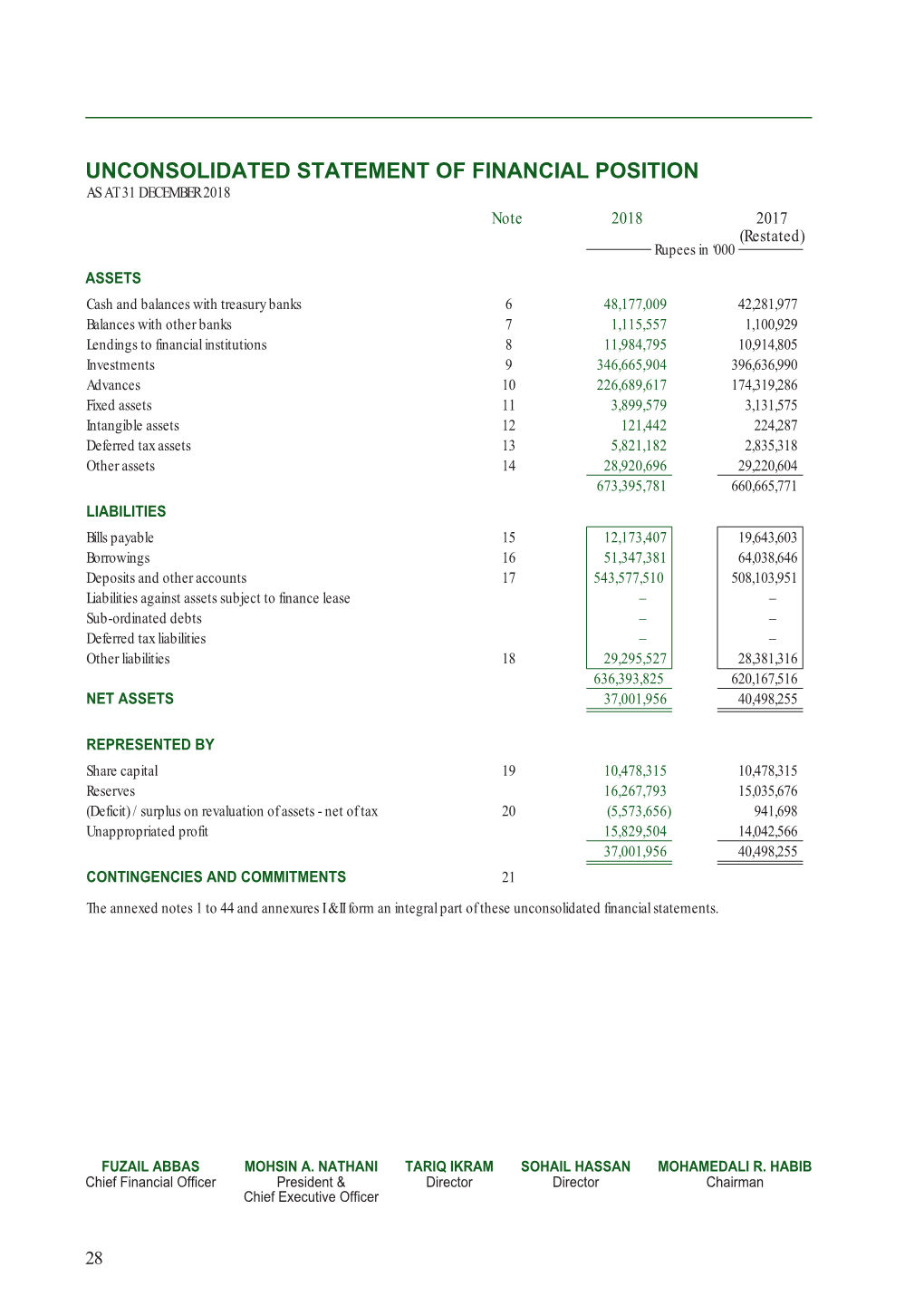

UNCONSOLIDATED STATEMENT of FINANCIAL POSITION AS at 31 DECEMBER 2018 Note 2018 2017 (Restated) Rupees in ‘000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Schools Based in Karachi to Whom the Book Quaid-I-Azam Nay Farmaya Is Being Distributed Free of Cost 1

