Portfolio Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

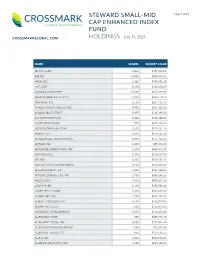

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

GTC One Minute Brief

ONE M i n u t e Brief 23 AUGUST 2021 ONE MINUTE BRIEF | 23 August 2021 Economic and Political News South Africa (SA) on high alert amid threat of national protests. To Read More Click Here SA opens Covid-19 jabs to all adults. To Read More Click Here Alert level 3 of the lockdown will continue, says Health Minister Joe Phaahla. To Read More Click Here Claims for unrest damage hit ZAR14bn, says SA Special Risk Insurance Association (Sasria) To Read More Click Here National Energy Regulator of SA (Nersa) gets green light to approve new nuclear power procurement. To Read More Click Here Eco & Political News Equity Currencies & Commodities Corporate & Global Economic News Economic Calendar 40 Best Performers Disclaimer ONE MINUTE BRIEF | 23 August 2021 South Africa Market q US Market p South African markets closed in the red on Friday, weighed down by losses in retail and US markets closed firmer on Friday, as concerns over the Federal Reserve’s (Fed) taper talks mining sector stocks. eased and helped by gains in technology sector stocks. To Read More Click Here S&P 500 futures To Read More Click Here JSE All Share (ZAR) JSE Top 40 (ZAR) JSE Africa Fin. (ZAR) S&P 500 (USD) Nasdaq Composite (USD) DJIA (USD) q 66,011.06 q 59,800.02 q 13,857.29 p 4,441.67 p 14,714.66 p 35,120.08 1 Day Chg 1 D % Chg 1 Day Chg 1 D % Chg 1 Day Chg 1 D % Chg 1 Day Chg 1 D % Chg 1 Day Chg 1 D % Chg 1 Day Chg 1 D % Chg -102.42 -0.15 -54.76 -0.09 -28.44 -0.20 35.87 0.81 172.87 1.19 225.96 0.65 WTD % Chg. -

Pershing Square Holdings, Ltd. 2020 Annual Report Pershing Square Holdings, Ltd

Pershing Square Holdings, Ltd. 2020 Annual Report Pershing Square Holdings, Ltd. 2020 Annual Report Table of Contents Company Overview . 1 Company Performance . 2 Chairman’s Statement . 3 Investment Manager’s Report . 8 Principal Risks and Uncertainties . 22 Directors . 27 Report of the Directors . 30 Directors’ Remuneration Report . 39 Corporate Governance Report . 41 Report of the Audit Committee . 48 Report of Independent Auditor . 53 Statement of Financial Position . 61 Statement of Comprehensive Income . 63 Statement of Changes in Net Assets Attributable to Management Shareholders . 64 Statement of Changes in Equity . 65 Statement of Cash Flows . 66 Notes to Financial Statements . 67 Supplemental U.S. GAAP Disclosures Condensed Schedule of Investments . .103 Financial Highlights . .105 Disclosures Certain Regulatory Disclosures . 106 Affirmation of the Commodity Pool Operator . 108 Endnotes and Disclaimers . 109 Pershing Square Holdings, Ltd. Annual Report 2020 Company Overview The Company Pershing Square Holdings, Ltd. (“PSH”, or the “Company”) (LN:PSH) (LN:PSHD) (NA:PSH) is an investment holding company structured as a closed-ended fund that makes concentrated investments in publicly traded, principally North American-domiciled, companies. PSH’s objective is to maximize its long-term compound annual rate of growth in intrinsic value per share. PSH has appointed Pershing Square Capital Management, L.P. (“PSCM,” the “Investment Manager” or “Pershing Square”), as its investment manager. The Investment Manager has responsibility, subject to the overall supervision of the Board of Directors, for the investment of PSH’s assets and liabilities in accordance with the investment policy of PSH set forth on pages 30-31 of this Annual Report (the “Investment Policy”). -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

