Annual Report Our Vision

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SSC HSSC Brochure Final AW 2

QUALIFICATIONS YOU CAN TRUST I am delighted to note that an increasing number of students clearing HSSC from the Aga Khan University Examination Board are doing well in the IBA admission test. Students from AKU-EB go beyond the conventional textbook, which is essential for the practical application of knowledge. Dr Ishrat Hussain, Director, Institute of Business Administration, Karachi OUR VISION To be a model of excellence and innovation in education for Pakistan and the developing world. OUR MISSION To increase access to quality education for lower and middle income students at a secondary and higher secondary school level. To inculcate a culture of higher order thinking in the youth through indigenous educational development and assessment programmes. To acquire new knowledge through research and share best practices in education. Development of Syllabi & Learning Resources Examination Teacher Development Research Development & Conduct Assessment Impact | Quality | Relevance | Access We, as a nation need to educate our children to become thinkers. For this they need syllabi that provide stimulus so that they can see the bigger picture, since thoughts become words, and words become deeds, and deeds become one’s character. AKU-EB triggers thought processes which determine characters that have humanity ingrained, and the determination to do good for humanity as a whole. Kermin S. Parakh Principal BVS Parsi High School Why AKU-EB? AKU-EB offers quality secondary and higher secondary examinations of international standards, accessible to all, at affordable fees for both English and Urdu medium schools. The syllabi are based on the national curriculum of Pakistan and examinations are aligned with the national scheme of studies. -

Thal Limited 2015 Annual Report Growth Through Innovation at Thal Limited, It Is a Belief That Success Comes from Innovation and Flawless Execution

Thal Limited 2015 annual report Growth Through Innovation At Thal Limited, it is a belief that success comes from innovation and flawless execution. We endeavor constantly and consistently to innovate through new products to meet our customers’ expectations and satisfaction. Contents Organization 04 Our Vision 06 Core Values 07 Company Profile 08 Code of Conduct and Ethics 10 Stakeholders' Information 12 Corporate Information 14 Key Figures 15 Thal Structure 16 Awards & Recognitions 17 Corporate Governance 18 Board of Directors 20 Board of Directors’ Profile 22 Role of Chairman 24 Performance Evaluation of the Board of Directors 24 Responsibilities of the Chief Executive Officer 25 Performance Review of the Chief Executive Officer 25 Management Team 26 Strategic Objectives 27 Organization Structure 28 Board Committees & their Terms of References 29 Stakeholder Relations 30 Whistle Blowing 31 United Nations Global Compact 32 Information Technology Governance & Security 33 Financial Summary 34 Statement of Value Addition 36 Quarterly Analysis 37 Financial Performance - Six Years at a Glance 38 Graphical Presentation - Six Years at a Glance 39 Horizontal Analysis 40 Vertical Analysis 42 Six Year Ratio Analysis 44 Graphical Presentation of Ratios 45 Comments on Six Year Analysis 46 DuPont Analysis 48 Share Price Sensitivity Analysis 50 Cash Flow Statement through Direct Method 51 Directors’ Report 52 Economic Highlights 54 Overview of Financial Results 55 Overview of Business Segments 56 Overview of Subsidiaries 72 Financial Performance 74 -

HU Tops 2016-17

Habib University TTalent Outreach Promotion andPS Support Program IMPOSSIBLE IS POSSIBLE. #IAMHU | Hear Me Roar Muhammad Ahsan Syed, Class of 2020 HU TOPS SCHOLAR Habib University’s Talent Outreach, Promotion and Support Program (HU TOPS) specically provides an opportunity to talented students enrolled in Pakistan’s Board of Intermediate Education (BIE) or Federal Board (FB), or Aga Khan University Examination Board (AKUEB) to get enroled in a fully funded* four-year undergraduate program based on their academic talent and passion to learn. *e term fully funded refers to a complete tuition fee waiver. Visit www.habib.edu.pk/hutops | Deadline to apply for HU TOPS is 28th January, 2017. • Habib University is chartered by the Government of Sindh and is recognized by the Higher Education Commission of Pakistan. • Habib University’s Electrical Engineering Program has been launched with the endorsement of Pakistan Engineering Council. IMPOSSIBLE IS POSSIBLE. #IAMHU | Hear Me Roar • Habib University is chartered by the Government of Sindh and is recognized by the Higher Education Commission of Pakistan. • Habib University’s Electrical Engineering Program has been launched with the endorsement of Pakistan Engineering Council. Deadline to apply for HU TOPS is 28th January, 2017. e. Habib University provides Global Learning opportunities to its students in order to diversify their learning experience and help them connect with the world around them o e University facilitates its students to aend courses at international universities. Under the MoUs signed with Stanford University and the University of Michigan, every year, a group of students from HU will aend summer programs at these universities. -

