NW18 Cov Letter-Investors' Update 30.06.2020.Jpg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BETTER PHOTOGRAPHY 16Th ANNIVERSARY SPECIAL • LEARN from the PROS: 40 Tips on Portraiture • EXCLUSIVE Test: FUJIFILM X100S VOL

NON MINEES OF POY, WPOY • BP POCKET GUIDE: SECRETS OF SHOOTING ABSTRACTS June 2013 Learn 100-Pagethe basics of colours Pocket and Guidestyling (Total 222 pages + 8 pg supplement before you start a portraitFREE shoot + 2 Pocket Guides of 100 pg each) BETTER PHOTOGRAPHY www.betterphotography.in 16th ANNIVERSARY SPECIAL • SPECIAL LEARN16th ANNIVERSARY FROM Better technique. Better Insight. Better Pictures SPECIAL MAGAZINE INSIDE thE PROS: 40 HOW TO MAKE GREAT PICTURES WITH YOUR CELLPHONE t IPS ON POR IPS EXCLUSIVE tEStS Fujifilm X100S t RAI Nikon COOLPIX A t Olympus VG-190 URE • EXCLUSIVE GREAt MAStERS Dario Mitidieri on his t ES t iconic imagery on : FUJIFILM X100S Mumbai's streets MARKEt SENSE All you need to know about publishing your own eBook ASHOK SALIAN RAFIQUE SAYED 1 • JUNE 2013 17 • NO. VOL. AMIT ASHAR (with 40 Simple tips) VIKRAM BAWA SHANTANU SHEOREY Give a Practical Guide on how they Make a Great Portrait VISUAL MUSINGS ON ASSIGNMENT PHOTOFEATURE PROFILE Jörg Colberg ponders over the Portraying a home through Exploring fantasy & dreams Saibal Das on bridging the gap importance given to the project the wall scribbles of a child of industrial workers in Dhaka between two parallel worlds VOLUME 17 ISSUE 1 JUNE 2013 Founder & Editor, Network18 Group CEO, Network18 GET PUBLISHED IN BETTER PHOTOGRAPHY Raghav Bahl B Sai Kumar Share your best images, tips and techniques President & Editorial Director, TV18 CEO-Network18 Publishing with us and get your work noticed. Follow these Senthil Chengalvarayan Sandeep Khosla simple guidelines: Editor-in-chief, Web & Publishing, Network18 EVP-Human Reasources For PhotoCritique and Your Pictures: R. -

Assets.Kpmg › Content › Dam › Kpmg › Pdf › 2012 › 05 › Report-2012.Pdf

Digitization of theatr Digital DawnSmar Tablets tphones Online applications The metamorphosis kingSmar Mobile payments or tphones Digital monetizationbegins Smartphones Digital cable FICCI-KPMG es Indian MeNicdia anhed E nconttertainmentent Tablets Social netw Mobile advertisingTablets HighIndus tdefinitionry Report 2012 E-books Tablets Smartphones Expansion of tier 2 and 3 cities 3D exhibition Digital cable Portals Home Video Pay TV Portals Online applications Social networkingDigitization of theatres Vernacular content Mobile advertising Mobile payments Console gaming Viral Digitization of theatres Tablets Mobile gaming marketing Growing sequels Digital cable Social networking Niche content Digital Rights Management Digital cable Regionalisation Advergaming DTH Mobile gamingSmartphones High definition Advergaming Mobile payments 3D exhibition Digital cable Smartphones Tablets Home Video Expansion of tier 2 and 3 cities Vernacular content Portals Mobile advertising Social networking Mobile advertising Social networking Tablets Digital cable Online applicationsDTH Tablets Growing sequels Micropayment Pay TV Niche content Portals Mobile payments Digital cable Console gaming Digital monetization DigitizationDTH Mobile gaming Smartphones E-books Smartphones Expansion of tier 2 and 3 cities Mobile advertising Mobile gaming Pay TV Digitization of theatres Mobile gamingDTHConsole gaming E-books Mobile advertising RegionalisationTablets Online applications Digital cable E-books Regionalisation Home Video Console gaming Pay TVOnline applications -

