1. Il Quadro Economico E Regolamentare

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download the 54Th Annual Program Book

THE 54TH ANNUAL DECEMBER 4, 2020 1 Welcome To The We celebrate Fifty-Fourth Annual Cable TV Pioneers and appreciate Induction Celebration everything you are, and all that you do. Class of 2020 Induction Gala Charter Field Operations In Appreciation of C-SPAN would like to congratulate Ann Our Sponsors on joining the esteemed ranks How It All Began Officers and Managing Board of the Cable TV Pioneers The Spirit of the Pioneers who have shaped the Presenting the Class of 2020 Cable TV industry. Congratulations to the 25th Anniversary Class of 1995 In Memorium Active Membership 2020 Celebration Executive Committee David Fellows Yvette Kanouff Patricia Kehoe Michael Pandzik Sean McGrail Your leadership Susan Bitter Smith and forward thinking Jim Faircloth personifi es what it means to be a Cable TV Pioneer. 2 3 We’re Going Special Thanks Primetime Thanks To Our Sponsors To Thank you to our friends at C-SPAN for televising and streaming the induction ceremony for the Class of 2020. C-SPAN was created by the cable industry in 1979 as a gift to the American people and today with their stellar reputation, they are more relevant than ever. Unique to media as a non-profit, C-SPAN is a true public service of the cable and satellite providers that fund it. It’s thanks to the support of so many Cable TV Pioneers that C-SPAN has thrived. Many have served on C-SPAN’s board of directors, while others committed to add the services to their channel line-ups. So many local cable folks have welcomed C-SPAN into their markets to meet with the community and work with educators and local officials. -

Employment Effects of Subsidized Broadband Internet for Low-Income Americans

Online Appendix: Wired and Hired: Employment Effects of Subsidized Broadband Internet for Low-Income Americans George W. Zuo Appendix A: Appendix Tables and Figures Figure A1: Major Comcast Cable M&A Events: 1990-2018 1994 • Comcast acquires Canadian based Maclean Hunter’s U.S. cable operation based in New Jersey, Michigan, and Florida, adding 550,000 subscribers 1995 • Comcast acquires E.W. Scripps cable systems based in California, Tennessee, Georgia, West Virginia, Florida, and Kentucky, adding 800,000 subscribers 1998 • Comcast acquires Jones Intercable, Inc in the Mid-Atlantic adding 1 million subscribers 1998 • Comcast acquires Prime Communications in Maryland, Virginia, adding 430,000 subscribers 1999 • Comcast acquires Greater Philadelphia Cablevision, Inc in Philadelphia, adding 79,000 subscribers 1999 • Comcast and AT&T enter agreement to exchange cable communications systems, gaining cable communications systems serving 1.5 million subscribers 2000 • Comcast acquires Lenfest Communications in Pennsylvania, Delaware and New Jersey adding 1.3 millions subscribers 2000 • Comcast completes cable swaps with Adelphia and AT&T broadband, gaining customers in Florida, Indiana, Michigan, New Jersey, New Mexico, Pennsylvania and Washington D.C. 2001 • Comcast acquires select AT&T Broadband cable systems in New Mexico, Maryland, Delaware, New Jersey, Pennsylvania and Tennessee adding 585,000 subscribers 2001 • Comcast acquires AT&T Broadband cable systems in Baltimore adding 112,000 subscribers 2001 • Comcast and A&T Broadband merge forming -

