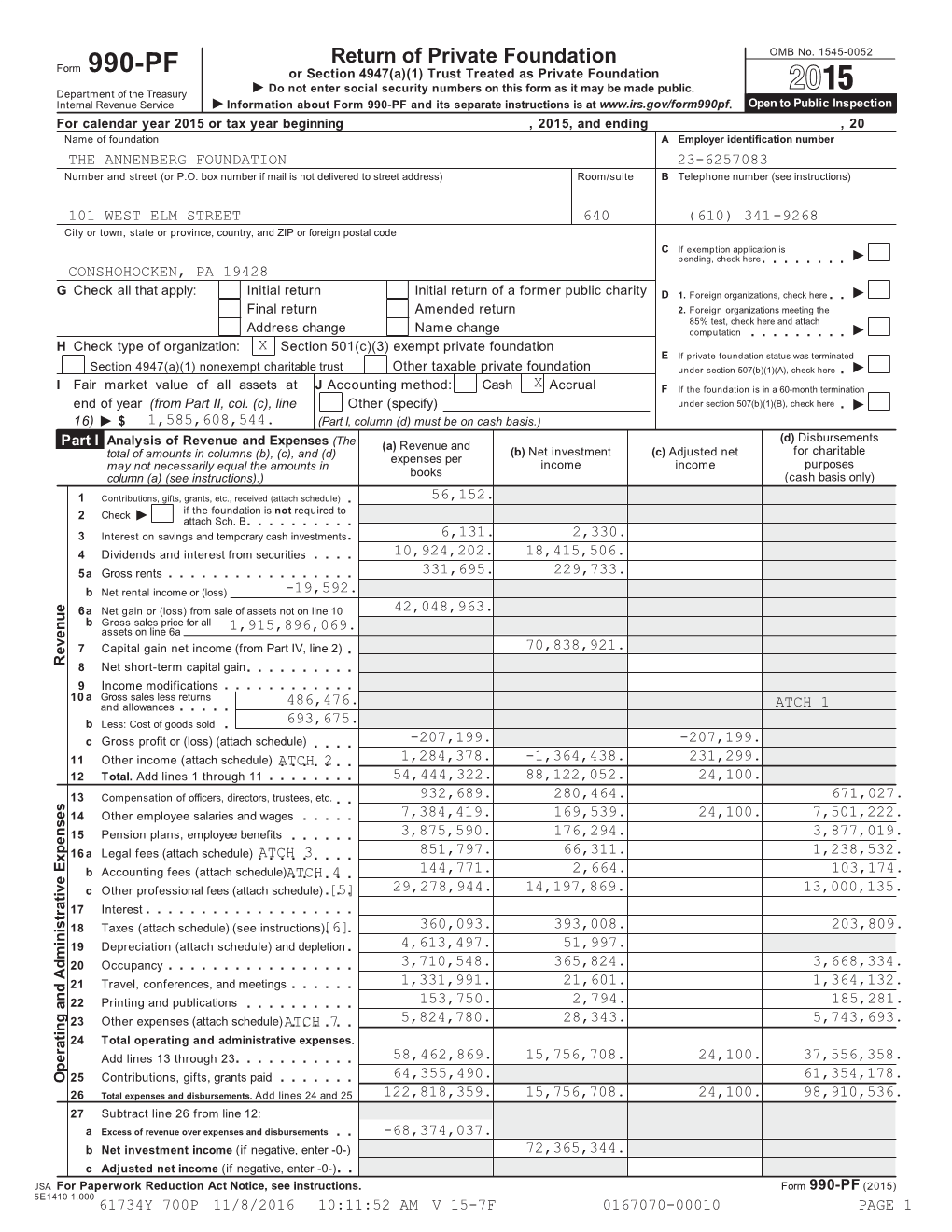

2015 Form 990-PF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Annenberg Foundation

Trustees Gregory Annenberg Weingarten, Charles Anenberg Weingarten, Wallis Annenberg and Lauren Bon (photo by Jim McHugh) The Annenberg Foundation Courtesy of Southern California Grantmakers By James Klein, James Klein Consulting While global in scope, the Annenberg Foundation has a special relationship with the Los Angeles area. The Annenberg Foundation’s Radnor, Pennsylvania headquarters was established with its creation in 1989, while the Southern California office didn’t become fully operational until 2003. Four out of five of the Foundation’s Trustees live in Los Angeles County, however, and work from its Century City office. While both locations accept grant submissions from anywhere in the world, the Trustees’ presence in the region and close involvement in the organization naturally leads to support for local projects. “Our perspective is a Los Angeles one,” says Leonard Aube, Managing Director of the Annenberg Foundation’s Southern California operations. “Those of us here today were not transferred from the Radnor, Pennsylvania office. We were brought on under Wallis Annenberg’s leadership to support her philanthropy in the region primarily.” The Annenberg Foundation is the 11th largest nationwide in giving, authorizing over $250 million in grants to more than 500 nonprofit organizations in its most recently completed fiscal year. The institution ranks 18th overall in total assets nationwide with more than $2.5 billion. Though sizable, the Annenberg Foundation is a family affair. Publisher, diplomat, and philanthropist Walter H. Annenberg founded the organization in 1989. His wife, Leonore Annenberg, became President and Chairman after his passing in 2002. His daughter, Wallis Annenberg, emerged as Vice President. -

For Immediate Release Annenberg Foundation in Association With

For Immediate Release Annenberg Foundation in association with KCRW presents COUNTRY IN THE CITY Three Free Concerts inspired by Annenberg Space for Photography’s current exhibit, Country: Portraits of an American Sound Performances by GREGG ALLMAN, SHELBY LYNNE, WYNONNA & THE BIG NOISE and more LOS ANGELES, CA (June 3, 2014) The Annenberg Foundation today announced Country in the City, an all ages, free concert series inspired by the Annenberg Space for Photography’s current exhibition, Country: Portraits of an American Sound. Country in the City will take place on three Saturday evenings, July 19, July 26 and August 2, in Century Park in Century City on the lawn adjacent to the