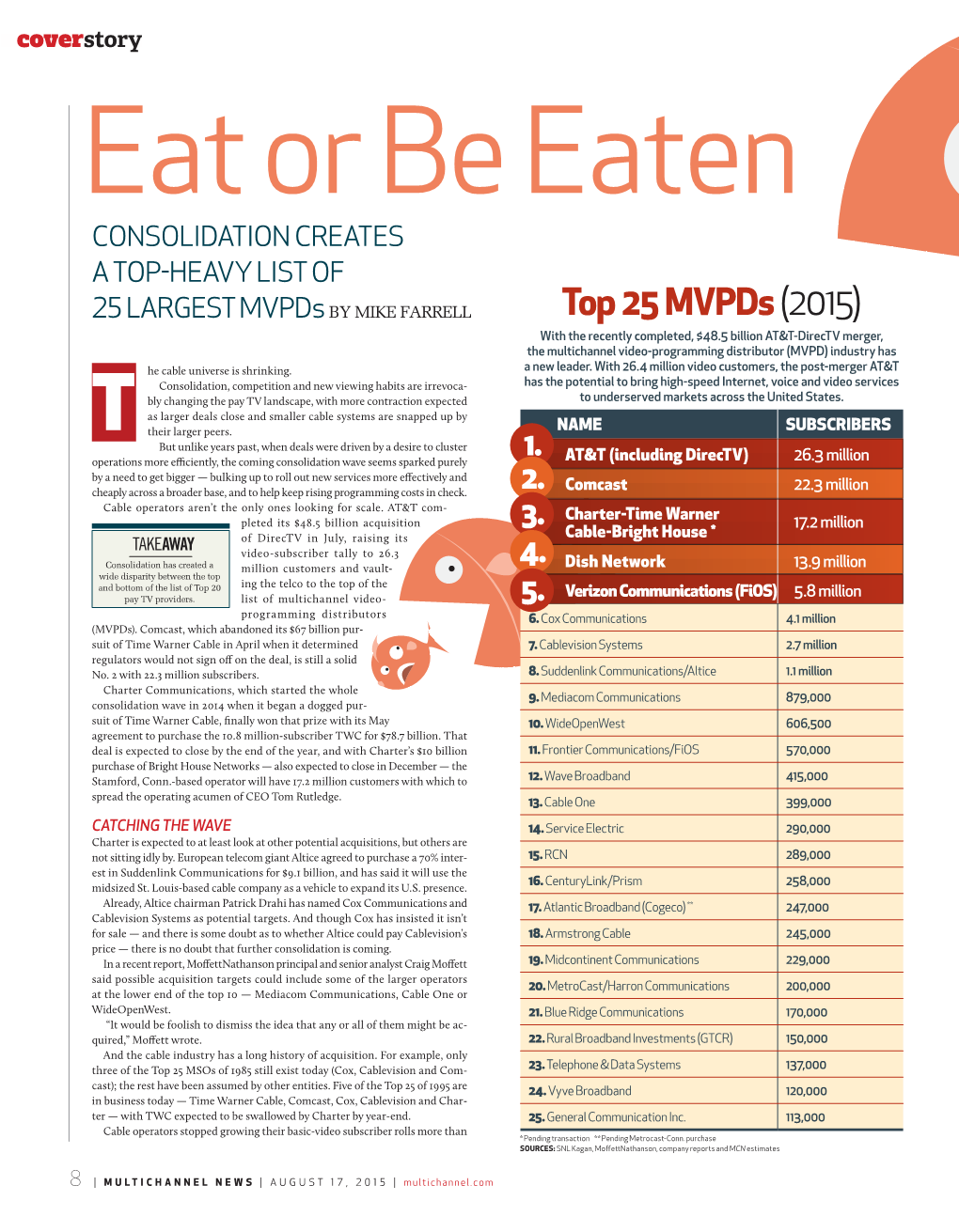

Top 25 Mvpds (2015)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download the 54Th Annual Program Book