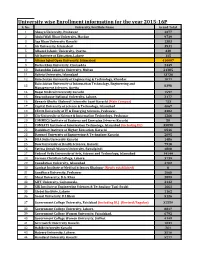

University Wise Enrollment Information for the Year 2015-16P S

University wise Enrollment information for the year 2015-16P S. No. University/Institute Name Grand Total 1 Abasyn University, Peshawar 4377 2 Abdul Wali Khan University, Mardan 9739 3 Aga Khan University Karachi 1383 4 Air University, Islamabad 3531 5 Alhamd Islamic University, Quetta. 338 6 Ali Institute of Education, Lahore 115 8 Allama Iqbal Open University, Islamabad 416607 9 Bacha Khan University, Charsadda 2449 10 Bahauddin Zakariya University, Multan 21385 11 Bahria University, Islamabad 13736 12 Balochistan University of Engineering & Technology, Khuzdar 1071 Balochistan University of Information Technology, Engineering and 13 8398 Management Sciences, Quetta 14 Baqai Medical University Karachi 1597 15 Beaconhouse National University, Lahore. 2177 16 Benazir Bhutto Shaheed University Lyari Karachi (Main Campus) 753 17 Capital University of Science & Technology, Islamabad 4067 18 CECOS University of IT & Emerging Sciences, Peshawar. 3382 19 City University of Science & Information Technology, Peshawar 1266 20 COMMECS Institute of Business and Emerging Sciences Karachi 50 21 COMSATS Institute of Information Technology, Islamabad (including DL) 35890 22 Dadabhoy Institute of Higher Education, Karachi 6546 23 Dawood University of Engineering & Technology Karachi 2095 24 DHA Suffa University Karachi 1486 25 Dow University of Health Sciences, Karachi 7918 26 Fatima Jinnah Women University, Rawalpindi 4808 27 Federal Urdu University of Arts, Science and Technology, Islamabad 14144 28 Forman Christian College, Lahore. 3739 29 Foundation University, Islamabad 4702 30 Gambat Institute of Medical Sciences Khairpur (Newly established) 0 31 Gandhara University, Peshawar 1068 32 Ghazi University, D.G. Khan 2899 33 GIFT University, Gujranwala. 2132 34 GIK Institute of Engineering Sciences & Technology Topi-Swabi 1661 35 Global Institute, Lahore 1162 36 Gomal University, D.I.Khan 5126 37 Government College University, Faislabad (including DL) (Revised/Regular) 32559 38 Government College University, Lahore. -

OICCI CSR Report 2018-2019

COMBINING THE POWER OF SOCIAL RESPONSIBILITY Corporate Social Responsibility Report 2018-19 03 Foreword CONTENTS 05 OICCI Members’ CSR Impact 06 CSR Footprint – Members’ Participation In Focus Areas 07 CSR Footprint – Geographic Spread of CSR Activities 90 Snapshot of Participants’ CSR Activities 96 Social Sector Partners DISCLAIMER The report has been prepared by the Overseas Investors Chamber of Commerce and Industry (OICCI) based on data/information provided by participating companies. The OICCI is not liable for incorrect representation, if any, relating to a company or its activities. 02 | OICCI FOREWORD The landscape of CSR initiatives and activities is actively supported health and nutrition related initiatives We are pleased to present improving rapidly as the corporate sector in Pakistan has through donations to reputable hospitals, medical care been widely adopting the CSR and Sustainability camps and health awareness campaigns. Infrastructure OICCI members practices and making them permanent feature of the Development was also one of the growing areas of consolidated 2018-19 businesses. The social areas such as education, human interest for 65% of the members who assisted communi- capital development, healthcare, nutrition, environment ties in the vicinity of their respective major operating Corporate Social and infrastructure development are the main focus of the facilities. businesses to reach out to the underprivileged sections of Responsibility (CSR) the population. The readers will be pleased to note that 79% of our member companies also promoted the “OICCI Women” Report, highlighting the We, at OICCI, are privileged to have about 200 leading initiative towards increasing level of Women Empower- foreign investors among our membership who besides ment/Gender Equality. -

