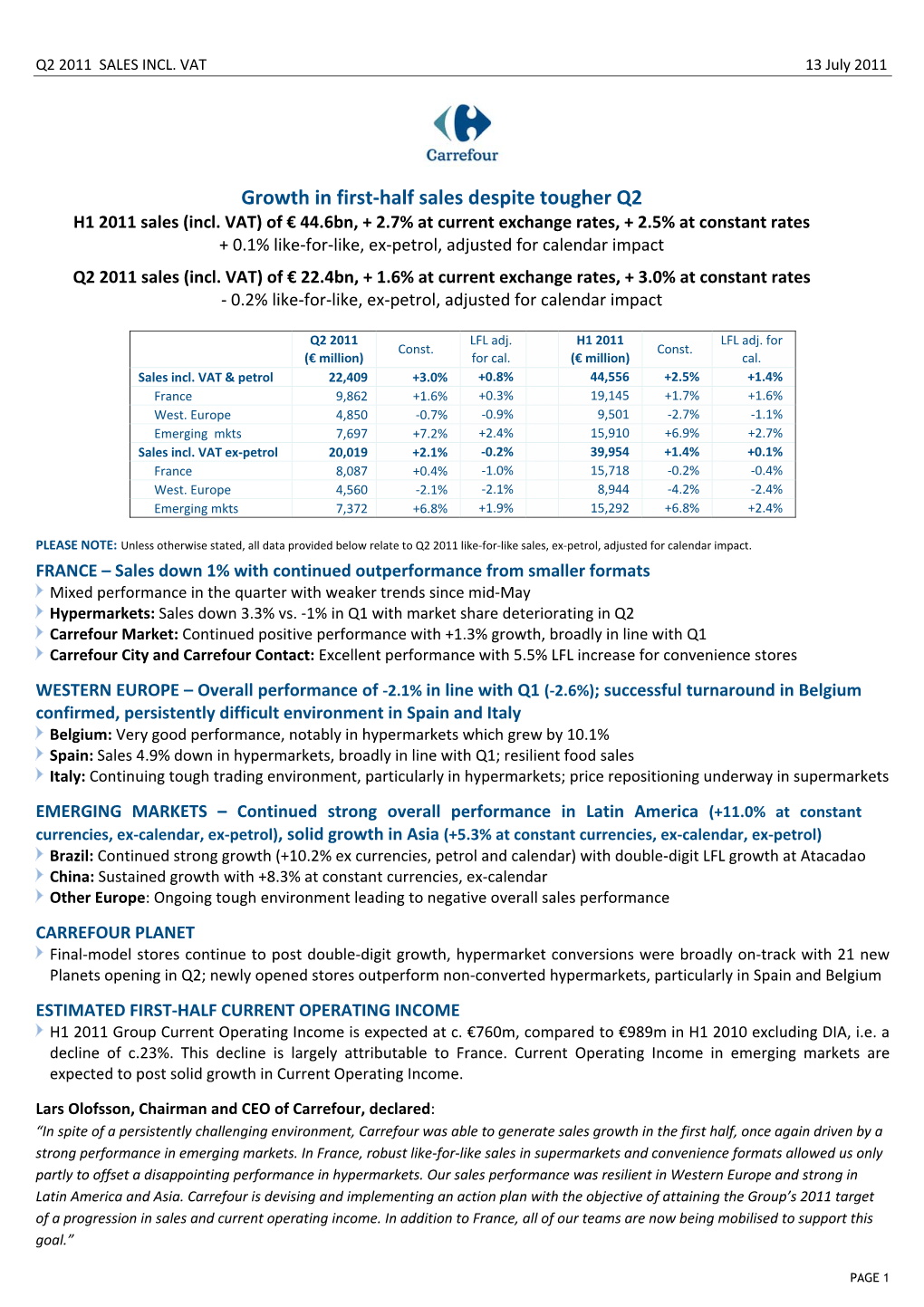

Growth in First-Half Sales Despite Tougher Q2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enquête Par Entretiens Auprès Des Entreprises De L'industrie Du

