BT20 Liste Des Titres 200110 EN.Fm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

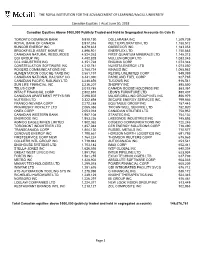

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2018 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) TORONTO DOMINION BANK 9,910,190 DOLLARAMA INC 1,209,739 ROYAL BANK OF CANADA 8,917,316 KELT EXPLORATION LTD 1,188,512 SUNCOR ENERGY INC 6,879,833 QUEBECOR INC 1,183,053 BROOKFIELD ASSET MGMT INC 4,896,921 ENERFLEX LTD 1,150,883 CANADIAN NATURAL RESOURCES 4,524,263 FIRST QUANTUM MINERALS LTD 1,145,213 CGI GROUP INC 4,482,828 MULLEN GROUP LTD 1,083,045 CCL INDUSTRIES INC 4,351,728 ENCANA CORP 1,073,348 CONSTELLATION SOFTWARE INC 4,212,781 NUVISTA ENERGY LTD 1,073,050 ROGERS COMMUNICATIONS INC 3,788,734 KINAXIS INC 1,065,983 ALIMENTATION COUCHE-TARD INC 3,581,197 RECIPE UNLIMITED CORP 949,389 CANADIAN NATIONAL RAILWAY CO 3,441,390 PARKLAND FUEL CORP 927,785 CANADIAN PACIFIC RAILWAY LTD 3,240,856 TUCOWS INC 916,541 SUN LIFE FINANCIAL INC 3,236,207 SHOPIFY INC 895,850 TELUS CORP 3,013,785 CANADA GOOSE HOLDINGS INC 883,361 INTACT FINANCIAL CORP 2,802,815 LEON'S FURNITURE LTD 880,407 CANADIAN APARTMENT PPTYS REI 2,498,502 MAJOR DRILLING GROUP INTL INC 856,979 NUTRIEN LTD 2,322,898 SECURE ENERGY SERVICES INC 799,566 FRANCO-NEVADA CORP 2,272,288 EQUITABLE GROUP INC 787,443 PRAIRIESKY ROYALTY LTD 2,065,386 TRICAN WELL SERVICE LTD 782,920 ONEX CORP 2,053,018 CANADIAN UTILITIES LTD 758,952 CANADIAN WESTERN BANK 1,987,108 STANTEC INC 754,132 ENBRIDGE INC 1,953,226 LASSONDE INDUSTRIES INC 745,893 AGNICO EAGLE MINES LIMITED 1,902,362 COGECO COMMUNICATIONS -

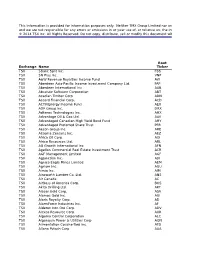

This Information Is Provided for Information Purposes Only. Neither

This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies represents, warrants or guarantees the accuracy or completeness of the information contained in this document and we are not responsible for any errors or omissions in or your use of, or reliance on, the information provided. © 2014 TSX Inc. All Rights Reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. Root Exchange Name Ticker TSX 5Banc Split Inc. FBS TSX 5N Plus Inc. VNP TSX A&W Revenue Royalties Income Fund AW TSX Aberdeen Asia-Pacific Income Investment Company Ltd. FAP TSX Aberdeen International Inc. AAB TSX Absolute Software Corporation ABT TSX Acadian Timber Corp ADN TSX Accord Financial Corp. ACD TSX ACTIVEnergy Income Fund AEU TSX ADF Group Inc. DRX TSX Adherex Technologies Inc. AHX TSX Advantage Oil & Gas Ltd. AAV TSX Advantaged Canadian High Yield Bond Fund AHY TSX Advantaged Preferred Share Trust PFR TSX Aecon Group Inc. ARE TSX AEterna Zentaris Inc. AEZ TSX Africa Oil Corp. AOI TSX Africo Resources Ltd. ARL TSX AG Growth International Inc AFN TSX Agellan Commercial Real Estate Investment Trust ACR TSX AGF Management Limited AGF TSX AgJunction Inc. AJX TSX Agnico Eagle Mines Limited AEM TSX Agrium Inc. AGU TSX Aimia Inc. AIM TSX Ainsworth Lumber Co. Ltd. ANS TSX Air Canada AC TSX AirBoss of America Corp. BOS TSX Akita Drilling Ltd. AKT TSX Alacer Gold Corp. ASR TSX Alamos Gold Inc. AGI TSX Alaris Royalty Corp. AD TSX AlarmForce Industries Inc. AF TSX Alderon Iron Ore Corp. -

