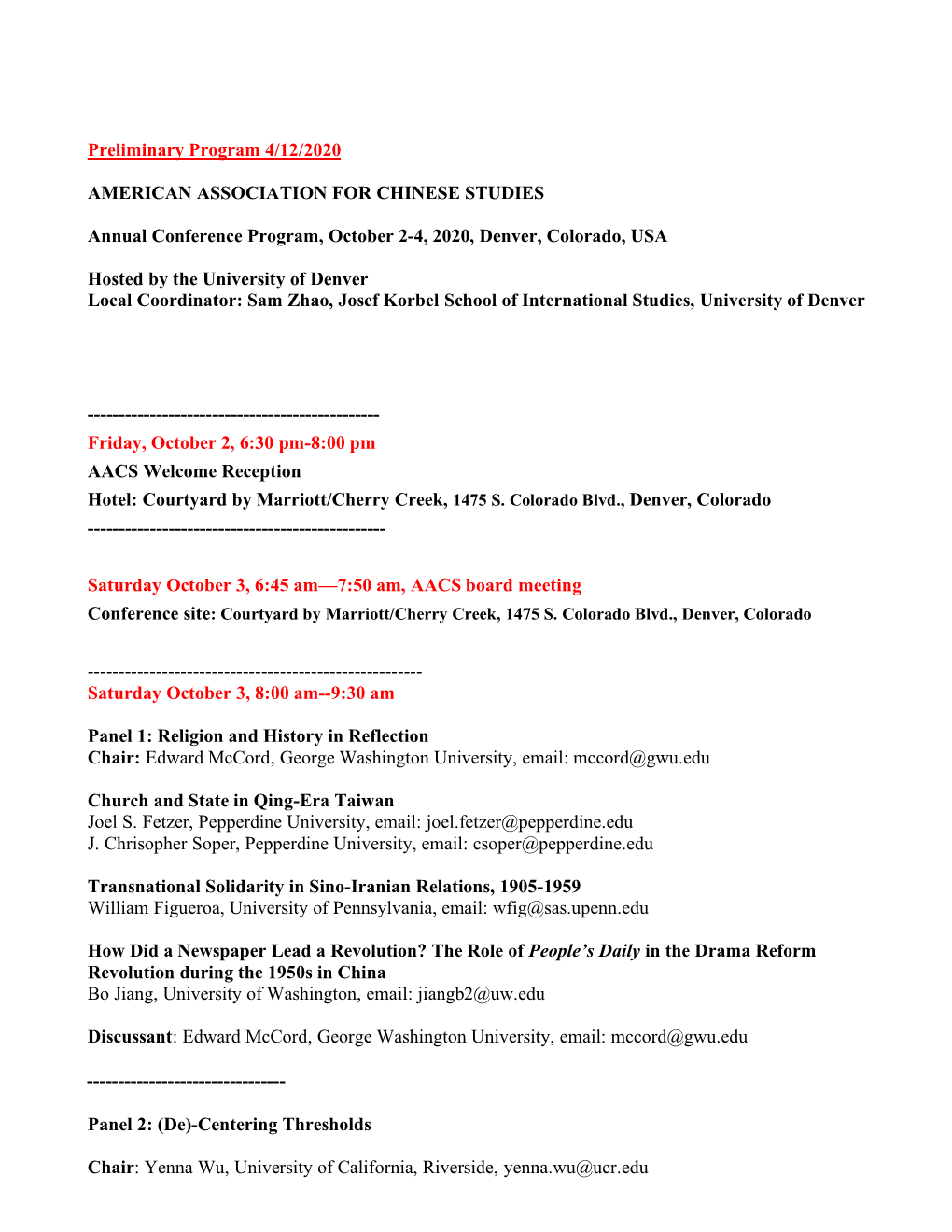

Preliminary Program 4/12/2020 AMERICAN ASSOCIATION for CHINESE STUDIES Annual Conference Program, October 2-4, 2020, Denver

