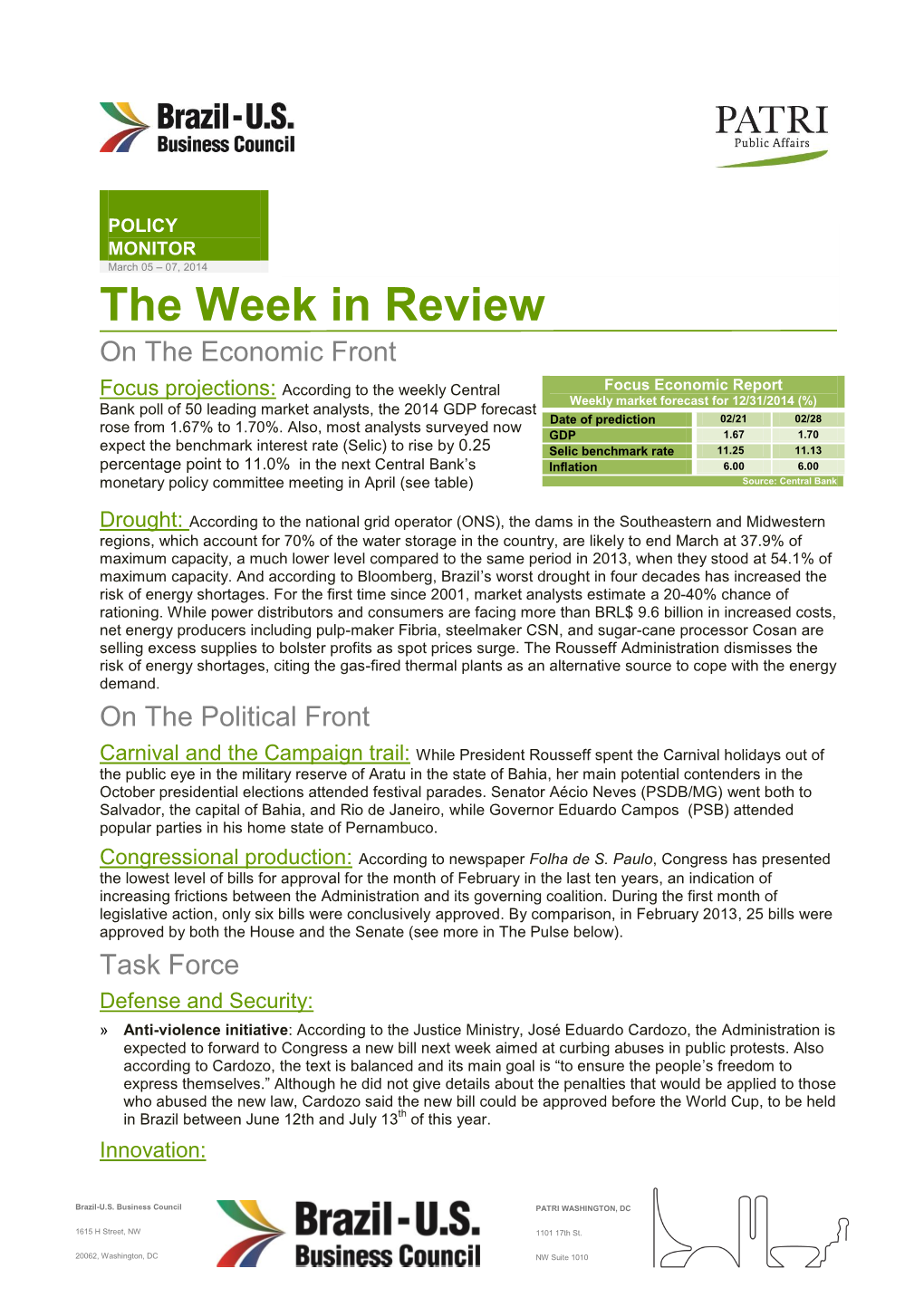

The Week in Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Political Realignment in Brazil: Jair Bolsonaro and the Right Turn