SL.NO CHANNEL LCN Genre STAR PLUS 101 HINDI GEC

SL.NO CHANNEL LCN Genre 1 STAR PLUS 101 HINDI GEC PAY 2 ZEE TV 102 HINDI GEC PAY 3 SET 103 HINDI GEC PAY 4 COLORS 104 HINDI GEC PAY 5 &TV 105 HINDI GEC PAY 6 SAB 106 HINDI GEC PAY 7 STAR BHARAT 107 HINDI GEC PAY 8 BIG MAGIC 108 HINDI GEC PAY 9 PAL 109 HINDI GEC PAY 10 COLORS RISHTEY 110 HINDI GEC PAY 11 STAR UTSAV 111 HINDI GEC PAY 12 ZEE ANMOL 112 HINDI GEC PAY 13 BINDASS 113 HINDI GEC PAY 14 ZOOM 114 HINDI GEC PAY 15 DISCOVERY JEET 115 HINDI GEC PAY 16 STAR GOLD 135 HINDI MOVIES PAY 17 ZEE CINEMA 136 HINDI MOVIES PAY 18 SONY MAX 137 HINDI MOVIES PAY 19 &PICTURES 138 HINDI MOVIES PAY 20 STAR GOLD 2 139 HINDI MOVIES PAY 21 ZEE BOLLYWOOD 140 HINDI MOVIES PAY 22 MAX 2 141 HINDI MOVIES PAY 23 ZEE ACTION 142 HINDI MOVIES PAY 24 SONY WAH 143 HINDI MOVIES PAY 25 COLORS CINEPLEX 144 HINDI MOVIES PAY 26 UTV MOVIES 145 HINDI MOVIES PAY 27 UTV ACTION 146 HINDI MOVIES PAY 28 ZEE CLASSIC 147 HINDI MOVIES PAY 29 ZEE ANMOL CINEMA 148 HINDI MOVIES PAY 30 STAR GOLD SELECT 149 HINDI MOVIES PAY 31 STAR UTSAV MOVIES 150 HINDI MOVIES PAY 32 RISHTEY CINEPLEX 151 HINDI MOVIES PAY 33 MTV 175 HINDI MUSIC PAY 34 ZING 178 HINDI MUSIC PAY 35 MTV BEATS 179 HINDI MUSIC PAY 36 9X M 181 HINDI MUSIC PAY 37 CNBC AWAAZ 201 HINDI NEWS PAY 38 ZEE BUSINESS 202 HINDI NEWS PAY 39 INDIA TODAY 203 HINDI NEWS PAY 40 NDTV INDIA 204 HINDI NEWS PAY 41 NEWS18 INDIA 205 HINDI NEWS PAY 42 AAJ TAK 206 HINDI NEWS PAY 43 ZEE NEWS 207 HINDI NEWS PAY 44 ZEE HINDUSTAN 209 HINDI NEWS PAY 45 TEZ 210 HINDI NEWS PAY 46 STAR JALSHA 251 BENGALI GEC PAY 47 ZEE BANGLA 252 BENGALI GEC PAY 48 COLORS -