Annenberg Space for Photography. Presented in association with KCRW, the concerts will be offered free to the public. Each of the concerts will require separate, advance online registration at KCRW.com. Emails will be sent to those who have registered with detailed instructions in advance of their arrival at the concert site. RSVP is required for entry. No tickets are needed. However, registered guests must collect wristbands upon arrival at check in to gain access to concerts. The talent lineup is as follows: July 19: GREGG ALLMAN, Sturgill Simpson July 26: SHELBY LYNNE, Jamestown Revival August 2: WYNONNA & THE BIG NOISE, Nikki Lane Gregg Allman, who is a Rock and Roll Hall of Fame inductee as a founding member of the Allman Brothers Band, headlines the first evening on July 19. Named one of the "100 Greatest Singers of All Time’’ by Rolling Stone, Allman recently released All My Friends: Celebrating the Songs & Voice of Gregg Allman, a live album that include guest performances by many of his contemporaries such as Trace Adkins, Jackson Browne, Martina McBride, Vince Gill, John Hiatt, Widespread Panic and many more. -

IRS TCF Form 990 for 2011

The Community Foundation Serving Boulder County 1123 Spruce Street Boulder, CO 80302-4001 2011 Exempt Org. Return 990 OMB No. 1545-0047 Form Return of Organization Exempt From Income Tax 2011 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) Open to Public Department of the Treasury Inspection Internal Revenue Service G The organization may have to use a copy of this return to satisfy state reporting requirements. A For the 2011 calendar year, or tax year beginning , 2011, and ending , B Check if applicable: C D Employer Identification Number Address change THE COMMUNITY FOUNDATION 84-1171836 E Name change SERVING BOULDER COUNTY Telephone number Initial return 1123 SPRUCE STREET (303)442-0436 Terminated BOULDER, CO 80302-4001 Amended return G Gross receipts $ 6,759,301. Application pending F Name and address of principal officer: H(a) Is this a group return for affiliates? Yes X No H(b) Are all affiliates included? Yes No SAME AS C ABOVE If 'No,' attach a list. (see instructions) I Tax-exempt status X 501(c)(3) 501(c) ( )H (insert no.) 4947(a)(1) or 527 G J Website: G WWW.COMMFOUND.ORG H(c) Group exemption number K Form of organization: X Corporation Trust Association OtherG L Year of Formation: 1991 M State of legal domicile: CO Part I Summary 1 Briefly describe the organization's mission or most significant activities: THE COMMUNITY FOUNDATION EXISTS TO IMPROVE THE QUALITY OF LIFE IN BOULDER COUNTY, NOW AND FOREVER, AND CREATE A CULTURE OF GIVING. -

