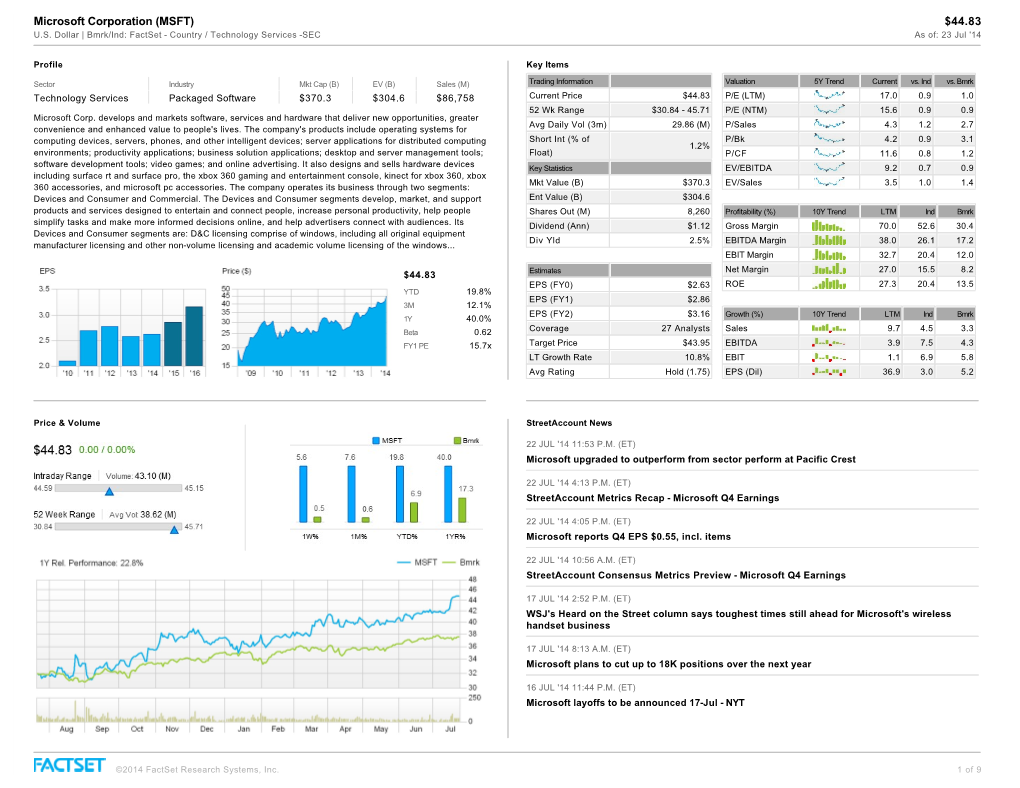

Microsoft Corporation (MSFT) $44.83 U.S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inside Windows 10 - an Early Look at Microsoft’S Newest Operating System Volume 1 - by Onuora Amobi

0 www.windows10update.com – Comprehensive Windows 10 News Copyright Notice INSIDE WINDOWS 10 - AN EARLY LOOK AT MICROSOFT’S NEWEST OPERATING SYSTEM VOLUME 1 - BY ONUORA AMOBI ©2015 Nnigma Inc. All rights reserved. Any unauthorized use, sharing, reproduction or distribution of these materials by any means, electronic, mechanical, or otherwise is strictly prohibited. No portion of these materials may be reproduced in any manner whatsoever, without the express written consent of the Publisher or Author. Published under the Copyright Laws of The United States of America by: Nnigma Inc. 3579 East Foothill Blvd, Suite #254 Pasadena, CA 91107 www.Nnigma.com i www.windows10update.com – Comprehensive Windows 10 News Legal Notice While all attempts have been made to verify information provided in this publication, neither the author nor the publisher assumes any responsibility for errors, omissions or contradictory interpretation of the subject matter herein. This publication is not intended to be used as a source of binding technical, technological, legal or accounting advice. Please remember that the information contained may be subject to varying state and/or local laws or regulations that may apply to the user’s particular practice. The purchaser or reader of this publication assumes responsibility for the use of these materials and information. Adherence to all applicable laws and regulations, both federal, state, and local, governing professional licensing, business practices, advertising and any other aspects of doing business in the US or any other jurisdiction is the sole responsibility of the purchaser or reader. Nnigma Inc. assumes no responsibility or liability whatsoever on behalf of any purchaser or reader of these materials. -

