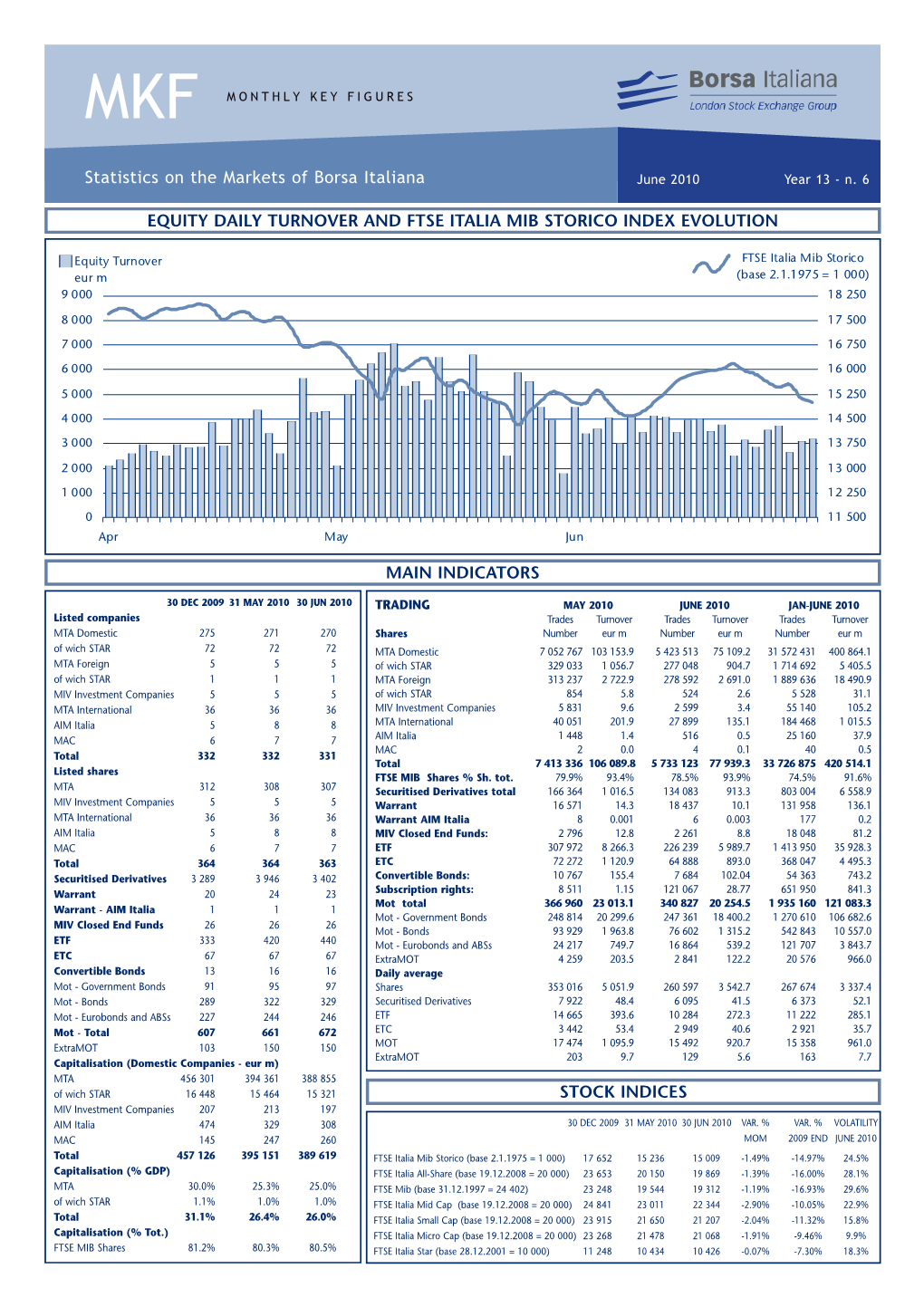

Stock Indices Main Indicators Equity Daily Turnover And

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Business Strategies of the Companies Listed on the FTSE MIB Index of Borsa Italiana Stock Exchange