List of Schools based in Karachi to whom the book Quaid-i-Azam Nay Farmaya is being distributed free of cost 1. AES School for Girls 2. Aisha Bawany Academy 3. Army Public School 4. Avicenna 5. Bay View Academy 6. Beacon Askari School and College 7. Beaconhouse School System 8. BVS High School 9. C.A.S. School System 10. Charterhouse Public School 11. Convent of Jesus & Mary 12. Cordoba School for A - Level 13. DA Public School O & A Levels 14. Date Palm School 15. Dawood Public School 16. Falconhouse Grammar School 17. Foundation Public School 18. Froebel Education Centre 19. Generation's School 20. Ghulaman-e- Abbas School 21. Habib Girls School 22. Habib Public School 23. Happy Home School 24. Happy Palace Grammar School 25. Jaffar Public School 26. Karachi Cadet School 27. Karachi Grammar School 28. Karachi High School 29. Ladybird Grammar School 30. Lahore Grammar School 31. L'ecole for Advanced Studies 32. Links School 33. Metropolis School System 34. Metropolitan School System 35. Nakhlah School 36. Nasra School 37. Qamr-e- Bani Hashim School 38. Shaheen Public School 39. Shahwilayat Public School 40. Shamsi Society Model School 41. St. Joseph's Convent School 42. St. Lawrence Convent Girls School 43. St. Michael's Convent School 44. St. Patrick's High School 45. St. Paul's English High School 46. Sunbeam Grammar School 47. The American Foundation School 48. The Centre for Advanced Studies 49. The City School 50. The Educators 51. The Fahim's School System 52. The Indus Academy 53. The Mama Parsi Girls' Secondary School 54. -

Little Champs Art & Creative Writing Competition 2015

Little Champs Art & Creative Writing Competition 2015 Partner Institutes Institute Branch / City Aga Khan School Federal B Area, Karachi Aga Khan School Garden Branch, Karachi Allied School Hafizabad Campus American Lycetuff Raiwind Campus Lahore American Lyceum Faisalabad Campus Army Public College Malir Cantt. Karachi Army Public College Malir Cantt. Karachi Army Public School Rahim Yar Khan Cantt. Army Public School DHA Phase I, Rawalpindi Army Public School & College (Azam Gar) Lahore Cantt. Army Public School & College Bakhar Island Sukkur Army Public School & College Fort Road, Rawalpindi Cantt. Army Public School & College Thall Cantt. Hangu, KPK Army Public School & College Okara Cantt Army Public School & College Khushab Road, Sargodha Cantt Army Public School & College Quaid Garrision, D.G Khan Asas International School F-8/3, Islamabad Bahria College Islamabad Naval Complex Primary Wing Bahria Town School Bahria Town, Lahore Beaconhouse School System Defence Campus, Lahore Beaconhouse School System Garden Town Campus Beaconhouse School System JTC, Senior Girls, Lahore Beaconhouse School System LMA Primary, Gulberg Lahore Beaconhouse School System Okara Campus Beaconhouse School System Palm Tree Campus, Gujranwala Beaconhouse School System Sialkot Campus Beaconhouse School System Allama Iqbal Town Lahore Beaconhouse School System Canal Side Girls, Lahore Beaconhouse School System Wapda Town, Gujranwala Brainiacs Montessori & High School Naval Anchorage, Islamabad DA Public School O/A Levels , DHA Karachi DA SKBZ College DHA Karachi -

A Plastic-Free Environment at C.A.S. 12Th Annual Evening of Rhythm and Rhyme the KBC National Inter-School Indoor Rowing Regatta

A student publication of Christmas Edition The C.A.S. School Vol. 17, Issue # 2: December 2019 12th annual Evening of Rhythm and Rhyme 5th National PASCH Donations for Refugee Children Zahra Zeina Gillani, 10A German Spelling Bee Tara Vera Ahmed, 11B An initiative was taken by Competition our school to help the Ramis Riaz Kamlani, 10B refugee children in Syria by donating warm clothes, food, bedding, and funds On 18 October, 5th National PASCH to help them survive the German Spelling Bee Competition harsh winter season. A was held at Goethe-Institut, Karachi. charity drive was organised Seven schools participated in this and managed by the competition. Hiba Ansari, Eman Student Government at Mallick Imam and I represented C.A.S. in which donations C.A.S. and secured first position. This of the above mentioned victory helped us proceed further to items were collected from compete in the final round, held in parents of KG, Junior and On 9 November, the 12th annual tried to bring attention to this crisis Lahore on 22 November. Once again Senior Sections as well as the school humanitarian services in areas struck Evening of Rhythm and Rhyme was through the choice of poetry and the team performed brilliantly and staff and faculty members. A by natural calamities, war and conflict. held at the Main Campus. 24 students music that they presented. secured third position in the contest. delegation of 8 students from the Students were briefed about the crisis from classes 10 and 11 had been Student Government travelled to by Mr Resat BASER, Head of selected to participate. -

