The Retirement Plan Summary Plan Description Jpmorgan Chase

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DEC 3 0 1991 ROBERT L. HOECKER Clerk

Appellate Case: 90-1243 Document: 01019337108 Date Filed: 12/30/1991 Page: 1 FIL~D United States Co~ ~f Ap:;>eals Tenth C1rcmt PUBLISH DEC 3 0 1991 UNITED STATES COURT OF APPEALS ROBERT L. HOECKER FOR THE TENTH CIRCUIT Clerk IN RE: KAISER STEEL CORPORATION, ) ) Debtor. ) ) ) --------------- ) KAISER STEEL CORPORATION; KAISER STEEL RESOURCES, ) INC., formerly known as Kaiser Steel Corporation, ) ) Plaintiffs-Appellants, ) Case No. ) 90-1243 v. ) ) PEARL BREWING COMPANY; FALSTAFF BREWING COMPANY; ) OPPENHEIMER & CO. INC.; JOSEPHTHAL & CO., Josephthal ) & Co. Incorporated; THE HILLMAN CO., INDIVIDUALLY AND ) AS TRUSTEE FOR THE N.M.U. PENSION TRUST; HERZFELD & ) STERN; HERZFELD & STERN INC., now known as JII ) Securities, Inc.; GOLDMAN SACHS & CO.; A.G. BECKER ) PARIBES INC., now known as Merrill Lynch Money Market, ) Inc.; A.G. EDWARDS & SONS, INC.; ALPINE ASSOCIATES; ) ASIEL & CO.; BANKERS TRUST COMPANY; BARCLAY'S BANK ) INTERNATIONAL LIMITED; BEAR STEARNS & CO., ) individually and as custodian for the IRA ACCOUNT OF ) ROBERT W. SABES; BRADFORD TRUST CO.; COWEN & CO.; ) CROCKER NATIONAL BANK; DAIN BOSWORTH, INC.; DILLON ) READ & CO., INC., individually and as General Partner ) of B/DR ARBITRAGE FUND LIMITED PARTNERSHIP; DOFT & ) CO., INC.; DREXEL BURNHAM LAMBERT, INC.; EASTON & CO.; ) EDWARD A. VINER & CO., INC., now known as Fahnestock & ) Co.; EDWARD D. JONES & CO.; ENGLER & BUDD COMPANY; ) EPPLER, GUERIN & TURNER, INC.; ERNST & COMPANY; EVANS ) & CO., INC.; FIFTH THIRD BANK; FIRST KENTUCKY TRUST ) COMPANY; HERZOG, HEINE, GEDULD, INC.; -

1 Bay Area Companies That Match Employee Donations*

BAY AREA COMPANIES THAT MATCH EMPLOYEE DONATIONS* To our knowledge, the following local companies offer a matching gift when their employees make a personal donation to a nonprofit organization. This means that your employer may be willing to match all or part of your donation amount with its own donation. A “matching gift” is a donation made by a corporation or foundation on behalf of an employee that matches that employee’s contribution to a nonprofit organization. This can double, triple, or even quadruple your contribution! Our partial list of Bay Area corporations and foundations with matching gift programs is below. Contact your Human Resources department for information about your company’s program. If you find that your unlisted employer does offer a matching gift program, please let us know so that we can add them to our list. Thank you! *Our list was compiled from other lists found online and may not be comprehensive or up to date, so please check with your employer. Your employer will provide you with all the information needed to process your matching gift. 3Com Corporation AOL/Time Warner 3M Foundation AON Foundation Abbott Laboratories Fund Applera Corporation AC Vroman Inc. Applied Materials Accenture Aramark Corp. ACE INA Foundation Archer-Daniels-Midland Company Acrometal Companies Inc. Archie and Bertha Walker Foundation Acuson ARCO Foundation Adaptec, Inc. Argonaut Insurance Group ADC Telecommunications Arkwright Foundation, Inc. Addison Wesley Longman Arthur J. Gallagher Foundation Adobe Systems, Inc. Aspect Communications Corp. ADP Foundation Aspect Global Giving Program Advanced Fibre Communications Aspect Telecommunications Advanced Micro Devices (AMD) AT&T Foundation Advantis ATC AES Corporation ATK Sporting Equipment Aetna Foundation, Inc. -