Revista de Estudios Sociales 69 | 01 julio 2019 Temas varios Political Realignment in Brazil: Jair Bolsonaro and the Right Turn Realineamiento político en Brasil: Jair Bolsonaro y el giro a la derecha Realinhamento político no Brasil: Jair Bolsonaro e o giro à direita Fabrício H. Chagas Bastos Electronic version URL: https://journals.openedition.org/revestudsoc/46149 ISSN: 1900-5180 Publisher Universidad de los Andes Printed version Date of publication: 1 July 2019 Number of pages: 92-100 ISSN: 0123-885X Electronic reference Fabrício H. Chagas Bastos, “Political Realignment in Brazil: Jair Bolsonaro and the Right Turn”, Revista de Estudios Sociales [Online], 69 | 01 julio 2019, Online since 09 July 2019, connection on 04 May 2021. URL: http://journals.openedition.org/revestudsoc/46149 Los contenidos de la Revista de Estudios Sociales están editados bajo la licencia Creative Commons Attribution 4.0 International. 92 Political Realignment in Brazil: Jair Bolsonaro and the Right Turn * Fabrício H. Chagas-Bastos ** Received date: April 10, 2019· Acceptance date: April 29, 2019 · Modification date: May 10, 2019 https://doi.org/10.7440/res69.2019.08 How to cite: Chagas-Bastos, Fabrício H. 2019. “Political Realignment in Brazil: Jair Bolsonaro and the Right Turn”. Revista de Estudios Sociales 69: 92-100. https://doi.org/10.7440/res69.2019.08 ABSTRACT | One hundred days have passed since Bolsonaro took office, and there are two salient aspects of his presidency: first, it is clear that he was not tailored for the position he holds; second, the lack of preparation of his entourage and the absence of parliamentary support has led the country to a permanent state of crisis. -

Maria Da Penha

Global Feminisms Comparative Case Studies of Women’s Activism and Scholarship BRAZIL Maria da Penha Interviewer: Sueann Caulfield Fortaleza, Brazil February 2015 University of Michigan Institute for Research on Women and Gender 1136 Lane Hall Ann Arbor, MI 48109‐1290 Tel: (734) 764‐9537 E‐mail: [email protected] Website: http://www.umich.edu/~glblfem © Regents of the University of Michigan, 2015 Maria da Penha, born in 1945 in Fortaleza, Ceará, is a leader in the struggle against domestic violence in Brazil. Victimized by her husband in 1983, who twice tried to murder her and left her a paraplegic, she was the first to successfully bring a case of domestic violence to the Inter‐American Commission on Human Rights. It took years to bring the case to public attention. In 2001, the case resulted in the international condemnation of Brazil for neglect and for the systematic delays in the Brazilian justice system in cases of violence against women. Brazil was obliged to comply with certain recommendations, including a change to Brazilian law that would ensure the prevention and protection of women in situations of domestic violence and the punishment of the offender. The federal government, under President Lula da Silva, and in partnership with five NGOs and a number of important jurists, proposed a bill that was unanimously passed by both the House and the Senate. In 2006, Federal Law 11340 was ratified, known as the “Maria da Penha Law on Domestic and Family Violence.” Maria da Penha’s contribution to this important achievement for Brazilian women led her to receive significant honors, including "The Woman of Courage Award” from the United States in 2010.1 She also received the Cross of the Order of Isabella the Catholic from the Spanish Embassy, and in 2013, the Human Rights Award, which is considered the highest award of the Brazilian Government in the field of human rights. -

Brazil: Background and U.S. Relations

Brazil: Background and U.S. Relations Updated July 6, 2020 Congressional Research Service https://crsreports.congress.gov R46236 SUMMARY R46236 Brazil: Background and U.S. Relations July 6, 2020 Occupying almost half of South America, Brazil is the fifth-largest and fifth-most-populous country in the world. Given its size and tremendous natural resources, Brazil has long had the Peter J. Meyer potential to become a world power and periodically has been the focal point of U.S. policy in Specialist in Latin Latin America. Brazil’s rise to prominence has been hindered, however, by uneven economic American Affairs performance and political instability. After a period of strong economic growth and increased international influence during the first decade of the 21st century, Brazil has struggled with a series of domestic crises in recent years. Since 2014, the country has experienced a deep recession, record-high homicide rate, and massive corruption scandal. Those combined crises contributed to the controversial impeachment and removal from office of President Dilma Rousseff (2011-2016). They also discredited much of Brazil’s political class, paving the way for right-wing populist Jair Bolsonaro to win the presidency in October 2018. Since taking office in January 2019, President Jair Bolsonaro has begun to implement economic and regulatory reforms favored by international investors and Brazilian businesses and has proposed hard-line security policies intended to reduce crime and violence. Rather than building a broad-based coalition to advance his agenda, however, Bolsonaro has sought to keep the electorate polarized and his political base mobilized by taking socially conservative stands on cultural issues and verbally attacking perceived enemies, such as the press, nongovernmental organizations, and other branches of government. -

