JP Morgan Private Equity Limited (“JPEL”)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JP Morgan Investment Management Inc. | Client Relationship Summary

J.P. MORGAN INVESTMENT MANAGEMENT INC. JULY 9, 2021 Client Relationship Summary The best relationships are built on trust and transparency. That’s why, at J.P. Morgan Investment Management Inc. (“JPMIM”, “our”, “we”, or “us”), we want you to fully understand the ways you can invest with us. This Form CRS gives you important information about our wrap fee programs, short-term fixed income and private equity separately managed accounts (“SMAs”). We are registered with the Securities and Exchange Commission (“SEC”) as an investment adviser. Brokerage and investment advisory services and fees differ, and it is important for retail investors (“you”) to understand the differences. Free and simple tools are available for you to research firms and financial professionals at Investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing. WHAT INVESTMENT SERVICES AND ADVICE CAN YOU PROVIDE ME? We have minimum account requirements, and for Private Equity SMAs, Wrap Fee and Other Similar Managed Account Programs clients must generally satisfy certain investor sophistication requirements. We offer investment advisory services to retail investors through SMAs More detailed information about our services is available at available within wrap fee and other similar managed account programs. www.jpmorgan.com/form-crs-adv. These programs are offered by certain financial institutions, including our affiliates ("Sponsors"). Depending on the SMA strategy, these accounts invest in individual securities (such as stocks and bonds), exchange-traded funds CONVERSATION STARTERS (“ETFs”) and/or mutual funds. Throughout this Client Relationship Summary we’ve included When we act as your discretionary investment manager, you give us “Conversation Starters.” These are questions that the SEC thinks you authority to make investment and trading decisions for your account without should consider asking your financial professional. -

