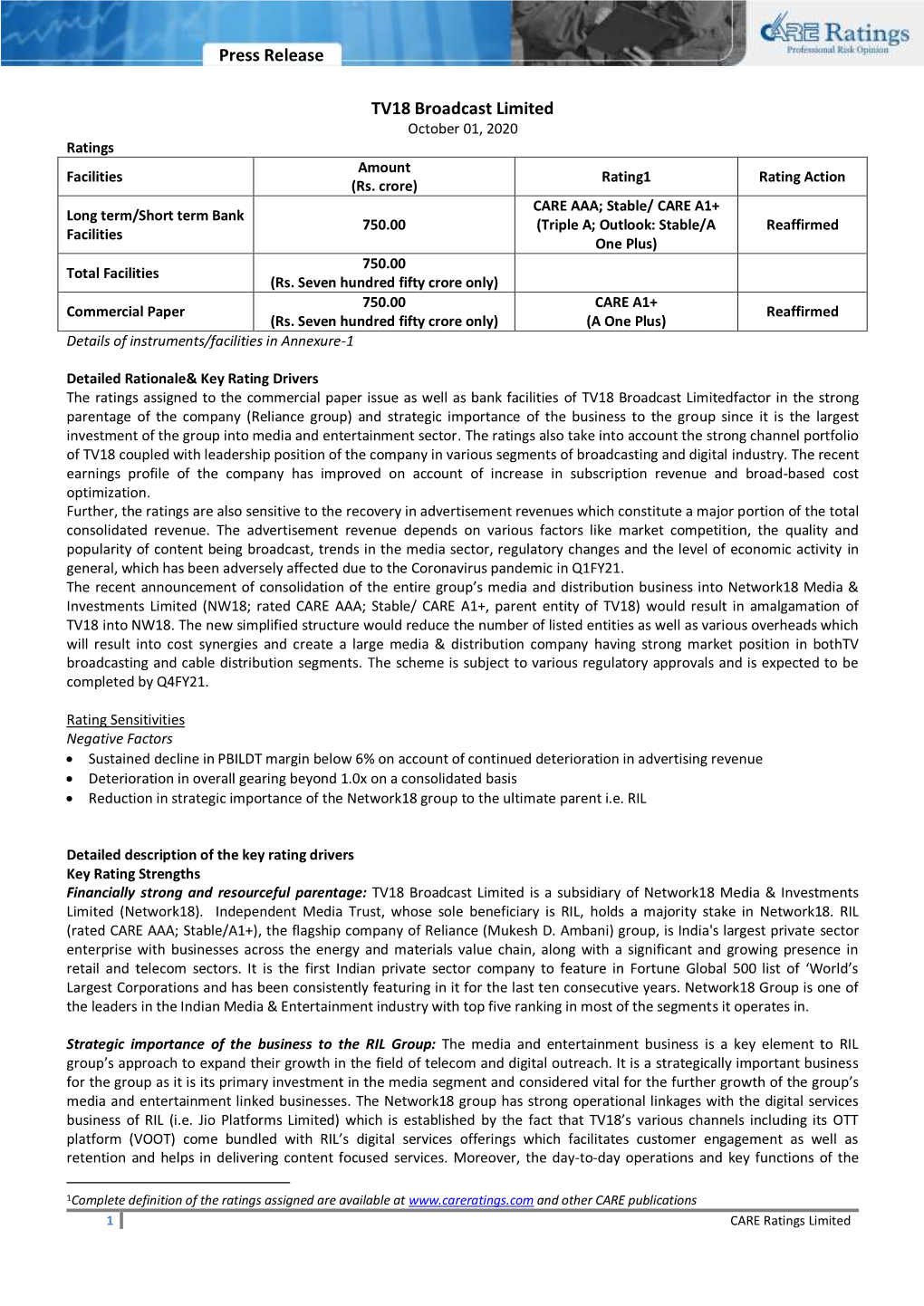

Press Release TV18 Broadcast Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BETTER PHOTOGRAPHY 16Th ANNIVERSARY SPECIAL • LEARN from the PROS: 40 Tips on Portraiture • EXCLUSIVE Test: FUJIFILM X100S VOL

