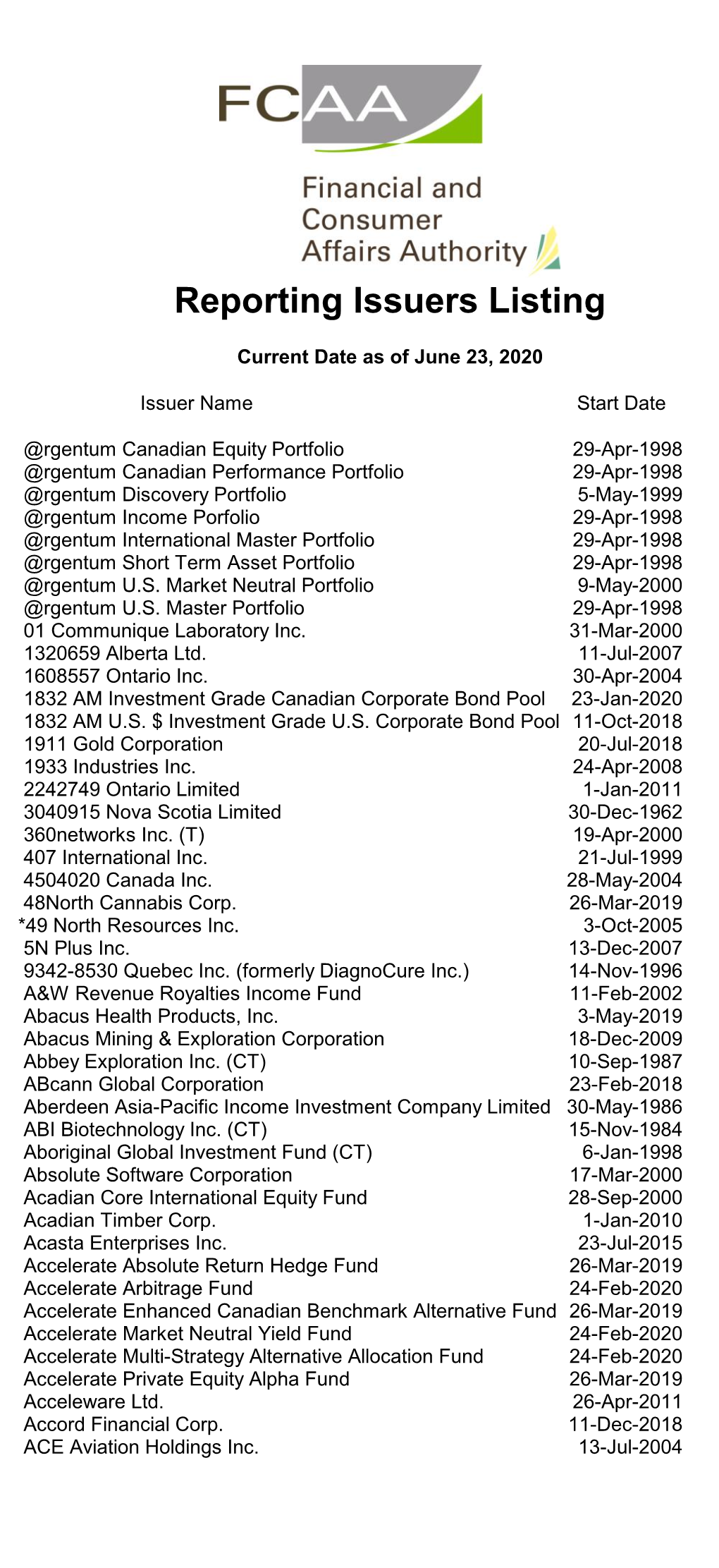

Reporting Issuers Listing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

This Information Is Provided for Information Purposes Only. Neither

This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies represents, warrants or guarantees the accuracy or completeness of the information contained in this document and we are not responsible for any errors or omissions in or your use of, or reliance on, the information provided. © 2014 TSX Inc. All Rights Reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. Root Exchange Name Ticker TSX 5Banc Split Inc. FBS TSX 5N Plus Inc. VNP TSX A&W Revenue Royalties Income Fund AW TSX Aberdeen Asia-Pacific Income Investment Company Ltd. FAP TSX Aberdeen International Inc. AAB TSX Absolute Software Corporation ABT TSX Acadian Timber Corp ADN TSX Accord Financial Corp. ACD TSX ACTIVEnergy Income Fund AEU TSX ADF Group Inc. DRX TSX Adherex Technologies Inc. AHX TSX Advantage Oil & Gas Ltd. AAV TSX Advantaged Canadian High Yield Bond Fund AHY TSX Advantaged Preferred Share Trust PFR TSX Aecon Group Inc. ARE TSX AEterna Zentaris Inc. AEZ TSX Africa Oil Corp. AOI TSX Africo Resources Ltd. ARL TSX AG Growth International Inc AFN TSX Agellan Commercial Real Estate Investment Trust ACR TSX AGF Management Limited AGF TSX AgJunction Inc. AJX TSX Agnico Eagle Mines Limited AEM TSX Agrium Inc. AGU TSX Aimia Inc. AIM TSX Ainsworth Lumber Co. Ltd. ANS TSX Air Canada AC TSX AirBoss of America Corp. BOS TSX Akita Drilling Ltd. AKT TSX Alacer Gold Corp. ASR TSX Alamos Gold Inc. AGI TSX Alaris Royalty Corp. AD TSX AlarmForce Industries Inc. AF TSX Alderon Iron Ore Corp. -

Mount Allison University Endowment Fund Holdings As of December 31, 2017

Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) EQUITY HOLDINGS Canadian Holdings 5N PLUS INC $ 155 ABSOLUTE SOFTWARE CORP $ 851 ACADIAN TIMBER CORP $ 302 ADVANTAGE OIL & GAS LTD $ 283,788 AECON GROUP INC $ 1,728 AFRICA OIL CORP $ 684 AG GROWTH INTERNATIONAL INC $ 1,163 AGELLAN COMMERCIAL REAL ESTATE $ 349 AGF MANAGEMENT LTD $ 990 AGNICO-EAGLE MINES LTD $ 427,207 AGT FOOD AND INGREDIENTS INC $ 653 AIMIA INC $ 832 AIR CANADA INC $ 325,411 AIRBOSS OF AMERICA CORP $ 315 ALACER GOLD CORP $ 1,289 ALAMOS GOLD INC $ 2,216 ALAMOS GOLD INC NEW COM CLASS A $ 4,877 ALARIS ROYALTY CORP $ 1,107 ALGOMA CENTRAL CORP $ 330 ALIMENTATION COUCHE-TARD INC $ 98,854 ALIO GOLD INC $ 472 ALLIED PROPERTIES REAL ESTATE INVESTMENT TRUST $ 2,575 ALTIUS MINERALS CORP $ 1,233 ALTUS GROUP LTD/CANADA $ 1,916 ANDREW PELLER LTD $ 1,448 ARGONAUT GOLD INC $ 656 ARTIS REAL ESTATE INVESTMENT TRUST $ 1,539 ASANKO GOLD INC $ 209 ATCO LTD $ 119,947 ATHABASCA OIL COP $ 703 ATS AUTOMATION TOOLING SYSTEMS INC $ 1,769 AURICO METALS INC $ 311 AUTOCANADA INC $ 1,128 AVIGILON CORP $ 1,258 B2GOLD CORP $ 29,898 BADGER DAYLIGHTING LTD $ 1,525 BANK OF MONTREAL $ 725,449 BANK OF NOVA SCOTIA $ 2,019,757 BARRICK GOLD CORP $ 459,749 BAYTEX ENERGY CORP $ 1,213 BCE INC $ 791,441 BELLATRIX EXPLORATION LTD $ 94 BIRCHCLIFF ENERGY LTD $ 1,479 BIRD CONSTRUCTION INC $ 731 1 Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) BLACK DIAMOND GROUP LTD $ 95 BLACKBERRY LIMITED $ 151,777 BLACKPEARL RESOURCES INC $ 672 BOARDWALK REAL ESTATE INVESTMENT TRUST $ 1,610 BONAVISTA ENERGY CORP $ 686 BONTERRA ENERGY CORP $ 806 BORALEX INC $ 2,276 BROOKFIELD ASSET MANAGEMENT INCORPORATED $ 672,870 BROOKFIELD INFRASTRUCTURE PARTNERS L.P. -