Annual Report 2007‐08

Annual Report 2007‐08 Table of Contents I ABOUT IBA ............................................................................................................ 3 II EXECUTIVE EDUCATION ................................................................................... 5 III FACULTY ............................................................................................................... 8 IV STUDENTS AT IBA ............................................................................................... 9 V COMMITTEES AT IBA ....................................................................................... 11 VI RESEARCH PUBLICATIONS ............................................................................. 14 VII BOOKS, MONOGRAPHS, & PROCEEDINGS .................................................. 17 VIII CONFERENCES ATTENDED BY FACULTY ................................................... 18 IX JOURNAL OF IBA - BUSINESS REVIEW......................................................... 20 X RECENTLY COMPLETED MIS/IT PROJECTS ................................................ 22 XI EMPLOYERS OF IBA GRADUATES................................................................. 23 XII STUDENT PROJECTS IN INDUSTRY ............................................................... 24 XIII VISITS OF SCHOLARS, DIPLOMATS AND DIGNITARIES .......................... 25 XIV ANNEXURE.......................................................................................................... 26 XV MEMBERS BOARD OF GOVERNORS - IBA .................................................. -

List of Bronze Medal Winners

LIST OF BRONZE MEDAL WINNERS FIRST POSITION IN INSTITUTION S. NO. ROLL NO. STUDENT NAME FATHER NAME CLASS INSTITUTION CITY/DISTRICT AAIMAH AHMED 1 18-47-20594-1-002-E IRFAN AHMED SUALEH 1 THE CITY NURSERY JHANG SUALEH 2 18-42-00739-1-014-E AAMINA HABIB HABIB QASIM 1 THE CITY SCHOOL JUNIOR LAHORE AL A'LA SCHOOL OF 3 18-42-20387-1-003-E AAMNA FAISAL FAISAL RIAZ 1 CONTEMPORARY AND LAHORE ISLAMIC STUDIES AANIYA AAMER 4 18-992-20490-1-003-E AAMER BHATTI 1 THE CITY NURSERY ABBOTTABAD BHATTI 5 18-051-00241-1-004-E AAYAN MASROOR TIPU MASROOR 1 ROOTS MILLENNIUM SCHOOL ISLAMABAD 6 18-544-20506-1-001-E ABBIHA MUNTAHA NISAR AHMAD 1 WINNINGTON SCHOOL JHELUM BLOOMFIELD HALL PREPS 7 18-61-00831-1-001-E ABDUL AHAD GARDEZI AHMAD NAWAZ GARDEZI 1 MULTAN AND JUNIOR SCHOOL ARMY PUBLIC SCHOOL 8 18-52-00546-1-069-E ABDUL AZIZ MUHAMMAD QASIM 1 SIALKOT JUNIOR CAMPUS 9 18-55-00222-1-011-E ABDUL AZIZ HAROON MUHAMMAD HAROON 1 THE NOOR SCHOOL GUJRANWALA THE CITY SCHOOL LIAQUAT 10 18-022-00518-1-001-E ABDUL HADI NASIR KHAN 1 HYDERABAD CAMPUS ALLIED SCHOOL 11 18-62-00468-1-009-E ABDUL HADI MUHAMMAD SHAKIR 1 BAHAWALPUR PRIMARY BAHAWALPUR CAMPUS ARMY PUBLIC SCHOOL 12 18-62-20346-1-008-E ABDUL KABEER HADI KHURRAM SHAHZAD 1 BAHAWALPUR MIDDLE BAHAWALPUR CANTT ABDUL MOIZ BIN MALIK RASHID THE CITY SCHOOL ATTOCK 13 18-57-00554-1-003-E 1 ATTOCK RASHID MEHMOOD CAMPUS AIR FOUNDATION SCHOOL 14 18-51-00538-1-004-E ABDUL RAFAY ABDUL HANAN ABBASSI 1 RAWALPINDI SYSTEM HARLEY CAMPUS AGA KHAN SCHOOL 15 18-021-00714-1-002-E ABDUL REHMAN MUHAMMAD IQBAL 1 KARACHI KHARADHAR ALLIED SCHOOL -