NON MINEES OF POY, WPOY • BP POCKET GUIDE: SECRETS OF SHOOTING ABSTRACTS June 2013 Learn 100-Pagethe basics of colours Pocket and Guidestyling (Total 222 pages + 8 pg supplement before you start a portraitFREE shoot + 2 Pocket Guides of 100 pg each) BETTER PHOTOGRAPHY www.betterphotography.in 16th ANNIVERSARY SPECIAL • SPECIAL LEARN16th ANNIVERSARY FROM Better technique. Better Insight. Better Pictures SPECIAL MAGAZINE INSIDE thE PROS: 40 HOW TO MAKE GREAT PICTURES WITH YOUR CELLPHONE t IPS ON POR IPS EXCLUSIVE tEStS Fujifilm X100S t RAI Nikon COOLPIX A t Olympus VG-190 URE • EXCLUSIVE GREAt MAStERS Dario Mitidieri on his t ES t iconic imagery on : FUJIFILM X100S Mumbai's streets MARKEt SENSE All you need to know about publishing your own eBook ASHOK SALIAN RAFIQUE SAYED 1 • JUNE 2013 17 • NO. VOL. AMIT ASHAR (with 40 Simple tips) VIKRAM BAWA SHANTANU SHEOREY Give a Practical Guide on how they Make a Great Portrait VISUAL MUSINGS ON ASSIGNMENT PHOTOFEATURE PROFILE Jörg Colberg ponders over the Portraying a home through Exploring fantasy & dreams Saibal Das on bridging the gap importance given to the project the wall scribbles of a child of industrial workers in Dhaka between two parallel worlds VOLUME 17 ISSUE 1 JUNE 2013 Founder & Editor, Network18 Group CEO, Network18 GET PUBLISHED IN BETTER PHOTOGRAPHY Raghav Bahl B Sai Kumar Share your best images, tips and techniques President & Editorial Director, TV18 CEO-Network18 Publishing with us and get your work noticed. Follow these Senthil Chengalvarayan Sandeep Khosla simple guidelines: Editor-in-chief, Web & Publishing, Network18 EVP-Human Reasources For PhotoCritique and Your Pictures: R. -

Assets.Kpmg › Content › Dam › Kpmg › Pdf › 2012 › 05 › Report-2012.Pdf

Digitization of theatr Digital DawnSmar Tablets tphones Online applications The metamorphosis kingSmar Mobile payments or tphones Digital monetizationbegins Smartphones Digital cable FICCI-KPMG es Indian MeNicdia anhed E nconttertainmentent Tablets Social netw Mobile advertisingTablets HighIndus tdefinitionry Report 2012 E-books Tablets Smartphones Expansion of tier 2 and 3 cities 3D exhibition Digital cable Portals Home Video Pay TV Portals Online applications Social networkingDigitization of theatres Vernacular content Mobile advertising Mobile payments Console gaming Viral Digitization of theatres Tablets Mobile gaming marketing Growing sequels Digital cable Social networking Niche content Digital Rights Management Digital cable Regionalisation Advergaming DTH Mobile gamingSmartphones High definition Advergaming Mobile payments 3D exhibition Digital cable Smartphones Tablets Home Video Expansion of tier 2 and 3 cities Vernacular content Portals Mobile advertising Social networking Mobile advertising Social networking Tablets Digital cable Online applicationsDTH Tablets Growing sequels Micropayment Pay TV Niche content Portals Mobile payments Digital cable Console gaming Digital monetization DigitizationDTH Mobile gaming Smartphones E-books Smartphones Expansion of tier 2 and 3 cities Mobile advertising Mobile gaming Pay TV Digitization of theatres Mobile gamingDTHConsole gaming E-books Mobile advertising RegionalisationTablets Online applications Digital cable E-books Regionalisation Home Video Console gaming Pay TVOnline applications -

