48436 JPM 2012.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Governance and Remuneration 2014

Governance & remuneration reportStrategic In this section Our Board 72 Our Corporate Executive Team 76 Chairman’s letter 78 Corporate governance framework 79 Board report to shareholders Oversight and stewardship in 2014 and future actions 80 remuneration & Governance Leadership and effectiveness 82 Committee reports Audit & Risk 86 Nominations 92 Corporate Responsibility 94 Remuneration report Chairman’s annual statement 96 Annual report on remuneration 97 2014 Remuneration policy report 119 Financial statements Financial Investor information Investor GSK Annual Report 2014 71 Our Board Strategic reportStrategic Diversity Experience International experience Composition Tenure (Non-Executives) % % % % Scientific 19 Global 75 Executive 19 Up to 3 years 39 % % % % Finance 31 USA 100 Non-Executive 81 3-6 years 15 % % % % Industry 50 Europe 94 Male 69 7-9 years 23 % % % EMAP 63 Female 31 Over 9 years 23 Sir Christopher Gent 66 Skills and experience Chairman Sir Christopher has many years of experience of leading global businesses and a track record of delivering outstanding performance Governance & remuneration & Governance Nationality in highly competitive industries. He was appointed Managing Director British of Vodafone plc in 1985 and then became its Chief Executive Officer Appointment date in 1997 until his retirement in 2003. Sir Christopher was also a 1 June 2004 and as Chairman Non-Executive Director of Ferrari SpA and a member of the British on 1 January 2005 Airways International Business Advisory Board. Committee membership External appointments Corporate Responsibility Sir Christopher is a Senior Adviser at Bain & Co. Committee Chairman, Nominations, Remuneration and Finance Sir Philip Hampton 61 Skills and experience Chairman Designate Prior to joining GSK, Sir Philip chaired major FTSE 100 companies including J Sainsbury plc. -

Doug Ogden December 2006

JPMorgan’s Hands-On China Series Views you can use Transcript – Doug Ogden December 2006 NEW REPORT Investment Opportunities in China’s Clean Energy Technology In this presentation to global investors, Douglas Ogden, Director of the China Sustainable Energy Program in Beijing and Executive Vice President of The Energy Foundation in San Francisco, discussed the numerous opportunities for clean energy technology investment in China. These opportunities depend on social investment in upstream policies that shape markets conducive to modern, clean energy technologies. China’s traditional energy technologies, based predominantly on oil and relatively dirty coal, are priced well below social costs, skewing China’s market in favor of inefficient, Doug Ogden outmoded, and heavily polluting energy technologies. The current unsustainable situation has enormous public health and environmental costs. Director, China Sustainable These conditions, however, are being gradually reversed through concerted public policy Energy Program and legal institutional capacity building supported by international non-profits, multilateral Executive Vice President, banks, and the business community. Energy Foundation Engagement in policy development and implementation can be a highly successful strategy for creating market opportunities for clean energy technologies: Witness the progress over the last 8 years that have ushered in: China’s advanced fuel economy standards—driving markets in advanced engine technologies; The national renewable energy law and wind concessions—creating -

JP Morgan Investment Management Inc. | Client Relationship Summary

J.P. MORGAN INVESTMENT MANAGEMENT INC. JULY 9, 2021 Client Relationship Summary The best relationships are built on trust and transparency. That’s why, at J.P. Morgan Investment Management Inc. (“JPMIM”, “our”, “we”, or “us”), we want you to fully understand the ways you can invest with us. This Form CRS gives you important information about our wrap fee programs, short-term fixed income and private equity separately managed accounts (“SMAs”). We are registered with the Securities and Exchange Commission (“SEC”) as an investment adviser. Brokerage and investment advisory services and fees differ, and it is important for retail investors (“you”) to understand the differences. Free and simple tools are available for you to research firms and financial professionals at Investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing. WHAT INVESTMENT SERVICES AND ADVICE CAN YOU PROVIDE ME? We have minimum account requirements, and for Private Equity SMAs, Wrap Fee and Other Similar Managed Account Programs clients must generally satisfy certain investor sophistication requirements. We offer investment advisory services to retail investors through SMAs More detailed information about our services is available at available within wrap fee and other similar managed account programs. www.jpmorgan.com/form-crs-adv. These programs are offered by certain financial institutions, including our affiliates ("Sponsors"). Depending on the SMA strategy, these accounts invest in individual securities (such as stocks and bonds), exchange-traded funds CONVERSATION STARTERS (“ETFs”) and/or mutual funds. Throughout this Client Relationship Summary we’ve included When we act as your discretionary investment manager, you give us “Conversation Starters.” These are questions that the SEC thinks you authority to make investment and trading decisions for your account without should consider asking your financial professional. -