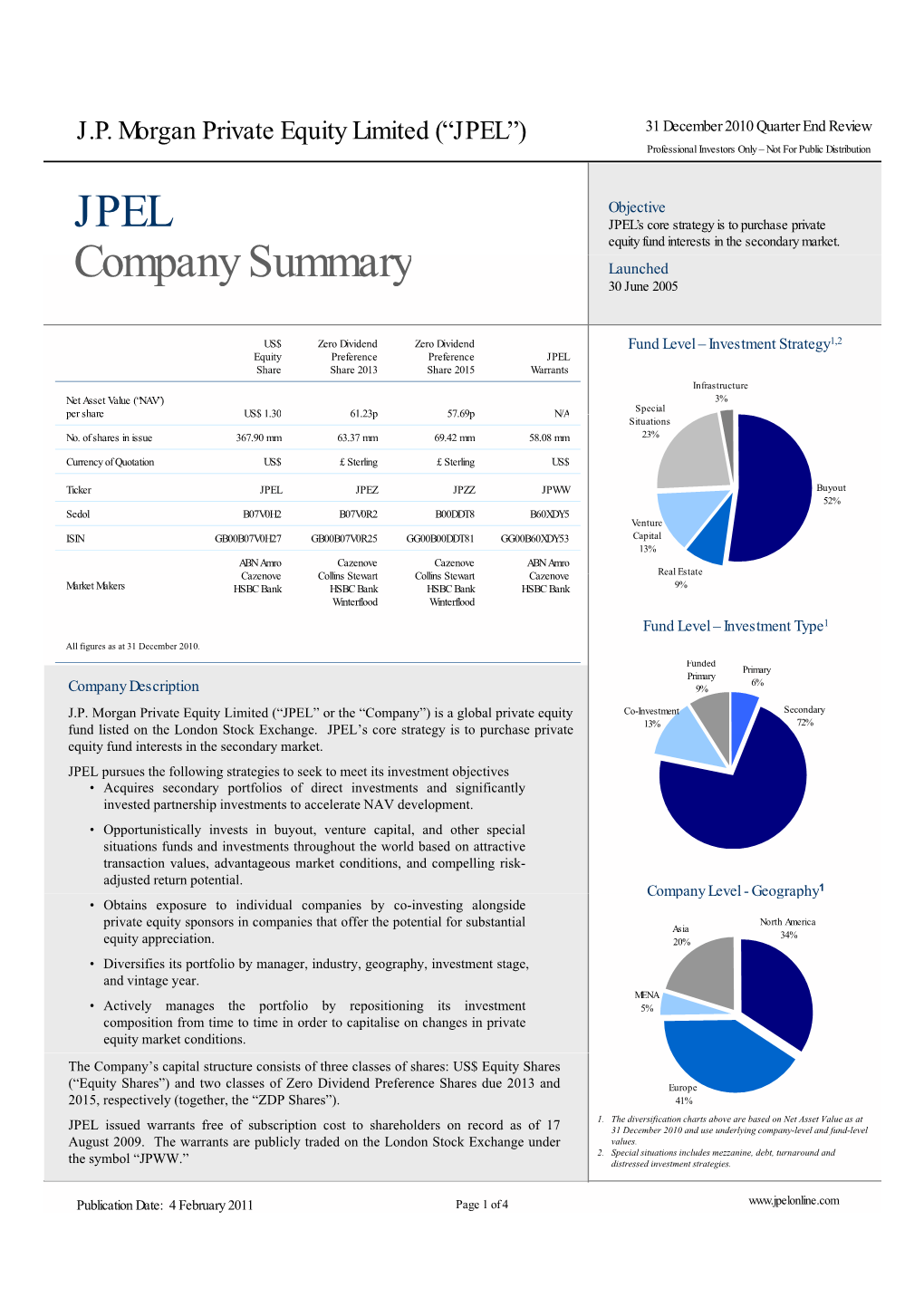

JPEL Company Summary

J.P. Morgan Private Equity Limited (“JPEL”) 30 September 2010 Quarter End Review Professional Investors Only – Not For Public Distribution Objective JPEL JPEL’s core strategy is to purchase private equity fund interests in the secondary market. Company Summary Launched 30 June 2005 US$ Zero Dividend Zero Dividend Fund Level – Investment Strategy1,2 Equity Preference Preference JPEL Share Share 2013 Share 2015 Warrants Infrastructure Net Asset Value (“NAV”) 3% Special per share US$ 1.29 60.15p 56.50p N/A Situations No. of shares in issue 367.88 mm 63.37 mm 69.42 mm 58.08 mm 23% Currency of Quotation US$ £ Sterling £ Sterling US$ Ticker JPEL JPEZ JPZZ JPWW Buyout 53% Sedol B07V0H2 B07V0R2 B00DDT8 B60XDY5 Venture ISIN GB00B07V0H27 GB00B07V0R25 GG00B00DDT81 GG00B60XDY53 Capital 13% ABN Amro Cazenove Cazenove ABN Amro Real Estate Cazenove Collins Stewart Collins Stewart Cazenove 8% Market Makers HSBC Bank HSBC Bank HSBC Bank HSBC Bank Winterflood Winterflood Fund Level – Investment Type1 All figures as at 30 September 2010. Funded Primary Primary 6% Company Description 10% J.P. Morgan Private Equity Limited (“JPEL” or the “Company”) is a global private equity Co-Investment Secondary 72% fund listed on the London Stock Exchange. JPEL’s core strategy is to purchase private 12% equity fund interests in the secondary market. JPEL pursues the following strategies to seek to meet its investment objectives •Acquires secondary portfolios of direct investments and siggynificantly invested partnership investments to accelerate NAV development. • Opportunistically invests in buyout, venture capital, and other special situations funds and investments throughout the world based on attractive transaction values, advantageous market conditions, and compelling risk- adjusted return potential. -

