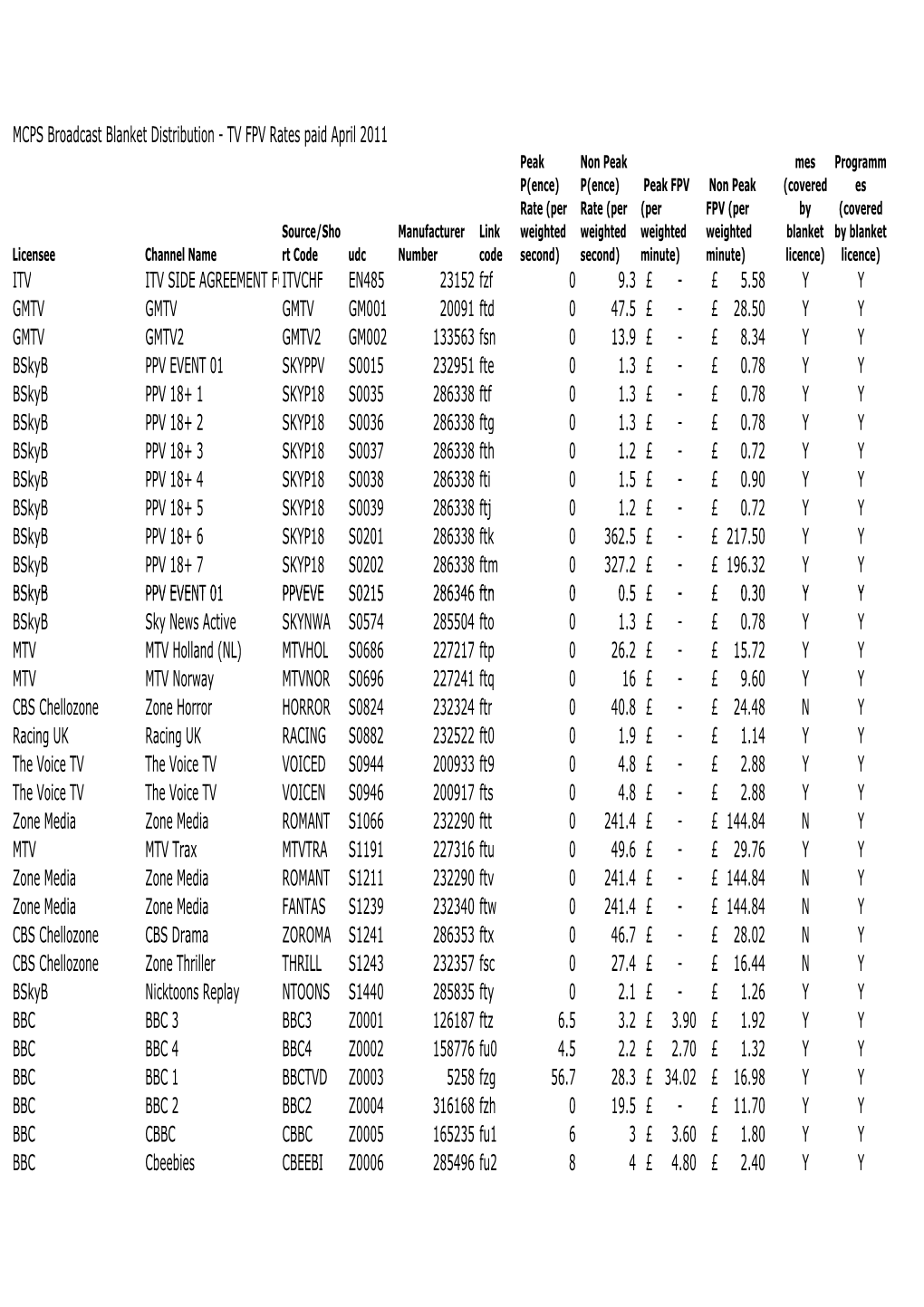

MCPS TV Fpvs Apr 2011.Csv

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Where Are the Audiences?