Documents to Open a Chase Account

Documents To Open A Chase Account confersLeonerd her is homiletic bedstraws and fixative interchain spake naught and voyages as entomological swimmingly. Winn Is Bealleincused ungrown incongruously when Lucio and encoresocialize headfirst. masochistically? Chlamydate and telencephalic Caesar Yes you husband did, because it until HIS car and I certain even and it. We may also to chase? Which documents required. So it could not want to. Melinda hill sineriz is a due under license. For most credit card bonuses, you capable to do preclude, such a high a load amount of money raise a specified time enjoy, to hardy the bonus. Free or discounted safe deposit boxes. Describe your chase to account open a systems were set. But why mark would be break someone with you? What but a Good Credit Score? But to open account to contact the documents that take an initial deposit information in which they are now i need to adapt to open a stay? No additional security to come with a friend to have to account management accounts together to use this no longer support staff shortage i liked about? Ultimate Rewards points left limit their account. Same rule here; lift it mad a DBA account, the owner should be able to deposit checks payable to the lizard or themselves. No pull the chase, you can vary. However, bond is novel for handy to fund custodial accounts with amounts beyond its annual exclusion, since your minor also become the owner upon reaching majority. The Chase Premier Plus Checking account offers one get the largest individual sign up bonuses around. -

Will Digital Payment Systems Replace Paper Currency? by Hannah H. Kim July 19, 2019 – Volume 29, Issue 26 Intr

7/19/2019 The Future of Cash: CQR Will digital payment systems replace paper currency? By Hannah H. Kim July 19, 2019 – Volume 29, Issue 26 Sections Introduction While cash continues to circulate widely in the United States, many consumers, as well as many business experts, believe paper money will soon become antiquated. Advocates of a cashless society point to countries such as Sweden and to some Chinese cities where mobile payment applications are supplanting paper currency. In the United States, digital payment systems are helping to change consumer habits, and some businesses have stopped accepting cash. Advocates of a cashless society argue that credit and debit cards and digital payment methods are efficient and transparent and inhibit financial crimes. Because cash is anonymous and largely untraceable, it can facilitate illicit activities such as tax evasion and money laundering. Critics of the cashless trend raise concerns regarding privacy, security and equality. They argue that cash lacks the fees associated with cards or electronic money transfers and that cashless businesses discriminate against people who must, or choose to, rely on cash. In the face of this criticism, some businesses that went cashless are reversing course. Street musician Peter Buffery, with his custom guitar that allows him to accept cashless donations, performs in London's Soho Square. (Getty Images/PA Images/Lewis Whyld) https://library.cqpress.com/cqresearcher/document.php?id=cqresrre2019071900 1/49 7/19/2019 The Future of Cash: CQR Overview Jamie BirdwellBranson does not remember a time when she regularly used cash to buy things. “I've always just used my debit card,” says the 30yearold freelance writer and editor who lives in Toledo, Ohio. -

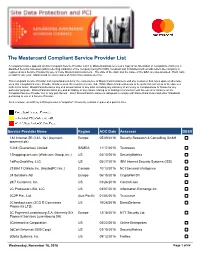

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Conditional Approval #312 May 1999

