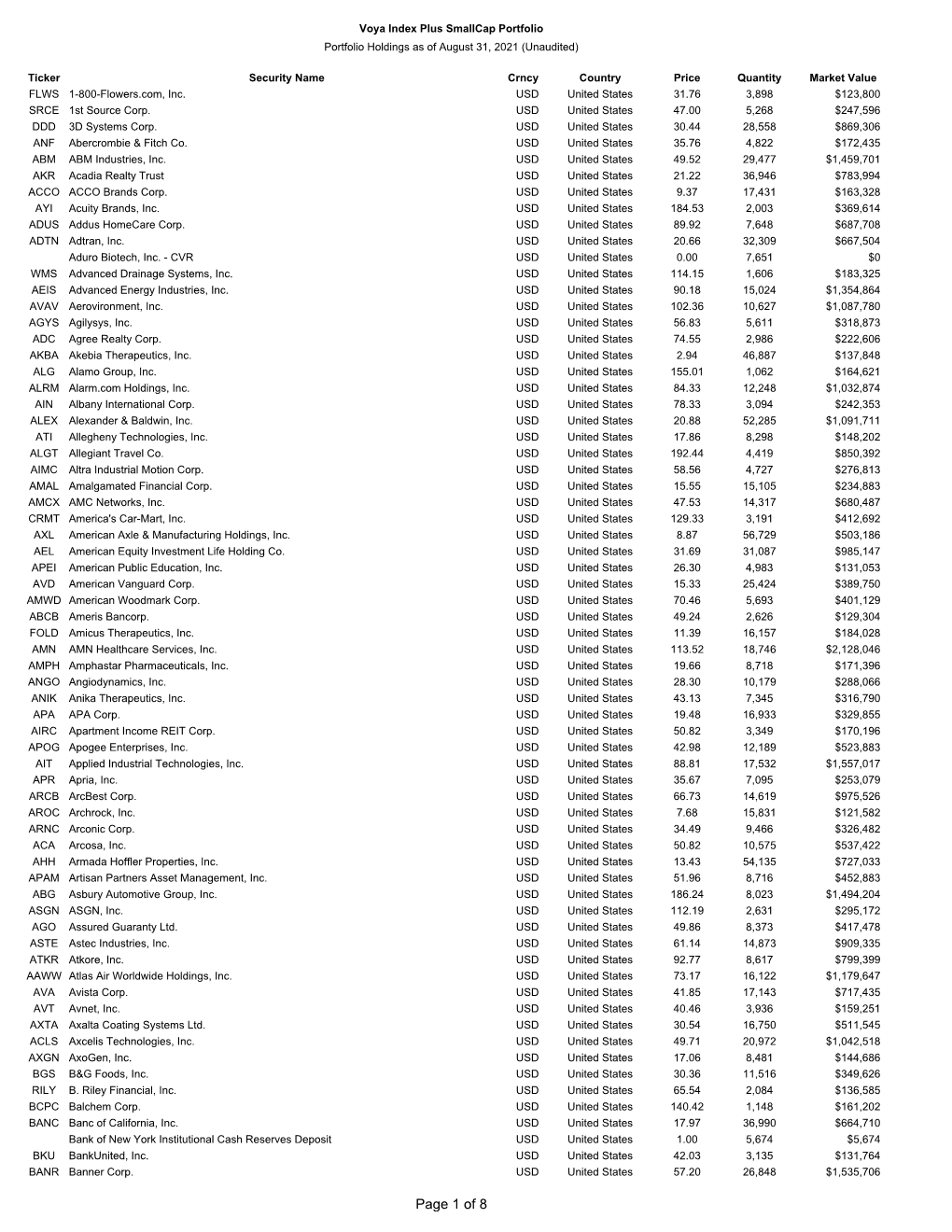

Of 8 Voya Index Plus Smallcap Portfolio Portfolio Holdings As of August 31, 2021 (Unaudited)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