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Integration of International Financial Regulatory Standards for the Chinese Economic Area: the Challenge for China, Hong Kong, and Taiwan Lawrence L.C

Northwestern Journal of International Law & Business Volume 20 Issue 1 Fall Fall 1999 Integration of International Financial Regulatory Standards for the Chinese Economic Area: The Challenge for China, Hong Kong, and Taiwan Lawrence L.C. Lee Follow this and additional works at: http://scholarlycommons.law.northwestern.edu/njilb Part of the International Law Commons, International Trade Commons, Law and Economics Commons, and the Securities Law Commons Recommended Citation Lawrence L.C. Lee, Integration of International Financial Regulatory Standards for the Chinese Economic Area: The hC allenge for China, Hong Kong, and Taiwan, 20 Nw. J. Int'l L. & Bus. 1 (1999-2000) This Article is brought to you for free and open access by Northwestern University School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of International Law & Business by an authorized administrator of Northwestern University School of Law Scholarly Commons. ARTICLES Integration of International Financial Regulatory Standards for the Chinese Economic Area: The Challenge for China, Hong Kong, and Taiwan Lawrence L. C. Lee* I. INTRODUCTION ................................................................................... 2 II. ORIGINS OF THE CURRENT FINANCIAL AND BANKING SYSTEMS IN THE CHINESE ECONOMIC AREA ............................................................ 11 * Lawrence L. C. Lee is Assistant Professor at Ming Chung University School of Law (Taiwan) and Research Fellow at Columbia University School of Law. S.J.D. 1998, Univer- sity of Wisconsin-Madison Law School; LL.M. 1996, American University Washington College of Law; LL.M. 1993, Boston University School of Law; and LL.B. 1991, Soochow University School of Law (Taiwan). Portions of this article were presented at the 1999 Con- ference of American Association of Chinese Studies and the 1997 University of Wisconsin Law School Symposium in Legal Regulation of Cross-Straits Commercial Activities among Taiwan, Hong Kong, and China. -

First Financial Restructuring and Operating Efficiency: Evidence from Taiwanese Commercial Banks

Journal of Banking & Finance 34 (2010) 1461–1471 Contents lists available at ScienceDirect Journal of Banking & Finance journal homepage: www.elsevier.com/locate/jbf First financial restructuring and operating efficiency: Evidence from Taiwanese commercial banks Hsing-Chin Hsiao a, Hsihui Chang b, Anna M. Cianci b,*, Li-Hua Huang a a Department of Accounting Information, National Taipei College of Business, Taipei City 100, Taiwan b Department of Accounting, LeBow College of Business, Drexel University, PA 19104, USA article info abstract Article history: This paper investigates the effect of the ‘‘First Financial Restructuring” (FFR) on the operating efficiency of Received 30 April 2008 commercial banks in Taiwan. Applying data envelopment analysis (DEA) to operations data for 40 com- Accepted 24 January 2010 mercial banks over the 6-year period 2000–2005, we find that while the banks have lower operating effi- Available online 1 February 2010 ciency on average during the reform period (2002–2003) compared to the pre-reform period (2000– 2001), improved operating efficiency is reflected in the post-reform period (2004–2005). Our results JEL classification: remain unchanged even after controlling for the non-performing loan ratio, capital adequacy ratio, bank G21 ownership, size, and GDP growth rate. These results suggest that the improved efficiency in the post- G28 reform period is possibly due to enhanced banking and risk management practices and benefits obtained Keywords: from compliance with the FFR. First Financial Restructuring (FFR) Ó 2010 Elsevier B.V. All rights reserved. Operating efficiency Commercial banks Data envelopment analysis (DEA) 1. Introduction an effort to foster banking efficiency (Denizer et al., 2007; Isik and Hassan, 2003; Zhao et al., 2010). -