Casaroes the First Y

LATIN AMERICA AND THE NEW GLOBAL ORDER GLOBAL THE NEW AND AMERICA LATIN Antonella Mori Do, C. Quoditia dium hucient. Ur, P. Si pericon senatus et is aa. vivignatque prid di publici factem moltodions prem virmili LATIN AMERICA AND patus et publin tem es ius haleri effrem. Nos consultus hiliam tabem nes? Acit, eorsus, ut videferem hos morei pecur que Founded in 1934, ISPI is THE NEW GLOBAL ORDER an independent think tank alicae audampe ctatum mortanti, consint essenda chuidem Dangers and Opportunities committed to the study of se num ute es condamdit nicepes tistrei tem unum rem et international political and ductam et; nunihilin Itam medo, nondem rebus. But gra? in a Multipolar World economic dynamics. Iri consuli, ut C. me estravo cchilnem mac viri, quastrum It is the only Italian Institute re et in se in hinam dic ili poraverdin temulabem ducibun edited by Antonella Mori – and one of the very few in iquondam audactum pero, se issoltum, nequam mo et, introduction by Paolo Magri Europe – to combine research et vivigna, ad cultorum. Dum P. Sp. At fuides dermandam, activities with a significant mihilin gultum faci pro, us, unum urbit? Ublicon tem commitment to training, events, Romnit pari pest prorimis. Satquem nos ta nostratil vid and global risk analysis for pultis num, quonsuliciae nost intus verio vis cem consulicis, companies and institutions. nos intenatiam atum inventi liconsulvit, convoliis me ISPI favours an interdisciplinary and policy-oriented approach perfes confecturiae audemus, Pala quam cumus, obsent, made possible by a research quituam pesis. Am, quam nocae num et L. Ad inatisulic team of over 50 analysts and tam opubliciam achum is. -

Redalyc.Participation in Democratic Brazil: from Popular Hegemony And

Opinião Pública E-ISSN: 1807-0191 [email protected] Universidade Estadual de Campinas Brasil Avritzer, Leonardo Participation in democratic Brazil: from popular hegemony and innovation to middle-class protest Opinião Pública, vol. 23, núm. 1, abril, 2017, pp. 43-59 Universidade Estadual de Campinas São Paulo, Brasil Available in: http://www.redalyc.org/articulo.oa?id=32950439002 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative Participation in democratic Brazil: from popular hegemony and innovation to middle-class protest Leonardo Avritzer Introduction Democracy has had historically different patterns of collective action (Tilly, 1986, 2007; Tarrow, 1996). Repertoires of collective action are a routine of processes of negotiation and struggle between the state and social actors (Tilly, 1986, p. 4). Each political era has a repertoire of collective action or protest that is related to many variables, among them the form of organization of the state; the form of organization of production; and the technological means available to social actors. Early eighteenth- century France experienced roadblocks as a major form of collective action (Tilly, 1986). Late nineteenth-century France had already seen the development of other repertoires, such as the city mobilization that became famous in Paris and led to the re-organization of the city’s urban spaces (Tarrow, 1996, p. 138-139). At the same time that the French blocked roads and occupied cities, the Americans used associations and large demonstrations (Skocpol, 2001; Verba et al., 1994) to voice claims concerning the state. -

