministers, makes no representation and gives no warranty or undertaking, express or implied, in respect of the information contained in the Draft EIS and does not accept responsibility and is not liable for any loss or liability whatsoever arising as a result of any person acting or refraining from acting on any information contained in the Draft EIS. -

Annual Report 2018-2019

THE CORPORATION OF THE CITY OF ANNUAL REPORT 2018/2019 Reconciliation Action Plan Working Group ACKNOWLEDGEMENT OF COUNTRY We acknowledge the lands in our region belonging to the Barngarla people, and acknowledge them as the traditional custodians from the past, for the present and into the future. The Barngarla people are strong, and are continuously connecting to their culture and their country. Whyalla City Council and the Barngala people can work together to build a stronger future. This document fulfils our obligations under the Local Government Act 1999 which stipulates that all councils must produce an Annual report (relating to the immediately preceding financial year) to be prepared and adopted by council on or before 30 November. Information within this report is as prescribed by the legislation and as per the Annual Report Guidelines provided by the Local Government Association of South Australia. DISCLAIMER Every effort has been made to ensure the information contained within this Annual Report is accurate. No responsibility or liability can be accepted for any inaccuracies or omissions. 2018 – 19 ANNUAL REPORT CONTENTS MAYORS MESSAGE 1 OUR PEOPLE 40 CEO’S MESSAGE 2 OPERATIONAL HIGHLIGHTS OUR CITY PROFILE 3 CITY GROWTH 47 STRATEGIC PLAN 2017-2022 4 TOURISM 51 MEASURING OUR PERFORMANCE EVENTS 59 OUR PEOPLE 5 COMMUNITY 60 OUR PLACES 9 ARTS AND CULTURE 63 OUR ECONOMY 13 YOUTH 65 OUR IMAGE 17 CORPORATE 67 STRATEGIC MANAGEMENT PLANS, AIRPORT 69 DOCUMENTS & PROGRAMS 19 WHYALLA JETTY UPDATE 71 2018/2019 ANNUAL BUSINESS PLAN SUMMARY 20 INFRASTRUCTURE 73 ELECTED MEMBERS 23 FINANCIAL STATEMENT 90 GENERAL POLICIES 31 SUBSIDIARY REPORTS 136 CONNECTING WITH OUR COMMUNITY 35 1 CITY OF WHYALLA MAYOR'S MESSAGE I am pleased to present Whyalla City Council’s 2018-19 Annual Report, in my first term as Mayor of the City of Whyalla. -

Santos 2021 Climate Change Report

1 Climate Change Report Santos Climate Change Report 2021 CEO Statement Report highlights Contents 4 About us Industry-leading targets NTO SA S 6 CEO statement + Santos to achieve net-zero emissions by 2040. NET-ZERO 8 Executive summary + 26-30 per cent reduction from 2019-20 EMISSIONS 12 Introduction emissions and emissions intensity by 2030. + Reduce customer emissions by more than 16 Metrics and targets 2 0 4 0 one million tonnes per annum by 2030. Santos’ strategy and 22 climate change 46 Governance and risk Resilience and opportunity Zero-emission Zero-emission technologies: 54 technologies: carbon clean hydrogen in a lower-carbon future capture and storage (CCS) + Pathway to cleaner fuels + Moomba CCS Project ready for enabled by low-cost CCS. We acknowledge the Traditional final investment decision: the + Established new Midstream Owners of the land on which our world’s second largest CCS Infrastructure and Low-carbon project with lowest unit cost at Fuels division. operations exist and on which we less than A$30 per tonne. work. We recognise their continuing + Ability to store 1.7 million connection to land, waters and tonnes of CO2 per annum with culture. We pay our respects to their potential of up to 20 million. Reducing operational Elders past, present and emerging. emissions santos.com/sustainability + Emissions intensity reduced 20 per cent in the past 5 years. Nature-based offsets + Stringent management and Disclaimer: This report contains forward looking statements that are subject + West Arnhem Land Fire to risk factors associated with the oil and gas industry. It is believed that reporting of emissions. -