Morden Pharma

Morden Pharma https://www.indiamart.com/morden-pharma/ Network18 Publishing is India’s leading media company with strong market presence in diverse publishing business areas spanning Consumer Magazines, B2B space. Popular titles that come under the Network18 Publishing’s Business to ... About Us Network18 Publishing is India’s leading media company with strong market presence in diverse publishing business areas spanning Consumer Magazines, B2B space. Popular titles that come under the Network18 Publishing’s Business to Consumer (B2C) umbrella are Overdrive, Better Photography, Better Interiors. These magazines today are the epitome of passion based communities in India. In addition to publications, Network18 Publishing magazines also have allied events, exhibitions, awards, seminars & brand solutions. Network18 Publishing talks & interacts with their members not only through magazines but also on the web through respective magazine sites & social media. Network18 Publishing magazines have also had their presence felt on TV with shows such as Overdrive on CNBC TV18, CNN IBN & CNBC Awaaz & Awaaz Entrepreneur on CNBC Awaaz. Overdrive is one of the most downloaded iPad apps in India. The B2B division offers multiple solutions spanning Websites, Events and Tradeshows to help help businesses multiply & establish their ground. For more information, please visit https://www.indiamart.com/morden-pharma/aboutus.html OTHER PRODUCTS P r o d u c t s & S e r v i c e s Better Interiors Magazines Better Photography Magazines AV Max Magazines Editorial Statement Magazines F a c t s h e e t Nature of Business :Service Provider CONTACT US Morden Pharma Contact Person: Tanushree Bose Ruby House, A Wing, J.K. -

Declaration Under Section 4 (4) of the Telecommunication (Broadcasting and Cable) Services Interconnection (Addressable System) Regulation, 2017 (No

Version 1.0/2019 Declaration Under Section 4 (4) of The Telecommunication (Broadcasting and Cable) Services Interconnection (Addressable System) Regulation, 2017 (No. 1 of 2017) 4(4)a: Target Market Distribution Network Location States/Parts of State covered as "Coverage Area" Bangalore Karnataka Bhopal Madhya Pradesh Delhi Delhi; Haryana; Rajasthan and Uttar Pradesh Hyderabad Telangana Kolkata Odisha; West Bengal; Sikkim Mumbai Maharashtra 4(4)b: Total Channel carrying capacity Distribution Network Location Capacity in SD Terms Bangalore 506 Bhopal 358 Delhi 384 Hyderabad 456 Kolkata 472 Mumbai 447 Kindly Note: 1. Local Channels considered as 1 SD; 2. Consideration in SD Terms is clarified as 1 SD = 1 SD; 1 HD = 2 SD; 3. Number of channels will vary within the area serviced by a distribution network location depending upon available Bandwidth capacity. 4(4)c: List of channels available on network List attached below in Annexure I 4(4)d: Number of channels which signals of television channels have been requested by the distributor from broadcasters and the interconnection agreements signed Nil Page 1 of 37 Version 1.0/2019 4(4)e: Spare channels capacity available on the network for the purpose of carrying signals of television channels Distribution Network Location Spare Channel Capacity in SD Terms Bangalore Nil Bhopal Nil Delhi Nil Hyderabad Nil Kolkata Nil Mumbai Nil 4(4)f: List of channels, in chronological order, for which requests have been received from broadcasters for distribution of their channels, the interconnection agreements -

Genre Channel Name Channel No Hindi Entertainment Star Bharat 114 Hindi Entertainment Investigation Discovery HD 136 Hindi Enter