View Annual Report

TO OUR SHAREHOLDERS, CUSTOMERS, PARTNERS AND EMPLOYEES: This is a unique letter for me – the last shareholder letter I will write as the CEO of the company I love. We have always believed that technology will unleash human potential and that is why I have come to work every day with a heart full of passion for more than 30 years. Fiscal Year 2013 was a pivotal year for Microsoft in every sense of the word. Last year in my letter to you I declared a fundamental shift in our business to a devices and services company. This transformation impacts how we run the company, how we develop new experiences, and how we take products to market for both consumers and businesses. This past year we took the first big bold steps forward in our transformation and we did it while growing revenue to $77.8 billion (up 6 percent). In addition, we returned $12.3 billion (up 15 percent) to shareholders through dividends and stock repurchases. While we were able to grow revenue to a record level, our earnings results reflect investments as well as some of the challenges of undertaking a transformation of this magnitude. With this as backdrop, I’d like to summarize where we are now and where we’re headed, because it helps explain why I’m so enthusiastic about the opportunity ahead. Our strategy: High-value activities enabled by a family of devices and services We are still in the early days of our transformation, yet we made strong progress in the past year launching devices and services that people love and businesses need. -

Downloadable Content, and Peripherals

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended June 30, 2013 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From to Commission File Number 0-14278 MICROSOFT CORPORATION WASHINGTON 91-1144442 (STATE OF INCORPORATION) (I.R.S. ID) ONE MICROSOFT WAY, REDMOND, WASHINGTON 98052-6399 (425) 882-8080 www.microsoft.com/investor Securities registered pursuant to Section 12(b) of the Act: COMMON STOCK, $0.00000625 par value per share NASDAQ Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

V. 82, Issue 2, September 25, 2014

Volume 82, Issue 2 Smithfield, RI September 25, 2014 Inside Insight to Summer Abroad Follow Jenna as she reminisces on Summer Abroad in Germany By Jenna Husted its Legacy, which would be transfer credits this Staff Writer to Bryant as an upper level History Mode of Thought and a Political Science or Legal For those of you who are interested in Studies 400 level course. These two classes are studying abroad, but not for a whole semester, held Monday through Friday in Nuremberg, edition or maybe want to earn some class credits over Germany through the University of Erlangen. the summer…listen up! This past summer There are two professors from Creighton who I had the opportunity to go to Germany, split up the time teaching the International the Netherlands, Poland, and Austria over Criminal Law class, while Professor Bryant the course of a month. This program is run (a Legal Studies professor here at Bryant) through Creighton University, located in teaches the Holocaust course. Although this Business: Omaha, Nebraska. Traditionally, this program may sound like it is a lot of class, don’t worry, Members retire from was only for current Law School students, there is plenty of time to travel, shop, and but this was the first year the university experience the German culture. Microsoft board decided to open it up to undergraduates, and One other student, Nathan Hirshbein, it was a success! There were a total of four and I were the only two from Bryant who undergraduates and about thirty Law students went on this trip. -

Microsoft from Wikipedia, the Free Encyclopedia Jump To: Navigation, Search

Microsoft From Wikipedia, the free encyclopedia Jump to: navigation, search Coordinates: 47°38′22.55″N 122°7′42.42″W / 47.6395972°N 122.12845°W / 47.6395972; -122.12845 Microsoft Corporation Public (NASDAQ: MSFT) Dow Jones Industrial Average Type Component S&P 500 Component Computer software Consumer electronics Digital distribution Computer hardware Industry Video games IT consulting Online advertising Retail stores Automotive software Albuquerque, New Mexico Founded April 4, 1975 Bill Gates Founder(s) Paul Allen One Microsoft Way Headquarters Redmond, Washington, United States Area served Worldwide Key people Steve Ballmer (CEO) Brian Kevin Turner (COO) Bill Gates (Chairman) Ray Ozzie (CSA) Craig Mundie (CRSO) Products See products listing Services See services listing Revenue $62.484 billion (2010) Operating income $24.098 billion (2010) Profit $18.760 billion (2010) Total assets $86.113 billion (2010) Total equity $46.175 billion (2010) Employees 89,000 (2010) Subsidiaries List of acquisitions Website microsoft.com Microsoft Corporation is an American public multinational corporation headquartered in Redmond, Washington, USA that develops, manufactures, licenses, and supports a wide range of products and services predominantly related to computing through its various product divisions. Established on April 4, 1975 to develop and sell BASIC interpreters for the Altair 8800, Microsoft rose to dominate the home computer operating system (OS) market with MS-DOS in the mid-1980s, followed by the Microsoft Windows line of OSes. Microsoft would also come to dominate the office suite market with Microsoft Office. The company has diversified in recent years into the video game industry with the Xbox and its successor, the Xbox 360 as well as into the consumer electronics market with Zune and the Windows Phone OS. -