Table 1 AT&T-Mediaone Merger Results of MHHI Analysis With

Table 1 AT&T-MediaOne Merger Results of MHHI Analysis with Respect to the Supply of Video Programming Services Pre-Merger MHHI Post-Merger MHHI Delta MHHI1 Silent Interest2 Post-Merger, MediaOne's interest in Time Warner Entertainment becomes silent Case 1: Liberty is a separate entity from AT&T 1934 1981 48 Case 2: Liberty is owned and controlled by AT&T 1940 2045 104 Proportional Control 3 Post-Merger, MediaOne's interest confers proportional control of Time Warner Entertainment Case 3: Liberty is a separate entity from AT&T 1934 1937 4 Case 4: Liberty is owned and controlled by AT&T 1940 2059 118 Notes: 1May not equal the difference of the pre-merger and post-merger MHHls due to rounding. 2All other control interests are proportional to ownership interests except in the following cases: Liberty's 9% interest in Time Warner and 8% interest in News Corp. are silent and AT&rs 33% interest in Cablevision is silent. 3AII ownership interests confer proportional control except the cases noted in footnote 2. 58 Table 2 AT&T-MediaOne Merger Results of MHHI Analysis 1 with Respect to the Purchase of Video Programming Services Pre-Merger MHHI Post-Merger MHHI Delta MHHI2 Silent Interest3 Post-Merger, MediaOne's interest in Time Warner Entertainment becomes silent Case 1: Liberty is a separate entity from AT&T 1051 1304 254 Case 2: Liberty is owned and controlled by AT&T 1069 1328 258 Proportional Control4 Post-Merger, MediaOne's interest confers proportional control of Time Warner Entertainment Case 3: Liberty is a separate entity from AT&T 1051 1432 381 Case 4: Liberty is owned and controlled by AT&T 1069 1452 383 Notes: 'AT&T sells 735,000 subscribers to Comcast post-merger. -

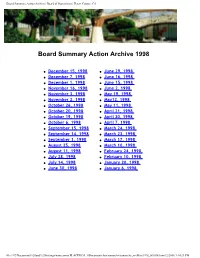

1998 Board Summary Action Archive

Board Summary Action Archive | Board of Supervisors | Placer County, CA Board Summary Action Archive 1998 ● December 15, 1998 ● June 29, 1998 ● December 7, 1998 ● June 16, 1998 ● December 1, 1998 ● June 15, 1998 ● November 16, 1998 ● June 2, 1998 ● November 3, 1998 ● May 19, 1998 ● November 2, 1998 ● May12, 1998 ● October 26, 1998 ● May 11, 1998 ● October 20, 1998 ● April 21, 1998 ● October 19, 1998 ● April 20, 1998 ● October 6, 1998 ● April 7, 1998 ● September 15, 1998 ● March 24, 1998 ● September 14, 1998 ● March 23, 1998 ● September 1, 1998 ● March 17, 1998 ● August 25, 1998 ● March 10, 1998 ● August 11, 1998 ● February 24, 1998 ● July 28, 1998 ● February 10, 1998 ● July 14, 1998 ● January 20, 1998 ● June 30, 1998 ● January 6, 1998 file:///C|/Documents%20and%20Settings/mmccorma.PLACERCO...0Documents/bos/sumarchv/sumarchv_revMast1998_060106.htm6/2/2006 1:14:23 PM Board Summary Action, December 15, 1998 -- Placer County, Calif. Board Summary Action, December 15, 1998 Board of Supervisors' Chambers 175 Fulweiler Avenue Auburn, CA 95603 FLAG SALUTE - Lead by Supervisor Williams. STATEMENT OF MEETING PROCEDURES - Read by Clerk. PUBLIC COMMENT: None given. CONSENT AGENDA: Moved #14 for separate action. Consent Agenda approved as amended and with action as indicated. MOTION Bloomfield/Weygandt VOTE: 4:0 (White absent). 1. BOARD OF SUPERVISORS MINUTES - Approved August 11 & 25, 1998. 2. CLAIMS AGAINST THE COUNTY - Rejected the following claim: a. 98-152, Farmers (Hamblin), $3,042.56 (Claim for property damage). 3.ADMINISTRATIVE SERVICES: a. Information Technology - Approved an increase to blanket purchase order 6302 with Infosol, Inc., in the amount of $95,000, to retrofit the existing payroll system to Year 2000 standards and extend the agreement to June 30, 2000. -