Annual Report 2005 J P M O R G a N C H a S E

JPMORGAN CHASE & CO. Annual Report 2005 JPMorgan Chase & Co. 2005 Annual Report JPMorgan Chase & Co. www.jpmorganchase.com JPMorgan Chase & Co. JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $1.2 trillion and operations in more than 50 countries. The firm is a leader in investment banking, financial services Corporate headquarters Directors Direct deposit of dividends for consumers, small business and commercial banking, financial transaction processing, asset and wealth 270 Park Avenue To contact any of the Board members please For information about direct deposit of management, and private equity. A component of the Dow Jones Industrial Average, JPMorgan Chase New York, New York 10017-2070 mail correspondence to: dividends, please contact Mellon Investor serves millions of consumers in the United States and many of the world’s most prominent corporate, Telephone: 212-270-6000 JPMorgan Chase & Co. Services LLC. http://www.jpmorganchase.com Attention (Board member) institutional and government clients under its JPMorgan and Chase brands. Stockholder inquiries Office of the Secretary Principal subsidiaries 270 Park Avenue Contact Mellon Investor Services LLC: JPMorgan Chase Bank, New York, New York 10017-2070 National Association By telephone: Chase Bank USA, The corporate governance principles of Within the United States, Canada and National Association the board, the charters of the principal Puerto Rico: 1-800-758-4651 J.P. Morgan Securities Inc. board committees and other governance (toll free) information can be accessed by visiting From all other locations: JPMorgan has one of the largest client franchises in the world. Our clients include corporations, Annual report on Form 10-K www.jpmorganchase.com and clicking on 1-201-680-6578 (collect) institutional investors, hedge funds, governments and affluent individuals in more than 100 countries. -

The Retirement Plan Summary Plan Description Jpmorgan Chase

The Retirement Plan Summary Plan Description JPMorgan Chase January 1, 2019 This summary plan description applies only to employees who were hired before December 2, 2017 and have a cash balance account in the JPMorgan Chase Retirement Plan as of December 31, 2018 (and certain rehires after December 31, 2018). The Retirement Plan The JPMorgan Chase Retirement Plan (the “Plan” or Update: Your Summary Plan “Retirement Plan”) is fully paid for by JPMorgan Chase and Description for the JPMorgan Chase Retirement Plan provides a foundation for your retirement income. (Replaces the January 1, 2016 summary As discussed in greater detail below, the Plan is now plan description) “frozen” and closed to new entrants. Prior to the freeze, This document is your summary plan description of the JPMorgan Chase participation in the Retirement Plan was automatic once Retirement Plan. This summary plan description provides you with important you completed one year of total service. Your Retirement information required by the Employee Plan benefit is expressed as a cash balance benefit that Retirement Income Security Act of 1974 (ERISA) about the Retirement Plan. grows in a notional bookkeeping account over time through While ERISA does not require pay credits and interest credits. For each month you work at JPMorgan Chase to provide you with benefits, it does mandate that JPMorgan Chase while eligible for the Plan through JPMorgan Chase clearly communicate to December 31, 2019, the company will credit your account you how the Retirement Plan operates and what rights you have under the law regarding with a percentage of your Eligible Compensation — from Plan benefits. -

Annual Report Jpmorgan Chase &

JPMORGAN CHASE & CO. ANNUAL REPORT2006 FINANCIAL HIGHLIGHTS As of or for the year ended December 31, (in millions, except per share, ratio and headcount data) 2006 2005 Reported basis (a) Total net revenue $ 61,437 $ 53,748 Provision for credit losses 3,270 3,483 Total noninterest expense 38,281 38,426 Income from continuing operations 13,649 8,254 Net income $ 14,444 $ 8,483 Per common share: Basic earnings per share Income from continuing operations $ 3.93 $ 2.36 Net income 4.16 2.43 Diluted earnings per share Income from continuing operations $ 3.82 $ 2.32 Net income 4.04 2.38 Cash dividends declared per share 1.36 1.36 Book value per share 33.45 30.71 Return on common equity Income from continuing operations 12% 8% Net income 13 8 Return on common equity (net of goodwill) Income from continuing operations 20% 13% Net income 22 14 Tier 1 capital ratio 8.7 8.5 Total capital ratio 12.3 12.0 Total assets $ 1,351,520 $1,198,942 Loans 483,127 419,148 Deposits 638,788 554,991 Total stockholders’ equity 115,790 107,211 Headcount 174,360 168,847 (a) Results are presented in accordance with accounting principles generally accepted in the United States of America. JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $1.4 trillion and operations in more than 50 countries. The firm is a leader in investment banking, financial services for consumers, small business and commercial banking, financial transaction processing, asset management and private equity. -