Genre Channel Name Channel No Hindi Entertainment Star Bharat 114 Hindi Entertainment Investigation Discovery HD 136 Hindi Entertainment Big Magic 124 Hindi Entertainment Colors Rishtey 129 Hindi Entertainment STAR UTSAV 131 Hindi Entertainment Sony Pal 132 Hindi Entertainment Epic 138 Hindi Entertainment Zee Anmol 140 Hindi Entertainment DD National 148 Hindi Entertainment DD INDIA 150 Hindi Entertainment DD BHARATI 151 Infotainment DD KISAN 152 Hindi Movies Star Gold HD 206 Hindi Movies Zee Action 216 Hindi Movies Colors Cineplex 219 Hindi Movies Sony Wah 224 Hindi Movies STAR UTSAV MOVIES 225 Hindi Zee Anmol Cinema 228 Sports Star Sports 1 Hindi HD 282 Sports DD SPORTS 298 Hindi News ZEE NEWS 311 Hindi News AAJ TAK HD 314 Hindi News AAJ TAK 313 Hindi News NDTV India 317 Hindi News News18 India 318 Hindi News Zee Hindustan 319 Hindi News Tez 326 Hindi News ZEE BUSINESS 331 Hindi News News18 Rajasthan 335 Hindi News Zee Rajasthan News 336 Hindi News News18 UP UK 337 Hindi News News18 MP Chhattisgarh 341 Hindi News Zee MPCG 343 Hindi News Zee UP UK 351 Hindi News DD UP 400 Hindi News DD NEWS 401 Hindi News DD LOK SABHA 402 Hindi News DD RAJYA SABHA 403 Hindi News DD RAJASTHAN 404 Hindi News DD MP 405 Infotainment Gyan Darshan 442 Kids CARTOON NETWORK 449 Kids Pogo 451 Music MTV Beats 482 Music ETC 487 Music SONY MIX 491 Music Zing 501 Marathi DD SAHYADRI 548 Punjabi ZEE PUNJABI 562 Hindi News News18 Punjab Haryana Himachal 566 Punjabi DD PUNJABI 572 Gujrati DD Girnar 589 Oriya DD ORIYA 617 Urdu Zee Salaam 622 Urdu News18 Urdu 625 Urdu -

List of Bouquets of FTA Basic Service Tier

List of Bouquets of FTA Basic Service Tier BST North Channel Genre DD7 Bangla Bangla Aakash aath Bangla Dhoom Music Bangla News Time Bangla Sangeet Bangla Bangla R Plus Bangla ABP Ananda Bangla DD Bihar Bihar Sangeet Bhojpuri Bihar Dangal TV Bihar Bhojpuri Cinema Bihar Dabang Bihar Aastha Devotional Aastha Bhajan Devotional Arihant TV Devotional Divya TV Devotional GOD TV Devotional Ishwar TV Devotional Mahavira Devotional Peace of Mind Devotional Sanskar Devotional Satsang Devotional Vedic Devotional Sadhna Bhakti Devotional Shubh TV Devotional India Ahead Eng News Republic TV Eng News DD Girnar Gujarati TV9 Gujarati Gujarati GS TV Gujarati Sandesh News Gujarati ABP Asmita Gujarati DD India Hindi Gec DD Bharati Hindi Gec DD National Hindi Gec Big Magic Hindi Gec Box Cinema Hindi Movie Maha Movie Hindi Movies WOW Cinema Hindi Movies Cinema TV Hindi Movies Manoranjan Movies Hindi Movies Manoranjan TV Hindi Movies Housefull Movies Hindi Movies B4U Movies Hindi Movies Sky Star Hindi Movies Enterr10 Hindi Movies Movie House Hindi Movies DD9 Chandana (Kannada) Kannada DD Kashir Kashmir DD Loksabha Hindi News DD Rajyasabha Hindi News DD News Hindi News Aaj Tak Hindi News ABP news Hindi News Sadhana Plus Hindi News India News Hindi News India tv Hindi News News Nation Hindi News News 24 Hindi News Zee Hindustan Hindi News Zee News Hindi News Republic Bharat Hindi News DD Kisan Infotainment Digishala Infotainment CGTN International France 24 International Russia Today International Home shop 18 Lifestyle/Fashion NT 1 Lifestyle/Fashion Divyarishi -

Network18 Media & Investments Limited – Update on Material Event Rationale

April 29, 2021 Network18 Media & Investments Limited – Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 1,500.0 1,500.0 [ICRA]A1+ Overdraft / Working Capital 30.0 30.0 [ICRA]A1+ Demand Loan Short-term Unallocated Limits 470.0 470.0 [ICRA]A1+ Total 2,000.00 2,000.00 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals; to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remains unchanged at the earlier rating of [ICRA]A1+ as the company would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group. -