Perserving the Public Interest: a Topical Analysis of Cable/DBS

PRESERVING THE PUBLIC INTEREST: A TOPIcAL ANALYSIS OF CABLEJDBS CROSSOWNERSHIP IN THE RULEMAKING FOR THE DIRECT BROADCAST SATELLITE SERVICE Stephen F. Varholy In the early 1980's the direct broadcast satellite Dish Network4 becoming ubiquitous, DBS's fu- service ("DBS") I was envisioned both as a revolu- ture is assured. It has made one of the most suc- 5 tion for the nation's television screens and as a cessful debuts in consumer electronic history, technical curiosity that would forever supplement with industry analysts touting that in the short pe- cable television in areas where cable could not riod between the service's inauguration in 1994 to reach.2 Today, with names such as DirecTV3 and present,6 DBS has acquired over 9 million sub- I DBS is a non-broadcast video service in which satellites that DBS would remedy the lack of commercial television in beam television signals back to earth using high-powered rural areas. One witness before Congress disputed this asser- transponders (transmitters) that allow the use of small size tion, testifying that DBS reception would be problematic and satellite receiving antennas (dishes). See DANIEL L. BRENNER, that it would serve a non-existent consumer demand for en- MONROE E. PRICE AND MICHAEL I. MEVERSON, 2 CABLE TELEVI- tertainment sources (citing that video cassettes and discs, SION AND OTHER NONBROADCAST VIDEO § 15.01 (April 1998) among other media, would more easily satisfy this demand). [hereinafter Nonbroadcast Video]; c.f, Satellite Communications/ See Satellite Communications/Direct Broadcast Satellites Hearing Direct Broadcast Satellites Hearing Before the Subcomm. on Before the Subcomm. -

Federal Communications Commission Record 9 FCC Red No

FCC 94-119 Federal Communications Commission Record 9 FCC Red No. 13 Systems (SMATV) Before the D. Local Exchange Carriers (LECs) 41 Federal Communications Commission Washington, D.C. 20554 E. Cable Overbuilds 47 F. Over-the-air Television Broadcasting Service 50 G. Technological Advances 52 CS Docket No. 94-48 IV. Trends in Horizontal Ownership and Vertical Integration in the Market for the Delivery of In the Matter of Video Programming 55 V. Changes in Practices/Conduct of Multichannel Implementation of Section 19 Video Programming Vendors and Distributors of the Cable Television Since Passage of the 1992 Cable Act 65 Consumer Protection and VI. Collection of Data for Future Reports 78 Competition Act of 1992 VII. Procedural Matters 90 Annual Assessment of the Status of Competition in the I. INTRODUCTION Market for the Delivery of 1. On October 5. 1992. Congress enacted the Cable Video Programming Television Consumer Protection and Competition Act of 1992 ("1992 Cable Act" or "Act").' Section 19(g) of the 1992 Cable Act directs the Commission to "beginning not NOTICE OF INQUIRY later than 18 months after promulgation of the regulations required by [Section 19(c) of the 1992 Cable Act], annually Adopted: May 19, 1994; Released: May 19, 1994 report to Congress on the status of competition in the market for the delivery of video programming." 2 Because the Commission adopted regulations implementing Section By the Commission: 19(c) on April 1. 1993. the first report must be submitted to Congress no later than October 1. 1994.-1 Notice of Comments Due: June 29, 1994 Inquiry ("i\©OI") to assist in gathering the information nec Replies Due: July 29, 1994 essary to comply with this statutory requirement. -

FORM 13F-E Quarterly 13F Report Filed by Institutional Managers

SECURITIES AND EXCHANGE COMMISSION FORM 13F-E Quarterly 13F report filed by institutional managers Filing Date: 1998-11-19 | Period of Report: 1998-09-30 SEC Accession No. 0000009749-98-000108 (HTML Version on secdatabase.com) FILER BANKERS TRUST CORP Mailing Address Business Address 130 LIBERTY STREET 130 LIBERTY ST CIK:9749| IRS No.: 136180473 | State of Incorp.:NY | Fiscal Year End: 1231 NEW YORK NY 10006 NEW YORK NY 10006 Type: 13F-E | Act: 34 | File No.: 028-00355 | Film No.: 98755303 2122502500 SIC: 6022 State commercial banks Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document <TABLE> <C> <C> PAGE 1 SECURITIES AND EXCHANGE COMMISSION FORM 13F-E Report for the Calendar Year or Quarter Ended: 09/30/98 Institutional Investment Manager: BANKERS TRUST CORPORATION BANKERS TRUST PLAZA 130 LIBERTY STREET NEW YORK CITY NE 10006 I REPRESENT THAT I AM AUTHORIZED TO SUBMIT THIS FORM AND THAT ALL INFORMATION IN THIS FORM AND THE ATTACHMENTS TO IT IS TRUE, CORRECT AND COMPLETE AND I UNDERSTAND THAT ALL REQUIRED ITEMS, STATEMENTS AND SCHEDULES ARE INTEGRAL PARTS OF THIS FORM AND THAT THE SUBMISSION OF ANY AMENDMENT REPRESENTS THAT ALL UNAMENDED ITEMS, STATEMENTS AND SCHEDULES REMAIN TRUE, CORRECT AND COMPLETE AS PREVIOUSLY SUBMITTED I AM SIGNING THIS REPORT AS REQUIRED BY THE SECURITIES EXCHANGE ACT OF 1934 Other Managers on Whose Behalf this Report is Filed: Bankers Trust Company 01 BT Australia Limited 02 BT Alex. Brown Incorporated 03 BT Holdings (New York), Inc. 04 Investment Company Capital Corporation 06 Bankers Trust AG 07 THE REPORTABLE SECURITIES OF ALEX. -