Acta Europeana Systemica n°3 Business Strategies of the Companies listed on the FTSE MIB index of Borsa Italiana Stock Exchange Riccardo Profumo CSE-Crescendo, Milan, Italy www.cse-crescendo.com ABSTRACT The aim of the research is to provide a gross evaluation of the entrepreneurial system’s ability to create new industries. The research focuses on the most important Italian firms: the companies listed on the FTSE MIB index of Borsa Italiana. The way to comprehend the entrepreneurial system’s capability to create new industries, is by understanding the innovation level they are able to generate by the strategic planning activity. The model used for this research is the “Value Life Cycle Model” developed by Mr Francesco Zanotti. The overall result shows that the FTSE MIB Companies don’t have a strategic goal of creating new industries. The innovation level inside the business strategies designed by the FTSE MIB companies is generally very low. KEYWORDS Industry, Attractiveness, Innovation, Industry Attractiveness, Entrepreneurial Strategy, Entrepreneurial innovation, FTSE MIB, Value Life Cycle Model THE CONTEXT The necessity of the construction of a new economic and social system is absolutely shared by a lot of contemporary observers. Without doubt, the entrepreneurial system plays a key role for the economic growth and social development. The creation of new industries is crucial: radically new products (or services) are the only way to create new industries and developing markets. The aim of the research is to provide a gross evaluation of the entrepreneurial system’s ability to create new industries. The way to comprehend the entrepreneurial system’s capability to create new industries, is by understanding the innovation level they are able to generate by the strategic planning activity. -

Ishares FTSE MIB UCITS ETF EUR (Dist)

iShares FTSE MIB UCITS ETF EUR (Dist) IMIB August Factsheet Unless otherwise stated, Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug-2021 All other data as at 07-Sep-2021 This document is marketing material. For Investors in Switzerland. Investors should read the Key Capital at risk. All financial investments Investor Information Document and Prospectus prior to investing. involve an element of risk. Therefore, the value of your investment and the income from it will The Fund seeks to track the performance of an index composed of 40 of the largest and most liquid vary and your initial investment amount cannot Italian companies be guaranteed. KEY FACTS KEY BENEFITS Asset Class Equity Fund Base Currency EUR Exposure to broadly diversified Italian companies 1 Share Class Currency EUR 2 Direct investment into 40 Italian companies Fund Launch Date 06-Jul-2007 Share Class Launch Date 06-Jul-2007 3 Single country and large market capitalisation companies exposure Benchmark FTSE MIB Index Valor 3246482 Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. ISIN IE00B1XNH568 Total Expense Ratio 0.35% This means the Fund is more sensitive to any localised economic, market, political or regulatory Distribution Frequency Semi-Annual events. The value of equities and equity-related securities can be affected by daily stock market Domicile Ireland movements. Other influential factors include political, economic news, company earnings and Methodology Replicated significant corporate events. Counterparty Risk: The insolvency of any institutions providing Product Structure Physical services such as safekeeping of assets or acting as counterparty to derivatives or other Rebalance Frequency Quarterly instruments, may expose the Fund to financial loss. -

An Analysis of the Level of Qualitative Efficiency for the Equity Research Reports in the Italian Financial Market

http://ijba.sciedupress.com International Journal of Business Administration Vol. 9, No. 2; 2018 An Analysis of the Level of Qualitative Efficiency for the Equity Research Reports in the Italian Financial Market Paola Fandella1 1 Università Cattolica del Sacro Cuore, Italy Correspondence: Paola Fandella, Università Cattolica del Sacro Cuore, Italy. Received: January 15, 2018 Accepted: February 6, 2018 Online Published: February 8, 2018 doi:10.5430/ijba.v9n2p21 URL: https://doi.org/10.5430/ijba.v9n2p21 Abstract Corporate reports issued by various financial intermediaries play a major role in investment decisions. For this reason, it is particularly interesting to understand the accuracy of the forecasts, by carrying out an empirical analysis of the "equity research" system in Italy, identifying structural features, degree of reliability and incidence in the market. The choice of the analysis of the efficiency level information on the Italian market proposes to assess the interest of equity research of a niche market (339 listed companies in 2017) but with characteristics of potential growth such as having been acquired by LSEGroup in 2007, the 6th stock-exchange group at international level for the number of listed companies and the 4th for capitalization. The analysis was carried out on the reports issued on companies belonging to the Ftse Mib stock index during a period of 5 years. It aims to analyse the composition of the equity research system in Italy as well as the analysts' ability to properly evaluate the stocks' fair price, so as to test their degree of reliability and detect possible anomalies in recommendations to the investors. -