List of Gold Medal Winners

LIST OF GOLD MEDAL WINNERS FIRST POSITION IN PAKISTAN S. NO. ROLL NO. STUDENT NAME FATHER NAME CLASS INSTITUTION CITY/DISTRICT MIANWALI EDUCATION 1 18-459-00612-1-010-E AAFIA REHMAN SHAFIQ-UR-REHMAN 1 MIANWALI TRUST COLLEGE THE CITY SCHOOL CHAKWAL 2 18-543-00631-1-025-E AAIMA ABBAS GHULAM ABBAS 1 CHAKWAL CAMPUS 3 18-42-20719-1-009-E AAIZA ARSLAN ARSLAN ALI 1 LAHORE GRAMMAR SCHOOL LAHORE THE LYNX SCHOOL PRIMARY 4 18-051-00600-1-028-E AALEEN FATIMA IMRAN HUSSAIN 1 ISLAMABAD BRANCH THE LYNX SCHOOL PRIMARY 5 18-051-00600-1-013-E ABDUL HANAN KHALID KHALID MEHMOOD 1 ISLAMABAD BRANCH ABDUL HANAN THE LYNX SCHOOL PRIMARY 6 18-051-00600-1-012-E MOHSIN ALI 1 ISLAMABAD MOHSIN BRANCH THE CITY SCHOOL 7 18-244-00841-1-010-E ABDUL KABEER BISHARAT AKBAR 1 NAWABSHAH NAWABSHAH CAMPUS ROOTS INTERNATIONAL 8 18-51-20599-1-016-E ABDUL MOIZ SHAFQAT ALI 1 RAWALPINDI SCHOOL MUHAMMAD DANISH THE LYNX SCHOOL PRIMARY 9 18-051-00600-1-050-E ABDUL MOIZ DANISH 1 ISLAMABAD AMJAD BRANCH ABDUL RAAFAY THE CITY SCHOOL CANTT 10 18-91-20080-1-009-E SM RIZWAN IQBAL 1 PESHAWAR RIZWAN NURSERY BRANCH BAHRIA COLLEGE NAVAL 11 18-051-00224-1-003-E ABDUL RAFAY ZAFAR JABBAR 1 ISLAMABAD COMPLEX BAHRIA COLLEGE NAVAL 12 18-051-00224-1-068-E ABDULLAH KASHIF MUHAMMAD KASHIF 1 ISLAMABAD COMPLEX BEACONHOUSE SCHOOL 13 18-51-00199-1-054-E ABDULLAH SHAKEEL M. SHAKEEL 1 RAWALPINDI SYSTEM PRIMARY BRANCH THE CITY SCHOOL CANTT 14 18-91-20080-1-002-E ABDUR RAB ZAHEER ZAHEER UD DIN 1 PESHAWAR NURSERY BRANCH THE LYNX SCHOOL PRIMARY 15 18-051-00600-1-042-E ABEEHA RIZWAN RIZWAN SULTAN 1 ISLAMABAD BRANCH -