Enquête par entretiens auprès des entreprises de l’Industrie du Commerce Une analyse de l’ancrage des sièges sociaux et des entreprises Pour le PICOM Sabine KAZMIERCZAK, Hervé BARRY et Hassan EL ASRAOUI Benchmarking et analyse bibliographique préliminaire Avril 2012 1 Contenu Introduction : ........................................................................................................................................... 3 La question des sièges sociaux et de leurs localisations. Le traitement de la question dans le Monde, en Europe et en France. Les principaux enseignements. ........................................................................ 4 1. Les sièges dans la littérature économique .................................................................................. 5 1.1. Le débat sur la fiscalité. ....................................................................................................... 5 1.2. Le rôle des sièges dans la structuration des espaces urbains ............................................. 5 2. Les grands sièges sociaux en Europe et la place de l’industrie du commerce ............................ 6 2.1. Les grands sièges dans le Monde et en Europe (localisation, secteurs d’activités…) ......... 6 2.2. L’industrie du commerce ..................................................................................................... 9 3. Les logiques de localisation ....................................................................................................... 10 3.1. L’expérience en Ile-de-France -

FRENCH MARKET PRESENTATION for : FEVIA from : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19Th June, 2014

FRENCH MARKET PRESENTATION For : FEVIA From : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19th June, 2014 FEVIA 1 I. GREEN SEED GROUP : WHO WE ARE II. MARKET BACKGROUND AND CONSUMER TRENDS III. THE FRENCH RETAIL SECTOR IV. KEY RETAILERS PROFILES V. FOODSERVICE VI. KEY LEARNINGS VII. CASE STUDIES FEVIA 2 Green Seed Group Having 25 years of experience, the Green Seed Group is a unique international network of 11 offices in Europe, North America and Australia, specializing in the food & beverage sector OUR MISSION Advise both French and foreign food and beverage companies or marketing boards, on how to develop a sustainable and profitable position abroad Green Seed France help you to develop your activity in France using our in-depth knowledge of the local food and beverage market and our established contacts within the trade FEVIA 3 A growing and unique international network Germany (+ A, CH) The Netherlands Scandinavia U.S.A./Canada Great Britain Belgium France Portugal Spain Italy 11 offices covering 18 countries Australasia FEVIA 4 The Green Seed model Over the last decade, one of the most important trends in the French food & drink trade has been for retailers to deal with their suppliers on a direct line. Green Seed France has developed its business model around this trend. We act as business facilitators ensuring that every step of the process is managed with maximum efficiency. From first market visit, to launch as well as the ongoing relationship that follows. We offer a highly cost-effective solution of “flexible local sales and marketing management support” aimed at adding value. -

L'hyper N°370/12

N°370/12N°370/12 2323 janvierjanvier 20122012 L'HyperL'Hyper 1818 pagespages La gazette des délégués CFDT Carrefour Alerte & Enquête http:/www.cfdt-carrefour.com E.mail: [email protected] Ouverture Sommaire et édito ▼ Ouverture Sommaire et édito page 02 ▼ Droit d'alerte économique Réunions CCE du 20 janvier page 04 ▼ Presse Revue de presse page 08 Ce que nous en voulons pas page 13 Noël Prioux et François Fillon ▼ CCE Carrefour 12 janvier 2012 au centre de formation Carre- four "espace emploi" (Paris 13ème) Méli-mélo à l'ordre du jour page 16 On n'était pas invité ! Des salariés heureux page 18 Quelqu'un a t-il parlé des 10 000 emplois supprimés en 3 ans. ▼ Comité de groupe France Rencontre avec Noël Prioux page 19 Les syndicats dénon- cent un climat social délétère. Ils contes- tent fortement la stratégie du PDG de Carrefour Lars Olofs- son et de l'actionnaire majori- taire, Colony Capital. Que répon- dez-vous ? Les syndicats ont exercé leur droit d'alerte. Carrefour s'est engagé à leur apporter des réponses lors d'un prochain comité central d'entre- prise. Depuis mon arrivée, j'ai ren- contré les partenaires sociaux, et je le referai cette année. Il faut que les salariés partagent notre stratégie, qu'ils participent à la transforma- tion de l'entreprise. Je suis partisan d'un dialogue sans tabou avec les Petit cadeau de Noël Prioux aux salariés des sièges syndicats. pour la nouvelle année. A vous de traduire ! On est quelques uns à attendre nos étrennes . 2/22 • L'Hyper n° 370/12 du 23 janvier 2012 Editorial Tirons tous dans le même sens ! Par Serge Corfa Délégué syndical national Attention que tout ce remue ménage autour de la si- Pouvoirs publics tuation économique de l'entreprise ne finisse que Depuis plusieurs années, nous évoquons dans un si- par des rapports d'experts qui finiront au placard. -