FTSE MIB Quarterly Rebalancing Changes 12 March 2018

FTSE MIB Quarterly Rebalancing Changes 12 March 2018 FTSE announces the new shares number and Investability Weighting Factors for the FTSE MIB Index effective after the close of business on Friday, 16 March 2018, i.e. on Monday, 19 March 2018. According to the FTSE MIB Ground Rules art. 7.4 and Appendix C, FTSE publishes share in issue & IWF figures updated at the cut-off date, where needed adjusted for capping based on capitalisation calculated with closing prices of five trading days before the rebalancing. The share in issue figure excludes all treasury shares and the Investability Weighting is computed with reference to shares in issue net of treasury shares. The new index divisor will be published after close of business on Friday, 16 March 2018. FTSE comunica il nuovo numero di azioni e i pesi di investibilità per l'Indice FTSE MIB che saranno effettivi dopo la chiusura delle contrattazioni di venerdì 16 marzo 2018 (vale a dire da lunedì 19 marzo 2018). Secondo le Regole di base del FTSE MIB art. 7.4 e l'Appendice C, sono indicati i valori del numero di azioni e peso di investibilità aggiornati alla data del cut-off, eventualmente soggetti alla correzione del capping applicata con riferimento alle capitalizzazioni calcolate con i prezzi di chiusura di cinque giorni di negoziazione prima della data di ribilanciamento. Il numero di azioni esclude tutte le azioni proprie e la percentuale di flottante è calcolata con riferimento al numero di azioni al netto delle azioni proprie. Il nuovo divisor per il FTSE MIB sarà reso disponibile dopo la chiusura delle contrattazioni di venerdì 16 marzo 2018. -

Technical Analysis FTSE MIB Basket

Technical Analysis Equity 10 August 2020: 7:14 CET Date and time of production FTSE MIB Basket Daily Report Technical Indicators FTSE MIB Constituents in EUR/share Strong uptrends Amplifon Davide Campari Interpump Italgas Prysmian Strong uptrends are when M/L and short trend arrows are both up. Trading signals New In New Out Trading signals are the new short-term indication (IN) and exit (OUT) from the column "Position" in the basket. Sample Intesa Sanpaolo Research Dept Corrado Binda – Technical Analyst +39 02 7265 0983 [email protected] Sergio Mingolla – Technical Analyst Source: Intesa Sanpaolo elaborations on Thomson Reuters data +39 02 7265 0538 Report priced at market close on day prior to issue (except where otherwise indicated) [email protected] Equity Derivatives Sales +39 02 7261 2806 See page 3 for full disclosure and analyst certification 10 August 2020: 07:17 CET Date and time of first circulation FTSE MIB Basket 10 August 2020 FTSE MIB Index Source: Thomson Reuters – Metastock Sample 2 Intesa Sanpaolo Research Department FTSE MIB Basket 10 August 2020 Disclaimer Analyst certification The financial analysts who prepared this report, and whose names and roles appear within the document, certify that: 1. The views expressed on the company mentioned herein accurately reflect independent, fair and balanced personal views; 2. No direct or indirect compensation has been or will be received in exchange for any views expressed. Specific disclosures Neither the analysts nor any persons closely associated with the analysts have a financial interest in the securities of the Company. Neither the analysts nor any persons closely associated with the analysts serve as an officer, director or advisory board member of the Companies cited in the report. -