Mount Allison University Endowment Fund Holdings As of December 31, 2017

Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) EQUITY HOLDINGS Canadian Holdings 5N PLUS INC $ 155 ABSOLUTE SOFTWARE CORP $ 851 ACADIAN TIMBER CORP $ 302 ADVANTAGE OIL & GAS LTD $ 283,788 AECON GROUP INC $ 1,728 AFRICA OIL CORP $ 684 AG GROWTH INTERNATIONAL INC $ 1,163 AGELLAN COMMERCIAL REAL ESTATE $ 349 AGF MANAGEMENT LTD $ 990 AGNICO-EAGLE MINES LTD $ 427,207 AGT FOOD AND INGREDIENTS INC $ 653 AIMIA INC $ 832 AIR CANADA INC $ 325,411 AIRBOSS OF AMERICA CORP $ 315 ALACER GOLD CORP $ 1,289 ALAMOS GOLD INC $ 2,216 ALAMOS GOLD INC NEW COM CLASS A $ 4,877 ALARIS ROYALTY CORP $ 1,107 ALGOMA CENTRAL CORP $ 330 ALIMENTATION COUCHE-TARD INC $ 98,854 ALIO GOLD INC $ 472 ALLIED PROPERTIES REAL ESTATE INVESTMENT TRUST $ 2,575 ALTIUS MINERALS CORP $ 1,233 ALTUS GROUP LTD/CANADA $ 1,916 ANDREW PELLER LTD $ 1,448 ARGONAUT GOLD INC $ 656 ARTIS REAL ESTATE INVESTMENT TRUST $ 1,539 ASANKO GOLD INC $ 209 ATCO LTD $ 119,947 ATHABASCA OIL COP $ 703 ATS AUTOMATION TOOLING SYSTEMS INC $ 1,769 AURICO METALS INC $ 311 AUTOCANADA INC $ 1,128 AVIGILON CORP $ 1,258 B2GOLD CORP $ 29,898 BADGER DAYLIGHTING LTD $ 1,525 BANK OF MONTREAL $ 725,449 BANK OF NOVA SCOTIA $ 2,019,757 BARRICK GOLD CORP $ 459,749 BAYTEX ENERGY CORP $ 1,213 BCE INC $ 791,441 BELLATRIX EXPLORATION LTD $ 94 BIRCHCLIFF ENERGY LTD $ 1,479 BIRD CONSTRUCTION INC $ 731 1 Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) BLACK DIAMOND GROUP LTD $ 95 BLACKBERRY LIMITED $ 151,777 BLACKPEARL RESOURCES INC $ 672 BOARDWALK REAL ESTATE INVESTMENT TRUST $ 1,610 BONAVISTA ENERGY CORP $ 686 BONTERRA ENERGY CORP $ 806 BORALEX INC $ 2,276 BROOKFIELD ASSET MANAGEMENT INCORPORATED $ 672,870 BROOKFIELD INFRASTRUCTURE PARTNERS L.P. -

ATSX Fund Facts 05.09.19

ACCELERATE ENHANCED CANADIAN BENCHMARK ALTERNATIVE FUND QUICK FACTS About the Fund The Accelerate Enhanced Canadian Benchmark Alternative Fund (TSX: ATSX) provides Type: combined exposure to the S&P/ TSX 60 plus a long-short Canadian equity overlay Long-short equity portfolio designed to add outperformance above the broad Canadian equity index. Date started: May 10, 2019 Investment Objectives Management Fee: ・ Outperform the broad Canadian equity index 0.00% ・ Provide volatility in-line with the broad Canadian equity index Performance Fee / Hurdle: 50% of outperformance over high watermark / S&P/ TSX 60 Total Return Investment Manager: Accelerate Enhanced Canadian Benchmark Accelerate Financial Technologies Inc. Reference Portfolio Performance 25,000 Distribution Frequency: Quarterly 16.6% annualized Exchange: 20,000 TSX Currency: CAD 15,000 Risk-Rating: Medium 10,000 As of May 09, 2019 ATSX Price: n/a 5,000 ATSX NAV: n/a Change: 0 n/a Volume: n/a Growth of 1,000 Net Assets: DISCLAIMER: Results of the Accelerate Enhanced Canadian Benchmark reference portfolio are hypothetical and do not reflect investment results attained by any investor. Past performance is not indicative of future results. Performance is net of all estimated trading fees and performance fees. Investing involves varying n/a degrees of risk and there can be no assurance that the future performance of any investment strategy will be profitable. This does not constitute investment advice. [email protected] www.accelerateshares.com 1-855-892-0740 ACCELERATE ENHANCED CANADIAN BENCHMARK ALTERNATIVE FUND Investment Process In addition to providing exposure to the broad Canadian equity index, either through derivatives, ETFs or the underlying equities, ATSX holds a diversified, long-short equity overlay portfolio of Canadian equities. -