THE 54TH ANNUAL DECEMBER 4, 2020 1 Welcome To The We celebrate Fifty-Fourth Annual Cable TV Pioneers and appreciate Induction Celebration everything you are, and all that you do. Class of 2020 Induction Gala Charter Field Operations In Appreciation of C-SPAN would like to congratulate Ann Our Sponsors on joining the esteemed ranks How It All Began Officers and Managing Board of the Cable TV Pioneers The Spirit of the Pioneers who have shaped the Presenting the Class of 2020 Cable TV industry. Congratulations to the 25th Anniversary Class of 1995 In Memorium Active Membership 2020 Celebration Executive Committee David Fellows Yvette Kanouff Patricia Kehoe Michael Pandzik Sean McGrail Your leadership Susan Bitter Smith and forward thinking Jim Faircloth personifi es what it means to be a Cable TV Pioneer. 2 3 We’re Going Special Thanks Primetime Thanks To Our Sponsors To Thank you to our friends at C-SPAN for televising and streaming the induction ceremony for the Class of 2020. C-SPAN was created by the cable industry in 1979 as a gift to the American people and today with their stellar reputation, they are more relevant than ever. Unique to media as a non-profit, C-SPAN is a true public service of the cable and satellite providers that fund it. It’s thanks to the support of so many Cable TV Pioneers that C-SPAN has thrived. Many have served on C-SPAN’s board of directors, while others committed to add the services to their channel line-ups. So many local cable folks have welcomed C-SPAN into their markets to meet with the community and work with educators and local officials. -

PUBLIC NOTICE Federal Communications Commission 445 12Th St., S.W

PUBLIC NOTICE Federal Communications Commission 445 12th St., S.W. News Media Information 202 / 418-0500 Internet: https://www.fcc.gov Washington, D.C. 20554 TTY: 1-888-835-5322 DA 17-889 Released: September 14, 2017 MEDIA BUREAU EXTENDS DEADLINE FOR MVPDs TO FILE EEO PROGRAM ANNUAL REPORTS (FCC FORM 396-C) TO OCTOBER 16, 2017, AND IDENTIFIES THOSE THAT MUST RESPOND TO SUPPLEMENTARY INVESTIGATION QUESTIONS Pursuant to Section 76.77 of the Commission’s Rules, 47 C.F.R. § 76.77, by September 30 of each year multi-channel video program distributors (“MVPDs”) must file with the Commission an FCC Form 396-C, Multi-Channel Video Programming Distributor EEO Program Annual Report, for employment units with six or more full-time employees. By this Notice we remind all MVPDs of this recurring obligation, provide details on the filing process, and identify those MVPDs that must complete the Supplementary Investigation Sheet portion of the form. Because of technical difficulties in preparing for the filing, we extend the deadline to October 16, 2017. In addition, if filers, particularly those in hurricane-damaged areas, need more time to file, they can email [email protected] and request an extension of time. Users can access the electronic filing system via the Internet from the Commission’s website at: https://licensing.fcc.gov/cgi-bin/ws.exe/prod/cdbs/forms/prod/cdbsmenu.hts. Paper versions of the form will not be accepted unless accompanied by an appropriate request for waiver of the electronic filing requirement. The Commission has recognized the need for limited waivers of that requirement in light of the “burden that electronic filing could place upon some [entities] who are seeking to serve the public interest, with limited resources, and succeed in a highly competitive local environment.” Streamlining of Mass Media Applications, Rules and Processes, Report and Order, 13 FCC Rcd 23056, 23061 (1998). -

MB Docket No. ) File. No CSR- -P WAVEDIVISION HOLDINGS, LLC ) ASTOUND BROADBAND, LLC ) EXPEDITED TREATMENT ) REQUESTED Petitioners, ) ) V

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC 20554 ) In the Matter of: ) ) MB Docket No. ) File. No CSR- -P WAVEDIVISION HOLDINGS, LLC ) ASTOUND BROADBAND, LLC ) EXPEDITED TREATMENT ) REQUESTED Petitioners, ) ) v. ) ) COMCAST SPORTSCHANNEL PACIFIC ) ASSOCIATES ) COMCAST SPORTSNET CALIFORNIA, LLC ) COMCAST SPORTSNET NORTHWEST, LLC) NBCUNIVERSAL MEDIA, LLC ) ) Respondent Programmers ) ) TO THE COMMISSION: PETITION FOR DECLARATORY RULING THAT CONDUCT VIOLATES 47 U.S.C. § 548(b) James A. Penney Eric Breisach General Counsel WaveDivision Holdings, LLC Breisach Cordell PLLC 401 Parkplace Center, Suite 500 5335 Wisconsin Ave., NW, Suite 440 Kirkland, WA 98033 Washington, DC 20015 (425) 896-1891 (202) 751-2701 Its Attorneys Date: December 19, 2017 SUMMARY This Petition is about the conduct of three Comcast-owned regional sports networks whose deliberate actions undermined the fundamental structure of their distribution agreements with a cable operator and then, when the operator could no longer meet minimum contractual penetration percentages, presented the operator with a Hobson’s choice: (1) restructure its services through a forced bundling scheme in a way that would make them commercially and competitively unviable; or (2) face shut-off of the services four days later. These efforts to hinder significantly or prevent the operator from providing this programming are not only prohibited by 47 U.S.C. 548(b), but are particularly egregious because they are taken against the only terrestrial competitor to Comcast’s cable systems in the areas served by the cable operator. It was only after the Comcast regional sports networks extracted a payment of approximately $2.4 million and a promise to pay even more on an ongoing basis – amounts far in excess of what would have been required by the distribution agreements, was the imminent threat to withhold the services withdrawn. -