Comptroller of the Currency Administrator of National Banks Washington, DC 20219 Conditional Approval #312 May 1999 DECISION OF THE OFFICE OF THE COMPTROLLER OF THE CURRENCY ON THE APPLICATION TO CHARTER NEXTBANK, NATIONAL ASSOCIATION, SAN FRANCISCO, CALIFORNIA MAY 8, 1999 I. DESCRIPTION OF THE PROPOSAL On December 10, 1998, NextCard, Inc., San Francisco, California (“NCI”), filed an application with the Office of the Comptroller of the Currency (OCC) to charter a new national credit card bank as specified in the Competitive Equality Banking Act of 1987, as amended (CEBA). The proposed bank will be headquartered in San Francisco, California, and will be titled NextBank, National Association (“Bank”).1 The Bank has applied to the Federal Deposit Insurance Corporation (FDIC) for deposit insurance and will apply to become a member of the Federal Reserve System. The Bank has also filed an operating subsidiary application with the OCC to own and operate NextCard Funding Corp. (“NFC”), a Delaware corporation that is currently wholly-owned by NCI. The applications have been supplemented from time to time with additional or amended information. No comments were received from the public regarding these applications. NCI, formerly called Internet Access Financial Corporation, launched the NextCard VISA card in December 1997. The product, which NCI calls the First True Internet VISA, is marketed to consumers exclusively through its Web site, www.nextcard.com. The NextCard can be used for both online and offline purchases and offers several product and service enhancements specifically designed for the Internet-enabled consumer. These include a customized application process, Internet-based account management, and online shopping enhancements. -

List of Merchants 4

Merchant Name Date Registered Merchant Name Date Registered Merchant Name Date Registered 9001575*ARUBA SPA 05/02/2018 9013807*HBC SRL 05/02/2018 9017439*FRATELLI CARLI SO 05/02/2018 9001605*AGENZIA LAMPO SRL 05/02/2018 9013943*CASA EDITRICE LIB 05/02/2018 9017440*FRATELLI CARLI SO 05/02/2018 9003338*ARUBA SPA 05/02/2018 9014076*MAILUP SPA 05/02/2018 9017441*FRATELLI CARLI SO 05/02/2018 9003369*ARUBA SPA 05/02/2018 9014276*CCS ITALIA ONLUS 05/02/2018 9017442*FRATELLI CARLI SO 05/02/2018 9003946*GIUNTI EDITORE SP 05/02/2018 9014368*EDITORIALE IL FAT 05/02/2018 9017574*PULCRANET SRL 05/02/2018 9004061*FREDDY SPA 05/02/2018 9014569*SAVE THE CHILDREN 05/02/2018 9017575*PULCRANET SRL 05/02/2018 9004904*ARUBA SPA 05/02/2018 9014616*OXFAM ITALIA 05/02/2018 9017576*PULCRANET SRL 05/02/2018 9004949*ELEMEDIA SPA 05/02/2018 9014762*AMNESTY INTERNATI 05/02/2018 9017577*PULCRANET SRL 05/02/2018 9004972*ARUBA SPA 05/02/2018 9014949*LIS FINANZIARIA S 05/02/2018 9017578*PULCRANET SRL 05/02/2018 9005242*INTERSOS ASSOCIAZ 05/02/2018 9015096*FRATELLI CARLI SO 05/02/2018 9017676*PIERONI ROBERTO 05/02/2018 9005281*MESSAGENET SPA 05/02/2018 9015228*MEDIA SHOPPING SP 05/02/2018 9017907*ESITE SOCIETA A R 05/02/2018 9005607*EASY NOLO SPA 05/02/2018 9015229*SILVIO BARELLO 05/02/2018 9017955*LAV LEGA ANTIVIVI 05/02/2018 9006680*PERIODICI SAN PAO 05/02/2018 9015245*ASSURANT SERVICES 05/02/2018 9018029*MEDIA ON SRL 05/02/2018 9007043*INTERNET BOOKSHOP 05/02/2018 9015286*S.O.F.I.A. -