Habib Metropolitan Bank Ltd. Subsidiary of Habib Bank AG Zurich

ANNUAL REPORT 2020 OUR VISION To be the most respected financial institution based on trust, ser vice and commitment CONTENTS Corporate Information 03 Our Board of Directors 04 Our Management 06 Chairman’s Review to the Shareholders 08 Directors’ Report to the Shareholders 10 Corporate Governance 19 Statement of Compliance with the Code of Corporate Governance 22 Independent Auditors’ Review Report to the Members on Statement of Compliance with the Code of Corporate Governance 25 Statement of Internal Controls 26 Report of Shari’ah Board 27 Independent Auditors’ Report to the Members 29 Unconsolidated Statement of Financial Position 34 Unconsolidated Profit and Loss Account 35 Unconsolidated Statement of Comprehensive Income 36 Unconsolidated Statement of Changes in Equity 37 Unconsolidated Cash Flow Statement 38 Notes to the Unconsolidated Financial Statements 39 Pattern of Shareholdings 121 Consolidated Financial Statements 125 222 231 Branch Network 232 Notice of Annual General Meeting 236 Proxy Form 1 CORPORATE INFORMATION BOARD OF DIRECTORS CHAIRMAN Mohamedali R. Habib PRESIDENT & CHIEF EXECUTIVE OFFICER Mohsin A. Nathani DIRECTORS Anjum Z. Iqbal Firasat Ali Hamza Habib Mohomed Bashir Muhammad H. Habib Rashid Ahmed Jafer Tahira Raza BOARD COMMITTEES AUDIT INFORMATION TECHNOLOGY Anjum Z. Iqbal Anjum Z. Iqbal Hamza Habib Firasat Ali Rashid Ahmed Jafer Mohsin A. Nathani CREDIT RISK & COMPLIANCE Anjum Z. Iqbal Anjum Z. Iqbal Mohamedali R. Habib Firasat Ali Mohsin A. Nathani Mohsin A. Nathani Muhammad H. Habib Tahira Raza HUMAN RESOURCE & REMUNERATION Firasat Ali Mohsin A. Nathani Tahira Raza COMPANY SECRETARY SHARE REGISTRAR Ather Ali Khan CDC Share Registrar Services Limited CDC House, 99-B, Block-B, REGISTERED OFFICE S.M.C.H.S., Main Shahra-e-Faisal, Ground Floor, Spencer’s Building, Karachi - 74400. -

HOH Profile-04

Our ability to Amplify Growth in all spheres of business and sustainability drives us forward as we channel our energies towards the dream of a better world. About Us House of Habib plays a pivotal role in shaping the economics of Pakistan through its portfolio of businesses in the Automobile, Auto Parts, Building Materials, Energy, Packaging and Real Estate sectors. We add value to over 15 Million lives each day by creating sustainable solutions in key areas with investments that are impacting both stakeholders and the community at large. Our History In 1841, Esmail Ali started Khoja Mithabhai Nathoo Trading Company. Fifty years later, his son - Habib Esmail turned his father’s legacy into one of Pakistan’s largest conglomerates - The House of Habib. In 1941 the family entered the financial sector with Habib Bank and Habib Insurance followed closely by the global footprint of Habib AG Zurich. In 1947, this pioneering family went on to lend vital support to the newly independent state of Pakistan by providing a blank cheque to Quaid-e-Azam in order to help the young economy find its feet. In the 60’s, the group’s industrial interests started out with Thal Jute and Pakistan Papersack Division. In the years following, HOH’s legacy gave rise to Indus Motor Company, Balouchistan Laminates Division, Shabbir Tiles, AuVitronics, Agriautos and Thal Engineering - each of these businesses went onto become leaders in their categories and continue to flourish till today HOH entered the energy market with a stake in Sindh Engro Coal Mining Company in 2010, and its interests continue to grow with the newly formed ThalNova Power Thar (Private) Limited, a 330 MW coal fired power plant set to launch soon in Tharparker, Sindh. -

Issue 4 Full Version B Low Version

THE HABIBIAN ONWARD & UPWARDS! ALUMNI NEWSLETTER OF THE HABIB PUBLIC SCHOOL VOLUME 1 MONDAY Issue 4 04th, March, 2019 HABIB PUBLIC SCHOOL VOLUME 1 Issue 4 01 EDITORIAL Playing Life on the Front Foot Assalamalaikum, and welcome HABIBIANS to the first designed edition of The HABIBIAN. We come to you at a time of considerable turbulence and turmoil in the macro operating environment, making it more neces- sary to stay connected with our happy places, and when were we happier than when we were in school? This fact is reflected in the very large turnout for our alumni convention where old friends met and dined after lengthy periods of time. School Captain Abdul Rafay Qadir, on the verge of completing his ‘O’ Levels, was present on the occasion and gave the alumni a sampling of the new gen- eration’s mindset and vision. The HPS Convocation 2018 was a glorious affair that blessed the gradu- ating class with the feel good factor by the very elaborate and grand manner in which the school conducted the proceedings, with the School Band earning a well-deserved mentioned. Also for your imbibing pleasure are some very profound thoughts ex- pressed in the Keynote Speech delivered on Graduation Day 2018 by alumni Mr. Khalid Mahmood of Getz Pharma, the Chief Guest on the oc- casion. In this issue we carry glimpses of school activities, and there are many more that will go unreported due to space constraints, all testifying to a vibrant co-curricular culture so critical for producing well-rounded and balanced personalities. -