5N Plus 5N Plus A&W Revenue Royalties Aberdeen Asia-Pacific Inc

Toronto Stock Exchange - The Globe and Mail - June 29, 2018 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield 5N Plus VNP.DB 100.500 101.750 98.400 2.29 7109 558.33 0.0 5N Plus VNP 3.350 3.710 2.220 10.20 7980 18.61 0.0 A&W Revenue Royalties AW.UN 32.000 36.830 28.360 -7.94 1781 17.58 5.2 Aberdeen Asia-Pacific Inc Inve FAP 3.950 4.800 3.920 -17.21 5728 13.62 9.9 Aberdeen International Inc. AAB 0.130 0.210 0.115 .00 9673 1.30 0.0 Absolute Software ABT 6.930 8.820 6.060 -10.08 7393 na 4.6 Acadian Timber Corp. ADN 19.900 20.240 18.050 3.03 782 11.85 5.7 Acasta Enterprises AEF.WT 0.015 0.950 0.005 -98.08 13110 na 0.0 Acasta Enterprises AEF 1.510 7.850 1.400 -79.73 8328 na 0.0 Accord Financial ACD 9.180 9.800 8.220 4.57 99 12.75 3.9 Acerus Pharmaceuticals Corp. ASP.WT 0.045 0.045 0.030 - 986 na 0.0 Acerus Pharmaceuticals Corp. ASP 0.240 0.520 0.095 108.33 31783 na 0.0 ACTIVEnergy Income Fund AEU.UN 4.230 4.230 4.230 .00 0 na 5.7 ADF Group DRX 1.610 2.840 1.590 -40.37 331 na 1.3 Advantage Oil & Gas AAV 4.110 9.240 3.480 -51.22 174191 12.45 0.0 Advantaged Cdn High Yd Bond AHY.UN 7.870 8.000 7.440 -1.79 146 na 5.0 Aecon Group ARE 15.460 20.060 14.130 -3.63 42006 32.89 3.2 Aecon Group ARE.DB.B 100.980 104.500 100.000 -2.28 32496 214.85 0.0 AEterna Zentaris (D) AEZS 2.570 4.170 1.240 94.66 2157 na 0.0 Africa Oil Corp. -

5N Plus 5N Plus A&W Revenue Royalties Aberdeen Asia-Pacific Inc

Toronto Stock Exchange - The Globe and Mail - September 28, 2018 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield 5N Plus VNP.DB 101.000 101.750 98.550 .50 7884 594.12 0.0 5N Plus VNP 3.300 3.730 2.220 3.26 11368 19.41 0.0 A&W Revenue Royalties AW.UN 36.250 37.740 28.360 -2.43 2719 19.81 4.7 Aberdeen Asia-Pacific Inc Inve FAP 3.290 4.750 3.190 -29.35 9527 11.34 12.0 Aberdeen International Inc. AAB 0.080 0.210 0.080 -46.43 13537 .80 0.0 Absolute Software ABT 7.490 8.820 6.060 -9.79 9602 62.42 4.3 Acadian Timber Corp. ADN 18.220 20.240 18.050 -3.95 1196 11.75 6.1 Acasta Enterprises AEF.WT 0.015 0.650 0.005 -97.78 14702 na 0.0 Acasta Enterprises AEF 1.150 6.700 0.760 -81.26 10656 na 0.0 Accord Financial ACD 10.130 10.150 8.220 12.36 259 14.07 3.6 Acerus Pharmaceuticals Corp. ASP.WT 0.030 0.050 0.025 - 2959 na 0.0 Acerus Pharmaceuticals Corp. ASP 0.250 0.520 0.095 95.83 42452 na 0.0 ACTIVEnergy Income Fund AEU.UN 4.230 4.230 4.230 .00 0 na 5.7 ADF Group DRX 1.640 2.790 1.200 -39.62 479 na 1.2 Advantage Oil & Gas AAV 3.600 8.120 3.110 -51.49 238651 24.00 0.0 Advantaged Cdn High Yd Bond AHY.UN 7.800 8.000 7.440 .65 200 5.27 5.0 Aecon Group ARE 16.230 20.060 14.270 -4.22 67782 27.05 3.1 Aecon Group ARE.DB.B 100.260 103.750 100.000 -3.31 43892 167.10 0.0 AEterna Zentaris (D) AEZS 2.250 4.170 1.500 -16.35 2384 14.06 0.0 Africa Oil Corp. -