ANNUAL REPORT 2004 Financial Highlights

ANNUAL REPORT 2004 Financial highlights As of or for the year ended December 31, (in millions, except per share, ratio and headcount data) 2004 2003 Reported basis(a) Total net revenue $ 43,097 $ 33,384 Net income 4,466 6,719 Net income per share: Basic 1.59 3.32 Diluted 1.55 3.24 Return on common equity 6% 16% Headcount 160,968 96,367 Pro forma combined-operating basis Total net revenue $ 57,280 $ 55,697 Earnings 10,289 9,330 Diluted earnings per share 2.85 2.61 Return on common equity 10% 9% (a) Results are presented in accordance with accounting principles generally accepted in the United States of America. 2004 results include six months of the combined Firm’s results and six months of heritage JPMorgan Chase results. 2003 reflects the results of heritage JPMorgan Chase only. The financial information provided on pages 1-15 is presented on a pro forma combined- operating basis. The unaudited pro forma combined historical results represent how the financial information of JPMorgan Chase & Co. and Bank One Corporation may have appeared on a combined basis had the two companies been merged as of the earliest date indicated. Additional information, including reconciliation of the pro forma numbers to GAAP, can be found on Form 8-K/A furnished to the Securities and Exchange Commission on January 19, 2005. For a description of operating basis, including management's reasons for its use of such measures, see page 25 of this Annual Report. Right: Bill Harrison Chairman and Chief Executive Officer Left: Jamie Dimon President and Chief Operating Officer Dear fellow shareholder, On January , , we shared with you our plan to unite Bank One and JPMorgan Chase with the goal of creating the best financial services company in the world. -

JP Morgan Private Equity Limited (“JPEL”)

J.P. Morgan Private Equity Limited (“JPEL”) 31 March 2010 Quarter End Review Professional Investors Only – Not For Public Distribution Objective JPEL JPEL’s core strategy is to purchase private equity fund interests in the secondary market. Company Summary Launched 30 June 2005 US$ Zero Dividend Zero Dividend Fund Level – Investment Strategy1,2 Equity Preference Preference JPEL Share Share 2013 Share 2015 Warrants Infrastructure Net Asset Value (“NAV”) 5% per share US$ 1.34 58.06p 54.20p N/A Special Situations No. of shares in issue 367.74 mm 63.37 mm 69.42 mm 58.08 mm 19% Currency of Quotation US$ £ Sterling £ Sterling US$ Ticker JPEL JPEZ JPZZ JPWW Buyout 54% Sedol B07V0H2 B07V0R2 B00DDT8 B60XDY5 Venture Capital ISIN GB00B07V0H27 GB00B07V0R25 GG00B00DDT81 GG00B60XDY53 14% ABN Amro Cazenove Cazenove ABN Amro Real Estate Cazenove Collins Stewart Collins Stewart Cazenove 8% Market Makers HSBC Bank HSBC Bank HSBC Bank HSBC Bank Winterflood Winterflood Fund Level – Investment Type1 All figures as at 31 March 2010. Funded Primary Primary 6% Company Description 11% J.P. Morgan Private Equity Limited (“JPEL” or the “Company”) is a global private equity Co-Investment Secondary fund listed on the London Stock Exchange. JPEL’s core strategy is to purchase private 10% 73% equity fund interests in the secondary market. JPEL pursues the following strategies to seek to meet its investment objectives •Acquires secondary portfolios of direct investments and siggynificantly invested partnership investments to accelerate NAV development. • Opportunistically invests in buyout, venture capital, and other special situations funds and investments throughout the world based on attractive transaction values, advantageous market conditions, and compelling risk- adjusted return potential. -