JSMDID Janus Index & Calculation Services LLC Announces The

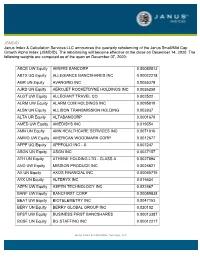

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

MDT Small Cap Value SMA Model Portfolio Holdings -- June 30, 2020

MDT Small Cap Value SMA Model Portfolio Holdings -- June 30, 2020 Sector Holding Name Communication Services Cars.com Inc. Consumer Discretionary Aaron's, Inc. * Laureate Education, Inc. Lithia Motors, Inc. Macy's, Inc. Murphy USA Inc. Papa John's International, Inc. Rent-A-Center, Inc. Sally Beauty Holdings, Inc. Stamps.com Inc. Tuesday Morning Corporation Weight Watchers International, Inc. Wingstop, Inc. * Consumer Staples BJ’s Wholesale Club Holdings, Inc. Ingles Markets, Incorporated United Natural Foods, Inc. Universal Corporation Energy CVR Energy, Inc. Newpark Resources, Inc. Oil States International, Inc. Peabody Energy Corporation RPC Inc Southwestern Energy Company Financials 1st Source Corporation American Equity Investment Life Holding Co Argo Group International BankUnited, Inc. Berkshire Hills Bancorp, Inc. CNO Financial Group, Inc. First Bancorp * First BanCorp. First Business Financial Servies, Inc. First Financial Corporation Fulton Financial Corporation Green Dot Corporation Hancock Whitney Corporation Horace Mann Educators Corp. Investors Bancorp, Inc. * Marlin Business Services Corp. Pacific Premier Bancorp Inc Pennymac Financial Services Premier Financial Corporation * ProAssurance Corporation Provident Financial Holdings, Inc. Radian Group Inc. Republic Bancorp, Inc. Selective Insurance Group, Inc. * Territorial Bancorp Inc. UMB Financial Corporation Health Care Akebia Therapeutics, Inc. Arcus Biosciences, Inc. Intra-Cellular Therapies, Inc. Livongo Health, Inc. Luminex Corporation Mallinckrodt plc Myriad Genetics, Inc. Nextcure, Inc. Novavax, Inc. Prestige Consumer Healthcare TG Therapeutics, Inc. Industrials AAR Corp. * ACCO Brands Corporation Aerojet Rocketdyne Holdings, Inc. Arcosa, Inc. ASGN Incorporated Barnes Group Inc. Dycom Industries, Inc. Ennis, Inc. Fluor Corp GMS, Inc. * Granite Construction Incorporated Titan Machinery Inc. Triton International Limited Information Technology Avaya Holdings Corp. Cirrus Logic, Inc. Conduent, Inc. -

2021 Quarterly Report (Unaudited)

APRIL 30, 2021 2021 Quarterly Report (Unaudited) BlackRock Funds II BlackRock Multi-Asset Income Portfolio Not FDIC Insured - May Lose Value - No Bank Guarantee Schedule of Investments (unaudited) BlackRock Multi-Asset Income Portfolio (Percentages shown are based on Net Assets) April 30, 2021 Par (000) Par (000) Security Par (000) Value Security Par (000) Value Asset-Backed Securities — 6.9% Asset-Backed Securities (continued) Accredited Mortgage Loan Trust, Series 2004-4, Series 2020-SFR1, Class F, 3.57%, Class M2, (LIBOR USD 1 Month + 1.58%), 04/17/37 ..................... USD 19,850 $ 20,201,395 1.68%, 01/25/35(a) ................. USD 1,126 $ 1,115,000 Series 2020-SFR1, Class G, 4.31%, AGL CLO 3 Ltd., Series 2020-3A, Class C, 04/17/37 ..................... 7,500 7,624,247 (LIBOR USD 3 Month + 2.15%), 2.33%, Anchorage Capital CLO 3-R Ltd.(a)(b): 01/15/33(a)(b) ..................... 2,000 2,001,417 Series 2014-3RA, Class B, (LIBOR USD 3 AGL Core CLO 5 Ltd., Series 2020-5A, Class Month + 1.50%), 1.68%, 01/28/31 .... 3,400 3,351,635 B, (LIBOR USD 3 Month + 2.78%), 2.97%, Series 2014-3RA, Class C, (LIBOR USD 3 07/20/30(a)(b) ..................... 3,000 3,007,297 Month + 1.85%), 2.03%, 01/28/31 .... 1,250 1,245,314 AIG CLO Ltd.(a)(b): Anchorage Capital CLO 4-R Ltd.(a)(b): Series 2018-1A, Class CR, (LIBOR USD 3 Series 2014-4RA, Class C, (LIBOR USD 3 Month + 2.05%), 2.22%, 04/20/32 ... -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

FTSE Publications

2 FTSE Russell Publications FTSE 100 Semi Annual Equally 19 August 2021 Weighted Net Tax Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.95 UNITED Fresnillo 0.86 UNITED Prudential 0.92 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 1.06 UNITED GlaxoSmithKline 1.08 UNITED Reckitt Benckiser Group 1.02 UNITED KINGDOM KINGDOM KINGDOM Anglo American 0.91 UNITED Glencore 0.94 UNITED RELX 1.05 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.91 UNITED Halma 1.05 UNITED Rentokil Initial 1.04 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.04 UNITED Hargreaves Lansdown 0.98 UNITED Rightmove 1.09 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.96 UNITED Hikma Pharmaceuticals 1.03 UNITED Rio Tinto 0.96 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 1.11 UNITED HSBC Hldgs 0.94 UNITED Rolls-Royce Holdings 0.9 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.15 UNITED Imperial Brands 0.98 UNITED Royal Dutch Shell A 0.56 UNITED KINGDOM KINGDOM KINGDOM Avast 1.07 UNITED Informa 0.94 UNITED Royal Dutch Shell B 0.49 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 1.08 UNITED InterContinental Hotels Group 0.97 UNITED Royal Mail 0.99 UNITED KINGDOM KINGDOM KINGDOM Aviva 1 UNITED Intermediate Capital Group 0.99 UNITED Sage Group 1.06 UNITED KINGDOM KINGDOM KINGDOM B&M European Value Retail 1.04 UNITED International Consolidated Airlines 0.85 UNITED Sainsbury (J) 1.03 UNITED KINGDOM Group KINGDOM KINGDOM BAE Systems 1 UNITED Intertek -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Stephens Bank Research Team