Selections from the Gift Collection of Walter and Leonore

Graduated brass weights cast in the shape of elephants (page 47). Previous page A sampling of decorative boxes that the Annenbergs received as gifts over the decades. TREASURES AT SUNNYLANDS: SELECTIONS FROM THE GIFT COLLECTION OF WALTER & LEONORE ANNENBERG January 25, 2015 through January 17, 2016 by Anne Rowe Text, design, and all images copyright © The Annenberg Foundation Trust at Sunnylands 2014. An illustration of Washington, D.C. from First published in 2014 by The Annenberg Foundation Trust at Sunnylands, the interior of the decoupage presentation 71231 Tamarisk Lane, Rancho Mirage, CA 92270, United States of America. box given to the Annenbergs by All rights reserved. No part of this book may be reproduced or utilized, in any form or by any Jay and Sharon Rockefeller (page 51). means, electronic or mechanical, without prior permission in writing from the publisher. Library of Congress Control Number: 2014951183 ISBN: 978-0-9858429-9-4. Printed in the United States of America. Book and cover design by JCRR Design. Contents The Annenberg Retreat at Sunnylands by Geoffrey Cowan page 6 Walter and Leonore Annenberg by Janice Lyle, Ph.D. page 6 Treasures at Sunnylands by Anne Rowe pages 7 – 17 Gifts from Presidents & First Ladies pages 18 – 27 Gifts from Royalty pages 28 – 33 Gifts from Diplomats pages 34 – 43 Gifts from Business Leaders pages 44 – 53 Gifts from Entertainers pages 54 – 59 Gifts from Family pages 60 – 63 Acknowledgments page 64 This eighteenth-century silver creamer was a gift from David Rockefeller (page 45). 5 The Annenberg Retreat at Sunnylands Walter and Leonore Annenberg For more than forty years, Sunnylands served as Sunnylands was the winter home of Walter and an oasis for presidents of the United States, other Leonore Annenberg. -

2016 Form 990-PF

Return of Private Foundation OMB No. 1545-0052 Form 990-PF I or Section 4947(a)(1) Trust Treated as Private Foundation À¾µº Do not enter social security numbers on this form as it may be made public. Department of the Treasury I Internal Revenue Service Information about Form 990-PF and its separate instructions is at www.irs.gov/form990pf. Open to Public Inspection For calendar year 2016 or tax year beginning , 2016, and ending , 20 Name of foundation A Employer identification number THE ANNENBERG FOUNDATION 23-6257083 Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B Telephone number (see instructions) 101 WEST ELM STREET 640 (610) 341-9268 City or town, state or province, country, and ZIP or foreign postal code C If exemption applicatmionm ism m m m m m I pending, check here CONSHOHOCKEN, PA 19428 m m I G Check all that apply: Initial return Initial return of a former public charity D 1. Foreign organizations, check here Final return Amended return 2. Foreign organizations meeting the 85% test, checkm hem rem anmd am ttamchm m m I Address change Name change computation H Check type of organization: X Section 501(c)(3) exempt private foundation E If private foundation status was terminamtedI Section 4947(a)(1) nonexempt charitable trust Other taxable private foundation under section 507(b)(1)(A), check here I Fair market value of all assets at J Accounting method: Cash X Accrual F If the foundation is in a 60-month terminmatIion end of year (from Part II, col. -

Remarks Announcing the Annenberg Foundation Education Challenge Grants December 17, 1993