Global Events

GLOBAL EVENTS Education • Professional Leverage • Networking • Philanthropy Industry Icons Sep 18, 2013 New York: A Conversation With Adena T. Friedman, Chief Financial Officer, The Carlyle Group Adena Friedman, Chief Financial Officer, The Carlyle Group Bill Stone, Founder and CEO, Moderator, SS&C Technologies Jun 3, 2013 Washington: Conversation with David M. Rubenstein, Co-Founder, The Carlyle Group David M. Rubenstein, Co-Founder, The Carlyle Group Jeffrey R. Houle, Moderator, Partner, DLA Piper Apr 3, 2013 New York: Fireside Chat with Saba Capital's Boaz Weinstein Boaz Weinstein, Founder & CIO, Saba Capital Stephanie Ruhle, Moderator, Anchor, Bloomberg Oct 30, 2012 Newport Beach: A Conversation with Dr. Mohamed El-Erian of PIMCO: Investing in a Zero-Interest Rate Environment Dr. Mohamed El-Erian, Chief Executive Officer and Co-CIO, PIMCO Lupin Rahman, Moderator, Executive Vice President, PIMCO Marc Seidner, Managing Director and Generalist Portfolio Manager, PIMCO Qi Wang, Managing Director and Portfolio Manager, PIMCO Oct 16, 2012 New York: Know Yourself and Your Decision-Making Process: A Conversation with Nobel Laureate Dr. Daniel Kahneman Dr. Daniel Kahneman, Eugene Higgins Professor of Psychology and Professor of Public Affairs Emeritus, Princeton University Jason Zweig, Moderator, Columnist, Wall Street Journal Sep 19, 2012 New York: Conversation with Eric E. Schmidt, Executive Chairman of Google Eric E. Schmidt, Executive Chairman, Google Apr 30, 2012 New York: An Armchair Discussion with John J. Mack on Leadership John J. Mack, former Chairman and CEO, Morgan Stanley Joanne Pace, Moderator, former Chief Operating Officer, Morgan Stanley Investment Management Jan 25, 2012 Geneva: Philippe Jabre Talks Markets Philippe Jabre, Chief Investment Officer, Jabre Capital Partners Dec 8, 2011 Los Angeles: Dinner Event with Howard Marks, Chairman, Oaktree Capital Oct 26, 2011 Los Angeles: Renee Haugerud, Founder, CIO & Managing Principal, Galtere, Ltd. -