Stephens Bank Research Team – Upcoming Investor Events August 22, 2018 Non-Deal Roadshow 2018 Stephens Bank CEO Forum August, 2018 Company Name (Ticker) Company Name (Ticker) Company Name Day Location Allegiance Bancshares, Inc. (ABTX) LegacyTexas Financial Group (LTXB) BancorpSouth Bank (BXS) 22 Boston Ameris Bancorp (ABCB) Merchants Bancorp (MBIN) Banner Corp. (BANR) 28-29 New York, Boston Bank OZK, Inc. (OZK) Midland States Bancorp, Inc. (MSBI) September, 2018 BofI Holding, Inc. (BOFI) National Bank Holdings (NBHC) Company Name Day Location BOK Financial Corporation (BOKF) National Commerce Corp. (NCOM) F.N.B. Corporation (FNB) 11-12 Dallas, Houston Business First Bancshares (BFST) Old Line Bancshares (OLBK) Sterling Bancorp (STL) 19 Boston Byline Bancorp (BY) Old National Bancorp (ONB) November, 2018 Cadence Bancorporation (CADE) Origin Bancorp, Inc. (OBNK) Company Name Day Location CBTX, Inc. (CBTX) Pacific Premier Bancorp, Inc. (PPBI) Carolina Financial Corp. (CARO) 1-2 Kansas City, St. Louis, Dallas CenterState Banks (CSFL) PacWest Bancorp (PACW) Analyst Marketing Chemical Financial (CHFC) Pinnacle Financial (PNFP) August, 2018 City Holding Co (CHCO) Preferred Bank (PFBC) Analyst(s) Day Location County Bancorp (ICBK) Prosperity Bancshares (PB) Terry McEvoy / Austin Nicholas 22-24 New York Stephens 8th Annual Bank Eagle Bancorp (EGBN) RBB Bancorp, Inc. (RBB) Tyler Stafford, CFA 27 New York CEO Forum will take Equity Bancshares (EQBK) Renasant Corp (RNST) th Matt Olney, CFA / Austin Nicholas 28 San Francisco place September 24 – FB Financial Corporation (FBK) Simmons First National Corp (SFNC) 26th in Little Rock – See September, 2018 here for further details. Fidelity Southern Corporation (LION) SmartFinancial (SMBK) Analyst(s) Day Location First Bancshares (FBMS) South State Corporation (SSB) Tyler Stafford, CFA / Matt Olney, CFA 4-5 Kansas City, St. -

The Activist Investing Annual Review

2021 THE ACTIVIST INVESTING ANNUAL REVIEW THE EIGHTH ANNUAL REVIEW OF TRENDS IN SHAREHOLDER ACTIVISM Activist Campaign Activist Adviser SCHULTE ROTH & ZABEL of the Year of the Year THE DEAL AWARDS U.S. THE DEAL AWARDS EUROPE FOREWORD Marc Weingarten, Ele Klein, and Brandon Gold. The enduring coronavirus pandemic and political and Shaw, signaling that corporate environmental responsibility social upheaval during the course of the 2020 presidential will no longer be taken lightly by institutional investors and campaigns and election have brought about a seismic shift in heavyweight market players. activism and market focus in 2021 that we expect to continue throughout the year. We believe that, as activists have This sentiment was also expressed in TCI Fund POWERHOUSE stepped back and refocused their efforts, a “new normal” has Management’s “say on climate” campaign, where it submitted emerged that will guide the tenure of activism for years to proposals to major institutions such as Moody’s Corp, Union PRACTITIONERS come. Pacific Railroad, Charter Communications, and Alphabet, to adopt procedures through which shareholders can cast “… Schulte Roth & Zabel, widely regarded “Schulte is one of the top U.S. law firms THERE WILL BE BLOOD advisory votes on annually disclosed plans to manage as the dominant global law firm for that represents activists in the insurgencies.” greenhouse gas emissions. shareholder activism and activist investing – THE DEAL The market crash of March 2020 deflated asset prices for … advises some of the most active and a brief period, in turn revealing which companies, boards, Given the support these campaigns have generated, and influential activist investors in the space.” “Schulte Roth & Zabel … [has] come to and management teams were underperforming.