The 51St Annual Cable Tv Pioneers Banquet

THE 51ST ANNUAL CABLE TV PIONEERS BANQUET CELEBRATING THE 50TH ANNIVERSARY CABLE TV PIONEERS BANQUET CELEBRATING THE PEAK CLASS OF 2017 DENVER, CO OCTOBER 17, 2017 THE BROWN PALACE How It All Began CLASS OF 1966 2 We are glad to welcome you to THE FIFTY-FIRST ANNIVERSARY Cable TV Pioneers Banquet TUESDAY – OCTOBER 17, 2017 v The Chairman’s Report Presentation of the 25th Anniversary Class of 1992 Induction Ceremony of the Class of 2017 v Susan Bitter Smith Chairman Jim K. Faircloth Executive Director David M. Fellows Dinner Host v Join Us At The Afterglow Party Coffee – Cocktails – Cordials 3 Cable TV Pioneers Officers and Managing Board CLASS TITLE Susan Bitter Smith 2002 Chairman David M. Fellows 2008 Vice Chairman Pat Kehoe 2010 Secretary-Treasurer Jim K. Faircloth 1989 Executive Director Michael L. Pandzik 1992 Past Chairman Leslie H. Read 1977 Director Emeritus Frank M. Drendel 1983 Director Jim Gleason 2007 Director Yvette Kanouff 2016 Director John G. Pascarelli 2008 Director Matthew M. Polka 2009 Director Lisa W. Schoenthaler 2012 Director John J. Hagerty 2006 Director Sean McGrail 2017 Class Representative v 4 Good Evening and Welcome Fellow Pioneers and Guests: As we enter our 51st year of existence, it is appropriate to remember that our amazing group was founded initially to identify and recognize accomplished cable pioneers and celebrate their camaraderie at an annual banquet. Over the years, as the spirit of these initial Cable TV Pioneers lives on, the profile and purpose of our organization has changed dramatically. Now, inclusion in the Pioneers goes beyond just years of service in the industry and encompasses those who demonstrate leadership, progress in their careers, community and civic involvement, and the commitment to "go the extra mile." Today's membership is over 500 strong and reflects members from every segment of the ever-evolving cable industry. -

SECURITIES and EXCHANGE COMMISSION Washington, D.C

================================================================================ FORM 10-K ------------------------------ SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 1999 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM ___________ TO ____________ Commission file number 0-6983 [GRAPHIC OMITTED - LOGO] COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 23-1709202 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 1500 Market Street, Philadelphia, PA 19102-2148 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (215) 665-1700 -------------------------------- SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: NONE --------------------------------- SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: Class A Common Stock, $1.00 par value Class A Special Common Stock, $1.00 par value ---------------------------- Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ] -------------------------------- Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. -

Federal Communications Commission DA 00-1534 Before the Federal

Federal Communications Commission DA 00-1534 Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of: ) ) Costa de Oro Television, Inc. ) For Modification of Market of ) Station KJLA, Ventura, California ) Petition for Reconsideration ) CSR-5096-A ) Century Cable of Southern California, Century ) Southwest Cable Television, Inc. and Multivision, ) Marcus Cable, MediaOne of Los Angeles, Inc., ) American Cablesystems of South Central Los ) Angeles, Inc. dba MediaOne, King Videocable ) Company dba MediaOne, and TCI Cablevision of ) California, dba TCI of East San Fernando Valley. ) For Modification of Market of ) Station KJLA, Ventura, California ) Petition for Reconsideration ) ) Costa de Oro Television, Inc. v. Cox ) Communications, Inc. ) CSR-5515-M Request for Carriage ) ) Costa de Oro Television, Inc. v. Time Warner ) Cable ) CSR-5520-M Request for Carriage ) ) CoxCom, Inc. ) For Modification of Market of ) CSR-5537-A Station KJLA, Ventura, California ) ORDER ON RECONSIDERATION MEMORANDUM OPINION AND ORDER Adopted: July 7, 2000 Released: July 10, 2000 By the Deputy Chief, Cable Services Bureau: I. INTRODUCTION 1. The Bureau has before it several matters that pertain to the cable television carriage rights of broadcast television station KJLA, Ventura, California. These matters include petitions for reconsideration, mandatory carriage, and modification of the station’s market. For administrative convenience, the Bureau is consolidating the petitions into one proceeding. Costa de Oro Television, Inc., licensee -