5N Plus 5N Plus A&W Revenue Royalties Aberdeen Asia-Pacific Inc

Toronto Stock Exchange - The Globe and Mail - June 29, 2018 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield 5N Plus VNP.DB 100.500 101.750 98.400 2.29 7109 558.33 0.0 5N Plus VNP 3.350 3.710 2.220 10.20 7980 18.61 0.0 A&W Revenue Royalties AW.UN 32.000 36.830 28.360 -7.94 1781 17.58 5.2 Aberdeen Asia-Pacific Inc Inve FAP 3.950 4.800 3.920 -17.21 5728 13.62 9.9 Aberdeen International Inc. AAB 0.130 0.210 0.115 .00 9673 1.30 0.0 Absolute Software ABT 6.930 8.820 6.060 -10.08 7393 na 4.6 Acadian Timber Corp. ADN 19.900 20.240 18.050 3.03 782 11.85 5.7 Acasta Enterprises AEF.WT 0.015 0.950 0.005 -98.08 13110 na 0.0 Acasta Enterprises AEF 1.510 7.850 1.400 -79.73 8328 na 0.0 Accord Financial ACD 9.180 9.800 8.220 4.57 99 12.75 3.9 Acerus Pharmaceuticals Corp. ASP.WT 0.045 0.045 0.030 - 986 na 0.0 Acerus Pharmaceuticals Corp. ASP 0.240 0.520 0.095 108.33 31783 na 0.0 ACTIVEnergy Income Fund AEU.UN 4.230 4.230 4.230 .00 0 na 5.7 ADF Group DRX 1.610 2.840 1.590 -40.37 331 na 1.3 Advantage Oil & Gas AAV 4.110 9.240 3.480 -51.22 174191 12.45 0.0 Advantaged Cdn High Yd Bond AHY.UN 7.870 8.000 7.440 -1.79 146 na 5.0 Aecon Group ARE 15.460 20.060 14.130 -3.63 42006 32.89 3.2 Aecon Group ARE.DB.B 100.980 104.500 100.000 -2.28 32496 214.85 0.0 AEterna Zentaris (D) AEZS 2.570 4.170 1.240 94.66 2157 na 0.0 Africa Oil Corp. -

Canadian Equities │ As at June 30, 2020

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2020 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) ROYAL BANK OF CANADA 11,271,593 ATS AUTOMATION TOOLING SYS INC 1,384,288 TORONTO DOMINION BANK 9,536,684 ENGHOUSE SYSTEMS LTD 1,291,660 SHOPIFY INC 8,737,059 RESTAURANT BRANDS INTL INC 1,290,046 BROOKFIELD ASSET MGMT INC 7,011,275 NORBORD INC 1,262,688 BARRICK GOLD CORP 6,630,926 WINPAK LTD 1,238,925 CANADIAN PACIFIC RAILWAY LTD 6,483,728 ENBRIDGE INC 1,193,735 CONSTELLATION SOFTWARE INC 6,413,612 ONEX CORP 1,170,728 ALIMENTATION COUCHE-TARD INC 6,178,610 LASSONDE INDUSTRIES INC 1,082,435 FRANCO-NEVADA CORP 5,398,387 ARITZIA INC 1,076,555 TC ENERGY CORP 5,050,176 FIRSTSERVICE CORP 1,075,129 SUN LIFE FINANCIAL INC 4,033,656 GDI INTEGRATED FAC SVCS INC 1,072,430 FORTIS INC 3,645,439 ELEMENT FLEET MANAGEMENT CORP 964,862 SUNCOR ENERGY INC 3,358,993 SAVARIA CORP 934,213 CANADIAN NATIONAL RAILWAY CO 3,191,563 EQUITABLE GROUP INC 871,672 INTACT FINANCIAL CORP 2,984,363 PARKLAND CORP 863,920 THOMSON REUTERS CORP 2,548,130 CHOICE PROPERTIES REIT 846,535 WHEATON PRECIOUS METALS CORP 2,543,825 FIRST QUANTUM MINERALS LTD 842,348 MANULIFE FINANCIAL CORP 2,543,799 ALTUS GROUP LTD 836,113 CANADIAN APARTMENT PPTYS REIT 2,514,435 LOGISTEC CORP 820,545 CGI INC 2,501,068 LEON'S FURNITURE LTD 771,345 DOLLARAMA INC 2,438,279 BOYD GROUP SERVICES INC 755,338 PEMBINA PIPELINE CORP 2,352,178 BADGER DAYLIGHTING LTD 688,969 COLLIERS INTL GROUP INC 2,133,136 METHANEX -

