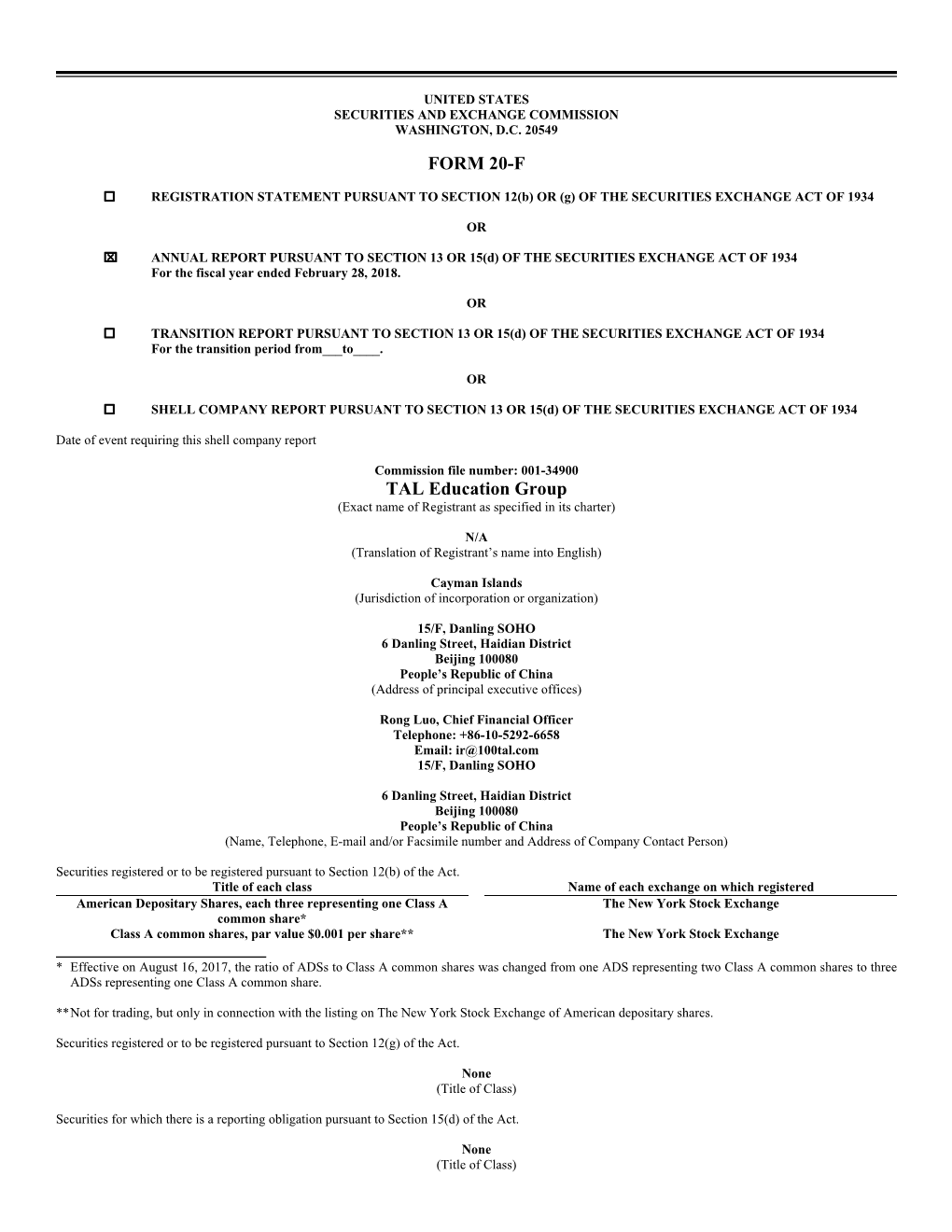

FORM 20-F TAL Education Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Annual Report 2019

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2019 2019 年度報告 2019 年度報告 Annual Report CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 4 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 8 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 134 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 135 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 233 Section XI FINANCIAL REPORT 242 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 243 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 244 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the seventh meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. Deloitte Touche Tohmatsu (Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP (Special General Partnership)) have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated. -

