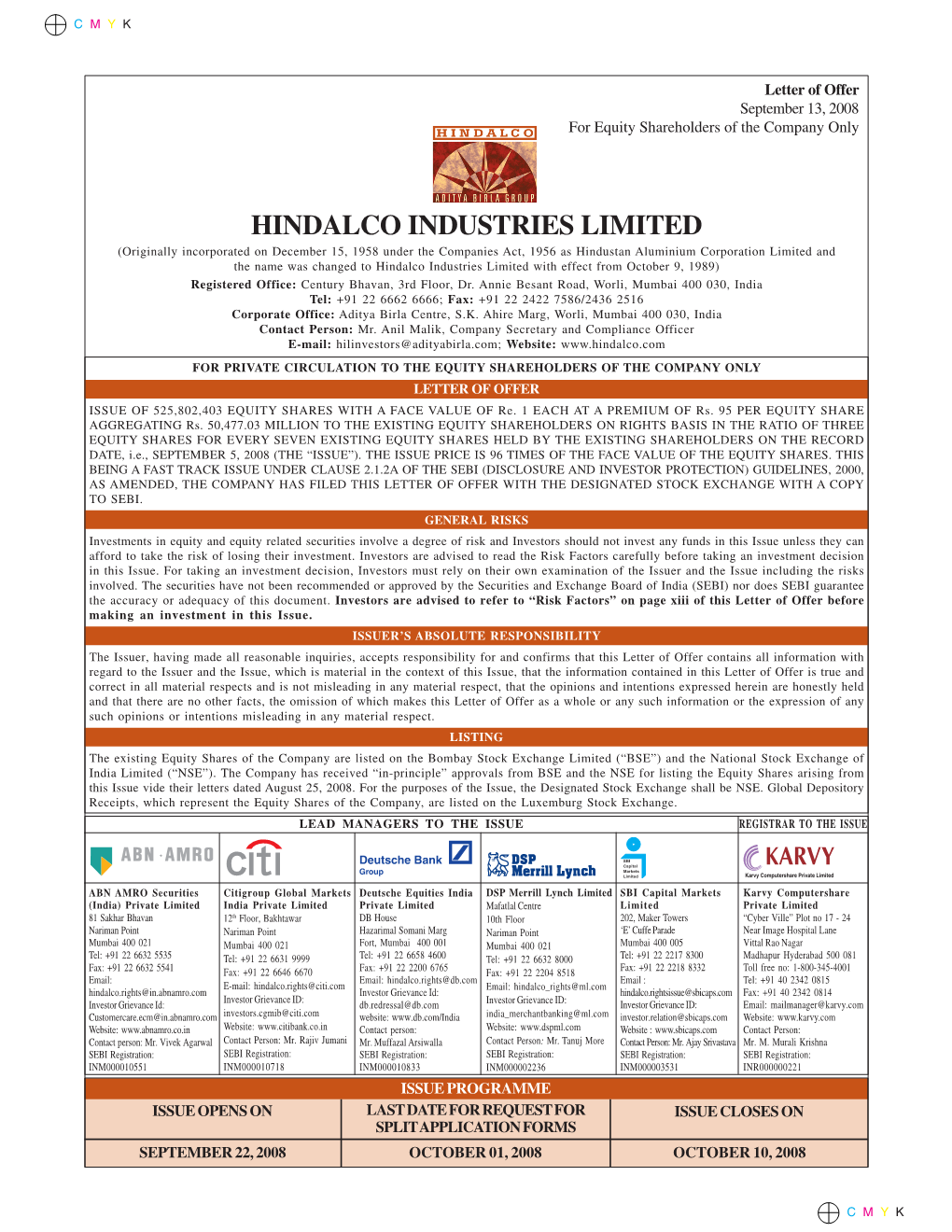

Hindalco Industries Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Launch Issuemarch 2010