Dec. 17 / Administration of William J. Clinton, 1993 Remarks Announcing the Annenberg Foundation Education Challenge Grants December 17, 1993 Thank you very much, Secretary Riley and safe schools act so that we don't have 160,000 Secretary and Mrs. Bentsen, Deputy Secretary kids stay home every day because they're afraid of Education Madeleine Kunin. I want to men- to go to school; establishing a system of lifetime tion some of the people who are here. I'm glad learning. These things make a real difference. to see Senator Kennedy, Senator Pell, and Con- But if I have learned one thing in all the years, gressman Reed here, and my former colleagues in all the countless hours that Hillary and I and friends Governor Romer and Governor have spent in public schools all across this coun- Edgar, Dr. Gregorian and David Kearns and try, it is that the true magic of education in Ted Sizer and Frank Newman and so many the end occurs between teachers and students people that I've worked with over the years. and principals and parents and those who care When Walter Annenberg was giving his very about what happens in the classroom and out- brief statement, it reminded me of a comment side the classroom. that the President with the best developed mind, And one of the things that has plagued me Thomas Jefferson, once said. He said, ``You all these years is seeing all the successes, be- know, if I had more time I could write shorter cause, I tell you, I have tried to focus the Amer- letters.'' [Laughter] So I think he said all that ican people in the last several weeks on the needed to be said. -

Doing Diabetes (Type 1): Symbiotic Ethics and Practices of Care Embodied in Human-Canine Collaborations and Olfactory Sensitivity

Doing diabetes (Type 1): Symbiotic ethics and practices of care embodied in human-canine collaborations and olfactory sensitivity Submitted by Fenella Eason to the University of Exeter as a thesis for the degree of Doctor of Philosophy in Anthrozoology in August 2017 This thesis is available for Library use on the understanding that it is copyright material and that no quotation from the thesis may be published without proper acknowledgement. I certify that all material in this thesis which is not my own work has been identified and that no material has previously been submitted and approved for the award of a degree by this or any other University. Signature.................................................................. 1 ABSTRACT The chronically ill participants in this study are vulnerable experts in life’s uncertainties, and have become aware over time of multiple medical and social needs and practices. But, unlike the hypo-aware respondents documented in some studies of diabetes mellitus Type 1, these research participants are also conscious of their inability to recognise when their own fluctuating blood glucose levels are rising or falling to extremes, a loss of hyper- or hypo-awareness that puts their lives constantly at risk. Particular sources of better life management, increased self-esteem and means of social (re-)integration are trained medical alert assistance dogs who share the human home, and through keen olfactory sensitivity, are able to give advance warning when their partners’ blood sugar levels enter ‘danger’ zones. Research studies in anthrozoology and anthropology provide extensive literature on historic and contemporary human bonds with domestic and/or wild nonhuman animals. -

Philanthropy New York, 2008

History of U.S. Philanthropy The word "philanthropy" derives from the Ancient Greek phrase philanthropia , meaning "to love people." Today, the concept of philanthropy includes the act of voluntary giving by individuals or groups to promote the common good. It also refers to the formal practice of grantmaking by foundations to nonprofit organizations. Cultural Origins in the U.S. Philanthropy in the Unites States has emerged from a number of cultural influences, such as: • Strong religious beliefs and traditions • Practices of collective hunting, food distribution and potlatches in Native American communities • Cultures of mutual assistance and support among multiple waves of settler and immigrant communities It wasn't until after the Civil war that the modern business of philanthropy began to form. Until then, charity was a mostly fragmented endeavor driven largely by religious groups and characterized by almsgiving and volunteerism aimed at assisting the immediate problems of the urban poor. Industrialization and the Rise of Modern Philanthropy. At the end of the 19th century, charities started taking a more systematic approach to the work of improving social conditions, and adopted management methods that were gaining a following in the business world. Modern grantmaking was founded on the large-scale donations of a number of individuals and families who made their wealth during the late 19th and early 20th centuries in the steel, oil, railroad, telegraph, and automobile industries (such as Sage, Carnegie, Rockefeller, and Ford). Democratization and Growth of the Field. American generosity and volunteerism was spurred again by World War I. During this time, Americans gave more then $400 million in gifts and membership dues to the Red Cross in connection with the war, signaling the growth of grassroots fundraising and the democratization of giving. -