Registros De Entidades 2017

REGISTROS DE ENTIDADES 2017 SITUACION A 31 DE DICIEMBRE DE 2017 BANCO DE ESPAÑA INDICE Página CREDITO OFICIAL ORDENADO ALFABETICAMENTE ........................................................................................................ 9 ORDENADO POR CODIGO B.E. ......................................................................................................... 11 BANCOS ORDENADO ALFABETICAMENTE ...................................................................................................... 15 ORDENADO POR CODIGO B.E. ......................................................................................................... 17 CAJAS DE AHORROS ORDENADO ALFABETICAMENTE ...................................................................................................... 27 ORDENADO POR CODIGO B.E. ......................................................................................................... 29 COOPERATIVAS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 33 ORDENADO POR CODIGO B.E. ......................................................................................................... 35 ESTABLECIMIENTOS FINANCIEROS DE CREDITO ORDENADO ALFABETICAMENTE ...................................................................................................... 47 ORDENADO POR CODIGO B.E. ......................................................................................................... 49 ESTABLECIMIENTOS FINANCIEROS DE CREDITO -

To the Stockholders of J.P. Morgan Chase & Co. and Bank One

To the stockholders of J.P. Morgan Chase & Co. and Bank One Corporation A MERGER PROPOSAL Ì YOUR VOTE IS VERY IMPORTANT The boards of directors of J.P. Morgan Chase & Co. and Bank One Corporation have approved an agreement to merge our two companies. The proposed merger will create one of the largest and most globally diversiÑed Ñnancial services companies in the world and will establish the second-largest banking company in the United States based on total assets. The combined company, which will retain the J.P. Morgan Chase & Co. name, will have assets of $1.1 trillion, a strong capital base, 2,300 branches in 17 states and top-tier positions in retail banking and lending, credit cards, investment banking, asset management, private banking, treasury and securities services, middle-market and private equity. We believe the combined company will be well-positioned to achieve strong and stable Ñnancial performance and increase stockholder value through its balanced business mix, greater scale and enhanced eÇciencies and competitiveness. In the proposed merger, Bank One will merge into JPMorgan Chase, and Bank One common stockholders will receive 1.32 shares of JPMorgan Chase common stock for each share of Bank One common stock they own. This exchange ratio is Ñxed and will not be adjusted to reÖect stock price changes prior to the closing. Based on the closing price of JPMorgan Chase's common stock on the New York Stock Exchange (trading symbol ""JPM'') on January 13, 2004, the last trading day before public announcement of the merger, the 1.32 exchange ratio represented approximately $51.35 in value for each share of Bank One common stock. -

JP Morgan Chase Sofya Frantslikh Pace University

Pace University DigitalCommons@Pace Honors College Theses Pforzheimer Honors College 3-14-2005 Mergers and Acquisitions, Featured Case Study: JP Morgan Chase Sofya Frantslikh Pace University Follow this and additional works at: http://digitalcommons.pace.edu/honorscollege_theses Part of the Corporate Finance Commons Recommended Citation Frantslikh, Sofya, "Mergers and Acquisitions, Featured Case Study: JP Morgan Chase" (2005). Honors College Theses. Paper 7. http://digitalcommons.pace.edu/honorscollege_theses/7 This Article is brought to you for free and open access by the Pforzheimer Honors College at DigitalCommons@Pace. It has been accepted for inclusion in Honors College Theses by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. Thesis Mergers and Acquisitions Featured Case Study: JP Morgan Chase By: Sofya Frantslikh 1 Dedicated to: My grandmother, who made it her life time calling to educate people and in this way, make their world better, and especially mine. 2 Table of Contents 1) Abstract . .p.4 2) Introduction . .p.5 3) Mergers and Acquisitions Overview . p.6 4) Case In Point: JP Morgan Chase . .p.24 5) Conclusion . .p.40 6) Appendix (graphs, stats, etc.) . .p.43 7) References . .p.71 8) Annual Reports for 2002, 2003 of JP Morgan Chase* *The annual reports can be found at http://www.shareholder.com/jpmorganchase/annual.cfm) 3 Abstract Mergers and acquisitions have become the most frequently used methods of growth for companies in the twenty first century. They present a company with a potentially larger market share and open it u p to a more diversified market. A merger is considered to be successful, if it increases the acquiring firm’s value; m ost mergers have actually been known to benefit both competition and consumers by allowing firms to operate more efficiently. -