A Cost Efficiency Analysis of Local Commercial Banks in Taiwan by Elaine Yiling Lin a Thesis Submitted in Partial Fulfillment Of

A Cost Efficiency Analysis of Local Commercial Banks in Taiwan By Elaine Yiling Lin A Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Science Applied Economics At The University of Wisconsin-Whitewater Table of Contents Title Page ....................................................................................................................... i. Approval Page ............................................................................................................... ii. Table of Contents ........................................................................................................ iii. List of Tables & Figures .............................................................................................. iv. Abstract ......................................................................................................................... v. 1. Introduction ............................................................................................................. 1 2. Literature Review .................................................................................................... 2 3. Model Specification ................................................................................................ 5 4. Data Description ..................................................................................................... 7 5. Empirical Results .................................................................................................... 8 6. Conclusion ........................................................................................................... -

Internationalization of the Taiwan Banking Industry, 1990-2001

International Journal of Social Science and Humanity, Vol. 5, No. 3, March 2015 Internationalization of the Taiwan Banking Industry, 1990-2001 Hsien-Jui Chung operational procedures. Regulation, prior to 1991, had the Abstract—This article depicts and analyses the effect of limiting the number of financial institutions and so internationalization of the banking industry in Taiwan during the industry expanded as banks established new branches the period 1999 to 2001. We draw on the perspective of across the country. As a result incumbent banks earned capabilities to describe and explain how banks’ domestic significant profits in a closed and stable financial operations experience prior to internationalization both restrained and contributed to overseas expansion. As a bank environment characterized by a low degree of competition has an initial internationalization experience, domestic Government policy focused on creating a stable platform experience did not prejudice the subsequent for economic development and this came at the expensive of internationalization. considering internationalization. The Government’s approach, initiated in 1970, was conservative and directed Index Terms—Banking, industry internationalization, towards newly-established financial institutions including overseas expansion, capability development. two overseas Chinese-funded banks (OCBC Bank and United Bank), two City-controlled Banks, an Export-Import I. INTRODUCTION Bank, a few private banks and a number of credit cooperatives. In other countries, such as South Africa and International expansion is an accumulative process in New Zealand, deregulation of the industry was having which firms developed their international operation significant effects on the internationalization of banks [2]. capabilities in a long period that are necessary for effective The Government in Taiwan, similarly, faced increasing calls management of international businesses [1]. -

Legal Aspects of Offshore Banking in Taiwan Ya-Huei Chen

Maryland Journal of International Law Volume 8 | Issue 2 Article 4 Legal Aspects of Offshore Banking in Taiwan Ya-Huei Chen Follow this and additional works at: http://digitalcommons.law.umaryland.edu/mjil Part of the International Law Commons, and the International Trade Commons Recommended Citation Ya-Huei Chen, Legal Aspects of Offshore Banking in Taiwan, 8 Md. J. Int'l L. 237 (1984). Available at: http://digitalcommons.law.umaryland.edu/mjil/vol8/iss2/4 This Article is brought to you for free and open access by DigitalCommons@UM Carey Law. It has been accepted for inclusion in Maryland Journal of International Law by an authorized administrator of DigitalCommons@UM Carey Law. For more information, please contact [email protected]. LEGAL ASPECTS OF OFFSHORE BANKING IN TAIWAN YA-HUEI CHEN* I. INTRODUCTION Taiwan has enjoyed uniformly high growth rates since the early 1950's, except during the 1974-75 oil crisis.' It is expected that the gains already achieved will be held and that economic development will con- tinue.' The demand for capitakis increasing because of this economic and industrial development, but the financial market in Taiwan is still poorly developed and generally unresponsive to market demand.' Financial ser- vices in Taiwan have been criticized as being inadequate, inefficient, disor- derly and too conservative. The liberalization, reorganization, moderniza- tion and internationalization of Taiwan's financial system is necessary and imminent.' The expansion and internationalization of the capital market is a prior- ity of Taiwan's government. Progress has already been made toward en- hancing Taiwan's economic position by making the country an international financial center. -