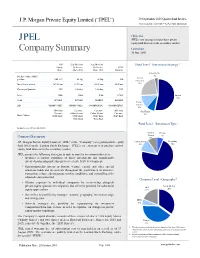

JPEL Company Summary

J.P. Morgan Private Equity Limited (“JPEL”) 30 September 2010 Quarter End Review Professional Investors Only – Not For Public Distribution Objective JPEL JPEL’s core strategy is to purchase private equity fund interests in the secondary market. Company Summary Launched 30 June 2005 US$ Zero Dividend Zero Dividend Fund Level – Investment Strategy1,2 Equity Preference Preference JPEL Share Share 2013 Share 2015 Warrants Infrastructure Net Asset Value (“NAV”) 3% Special per share US$ 1.29 60.15p 56.50p N/A Situations No. of shares in issue 367.88 mm 63.37 mm 69.42 mm 58.08 mm 23% Currency of Quotation US$ £ Sterling £ Sterling US$ Ticker JPEL JPEZ JPZZ JPWW Buyout 53% Sedol B07V0H2 B07V0R2 B00DDT8 B60XDY5 Venture ISIN GB00B07V0H27 GB00B07V0R25 GG00B00DDT81 GG00B60XDY53 Capital 13% ABN Amro Cazenove Cazenove ABN Amro Real Estate Cazenove Collins Stewart Collins Stewart Cazenove 8% Market Makers HSBC Bank HSBC Bank HSBC Bank HSBC Bank Winterflood Winterflood Fund Level – Investment Type1 All figures as at 30 September 2010. Funded Primary Primary 6% Company Description 10% J.P. Morgan Private Equity Limited (“JPEL” or the “Company”) is a global private equity Co-Investment Secondary 72% fund listed on the London Stock Exchange. JPEL’s core strategy is to purchase private 12% equity fund interests in the secondary market. JPEL pursues the following strategies to seek to meet its investment objectives •Acquires secondary portfolios of direct investments and siggynificantly invested partnership investments to accelerate NAV development. • Opportunistically invests in buyout, venture capital, and other special situations funds and investments throughout the world based on attractive transaction values, advantageous market conditions, and compelling risk- adjusted return potential. -

Annual Report 2015

Annual Report 2015 2015 saw substantial progress to accelerate new product sales growth and strengthen our Pharmaceuticals, Vaccines and Consumer Healthcare businesses Overview of 2015 Strategic report “ In 2015, we made substantial progress to accelerate new product sales growth, integrate new businesses in Vaccines and Consumer Healthcare and restructure our global Pharmaceuticals business. This progress means the Group is well positioned to return to core earnings growth in 2016.” Sir Andrew Witty, Chief Executive Officer Governance & remunerationPerformance Financial statements summary Investor information £23.9bn £10.3bn £5.7bn £3.9bn Group turnover Total operating profit Core operating profit Cash dividends paid (up 6% CER/up 1% CER (up >100% CER) a (down 9% CER/down 3% in 2015 pro-forma) a CER pro-forma)a £2.0bn 174.3p 75.7p 10 0 % New product sales b Total earnings per share Core earnings per share Markets now operating (up >100%) (up >100%, primarily (down 15% CER, primarily new commercial model reflecting impact of reflecting short-term dilution transaction gains) of the Novartis transaction)a ~40 20 ~13 % 1st Potential new medicines Potential to file up to Estimated internal In Access to Medicine and vaccines profiled at R&D 20 assets with regulators rate of return in R&D Index event, 80% of which have by 2020 in 2015 potential to be first-in-classc Footnotes a We use a number of adjusted measures to report the performance of our business, as described on page 54. These include core results, CER growth rates and pro-forma CER growth rates. A reconciliation of total results to core results is set out on page 62. -

A View from the East: Talk Markets with Jing Ulrich of J.P. Morgan and Susan Li of Bloomberg TV

A View from the East: Talk markets with Jing Ulrich of J.P. Morgan and Susan Li of Bloomberg TV October 25, 2011 at 6 PM Hong Kong We invite you to an interview of Jing Ulrich, J.P. Morgan's Chairman of Global Markets for China by Susan Li of Bloomberg TV. The conversation will explore concerns of China's economic slowdown as well as Jing's outlook for Chinese inflation and macro policy. Jing will also offer advice on investing in turbulent markets and will discuss areas of opportunity across asset classes. As part of our ongoing 100WHF 10th anniversary year, during the month of October we are celebrating our global network. We encourage you to attend an October event in your local City or wherever in the World you may be traveling or watch a 100WHF webcast from one of our global locations on 100WHF Connect! Participants Jing Ulrich, J.P.Morgan Susan Li, Moderator, Bloomberg TV Event Details Date: October 25, 2011 Time: 5:30 PM Registration. We will begin promptly at 6 PM; please arrive early. Since it is disruptive to everyone when latecomers enter the session, those arriving after an education session has begun will only be admitted at the discretion of 100WHF and the host. Please note the start time on this invite and plan to arrive early. Networking and cocktails will follow. Host: E&Y Location: Ernst & Young (E&Y) 18th Floor, Two International Finance Centre, 8 Finance Street, Central, Hong Kong, Hong Kong RSVP: RSVP Now This event is NOT FOR ATTRIBUTION. -