Country Retail Scene Report

SPAIN COUNTRY RETAIL SCENE REPORT December 2012 KANTAR RETAIL 24 – 28 Bloomsbury Way, London WC1A 2PX, UK / Tel. +44 (0)207 031 0272 / www.KantarRetail.com INFORMATION / INSIGHT / STRATEGY / EXECUTION © Kantar Retail 2012 245 First Street 24 – 28 Bloomsbury Way T +44 (0) 207 0310272 Suite 1000 London, WC1A 2PX F +44 (0) 207 0310270 Cambridge, MA 02142 UK [email protected] USA www.kantarretail.com Index I. Key Themes .......................................................................................................... 2 II. Socio – Economic Background .............................................................................. 3 III. Key Players in the Grocery Retail Sector ............................................................ 11 IV. Grocery Retail Channels ..................................................................................... 19 V. Conclusion ........................................................................................................... 24 © 2012 KANTAR RETAIL | 2012 Spain Retail Scene | www.kantarretail.com 1 245 First Street 24 – 28 Bloomsbury Way T +44 (0) 207 0310272 Suite 1000 London, WC1A 2PX F +44 (0) 207 0310270 Cambridge, MA 02142 UK [email protected] USA www.kantarretail.com I. Key Themes National players are capturing growth and increasing concentration in Spain Despite the economic turmoil in Spain, leading Spanish grocery retailers are expected to see their growth accelerate in the coming years, led by retailers such as Mercadona and Dia, both growing at over 5% per year. Mercadona is by far the largest Spanish grocery retailer in terms of sales and has successfully adapted its strategy to the economic crisis that Spain is facing. Its impressive business model has enabled it to retain shopper loyalty and support robust physical expansion and the retailer is looking to further strengthen its domination of the supermarket channel and the grocery market overall. Due to the strong growth of two of the top five grocery retailers in Spain the dominance of a few major players will increase. -