BEST U.S. COLLEGES–AND the ONES to AVOID/Pg.82 RNI REG

BEST U.S. COLLEGES–AND THE ONES TO AVOID/Pg.82 RNI REG. NO. MAHENG/2009/28102 INDIA PRICEPRICE RSRS. 100100. AUGUST 2323, 2013 FORBES INDIA INDEPENDENCESpecial Issue Day VOLUME 5 ISSUE 17 TIME TO Pg.37 INDIA AUGUST 23, 2013 BRE A K INDEPENDENCE DAY SPECIAL FREThe boundaries of E economic, political and individual freedom need to be extended www.forbesindia.com LETTER FROM THE EDITOR-IN-CHIEF Towards Greater Freedom or a country that became politically free in 1947 and took a stab at economic freedom in 1991, the script in 2013 could not have been worse: An economy going downhill, a currency into free fall, and a widespread Ffeeling of despondency and frustration. A more full-blooded embrace of markets should have brought corruption down and increased competition for the benefi t of customers and citizens alike. But that was not the path we took over the last decade. An expanding pie should have provided adequate resources for off ering safety nets to the really poor even while leaving enough with the exchequer to fund public goods. But India is currently eating the seedcorn of future growth with mindless social spending. Corruption has scaled new heights, politicians have been found hand-in-glove with businessmen to hijack state resources for private ends, and a weakened state is opting for even harsher laws and an INDIA ever-expanding system of unaff ordable doles to maintain itself in power. Politicians have raided the treasury for private purposes, and businessmen fi nd more profi t in rent-seeking behaviour than in competing fairly in the marketplace. -

Network • January 28, 2019

Network • January 28, 2019 National Stock Exchange of India Limited, BSE Limited Listing Department, Department of Corpo rate Services - Listing Exchange Plaza , Plot No. C/1, P J Towers, G-Block, Bandra-Kurla Complex, Dalal Street, Bandra (E), Mumbai-400051 Mumbai - 400 001 Trading Symbol : NETWORK18 SCRIP CODE : 532798 Sub .: Regulation 30 of SEBI (Listing Obligation and Disclosure Requirements) Regulation, 2015 - Credit Rating Dear Sir / lVIadam, This is to inform you that ICRA Limited (ICRA), the Credit Rating Agency, has assigned the credit rating of "[ICRA] AAA (Stable)" to the Company's Long-term Borrowing Programme (Bank Loan / Non-convertible Debenture Programme) of Rs.1,000 crore (enhanced from Rs.500 crore). Further, the rating for Company's Commercial Paper Programme and Long-term / Short term, Fund-based / Non-fund Based Facilities limits remain unchanged. We are enclosing the rating rationale issued by ICRA. You are requested to kindly take the above information on record. Thanking you, Yours faithfully, For Network18 Media & Investments Limited Ratnesh Rukhar ar Group Company Secretary Encl: as above Network18 Media & Investments Limited (CIN - L6591OMH1996PLC280969) Regd . office :First Floor, Empire Complex, 414- Senapati Bapat Marg, Lower Parel, Mumbai-400013 T+91 22 40019000, 66667777 W www.nw 18.comE:investors.n18@nwI8. com Network18 Media & Investments Limited January 25, 2019 Network18 Media & Investments Limited: [ICRA]AAA (Stable) assigned for fresh long-term borrowing programme Summary of rated action Previous -