MDT Small Cap Value SMA Model Portfolio Holdings -- June 30, 2020

MDT Small Cap Value SMA Model Portfolio Holdings -- June 30, 2020 Sector Holding Name Communication Services Cars.com Inc. Consumer Discretionary Aaron's, Inc. * Laureate Education, Inc. Lithia Motors, Inc. Macy's, Inc. Murphy USA Inc. Papa John's International, Inc. Rent-A-Center, Inc. Sally Beauty Holdings, Inc. Stamps.com Inc. Tuesday Morning Corporation Weight Watchers International, Inc. Wingstop, Inc. * Consumer Staples BJ’s Wholesale Club Holdings, Inc. Ingles Markets, Incorporated United Natural Foods, Inc. Universal Corporation Energy CVR Energy, Inc. Newpark Resources, Inc. Oil States International, Inc. Peabody Energy Corporation RPC Inc Southwestern Energy Company Financials 1st Source Corporation American Equity Investment Life Holding Co Argo Group International BankUnited, Inc. Berkshire Hills Bancorp, Inc. CNO Financial Group, Inc. First Bancorp * First BanCorp. First Business Financial Servies, Inc. First Financial Corporation Fulton Financial Corporation Green Dot Corporation Hancock Whitney Corporation Horace Mann Educators Corp. Investors Bancorp, Inc. * Marlin Business Services Corp. Pacific Premier Bancorp Inc Pennymac Financial Services Premier Financial Corporation * ProAssurance Corporation Provident Financial Holdings, Inc. Radian Group Inc. Republic Bancorp, Inc. Selective Insurance Group, Inc. * Territorial Bancorp Inc. UMB Financial Corporation Health Care Akebia Therapeutics, Inc. Arcus Biosciences, Inc. Intra-Cellular Therapies, Inc. Livongo Health, Inc. Luminex Corporation Mallinckrodt plc Myriad Genetics, Inc. Nextcure, Inc. Novavax, Inc. Prestige Consumer Healthcare TG Therapeutics, Inc. Industrials AAR Corp. * ACCO Brands Corporation Aerojet Rocketdyne Holdings, Inc. Arcosa, Inc. ASGN Incorporated Barnes Group Inc. Dycom Industries, Inc. Ennis, Inc. Fluor Corp GMS, Inc. * Granite Construction Incorporated Titan Machinery Inc. Triton International Limited Information Technology Avaya Holdings Corp. Cirrus Logic, Inc. Conduent, Inc. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Stephens Bank Research Team

Stephens Bank Research Team – Upcoming Investor Events August 22, 2018 Non-Deal Roadshow 2018 Stephens Bank CEO Forum August, 2018 Company Name (Ticker) Company Name (Ticker) Company Name Day Location Allegiance Bancshares, Inc. (ABTX) LegacyTexas Financial Group (LTXB) BancorpSouth Bank (BXS) 22 Boston Ameris Bancorp (ABCB) Merchants Bancorp (MBIN) Banner Corp. (BANR) 28-29 New York, Boston Bank OZK, Inc. (OZK) Midland States Bancorp, Inc. (MSBI) September, 2018 BofI Holding, Inc. (BOFI) National Bank Holdings (NBHC) Company Name Day Location BOK Financial Corporation (BOKF) National Commerce Corp. (NCOM) F.N.B. Corporation (FNB) 11-12 Dallas, Houston Business First Bancshares (BFST) Old Line Bancshares (OLBK) Sterling Bancorp (STL) 19 Boston Byline Bancorp (BY) Old National Bancorp (ONB) November, 2018 Cadence Bancorporation (CADE) Origin Bancorp, Inc. (OBNK) Company Name Day Location CBTX, Inc. (CBTX) Pacific Premier Bancorp, Inc. (PPBI) Carolina Financial Corp. (CARO) 1-2 Kansas City, St. Louis, Dallas CenterState Banks (CSFL) PacWest Bancorp (PACW) Analyst Marketing Chemical Financial (CHFC) Pinnacle Financial (PNFP) August, 2018 City Holding Co (CHCO) Preferred Bank (PFBC) Analyst(s) Day Location County Bancorp (ICBK) Prosperity Bancshares (PB) Terry McEvoy / Austin Nicholas 22-24 New York Stephens 8th Annual Bank Eagle Bancorp (EGBN) RBB Bancorp, Inc. (RBB) Tyler Stafford, CFA 27 New York CEO Forum will take Equity Bancshares (EQBK) Renasant Corp (RNST) th Matt Olney, CFA / Austin Nicholas 28 San Francisco place September 24 – FB Financial Corporation (FBK) Simmons First National Corp (SFNC) 26th in Little Rock – See September, 2018 here for further details. Fidelity Southern Corporation (LION) SmartFinancial (SMBK) Analyst(s) Day Location First Bancshares (FBMS) South State Corporation (SSB) Tyler Stafford, CFA / Matt Olney, CFA 4-5 Kansas City, St. -