P001_ADEU_MAR10.qxp:Layout 1 4/3/10 19:02 Page 1 The pan-European magazine of the SAE International Launch issueMarch 2010 ■ Lightweight strategies under the microscope ■ Ford’s EcoBoost delivers 20% fuel savings ■ NVH Testing: sound engineering gets serious ■ Innovation and collaboration at SAE World Congress Lightweight champion. The all-new XJ fully exposed P002_ADEU_MAR10 3/3/10 11:49 Page 1 DUAL CLUTCH TRANSMISSION TECHNOLOGY IS MOVING THE INDUSTRY FORWARD. ARE YOU MOVING WITH IT? Maybe it’s the fact that in the time you read this, a Dual Clutch Transmission could switch gears 40,000 times. Perhaps it’s the fact that DCTs appeal to more buyers by combining impressive fuel-economy, the smooth ride of an automatic and the speed of a manual. It could be the fact that leading clutch suppliers estimate they’ll quadruple DCT sales by 2014. Or maybe it’s the fact that by 2015, 10% of all passenger cars will have them. DCTFACTS.COM gives you endless reasons to believe that DCTs are the future generation DCTFACTS.COM of transmissions. And the more you know about them, the further ahead you’ll get. P003_ADEU_MAR10.qxp:Layout 1 4/3/10 19:27 Page 3 Contents Vol.1 Issue.1 12 Cover feature 5 Comment Jaguar’s green technology Design Jaguar is synonymous with sporting elegance and collaboration will refinement – and now also high tech materials and drive recovery green endeavour. Ian Adcock gets the inside story from the all new XJ’s engineering design team 6 News 18 Spotlight on Phil Hodgkinson Performance hybrids Phil Hodgkinson talks with Ian Adcock about Jaguar Land Rover’s future engineering strategy Renault bids for 22 Engine technology CO2 leadership EcoBoost set to cut fuel consumption by 20% Ford’s EcoBoost is about more than cutting engine MultiAir set to capacity and adding direct injection, turbocharging grow and twin variable camshafts. -

Hindalco Industries Launches India's First All-Aluminium Freight Trailer

ADITYA BIRLA HINDALCO December 4, 2019 BY PORTAL BSE Limited National Stock Exchange of India Phiroze Jeejeebhoy Towers Limited Dalal Street Exchange Plaza, 5th Floor Mumbai: 400 001 Plot No. C/1, G Block Bandra Kurla Complex Scrip Code: 500440 Bandra (East), Mumbai - 400 051 Scrip Symbol: HINDALCO Banque Internationale A Luxembourg SocieteAnonyme 69, Route Esch L-2953; Luxembourg Fax No. 00352 4590 2010 Tel. 00 352 4590-1 Dear Sirs, Sub: Press Release — Hindalco Industries launches India's first All-Aluminium Freight Trailer Ref: Regulation 30 of Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 We enclosed herewith a press release dated December 04, 2019 on the above subject, which is self- explanatory. This is for the information of your members and all concerned. Thanking you, Yours faithfully, For indalco Industries Limited r tvevmw C) to Anil ik President & Company Secretary Encl: as above Hindalco Industries Limited. 6th "lth & / Floor, Birla Centurion, Pandurang Budhkar Marg, Worli, Mumbai — 400030, India T:+91 22 66626666/62610555 I F:+912262610400/62610500 I W: www.hindalco.com Registered Office : Ahura Centre, 1st Floor, B wing, Mahakali Caves Road, Andheri (East), Mumbai — 400093, India Corporate ID No: L27020MH1958PLC011238 Hindalco Industries Limited launches India’s first All-Aluminium freight trailer Jaipur, 04 December 2019: Hindalco Industries Limited, a global leader in aluminium and copper, launched India’s’ first all-aluminium freight trailer in Jaipur, Rajasthan. Shri Udai Lal Anjana, Honourable Minister of Co-operative and IGNP, and Shri Pratap Singh Khachariyawas, Honourable Minister of Transport, Govt. of Rajasthan, along with Mr. -