WHERE ARE THE AUDIENCES? Full Report Introduction • New Zealand On Air (NZ On Air) supports and funds audio and visual public media content for New Zealand audiences. It does so through the platform neutral NZ Media Fund which has four streams; scripted, factual, music, and platforms. • Given the platform neutrality of this fund and the need to efficiently and effectively reach both mass and targeted audiences, it is essential NZ On Air have an accurate understanding of the current and evolving behaviour of NZ audiences. • To this end NZ On Air conduct the research study Where Are The Audiences? every two years. The 2014 benchmark study established a point in time view of audience behaviour. The 2016 study identified how audience behaviour had shifted over time. • This document presents the findings of the 2018 study and documents how far the trends revealed in 2016 have moved and identify any new trends evident in NZ audience behaviour. • Since the 2016 study the media environment has continued to evolve. Key changes include: − Ongoing PUTs declines − Anecdotally at least, falling SKY TV subscription and growth of NZ based SVOD services − New TV channels (eg. Bravo, HGTV, Viceland, Jones! Too) and the closure of others (eg. FOUR, TVNZ Kidzone, The Zone) • The 2018 Where Are The Audiences? study aims to hold a mirror up to New Zealand and its people and: − Inform NZ On Air’s content and platform strategy as well as specific content proposals − Continue to position NZ On Air as a thought and knowledge leader with stakeholders including Government, broadcasters and platform owners, content producers, and journalists. -

Smartglass International “Tunes In” to ITV Daybreak…

Project Case Study No. 19 SmartGlass International “tunes in” to ITV Daybreak… Client: ITV Daybreak Operator: GMTV Limited Daybreak is the weekday breakfast television programme Contract Size: £135k broadcast from 6:00am to 8:30am for the British commercial ITV Date: August 2010 network anchored by Adrian Chiles and Christine Bleakley. The ability to instantly switch the glass to maximize daylight when Daybreak took to the air on Monday 6 th September as the much- it’s really needed and to provide controllable solar shading during heralded replacement for breakfast TV show GMTV. More than peak light conditions is valuable and unique. This feature is one million people tuned in to see the launch of ITV's new especially useful for application in a television studio as it allows breakfast show - an improvement over its predecessor, GMTV. for maximum daylight to enter without compromising recording ITV said the show, which featured an interview with former Prime quality and controls room temperature which is also critical in this Minister Tony Blair, peaked at 1.5m viewers. ITV are one of the particular environment. UK’s largest broadcasting stations and reach approximately 13 million viewers a week with Daybreak regularly accounting for a Daybreak is broadcast from dawn meaning the levels of sunlight large proportion of this. entering the studio vary throughout the morning. When the sun is just rising over London the backdrop is in darkness, at this stage The Daybreak studio is located in the heart of London at South the glass is at its clearest state where it will allow for maximum Bank studios. -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

Pre-Upfront Thoughts on Broadcast TV, Promotions, Nielsen, and AVOD by Steve Sternberg

April 2021 #105 ________________________________________________________________________________________ _______ Pre-Upfront Thoughts on Broadcast TV, Promotions, Nielsen, and AVOD By Steve Sternberg Last year’s upfront season was different from any I’ve been involved in during my 40 years in the business. Because of the COVID-19 pandemic, there were no live network presentations to the industry, and for the first time since I’ve been evaluating television programming, I did not watch any of the fall pilots before the shows aired. Many new and returning series experienced production delays, resulting in staggered premieres, shortened seasons, and unexpected cancellations. The big San Diego and New York comic-cons were canceled. There was virtually no pre-season buzz for new broadcast or cable series. Stuck at home with fewer new episodes of scripted series than ever to watch on ad-supported TV, people turned to streaming services in large numbers. Netflix, which had plenty of shows in the pipeline, surged in terms of both viewers and new subscribers. Disney+, boosted by season 2 of The Mandalorian and new Marvel series, WandaVision and Falcon and the Winter Soldier, was able to experience tremendous growth. A Sternberg Report Sponsored Message The Sternberg Report ©2021 ________________________________________________________________________________________ _______ Amazon Prime Video, and Hulu also managed to substantially grow their subscriber bases. Warner Bros. announcing it would release all of its movies in 2021 simultaneously in theaters and on HBO Max (led by Wonder Woman 1984 and Godzilla vs. Kong), helped add subscribers to that streaming platform as well – as did its successful original series, The Flight Attendant. CBS All Access, rebranded as Paramount+, also enjoyed growth. -