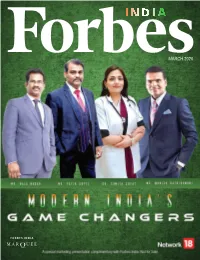

March 2020 from the Editor

MARCH 2020 FROM THE EDITOR: A visionary leader or a company that has contributed to or had a notable impact on the society is known as a game changer. India is a land of such game changers where a few modern Indians have had a major impact on India's development through their actions. These modern Indians have been behind creating a major impact on the nation's growth story. The ones, who make things happen, prove their mettle in current time and space and are highly SHILPA GUPTA skilled to face the adversities, are the true leaders. DIRECTOR, WBR Corp These Modern India's Game Changers and leaders have proactively contributed to their respective industries and society at large. While these game changers are creating new paradigms and opportunities for the growth of the nation, they often face a plethora of challenges like lack To read this issue online, visit: of funds and skilled resources, ineffective strategies, non- globalindianleadersandbrands.com acceptance, and so on. WBR Corp Locations Despite these challenges these leaders have moved beyond traditional models to find innovative solutions to UK solve the issues faced by them. Undoubtedly these Indian WBR CORP UK LIMITED 3rd Floor 207 Regent Street, maestros have touched the lives of millions of people London, Greater London, and have been forever keen on exploring beyond what United Kingdom, is possible and expected. These leaders understand and W1B 3HH address the unstated needs of the nation making them +44 - 7440 593451 the ultimate Modern India's Game Changers. They create better, faster and economical ways to do things and do INDIA them more effectively and this issue is a tribute to all the WBR CORP INDIA D142A Second Floor, contributors to the success of our great nation. -

Declaration Under Section 4 (4) of the Telecommunication (Broadcasting and Cable Services) Interconnection (Addressable Systems) Regulations, 2017 (No.1 of 2017)

Declaration under Section 4 (4) of The Telecommunication (Broadcasting and Cable Services) Interconnection (Addressable Systems) Regulations, 2017 (No.1 of 2017) 1. TARGET MARKET [Reg. 4 (4) (a)] Distribution Network State/Parts of State covered as “Coverage Area” Location Kolkata West Bengal, Odisha , Jharkhand 2. TOTAL CHANNEL CARRYING CAPACITY [Reg. 4 (4) (b)] LOCATION NAME NO.OF SD SERVICES NO.OF HD SERVICES TOTAL SERVICE CAPACITY* Kolkata 361 67 513 *Kindly Note: 1. Capacity in SD Terms is clarified as 1 SD = 1 SD; 1 HD = 2 SD; 2. Number of channels may vary within the area serviced by a distribution network location depending on available Bandwidth capacity. 3. LIST OF CHANNELS AVAILABLE ON NETWORK [Reg. 4 (4) (c)] DISTRIBUTION NETWORK LOCATION: KOLKATA Sl No Channel Name Count in SD terms Type 1 &FLIX 1 SD 2 &FLIX HD 2 HD 3 &PICTURES 1 SD 4 &PICTURES HD 2 HD 5 &PRIVE HD 2 HD 6 &TV 1 SD 7 &TV HD 2 HD 8 &XPLOR HD 2 HD 1 9 24 GHANTA 1 SD 10 24 HOURS TV 1 SD 11 35 MM 1 SD 12 9X JALWA 1 SD 13 9X JHAKAAS 1 SD 14 9X TASHAN 1 SD 15 9XM 1 SD 16 9XO 1 SD 17 AAJ TAK 1 SD 18 AAJ TAK HD 2 HD 19 AAKASH AATH 1 SD 20 AALAMI SAHARA 1 SD 21 AASTHA 1 SD 22 AASTHA BHAJAN 1 SD 23 ABP ANANDA 1 SD 24 ABP MAJHA 1 SD 25 ABP NEWS 1 SD 26 ADITHYA TV 1 SD 27 AL JAZEERA 1 SD 28 ALANKAR 1 SD 29 AMAR CHANNEL 1 SD 30 AMAR CINEMA 1 SD 31 ANIMAL PLANET 1 SD 32 ANIMAL PLANET HD WORLD 2 HD 33 ANJAN TV 1 SD 34 ARIHANT 1 SD 35 ARIRANG 1 SD 36 ARTAGE NEWS 1 SD 37 ASIANET 1 SD 38 ASIANET MOVIES 1 SD 39 ASIANET NEWS 1 SD 40 ASIANET PLUS 1 SD 41 AXN 1 SD 42 AXN HD 2 HD