Borsa Italiana Welcomes Stellantis

Press Release 18 January 2021 Borsa Italiana welcomes Stellantis Today Borsa Italiana welcomes Stellantis, a new leading group in the automotive sector created from the merger by incorporation of Peugeot (PSA) into Fiat Chrysler Automobiles (FCA). The ordinary shares of Stellantis will begin trading today, 18 January 2021, on the Main Market (MTA) of Borsa Italiana and on Euronext Paris. And from tomorrow, 19 January 2021, also on the New York Stock Exchange (NYSE). The Stellantis stock will be part of the FTSE MIB index from the start of trading. Raffaele Jerusalmi, CEO, Borsa Italiana: “It is with emotion and pride that today we welcome the new group Stellantis to Borsa Italiana. The union between FCA and PSA represents another important step on the centuries-old path traced by the Agnelli family that can respond to the global challenges of the automotive sector. Borsa Italiana has had the privilege to celebrate other significant milestones of FCA, and even before of FIAT: from the spin-off of FIAT Industrial, to the creation of FCA, to the most recent spin-off of Ferrari. We are happy to see the group continue to grow, from an Italian company to an international global player.” John Elkann, Chairman, Stellantis: "This historic first day of trading of Stellantis shares on Borsa Italiana marks the beginning of an era of extraordinary opportunity for our company. These are 1 Press release 18 January 2021 challenging but exciting times in our industry, with change as rapid as at any point since its foundation over a century ago. Stellantis begins life with the leadership, the resources, the diversity and the knowhow with which to build something truly unique and something great, providing our customers with outstanding vehicles and mobility solutions, creating consistent value for all of our stakeholders.” Carlos Tavares, CEO, Stellantis: “Today is the day where Stellantis is born. -

MONTHLY UPDATE JANUARY 2021 EQUITY DAILY TURNOVER and MAIN INDICES (Base = 1000 30.10.2020)

MONTHLY UPDATE JANUARY 2021 EQUITY DAILY TURNOVER AND MAIN INDICES (base = 1000 30.10.2020) Equity Turnover eur m FTSE Mib FTSE Italia Star FTSE Italia Mib Storico 6 000 1 300 5 000 1 200 4 000 1 100 3 000 1 000 2 000 900 1 000 800 0 700 Nov Dec Jan STOCK INDICES FTSE MIB VOLATILITY 30 DEC 2020 29 JAN 2021 Var. % Volatility MoM JAN 2021 40% 35% FTSE Italia Mib Storico 20 310 19 745 -2.8% 11.6% FTSE Mib 22 233 21 573 -3.0% 17.2% 30% FTSE Italia Star 44 617 43 961 -1.5% 12.8% FTSE Italia PIR PMI TR 27 142 26 594 -2.0% 12.1% 25% FTSE Italia Brands 15 408 14 960 -2.9% 17.2% 20% TRADING - DAILY AVERAGE 15% JANUARY 2020 JANUARY 2021 10% Trades Turnover Trades Turnover (*) Number eur m Number eur m 5% Shares 280 280 2 321.6 342 448 2 341.8 Securitised Derivatives 9 844 94.8 10 582 76.6 0% ETFplus 25 260 461.5 40 196 535.3 Nov Dec Jan Fixed Income 12 514 680.7 12 766 806.2 (*) Indicators are related to turnover figures. LISTING MOST TRADED SHARES IN THE MONTH 30 DEC 2019 30 DEC 2020 29 JAN 2021 Shares Mkt Turnover % TOT MTA Domestic 239 235 234 eur m of which STAR 77 75 74 Stellantis MTA 5 354.3 11.4% MTA Foreign 3 3 3 Enel MTA 4 642.5 9.9% of which STAR 1 1 1 Intesa Sanpaolo MTA 3 771.1 8.1% MIV * 1 1 1 Unicredit MTA 3 561.5 7.6% Global Equity Market 87 87 86 Eni MTA 3 018.9 6.4% AIM Italia - MAC 132 138 138 Listed Companies Total 462 464 462 Warrant 74 76 76 BEST PERFORMANCES IN THE MONTH MIV Closed End Funds 14 12 12 ATFund 114 94 94 Shares Mkt Var. -