Concurrence Et Strategie Dans La Grande Distribution

Université Montpellier 1 Faculté de droit et de science politique CONCURRENCE ET STRATEGIE DANS LA GRANDE DISTRIBUTION Présenté et soutenu par Hélène SART Mémoire de spécialité en vue de l’obtention du Master 2 Professionnel Consommation et Concurrence Directeur de recherche Monsieur Amine Mansour Année universitaire 2013-2014 2 Université Montpellier 1 Faculté de droit et de science politique CONCURRENCE ET STRATEGIE DANS LA GRANDE DISTRIBUTION Présenté et soutenu par Hélène SART Mémoire de spécialité en vue de l’obtention du Master 2 Professionnel Consommation et Concurrence Directeur de recherche Monsieur Amine Mansour Année universitaire 2013-2014 3 REMERCIEMENTS En préambule à ce mémoire, je souhaiterais adresser mes remerciements aux personnes m’ayant apporté leur aide, leur contribution et leur soutien tout au long de l'élaboration de ce mémoire. Je tiens avant tout à remercier Monsieur Amine Mansour, en sa qualité de directeur de recherche, qui par ses conseils, son temps et son expertise m’a permis d’accomplir ce mémoire. Mes remerciements s’adressent également à Madame Sonia Fabre, responsable juridique et tutrice du stage que j’effectue au sein du groupe Casino, qui m’a apporté ses connaissances et son expérience sur une partie du mémoire concernant le groupe Casino. Sans oublier, Monsieur Malo Depincé, et Monsieur le Professeur Daniel Mainguy ainsi que l’ensemble du corps enseignant, pour leurs interventions tout au long de l’année, qui m’ont permis d’acquérir de nombreuses connaissances dans des domaines approchant de près ou de loin, le thème de mon mémoire. Et enfin, la promotion 2013/2014 du Centre du droit du marché et de la consommation pour leur aide et leur soutien et sans qui je n’aurais pas pu passer une si agréable année. -

Carrefour Strategy Update: Reinventing the Hypermarket

Carrefour strategy update: Reinventing the hypermarket 'En avant' Transformation Plan and strategy It's been a little over a year since you presented your Transformation Plan to the market. Where does Carrefour stand now? I think we can be very satisfied with the results so far. If you look into it, we started the Transformation Plan in June, July last year. Last year we delivered for instance 500m - 590m, even - in operational savings. This year we will save another 500m. If we then talk about purchasing savings, also then we're up to target and we will be up to target even this year. In terms of stock reduction, we reduced more than two days last year so we really delivered what we said last year. And this year we are also on track in order to deliver the improvements. So I think it's very, very encouraging to see in terms of the cost improvements. Now the other side, I also said that we need to enrich and renew the management team and here I'm pleased to say that we now have a complete Executive Board with some, I would say, exceptional international talents, and today we have a complete team. And I must say that it is the best team in my point of view that any retailer is putting up and it's for sure the team that will take Carrefour to the levels that we want to do. So I think it's very satisfactory to see that. Now the last initiative, we had seven initiatives and one initiative that we so far haven't presented, is what we are doing today in this Analyst Day and where we're presenting the reinvention of the hypermarket. -

European Trade Policy and Investment Support Project (Eu- Mutrap)

1 EUROPEAN TRADE POLICY AND INVESTMENT SUPPORT PROJECT (EU- MUTRAP) Support Vietnamese enterprises to understand distribution processes and market demand in the EU and to adjust to such processes and demand Guidebook on the Organization and Operation of the Distribution Sector in the European Union Revised version further to the “Peer Review” by DM Expert 2 7 August 2014 Author: Andras Lakatos, DMI Expert With the contribution of Nguyen Cam Nhung, PMU Expert This document has been prepared with the assistance of the European Union. The views expressed herein are those of the authors and therefore in no way reflect the official opinion of the European Union nor the Ministry of Industry and Trade 2 Contents Acronyms ......................................................................................................................... 5 1. Foreword .................................................................................................................. 6 2. Introduction.............................................................................................................. 6 3. Overview of the EU distribution sector ....................................................................... 8 4. The distribution sectors of selected Member States .............................................. 21 4.1 Germany’s distribution sector........................................................................... 22 4.1.1 Focus on METRO Group ........................................................................ 24 International Activities -