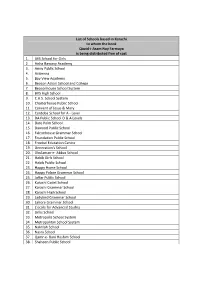

List of Schools Based in Karachi to Whom the Book Quaid-I-Azam Nay Farmaya Is Being Distributed Free of Cost 1

List of Schools based in Karachi to whom the book Quaid-i-Azam Nay Farmaya is being distributed free of cost 1. AES School for Girls 2. Aisha Bawany Academy 3. Army Public School 4. Avicenna 5. Bay View Academy 6. Beacon Askari School and College 7. Beaconhouse School System 8. BVS High School 9. C.A.S. School System 10. Charterhouse Public School 11. Convent of Jesus & Mary 12. Cordoba School for A - Level 13. DA Public School O & A Levels 14. Date Palm School 15. Dawood Public School 16. Falconhouse Grammar School 17. Foundation Public School 18. Froebel Education Centre 19. Generation's School 20. Ghulaman-e- Abbas School 21. Habib Girls School 22. Habib Public School 23. Happy Home School 24. Happy Palace Grammar School 25. Jaffar Public School 26. Karachi Cadet School 27. Karachi Grammar School 28. Karachi High School 29. Ladybird Grammar School 30. Lahore Grammar School 31. L'ecole for Advanced Studies 32. Links School 33. Metropolis School System 34. Metropolitan School System 35. Nakhlah School 36. Nasra School 37. Qamr-e- Bani Hashim School 38. Shaheen Public School 39. Shahwilayat Public School 40. Shamsi Society Model School 41. St. Joseph's Convent School 42. St. Lawrence Convent Girls School 43. St. Michael's Convent School 44. St. Patrick's High School 45. St. Paul's English High School 46. Sunbeam Grammar School 47. The American Foundation School 48. The Centre for Advanced Studies 49. The City School 50. The Educators 51. The Fahim's School System 52. The Indus Academy 53. The Mama Parsi Girls' Secondary School 54. -

Student Handbook

STUDENT RESOURCES HANDBOOK 2020-21 HABIB UNIVERSITY INTRODUCTION Welcome to Habib University (HU), Pakistan’s premier Liberal Arts and Sciences institu- tion of higher learning that provides a comprehensive undergraduate education to nurture future innovators and leaders. During your rst year at HU, you may be unsure of how the University functions, what your academic requirements may be, what sort of career path you wish to pursue, or where you should go to receive the help you need to excel in your academics. Habib University is cognizant of the needs of students who are transiting from high school to university and from university to the job market. We believe in shaping the future of our students with care and compassion and engag- ing them in a process of thoughtful self-cultivation. To realize this vision, the University has made huge investments in creating a comprehensive student support services framework. HU Student Support Services ensure the overall wellbeing of students, help them to thrive academically and nurture them into becoming thoughtful leaders and conscious citizens. In the next few pages, we hope to introduce you to the many resources that are available to engage students to their fullest, beginning with their academic journey through the Ofce of Academic Performance and their on-campus life through Student Life, to their post-university prospects through the Ofce of Career Services. Our job at Habib University is to help you nd your passion and to foster a new generation of scholars who can positively inuence society. We will be with you every step of the way. -