5N Plus 5N Plus A&W Revenue Royalties Aberdeen Asia-Pacific Inc

Toronto Stock Exchange - The Globe and Mail - December 29, 2017 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield 5N Plus VNP.DB 100.300 101.750 88.990 11.14 24497 na 0.0 5N Plus VNP 3.000 3.710 1.620 72.41 16032 na 0.0 A&W Revenue Royalties AW.UN 33.690 42.160 30.110 -8.97 3949 24.24 4.8 Aberdeen Asia-Pacific Inc Inve FAP 4.550 4.870 4.350 3.41 10367 15.69 8.6 Aberdeen International Inc. AAB 0.190 0.210 0.110 18.75 32021 1.73 10.8 Absolute Software ABT 6.880 8.820 6.300 8.69 16631 na 4.7 Acadian Timber Corp. ADN 19.500 20.120 17.000 6.85 2394 22.41 5.7 Acasta Enterprises AEF 5.990 10.290 4.600 -40.63 8324 na 0.0 Acasta Enterprises AEF.WT 0.550 1.450 0.250 -59.26 10110 na 0.0 Accord Financial ACD 9.200 9.550 8.400 2.34 418 11.95 3.8 Acerus Pharmaceuticals Corp. ASP 0.290 0.520 0.095 107.14 77908 na 0.0 ACTIVEnergy Income Fund AEU.UN 4.230 5.190 4.200 -16.57 1310 na 5.7 ADF Group DRX 2.150 3.030 1.900 -25.09 789 71.67 0.9 Advantage Oil & Gas AAV 5.400 9.310 4.840 -40.85 154893 15.43 0.0 Advantaged Cdn High Yd Bond AHY.UN 7.620 7.870 7.250 5.10 421 na 6.0 Aecon Group ARE 19.940 20.040 14.130 30.67 92573 32.16 2.5 Aecon Group ARE.DB.B 101.750 106.250 101.030 -1.69 83480 164.11 0.0 AEterna Zentaris (D) AEZS 2.980 5.440 1.100 -37.92 14533 na 0.0 Africa Oil Corp. -

Reporting Issuers in Good Standing in Newfoundland and Labrador (As of 7:37Am NST September 27, 2021)

Reporting Issuers in Good Standing in Newfoundland and Labrador (As of 7:37am NST September 27, 2021) 01 Communique Laboratory Inc. 1285081 Ontario 1608557 Ontario Inc. 1832 AM Canadian All Cap Equity Pool (formerly Scotia Private Canadian All Cap Equity Pool) 1832 AM Emerging Markets Equity Pool (formerly Scotia Emerging Markets Equity Fund) 1832 AM Fundamental Canadian Equity Pool (formerly Scotia Private Fundamental Canadian Equity Pool) 1832 AM Global Credit Pool (formerly Scotia Private Global Credit Pool) 1832 AM International Growth Equity Pool (formerly Scotia Private International Growth Equity Pool) 1832 AM Investment Grade Canadian Corporate Bond Pool 1832 AM U.S. $ Investment Grade U.S. Corporate Bond Pool (formerly 1832 AM Investment Grade U.S. Corporate Bond Pool) 1911 Gold Corporation 20/20 Group 1990 Limited Partnership 20/20 Group 1992 Limited Partnership 2242749 Ontario Limited (formerly Armtec Infrastructure Inc.) 2737469 Canada Inc. (formerly, CanWest Global Communications Corp.) 360networks inc. 3iQ CoinShares Bitcoin ETF (formerly, 3iQ Bitcoin ETF) 3iQ CoinShares Ether ETF (formerly, 3iQ Ether ETF) 407 International Inc. 4141377 Canada Inc. 4504020 Canada Inc. (formerly Railpower Technologies Corp.) 48North Cannabis Corp. 49 North 2007 Resource Flow‐Through Limited Partnership 49 North 2008 Resource Flow‐Through Limited Partnership 49 North 2009 Resource Flow‐Through Limited Partnership 4Front Ventures Corp. 5N Plus Inc. 9342‐8530 Québec Inc. (formerly DiagnoCure Inc.) AAER Inc. Abacus Mining & Exploration Corporation Abaxx Technologies Inc. ABC Technologies Holdings Inc. Pg. 1 of 220 Reporting Issuers in Good Standing in Newfoundland and Labrador (As of 7:37am NST September 27, 2021) Aberdeen Asia‐Pacific Income Investment Company Limited Absolute Software Corporation Acadian Core International Equity Fund Acadian Timber Corp. -