Brazil's Highway BR-319 Demonstrates a Crucial Lack Of

This file has been cleaned of potential threats. If you confirm that the file is coming from a trusted source, you can send the following SHA-256 hash value to your admin for the original file. dbff54e91e3fc5f9f0f132d9f8a5ab40efb8e6c5e76a2c405fde14007f810941 To view the reconstructed contents, please SCROLL DOWN to next page. Environmental Conservation Brazil’s Highway BR-319 demonstrates a crucial lack of environmental governance in Amazonia Maryane BT Andrade1 , Lucas Ferrante1 and Philip M Fearnside2 1Programa de P´os-Graduação, Instituto Nacional de Pesquisas da Amazônia (INPA), Av. André Araújo, 2936, CEP cambridge.org/enc 69067-375, Manaus, Amazonas, Brazil and 2Instituto Nacional de Pesquisas da Amazônia (INPA), Av. André Araújo, 2936, CEP 69067-375, Manaus, Amazonas, Brazil ’ Comment Brazil s Amazon rainforest is being rapidly degraded by logging and forest fires, as well as by droughts that are increasing under a changing climate that both favours forest fires and kills Cite this article: Andrade MBT, Ferrante L, trees even without fire (Aleixo et al. 2019). Although deforestation is well known, greenhouse Fearnside PM (2021) Brazil’s Highway BR-319 gas emissions from forest degradation are also very large, and in 2016 they accounted for 38% of demonstrates a crucial lack of environmental the total forest carbon loss in the Brazilian Amazon (Walker et al. 2020). The southern and governance in Amazonia. Environmental Conservation page 1 of 4. doi: 10.1017/ eastern edges of the Brazilian Amazon is already heavily deforested and degraded (Fearnside S0376892921000084 2017), but in the western portion of the region the forest is still almost entirely intact. However, forest degradation is shifting to the western portion of the Brazilian Amazon Received: 4 November 2020 (Matricardi et al. -

THE DAL'/ DIARY of PRESIDENT Jlml'kly Chte3 HOTEL NACIONAL

THE DAL‘/ DIARY OF PRESIDENT JlMl’klY ChTE3 LOCATION HOTEL NACIONAL BRASILIA, BRAZIL PHObE 8:58 The President went to the ballroom in the Hotel Nacional. 9:30 The President participated in his twenty-eighth press conference. The President's remarks were broadcast live on Brazilian television. The President went to the holding room. The President participated in a prayer with: The First Lady I Guido Mondlin, Member of the Brazilian Congressional Prayer Group Daso deOlivera Comvra, Member of the Brazilian Congressional Prayer Group Dirceu Cardoso, Member of the Brazilian Congressional I Prayer Group I Aldo Fagundes, Member of the Brazilian Congressional I Prayer Group I Rev. Emmitt Young, Member of the Brazilian Congressional Prayer Group The President and the First Lady went to their motorcade. 9:46 9:53 The President and the First Lady motored from the Hotel Nacional to the Supreme Federal Tribunal of Brazil. I t The President and the First Lady were greeted by: I Jayme de Assis Almeida, Secretary General of the Supreme Federal Tribunal of Brazil Pedro Jose Xavier Mattose, Director General of the Supreme Federal Tribunal of Brazil I I The President and the First Lady, escorted by Mr. Almeida and ' Mr. Mattoso, went inside the Supreme Federal Tribunal. I The President and the First Lady were greeted by members I of the Supreme Federal Tribunal of Brazil. For a list I of attendees, see APPENDIX "A." The President and the First Lady, escorted by Members of the Supreme Federal Tribunal, went to the reception room. I i 10:15 The President and the First Lady attended a meeting of the i Supreme Federal Tribunal. -