Country Retail Scene Report

ITALY COUNTRY RETAIL SCENE REPORT August 2012 KANTAR RETAIL 6 More London Place, Tooley Street, London, UK / Tel. +44 (0)207 031 0251 / www.KantarRetail.com INFORMATION / INSIGHT / STRATEGY / EXECUTION © Kantar Retail 2012 245 First Street 6 More London Place T +44 (0) 207 0310272 Suite 1000 London F +44 (0) 207 0310270 Cambridge, MA 02142 SE1 2QY [email protected] USA UK www.kantarretail.com Index I. Key Themes .......................................................................................................... 2 II. Socio – Economic Background .............................................................................. 3 III. Key Players in the Grocery Retail Sector ............................................................ 11 IV. Grocery Retail Channels ..................................................................................... 19 V. Conclusion ........................................................................................................... 25 © 2012 KANTAR RETAIL | 2012 Italy Retail Scene | www.kantarretail.com 1 245 First Street 6 More London Place T +44 (0) 207 0310272 Suite 1000 London F +44 (0) 207 0310270 Cambridge, MA 02142 SE1 2QY [email protected] USA UK www.kantarretail.com I. Key Themes Private Label Due to the country’s difficult economic situation, Italian household spending is under pressure and shoppers are looking to cut their expenses as much as possible. Private labels are thus seen as a key way for shoppers to cut their grocery expenditure. Private labels are underdeveloped in Italy compared to France, representing only around 25% of sales, whereas French retailers can generate around 40% of their sales through their own brands. Italian retailers are aggressively expanding their assortments of private labels, and heavily promoting their own brands. National Champions The Italian grocery market is dominated by national retailers, from multi-channel retailers to discounters. These national champions accounted for 45% of the Italian grocery retail market in 2011. -

Annual Retail Foods France

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/31/2014 GAIN Report Number: FR9167 France Retail Foods Annual Approved By: David G Salmon Prepared By: Laurent J Journo Report Highlights: In 2013, French consumers spent approximately 10 percent of their budgets on food and beverage purchases, including alcohol. Over 70 percent of French household food purchases were made in hyper/supermarkets and hard discounters. However, in recent years the retail sector experienced deep changes with the multiplication of neighborhood distribution channels, development of sales via internet, and drive-thru services. Also, as a result of the economic slowdown in France and the increase in unemployment and taxes, consumers have had to tighten their food budgets. Retailers made additional efforts to attract consumers with lower prices and by increasing the use of private label products. Post: Paris Average exchange rate used in this report, unless otherwise specified: Calendar Year 2011: US Dollar 1 = 0.72 Euros Calendar Year 2012: US Dollar 1 = 0.78 Euros Calendar Year 2013: US Dollar 1 = 0.75 Euros Jan-Aug. 2014: US Dollar 1 = 0.73 Euros Source: The Federal Bank of New York and/or the International Monetary Fund. SECTION I. MARKET SUMMARY France’s retail distribution network is diverse and sophisticated. The food retail sector is generally comprised of six types of establishments, hypermarkets, supermarkets, hard discounters, convenience, gourmet centers in department stores, and traditional outlets (see definitions in Section C of this report). -

1/Organisation 2/Acteurs GALEC / LECLERC 16

Profil de la grande distribution française 1/Organisation Intégrée Indépendante Carrefour Auchan / Simply Market Leclerc* Casino (Géant) Intermarché (ITM) Cora / Match Système U Monoprix Société nationale *Magasin indépendant possède (structure de société possédée et dirigée par un ses magasins dirigés par des PDG) directeurs salariés se regroupent en (quelques magasins indépendants affiliés, structures régionales d’achat ou de logistique) structure d’achat et logistique régionale (SCA - Soca) puis en groupe d’achat national (GALEC) GT vin (groupe de travail) à chaque niveau Pour U et ITM, même principe avec des plateformes Supérettes 150 à 400 m2 régionales et des files locales d’achat Supermarchés ≤ 2 500 m2 Hypermarchés > 2 500 m2 2/Acteurs GALEC / LECLERC 16 SCA régionales : Scaso (sud ouest), Cestas - 33 Scapalsace (Coop Alsace), Colmar St Louis - 68 Scalandes, Mont de Marsan - 40 Scapest, Saint-Martin-sur-le-Pré - 51 Socamil, (Midi Pyrénées - Languedoc), Toulouse Scapartois, Tilloy-lès-Mofflaines - 62 Lecasud (sud est), Le Luc - 83 Scachap (Charentes Poitou), Ruffec - 16 Socara (Rhône Alpes), St-Quentin-Fallavier - 38 Scaouest, Saint-Etienne-de-Montluc - 44 Scacentre, Yseure - 03 Scarmor (Bretagne), Landerneau - 29 Scapnor (nord), Bruyères-sur-Oise - 95 Socamaine, Champagné - 72 Scadif (Ile de France), Savigny-le-Temple - 77 Scanormande, Lisieux - 14 Enseignes : 645 magasins 587 hyper et supermarchés Leclerc (avec 584 Leclerc drive) 458 superettes Leclerc express Carrefour France Structures affiliées : Provencia Ed - Dia France -