Little Champs Art & Creative Writing Competition 2015

Little Champs Art & Creative Writing Competition 2015 Partner Institutes Institute Branch / City Aga Khan School Federal B Area, Karachi Aga Khan School Garden Branch, Karachi Allied School Hafizabad Campus American Lycetuff Raiwind Campus Lahore American Lyceum Faisalabad Campus Army Public College Malir Cantt. Karachi Army Public College Malir Cantt. Karachi Army Public School Rahim Yar Khan Cantt. Army Public School DHA Phase I, Rawalpindi Army Public School & College (Azam Gar) Lahore Cantt. Army Public School & College Bakhar Island Sukkur Army Public School & College Fort Road, Rawalpindi Cantt. Army Public School & College Thall Cantt. Hangu, KPK Army Public School & College Okara Cantt Army Public School & College Khushab Road, Sargodha Cantt Army Public School & College Quaid Garrision, D.G Khan Asas International School F-8/3, Islamabad Bahria College Islamabad Naval Complex Primary Wing Bahria Town School Bahria Town, Lahore Beaconhouse School System Defence Campus, Lahore Beaconhouse School System Garden Town Campus Beaconhouse School System JTC, Senior Girls, Lahore Beaconhouse School System LMA Primary, Gulberg Lahore Beaconhouse School System Okara Campus Beaconhouse School System Palm Tree Campus, Gujranwala Beaconhouse School System Sialkot Campus Beaconhouse School System Allama Iqbal Town Lahore Beaconhouse School System Canal Side Girls, Lahore Beaconhouse School System Wapda Town, Gujranwala Brainiacs Montessori & High School Naval Anchorage, Islamabad DA Public School O/A Levels , DHA Karachi DA SKBZ College DHA Karachi -

Karachi Section Report

Annual Report for year 2015 Nomination: IEEE Best Section Award Middle Category IEEE Karachi Section Report PART A - SECTION SUMMARY A.1 Executive Summary Section Executive Committee Member List for 2015 1. Engr. Parkash Lohana , Chair 2015,IEEE Karachi Section – Usman Institute of Technology- [email protected] 2. Dr. Shahab Siddiqui, Vice Chair and TISP Coordinator for Section 2015- Hamdard University- [email protected] 3. Engr. Sarang Shaikh, Secretary and Treasurer for Karachi Section 2015- [email protected] 4. Dr. BS Chowdhary, COMSOC Karachi Chapter Chair IEEE Karachi Section 2015- Mehran University- [email protected] 5. Engr. Tahir Saleem, Industry Liaison Coordinator, United Engineering Services - [email protected] 6. Engr. Ahsan Saeed – Membership Development Chair for 2015- [email protected] 7. Engr. Murtaza Hanif – SAC Chair for 2015, [email protected] 8. Engr. Rabeet Sagri – Young Professionals Karachi Chapter Chair – [email protected] 9. Dr. Asim Rehman, Awards Committee Chair for 2015- [email protected] 10. Dr. Abdul Rehman Abbasi, Professional Activities Committee Chair 2015 – [email protected] 11. Dr. Zubair Shaikh, Computer Society Karachi Chapter Chair for 2015- [email protected] 12. Engr. Junaid Qureshi, Power Energy Society Karachi Chapter Interim Chair – [email protected] 13. Dr. Mohammad Shahid Shaikh– Habib University- [email protected] 14. Prof. Ashab Mirza IIEE University- [email protected] 15. Dr. Vali Uddin Director Hamdard University- [email protected] 16. Engr. Sheikh Imran ul Haque - 17. Dr. Haroon Rashid – Bahria University- [email protected] 18. Engr. Naushad Ahmed Siddiqi – [email protected] 19. -

A Plastic-Free Environment at C.A.S. 12Th Annual Evening of Rhythm and Rhyme the KBC National Inter-School Indoor Rowing Regatta