17 May 2012 One Thousand Export Cargoes from Port Bonython Today

Media enquiries Chandran Vigneswaran +61 8 8116 5856 / +61 (0) 467 775 055 [email protected] 17 May 2012 One thousand export cargoes from Port Bonython Today marked the 1,000th export cargo from Santos’ Port Bonython liquids processing plant near Whyalla in South Australia. Santos celebrated the milestone with the presentation of a commemorative plaque to the captain of the Tandara Spirit, currently taking on a cargo of crude oil. Port Bonython – named in honour of Santos’ founding Chairman, John Bonython AO – issued its first shipment in 1983. Since then, more than 40 million tonnes of product including crude oil, LPG and naphtha have been exported from the plant. Cargoes have gone to all Australian domestic refineries, New Zealand, Singapore, Japan, Hawaii, Indonesia, Hong Kong, Japan, India, Taiwan, South Korea and China. Gross revenue generated by Port Bonython totals over $14 billion and total gross wharfage paid to the South Australian Government exceeds $70 million. “We’re very pleased to celebrate this significant milestone,” said Lou Dello, Santos’ General Manager Oil & Offshore Business. “Port Bonython has long been an important part of Santos’ business, processing liquids from the Cooper Basin in South Australia’s remote north and shipping them right across the country and the Asia-Pacific. “It’s a testament to the vision of the company at the time, and the ongoing commitment of our employees, that Port Bonython remains a thriving business today.” Santos is the operator of Port Bonython and a 66.6% shareholder, with partners Delhi holding 20.2% and Origin 13.2%. Ends. -

The Detailed Map

MAJOR PIPELINE SYSTEMS OF AUSTRALIA Bayu-Undan Field NT5 DARWIN BONAPARTE BASIN NT8 Blacktip Gas Field Ichthys NT6 NT7 Gas Field BROWSE BASIN BEETALOO BASIN NT2 Karumba NT1 Broome Q11 NORTHERN TERRITORY Century Mine Tennant Creek NT10 W11 Townsville W13 Tanami QUEENSLAND W12 W9 W7 Mt Isa NT11 Q1 W10 CANNING BASIN W21 W6 Mackay Dampier Port Hedland Q10 W24 Telfer W16 Cannington W14 W8 GEORGINA BASIN BOWEN BASIN W17 Moranbah W23 W19 NT3 W20 Alice Springs Mereenie Q9 Barcaldine NT4 W4 Palm Valley ADAVALE BASIN Q4 NT9 AMADEUS BASIN Gladstone Q3 Gilmore Gas Field Q23 WESTERN AUSTRALIA Q12 Q25 Q24 Q2 Bundaberg Q26 Tarbat Q15 Q21 Q22 Q5 Roma COOPER-EROMANGA BASIN Ballera CARNARVON BASIN Q19 Q16 S1 Cheepie Wallumbilla Q18 W25 Jackson Q20 Q13 Q6 Moomba Q17 Q14 W18 COOPER BASIN Q7 BRISBANE Mount Magnet Moonie Toowoomba Q8 W22 Geraldton W3 Windimurra SOUTH AUSTRALIA S2 N4 SURAT BASIN Kalgoorlie N5 PERTH BASIN GUNNEDAH BASIN Kambalda S3 W15 NEW SOUTH WALES Tamworth W1 Port Bonython S7 N8 W5 Dubbo PERTH Whyalla N6 W2 Newcastle Parkes Port Pirie Orange 0 100 200 300 400 500 Bunbury Esperance Angaston N7 Forbes SYDNEY kilometres S4 Mildura ADELAIDE N3 Wollongong Wagga Wagga S6 ACT VICTORIA Tumut CANBERRA N2 Horsham V1 V2 Carisbrook Wodonga N1 S5 Wollert SYDNEY BASIN Mount Gambier Mortlake MELBOURNE V6 V7 S8 V3 Longford Compiled and published by Great Southern Press Pty Ltd Portland Geelong Orbost V16 V8 V15 V12 V14 V5 V4 V17 +61 (0)3 9248 5100 | [email protected] | www.pipeliner.com.au V13 V10 V9 Pipeline information and graphic design © Great Southern Press 2020. -