9Fe7860f-Dcb2-4670-B309-F1b26f8c1cf0

WorldReginfo - 9fe7860f-dcb2-4670-b309-f1b26f8c1cf0 TO OUR SHAREHOLDERS, CUSTOMERS, PARTNERS AND EMPLOYEES: Last year was a big year – we delivered strong results, launched fantastic new products and services, and positioned Microsoft for an incredible future. For fiscal year 2012, revenue grew to a record $73.7 billion. We also maintained strong cost discipline resulting in cash flow from operations of $31.6 billion, an increase of 17 percent from the prior year. In addition, we returned $10.7 billion to shareholders through stock buybacks and dividends. We delivered these results while preparing a pipeline of new and updated products that will launch in the year ahead. To best understand what we are about to deliver and what we’re building toward, it’s important to recognize a fundamental shift underway in our business and the areas of technology that we believe will drive the greatest opportunity in the future. Our Business: Devices and Services Last year in this letter I said that over time, the full value of our software will be seen and felt in how people use devices and services at work and in their personal lives. This is a significant shift, both in what we do and how we see ourselves – as a devices and services company. It impacts how we run the company, how we develop new experiences, and how we take products to market for both consumers and businesses. The work we have accomplished in the past year and the roadmap in front of us brings this to life. Devices With End-User Services We will continue to work with a vast ecosystem of partners to deliver a broad spectrum of Windows PCs, tablets and phones. -

Microsoft Corporation

Microsoft Corporation General Company Information Address One Microsoft Way Redmond, WA 98052-6399 United States Phone: 425 882-8080 Fax: 425 936-7329 Country United States Ticker MSFT Date of Incorporation June 1981 , WA, United States Number of Employees 89,000 (Approximate Full-Time as of 06/30/2010) Number of Shareholders 138,568 (record) (as of 07/20/2010) Company Website www.microsoft.com Annual Meeting Date In November Mergent Dividend Achiever No Closing Price As of 02/18/2011 : 27.06 02/20/2011 1 Mergent, Inc. Microsoft Corporation Business Description Industry Internet & Software NAICS Primary NAICS: 511210 - Software Publishers Secondary NAICS: 334119 - Other Computer Peripheral Equipment Manufacturing 423430 - Computer and Computer Peripheral Equipment and Software Merchant Wholesalers 541519 - Other Computer Related Services SIC Primary SIC: 7372 - Prepackaged software Secondary SIC: 3577 - Computer peripheral equipment, nec 7379 - Computer related services, nec Business Description Microsoft is engaged in developing, manufacturing, licensing, and supporting a range of software products and services for several computing devices. Co.'s software products and services include operating systems for personal computers, servers, and intelligent devices; server applications for distributed computing environments; information worker productivity applications; business and computing applications; software development tools; and video games. Co. also provides consulting and product and application support services, as well as trains and certifies computer system integrators and developers. In addition, Co. designs and sells hardware including the Xbox 360 gaming and entertainment console and accessories, the Zune digital music and entertainment device and accessories, and Microsoft personal computer (PC) hardware products. Co. operates through five segments. -