Corporate Board Governance and Director Compensation in Canada

Corporate Board Governance and Director Compensation in Canada A Review of 2014 In Partnership with Patrick O’Callaghan and Associates $110.00 per copy © Korn Ferry, January 2015 All rights reserved. No part of the contents of this report may be reproduced or transmitted in any form or by any means without the written permission of the Publisher. This report is also available in French. Table of contents The Surveyed Companies 2 Special Report: Counting the Hours 6 Board Independence 20 Board Composition 28 Board Size 40 Board Assessments, Director Selection and Director Development 44 Meetings and Attendance 52 Board Committees 56 Director Compensation 60 Board Chair Compensation 68 Lead Director Compensation 72 Committee Chair Compensation 74 Committee Member Compensation 80 Stock-Based Compensation 84 Director Share Ownership 89 Company Data 93 Endnotes 102 Korn Ferry 105 Patrick O’Callaghan and Associates 107 1 The Surveyed Companies The Most Comprehensive Canadian Governance Study We are pleased to present the most comprehensive review of public issuer governance data available in Canada. This twenty-second annual report examines governance in Canadian companies and includes our special report, Counting The Hours: How Time Consuming Is It To Be A Canadian Director? Our commitment is to provide directors and trustees with accurate and relevant Canadian data across a wide spectrum. 2 The data is collected from publicly traded companies that were on one or more of the following lists: * The Financial Post Top 210 (June 2014) * The Report on Business Top 205 (July 2014) * The S&P/TSX Composite Index (at any time during 2013) • We draw data from annual reports, management proxy circulars and annual information forms for fiscal year-ends in late 2013, or the first few months of 2014. -

Top News Before the Bell Stocks To

TOP NEWS • Thousands of Canadian National Railway workers go on strike About 3,000 workers of Canadian National Railway, the country's largest railroad operator, went on strike, labor union Teamsters Canada said after both parties failed to resolve contract issues. • EXCLUSIVE-Mine workers demanded more protection before deadly Burkina Faso attack Five months before an ambush killed 39 colleagues, local workers at a Canadian-owned gold mine in Burkina Faso pleaded with managers to fly them to the site rather than go by a road that was prone to attacks, two people present at the meeting said. • Keystone operator TC Energy sees EBITDA exceeding C$10 billion in 2022 Canada's TC Energy said it expects comparable earnings before interest, taxes, depreciation and amortization to exceed C$10 billion in 2022, driven by long-term contracts and assets. • Trump's "Section 232" autos tariff authority runs out of time, experts say The clock has run out on President Donald Trump's authority to impose "Section 232" tariffs on imports of foreign-made cars and auto parts, and he may have to find other means if he wants to pursue tariffs on European or Japanese cars, legal experts say. • Sales of grounded Boeing 737 MAX gather pace at Dubai Airshow Boeing's 737 MAX took centre stage at the Dubai Airshow as airlines announced plans to order up to 50 of the jets worth $6 billion at list prices despite a global grounding in place since March. BEFORE THE BELL Canada's main stock index futures gained, mirroring Wall Street futures, on fresh hopes over the progress in trade talks between the U.S. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