PORT BONYTHON REZONING (Paul Holloway)- NOTED

11/12/2006 INot Relevan~ 626 PORT BONYTHON REZONING (Paul Holloway)- NOTED INot Relevan~ 5 Minister for Police Minister for Mineral Resources Development Minister for Urban Developm~nt and Planning CABINET NOTE CN MUDP 06/025 TO: THE PREMIER FOR CABINET TO NOTE RE: PORT BONYTHON REZONING 1. PROPOSAL That Cabinet note the intention to review the current zoning of land at Port Bonython. 2. BACKGROUND 2.1 Mining is an important contributor to State economic performance, materially contributing to South Australia's Strategic Plan target of trebling the value of export income to $25 billion by 2013. The Strategic Infrastructure Plan for South Australia in the Upper Spencer Gulf and Outback includes several projects that would support expanded mining activity. 2.2 Current Port Bonython zoning is Special Industry (Hydrocarbons) and Deferred Industry (Petrochemical). Developing supportive land use zoning over Port Bonython for deep-water port development sends a message to the mining sector that commodities like iron ore can be cost effectively produced for export from the State. However, at this time, there are no known mineral deposits that, on current development plans, can justify the cost of constructing this infrastructure. 2.3 Port Bonython, if it were to be developed for bulk loading, would accommodate vessels requiring some 17 metres draft immediately adjacent the current Tanker berth. However, further to the west of the tanker berth, where the depths are much less, the draft would be subject to dredging of the berth box, tides and hydro graphic surveys. The water depth achievable at Port Bonython compares favourably with the newly dredged Outer Harbor that accommodates vessels requiring up to 14.2 metres draft. -

Spencer Gulf LNG Pty Ltd (SGLNG) Michael Schaumburg

Spencer Gulf LNG Pty Ltd (SGLNG) Michael Schaumburg Excellence in Oil and Gas Conference 11 – 12 March, 2014 Project Objectives . Develop a world class LNG facility in southern Australia . Establish a small scale LNG facility at Port Bonython Stage approach leveraging off existing infrastructure - (1 mtpa initially) : Low capital cost (project financing benefits) Recognised technology . Future growth (6 plus mtpa) Project History . Identify/Concept Stage – Completed Multi-criteria port options assessment Concept/Technical Description Report Site selection within port Business Plan Securing site High level environmental site audit Project History (Cont.) . Early Pre-FEED Activities Engagement of Parsons Brinckerhoff Prepared and issued brief for LNG technology providers – Black & Veatch, Air Products, Linde, GE Saloff Brief prepared for maritime sub-consultant – jetty location Project Execution Plan completed Initial discussions with potential gas suppliers Initial discussions with gas pipeline owners Initial discussions with potential LNG offtakers Site Location Future LNG Storage Tank Area Why Port Bonython? . Land : Minimal environmental significance Gently undulating nature Major industrial area – existing major industry Borders existing gas pipeline easement . Deepwater very close to the shoreline . Sheltered waters of Spencer Gulf – vessel loading ops . Small community only – distance of 3.5km . Close to Whyalla skilled workforce . Other major project approvals precedents . Close to Moomba - Adelaide pipeline and SE Aust gas pipeline network. Access to multiple gas basins– Cooper, Otway, Gippsland Existing Gas Transportation Moomba to Adelaide Pipeline LNG Floating Storage Offshore Infrastructure - Jetty Schedule . Major Approvals by mid 2015 . Pre-Feed complete end of 2014 . Feed complete end of 2015 . Financing Phase - January to June 2016 . Construction commences July 2016 . -

Deloitte Proposal Document A4

Regional Mining and Infrastructure Planning project - Eyre and Western Region Interim report for public consultation Prepared for the South Australian Department of Planning, Transport and Infrastructure and the Commonwealth Department of Infrastructure and Transport Contents Glossary 1 Foreword 2 1. Purpose and intent 3 2. Approach 5 3. Regional background 8 4. Regional mining profile 16 5. Existing infrastructure profile 27 6. Future mining demand 38 7. Future infrastructure demands 45 8. Potential infrastructure solutions 50 9. Next steps 91 10. How you can provide feedback 97 References 98 Appendix A - Approach 100 Appendix B – Eyre and Western environmental assets 107 Appendix C – Alignment of mines to DMITRE Pipeline 108 Appendix D – Infrastructure assessment benchmarks 110 Appendix E – Commodity price scenarios 112 This interim report is one of three prepared for the Regional Mining and Infrastructure Planning project. As each interim report is intended to be a ‘stand-alone’ document there is some duplication between the three reports, particularly in chapters 1, 2, 9 and 10. If you are planning to read each of the reports, please note that feedback provided on these chapters in one document will be taken to apply to all three. Glossary Term Definition ARTC Australian Rail Track Corporation Axle load Weight felt by road or rail surface for all wheels connected to a given axle Beneficiation Processing of raw ore to increase mineral concentration prior to export Bulk commodities Commodities shipped unpackaged in large volumes Concentrate