Construction & Decoration

Special Issue CONSTRUCTION & DECORATION VOL.53 ISSN 2219-7419 SGS Serial NO. QIP-ASR1341802 5 9 10 6 11 12 7 1 Aluninum Profile 4 FST-GRSW-04 2 Luxury Roll up FST-R-S-18 3 Aluninum Profile 5 FST-CW-110 4 Catalogue Shelf FST-FTS-A4 5 Aluninum Profile 2 FST-GP-02 6 Aluninum Profile 3 FST-IP-1-9 7 Aluninum Profile 1 FST-BA-02 8 Pop up Stand FST-PU-3X3 9 Aluninum Profile 6 FST-CW-110 10 Snap Frame FST-SF-A1-A4 11 A Frame FST-AL-D203A 12 Outdoor a Frame FST-007 8 TRADE YELLOW PAGES 1 Made-in-China.com Source Quality Products Made in China About us : Made-in-China.com was developed by, and is operated by Focus Technology Co., Ltd. Focus Technology is a pioneer and leader in the field of electronic business in China. With the continuous and explosive growth of Chinese export, trade and number of internet users, Focus Tech- nology launched its online trade platform, Made-in-China.com. Made-in-China.com provides the most complete, accurate and up-to-date information on Chinese products and Chinese suppliers available anywhere on the web. Nowadays, Made-in-China.com is a world leading B2B portal, specializing in bridging the gap between global buyers and quality Chinese suppliers. For more information, Focus Technology Co., Ltd. please contact our Buyer Service Department at Add: Block A, Software BLDG., Xinghuo Road, New & Hi-Tech [email protected] Development Zone, Nanjing 210061, China Tel: +86-25-6667 5777 Fax: +86-25-6667 0000 ➲ Business Sourcing Events http://www.made-in-china.com Business Sourcing Events is a professional service Made-in-China.com provides. -

Effect of Ultra-High Pressure Technology on Isomerization and Antioxidant Activity of Lycopene in Solanum Lycopersicum

American Journal of Biochemistry and Biotechnology Original Research Paper Effect of Ultra-High Pressure Technology on Isomerization and Antioxidant Activity of Lycopene in Solanum Lycopersicum 1Siqun Jing, 2Zainixi Lasheng, 2Saisai Wang and 2Hui Shi 1Yingdong Food College, Shaoguan University, Daxue Road 288, Zhenjiang District, Shaoguan, Guangdong 512005, China 2College of Life Sciences and Technology, Xinjiang University, Shengli Road 14, Urumqi, Xinjiang 830046, China Article history Abstract: To evaluate the influence of the Ultra-High Pressure processing Received: 04-03-2019 (UHP) on the isomerization and antioxidant activity of lycopene in tomatoes Revised: 20-05-2020 (Solanum lycopersicum), High Performance Liquid Chromatography (HPLC) Accepted: 19-06-2020 and Ultraviolet-Visible Spectroscopy (UV-Vis) were used to separate and identify the isomer of lycopene. The scavenging activities against Corresponding Author: Siqun Jing DPPH∙and∙OH present samples with and without UHP treatment were tested Yingdong Food College, with ascorbic acid as positive control. Full wavelength scanning figure Shaoguan University, Daxue showed that a characteristic absorption peak was created at 361 nm, which Road 288, Zhenjiang District, was caused by trans-lycopene isomerizing into cis isomer. HPLC analysis Shaoguan, Guangdong 512005, found that five peaks (Rt = 19.082, 13.307, 9.790, 8.123, 7.207 min) were China produced after UHP treatment, which were further identified by UV-Vis and Email: [email protected] four peaks among them showed a strong absorption peak at 361 nm which was in accordance with the UV-Vis spectroscopy of cis-lycopene. The total antioxidant, capable of scavenging hydroxyl radicals·OH and DPPH·radical of lycopene treated by UHP, were all higher than that of control and lycopene without UHP treated. -

2020 Annual Report.Pdf

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2020 年度報告2020 年度報告 Annual Report 2020 CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 3 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 7 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 136 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 137 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 229 Section XI FINANCIAL REPORT 240 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 241 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 242 2 HAITONG SECURITIES CO., LTD. | Annual Report 2020 (H Share) IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the 15th meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. PricewaterhouseCoopers Zhong Tian LLP (Special General Partnership) and PricewaterhouseCoopers have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated. -