Pacific Premier Bancorp March 2020 Investor Presentation

Investor Presentation Fourth Quarter 2019 Steve Gardner Chairman, President & Chief Executive Officer [email protected] 949-864-8000 Ronald J. Nicolas, Jr. Sr. EVP & Chief Financial Officer [email protected] 949-864-8000 FORWARD LOOKING STATEMENTS AND WHERE TO FIND MORE INFORMATION Forward Looking Statements This investor presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Pacific Premier Bancorp, Inc. (“PPBI”), including its wholly-owned subsidiary Pacific Premier Bank (“Pacific Premier”), Opus Bank (“Opus”), including its wholly-owned subsidiary PENSCO Trust Company (“PENSCO”), and the proposed acquisition. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on PPBI’s and Opus’s current expectations and assumptions regarding PPBI’s and Opus’s businesses, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect PPBI’s or Opus’s future financial results and performance and could cause actual results or performance to differ -

Printmgr File

As filed with the Securities and Exchange Commission on September 23, 2019 Registration No. 333-233435 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 AMENDMENT NO. 1 TO Form S-4 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 WESBANCO, INC. (Exact name of registrant as specified in its charter) West Virginia 6021 55-0571723 (State or other jurisdiction of (Primary Standard Industrial (I.R.S. Employer incorporation or organization) Classification Code Number) Identification No.) Todd F. Clossin President and Chief Executive Officer Wesbanco, Inc. 1 Bank Plaza 1 Bank Plaza Wheeling, West Virginia 26003 Wheeling, West Virginia 26003 (304) 234-9000 (304) 234-9000 (Address, including zip code, (Name, address, including zip code, and telephone number, including and telephone number, including area code of registrant’s principal executive offices) area code, of agent for service) With Copies to: James C. Gardill, Esq. Paul C. Cancilla, Esq. Frank C. Bonaventure, Jr., Esq. Phillips, Gardill, Kaiser & K&L Gates LLP Baker, Donelson, Bearman, Caldwell Altmeyer, PLLC K&L Gates Center & Berkowitz, PC 61 Fourteenth Street 210 Sixth Avenue 100 Light Street Wheeling, West Virginia 26003 Pittsburgh, PA 15222-2613 Baltimore, Maryland 21202 (304) 232-6810 (412) 355-6500 (410) 685-1120 Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective and upon completion of the merger. If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. -

Financial Services M&A Update: Q1 2018

Financial Services quarterly update Q1 2018 Deloitte Corporate Finance LLC | www.investmentbanking.deloitte.com Quarterly update | Q1 2018 | Financial Services Financial Services trends In this update US bank stock prices Shifting philosophy at the continue to perform well1 Consumer Financial • Financial Services trends Protection Bureau2 In the wake of the US • Economic outlook presidential election, bank stock Following the departure of prices have increased 40.0 director Richard Cordray from • Industry analysis percent since November 8, the Consumer Financial • Select M&A transactions 2016. This increase can be Protection Bureau in November • Appendix partially attributed to 2017, acting director Mick anticipated regulatory rollbacks Mulvaney has outlined a vision regarding the financial industry for the government agency in This update will focus on news as well as recent tax reform, which it acts with restraint and and trends in the following which has now passed. does not target companies without substantial evidence of areas: wrongdoing. In February 2018, Mulvaney further updated • US Banks priorities to address outdated regulations. • US Specialty Finance US Senate advances plan Slowing consumer to weaken and industrial loan Dodd-Frank Act3 growth4 A plan to scale back the While recent increases in Who we are Dodd-Frank Act, a post- rates for short-term loans financial-crisis banking ruleset, have made floating-rate passed a vote by the Senate on commercial loans more Deloitte Corporate Finance LLC March 6, 2018. If passed into lucrative, banks are not is a leading global middle law, the bill would exempt making many more loans. approximately two-dozen Data from December 2017 market M&A adviser. -