Public Equities Investment Inventory

Investment Inventory List PUBLIC EQUITIES AS AT MARCH 31, 2020 (UNAUDITED) British Columbia Investment Management Corporation 1 BCI’S INVESTMENT INVENTORY About BCI BCI is the leading provider of investment management BCI is bound by obligations of confidentiality to many services to British Columbia’s public sector. Our role is to parties, including its clients, and does not disclose generate investment returns that will enable our clients commercially sensitive information. All values in the to meet their future funding obligations. Employing a investment inventory are unaudited. global outlook, we seek investment opportunities that will This inventory reflects the investments managed by each meet our clients’ risk and return requirements over time. asset class. Our investment inventory provides an overview of the holdings within BCI’s investment portfolio as at March 31, 2020. BCI’S INVESTMENT INVENTORY 2 Public Equities Public equity's diverse portfolio is structured to capitalize on opportunities in Canada, the United States, and internationally in both developed and emerging markets. It combines index and active management strategies, using both internal and external managers. Our public equity portfolio represents 32.5 per cent of managed assets. PUBLIC EQUITY INVESTMENTS 1 As at March 31, 2020 (unaudited) ISSUER (COMMON SHARES EXCEPT AS NOTED) MARKET VALUE (C$ million) 3I GROUP PLC 4.48 3M CO 12.23 3SBIO INC 0.86 4IMPRINT GROUP PLC 0.63 51JOB INC-ADR 14.38 58.COM INC-ADR 2.98 5N PLUS INC 4.52 A2 MILK CO LTD 0.64 A2A SPA 1.76 1 -

September 2021

GLOBAL RESEARCH | PUBLISHED BY RAYMOND JAMES & ASSOCIATES September 2021 © 2021 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. All rights reserved. International Headquarters: The Raymond James Financial Center | 880 Carillon Parkway | St. Petersburg, Florida 33716 | 800-248-8863 Contents Consumer Healthcare Real Estate USA ............................ 16 USA .......................... 33 USA .......................... 44 CAN ........................... 19 CAN .......................... 37 CAN .......................... 47 Energy Industrial Technology & Communications USA ............................ 20 USA .......................... 38 USA .......................... 48 CAN ........................... 23 CAN .......................... 40 CAN .......................... 54 Financial Services Mining Transportation USA ............................ 26 CAN .......................... 42 USA .......................... 55 CAN ........................... 32 CAN .......................... 57 Research Coverage Changes ............................................. 3 Research Analysts and Sales & Trading Directories Rating and Suitability Definitions ....................................... 4 USA, Canada and Europe .... 58 Company Index .............................................................. 5 2 Raymond James Research Register - September 2021 Research Coverage Changes Additions USA CAN Byrna Technologies Inc. (BYRN:Q) Decibel Cannabis Company Inc. (DB:V) DigitalBridge Group, Inc. (DBRG:N) Quarterhill Inc. (QTRH:T) Duolingo, -