Mark Twain Silver Medal Iklc 2018

MARK TWAIN SILVER MEDAL IKLC 2018 CODE INSTITUTION NAME TEHSIL DISTRICT COORDINATOR NAME 00224 BAHRIA COLLEGE NAVAL COMPLEX ISLAMABAD ISLAMABAD ZAHRA SAMI INTERNATIONAL ISLAMIC UNIVERSITY 00254 MANSEHRA MANSEHRA SEHRISH JAMIL ISLAMABAD SCHOOLS MANSEHRA BEACONHOUSE SCHOOL SYSTEM RING 20677 LAHORE LAHORE SARA TAHIR ROAD CAMPUS 00433 KIPS GIRLS COLLEGE LAHORE LAHORE NAILA SHABAN BEACONHOUSE PRIMARY SCHOOL 00309 LAHORE LAHORE MEHREEN HUMAYUN GARDEN TOWN CAMPUS 00391 ADABISTAN-E-SOOPHIA SCHOOL LAHORE LAHORE SARA NADEEM 00442 BLOOMFIELD HALL SCHOOLS SAHIWAL SAHIWAL AMIR RASHED 00661 COMMECS COLLEGE KARACHI KARACHI ZAINULABDEEN 00909 THE CITY SCHOOL PREP + CLASS SR 1 KARACHI KARACHI RABIA SALEEM THE CITY SCHOOL MUSLIM TOWN GIRLS 20088 LAHORE LAHORE SAMINA REHMAN CAMPUS BEACONHOUSE SCHOOL SYSTEM PALM 20455 GUJRANWALA GUJRANWALA ZARNAB BURKI TREE CAMPUS GIRLS BRANCH 20473 THE CITY SCHOOL GULISTAN-E-JOHAR II KARACHI KARACHI SADAF NAZ 20469 NIXOR O-LEVELS KARACHI KARACHI AMNA NIAZI 20329 PUNJAB COLLEGE OF SCIENCE CAMPUS 8 LAHORE LAHORE WAQAS AHMED BAIG ARMY PUBLIC SCHOOL AND COLLEGE 00358 RAWALPINDI RAWALPINDI ZEB UN NISA BOYS 20512 BAY VIEW HIGH SENIOR SCHOOL KARACHI KARACHI TASNEEM ALLIBHOY 00488 HABIB PUBLIC SCHOOL KARACHI KARACHI BATOOL ABBAS 00304 PUNJAB COLLEGE FOR WOMEN FAISALABAD FAISALABAD ABDUL AZIZ HAYAT GIRLS HIGHER SECONDARY 00954 HYDERABAD HYDERABAD SHAHANA HAYAT SHAIKH SCHOOL 00672 HEAD START JUNIOR HIGH PECHS BRANCH KARACHI KARACHI VARDA TARIQ INTERNATIONAL ISLAMIC UNIVERSITY 00206 GUJRAT GUJRAT BISMAH RIASAT ISLAMABAD SCHOOLS GUJRAT -