Top Stocks Canada Accelerate Alpha Rank

December 2020 Accelerate Alpha Rank - Top Stocks Canada Past Month Performance of Top Decile Alpha Rank Portfolio Growth of 100K in Top Decile Alpha Rank Portfolio over 5 Years 150,000 10.4% 125,000 100,000 -0.4% 75,000 Nov/2015 Nov/2016 Nov/2017 Nov/2018 Nov/2019 Nov/2020 TSX` 60 Total Return Top Decile AlphaRank Price Operating Company Alpha Rank* Value Quality Momentum Momentum Trend ATD.B Alimentation Couche-Tard Inc 95.3 OSB Norbord Inc 95.2 PBL Pollard Banknote Ltd 94.8 LAS.A Lassonde Industries Inc 94.7 WJX Wajax Corp 94.7 QBR.B Quebecor Inc 94.6 TCL.A Transcontinental Inc 94.6 CFP Canfor Corp 94.4 RME Rocky Mountain Dealerships Inc 94.1 ORA Aura Minerals Inc 94.0 Accelerate Alpha Rank - Bottom Stocks Canada Past Month Performance of Bottom Decile Alpha Rank Portfolio Growth of 100K in Bottom Decile Alpha Rank Portfolio over 5 Years 175,000 10.4% 150,000 125,000 100,000 75,000 -3.8% 50,000 TSX 60 Total Return Bottom Decile AlphaRank Nov/2015 Nov/2016 Nov/2017 Nov/2018 Nov/2019 Nov/2020 Price Operating Company Alpha Rank* Value Quality Momentum Momentum Trend OGI Organigram Holdings Inc 0.5 KEL Kelt Exploration Ltd 2.0 FURY Fury Gold Mines Ltd 2.2 AC Air Canada 2.5 NVO Novo Resources Corp 3.8 SCR Score Media And Gaming Inc 4.1 HSE Husky Energy Inc 4.3 SDE Spartan Delta Corp 4.7 BSR Bluestone Resources Inc/Canada 4.8 TRZ Transat AT Inc 5.6 * AlphaRank is ex clusiv ely produced by Accelerate Financial Technologies Inc. -

5N Plus 5N Plus A&W Revenue Royalties Aberdeen Asia-Pacific Inc

Toronto Stock Exchange - The Globe and Mail - September 28, 2018 Company Symbol Last Price 52W 52W 1 Year Vol. Yr P/E Div. High Low % Chg (000) Yield 5N Plus VNP.DB 101.000 101.750 98.550 .50 7884 594.12 0.0 5N Plus VNP 3.300 3.730 2.220 3.26 11368 19.41 0.0 A&W Revenue Royalties AW.UN 36.250 37.740 28.360 -2.43 2719 19.81 4.7 Aberdeen Asia-Pacific Inc Inve FAP 3.290 4.750 3.190 -29.35 9527 11.34 12.0 Aberdeen International Inc. AAB 0.080 0.210 0.080 -46.43 13537 .80 0.0 Absolute Software ABT 7.490 8.820 6.060 -9.79 9602 62.42 4.3 Acadian Timber Corp. ADN 18.220 20.240 18.050 -3.95 1196 11.75 6.1 Acasta Enterprises AEF.WT 0.015 0.650 0.005 -97.78 14702 na 0.0 Acasta Enterprises AEF 1.150 6.700 0.760 -81.26 10656 na 0.0 Accord Financial ACD 10.130 10.150 8.220 12.36 259 14.07 3.6 Acerus Pharmaceuticals Corp. ASP.WT 0.030 0.050 0.025 - 2959 na 0.0 Acerus Pharmaceuticals Corp. ASP 0.250 0.520 0.095 95.83 42452 na 0.0 ACTIVEnergy Income Fund AEU.UN 4.230 4.230 4.230 .00 0 na 5.7 ADF Group DRX 1.640 2.790 1.200 -39.62 479 na 1.2 Advantage Oil & Gas AAV 3.600 8.120 3.110 -51.49 238651 24.00 0.0 Advantaged Cdn High Yd Bond AHY.UN 7.800 8.000 7.440 .65 200 5.27 5.0 Aecon Group ARE 16.230 20.060 14.270 -4.22 67782 27.05 3.1 Aecon Group ARE.DB.B 100.260 103.750 100.000 -3.31 43892 167.10 0.0 AEterna Zentaris (D) AEZS 2.250 4.170 1.500 -16.35 2384 14.06 0.0 Africa Oil Corp.