Grasim Industries Limited

Grasim Industries Limited https://www.indiamart.com/company/143527/ A US $29.2 billion corporation, the Aditya Birla Group is in the league of Fortune 500. It is anchored by an extraordinary force of 130,000 employees, belonging to 30 different nationalities. In India, the Group has been adjudged "The Best ... About Us A US $29.2 billion corporation, the Aditya Birla Group is in the league of Fortune 500. It is anchored by an extraordinary force of 130,000 employees, belonging to 30 different nationalities. In India, the Group has been adjudged "The Best Employer in India and among the top 20 in Asia" by the Hewitt- Economic Times and Wall Street Journal Study 2007. Over 50 per cent of its revenues flow from its overseas operations. The Group operates in 25 countries India, UK, Germany, Hungary, Brazil, Italy, France, Luxembourg, Switzerland, Australia, USA, Canada, Egypt, China, Thailand, Laos, Indonesia, Philippines, Dubai, Singapore, Myanmar, Bangladesh, Vietnam, Malaysia and Korea. Globally the Aditya Birla Group is: A metals powerhouse, among the world's most cost-efficient aluminium and copper producers. Hindalco-Novelis is the largest aluminium rolling company. It is one of the three biggest producers of primary aluminium in Asia, with the largest single location copper smelter No.1 in viscose staple fibre The fourth largest producer of insulators The fourth largest producer of carbon black The 11th largest cement producer globally, the seventh largest in Asia and the second largest in India Among the world's top 15 BPO companies and among India's top four Among the best energy efficient fertiliser plants Beyond business the Aditya Birla Group is: Working in 3,700 villages Reaching.. -

View Corporate Brochure

next | contents GREENER STRONGER SMARTER previous | next | contents Contents The Materials that Build the Future 02 Customers as Business Partners 04 The Hindalco Growth Story & Metals Flagship of a Global Conglomerate 05 Local & Global Advantages 07 Hindalco Aluminium : Manufacturing Excellence 09 Robust Growth in Flat Rolled & Extruded Products 16 Major Aluminium Brands 17 Novelis Aluminium 18 Hindalco in Speciality Alumina 20 Hindalco Copper 26 Sustainability Framework 32 Research & Development 36 People at the Core 42 Reaching out to Communities 46 From islands of Excellence to a World of Excellence 54 Offices 55 Growing Worldwide Presence — India Map I — World Map II Across the Metals Value Chain — The Making of Aluminium III Across the Metals Value Chain — The Making of Copper IV previous | next GREENER STRONGER SMARTER THE MATERIALS THAT BUILD THE FUTURE Hindalco produces materials that create a The metals from Hindalco, namely, aluminium greener, stronger, smarter, world. Its products and copper are green in more ways than one. sustain the environment, power the global Their use in electric vehicles or solar panels economy and offer smart solutions for today contribute to a sustainable planet. and the future. From mining to manufacturing, Hindalco cares From infrastructure to aeronautics to seafaring for the environment at every stage. Combining vessels, Hindalco products find applications advantages of lightweight and strength, across land, sea and air. From new generation recyclability and manufacturing excellence, automobiles to aerospace and bullet trains, strong research and development capability to innovations like tempered glass for the and a global talent pool, Hindalco today is transformational mobile communication big in your life. -

Alcan’S Business Structure

P r o f il e e t profile a r Can Alcan Claim t o be t he Best ? It’s Corporate and Soci al Responsibility In Question po A P r of ile of Canadian Aluminum Gi ant r o Alcan c p r Oct ober 2005 o P r epar ed by Richard Gir ar d P olar is Institute R esear cher W it h Additional research by Colleen French, Rosa K our i Jesse R osenfeld, and Ver onique R oy f il e corporate Table of Contents Introduction ....................................................................................................................... 1 Chapter 1: Organizational Profile.................................................................................... 2 1.1 Alcan’s business structure...................................................................................... 2 1.2 Executives ................................................................................................................. 7 1.3 Board of Directors .................................................................................................... 7 1.4 University Links ........................................................................................................ 9 1.5 Lawsuits..................................................................................................................... 9 Chapter 2: Economic Profile.......................................................................................... 11 2.1 Financial data .......................................................................................................... 11 2.2 Main customers...................................................................................................... -