General Motors & China‟S Automotive Market

GENERAL MOTORS & CHINA‟S AUTOMOTIVE MARKET A public lecture by Michael J. Dunne, author American Wheels, Chinese Roads November 30, 5:00 – 6:00 pm Blau Auditorium, Ross School of Business University of Michigan Reception and Book Signing 6:00 – 6:45 American Wheels, Chinese Roads, The Story of General Motors in China (Wiley 2011) gives a vivid account of how GM secured the strategic partnership with Shanghai Automotive Industry Corp that propelled their joint venture to top position in the world‟s largest, fastest-growing, and highly-competitive auto market. While huge losses in the U.S. market during the global financial crisis forced the company into bankruptcy, requiring a bailout by the U.S. government, its operations in China saw record increases in sales and profits. In this talk, author Mike Dunne will summarize the book‟s narrative, highlighting how GM‟s executive team navigated the challenges posed by China‟s complex and unique business environment. He will also discuss and take questions on the current state of the auto industry in China and other Asian countries. A Detroit-area native, Mike obtained his BA, MBA and MA in Asian Studies at the University of Michigan, where he became fluent and literate in the Chinese and Thai languages. His entrepreneurial venture, Automotive Resources Asia, established in Bangkok in 1992, and subsequently expanded to China, was one of the earliest consultancies on the Asian automotive industry. After selling it to J.D. Powers & Associates in 2006, Mike served as the market research company‟s Vice-President for Asia-Pacific till 2009. -

Kathy Matsui, Stephanie Hui, Kate Richdale And

COVER STORY 20 FINANCEASIA JULY / AUGUST 2015 FINANCEASIA.COM COVER STORY By FinanceAsia reporters inanceAsia’s 2015 honour roll of the most influential women across the Asia FPacific region spans investment bank- ing and commercial bankers. We also bring you leading women in new ar- eas of finance such as Fintech where Asian companies are among the fastest-growing in the world. FinanceAsia also canvased corporate fin- anciers for exceptional women working in deal advisory including lawyers and accountants. We wanted to include women from across the region and admit we found this easier in China and Australia than say Korea and Japan. There is also a positive skew in the re- sults towards FinanceAsia’s own area of ex- pertise, corporate finance. FA FINANCEASIA.COM JULY / AUGUST 2015 FINANCEASIA 21 COVER STORY KELLY BAYER Delivering products that year. The division also achieved established software help companies to achieve a 9% increase in average companies. She is a Master of ROSMARIN their targets and increase lending balances and a 9% Science graduate from profits is the driving aspiration boost in average deposit Stanford University. COMMONWEALTH behind Kelly Bayer Rosmarin in balances, clocking up 41 new “I inherited a healthy BANK OF AUSTRALIA her role as head of institutional transaction banking mandates business with a strong track GROUP EXECUTIVE banking and markets at the in 2014. record in customer satisfaction FOR INSTITUTIONAL Commonwealth Bank of Big clients include Telstra, but since then we have focused BANKING AND MARKETS Australia. Woolworths, Origin Energy, heavily on using technology to Bayer Rosmarin’s team of Transurban, Queensland give clients more granular and about 1,500 staff across nine Motorways, and the Scentre insightful information about countries generates nearly 15% Group. -