British Sky Broadcasting Group Plc Annual Report 2009 U07039 1010 P1-2:BSKYB 7/8/09 22:08 Page 1 Bleed: 2.647 Mm Scale: 100%

British Sky Broadcasting Group plc Annual Report 2009 U07039 1010 p1-2:BSKYB 7/8/09 22:08 Page 1 Bleed: 2.647mm Scale: 100% Table of contents Chairman’s statement 3 Directors’ report – review of the business Chief Executive Officer’s statement 4 Our performance 6 The business, its objectives and its strategy 8 Corporate responsibility 23 People 25 Principal risks and uncertainties 27 Government regulation 30 Directors’ report – financial review Introduction 39 Financial and operating review 40 Property 49 Directors’ report – governance Board of Directors and senior management 50 Corporate governance report 52 Report on Directors’ remuneration 58 Other governance and statutory disclosures 67 Consolidated financial statements Statement of Directors’ responsibility 69 Auditors’ report 70 Consolidated financial statements 71 Group financial record 119 Shareholder information 121 Glossary of terms 130 Form 20-F cross reference guide 132 This constitutes the Annual Report of British Sky Broadcasting Group plc (the ‘‘Company’’) in accordance with International Financial Reporting Standards (‘‘IFRS’’) and with those parts of the Companies Act 2006 applicable to companies reporting under IFRS and is dated 29 July 2009. This document also contains information set out within the Company’s Annual Report to be filed on Form 20-F in accordance with the requirements of the United States (“US”) Securities and Exchange Commission (the “SEC”). However, this information may be updated or supplemented at the time of filing of that document with the SEC or later amended if necessary. This Annual Report makes references to various Company websites. The information on our websites shall not be deemed to be part of, or incorporated by reference into, this Annual Report. -

MCPS TV Fpvs

MCPS Broadcast Blanket Distribution - TV FPV Rates paid July 2014 Non Peak Non Peak Progs Progs P(ence) P(ence) Peak FPV Non Peak (covered (covered Manufact Period Rate (per Rate (per (per FPV (per by by Source/S urer Source Link (YYMMYYM weighted weighted weighted weighted blanket blanket Licensee Channel Name hort Code udc Number Type code M) second) second) minute) minute) licence) licence) AATW Ltd Channel AKA CHNAKA S1759 287294 208 qbc 13091312 0.015 0.009 Y Y BBC BBC 1 BBCTVD Z0003 5258 201 qdw 14011403 75.452 37.726 45.2712 22.6356 Y Y BBC BBC 2 BBC2 Z0004 316168 201 qdx 14011403 17.879 8.939 10.7274 5.3634 Y Y BBC BBC ALBA BBCALB Z0008 232662 201 qe2 14011403 6.48 3.24 3.888 1.944 Y Y BBC BBC HD BBCHD Z0010 232654 201 qe4 14011403 6.095 3.047 3.657 1.8282 Y Y BBC BBC Interactive BBCINT AN120 251209 201 qbk 14011403 6.854 4.1124 Y Y BBC BBC News BBC NE Z0007 127284 201 qe1 14011403 8.193 4.096 4.9158 2.4576 Y Y BBC BBC Parliament BBCPAR Z0009 316176 201 qe3 14011403 13.414 6.707 8.0484 4.0242 Y Y BBC BBC Side Agreement for S4C BBCS4C Z0222 316184 201 qip 14011403 7.747 4.6482 Y Y BBC BBC3 BBC3 Z0001 126187 201 qdu 14011403 15.677 7.838 9.4062 4.7028 Y Y BBC BBC4 BBC4 Z0002 158776 201 qdv 14011403 9.205 4.602 5.523 2.7612 Y Y BBC CBBC CBBC Z0005 165235 201 qdy 14011403 8.96 4.48 5.376 2.688 Y Y BBC Cbeebies CBEEBI Z0006 285496 201 qdz 14011403 12.457 6.228 7.4742 3.7368 Y Y BBC Worldwide BBC Entertainment Africa BBCENA Z0296 286601 201 qk2 14011403 5.556 2.778 3.3336 1.6668 N Y BBC Worldwide BBC Entertainment Nordic BBCENN Z0300 -