2018 Annual Report 1020141Pe Cover.Indd 1 3/15/19 12:57 PM

Annual Report “ We are introducing a new vision: PepsiCo 2018 Annual Report Annual PepsiCo2018 Be the global leader in convenient foods and beverages by Winning with Purpose. To advance this vision, we will focus on becoming Faster, Stronger, and Better in everything we do.” 1020141pe_cover.indd 1 3/15/19 12:57 PM Annual Report “ We are introducing a new vision: PepsiCo Annual 2018 Report Be the global leader in convenient foods and beverages by Winning with Purpose. To advance this vision, we will focus on becoming Faster, Stronger, and Better in everything we do.” 1020141pe_cover.indd 1 3/15/19 12:57 PM 2018 PepsiCo Annual Report Dear Fellow Ramon Laguarta PepsiCo Chairman of the Board of Directors Shareholders, and Chief Executive Officer s I start my first full year as Chairman and These traits have enabled PepsiCo to consistently CEO, I’m excited to lead PepsiCo into the perform well over the years – both financially and A next chapter of our company’s successful in the marketplace. story, and I feel very fortunate to assume my new role at such a well-positioned company: In 2018, we met or exceeded each of the financial • We compete in attractive and growing categories targets we outlined at the beginning of the year. with leading brands and a broad product portfolio; 2018 Financial Results include:1 • We have a global footprint with strong positions Organic revenue grew 3.7 percent in our largest markets; Core constant currency EPS grew 9 percent • We have many capabilities, from brand-building to Generated $7.6 billion of free cash flow excluding route-to-market to research and development that certain items have been built and strengthened over decades; Returned approximately $7 billion to shareholders • Our associates are passionate about our through dividends and share repurchases business; and Increased the dividend for the 46th • We have a winning culture and strong sense consecutive year of purpose. -

Investment Company Report

Investment Company Report Meeting Date Range: 01-Jul-2020 - 30-Jun-2021 Report Date: 06-Aug-2021 Page 2094 of 9621 Natixis Sustainable Future 2025 Fund- AIA ACTIVISION BLIZZARD, INC. Security: 00507V109 Agenda Number: 935427749 Ticker: ATVI Meeting Type: Annual ISIN: US00507V1098 Meeting Date: 21-Jun-21 Prop. # Proposal Proposed Proposal Vote For/Against by Management's Recommendation 1A. Election of Director: Reveta Bowers Mgmt No vote 1B. Election of Director: Robert Corti Mgmt No vote 1C. Election of Director: Hendrik Hartong III Mgmt No vote 1D. Election of Director: Brian Kelly Mgmt No vote 1E. Election of Director: Robert Kotick Mgmt No vote 1F. Election of Director: Barry Meyer Mgmt No vote 1G. Election of Director: Robert Morgado Mgmt No vote 1H. Election of Director: Peter Nolan Mgmt No vote 1I. Election of Director: Dawn Ostroff Mgmt No vote 1J. Election of Director: Casey Wasserman Mgmt No vote Investment Company Report Meeting Date Range: 01-Jul-2020 - 30-Jun-2021 Report Date: 06-Aug-2021 Page 2095 of 9621 Prop. # Proposal Proposed Proposal Vote For/Against by Management's Recommendation 2. To provide advisory approval of our executive Mgmt No vote compensation. 3. To ratify the appointment of Mgmt No vote PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2021. Investment Company Report Meeting Date Range: 01-Jul-2020 - 30-Jun-2021 Report Date: 06-Aug-2021 Page 2096 of 9621 Natixis Sustainable Future 2025 Fund- AIA ACUITY BRANDS, INC. Security: 00508Y102 Agenda Number: 935304410 Ticker: AYI Meeting Type: Annual ISIN: US00508Y1029 Meeting Date: 06-Jan-21 Prop. -