2016 Information About Form 990-PF and Its Separate Instructions Is At

r -^ Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947( a)(1) Trust Treated as Private Foundation Do not enter social security numbers on this form as it may be made public. Department of the Treasury ► 2016 Information about Form 990-PF and its separate instructions is at www.irs.gov/form990pf. en o u Internal Revenue Service ► iFI nspect ion For calendar year 2016 or tax year beginning , and ending Name ofloundatlon A Employer identification number AMnR'P.g0W-'PnrCF.RG FnTTNnArPTC)N - INC'. 22-3052390 Number and street (or P O box number if mail is not delivered to street address) Room/suite B Telephone number 327 WEST 19TH STREET 212-989-9331 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending , check here NEW YORK , NY 10011 G Check all that apply: El Initial return El initial return of a former public charity D 1 Foreign organizations, check here Final return 0 Amended return 2. Foreign organizations meeting the 85% test, D Address chan g e D Name change check here and attach computation H Check type of organization: ® Section 501(c)(3) exempt private foundation E If private foundation status was terminated 0 Section 4947(a)( 1 ) nonexem pt charitable trust El Other taxable p rivate foundation under section 507(b)(1)(A), check here I Fair market value of all assets at end of year J Accounting method: 0 Cash ® Accrual F If the foundation is in a 60-month termination (from Part 11, col (C), line 16) 0 Other (specify) under section 507(b)(1)(B), check here 1, column (d) must be on cash basis.) ► $ 14 8 41 313 . -

Consolidated Financial Statements and Report of Independent Certified Public Accountants

Consolidated Financial Statements and Report of Independent Certified Public Accountants Annenberg Foundation December 31, 2019 and 2018 Contents Page Report of Independent Certified Public Accountants 3 Consolidated financial statements Consolidated statements of financial position 5 Consolidated statements of activities 6 Consolidated statement of functional expenses 7 Consolidated statements of cash flows 8 Notes to the consolidated financial statements 9 GRANT THORNTON LLP REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS 2001 Market St., Suite 700 Philadelphia, PA 19103-7065 D +1 215 561 4200 F +1 215 561 1066 S linkd.in/grantthorntonus twitter.com/grantthorntonus Board of Directors Annenberg Foundation We have audited the accompanying consolidated financial statements of the Annenberg Foundation (a nonprofit organization) (the Foundation), which comprise the consolidated statements of financial position as of December 31, 2019 and 2018, and the related consolidated statements of activities, functional expenses, and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s responsibility for the financial statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. -

Annenberg Foundation FS-2015

Consolidated Financial Statements and Report of Independent Certified Public Accountants Annenberg Foundation December 31, 2015 and 2014 Annenberg Foundation Contents Page Report of Independent Certified Public Accountants 1 Consolidated statements of financial position 3 Consolidated statements of activities 4 Consolidated statements of cash flows 5 Notes to the consolidated financial statements 6 Audit – Tax – Advisory Grant Thornton LLP 515 South Flower Street, 7th Floor Report of Independent Certified Public Accountants Los Angeles, CA 90071-2201 T 213.627.1717 F 213.624.6793 Board of Directors www.GrantThornton.com Annenberg Foundation We have audited the accompanying consolidated financial statements of the Annenberg Foundation (a nonprofit organization) (the Foundation), which comprise the consolidated statements of financial position as of December 31, 2015 and 2014, and the related consolidated statements of activities and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s responsibility for the financial statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. -

Just Added in Des Moines!

Just Added in Des Moines! The United Way of Central Iowa and The Grantsmanship Center are bringing the Grantsmanship Training Program to Des Moines, Iowa, May 2-6, 2016. Learn how to win grants! Do you want foundation, corporate, or government funding? We'll give you the skills and knowledge you need to win grants because we literally wrote the book! Over 40 years ago, The Grantsmanship Center set the industry standard for training with the Grantsmanship Training Program. This training has always set the pace for the field and now, with an updated textbook, it has more muscle than ever. This textbook, Grantsmanship: Program Planning & Proposal Writing, is the expanded edition of the seminal work in the field. The original sold more than a million copies and the new edition has opened to rave reviews! All grant proposal writers will benefit from Grantsmanship: Program Planning & Proposal Writing, with its essential framework for success....this new edition is beautifully illustrated, cleanly edited, and a page turner to boot. Go turn it into money! Jennifer Leonard President and CEO Rochester Area Community Foundation (NY) There's only one thing better than this book for someone who wants to learn how to secure grant funding--take The Grantsmanship Center training along with this book. Wallis Annenberg Chairman of the Board, President & CEO Annenberg Foundation If you're new to proposal writing, this class will build your foundation for success. If you're an experienced professional, this class will polish your skills. Working actively with new colleagues, you'll learn and practice "grant thinking" that will give your proposals a razor-sharp competitive edge.