Liste Des Chaines

Available channel temporary unabled channel disabled channel Channels List channel replay Setanta Sport 46 92 Gold Family UK Asian UK 47 Box Nation channel number channel name 93 Dave channel number channel name channel number channel name 48 ESPN HD 1 beIN Sports News HD 94 Alibi 104 SKY ONE 158 Zee tv UK 49 Eurosport UK 95 E4 105 Sky Two UK 159 Zee cinema UK 2 Bein Sports Global HD 50 Eurosport 2 UK 96 More 4 106 Sky Living 160 Zee Punjabi UK 3 BEIN SPORT 1 HD 51 Sky Sports News 97 Dmax 107 Sky Atlantic UK 161 Zing UK 52 At The Races 4 BEIN SPORT 2 HD 98 5 STAR 108 Sky Arts1 162 Star Gold UK 53 Racing UK 5 BEIN SPORT 3 HD 99 3E 109 Sky Real Lives UK 163 Star Jalsha UK 54 Motor TV 100 Magic 110 Fox UK 164 Star Plus UK 6 BEIN SPORT 4 HD 55 Manchester United Tv 101 TV 3 111 Comedy Central UK 165 Star live UK 7 BEIN SPORT 5 HD 56 Chealsea Tv 102 Film 4 121 Comedy Central Extra UK 166 Ary Digital UK 57 Liverpool Tv 8 BEIN SPORT 6 HD 103 Flava 125 Nat Geo UK 167 Sony Tv UK 113 Food Network 126 Nat Geo Wild uk 168 Sony Sab Tv UK 9 BEIN SPORT 7 HD Cinema Uk 114 The Vault 127 Discovery UK 169 Aaj Tak UK 10 BEIN SPORT 8 HD channel number channel name 115 CBS Reality 128 Discovery Science uk 170 Geo TV UK 60 Sky Movies Premiere UK 11 BEIN SPORT 9 HD 116 CBS Action 129 Discovery Turbo UK 171 Geo news UK 61 Sky Select UK 12 BEIN SPORT 10 HD 130 Discovery History 172 ABP news Uk 62 Sky Action UK 117 CBS Drama 131 Discovery home UK 13 BEIN SPORT 11 HD 63 Sky Modern Great UK 118 True Movies 132 Investigation Discovery 64 Sky Family UK 119 True Movies -

Annex 2: Providers Required to Respond (Red Indicates Those Who Did Not Respond Within the Required Timeframe)

Video on demand access services report 2016 Annex 2: Providers required to respond (red indicates those who did not respond within the required timeframe) Provider Service(s) AETN UK A&E Networks UK Channel 4 Television Corp All4 Amazon Instant Video Amazon Instant Video AMC Networks Programme AMC Channel Services Ltd AMC Networks International AMC/MGM/Extreme Sports Channels Broadcasting Ltd AXN Northern Europe Ltd ANIMAX (Germany) Arsenal Broadband Ltd Arsenal Player Tinizine Ltd Azoomee Barcroft TV (Barcroft Media) Barcroft TV Bay TV Liverpool Ltd Bay TV Liverpool BBC Worldwide Ltd BBC Worldwide British Film Institute BFI Player Blinkbox Entertainment Ltd BlinkBox British Sign Language Broadcasting BSL Zone Player Trust BT PLC BT TV (BT Vision, BT Sport) Cambridge TV Productions Ltd Cambridge TV Turner Broadcasting System Cartoon Network, Boomerang, Cartoonito, CNN, Europe Ltd Adult Swim, TNT, Boing, TCM Cinema CBS AMC Networks EMEA CBS Reality, CBS Drama, CBS Action, Channels Partnership CBS Europe CBS AMC Networks UK CBS Reality, CBS Drama, CBS Action, Channels Partnership Horror Channel Estuary TV CIC Ltd Channel 7 Chelsea Football Club Chelsea TV Online LocalBuzz Media Networks chizwickbuzz.net Chrominance Television Chrominance Television Cirkus Ltd Cirkus Classical TV Ltd Classical TV Paramount UK Partnership Comedy Central Community Channel Community Channel Curzon Cinemas Ltd Curzon Home Cinema Channel 5 Broadcasting Ltd Demand5 Digitaltheatre.com Ltd www.digitaltheatre.com Discovery Corporate Services Discovery Services Play -