FTSE Publications

FTSE Russell Factsheet FTSE MIB Index Data as at: 31 August 2021 bmkTitle1 The FTSE MIB Index is the primary benchmark index for the Italian equity market and FEATURES represents the large cap component of the FTSE Italia All-Share Index. Capturing approximately 80% of the domestic market capitalisation, the FTSE MIB Index measures the performance of Coverage the 40 most liquid and capitalised Italian shares and seeks to replicate the broad sector weights The FTSE MIB Index consists of the 40 most of the Italian stock market. liquid and capitalised stocks listed on Borsa 1-Year Performance - Capital Return Italiana (BIt) MTA and MIV markets, based (EUR) on published ground rules with constituent 140 list overseen by the FTSE Italia Index Series 130 Technical Committee. 120 Objective 110 The index is designed for use in the creation of index tracking funds, derivatives and as a 100 performance benchmark. 90 Aug-2020 Oct-2020 Dec-2020 Feb-2021 Apr-2021 Jun-2021 Aug-2021 Investability Data as at month end Stocks are free-float weighted to ensure that only the investable opportunity set is FTSE MIB included within the indexes. Capping 5-Year Performance - Capital Return (EUR) Constituents are capped at 15% to avoid 160 over-concentration. 150 Liquidity 140 Stocks are screened to ensure that the index 130 120 is tradable. Foreign shares are eligible for 110 inclusion, although secondary lines are 100 excluded. 90 Transparency Aug-2016 Aug-2017 Aug-2018 Aug-2019 Aug-2020 Aug-2021 Data as at month end The index uses a transparent, rules-based construction process. -

Xtrackers FTSE MIB UCITS ETF 1D

MARKETING MATERIAL This factsheet is as at 31 August 2021 unless otherwise specified. Past performance is not a reliable indicator of future results. Xtrackers FTSE MIB UCITS ETF 1D a sub fund of Xtrackers At a glance FTSE MIB Net Total Return Index - Direct investment in Italian equities The FTSE MIB index aims to reflect the performance of the following market: - Provides diversified exposure to the top 40 blue chip Italian stocks - Italian blue chip companies listed in EUR on the Borsa Italiana - The 40 largest and most liquid companies - Weighted by free-float adjusted market capitalisation - Quarterly index review, largest component capped at 15% Additional information on the index, selection and weighting methodology is available at www.ftse.com Fund information Key Risks ISIN LU0274212538 —The Fund is not guaranteed and your investment is at risk. The value of your investment may go down as well as up. Share class currency EUR —The value of an investment in shares will depend on a number of factors including, Fund Currency EUR but not limited to, market and economic conditions, sector, geographical region Fund launch date 04 January 2007 and political events. Domicile Luxembourg —The Fund is exposed to market movements in a single country or region which Portfolio Methodology Direct Replication may be adversely affected by political or economic developments, government Sub-Portfolio Manager DWS Investments UK Ltd action or natural events that do not affect a fund investing in broader markets. Investment Manager DWS Investment GmbH Custodian State Street Bank International GmbH, Luxembourg Branch All-in fee¹ 0.30% p.a. -

Effects of Covid-19 on 9M 2020 Results

EFFECTS OF COVID -19 ON 9M 2020 RESULTS FOR MULTINATIONALS A ND FTSE MIB COMPANIES MULTINAT IONAL S: SOFTWARE /INTERNET , LARGE -SCALE DISTRIBUTION A ND ELECTRONICS CONTINUE TO GROW ; OIL /GAS , FASHION AND A UTOMOTIVE STRUGGLING FTSE MIB COMPANIES : €46 BN IN MARKET CAP WIPED OFF THE STOCK MARKET IN 9M, SOME OF WHICH HAS BEEN RECOVERED ALREADY ; POSITIVE RESPONSE FR OM MANUFACTURING INDUST RY IN 3Q Milan, 19 November 2020 The Mediobanca Research Area has analysed the impact of the Covid-19 pandemic on the 9M 2020 financial statements of over 160 global industrial multinationals with annual turnover of more than €3bn, and the 26 industrial and services companies included in the FTSE MIB index. 1 The presentation is available for download from the company’s website at www.mbres.it. ****** Industrial multinationals in 9M 2020: comparison between sectors In the first nine months of 2020, the turnover posted by the industrial multinationals analysed shrank by 4.3% Y.o.Y., with the reductions by certain sectors offset in part by the growth in others. Software/internet, large-scale distribution, electronics and food are the only sectors that saw total sales increase in all the first three quarters of 2020. In particular, top-line growth was reported by the software/internet companies (total sales up 18.4% Y.o.Y.), followed by large-scale distribution (up 8.8%) and electronics (up 5.7%). Other good performances were reported by the food multinationals (total sales up 3.7%), the pharmaceutical companies (up 3.1%) and the firms operating in the pay tech industry (up 0.3%). -