Federal Register / Vol. 60, No. 53 / Monday, March 20, 1995 / Notices 14779

Federal Register / Vol. 60, No. 53 / Monday, March 20, 1995 / Notices 14779 Interested persons may obtain a copy of Tula, S.A. de C.V., Col Juarez, DF, Division), Pleasanton, CA; Videotron the EA from SEA by writing to it at Mexico; Cable TV, Inc., Hazleton, PA; Ltee, Montreal, PQ, Canada; Western (Room 3219, Interstate Commerce Cablevision Industries Corp., Liberty, Co-Axial Ltd., Hamilton, ON, Canada; Commission, Washington, DC 20423) or NY; Cablevision Systems Corporation, WinDBreak Cable, Gering, NE; World by calling Elaine Kaiser, Chief, SEA at Woodbury, NY; CF Cable TV Inc., Company (The), Fort Collins, CO. (202) 927±6248. Comments on Montreal, PQ, Canada; Chambers The area of planned activity is environmental and historic preservation Communications Corp., Eugene, OR; researching and developing matters must be filed within 15 days Classic Communications Ltd., specifications for equipment that will after the EA becomes available to the Richmond Hill, ON, Canada; Coaxial enable cable television systems to public. Communications, Columbus, Ohio; deliver telecommunications services to Environmental and historic Cogeco Inc., Montreal, PQ Canada; customers via a hybrid fiber/coax preservation, public use, or trail use/rail Colony Communications, Inc., network architecture. banking conditions will be imposed, Providence, RI; Comcast Corporation, Constance K. Robinson, where appropriate, in a subsequent Philadelphia, PA; Continental Director of Operations, Antitrust Division. decision in Docket No. AB±12 (Sub-No. Cablevision, Inc., Boston, MA; Cox [FR Doc. 95±6737 Filed 3±17±95; 8:45 am] 183X). Cable Communications, Inc., Atlanta, BILLING CODE 4410±01±M Decided: March 14, 1995. GA; Cross Country Cable, Inc., Warren, By the Commission, David M. -

Top 25 Mvpds (2015)

coverstory Eat or Be Eaten CONSOLIDATION CREATES A TOP-HEAVY LIST OF 25 LARGEST MVPDs BY MIKE FARRELL Top 25 MVPDs (2015) With the recently completed, $48.5 billion AT&T-DirecTV merger, the multichannel video-programming distributor (MVPD) industry has he cable universe is shrinking. a new leader. With 26.4 million video customers, the post-merger AT&T Consolidation, competition and new viewing habits are irrevoca- has the potential to bring high-speed Internet, voice and video services bly changing the pay TV landscape, with more contraction expected to underserved markets across the United States. as larger deals close and smaller cable systems are snapped up by NAME SUBSCRIBERS T their larger peers. But unlike years past, when deals were driven by a desire to cluster operations more efficiently, the coming consolidation wave seems sparked purely 1. AT&T (including DirecTV) 26.3 million by a need to get bigger — bulking up to roll out new services more effectively and cheaply across a broader base, and to help keep rising programming costs in check. 2. Comcast 22.3 million Cable operators aren’t the only ones looking for scale. AT&T com- Charter-Time Warner pleted its $48.5 billion acquisition 3. 17.2 million Cable-Bright House * TAKE of DirecTV in July, raising its AWAY video-subscriber tally to 26.3 Consolidation has created a million customers and vault- 4. Dish Network 13.9 million wide disparity between the top ing the telco to the top of the and bottom of the list of Top 20 Verizon Communications (FiOS) 5.8 million pay TV providers.