Policy Monitor

Week of July 14-18 2014 The Week in Review On The Economic Front Interest Rate On Wednesday, the Central Bank (CB) maintained the Selic benchmark interest rate at 11% for the second consecutive month. The Monetary Policy Committee halted the Selic hikes in May after nine consecutive increases. World Cup Effect on Politics and the Economy Still Ambiguous According to the "Financial Times", the FIFA World Cup provided some stimulus to the Brazilian economy, and Apex, the Brazilian trade and investment promotion agency, suggests that the largest sporting event in the world increased foreign business travel resulting in deals worth $6 billion. It is estimated that over the past four years, the World Cup contributed, directly and indirectly, an additional $50 billion to national output. Notwithstanding these gains, national economic growth has continued to decline over the same period, and certain sectors have suffered, in part from lost time to World Cup games. Automobile production, for example, continued a downward trend, decreasing 33% in June. At the same time, consumer and business confidence has hit new lows, while the stock market has responded positively following Brazil’s last two lopsided defeats. The market’s upward trend continues to coincide with President Rousseff’s fall in popularity over the last year, reflecting investors’ increased hopes that she will not be reelected. In addition, investors consider President Rousseff's interventionist economic policies as responsible for exacerbating Brazil’s weak economic performance and believe a new president with more market-friendly policies could turn the economic decline around in 2015. On The Political Front World Cup Evaluation According to a Datafolha poll released on Tuesday, the FIFA World Cup left foreigners who came to the country to watch the matches with a surprisingly positive image of Brazil. -

Brazil: Political and Economic Situation and U.S

Brazil: Political and Economic Situation and U.S. Relations Peter J. Meyer Analyst in Latin American Affairs March 27, 2014 Congressional Research Service 7-5700 www.crs.gov RL33456 Brazil: Political and Economic Situation and U.S. Relations Summary The United States has traditionally enjoyed cooperative relations with Brazil, which is the seventh-largest economy in the world and is recognized by the Obama Administration’s National Security Strategy as an emerging center of influence. Administration officials have often highlighted Brazil’s status as a multicultural democracy, referring to the country as a natural partner that shares values and goals with the United States. Bilateral ties have been strained from time to time, however, as the countries’ occasionally divergent national interests and independent foreign policies have led to disagreements. U.S.-Brazilian relations have been particularly strained over the past year as a result of alleged National Security Agency (NSA) activities inside Brazil. Nevertheless, the countries continue to engage on issues such as trade, energy, security, racial equality, and the environment. Political and Economic Situation Dilma Rousseff of the center-left Workers’ Party was inaugurated to a four-year presidential term on January 1, 2011, inheriting a country that had benefited from 16 years of stable governance under Presidents Fernando Henrique Cardoso (1995-2002) and Luis Inácio Lula da Silva (2003- 2010). She has spent much of her time in office focusing on domestic economic challenges. Brazil experienced a rapid economic expansion from 2004 to 2010, but growth began to slow in 2011. While Rousseff’s efforts to stimulate domestic consumption and protect domestic industry have helped keep unemployment near record lows, economic growth has yet to accelerate, averaging 2% annually during the first three years of her term. -

The Perfect Misogynist Storm and the Electromagnetic Shape of Feminism: Weathering Brazil’S Political Crisis

Journal of International Women's Studies Volume 20 Issue 8 Issue #2 (of 2) Women’s Movements and the Shape of Feminist Theory and Praxis in Article 6 Latin America October 2019 The Perfect Misogynist Storm and The Electromagnetic Shape of Feminism: Weathering Brazil’s Political Crisis Cara K. Snyder Cristina Scheibe Wolff Follow this and additional works at: https://vc.bridgew.edu/jiws Part of the Women's Studies Commons Recommended Citation Snyder, Cara K. and Wolff, Cristina Scheibe (2019). The Perfect Misogynist Storm and The Electromagnetic Shape of Feminism: Weathering Brazil’s Political Crisis. Journal of International Women's Studies, 20(8), 87-109. Available at: https://vc.bridgew.edu/jiws/vol20/iss8/6 This item is available as part of Virtual Commons, the open-access institutional repository of Bridgewater State University, Bridgewater, Massachusetts. This journal and its contents may be used for research, teaching and private study purposes. Any substantial or systematic reproduction, re-distribution, re-selling, loan or sub-licensing, systematic supply or distribution in any form to anyone is expressly forbidden. ©2019 Journal of International Women’s Studies. The Perfect Misogynist Storm and The Electromagnetic Shape of Feminism: Weathering Brazil’s Political Crisis By Cara K. Snyder1 and Cristina Scheibe Wolff2 Abstract In Brazil, the 2016 coup against Dilma Rousseff and the Worker’s Party (PT), and the subsequent jailing of former PT President Luis Ignacio da Silva (Lula), laid the groundwork for the 2018 election of ultra-conservative Jair Bolsonaro. In the perfect storm leading up to the coup, the conservative elite drew on deep-seated misogynist discourses to oust Dilma Rousseff, Brazil’s progressive first woman president, and the Worker’s Party she represented. -