Morden Pharma

Morden Pharma https://www.indiamart.com/morden-pharma/ Network18 Publishing is India’s leading media company with strong market presence in diverse publishing business areas spanning Consumer Magazines, B2B space. Popular titles that come under the Network18 Publishing’s Business to ... About Us Network18 Publishing is India’s leading media company with strong market presence in diverse publishing business areas spanning Consumer Magazines, B2B space. Popular titles that come under the Network18 Publishing’s Business to Consumer (B2C) umbrella are Overdrive, Better Photography, Better Interiors. These magazines today are the epitome of passion based communities in India. In addition to publications, Network18 Publishing magazines also have allied events, exhibitions, awards, seminars & brand solutions. Network18 Publishing talks & interacts with their members not only through magazines but also on the web through respective magazine sites & social media. Network18 Publishing magazines have also had their presence felt on TV with shows such as Overdrive on CNBC TV18, CNN IBN & CNBC Awaaz & Awaaz Entrepreneur on CNBC Awaaz. Overdrive is one of the most downloaded iPad apps in India. The B2B division offers multiple solutions spanning Websites, Events and Tradeshows to help help businesses multiply & establish their ground. For more information, please visit https://www.indiamart.com/morden-pharma/aboutus.html OTHER PRODUCTS P r o d u c t s & S e r v i c e s Better Interiors Magazines Better Photography Magazines AV Max Magazines Editorial Statement Magazines F a c t s h e e t Nature of Business :Service Provider CONTACT US Morden Pharma Contact Person: Tanushree Bose Ruby House, A Wing, J.K. -

Network18 Media & Investments Limited – Update on Material Event Rationale

April 29, 2021 Network18 Media & Investments Limited – Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 1,500.0 1,500.0 [ICRA]A1+ Overdraft / Working Capital 30.0 30.0 [ICRA]A1+ Demand Loan Short-term Unallocated Limits 470.0 470.0 [ICRA]A1+ Total 2,000.00 2,000.00 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals; to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remains unchanged at the earlier rating of [ICRA]A1+ as the company would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group. -

Network • January 28, 2019

Network • January 28, 2019 National Stock Exchange of India Limited, BSE Limited Listing Department, Department of Corpo rate Services - Listing Exchange Plaza , Plot No. C/1, P J Towers, G-Block, Bandra-Kurla Complex, Dalal Street, Bandra (E), Mumbai-400051 Mumbai - 400 001 Trading Symbol : NETWORK18 SCRIP CODE : 532798 Sub .: Regulation 30 of SEBI (Listing Obligation and Disclosure Requirements) Regulation, 2015 - Credit Rating Dear Sir / lVIadam, This is to inform you that ICRA Limited (ICRA), the Credit Rating Agency, has assigned the credit rating of "[ICRA] AAA (Stable)" to the Company's Long-term Borrowing Programme (Bank Loan / Non-convertible Debenture Programme) of Rs.1,000 crore (enhanced from Rs.500 crore). Further, the rating for Company's Commercial Paper Programme and Long-term / Short term, Fund-based / Non-fund Based Facilities limits remain unchanged. We are enclosing the rating rationale issued by ICRA. You are requested to kindly take the above information on record. Thanking you, Yours faithfully, For Network18 Media & Investments Limited Ratnesh Rukhar ar Group Company Secretary Encl: as above Network18 Media & Investments Limited (CIN - L6591OMH1996PLC280969) Regd . office :First Floor, Empire Complex, 414- Senapati Bapat Marg, Lower Parel, Mumbai-400013 T+91 22 40019000, 66667777 W www.nw 18.comE:investors.n18@nwI8. com Network18 Media & Investments Limited January 25, 2019 Network18 Media & Investments Limited: [ICRA]AAA (Stable) assigned for fresh long-term borrowing programme Summary of rated action Previous -