Online Banking Information

Information Management and Business Review Vol. 4, No. 11, pp. 570-582, Nov 2012 (ISSN 2220-3796) Customer Adoption of Internet Banking: An Empirical Investigation in Taiwanese Banking Context *Chao Chao Chuang, Fu-Ling Hu Hsing Wu University, Taiwan *[email protected] Abstract: In these days, banks work hard to attract consumers and keep their market share by providing them with more innovative services through Internet banking. Banking services are now just at the distance of one click from the mouse. The purpose of this paper is to explore how and why specific factors affect adoption of Internet banking in Taiwan context. The findings suggest six identified factors are significant in respect of customers’ adoption of Internet banking services. Convenience, accessibility and feature availability are the main motivators for consumers to use Internet banking service. Results also reveal that security and privacy play important roles in discouraging the customers to use Internet banking services. Conclusions and managerial suggestions are proposed to provide a practical contribution for bank managers to better understand customers’ perception of e-banking service quality and enhance customers’ adoption rates. Keywords: Internet banking, banking services, customer adoption 1. Introduction In recent years, Internet banking has experienced amazing growth and has changed conventional banking practice. Internet banking users can access their accounts very easily through logging in to the bank’s website with their personal identification numbers and passwords. Internet banking services include checking accounts balance, paying bills, transferring money between bank accounts, investing, trading foreign currency, etc. By providing Internet banking services, conventional financial institutions hope to lower operational costs, enhance banking service quality, and make customer relationship management more effective to further increase market share. -

The Prolonged Reform of Taiwan's State-Owned Banks (1989-2005)

China Perspectives 2007/1 | 2007 Climate change: the China Challenge The Prolonged Reform of Taiwan's State-owned Banks (1989-2005) Chia-Feng Leou Édition électronique URL : http://journals.openedition.org/chinaperspectives/1343 DOI : 10.4000/chinaperspectives.1343 ISSN : 1996-4617 Éditeur Centre d'étude français sur la Chine contemporaine Édition imprimée Date de publication : 15 janvier 2007 ISSN : 2070-3449 Référence électronique Chia-Feng Leou, « The Prolonged Reform of Taiwan's State-owned Banks (1989-2005) », China Perspectives [En ligne], 2007/1 | 2007, mis en ligne le 08 avril 2008, consulté le 28 octobre 2019. URL : http://journals.openedition.org/chinaperspectives/1343 ; DOI : 10.4000/chinaperspectives.1343 © All rights reserved Economy s e Financial Liberalisation and v i a t c n i Democratisation: e h p s c The Prolonged Reform of Taiwan’s State-Owned Banks (1989-2005) r e p CHIA-FENG LEOU Following the global trend of financial liberalisation, Taiwan’s government has dedicated itself to its own financial “Big Bang” since the late 1980s. An essential part of this financial overhaul has been the reform of the state-owned banks (SOBs). It was believed that privatisation and deregulation of the SOBs could effectively enhance the efficiency of Taiwan’s financial sector. After almost two decades, however, the reform is still not complete. Given its importance, the question arises: why is it taking so long? This article argues that the state has been unable to implement its planned reform policies as its ability to carry out the SOB reform has been significantly constrained by the newly rising political forces resulting from Taiwan’s democratisation. -