BMJ Open Is Committed to Open Peer Review. As Part of This Commitment We Make the Peer Review History of Every Article We Publish Publicly Available

BMJ Open: first published as 10.1136/bmjopen-2020-040196 on 29 October 2020. Downloaded from http://bmjopen.bmj.com/ on September 27, 2021 by guest. Protected by copyright. responses online. online. responses ). ). http://bmjopen.bmj.com email please process review peer open BMJ Open’s on any questions If you have [email protected] BMJ Open is committed to open peer review. As part of this commitment we make the peer review review peer the make we commitment of this As part review. open peer to committed is Open BMJ available. publicly publish we article every of history authors’ the and comments reviewers’ the peer we post published is an article When that versions the are These peer review. during used were that paper of the versions the post We also to. apply comments review the peer review the peer during submitted that were versions the are follow that paper of the The versions or cited be not should They versions. published final or the of record versions the not are They process. manuscript. of this version published as the distributed of of record version author-corrected and typeset final, the full, journal and open access an is Open BMJ fees pay-per-view or charges subscription controls, access with no site on our available is manuscript the ( BMJ Open BMJ Open: first published as 10.1136/bmjopen-2020-040196 on 29 October 2020. Downloaded from Validation of handheld fundus camera with mydriasis for retinal imaging to increase uptake of diabetic retinopathy screening in China ForJournal: peerBMJ Open review only Manuscript -

SHANGHAI M&G STATIONERY INC. Annual Report 2020

Annual Report 2020 Stock Code: 603899 Short Name: M&G Stationery SHANGHAI M&G STATIONERY INC. Annual Report 2020 1 / 244 Annual Report 2020 Going Forward with our Mission Dear shareholders, partners and friends, The year 2020 was an extraordinary year. Since the beginning of the year, the sudden outbreak of the COVID-19 pandemic has brought tremendous impacts to various industries. Due to such macroeconomic climate and the delay in school return date, many stationery shops faced grave challenges to resume operation. Among such uncertainties, what M&G can do is do "things with certainty". The Company acted quickly to fight against the pandemic. On the one hand, we adopted pandemic prevention and control measures to protect our employees, provided PPE for front-line workers and donated money and materials. On the other hand, the Company took resolute steps to restart factories to resume production. In the first half of the year, the Company recorded a decrease in results. With our strenuous efforts, we achieved satisfactory performance in the second half. One of the most important things we learned in 2020 is that if you truly aspire something , you can always work out a way and if you persist enough, you can make the seemingly impossible come true. In 2020, the Company recorded revenue of RMB13 billion, an increase of 17.9%, and net profit of RMB1.2 billion, an increase of 18.4%. For the past years since going public, M&G has maintained health growth and sound asset condition. The year 2020 was of great significance to M&G. -