Membership List; Russell 2000 Index

Russell US Indexes Membership list Russell 2000® Index Company Ticker Company Ticker 1-800-FLOWERS.COM CL A FLWS AFC GAMMA AFCG 1LIFE HEALTHCARE ONEM AFFIMED N.V. AFMD 1ST SOURCE SRCE AGEAGLE AERIAL SYSTEMS UAVS 22ND CENTURY GROUP INC. XXII AGENUS AGEN 2U TWOU AGILITI AGTI 3-D SYSTEMS DDD AGILYSYS AGYS 4D MOLECULAR THERAPEUTICS FDMT AGIOS PHARMACEUTICALS AGIO 89BIO ETNB AGREE REALTY ADC 8X8 EGHT AIR TRANSPORT SERVICES GROUP ATSG 9 METERS BIOPHARMA INC NMTR AKEBIA THERAPEUTICS AKBA 908 DEVICES MASS AKERO THERAPEUTICS AKRO A10 NETWORKS ATEN AKOUOS AKUS AAON INC AAON AKOUSTIS TECHNOLOGIES INC AKTS AAR CORP AIR AKOYA BIOSCIENCES AKYA ABERCROMBIE & FITCH A ANF ALAMO GROUP ALG ABM INDUSTRIES INC ABM ALARM.COM HOLDINGS ALRM ACACIA RESEARCH - ACACIA TECHNOLOGIES ACTG ALBANY INTERNATIONAL A AIN ACADEMY SPORTS AND OUTDOORS ASO ALBIREO PHARMA ALBO ACADIA PHARMACEUTICALS ACAD ALDEYRA THERAPEUTICS ALDX ACADIA REALTY AKR ALECTOR ALEC ACCEL ENTERTAINMENT (A) ACEL ALERUS FINANCIAL CORP. ALRS ACCELERATE DIAGNOSTICS AXDX ALEXANDER & BALDWIN INC. ALEX ACCO BRANDS ACCO ALEXANDERS INC ALX ACCOLADE ACCD ALIGNMENT HEALTHCARE ALHC ACCRETIVE HEALTH RCM ALIGOS THERAPEUTICS ALGS ACCURAY ARAY ALKAMI TECHNOLOGY ALKT ACI WORLDWIDE ACIW ALKERMES PLC ALKS ACLARIS THERAPEUTICS ACRS ALLAKOS ALLK ACUSHNET HOLDINGS GOLF ALLEGHENY TECHNOLOGIES ATI ACUTUS MEDICAL AFIB ALLEGIANCE BANCSHARES ABTX ADAPTHEALTH AHCO ALLEGIANT TRAVEL ALGT ADDUS HOMECARE ADUS ALLETE ALE ADICET BIO INC ACET ALLIED MOTION TECHNOLOGIES AMOT ADIENT PLC ADNT ALLOGENE THERAPEUTICS ALLO ADTALEM GLOBAL EDUCATION -

Supplementary Appendix: Bank CEO Optimism and the Financial Crisis

Supplementary Appendix: Bank CEO Optimism and the Financial Crisis Yueran Ma∗ I Additional Tables Table A1: CEO Optimism and Pre-Crisis Growth of Real Estate Loans (Matching Estimates) CEOs in sample are divided into the \more optimistic" group (CEO equity holding change above median) and the \less optimistic" group (CEO equity holding change below median). The constant term is the matching estimate of the difference in real estate loan growth between these two subsamples. The matching covariates used in a given specification are labeled with \Yes", and the set of covariates are the same as the control variables in Table 4 in the paper. I use matching with replacement and three matched observations per target observation (with bias adjustment). Log Change in Loans backed by RE (2002|2005) (1) (2) (3) (4) (5) Constant 0.158*** 0.114** 0.178*** 0.110** 0.178*** (0.0511) (0.0444) (0.0610) (0.0429) (0.0560) Matching Covariates FHFA Index Change Yes Yes Yes Dividend Yield as of 2002 Yes Yes Yes Yes Volatility as of 2002 Yes Yes Yes Yes RE Loans/Assets by 2002 Yes Yes Yes Yes Size (log assets) by 2002 Yes Yes Yes Yes Log Holding Change (98{01) Yes Yes RE Loan Growth (98{01) Yes Yes Observations 142 136 76 136 76 Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1 ∗Harvard University (email: [email protected]). 1 Table A2: CEO Optimism and Loans Sold for Securitization This table performs the same set of tests as Table 5 of the paper using HMDA data, but focus on originated-and-sold loans rather than originated-and-held loans: The dependent variable is the bank fixed effect bi estimated from log(loan0205ij) − log(loan9801ij) = bi + cj + ij, where loan0205ij is the total originated-and-sold HMDA loans made in 2002|2005 by bank i in county j, loan9801ij is the total originated-and-sold HMDA loans made in 1998|2001 by bank i in county j, and cj is the county fixed effect. -

Pacific Premier Bancorp Annual Report 2020

Pacific Premier Bancorp Annual Report 2020 Form 10-K (NASDAQ:PPBI) Published: April 3rd, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K/A (Amendment No. 1) ANNUAL REPORT PURSUANT TO SECTION 13 OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 Commission File No.: 0-22193 (Exact name of registrant as specified in its charter) Delaware 33-0743196 (State of Incorporation) (I.R.S. Employer Identification No) 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614 (Address of Principal Executive Offices and Zip Code) Registrant’s telephone number, including area code: ( 949) 864-8000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered Common Stock, par value $0.01 per share PPBI NASDAQ Stock Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.