Northland 2020 Annual Customer Notification

SERVICE INTERRUPTIONS/REFUNDS any equipment leased from us unless caused by tampering, neglect or abuse. See https://www. telecommunications devices used by disabled customers (which require electricity) may not Northland Communications maintains a high standard of technical operations within our systems yournorthland.com for more information. be available for use. For adaptive devices, please consult the manufacturer for options. We and responds promptly to most service interruptions. If you have a service problem, please contact recommend keeping a corded (landline) phone in your home for use in the event of an outage. us immediately, as any available credit, to the extent applicable, will be issued from the date you You also have the option of removing, repairing, rearranging or maintaining the inside wiring yourself Corded phones do not need a separate power source to operate and can function with a battery notify us. On occasion, service interruptions may arise due to unforeseen problems such as power or of hiring an outside contractor to do the work. It is important that only high-quality wiring materials back up by plugging the cord directly into the telephone jack on your EMTA. be used and that these materials be properly installed to avoid signal leakage and maintain signal outages, electrical storms, severe weather conditions, equipment failures, fiber cuts, auto accidents • During a power outage, keep non-emergency calls to a minimum to prolong the life of the involving utility poles, and in some cases, loss of signal at the origination point of a program. In addi- quality in compliance with FCC technical regulations. -

Downloading of Movies, Television Shows and Other Video Programming, Some of Which Charge a Nominal Or No Fee for Access

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission file number 001-32871 COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 27-0000798 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) One Comcast Center, Philadelphia, PA 19103-2838 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (215) 286-1700 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Name of Each Exchange on which Registered Class A Common Stock, $0.01 par value NASDAQ Global Select Market Class A Special Common Stock, $0.01 par value NASDAQ Global Select Market 2.0% Exchangeable Subordinated Debentures due 2029 New York Stock Exchange 5.50% Notes due 2029 New York Stock Exchange 6.625% Notes due 2056 New York Stock Exchange 7.00% Notes due 2055 New York Stock Exchange 8.375% Guaranteed Notes due 2013 New York Stock Exchange 9.455% Guaranteed Notes due 2022 New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Touchstone® TM722 Telephony Modem User's Guide

Touchstone® TM722 Telephony Modem User’s Guide Get ready to experience the Internet’s express lane! Whether you’re checking out streaming media, downloading new software, checking your email, or talking with friends on the phone, the Touchstone TM722 Telephony Modem brings it all to you up to four times faster than standard DOCSIS 2.0 cable modems. All while provid- ing toll quality Voice over IP telephone service. Some models even provide a Lithium-Ion battery backup to provide continued telephone service during power outages. The Touchstone Telephony Modem provides an Ethernet connection for use with either a single computer or home/office Local Area Network (LAN). Some Telephony Modems also provide a USB connection. You can connect two separate computers at the same time using both of these connections. In addition, the Touchstone Tele- phony Modem provides for up to two separate lines of telephone service. Installation is simple and your cable company will provide assistance to you for any special requirements. The links below provide more detailed instructions. Safety Requirements Getting Started Battery Installation and Replacement (TM722G Only) Installing and Connecting Your Telephony Modem Installing USB Drivers on Your PC Configuring Your Ethernet Connection Using the Telephony Modem Troubleshooting Glossary Touchstone® TM722 Telephony Modem User’s Guide Export Regulations Safety Requirements FCC Part 15 European Compliance Energy Consumption (TM722S Models only) Getting Started About Your New Telephony Modem What’s in the Box? -

The Fastest Isps of 2017 | Pcmag.Com

9/4/2017 The Fastest ISPs of 2017 | PCMag.com The Fastest ISPs of 2017 What happens when PCMag readers test their internet providers' bandwidth? We nd the fastest. By Eric Grifth June 2, 2017 12:32PM ESTJune 2, 2017 PCMag reviews products independently, but we may earn afliate commissions from buying links on this page. Terms of use. Internet connectivity in the US is a hot-button issue in 2017, thanks to the new FCC chairman performing an about-face on issues like net neutrality, subsidizing access for the poor, and permitting internet service providers (ISPs) to do what they please with your data. None of it bodes well. This comes as the speeds in our tests remain relatively stagnant. Despite cable companies—the major broadband providers in the US—rolling out more and more of the latest high-end modems to customers to increase speeds, and the advent https://www.pcmag.com/article/353936/the-fastest-isps-of-2017 1/21 9/4/2017 The Fastest ISPs of 2017 | PCMag.com of more and more ber-to-the-home (or to-the-premises) coverage in select areas, it's not having much impact, on average. On the world stage, the US isn't even close to the top 10 countries when it comes to average broadband speed. Maybe it's because there is far too much happening on the mergers and acquisitions end of things for domestic ISPs to even pretend to be competitive in ways that matter; you know, the little things, like speed and customer service. -