出版日期: 2018 年1 月- Designated Hospital List in Mainland China

中國內地指定醫院列表 (((生活守護保障(生活守護保障))) 出版日期: 2018 年年年 1 月月月 Designated Hospital List in Mainland China (Life Impact Reliever) Published Date: Jan 2018 省省省 / 自治區 / 直直直 轄市 Provinces / 城市 醫院 地址 電話號碼 Autonomous City Hospital Address Tel. No. Regions / Municipalities 安徽省 合肥 合肥市第一人民醫院 盧陽區淮河路 390 號 551-2652893 Anhui Hefei Hefei No.1 People's Hospital 390 Huaihe Road, Luyang District 安徽省 合肥 合肥市第二人民醫院 包河區和平路 246 號 551-2203500 Anhui Hefei Hefei No.2 People's Hospital 246 Heping Road, Yaohai District 安徽省 合肥 安徽中醫學院第一附屬醫院 (安徽省中醫院) 蜀山區梅山路 117 號 551-2821852 Anhui Hefei Anhui TCM College No. 1 Hospital 117 Meishan Road, Shushan District 安徽省 合肥 安徽省立兒童醫院 包河區望江東路 39 號 551-2237114 Anhui Hefei Anhui Children's Hospital 39 Wangjiang East Road, Baohe District 安徽省 合肥 安徽省立醫院 廬陽區廬江路 17 號 551-2283114 Anhui Hefei Anhui Hospital 17 Lujiang Road, Luyang District 安徽省 合肥 安徽醫科大學第一附屬醫院 蜀山區績溪路 218 號 551-2922114 Anhui Hefei Anhui Medical University No.1 Hospital 218 Jixi Road, Shushan District 安徽省 合肥 安徽醫科大學第二附屬醫院 經濟技術開發區芙蓉路 678 號 551-3869420 Anhui Hefei Anhui Medical University No.2 Hospital 678 Furong Road, Shushan District 中國中醫科學院廣安門醫院 北京 北京 西城區北線閣 5 號 Guang'anmen Hospital, China Academy of Chinese 10-83123311 Beijing Beijing 5 Beixiange St. Xicheng District Medical Sciences 北京 北京 中國中醫科學院望京醫院 朝陽區花家地街 10-84739047 Beijing Beijing Wangjing Hospital of CACMS Huajiadi Street, Chaoyang District 北京 北京 中國中醫科學院西苑醫院 (西苑醫院) 海澱區西苑操場 1 號 10-62835678 Beijing Beijing Xiyuan Hospital CACMS No.1, Xiyuang Caochang, Haidian District 北京 北京 中國人民解放軍海軍總醫院 (海軍總醫院) 海澱區阜成路 6 號 10-66958114 Beijing Beijing PLA Naval General Hospital 6 Fucheng Road, Haidian District 北京 北京 中國人民解放軍空軍總醫院 (空軍總醫院) 海澱區阜成路 30 號 10-68410099 Beijing Beijing Air Force General Hospital, PLA 30 Fucheng Road, Haidian District 北京 北京 中國人民解放軍第 302 醫院 豐台區西四環中路 100 號 10-66933129 Beijing Beijing 302 Military Hospital of China 100 West No.4 Ring Road Middle, Fengtai District 重要資料: Important Notes: 1. -

Shaoguan Tuhua, a Local Vernacular of Northern Guangdong Province, China: a New Look from a Quantitative and Contact Linguistic Perspective

Shaoguan Tuhua, a Local Vernacular of Northern Guangdong Province, China: A New Look from a Quantitative and Contact Linguistic Perspective Thesis Presented in Partial Fulfillment of the Requirements for the Degree Master of Arts in the Graduate School of The Ohio State University By Litong Chen, B.A. Graduate Program in East Asian Languages and Literatures The Ohio State University 2012 Thesis Committee: Marjorie K. M. Chan, Advisor Donald Winford Zhiguo Xie Copyright by Litong Chen 2012 Abstract This thesis reanalyzes data collected from published fieldwork sources and brings a new perspective to Shaoguan Tuhua, the genetically unclassified vernacular speech used in the Shaoguan area, northern Guangdong Province, China. The reanalysis consists of a quantitative study of the Shaoguan Tuhua varieties and some Hakka varieties (the regional lingua franca) and a contact linguistic study on one of the Shaoguan Tuhua varieties, Shibei Shaoguan Tuhua, and its Hakka neighbor, Qujiang Hakka. This thesis uses a combined methodology. It consists of the traditional Chinese dialectological research methods, phylogenetic network (computational) methods, and contact linguistic frameworks. Neither phylogenetic network methods nor contact linguistic frameworks are sufficiently used in Chinese dialectology. In terms of studying Shaoguan Tuhua, the use of these methodologies is new. This thesis first of all introduces the historical and sociolinguistic contexts of Shaoguan Tuhua. Shaoguan Tuhua has been in contact with Hakka for about seven hundred years, and Hakka speakers significantly outnumber Shaoguan Tuhua speakers. The majority of Shaoguan Tuhua speakers, especially the younger generation, can speak fluent Hakka. ii Based on the historical and sociolinguistic background, this thesis goes on to examine the result of the Shaoguan Tuhua-Hakka contact. -