Club Mahindra Better Photography Fun Frames, India's First Family

Club Mahindra Better Photography Fun Frames, India’s first family Photography Awards has a winner from Delhi By : INVC Team Published On : 9 Dec, 2011 12:00 AM IST INVC,, Delhi,, The Club Mahindra Better PhotographyMr. Sandeep Khosla, Chief Executive Officer,Infomedia 18 which began as an initiative by India’s No. 1 photography magazine,Better Photographywas open for all to participate. The concept was to capture precious memorable moments shared with family and friends through photographs. Along with an International holiday package to Bangkok from Club Mahindra for an entire family and a fabulous Olympus PEN E-PL3 camera from associate partner Olympus, the winner also won an opportunity to be recognized on a national level by the magazine. Additionally seeing the response of the participants, Club Mahindra decided to give away a second prize to the runner-up which is a domestic holiday package to any Club Mahindra resort in India, and was won by Debashis Mukherjee from Kolkata. The occasion was graced by the presence of renowned photographers like Dinesh Khanna, Diinesh Kumble, H Satish, C R Satyanarayana, Pallon Daruwala, Swapan Nayak and Vivek Victor Sequiera. They were also joined by General Manager, Club Mahindra Kodagu Valley, Coorg, Vikas Syal. The magazine received an overwhelming 6,000 entries from towns and cities all over India wherein six participants were chosen for the final competitive Face-Off, at Club Mahindra’s Kodagu Valley Resort, Coorg. The theme of the Face-Off was ‘Frames for Life’ wherein the best entry would decide the final winner. Mr. Rajiv Kumar Solanki from Delhi was chosen the winner of Better Photography Magazine’s very first family photography awards. -

NW18 Cov Letter-Investors' Update 30.06.2020.Jpg

EARNINGS RELEASE: Q1 2020-21 Mumbai, 22nd July, 2020 – Network18 Media & Investments Limited today announced its results for the quarter ended 30th June 2020. Summary Consolidated Financials . COVID-19 linked clampdown on spending by advertisers dragged ad-revenues sharply, especially on Entertainment. However, TV subscription revenue remained resilient, and Digital subscriptions have accelerated. The business strategy and operating methodology were re-engineered amidst a strategic review to address the current challenging environment. The cost base was comprehensively reset across verticals, as the organisation embraced tech-solutions and a leaner, nimbler approach. Operating EBITDA dipped on account of the revenue drag. However, aggressive and broad-based cost-controls across business verticals limited the fall. Consolidated PAT improved YoY led by a decline in finance costs. Q1FY21 Q1FY20 Growth Consolidated Operating Revenue (Rs Cr) 807 1,245 -35% Consolidated Operating EBITDA (Rs Cr) 27 46 -41% Highlights for the quarter Peak impact of COVID-19 absorbed through the quarter: Viewership in both TV and Digital media rose substantially during the lockdown, but advertising revenue was impacted as the pandemic affected consumption across advertiser categories. While News was relatively better off due to a surge in viewership, General Entertainment suffered due to no original content being produced during the lockdown and nil movie releases. Resilience in TV subscription and Digital syndication revenue partly blunted the impact, limiting the fall in Operating Revenue to 35% YoY. Linear TV subscription revenue remained resilient, 6% YoY growth in Q1: The broadcast industry was able to deliver uninterrupted services despite logistical challenges posed by the lockdown. While some rationing was witnessed (Eg: TV connections in offices, etc), subscriptions have held strong in general. -