Ishares FTSE MIB UCITS ETF EUR (Acc)

iShares FTSE MIB UCITS ETF EUR (Acc) CSMIB August Factsheet Unless otherwise stated, Performance, Portfolio Breakdowns and Net Assets information as at: 31-Aug-2021 All other data as at 07-Sep-2021 This document is marketing material. For Investors in Switzerland. Investors should read the Key Capital at risk. All financial investments Investor Information Document and Prospectus prior to investing. involve an element of risk. Therefore, the value of your investment and the income from it will The Fund seeks to track the performance of an index composed of 40 of the largest and most liquid vary and your initial investment amount cannot Italian companies be guaranteed. KEY FACTS KEY BENEFITS Asset Class Equity Fund Base Currency EUR Exposure to broadly diversified Italian companies 1 Share Class Currency EUR 2 Direct investment into 40 Italian companies Fund Launch Date 26-Jan-2010 Share Class Launch Date 26-Jan-2010 3 Single country and large market capitalisation companies exposure Benchmark FTSE MIB Index Valor 10737596 Key Risks: Investment risk is concentrated in specific sectors, countries, currencies or companies. ISIN IE00B53L4X51 Total Expense Ratio 0.33% This means the Fund is more sensitive to any localised economic, market, political or regulatory Distribution Frequency None events. The value of equities and equity-related securities can be affected by daily stock market Domicile Ireland movements. Other influential factors include political, economic news, company earnings and Methodology Replicated significant corporate events. Counterparty Risk: The insolvency of any institutions providing Product Structure Physical services such as safekeeping of assets or acting as counterparty to derivatives or other Rebalance Frequency Quarterly instruments, may expose the Fund to financial loss. -

Monthly Update

MONTHLY UPDATE March 2012 EQUITY DAILY TURNOVER AND MAIN INDICES (BASE = 1000 30.12.2011) Equity Turnover FTSE Mib FTSE Italia Star FTSE Italia Mib Storico eur m 6 400 1 200 5 600 1 150 4 800 1 100 4 000 1 050 3 200 1 000 2 400 950 1 600 900 800 850 0 800 Jan Feb Mar STOCK INDICES FTSE MIB VOLATILITY 29 FEB 2012 30 MAR 2012 Var. % Var. % Volatility 40% MoM 2011 end mar 2012 35% FTSE Italia Mib Storico M 13 571 13 233 -2.5% 7.9% 17.2% FTSE Mib M 16 351 15 980 -2.3% 5.9% 24.4% 30% FTSE Italia Star L 10 727 11 037 2.9% 17.6% 14.6% 25% TRADING - DAILY AVERAGE 20% JAN-MAR 2011 JAN-MAR 2012 MARCH 2012 15% Trades Turnover Trades Turnover Trades Turnover (*) Number eur m Number eur m Number eur m 10% Shares M 300 954 3 359.0 268 362 2 259.7 273 087 2 359.6 Securitised Derivatives M 6 248 57.1 5 536 55.3 5 152 48.9 5% M ETF Plus 16 365 356.4 12 312 255.5 12 718 259.5 0% Fixed Income L 15 882 777.3 29 383 1 525.0 34 759 1 848.2 Jan Feb Mar (*) Indicators are related to turnover figures. LISTING MOST TRADED SHARES IN THE MONTH 30 DEC 2011 29 FEB 2012 30 MAR 2012 Shares Mkt Turnover % TOT MTA Domestic 257 256 255 eur m of which STAR 70 70 70 MTA Foreign 5 5 5 Unicredit MTA 8 940.9 17.2% of which STAR 1 1 1 Intesa Sanpaolo MTA 5 208.9 10.0% MIV (Investment Companies and SPAC) 6 6 6 Eni MTA 4 881.6 9.4% 36 36 36 MTA International Enel MTA 3 968.0 7.6% AIM Italia 14 14 14 Fiat MTA 2 734.5 5.3% MAC 10 10 12 Listed Companies Total 328 327 328 Warrant - Mta-Mercato Expandi 19 19 19 Warrant - AIM Italia 5 5 5 BEST PERFORMANCES IN THE MONTH MIV Closed End Funds 26 26 26 ETF 570 587 591 Shares Mkt Var.