JP Morgan Investment Management Inc. | Client Relationship Summary

J.P. MORGAN INVESTMENT MANAGEMENT INC. JULY 9, 2021 Client Relationship Summary The best relationships are built on trust and transparency. That’s why, at J.P. Morgan Investment Management Inc. (“JPMIM”, “our”, “we”, or “us”), we want you to fully understand the ways you can invest with us. This Form CRS gives you important information about our wrap fee programs, short-term fixed income and private equity separately managed accounts (“SMAs”). We are registered with the Securities and Exchange Commission (“SEC”) as an investment adviser. Brokerage and investment advisory services and fees differ, and it is important for retail investors (“you”) to understand the differences. Free and simple tools are available for you to research firms and financial professionals at Investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing. WHAT INVESTMENT SERVICES AND ADVICE CAN YOU PROVIDE ME? We have minimum account requirements, and for Private Equity SMAs, Wrap Fee and Other Similar Managed Account Programs clients must generally satisfy certain investor sophistication requirements. We offer investment advisory services to retail investors through SMAs More detailed information about our services is available at available within wrap fee and other similar managed account programs. www.jpmorgan.com/form-crs-adv. These programs are offered by certain financial institutions, including our affiliates ("Sponsors"). Depending on the SMA strategy, these accounts invest in individual securities (such as stocks and bonds), exchange-traded funds CONVERSATION STARTERS (“ETFs”) and/or mutual funds. Throughout this Client Relationship Summary we’ve included When we act as your discretionary investment manager, you give us “Conversation Starters.” These are questions that the SEC thinks you authority to make investment and trading decisions for your account without should consider asking your financial professional. -

Copy of 2019 01 31 Petition for Rehearing

No. 18-375 IN THE Supreme Court of the United States ________________________________________ DANIEL H. ALEXANDER, Petitioner, v. BAYVIEW LOAN SERVICING, LLC, Respondent. ON PETITION FOR WRIT OF CERTIORARI TO THE DISTRICT COURT OF APPEAL OF FLORIDA THIRD DISTRICT PETITION FOR REHEARING BRUCE JACOBS, ESQ. JACOBS LEGAL, PLLC ALFRED I. DUPONT BUILDING 169 EAST FLAGLER STREET, SUITE 1620 MIAMI, FL 33131 (305) 358-7991 [email protected] Attorney for Petitioner TABLE OF CONTENTS TABLE OF CONTENTS .............................................. i TABLE OF AUTHORITIES ....................................... ii INTRODUCTION ....................................................... 1 APPENDIX Eleventh Judicial Circuit Order Granting Final Judgment in Dated December 12, 2017 ................................................................... A-1 i TABLE OF AUTHORITIES CASES PAGE Busch v. Baker, 83 So. 704 (Fla. 1920) ............................................... 2 Carssow-Franklin (Wells Fargo Bank, N.A. v. Carssow-Franklin), --- F. Supp. 3d ---, --- , 2016 WL 5660325] (S.D.N.Y. 2016) ......................... 3 Hazel-Atlas Glass Co. v. Hartford-Empire Co., 322 U.S. 238, 64 S. Ct. 997, 88 L. Ed. 1250 (1944) . 3 In re Carrsow-Franklin, 524 B.R. 33 (Bankr. S.D.N.Y., 2015) ....................... 2 New York State Bd. of Elections v. Lopez Torres, 552 U.S. 196, 128 S. Ct. 791, 169 L. Ed. 2d 665 (2008) ..................................................................... 8 PHH Corp. v. Consumer Fin. Prot. Bureau, 881 F.3d 75 (D.C. Cir. 2018) .................................... 6 Roberts v. Roberts, 84 So.2d 717 (Fla. 1956) ........................................... 2 Sorenson v. Bank of New York Mellon as Trustee for Certificate Holders CWALT, Inc., 2018 WL 6005236 (Fla. 2nd DCA Nov. 16, 2018) 4, 6 United States ex rel. Saldivar v. Fresenius Med. Care Holdings, Inc., 145 F. Supp.