BT20 Liste Des Titres 200110 EN.Fm

List of tradable securities in the 2020 Bourstad Challenge Posted on January 10, 2020 The strike prices of the option series will be published on Fe- bruary 7, 2020. platinum sponsor www.bourstad.ca The 600 securities of the 2020 Bourstad Challenge are divided into 17 categories. Participants who manage the Bourstad Portfolio can trade 496 securities : • Shares of Canadian companies (225) • Shares of US companies (96) • Shares of Asian Companies(16) • Shares of companies from Australia, South America and Africa (9) • Shares of European companies (31) • Exchange-Traded Index Funds – Canadian Equities (11) • Exchange-traded Index funds – US and International Bonds (6) • Exchange-traded Index funds – Canadian and International Bonds (14) • Exchange-Traded Index Funds – Money Market (2) • Exchange-Traded Index Funds – US Equities (17) • Exchange-traded Index Funds – International Equities (15) • Currencies(6) • Actively Managed Mutual Funds (36) • Exchange-traded leveraged index funds traded in Canada (10) • Precious Metals Funds(2) Participants who manage a Bourstad Plus Portfolio may trade 104 additional securities: • US leveraged index funds traded in the United States (32) • Options on Canadian Equities and ETFs (72) 2020 BOURSTAD Challenge 1. Securities of the Bourstad • Boralex (BLX:CA) Portfolio • Brick Brewing Co (BRB:CA) • Brookfield Asset Management (BAM.A:CA) • Brookfield Property Partners (BPY.UN:CA) A. Shares of Canadian companies (225) • Brookfield Renewable Partners L.P. • 5N Plus (VNP:CA) (BEP.UN:CA) • A&W Revenue Royalties Income Fund • BRP (DOO:CA) (AW.UN:CA) • BTB Real Estate Investment Trust • Abitibi Royalties Inc. (RZZ:CA) (BTB.UN:CA) • Absolute Software Corporation (ABT:CA) • CAE (CAE:CA) • ADF Group Inc. -

List of Tradable Securities in the 2021 Bourstad Challenge Posted on January 25, 2021

List of tradable securities in the 2021 Bourstad Challenge Posted on January 25, 2021 The strike prices of the option series will be published on Fe- bruary 14, 2021. platinum sponsor www.bourstad.ca The 675 securities of the 2021 Bourstad Challenge are divided into 17 categories. Participants who manage the Bourstad Portfolio can trade 575 securities : • Shares of Canadian companies (248) • Shares of US companies (115) • Shares of Asian Companies(24) • Shares of companies from Australia, South America and Africa (13) • Shares of European companies (36) • Exchange-Traded Index Funds – Canadian Equities (17) • Exchange-traded Index funds – US and International Bonds (7) • Exchange-traded Index funds – Canadian and International Bonds (16) • Exchange-Traded Index Funds – Money Market (2) • Exchange-Traded Index Funds – US Equities (21) • Exchange-traded Index Funds – International Equities (19) • Currencies(6) • Actively Managed Mutual Funds (36) • Exchange-traded leveraged index funds traded in Canada (10) • Commodity Funds(5) Participants who manage a Bourstad Plus Portfolio may trade 100 additional securities: • US leveraged index funds traded in the United States (28) • Options on Canadian Equities and ETFs (72) 2021 BOURSTAD Challenge 1. Securities of the Bourstad • BioSyent Inc (RX:CA) Portfolio • Blackberry Ltd (BB:CA) • Bombardier Inc. Class B (BBD.B:CA) • Boralex (BLX:CA) A. Shares of Canadian companies (248) • Boyd Group Services Inc. (BYD:CA) • 5N Plus (VNP:CA) • Brookfield Asset Management (BAM.A:CA) • A&W Revenue Royalties Income Fund • Brookfield Property Partners (BPY.UN:CA) (AW.UN:CA) • Brookfield Renewable Partners L.P. • Abitibi Royalties Inc. (RZZ:CA) (BEP.UN:CA) • Absolute Software Corporation (ABST:CA) • BRP (DOO:CA) • ADF Group Inc. -

DFA Canada Canadian Core Equity Fund - Class F As of August 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Core Equity Fund - Class F As of August 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of