Taiwan and Los Angeles County

Taiwan and Los Angeles County Taipei World Trade Center Taiwan and Los Angeles County Prepared by: Ferdinando Guerra, International Economist Principal Researcher and Author Robert A. Kleinhenz, Ph.D., Chief Economist Kimberly Ritter-Martinez, Economist George Entis, Research Analyst February 2015 Los Angeles County Economic Development Corporation Kyser Center for Economic Research 444 S. Flower St., 37th Floor Los Angeles, CA 90071 Tel: (213) 622-4300 or (888) 4-LAEDC-1 Fax: (213)-622-7100 E-mail: [email protected] Web: http://www.laedc.org The LAEDC, the region’s premier business leadership organization, is a private, non-profit 501(c)3 organization established in 1981. GROWING TOGETHER • Taiwan and Los Angeles County As Southern California’s premier economic development organization, the mission of the LAEDC is to attract, retain, and grow businesses and jobs for the regions of Los Angeles County. Since 1996, the LAEDC has helped retain or attract more than 198,000 jobs, providing over $12 billion in direct economic impact from salaries and over $850 million in property and sales tax revenues to the County of Los Angeles. LAEDC is a private, non-profit 501(c)3 organization established in 1981. Regional Leadership The members of the LAEDC are civic leaders and ranking executives of the region’s leading public and private organizations. Through financial support and direct participation in the mission, programs, and public policy initiatives of the LAEDC, the members are committed to playing a decisive role in shaping the region’s economic future. Business Services The LAEDC’s Business Development and Assistance Program provides essential services to L.A. -

DP61 Achieving Effective Governance Under Divided Government and Private Interest Group Pressure

Discussion Paper 53 Achieving Effective Governance under Divided Government and Private Interest Group Pressure: Taiwan’s 2001 Financial Holding Company Law Sebastian Brück Laixiang Sun Department of Financial & Management Studies, SOAS, University of London, London WC1H 0XG, United Kingdom (THIS VERSION: (11 JANUARY 2006)) ABSTRACT In recent years, the division of Taiwan’s government between a DPP-led executive and opposition-dominated legislature has led to rather inefficient policy-making. This problem has been exacerbated by the increasing involvement of interest groups in the island’s legislative process. Drawing on the case of the 2001 Financial Holding Company Law, this paper examines the conditions under which effective governance can still be achieved in Taiwan. The law, which allowed commercial banks, investment banks and insurance companies to be integrated within one legal entity, had been devised by the Chen administration to address Taiwan’s most severe banking crisis in decades. Analyzing its adoption process shows that concerted media pressure can succeed in forcing Taiwan’s major parties to jointly pursue beneficial legislation. Furthermore, the paper argues that interest group involvement in Taiwanese policy-making does not necessarily lead to crippling regulatory capture but, on the contrary, can entail welfare enhancing change. Corresponding Author: Prof. Laixiang Sun, Department of Financial and Management Studies, SOAS, University of London, Thornhaugh Street, Russell Square, London WC1H 0XG, UK. Tel. +44-20-78984821, Fax. +44-20-76377075, Email: [email protected] . Centre for Financial and Management Studies 1 State Ownership and Corporate Performance: A Quantile Analysis on China’s Listed Companies 2 SOAS, University of London Discussion Paper 53 1. -

Musical Taiwan Under Japanese Colonial Rule: a Historical and Ethnomusicological Interpretation

MUSICAL TAIWAN UNDER JAPANESE COLONIAL RULE: A HISTORICAL AND ETHNOMUSICOLOGICAL INTERPRETATION by Hui‐Hsuan Chao A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy (Music: Musicology) in The University of Michigan 2009 Doctoral Committee: Professor Joseph S. C. Lam, Chair Professor Judith O. Becker Professor Jennifer E. Robertson Associate Professor Amy K. Stillman © Hui‐Hsuan Chao 2009 All Rights Reserved ACKNOWLEDGEMENTS Throughout my years as a graduate student at the University of Michigan, I have been grateful to have the support of professors, colleagues, friends, and family. My committee chair and mentor, Professor Joseph S. C. Lam, generously offered his time, advice, encouragement, insightful comments and constructive criticism to shepherd me through each phase of this project. I am indebted to my dissertation committee, Professors Judith Becker, Jennifer Robertson, and Amy Ku’uleialoha Stillman, who have provided me invaluable encouragement and continual inspiration through their scholarly integrity and intellectual curiosity. I must acknowledge special gratitude to Professor Emeritus Richard Crawford, whose vast knowledge in American music and unparallel scholarship in American music historiography opened my ears and inspired me to explore similar issues in my area of interest. The inquiry led to the beginning of this dissertation project. Special thanks go to friends at AABS and LBA, who have tirelessly provided precious opportunities that helped me to learn how to maintain balance and wellness in life. ii Many individuals and institutions came to my aid during the years of this project. I am fortunate to have the friendship and mentorship from Professor Nancy Guy of University of California, San Diego. -