Annual Report 2005 J P M O R G a N C H a S E

JPMORGAN CHASE & CO. Annual Report 2005 JPMorgan Chase & Co. 2005 Annual Report JPMorgan Chase & Co. www.jpmorganchase.com JPMorgan Chase & Co. JPMorgan Chase & Co. (NYSE: JPM) is a leading global financial services firm with assets of $1.2 trillion and operations in more than 50 countries. The firm is a leader in investment banking, financial services Corporate headquarters Directors Direct deposit of dividends for consumers, small business and commercial banking, financial transaction processing, asset and wealth 270 Park Avenue To contact any of the Board members please For information about direct deposit of management, and private equity. A component of the Dow Jones Industrial Average, JPMorgan Chase New York, New York 10017-2070 mail correspondence to: dividends, please contact Mellon Investor serves millions of consumers in the United States and many of the world’s most prominent corporate, Telephone: 212-270-6000 JPMorgan Chase & Co. Services LLC. http://www.jpmorganchase.com Attention (Board member) institutional and government clients under its JPMorgan and Chase brands. Stockholder inquiries Office of the Secretary Principal subsidiaries 270 Park Avenue Contact Mellon Investor Services LLC: JPMorgan Chase Bank, New York, New York 10017-2070 National Association By telephone: Chase Bank USA, The corporate governance principles of Within the United States, Canada and National Association the board, the charters of the principal Puerto Rico: 1-800-758-4651 J.P. Morgan Securities Inc. board committees and other governance (toll free) information can be accessed by visiting From all other locations: JPMorgan has one of the largest client franchises in the world. Our clients include corporations, Annual report on Form 10-K www.jpmorganchase.com and clicking on 1-201-680-6578 (collect) institutional investors, hedge funds, governments and affluent individuals in more than 100 countries. -

Friday May 9, 2014

Friday May 9, 2014 BACKGROUND Despite limited natural resources, Asia’s economic performance and competitiveness has performed well, with Singapore, Hong Kong and Japan in the top 10 ranking of the World Economic Forum’s Global Competitiveness Index. Indonesia and the Philippines are also rapidly gaining ground, while China, leads the BRICS economies by a wide margin as its institutional framework improves and its financial market matures. Those Asian economies with strong institutions and ample innovative capacity have the ability to do better than its neighbors without these assets. This half day symposium aims to address macro issues relating to global competitiveness in Asia, and sets out to advance thinking and knowledge that enables the global economy to remain productive in the long term. RUNDOWN 9:15 Welcome 9:20 Introductory Remarks 9:30 – 10:45 Panel I Competitiveness in Asia: Maintaining Innovation for Economic Growth With an average annual growth rate of close to six percent in the past decade, Asia’s share of the global economy has risen to a third. Yet while the economic performance and competitiveness of Asian countries improves, the disparities among the countries are deeper than other regions. What are the regional trends for competitiveness? Who are the competitive champions and what are their advantages? What are countries doing to address the issue of educating and building a workforce with the right skillset to complement economic development? Greg Clark, Global Fellow, Metropolitan Programme and Global Cities Initiative, -

The Retirement Plan Summary Plan Description Jpmorgan Chase

The Retirement Plan Summary Plan Description JPMorgan Chase January 1, 2019 This summary plan description applies only to employees who were hired before December 2, 2017 and have a cash balance account in the JPMorgan Chase Retirement Plan as of December 31, 2018 (and certain rehires after December 31, 2018). The Retirement Plan The JPMorgan Chase Retirement Plan (the “Plan” or Update: Your Summary Plan “Retirement Plan”) is fully paid for by JPMorgan Chase and Description for the JPMorgan Chase Retirement Plan provides a foundation for your retirement income. (Replaces the January 1, 2016 summary As discussed in greater detail below, the Plan is now plan description) “frozen” and closed to new entrants. Prior to the freeze, This document is your summary plan description of the JPMorgan Chase participation in the Retirement Plan was automatic once Retirement Plan. This summary plan description provides you with important you completed one year of total service. Your Retirement information required by the Employee Plan benefit is expressed as a cash balance benefit that Retirement Income Security Act of 1974 (ERISA) about the Retirement Plan. grows in a notional bookkeeping account over time through While ERISA does not require pay credits and interest credits. For each month you work at JPMorgan Chase to provide you with benefits, it does mandate that JPMorgan Chase while eligible for the Plan through JPMorgan Chase clearly communicate to December 31, 2019, the company will credit your account you how the Retirement Plan operates and what rights you have under the law regarding with a percentage of your Eligible Compensation — from Plan benefits.