Annual Report 2017

ANNUAL REPORT 2017 * For identification purpose only CONTENTS Section I DEFINITIONS AND IMPORTANT RISK WARNINGS 3 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 7 Section III SUMMARY OF THE COMPANY’S BUSINESS 23 Section IV REPORT OF THE BOARD OF DIRECTORS 29 Section V SIGNIFICANT EVENTS 74 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 104 Section VII PREFERENCE SHARES 114 Section VIII PARTICULARS ABOUT DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 115 Section IX CORPORATE GOVERNANCE 164 Section X CORPORATE BONDS 202 Section XI FINANCIAL REPORT 212 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 213 Section XIII INFORMATION DISCLOSURE OF SECURITIES COMPANY 214 HAITONG SECURITIES CO., LTD. Annual Report 2017 (H Share) 1 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the 29th meeting of the sixth session of the Board. The number of Directors to attend the Board meeting should be 13 and the number of Directors who actually attended the Board meeting was 11. Ms. Yu Liping, a non-executive Director, and Mr. Feng Lun, an independent non-executive Director, were unable to attend the Board meeting in person due to business trips, and had appointed Ms. Zhang Xinmei, a non-executive Director, and Mr. Xiao Suining, an independent non-executive Director, to vote on their behalves respectively. -

E185564A Midea Real Estate 1..2

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. MIDEA REAL ESTATE HOLDING LIMITED 美 的 置 業 控 股 有 限 公 司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 3990) VOLUNTARY ANNOUNCEMENT POSSIBLE DEVELOPMENT PROJECT IN ZHENJIANG DISTRICT OF SHAOGUAN CITY This is a voluntary announcement made by Midea Real Estate Holding Limited (the ‘‘Company’’). The board of directors (the ‘‘Board’’ or the ‘‘Director(s)’’) of the Company announces that Foshan Gaoming Midea Property Development Company Limited*(佛山市高明區美的房地 產發展有限公司)(‘‘Gaoming Midea’’), an indirect wholly-owned subsidiary of the Company, and the Shaoguan City Zhenjiang District People’s Government* (韶關市湞江區 人民政府) of the Guangdong Province of the People’s Republic of China (the ‘‘Zhenjiang Government’’) entered into an investment agreement on 27 November 2018 in relation to their proposed cooperation on the development of an ecotourism-focused development project located in Shaoguan City Zhenjiang District Xinshao Town College City* (韶關市湞 江區新韶鎮大學城片區) with an aggregate site area of approximately 21,000 mu (equivalent to approximately 14 million square meter) (the ‘‘Possible Development Project’’), in which 15,500 mu and 4,000 mu are planned to be developed as -

Classical Swine Fever Virus NS5A Protein Changed Inflammatory

Dong and Tang Virology Journal (2016) 13:135 DOI 10.1186/s12985-016-0582-7 ERRATUM Open Access Erratum to: Classical swine fever virus NS5A protein changed inflammatory cytokine secretion in porcine alveolar macrophages by inhibiting the NF-κB signaling pathway Xiao-Ying Dong1,2 and Sheng-Qiu Tang1,2* Erratum Upon publication of this article [1], it was noticed that there had been an error in the processing of Fig. 4b. Although submitted correctly, the figure was published with the top left image missing. This has now been updated in the original article; please see the corrected figure below: Received: 30 June 2016 Accepted: 30 June 2016 Reference 1. Dong XY, Tang SQ. Classical swine fever virus NS5A protein changed inflammatory cytokine secretion in porcine alveolar macrophages by inhibiting the NF-κB signaling pathway. Virol J. 2016;13:101. Submit your next manuscript to BioMed Central and we will help you at every step: • We accept pre-submission inquiries • Our selector tool helps you to find the most relevant journal • We provide round the clock customer support • Convenient online submission • Thorough peer review • Inclusion in PubMed and all major indexing services * Correspondence: [email protected] • Maximum visibility for your research 1College of Yingdong Agricultural Science and Engineering, Shaoguan University, Daxue Road, Zhenjiang District, Shaoguan 512005, China 2 Submit your manuscript at North Guangdong Collaborative Innovation and Development Center for www.biomedcentral.com/submit Swine Farming and Disease Control, Shaoguan 512005, China © 2016 The Author(s). Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.