Adding More Aluminum Creating Value

Adding More Aluminum Creating Value Sustainability Report 2014 1 Adding More, Creating Value Novelis Sustainability Report 2014 Overview Strategy Sourcing Manufacturing Customers Consumers About This Report Contents By adding high- 2 9 recycled-content Novelis aluminum Overview Strategy 3 Welcome 10 Pioneering a New to their products, 4 Letter from Our Chief Executive Officer Way of Doing 6 Performance Summary Business our customers are 7 About Novelis 16 Materiality creating value for 18 Stakeholder Engagement consumers – and 21 Sustainability Management and for the world. The 23 Governance following sections Sourcing explain how. 24 Re-engineering Our Supply Chain Adding More 30 67 Aluminum Manufacturing Consumers 31 Our Manufacturing Creating Value Operations 68 Engaging with 33 Our Environmental Consumers Performance 72 Product Safety 46 Developing Our and Health People 52 Engaging with Our Communities 73 60 About This Report Customers 74 The Global Reporting Initiative Index 61 Delivering Value to Our Customers 81 UNGC Communication 62 Sector Focus: Automotive on Progress Index 64 Sector Focus: Beverage Can 83 Awards and 66 Sector Focus: Specialties Recognitions 2 Adding More, Creating Value Novelis Sustainability Report 2014 Overview Strategy Sourcing Manufacturing Customers Consumers About This Report Welcome At Novelis, we have set an ambitious goal to use 80% recycled aluminum inputs in our operations by 2020. This goal is transforming our company and dramatically improving the sustainability profile of our products throughout their life cycle. This sustainability report, our fourth, reviews our We have aligned this report to conform to the new continued progress toward this goal – as well as G4 Sustainability Reporting Guidelines of the Global our other key targets – at each life cycle stage: Reporting Initiative (GRI) at the Comprehensive level. -

Annual Report 2019-20 1 Board of Directors

The Chairman’s Letter to Shareholders Dear Shareholder, Covid-19 and the associated lockdowns across countries have triggered a once-in-a-century crisis for the society and the economy in 2020. January now seems like a month of a bygone era — such has been the enormity of change. This is a defining period in human and business history: one that will test the resilience of individuals, societies, corporations, and nations. Given the fog of uncertainty all around, it is hard to be prescient in these times. But there is little doubt on one reality: companies with quality leadership, sound business fundamentals, and a track record of winning in turbulent times, will emerge as champions in the new global order. Global Economy It has been several months since the pandemic engulfed the world and yet there is a lot of uncertainty with respect to the extent of the economic contraction due to this crisis, and the subsequent pace of recovery. This year will see an economic contraction, but this 2020 recession is turning out very different from the past recessions. It has been too sudden – almost off the cliff; its spread has been all-encompassing – affecting almost every economy and sector, and the plunge in economic activity levels and employment has been unprecedented. On the positive side, this recession is likely to be one of the shortest, assuming no second wave of the pandemic recurs. As present lockdowns around As the world emerges the world get lifted, and businesses reopen, economic activity from the current is likely to bounce back fairly quickly. -

Going Electric: Some Materials Aspects for the Thai Automotive Industry Paritud Bhandhubanyong, John T

Going Electric: Some Materials Aspects for the Thai Automotive Industry Paritud Bhandhubanyong, John T. Pearce Department of Automotive Manufacturing Faculty of Engineering and Technology Panyapiwat Institute of Management Thai encouragement for EV production • The Government of Thailand announced in the year 2017 the policy to have 1 million EV running in Thailand by the year 2020 • Currently the Board of Investment (BoI) is offering attractive investment incentives to automakers to set up plants to produce BEVs. • The first carmaker to benefit from this scheme is FOMM Asia, a Thai-Japan joint venture company, who intend to build 10,000 compact BEVs per year with production due to start in January 2019. January 5, 2019 E-Leader, Tokyo, Japan, 2019 2 FOMM Asia EV styles FOMM One :– Driving range up to 160 km, max. speed 85 km/hr January 5, 2019 E-Leader, Tokyo, Japan, 2019 3 Growth trends for BEV and PHEV January 5, 2019 E-Leader, Tokyo, Japan, 2019 4 The automotive future is electric • It has been estimated that, by 2025, some 35% of new vehicles in the market will be driven by battery power. • Hence, to compensate for the weight of battery packs, light-weighting in these vehicles gains extra importance. • Although some first-generation electric vehicles have still used HSS for body and battery enclosure parts the trend is now towards complete replacement of steel by aluminium alloy in the form of sheet, extrusion profiles and die-castings, with some use of magnesium-based die-castings. January 5, 2019 E-Leader, Tokyo, Japan, 2019 5 -