15 Ibic 2020

15th IBIC 2020 CODE PRINCIPAL NAME INSTITUTION NAME DISTRICT 05515 COLONEL AFTAB HUSSAIN MILITARY COLLEGE JHELUM GUJRAT 05796 KULSOOM TANVEER BENCHMARK SCHOOL SYSTEM O LEVEL CAMPUS ISLAMABAD 05795 MADIHA RIZWAN SULEHRI JADEED DASTAGIR IDEAL HIGH SCHOOL GUJRANWALA 05807 SAMIRA RAMZAN FATIMIYAH BOYS' SCHOOL KARACHI 05507 SYEDA BATOOL FATIMA RIZVI GREEN ISLAND FOUNDATION SCHOOL KARACHI 05734 ADEELA RAHMAN ARMY PUBLIC SCHOOL AND COLLEGE RAWALPINDI 05823 IRMA AHSAN LAHORE GRAMMAR SCHOOL DEFENCE CAMPUS LAHORE 05804 MAHVASH ROSHANI DAWOOD PUBLIC SCHOOL KARACHI 05391 HAFSA ISHFAQ ARMY PUBLIC SCHOOL AND COLLEGE FOR GIRLS RAWALPINDI 05568 SHAUKAT ZAMAN FAZAIA INTER COLLEGE E-9 CAMPUS ISLAMABAD 05467 TAHIR MEHMOOD SIALKOT GRAMMAR SCHOOL SAMBRIAL SIALKOT 05427 KHALID SULTAN ARMY PUBLIC SCHOOL AND COLLEGE BOYS BRANCH RAWALPINDI 05562 MUHAMMAD SAEED SHAKIR GARRISON ACADEMY PRIMARY SECTION MULTAN 05765 MUHAMMAD ZAMAN CHEEMA ARMY PUBLIC SCHOOL AND COLLEGE JPJ CANTT GUJRAT MAJ. (R) ESHFAQUE AHMED 05030 ARMY PUBLIC SCHOOL AND COLLEGE FOR BOYS RAWALPINDI KHAN 05175 SAMINA KHALIL THE CITY SCHOOL IQBAL CAMPUS SIALKOT 05395 DR. MUJAHID ABBAS PAK-TURK MAARIF INTERNATIONAL SCHOOLS & COLLEGES BOYS CAMPUS ISLAMABAD 05325 MAHMOOD AHMED DOOL IBA COMMUNITY COLLEGE JACOBABAD 05376 AINEE SHEHZAD HABIB PUBLIC SCHOOL KARACHI 15th IBIC 2020 CODE PRINCIPAL NAME INSTITUTION NAME DISTRICT 05413 SYEDA AYESHA NADEEM ARMY PUBLIC SCHOOL & COLLEGE FWO RAWALPINDI 05428 RUBINA SHOAIB KHAN GARRISON ACADEMY FOR CAMBRIDGE STUDIES LAHORE 05818 HABIB ULLAH FAZAIA INTER COLLEGE KALLAR -

Annual Report Our Vision

2018ANNUAL REPORT OUR VISION To be the most respected financial institution based on trust, service and commitment CONTENTS Corporate Information 02 Notice of Annual General Meeting 03 Chairman’s Review to the Shareholders 07 Directors’ Report to the Shareholders 09 Statement of Compliance with the Code of Corporate Governance 16 Independent Auditor’s Review Report to the Members on Statement of Compliance with the Code of Corporate Governance 18 Statement of Internal Controls 19 Shari’ah Board’s Report 21 Independent Auditor’s Report to the Members 23 Unconsolidated Statement of Financial Position 28 Unconsolidated Profit and Loss Account 29 Unconsolidated Statement of Comprehensive Income 30 Unconsolidated Statement of Changes in Equity 31 Unconsolidated Cash Flow Statement 32 Notes to the Unconsolidated Financial Statements 33 Pattern of Shareholdings 111 Consolidated Financial Statements 115 204 211 Branch Network 212 Proxy Form 1 CORPORATE INFORMATION BOARD OF DIRECTORS CHAIRMAN Mohamedali R. Habib PRESIDENT & CHIEF EXECUTIVE OFFICER Mohsin A. Nathani DIRECTORS Ali S. Habib Anjum Z. Iqbal Firasat Ali Mohomed Bashir Muhammad H. Habib Sohail Hasan Tariq Ikram BOARD COMMITTEES AUDIT INFORMATION TECHNOLOGY Ali S. Habib Anjum Z. Iqbal Anjum Z. Iqbal Firasat Ali Sohail Hasan Mohsin A. Nathani CREDIT RISK & COMPLIANCE Anjum Z. Iqbal Anjum Z. Iqbal Mohamedali R. Habib Firasat Ali Mohsin A. Nathani Mohsin A. Nathani Muhammad H. Habib HUMAN RESOURCE & REMUNERATION Firasat Ali Mohsin A. Nathani Tariq Ikram COMPANY SECRETARY SHARE REGISTRAR Ather Ali Khan Central Depository Company of Pakistan Limited REGISTERED OFFICE CDC House, 99-B, Block-B Ground Floor, Spencer’s Building, S.M.C.H.S., Main Shahra-e-Faisal I.