Stream Name Category Name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---TNT-SAT ---|EU| FRANCE TNTSAT TF1 SD |EU|

stream_name category_name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---------- TNT-SAT ---------- |EU| FRANCE TNTSAT TF1 SD |EU| FRANCE TNTSAT TF1 HD |EU| FRANCE TNTSAT TF1 FULL HD |EU| FRANCE TNTSAT TF1 FULL HD 1 |EU| FRANCE TNTSAT FRANCE 2 SD |EU| FRANCE TNTSAT FRANCE 2 HD |EU| FRANCE TNTSAT FRANCE 2 FULL HD |EU| FRANCE TNTSAT FRANCE 3 SD |EU| FRANCE TNTSAT FRANCE 3 HD |EU| FRANCE TNTSAT FRANCE 3 FULL HD |EU| FRANCE TNTSAT FRANCE 4 SD |EU| FRANCE TNTSAT FRANCE 4 HD |EU| FRANCE TNTSAT FRANCE 4 FULL HD |EU| FRANCE TNTSAT FRANCE 5 SD |EU| FRANCE TNTSAT FRANCE 5 HD |EU| FRANCE TNTSAT FRANCE 5 FULL HD |EU| FRANCE TNTSAT FRANCE O SD |EU| FRANCE TNTSAT FRANCE O HD |EU| FRANCE TNTSAT FRANCE O FULL HD |EU| FRANCE TNTSAT M6 SD |EU| FRANCE TNTSAT M6 HD |EU| FRANCE TNTSAT M6 FHD |EU| FRANCE TNTSAT PARIS PREMIERE |EU| FRANCE TNTSAT PARIS PREMIERE FULL HD |EU| FRANCE TNTSAT TMC SD |EU| FRANCE TNTSAT TMC HD |EU| FRANCE TNTSAT TMC FULL HD |EU| FRANCE TNTSAT TMC 1 FULL HD |EU| FRANCE TNTSAT 6TER SD |EU| FRANCE TNTSAT 6TER HD |EU| FRANCE TNTSAT 6TER FULL HD |EU| FRANCE TNTSAT CHERIE 25 SD |EU| FRANCE TNTSAT CHERIE 25 |EU| FRANCE TNTSAT CHERIE 25 FULL HD |EU| FRANCE TNTSAT ARTE SD |EU| FRANCE TNTSAT ARTE FR |EU| FRANCE TNTSAT RMC STORY |EU| FRANCE TNTSAT RMC STORY SD |EU| FRANCE TNTSAT ---------- Information ---------- |EU| FRANCE TNTSAT TV5 |EU| FRANCE TNTSAT TV5 MONDE FBS HD |EU| FRANCE TNTSAT CNEWS SD |EU| FRANCE TNTSAT CNEWS |EU| FRANCE TNTSAT CNEWS HD |EU| FRANCE TNTSAT France 24 |EU| FRANCE TNTSAT FRANCE INFO SD |EU| FRANCE TNTSAT FRANCE INFO HD -

Annex 4: Report from the States of the European Free Trade Association Participating in the European Economic Area

ANNEX 4: REPORT FROM THE STATES OF THE EUROPEAN FREE TRADE ASSOCIATION PARTICIPATING IN THE EUROPEAN ECONOMIC AREA 1. Application by the EFTA States participating in the EEA 1.1 Iceland European works The seven covered channels broadcast an average of 39.6% European works in 2007 and 42.2% in 2008. This represents a 2.6 percentage point increase over the reference period. For 2007 and 2008, of the total of seven covered channels, three channels achieved the majority proportion specified in Article 4 of the Directive (Omega Television, RUV and Syn - Vision TV), while four channels didn't meet this target (Sirkus, Skjár 1, Stöð 2 and Stöð 2 Bio). The compliance rate, in terms of numbers of channels, was 42.9%. European works made by independent producers The average proportion of European works by independent producers on all reported channels was 10.7% in 2007 and 12.6% in 2008, representing a 1.9 percentage points increase over the reference period. In 2007, of the total of seven identified channels, two channels exceeded the minimum proportion under Article 5 of the Directive, while three channels remained below the target. One channel was exempted (Syn - Vision TV) and no data was communicated for another one (Omega Television). The compliance rate, in terms of number of channels, was 33.3%. For 2008, of the total of seven covered channels, three exceeded the minimum proportion specified in Article 5 of the Directive, while two channels were below the target (Skjár 1 and Stöð 2 Bio). No data were communicated for two channels. -