There's Only to Run a Business

The Hartford Financial Services Group, Inc. The Hartford Financial Services Group, Inc. 2001 Summary Annual Report Hartford Plaza, 690 Asylum Avenue Hartford, Connecticut 06115 There’s only to run a business... FORM 100025[2001] Design: Gene Mayer Associates, Inc. www.shareholderfocus.com Text: Daniel D. Elman Photography: Ted Kawalerski; page 8, Amy Etra the way. Financial Highlights (in millions except for per share data) 2001 2000 1999 Net income [1] $ 507 $ 974 $ 862 Operating income [1] [2] $ 724 $ 962 $ 837 Revenues [3] $ 15,147 $ 14,703 $ 13,528 Assets under management $ 198,047 $ 182,964 $173,425 Diluted Earnings Per Share: Net income [1] $ 2.10 $ 4.34 $ 3.79 Operating income [1] $ 3.00 $ 4.29 $ 3.68 [1] 2001 includes $440 of losses ($1.85 per basic and $1.82 per diluted share) related to the September 11 terrorist attack (“September 11”) and a $130 tax benefit ($0.55 per basic and $0.54 per diluted share) at Hartford Life, Inc. (“HLI”). [2] Operating income represents after-tax operational results excluding, as applicable, net realized capital gains or losses, extraordinary items, the cumulative effect of accounting changes and certain other items. [3] 2001 includes a $91 reduction in premiums from reinsurance cessions related to September 11. Net Income Operating Income Revenues Assets Under Management in millions in millionsin billions in billions $1,000 $1,200 $15 $200 800 960 12 160 600 720 9 120 400 480 6 80 200 240 3 40 2001 2000 1999 2001 2000 1999 2001 2000 1999 2001 2000 1999 Net income excluding Operating income excluding September 11 and HLI September 11 and HLI tax benefit tax benefit Dear Fellow Shareholders, It would be difficult to imagine a more tumultuous year than 2001. -

Comment Letter File Number S7-13-09 August 27, 2009

Hispanic Association on Corporate Responsibility 1444 I Street, NW, Suite 850 Washington, DC 20005 Phone: (202) 682-4012 August 31, 2009 The Honorable Mary L. Schapiro Chair, U.S. Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 Regarding: File Number S7-13-09 Dear Chair Schapiro: On behalf of the Hispanic Association on Corporate Responsibility (HACR), I strongly urge the U.S. Securities and Exchange Commission (SEC) to amend its Enhanced Nominating Committee Disclosure requirements to ensure corporate disclosure of the diversity and inclusion efforts of Nominating Committees of Corporate Boards. As an innovator, “watchdog” and leader in the area of Hispanic inclusion on corporate boards, HACR first published its Corporate Governance Study in 1994, tracking Hispanic participation on corporate boards (Fortune 500 companies). In spite of our continuing efforts and focus, in 2006 Hispanics still only comprised 3.1 percent of all Fortune 500 board seats. In that same year, Hispanic women held just 0.8 percent of all Fortune 500 seats. These statistics pale in light of Hispanics representing over 15 percent of the U.S. Population and having nearly a trillion dollars in buying power. Contemporary research tells us that greater inclusion on the board of directors leads to better diversity in company leadership and executive ranks. Acculturated decision-makers also ensure better opportunities in attracting and retaining the diverse global consumer base. Catalyst, the leading international nonprofit organization focused on women and the business world, has done extensive research and demonstrated correlations between diverse management participation and above average financial performance. Along with other critical selection criteria, HACR strongly believes that diversity must be considered when proposing/selecting candidates for corporate board positions. -

Annual Report 2014

2 CONTENTS Message from the Chair 5 | Message from the Director General 8 | Strategic Directions 12 Strategic Directions 1 And 2 - Maternal and Child Health 14 | Strategic Direction 3 - Malaria, HIV and TB 20 Strategic Direction 4 - Washing Dirt and Disease Away 26 | Strategic Direction 5 - Boosting Quality Services through Outreach and Training 32 | Strategic Direction 6 - Research 38 | Building Capacity 42 Fundraising and Partnerships 44 | Financial Report 47 | Country Highlights 50 The Amref Health Africa Team 76 | Amref Health Africa Contacts 78 | Amref Health Africa Donors 84 amref health africa • annual report | 3 MESSAGES FROM AMREF HEALTH AFRICA Message from the Chair amref annual report | 5 MESSAGE FROM THE CHAIR and impact on communities, particularly Finally, I would like to thank all our the health of women and children. The partners and donors, the International International Board of Directors is Board, members of the Advisory Councils grateful for her dedicated service to the and all staff for their commitment and organisation and the people of Africa, support during the year. I am confident and wishes her well in her retirement and I can count on your support as we work future undertakings. together to make a lasting positive difference in the health of African An intensive search for a suitable communities. replacement to solidify the gains made by Teguest and to take this organisation Omari Issa on to the next level is ongoing. In the meantime, the Board appointed Dr Lennie Kyomuhangi-Igbodipe Interim CEO. Lennie has been Country Director at AMREF Kenya for the past three years the year 2014 was a period of and brings a wealth of experienced to this refinement, adaptation and growth for role.