Network18 Media & Investments Limited: Update Summary of Rating

April 14, 2020 Network18 Media & Investments Limited: Update Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Commercial Paper Programme 1,500.0 1,500.0 [ICRA]A1+; outstanding Short-term, Fund-based / Non-fund 500.0 500.0 [ICRA]A1+; outstanding Based Bank Facilities Total 2,000.0 2,000.0 *Instrument details are provided in Annexure-1 Rationale The ongoing lockdown due to the coronavirus outbreak is likely to have an adverse impact on the advertisement revenues of the broadcasters in Q1 FY2021, as the corporates look to prune advertisement spends. Thus, ICRA has a Negative outlook on the industry. With advertisement comprising around 60-65% of the overall revenues of Network18 Media & Investments Limited (Network18), there is likely to be an adverse impact on its consolidated revenues and profitability during Q1 FY2021. There could also be marginal impact on the company’s consolidated Q4 FY2020 operating performance, as the lockdown was declared at the end of the quarter. Nevertheless, as per the Network18 management, subscription revenues are likely to remain stable supporting the operating performance. However, at a standalone level, the company has limited operations with large debt on its books making it dependent on cash flow support from its subsidiary, TV18 Broadcast Limited (TV18, rated [ICRA]A1+) for funding its losses and on its parentage for refinancing its existing debt. ICRA expects the company to avail additional debt or refinance its existing debt based on its strong parentage, which provides significant refinancing ability and can help to meet any short-term funding mismatch. -

Download Document

EARNINGS RELEASE: Q2 2018-19 Mumbai, 15th October, 2018 – Network18 Media & Investments Limited today announced its results for the quarter ended 30th September 2018. Summary Consolidated Financials (restated for current structure of ownership) Q2FY19 Q2FY18 Growth Consolidated Operating Revenue (Rs Cr) 1,237 1,138 9% Consolidated Operating EBITDA (Rs Cr) 92 58 59% Network18 reported a 59% jump in operating EBITDA to Rs. 92 crores in Q2FY19, driven by improved performance of regional channels (both news and entertainment); despite gestation losses of Colors Tamil and new launch Colors Kannada Cinema. While headline operating revenue grew 9% (on a comparable basis), revenue ex-movies grew 14% YoY, underscoring tailwinds in broadcasting. Highlights for the quarter The industry ad-environment has substantially improved compared with the previous year, though certain pockets of the market (mobiles, auto, colas, etc) are yet to resume advertising full- throttle. Broad-based growth in regional markets and upcoming festive season are positives. Broadcast subsidiary TV18 posted 17% revenue growth ex-movies on a comparable basis: . Advertising revenue for TV18 grew at ~18% YoY overall. Regional channels across news and entertainment drove viewership growth and ad-revenues for the portfolio, reducing our dependence on national channels. Subscription revenue for our entire bouquet grew 16% YoY. We are in negotiations with two of India’s leading DTH players for long-term deals on terms commensurate with the strength of our channel bouquet. TV18’s News bouquet (20 channels) is #1; News viewership share rose to 10.7%: . The viewership share of our regional news cluster has risen further to 5.7%, vs sub-2% two years ago. -

Q4 2016-17 Summary Consolidated Financials Highlights for the Quarter

EARNINGS RELEASE: Q4 2016-17 Mumbai, 19th April, 2017 – Network18 Media & Investments Limited today announced its results for the quarter and year ended 31st March, 2017. Summary Consolidated Financials Q4 Q4 Growth Growth Particulars (in Rs Crores) FY17 FY16 FY17 FY16 YoY% YoY% Revenue (incl. proportionate share of JVs) 898.4 898.8 0% 3,471.1 3,321.0 5% Segment profit (incl. prop. share of JVs) (65.5) 65.3 -200% (272.8) 145.3 -288% Adjusted Segment profit (incl. prop. share of JVs)* 5.0 65.3 -92% (26.1) 145.3 -118% Revenue (as per Ind AS) 387.7 473.2 -18% 1,491.0 1,527.3 -2% Operating profit (as per Ind AS) 20.7 82.7 -75% (138.0) 52.0 -365% Adjusted Operating profit (as per Ind AS)* 55.2 82.7 -33% (31.1) 52.0 -160% (*) - Adjusted for the impact of new initiatives launched within a year /one-time expense Network18 posted consolidated revenues of Rs. 3,471 crores (including proportionate share of JVs) in FY17 a 5% YoY growth, driven largely by its TV operations. Segment profits were significantly impacted by pullback in advertising spends in the latter half, operating losses of the new initiatives in regional and digital broadcasting, and losses in digital commerce businesses. Highlights for the quarter Tepid ad-industry environment dragged revenues, especially in regional markets. The media industry is still facing impact of deferment of advertising spends that kicked-in from November-December 2016 on likely slow-down in consumer spending. Further, the revival of advertising spends has been witnessed at a much faster clip for national channels, while regional markets are still recovering with a lag. -