62. for Each of the Company's Cable Systems, State the Number Of

REDACTED - FOR PUBLICINSPECTION 62. For each of the Company's Cable Systems, state the number of communities that have either specifically requested or agreed to the migration of PEG content to a digital platform. The following systems serve communities that have either specifically requested or agreed to the migration ofPEG content to a digital platform:49 West Bay, CA system 6 communities Denver, CO system I community Carbondale, CO system I community Naples, FL system 4 communities Jacksonville, FL system I community Boca Raton/Del Ray Beach, FL system 44 communities Tallahassee, FL system I community Atlanta, GA system 5 communities Augusta, GA system 2 communities North Chicago, IL system 6 communities South Chicago, IL system 13 communities West Chicago, IL system 8 communities New Hampshire, ME 4 communities Sema Region, MA I community West New England system 3 communities York, PA system I community Philadelphia, PA system I community Three Rivers East, PA system 10 communities Chattanooga, TN system 1 community Knoxville, TN system 2 communities Nashville, TN system I community Houston, TX system 1 community South Puget Sound, WA system 2 communities 63. Provide copies of all strategic plans, analyses or models for switched digital video ("SDV") deployment on any of the Company's Cable Systems. Any responsive documents have been produced herewith. In the response submitted on June 11,2010, Comcast indicated tbat there were 224 communities that have requested or agreed to digital PEG carriage. The lower number here reflects the fact that certain FCC registered communities that were counted in the June 11,2010, response are in unincorporated areas or other areas that are not separately franchised communities. -

1 Form 8-K Securities and Exchange Commission

1 FORM 8-K SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 -------------------- CURRENT REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of report (Date of earliest event reported): February 16, 2000 CHARTER COMMUNICATIONS, INC. ---------------------------- (Exact name of registrant as specified in its charter) Delaware -------- (State or Other Jurisdiction of Incorporation or Organization) 000-27927 43-1857213 --------- ---------- Commission File Number (Federal Employer Identification Number) 12444 Powerscourt Drive - Suite 400 St. Louis, Missouri 63131 - ----------------------------------- ----- (Address of Principal Executive Offices) (Zip Code) (Registrant's telephone number, including area code) (314) 965-0555 2 ITEM 5. OTHER ITEMS. On February 16, 2000, Charter Communications, Inc. announced 1999 fourth quarter financial results. A copy of the press release is being filed as Exhibit 99.1 with this report. 3 ITEM 7. EXHIBITS. 99.1 Press release dated February 16, 2000.* - ---------------- *filed herewith 4 SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, Charter Communications, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. CHARTER COMMUNICATIONS, INC., registrant Dated February 22, 2000 By: /s/ KENT D. KALKWARF ------------------------------------------ Name: Kent D. Kalkwarf Title: Senior Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) 5 EXHIBIT INDEX ------------- 99.1 Press release dated February 16, 2000. 1 EXHIBIT 99.1 [CHARTER COMMUNICATIONS LOGO] FOR IMMEDIATE RELEASE CHARTER COMMUNICATIONS, INC. ANNOUNCES FOURTH QUARTER FINANCIAL RESULTS FOR 1999 ST. LOUIS, MO - February 16, 2000 - Charter Communications, Inc. (Nasdaq: CHTR) announced today financial results for the three months and the year ended December 31, 1999. -