Forging Ahead Together Checklist: Employees Joining Novelis

Forging Ahead Together Checklist: Employees Joining Novelis Update your email signature to reflect that Aleris is now part ofNovelis * The legal entity name of your Aleris businesses does not change on day 1, so this will be whatever you currently use as your business name. Update your voice mail message Visit the InsideNovelis intranet to to reflect that Aleris is now part of learn about the company Novelis Aleris employees can access Desktop and mobile phone, if InsideNovelis from the link on AL or applicable directly at https://novelis.sharepoint.com Use Novelis when answering your Send any questions about integration company phone to your local HR business partner or the Integration Management Office “Thank you for calling Aleris – now a at integrationmanagementoffice@ Novelis company. This is NAME. How novelis.com can I help you?” Proceed with work in a business- Familiarize yourself with the Novelis as-usual fashion, unless directed Brand Guidelines otherwise by your manager Available on InsideNovelis > Our Company > Branding > Brand Identity Guidelines 2 Table of Contents CEO Welcome Letter - Forging Ahead Together .......................................................... 4 Day 1: What You Need to Know ................................................................................... 5 Integrated Company Overview ..................................................................................... 7 Our Locations ............................................................................................................... 8 Executive -

2020-Purpose-Report-ENG-Page.Pdf

To Our Partners This was a year of With the acquisition of Aleris, we significantly expanded exceptional growth Novelis’ global manufacturing footprint, as well as and accomplishment our workforce and entered the aerospace and at Novelis. We delivered industrial plate market. We also further enhanced our record financial results, sustainability capabilities with the addition of a high- welcomed thousands of recycled content building and construction business new employees to the and expanded our complementary recycling, casting, organization with the rolling and finishing assets in Asia. successful acquisition of Aleris, and celebrated Together, with the best engineers, metallurgists, our 15-year anniversary chemists and scientists in the industry, we are as a company. innovating alongside our customers to reimagine aluminum’s role in their products and provide rapid, And while this year was one of great achievement, we adaptive solutions for any manufacturing need. are now facing unprecedented challenges due to the global coronavirus pandemic. As a company, our people In addition to our business success, I am equally proud are our greatest strength and we will continue to put of what we accomplished outside our walls. This past them first in order to protect their health and well-being year marked the eighth year of Novelis Neighbor, our during these demanding times. I’m proud of how our global giving program that invests financial and human employees and partners have stepped up and supported capital in the places where we live and work. Over the each other at every opportunity. As we forge ahead past 12 months, we contributed millions of dollars to together, we will continue to be guided by our purpose our communities and invested nearly 30,000 volunteer and commitment to safety so that we make the best hours to causes close to our employees’ hearts. -

Applications – Car Body – Body Components

Applications – Car body – Body components Table of contents 2 Body components and modules ................................................................................................... 2 2.1 Engine cradles and engine mounts ........................................................................................ 2 2.2 Suspension strut domes ........................................................................................................ 8 2.3 Front end carriers .............................................................................................................. 12 2.4 Cross car beam (instrument panel support) .......................................................................... 13 2.5 Rear frame ........................................................................................................................ 16 2.6 Other aluminium components in the body structure .............................................................. 17 Version 2013 © European Aluminium Association ([email protected]) 1 2 Body components and modules Structural aluminium components and modules can be safely integrated into a steel body structure. There are different methods for joining aluminium to steel which fulfil highest requirements. However, when the integration of structural aluminium components and modules into a steel body structure is considered, solutions must be sought for two issues: - Aluminium/steel joints have to be designed and/or properly protected to safely avoid any possibility of galvanic corrosion. - Potential problems -

Constellium SE Constellium SE France

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________________________________________________________________ FORM 20-F __________________________________________________________________________ ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 001-35931 __________________________________________________________________________ Constellium SE (Exact Name of Registrant as Specified in its Charter) __________________________________________________________________________ Constellium SE (Translation of Registrant’s name into English) __________________________________________________________________________ France (Jurisdiction of incorporation or organization) __________________________________________________________________________ Washington Plaza, 300 East Lombard Street 40-44 rue Washington Suite 1710 75008 Paris Baltimore, MD, 21202 France United States (Head Office) (Address of principal executive offices) Rina E. Teran Chief Securities Counsel 300 East Lombard Street, Suite 1710, Baltimore, MD, 21202 United States Tel: (443) 420-7861 E-mail: [email protected] (Name, telephone, e-mail and/or facsimile