Bookmyshow Raises Largest Single Funding of INR 550 Crs to Focus on Becoming ‘Entertainment Destination of India’

BookMyShow raises largest single funding of INR 550 crs To focus on becoming ‘Entertainment Destination of India’ Mumbai, July 5, 2016: Mumbai based Bigtree Entertainment Pvt. Ltd., which owns and operates BookMyShow, has raised INR 550 crores in its fourth and largest single financing round. The round was led by US based Stripes Group, and saw participation from all existing investors - Network 18, Accel Partners, and SAIF Partners to further strengthen BookMyShow’s position as the largest online entertainment ticketing platform in the country. This fresh infusion of funds comes at a time when BookMyShow has entered new international territories such as Indonesia and looks to transform into the preferred ‘Entertainment Destination’ within India. Ashish Hemrajani, CEO & Co-Founder, BookMyShow commented, “We are excited to welcome Stripes Group on board as our newest partner, which comes with a wealth of experience in digital entertainment asset. With BookMyShow being their first investment in the Indian market, alongside the display of confidence by our existing investors Network 18, Accel Partners and SAIF Partners, this is an overall testament to how they believe in our roadmap for growth and innovation within the entertainment space.” “These funds will be utilized towards rolling out exclusive entertainment experiences on BookMyShow, enhancing the overall offering for our users, while we hopefully build out a 360 degree gateway of entertainment in India”, added Hemrajani. “We are thrilled to be partnering with three very special founders - Ashish, Rajesh and Parikshit – as well as a world class team and group of investors at BookMyShow. We look forward to sharing our operating and investing experience with online transactional and ticketing businesses, as well as digital media, to help the Company continue to scale.” said Stripes Group Managing Partner Dan Marriott. -

Q4 2018-19 Summary Consolidated Financials Highlights for the Quarter

EARNINGS RELEASE: Q4 2018-19 Mumbai, 15th April, 2019 – Network18 Media & Investments Limited today announced its results for the quarter and financial year ended 31st March 2019. Summary Consolidated Financials FY19 ex-film revenue rose 7% YoY on continued regional growth and a reviving ad- environment. Implementation of New tariff order impacted Q4, dragging full-year growth; but is likely to be a medium-term positive. FY19 EBITDA was up 13% YoY despite Rs 131 Cr investments into new regional channels, launch of FirstPost Print and Digital expansions (VOOT International & Kids, CricketNext). Regional News gestation losses reduced 42% YoY. Business-as-usual Entertainment EBITDA margins rose to 9% (vs 5%). (restated for current structure of ownership) Q4FY19 Q4FY18 Growth FY19 FY18 Growth Consolidated Operating Revenue (Rs Cr) 1,231 1,597 -23% 5,116 5,027 2% Revenue Ex-film production 1,183 1,268 -7% 4,901 4,577 7% Consolidated Operating EBITDA (Rs Cr) 12 54 -79% 212 188 13% Q4FY19 ex-film revenues dipped 7% YoY (headline revenue was down 23% due to movie ‘Padmaavat’ last year), led by flux around implementation of the new tariff order, and Nidahas trophy cricket and other live events, and union budget coverage in the base quarter which were absent this year. Highlights for the quarter Flux around implementation of new tariff order (NTO) from 1st Feb 2019: . Advertisers pulled back spends due to lack of stable viewership data. Viewership has been impacted for all major broadcasters as process of consumers choosing channels/packs and on-ground realignments in distribution value-chain are still underway.