A student publication of Christmas Edition The C.A.S. School Vol. 17, Issue # 2: December 2019 12th annual Evening of Rhythm and Rhyme 5th National PASCH Donations for Refugee Children Zahra Zeina Gillani, 10A German Spelling Bee Tara Vera Ahmed, 11B An initiative was taken by Competition our school to help the Ramis Riaz Kamlani, 10B refugee children in Syria by donating warm clothes, food, bedding, and funds On 18 October, 5th National PASCH to help them survive the German Spelling Bee Competition harsh winter season. A was held at Goethe-Institut, Karachi. charity drive was organised Seven schools participated in this and managed by the competition. Hiba Ansari, Eman Student Government at Mallick Imam and I represented C.A.S. in which donations C.A.S. and secured first position. This of the above mentioned victory helped us proceed further to items were collected from compete in the final round, held in parents of KG, Junior and On 9 November, the 12th annual tried to bring attention to this crisis Lahore on 22 November. Once again Senior Sections as well as the school humanitarian services in areas struck Evening of Rhythm and Rhyme was through the choice of poetry and the team performed brilliantly and staff and faculty members. A by natural calamities, war and conflict. held at the Main Campus. 24 students music that they presented. secured third position in the contest. delegation of 8 students from the Students were briefed about the crisis from classes 10 and 11 had been Student Government travelled to by Mr Resat BASER, Head of selected to participate. -

Conference Program V

INTERNATIONAL CONFERENCE ON MANAGEMENT, EDUCATION AND SOCIAL SCIENCES RESEARCH APRIL 4-5, 2015 International Conference on Management, Education and Social Sciences Research ICMESSR-2015 International Conference on Management, Education and Social Sciences Research \Emerging Nation's Perspective" Faculty of Education & Faculty of Social Sciences, Faculty of Management Sciences, University of Karachi Iqra University i International Conference on Management, Education and Social Sciences Research Table of Contents About University of Karachi (UoK) iii About Iqra University (IU) iv Conference Program v Conference Theme: Emerging Nation's Perspective xiii Conference Structure xiv Messages xv Vice Chancellor, University of Karachi Dean, Faculty of Social Sciences University of Karachi Chancellor, Iqra University Vice Chancellor, Iqra University Vice President, Iqra Univeristy Keynote Speakers 1 Plenary Speakers 5 Abstracts 20 Organizing Committee 72 ii International Conference on Management, Education and Social Sciences Research UNIVERSITY OF KARACHI At the time of creation of Pakistan as a sovereign state in 1947, Higher Educa- tion Institutes and Research facilities were negligible. Responding to the impending requirement of higher learning, Pakistan started establishing relevant educational in- stitutions of higher learning and thus the sector underwent rapid modernization. The University of Karachi was established by an act of Pakistan parliament in June, 1951. The present campus, to which the University shifted in 1959, is spread over 1279 acres of land, situated 12 Km away from the city center. Today the University is recognized as a premier center of learning and research. A number of scientists and scholars affiliated with the University are working at im- portant positions both within and outside Pakistan and have won recognition and acclaim. -

HU Space Brochure

A bustling metropolis of more than 20 million people, Karachi is the perfect playing field for students Habib University wishing to learn more about their country. It is a living, breathing, ever-expanding city of parks and s h a pin g f u t u r e s neighborhoods, festivals and fairs, museums, galleries, theatres, cafes and historic spots. Studying at Habib University, in Karachi, will provide access to a multitude of NGOs, international development organizations, media houses, corporations and financial institutions. Here you have limitless access to internships and professional opportunities. Students can handpick the projects they want to be a part of. The location of the University couldn’t have been better. SCHEDULE A CAMPUS TOUR Send us an email at [email protected] HABIB UNIVERSITY’S ICONIC CAMPUS The campus is located in Gulistan-e-Jauhar, Block 18. It is a part of Faisal Cantonment and is surrounded by Civil Aviation Area including Airport. Both the Cantonment and the Civil Aviation areas are highly secured and protected. One can easily reach Habib University from Shahrah-e-Faisal by taking a left turn to University Avenue, after crossing the Natha Khan Bridge. Habib University: Block 18, Gulistan-e-Jauhar, University Avenue, Off Shahrah-e-Faisal, Karachi. For further Information: Email us at [email protected] habib.edu.pk facebook.com/HabibUniversity twitter.com/HabibUniversity +92 21 38797082 We at Habib University realize that learning is a social activity that happens in many places beyond traditional classrooms. Lectures are accompanied by class dialogue; memory and recall are balanced with discovery and critical thinking.