Employment Effects of Subsidized Broadband Internet for Low-Income Americans

Online Appendix: Wired and Hired: Employment Effects of Subsidized Broadband Internet for Low-Income Americans George W. Zuo Appendix A: Appendix Tables and Figures Figure A1: Major Comcast Cable M&A Events: 1990-2018 1994 • Comcast acquires Canadian based Maclean Hunter’s U.S. cable operation based in New Jersey, Michigan, and Florida, adding 550,000 subscribers 1995 • Comcast acquires E.W. Scripps cable systems based in California, Tennessee, Georgia, West Virginia, Florida, and Kentucky, adding 800,000 subscribers 1998 • Comcast acquires Jones Intercable, Inc in the Mid-Atlantic adding 1 million subscribers 1998 • Comcast acquires Prime Communications in Maryland, Virginia, adding 430,000 subscribers 1999 • Comcast acquires Greater Philadelphia Cablevision, Inc in Philadelphia, adding 79,000 subscribers 1999 • Comcast and AT&T enter agreement to exchange cable communications systems, gaining cable communications systems serving 1.5 million subscribers 2000 • Comcast acquires Lenfest Communications in Pennsylvania, Delaware and New Jersey adding 1.3 millions subscribers 2000 • Comcast completes cable swaps with Adelphia and AT&T broadband, gaining customers in Florida, Indiana, Michigan, New Jersey, New Mexico, Pennsylvania and Washington D.C. 2001 • Comcast acquires select AT&T Broadband cable systems in New Mexico, Maryland, Delaware, New Jersey, Pennsylvania and Tennessee adding 585,000 subscribers 2001 • Comcast acquires AT&T Broadband cable systems in Baltimore adding 112,000 subscribers 2001 • Comcast and A&T Broadband merge forming -

Enforcement Bureau Reminds Mvpds of 2021 Fcc Form 396-C Deadline and Identifies Those Subject to Supplemental Investigation

DA 21-776 Released: July 1, 2021 ENFORCEMENT BUREAU REMINDS MVPDS OF 2021 FCC FORM 396-C DEADLINE AND IDENTIFIES THOSE SUBJECT TO SUPPLEMENTAL INVESTIGATION Pursuant to section 76.77 of the Commission’s rules, 47 CFR § 76.77, a multichannel video program distributor (MVPD) employment unit with six or more full-time employees must file a FCC Form 396-C, Multichannel Video Programming Distributor EEO Program Annual Report, by September 30 each year. By this Notice, we remind MVPDs of this recurring obligation—the deadline for which falls on Thursday, September 30, this year—and identify in the following pages those employment units that must complete the Supplemental Investigation Sheet (SIS). The Form 396-C also designates those filers required to submit the SIS with a check mark in Section I labeled “Supplemental Investigation Sheet attached”. SIS filers should take note of the following important information. • Part I: One job description must be provided for the Officials & Manager category. • Part II: Only questions 2, 4 and 6 must be answered. • Part III: The employment unit’s 2021 EEO Public File Report covering the previous 12 months must be attached. Form 396-C is available via the Commission’s Consolidated Database System (CDBS) Electronic Filing System (https://licensing.fcc.gov/prod/cdbs/forms/prod/cdbs_ef.htm). Paper versions of the form will not be accepted unless a waiver request of the electronic filing requirement is submitted. Such waivers are not routinely granted. CDBS technical assistance is available at (877) 480-3201. Enforcement Bureau Contacts: Elizabeth E. Goldin, [email protected] & Lynn Kalagian-Jones, [email protected] at 202.418.1450 1 FCC NOTICE REQUIRED BY THE PAPERWORK REDUCTION ACT We have estimated that each response to this collection of information will take from 0.166 to 2.5 hours. -

Grantee Changes and Corrections

CHANGES AND CORRECTIONS FOR APRIL 2013 MERGERS AND ACQUISITIONS Throughout the course of the SBI program, CN has maintained a repository of electronic records related to its provider outreach activities. Due to the high volume of mergers and acquisitions (M&A) within the provider community, CN continues to maintain a listing of M&A activities as a way of supplementing the Provider Changes and Corrections. M&A activities for this submission period for the state of Alaska are listed below with a brief description and date as obtained through public records or provider disclosure. Alaska Telecom, Inc. acquired atContact and became Futaris The website for Futaris states: “Alaska Telecom, Inc. acquired atContact in 2011, a leading enterprise and federal contractor providing fully managed satellite communication networks worldwide. atContact was founded in 1997 to service the demand for high-speed data, audio, and video communication in unserved and underserved regions of the globe. atContact delivers innovative broadcast, transport, and IP connectivity solutions to rural customers in the United States, Canada, Alaska, and Antarctica. “In 2008, our parent company, Calista Corporation, acquired Alaska Telecom, Inc. As part of the acquisition, Calista Corporation brought Alaska Telecom, Inc. and atContact together to form what is known today as Futaris. Futaris is committed to honoring Calista Corporation’s tradition of providing services to areas that continually meet challenges, such as access limitations and economic difficulties.” DATASET CHANGES AND CORRECTIONS As requested by the SBI Program Office, a listing of the changes and/or corrections to the datasets between the October 2012 and April 2013 submissions is included in this narrative.