GOVERNANCE and TRUST: an Institutional Economics Perspective on Taiwan's Financial Reform

GOVERNANCE AND TRUST: An institutional economics perspective on Taiwan's financial reform Doris Hsiao-Chi Chuang A thesis submitted in partial fulfillment of the requirements of the University of Brighton for the degree of Doctor of Philosophy 2012 The University of Brighton Abstract Evolution of the financial system involves continual institutional changes for reform pur- poses. However, reform experiences differed considerably from one country to another. Why is it that some countries can effectively implement reforms to foster successful devel- opment while others fail to do so? This study takes a first step in answering this question. It aims to explain the variations of financial reform experience in terms of informal institu- tional influence and highlight the importance of governance in shaping the reform outcome. The thesis studies governance characteristics that influence Taiwan’s banking evolution and examines the development of both formal and informal institutions. It argues that de- velopment of Taiwan’s banking sector has been path-dependent and significantly influ- enced by informal institutions, which held back its recent reform progress. The study com- prises three parts: theoretical framework, quantitative statistical research and qualitative country study. It applies the analytical framework set out in the theoretical part and draws on empirical evidences from quantitative research to form the basis for an empirical inves- tigation into the historical financial development and recent reform experience in Taiwan. At the conceptual level, the research adopts the New Institutional Economics (NIE) framework and argues that governance bears a decisive importance for an effective reform because it fosters trust in the institutions and facilitates the reform by encouraging coopera- tive behaviours among actors. -

China and Japan: Partners Or Permanent Rivals?

China and Japan: Partners or Permanent Rivals? Willem van Kemenade November 2006 NETHERLANDS INSTITUTE OF INTERNATIONAL RELATIONS CLINGENDAEL CIP-Data Koninklijke Bibliotheek, The Hague Kemenade, Willem van China and Japan: Partners or Permanent Rivals? / Willem van Kemenade – The Hague, Netherlands Institute of International Relations Clingendael. Clingendael Diplomacy Papers No. 9 ISBN-10: 90–5031–111-3 ISBN-13: 978-90-5031-111-3 Desk top publishing by Desiree Davidse Netherlands Institute of International Relations Clingendael Clingendael Diplomatic Studies Programme Clingendael 7 2597 VH The Hague Phonenumber +31(0)70 - 3746628 Telefax +31(0)70 - 3746666 P.O. Box 93080 2509 AB The Hague E-mail: [email protected] Website: http://www.clingendael.nl The Netherlands Institute of International Relations Clingendael is an independent institute for research, training and public information on international affairs. It publishes the results of its own research projects and the monthly ‘Internationale Spectator’ and offers a broad range of courses and conferences covering a wide variety of international issues. It also maintains a library and documentation centre. © Netherlands Institute of International Relations Clingendael. All rights reserved. No part of this book may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the copyright-holders. Clingendael Institute, P.O. Box 93080, 2509 AB The Hague, The Netherlands. ACKNOWLEDGEMENTS This Clingendael Diplomacy Paper is the combined product of three short- term research projects that I undertook from my base in Beijing in 2005 and 2006. The first involved a trip to Tokyo in April 2005 for a chapter on ‘The Political Economy of North-East Asian Integration’, which appeared in August 2005 as chapter 3 in a study commissioned by the Directorate- General External Relations (DG Relex) of the European Commission to the European Institute of Asian Studies in Brussels.