One Harvard, One Brazil June 15, 2019 | São Paulo, Brazil

One Harvard, One Brazil June 15, 2019 | São Paulo, Brazil 8:30 AM Registration & Breakfast 9:00 AM Setting the Stage: Welcome, Alumni Community and Summit Goals Ham Clark (EdM '78) Duval Guimarães (MPP '13) 9:15 AM The Power of Active and Responsible Civic Agency Danielle Allen (AM '98, PhD '01) - James Bryant Conant University Professor moderated by Lúcia Dellagnelo (EdM '95, PhD '00) 10:15 AM Coffee Break & Networking 11:00 AM Advancing Ethics, Equality and Justice in Brazil Ministra Carmen Lúcia moderated by Edith Bertoletti (LLM '99) 12:00 PM Aspirations for Our Alumni Community opening remarks by Sara Aske - Harvard Alumni Association Duval Guimarães (MPP '13) - Harvard Alumni Club of Brazil Graciema Bertoletti (MBA '99) - Harvard Business School Club of Brazil Magnus Arantes (OPM '10) - Harvard Business School Alumni Angels of Brazil Max Fontes (LLM '00) - Harvard Law School Association of Brazil moderated by Raquel Ajub Moyses (MPH '17) - Summit Executive Committee 12:30 PM Lunch & Networking 2:10 PM Group Photo 2:15 PM Building a Better Brazil: Perspectives and Priorities Flavio Calmon - Assistant Professor, Harvard John A. Paulson SEAS Guilherme Leal - Harvard DRCLAS Brazil Advisor Priscila Cruz (MPA '15) moderated by Edson Kenji Kondo (MPP '90, PhD '94) 3:45 PM Brazil at Harvard and Harvard in Brazil: Reflections and Opportunities Jorge Paulo Lemann (AB '61) - Harvard DRCLAS Brazil Advisor Luciana de Oliveira (AM '93, PhD '97) - Harvard Global Advisory Council Mariam Topehashvili (AB '19) moderated by Wolff Klabin (AB '96, OPM '13) - Harvard DRCLAS Brazil Advisor 4:25 PM Closing Words Claudio Haddad (OPM '87) - Chair, Harvard DRCLAS Brazil Advisory Group 4:40 PM Cocktail Reception & Networking MC: Bruno Levi Dancona (ALM '17) Summit Speakers, Moderators & MC: Hamilton “Ham” Clark (EdM ‘78): Head of School at Avenues São Paulo, Ham has over 40 years of experience in education leadership that spans the United States, Europe, and the Middle East. -

Brazil: Encouraging Lessons from a Large Federal System

8 Brazil: Encouraging Lessons from a Large Federal System Brazil has come a long way from its colonial days where education of the local population had not been a priority. This chapter describes how modern Brazil has extended public basic education to over 95% of the population; established assessment systems using an internationally benchmarked index that measures the progress of each school against a baseline; created student-based funding formulas that distribute funds fairly within states; used conditional cash transfers to lift poor families out of poverty through education; and encouraged states and municipalities to take actions to improve education in individual schools. Brazil has enjoyed 15 years of economic and political stability that has enabled it to develop a range of solid industries that now export to the world. Consumption is up among its citizens and this continues to fuel the Brazilian economy. Average PISA scores for Brazil have improved in all subjects measured over the last ten years. While these scores are well below the OECD average and obviously do not place Brazil among the high-performing countries, such gains do suggest that Brazil has put in place federal policies based on a coherent vision that appear to be generating some consistent improvements. The challenge now is to raise the level of education of its citizens high enough to enable them to take commerce and industry to competitive levels in a global marketplace. Strong PerformerS and SucceSSful reformerS in education: leSSonS from PiSa for the united StateS © OECD 2010 177 8 Brazil: Encouraging lEssons from a largE fEdEral systEm introduction in the early 1990s, Brazil suffered from hyperinflation and many of the other economic problems common to latin american countries.