J.P. Morgan Cazenove Platinum Week

South Africa Equity Research 10 August 2010 J.P. Morgan Cazenove Platinum Week News, Earnings & Valuation Metrics and Commodity trends Company News: Gold & Precious Metals Steve ShepherdAC • Norilsk Nickel produced 5% higher Pd (804koz in Jun-10 vs 765koz in Jun-09) and 14% higher Pt (198koz in (27-11) 507-0386 Jun-10 vs 174koz in Jun-09) in the June 2010 quarter. (Bloomberg Aug 02, 2010) [email protected] • Zimplats announced production of 93koz 4E (Mar10: 93koz 4E, +0%) and sales of 90koz (Mar10: 94koz, Allan CookeAC -4%). (Zimplats report Aug 02, 2010) (27-11) 507-0384 • Anglo Platinum announced that it has signed a tripartite agreement with the Department of Science and [email protected] AC Technology and US firm Altergy Systems for the manufacture of fuel cells in South Africa (Bloomberg Aug 03, Abhishek Tiwari 2010) (27-11) 507-0363 [email protected] • Xstrata reported a 2% increase in PGM volumes to 108koz 3E (105koz), due to the production build-up at J.P. Morgan Equities Ltd. Mototolo (+8% tonnes milled) partially offset by a 4% decrease in production at Eland due to lower quality stockpile material being milled. (Company report Aug 03, 2010) • Wesizwe Platinum announced that it has appointed Arthur Mashiatshidi as the new CEO from Oct. 1, replacing Michael Solomon. The board accepted a report from Deloitte & Touche and Deneys Reitz Attorneys which Our Bloomberg analyst pages: found no evidence of fraud, material financial loss, theft or a material breach of fiduciary duty by Michael Solomon following an investigation. -

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION (A Wholly-Owned Subsidiary of Jpmorgan Chase & Co.)

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION (a wholly-owned subsidiary of JPMorgan Chase & Co.) CONSOLIDATED FINANCIAL STATEMENTS For the quarterly period ended June 30, 2011 TABLE OF CONTENTS For the quarterly period ended June 30, 2011 Page(s) Consolidated Financial Statements - JPMorgan Chase Bank, National Association Consolidated Statements of Income (unaudited) for the three and six months ended June 30, 2011 and 2010 4 Consolidated Balance Sheets (unaudited) at June 30, 2011, and December 31, 2010 5 Consolidated Statements of Changes in Stockholder’s Equity and Comprehensive Income (unaudited) for the six months ended June 30, 2011 and 2010 6 Consolidated Statements of Cash Flows (unaudited) for the six months ended June 30, 2011 and 2010 7 Notes to Consolidated Financial Statements (unaudited) 8–90 Report of Independent Registered Public Accounting Firm 91 Supplementary Information Selected Quarterly Financial Data (unaudited) 92 Selected Annual Financial Data (unaudited) 93 Glossary of Terms 94–95 JPMORGAN CHASE BANK, NATIONAL ASSOCIATION (a wholly-owned subsidiary of JPMorgan Chase & Co.) CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) Three months ended June 30, Six months ended June 30, (in millions) 2011 2010 2011 2010 Revenue Investment banking fees $ 900 $ 717 $ 1,857 $ 1,379 Principal transactions 1,724 2,341 4,512 5,586 Lending- and deposit-related fees 1,646 1,583 3,185 3,224 Asset management, administration and commissions 2,546 2,383 4,990 4,638 Securities gains(a) 835 951 924 1,650 Mortgage fees and related income 1,102 -

Case 1:09-Cv-01656-RMC Document 54 Filed 11/22/10 Page 1 of 2

Case 1:09-cv-01656-RMC Document 54 Filed 11/22/10 Page 1 of 2 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA DEUTSCHE BANK NATIONAL TRUST COMPANY, Plaintiff, v. Case No. 09-CV-1656-RMC FEDERAL DEPOSIT INSURANCE CORPORATION (as receiver of Hon. Rosemary M. Collyer WASHINGTON MUTUAL BANK); JPMORGAN CHASE BANK, National Association; and WASHINGTON MUTUAL MORTGAGE SECURITIES CORPORATION, Defendants. FDIC RECEIVER’S MOTION TO DISMISS Defendant Federal Deposit Insurance Corporation, in its capacity as Receiver for Washington Mutual Bank (“FDIC Receiver”), by its undersigned counsel, hereby moves this Court, pursuant to Rules 12(b)(1) and 12(b)(6) of the Federal Rules of Civil Procedure, for an order dismissing with prejudice all claims asserted against FDIC Receiver in the above-captioned action. Support for this motion is set forth in the accompanying Memorandum of Points and Authorities in Support of FDIC Receiver’s Motion to Dismiss, and in the Declaration of Jason S. Cohen and the exhibits thereto. A proposed order is attached hereto. Case 1:09-cv-01656-RMC Document 54 Filed 11/22/10 Page 2 of 2 Dated: November 22, 2010 Respectfully submitted, Of Counsel: /s/ William R. Stein William R. Stein, D.C. Bar No. 304048 Kathryn R. Norcross, D.C. Bar No. 398120 Scott H. Christensen, D.C. Bar No. 476439 Senior Counsel, Commercial Litigation Unit Jason S. Cohen, D.C. Bar No. 501834 Anne M. Devens HUGHES HUBBARD & REED LLP Counsel, Commercial Litigation Unit 1775 I Street, N.W., Suite 600 Kaye A. Allison Washington, D.C. 20006-2401 Counsel, -