Broadcast Bulletin Issue Number 45

* Ofcom broadcast bulletin Issue number 45 10 October 2005 Ofcom broadcast bulletin 45 10 October 2005 Contents Introduction 3 Standards cases In Breach 4 Resolved 8 Other programmes not in breach/outside remit 11 2 Ofcom broadcast bulletin 45 10 October 2005 Introduction Ofcom’s Broadcasting Code took effect on 25 July 2005 (with the exception of Rule 10.17 which came into effect on 1 July 2005). This Code is used to assess the compliance of all programmes broadcast on or after 25 July 2005. The Broadcasting Code can be found at http://www.ofcom.org.uk/tv/ifi/codes/bcode/ The Rules on the Amount and Distribution of Advertising (RADA) apply to advertising issues within Ofcom’s remit from 25 July 2005. The Rules can be found at http://www.ofcom.org.uk/tv/ifi/codes/advertising/#content The Communications Act 2003 allowed for the codes of the legacy regulators to remain in force until such time as Ofcom developed its own Code. While Ofcom has now published its Broadcasting Code, the following legacy Codes apply to content broadcast before 25 July 2005. • Advertising and Sponsorship Code (Radio Authority) • News & Current Affairs Code and Programme Code (Radio Authority) • Code on Standards (Broadcasting Standards Commission) • Code on Fairness and Privacy (Broadcasting Standards Commission) • Programme Code (Independent Television Commission) • Programme Sponsorship Code (Independent Television Commission) • Rules on the Amount and Distribution of Advertising From time to time adjudications relating to advertising content may appear in the bulletin in relation to areas of advertising regulation which remain with Ofcom (including the application of statutory sanctions by Ofcom). -

SKY NETWORK TELEVISION LIMITED ANNUAL REPORT JUNE 2016 the Way We Consume Entertainment Continues to Evolve at a Rapid Pace

SKY NETWORK TELEVISION LIMITED ANNUAL REPORT JUNE 2016 The way we consume entertainment continues to evolve at a rapid pace. This is an exciting new era for SKY that we look forward to NEW PLATFORMS. taking to a new level MORE CONTENT, with Vodafone NZ. MORE CHOICE. IT’S FAST FORWARD FOR SKY. SKY ANNUAL REPORT 2016 3 SKY AT A GLANCE 2 YEAR IN REVIEW Chairman’s Letter 4 Chief Executive’s Letter 6 Board of Directors 10 IN FOCUS Creating a Leading 12 Telecommunications and Media Group We’ve got the Best Shows 14 from the Best Studios Good Sport 16 Full Stream Ahead 18 COMMUNITY AND 20 SPONSORSHIP SKY CHANNELS 22 2016 FINANCIALS 24 Financial Overview 25 Financial Trends 29 Directors’ Responsibility 31 Statement Consolidated Statement of 32 Comprehensive Income Consolidated Balance Sheet 33 Consolidated Statement of 34 Changes in Equity Consolidated Statement of 35 Cash Flows Notes to the Consolidated 36 Financial Statements Independent Auditors’ Report 63 OTHER INFORMATION 64 Corporate Governance 65 Interests Register 67 Company and Bondholder 69 Information Waivers and Information 74 Share Market and 75 Other Information Directory 76 2 SKY ANNUAL REPORT 2016 SKY AT A GLANCE CUSTOMERS FINANCIAL PERFORMANCE This year we have more total customers across all Our financial performance remains strong. our products, with digital oerings FAN PASS and NEON 852,679 928M 325M driving the growth. KIWIS ENJOY SKY REVENUE EBITDA EVERY DAY 147M NPAT SOCIAL PEOPLE SKY’s social reach continues to grow, with over 800,000 We employ over 1,200 permanent employees followers across our entertainment and sports brands on 800,000 and work with over 500 contractors hailing from 1,254 the country’s most popular social media platforms.