Top Grocery Retailers in Latin America

International Markets Bureau MARKET INDICATOR REPORT | AUGUST 2012 Top Grocery Retailers In Latin America Planet Retail Planet Retail Planet Source: Source: Source: Top Grocery Retailers in Latin America EXECUTIVE SUMMARY INSIDE THIS ISSUE The population of Latin America* Executive Summary 2 was estimated to be 396 million in 2009 (Planet Retail, 2012). Three quarters of its population live in Key Findings 3 and around cities. The largest cities in this region are: Sao Traditional vs. Modern 3 Paulo, Brazil; Buenos Aires, Argentina; Rio de Janeiro, Brazil; Lima, Peru; Bogota, Colombia; Santiago, Chile; Belo Horizonte, Grocery Market Size 4 Brazil; Caracas, Venezuela; Porto Alegre and Brasilia both in Brazil. Top Grocery Retailers 5 As a comparison, total grocery sales in this region are slightly higher than those in the U.K., with the largest grocery markets Local Retailers To Watch 15 being Brazil, Argentina, Colombia, Venezuela and Chile. After remaining flat in 2008 and 2009, grocery spending in Latin Definitions 20 America is on the rise, with total grocery sales reaching US$788.1 billion in 2011. Planet Retail predicts the size of this market, combined with the region’s potential economic growth, Buying Groups 21 will sustain long-term sales growth. Although the upper class owns a large portion of the region’s wealth, the growing middle- Key Resources 21 class should fuel sales in the coming years. Latin America has little market concentration in the grocery retail sector. For example, Brazil’s top five players account for approximately 25% of the market. Chile presents a different situation, however, with the top five players accounting for around 60% of the market. -

2011 Annual Activity and Sustainability Report

2011 Annual Activity and Sustainability Report www.carrefour.com Report Sustainability and Activity Annual € Société Anonyme with capital of 1,698,340,000 – RCS Nanterre 652 014 051 2011 884657_RADD_Couv_GB_BAG.indd4657_RADD_Couv_GB_BAG.indd 101101 009/08/129/08/12 117:087:08 Carrefour group’s other publications are also available on www.carrefour.com Design, creation, editing and production: Carrefour group Communications Direction and Photo credits: Carrefour library, Lionel Barbe, Nicolas Guerbe / Interlinks Image, Arno Lam, p.39 / Paul Bradbury / Getty images, Marta Nascimento / REA, David Pell Multimédia, Mark Roger, Thierry Schneider/ Girafe Photo, all rights reserved. Paper: The Carrefour group has made a commitment to responsible management of its paper purchases. The paper used in this report is FSC (Forest Stewardship Council) certifi ed. This certifi cation attests to compliance with a set of internationally recognised forest management principles and criteria. The aim of the FSC is to promote environmentally responsible, socially benefi cial and economically viable management of the Earth’s forests. Printing: This document was produced by Realgraphic, FSC and ISO 14001 Environmental Financial Report Carrefour Foundation Sustainable Development Management Systems (EMS) certifi ed. Realgraphic has received the Imprim’Vert label, Activity Report Expert Report meeting requirements for hazardous waste management, secure storage of hazardous materials and toxic products exclusion. 884657_RADD_Couv_GB_BAG.indd4657_RADD_Couv_GB_BAG.indd