11 Silver Squelchers & Their Interesting Associates

#11 Silver Squelchers & Their Interesting Associates Presented 2015 by Charles Savoie This presentation will be an anti-climax from #10 about the defeat of the Hunt-Arab silver play. I hope readers will find the information interesting. We’ll review 15 personalities from the 1980 Pilgrims rosters (scan above) who don’t appear to have had any direct connection to the downfall of the Hunts. This will give you more feel for the type of people who are members of this nearly unknown organization that stands at the highest levels of American and United Kingdom-British Commonwealth finance, industry, diplomacy, law and government. These are the world’s leading globalists whose interests are always advanced by brewing wars, and this is nothing new. It’s not easy deciding which examples to exclude because most emphatically, there are many more than 15 interesting types available for examination. Examination---that’s funny, because these Pilgrims aren’t willing subjects for scrutiny, which is why despite the combined influence of its membership, the group maintains such a low public profile as to be bizarre. It isn’t strange that their preference as an organization is for concealment, because many of them are individually famous. How else can they best work against the middle class and the non-aligned rich but to conceal that they are a phalanx? Actually some of the names we’ll review may have played a role in the Hunt silver crash; but there may not be definite indications to this effect. 1) Linwood Parks Shipley (Pilgrims 1980 and other years) was a partner in Brown Brothers, Harriman & Company at 59 Wall Street. -

1 a 1 a 12/5/2012 Algeria Pietro Franco Tali, Alessandro Bernini 1/5

REDIRECT: Please go here for up to date formats. THIS FORMAT IS INCORRECT. http://somethingthatdescribesmeandmyarticles.blogsp ot.com/2013/02/proof-of-500-elite-resignations- 1 A mass.html Corresponding (updated, rewritten) blog post to this spreadsheet can be found here: http://somethingthatdescribesmeandmyarticles.blogsp Comments? questions? email me.. or ot.com/2013/02/proof-of-500-elite-resignations- comment on my blog post (link in C1). IF mass.html It's up to you to decide whether this YOU WANT TO SHARE THIS: Share my activity is normal or not. Your interpretation is yours... blog link or the url for the good version of you can believe the things that I believe, how I this doc: http://michellemonk.tk/ For some interpret this[see blog]... or you can brush off my data, reason, this is public and anyone can find or you can give it a different meaning. Take what you and view it, but it won't let people "share" it 1 A will :) But I think it's great, abnormal, and legitimate. without requesting them to be editors. 12/5/2012 Algeria Saipem SpA (SPM) CEO & CFO at parent company Eni SpA (ENI) - troops on american streets Pietro Franco Tali, Alessandro Bernini 1/5/2013 Algeria Former Algerian prime minister Ahmed Ouyahia 2/21/2012 Argentina The general manager of the Central Bank of Argentina (BCRA) Benigno Velez 3/6/2013 Armenia Armenian politician Vardan Sedrakyan 2/4/2010 Australia Chief Scientist in Australia Penny Sackett 2/22/2010 Australia Dean of Architecture at the University of Sydney John Redmond 4/12/2010 Australia Royal Bank of Scotland Austrailan CEO Stephen Williams 6/23/2010 Australia Prime Minister (Leader of Labor Political Party) Kevin Rudd 8/6/2010 Australia Senator Mark Arbib PLEASE NOTE: Sorting the entire document via date and then posting it somewhere is awesome but is useless unless you have personally corerected all the data.